In a memo prepared for the industry, “procedurally, the IECC is singularly inappropriate for manufactured housing as that Code – up to and including its 2021 iteration – has been voted-on and approved exclusively by state and local building code officials representing governments that in many cases, discriminatorily exclude or restrict the placement of manufactured homes.” So says part of the media release below from the Manufactured Housing Association for Regulatory Reform (MHARR), to update members about arguably authentic efforts to thwart the threat of such regulations, that MHARR’s prior efforts defeated previously.

Following this memo is the actual brief attached. Note to MHI members; after years of providing their news at their request, MHI pivoted. MHI decided that they no longer wanted their news publicly available at the most-read trade media in manufactured housing. Nor does MHI routinely post their news on their own website. By contrast, almost every memo MHARR provides to their members, they post on their website. What that contrasting pattern suggests, when examined, is that MHI seemingly wants to be able to say – whatever – without later being held visibly accountable for their previous statements. That noted, MHProNews still obtains and reports on some of their news, examining their claims as in the report shown below.

Following the MHARR release will be followed by additional linked information that will shed light on how Warren Buffett, Michael Bloomberg, and the Manufactured Housing Institute (MHI), among other MHI industry-connected firms have responded in the past, which led the industry to this current regulatory battle.

OCTOBER 5, 2021

TO: MANUFACTURED HOUSING INDUSTRY PRODUCERS,

RETAILERS AND COMMUNITIES

FROM: MARK WEISS

RE: MHARR SUBMITS SECOND COMMENTS ON PROPOSED

DOE MANUFACTURED HOUSING ENERGY STANDARDS

Attached, for your information, are comments filed by the Manufactured Housing Association for Regulatory (MHARR) on October 1, 2021 in connection with the federal Manufactured Housing Consensus Committee’s (MHCC) ongoing consideration of proposed manufactured housing “energy conservation” standards published by the U.S. Department of Energy (DOE) in the Federal Register on August 26, 2021. The MHCC began its review of the DOE proposed rule at a teleconference meeting on September 23, 2021 and will continue its analysis of the rule — and development of responsive comments – at further meetings currently scheduled for October 8, 2021 and October 20, 2021. The attached comments are being submitted in connection with the MHCC meeting scheduled for October 8, 2021, and MHARR is currently preparing a third set of MHCC comments for the Committee meeting slated for October 20, 2021. At present, the deadline for submission of written comments to DOE on the proposed rule is October 25, 2021, although MHARR has filed a request for an extension of the comment deadline to December 27, 2021, due to the multi-faceted technical and cost issues raised by these new and unprecedented proposed standards.

MHARR’s October 1, 2021 comments address the complete and total unsuitability of the International Energy Conservation Code (IECC) as the basis for manufactured housing energy standards, both substantively and procedurally. Substantively, the IECC is not a legitimate or valid basis for manufactured housing standards because, as DOE itself admits, that code – for its entire existence – has been developed specifically for site-built residential structures, without regard to any of the technical and affordability concerns that are unique to manufactured housing as stressed in the Manufactured Housing Improvement Act of 2000. Similarly, procedurally, the IECC is singularly inappropriate for manufactured housing as that Code – up to and including its 2021 iteration – has been voted-on and approved exclusively by state and local building code officials representing governments that in many cases, discriminatorily exclude or restrict the placement of manufactured homes. Thus, the Energy Independence and Security Act of 2007 (EISA) which instructs DOE to use the IECC as the basis for its manufactured housing energy standards, directly conflicts with all pre-existing federal manufactured housing law, which seeks to protect both the purchase price affordability and availability of manufactured housing In addition to this fundamental issue, MHARR’s second comments also begin to address certain technical issues that will be implicated by the proposed DOE standards.

Based on initial responses to MHARR’s first set of MHCC comments, filed on September 15, 2021, industry members are clearly beginning to realize the devastating consequences that DOE’s proposed standards would have both for the industry and American consumers of affordable housing. Again, therefore, MHARR urges all industry members to submit comments to DOE to oppose these proposed standards, which discriminate against manufactured housing, violate existing federal law, and will severely undermine the purchase affordability of manufactured homes while excluding millions of lower and moderate-income Americans from the mainstream HUD Code manufactured housing market. To facilitate such participation, MHARR will continue to make its comments available to the entire industry in advance of the relevant MHCC and DOE deadlines. ##

Attachments

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: manufacturedhousingassociation.org

The text for the attachment is as shown below. It will be followed by additional related information plus a brief analysis from MHProNews.

October 1, 2021

VIA FEDERAL EXPRESS AND ELECTRONIC SUBMISSION

Manufactured Housing Consensus Committee

C/O Home Innovation Research Labs

Administering Organization

400 Prince George’s Boulevard

Upper Marlboro, Maryland 20774

Re: Energy Conservation Standards for Manufactured Housing – Second Comments

Dear Members of the Manufactured Housing Consensus Committee:

The Manufactured Housing Association for Regulatory Reform (MHARR) submits the following second set of comments in connection with the Manufactured Housing Consensus Committee’s (MHCC) consideration of a Supplemental Notice of Proposed Rulemaking (SNPR) regarding “Energy Conservation Standards for Manufactured Housing” published by the U.S. Department of Energy (DOE) in the Federal Register on August 26, 2021.[1] MHARR is a national trade association representing producers of manufactured housing subject to regulation pursuant to the National Manufactured Housing Construction and Safety Standards Act of 1974 (1974 Act), as amended by the Manufactured Housing Improvement Act of 2000 (2000 reform law), as well as relevant provisions of the Energy Independence and Security Act of 2007 (EISA).

I. INTRODUCTION

The following are MHARR’s second set of comments regarding MHCC consideration of DOE’s August 26, 2021 manufactured housing energy standards supplemental proposed rule. MHARR’s initial comments, submitted September 15, 2021, principally addressed policy issues related to the proposed standard, including its predictably destructive cost impact on manufactured housing consumers, the manufactured housing market and the manufactured housing industry – with disproportionate impacts on smaller industry businesses – as well as the absence of any genuine or legitimate need for excessive and discriminatory manufactured housing energy standards, based on U.S. Census Bureau data showing that manufactured housing residents already pay less for all types of home energy sources (i.e., oil, piped gas and electricity) than residents of detached, single-family homes, under existing HUD standards. The comments below will address: (1) the fundamental incompatibility of the International Energy Conservation Code (IECC) – either “modified” by DOE or not – with manufactured housing construction and affordability; (2) the fundamental incompatibility of the IECC’s stated objectives and voting system (through 2021) with the objectives and consensus processes of the Manufactured Housing Improvement Act of 2000; and (3) an initial statement of specific DOE proposed standards that would be inappropriate, non-cost-effective for manufactured housing, or otherwise destructive of manufactured housing and the manufactured housing market.

Again, for the reasons set forth in these comments, as well as MHARR’s September 15, 2021 comments, and the comments that MHARR will submit in advance of the MHCC’s scheduled October 20, 2021 meeting, the August 26, 2021 proposed DOE manufactured housing energy standards rule should be rejected by the MHCC with relevant comments submitted to DOE, as well as a request for an extension of the current October 25, 2021 comment deadline, in order to ensure a complete and thorough review of the DOE proposal, and proper stakeholder input.

II. COMMENTS

- THE IECC IS NOT AN APPROPRIATE CODE FOR MANUFACTURED HOUSING OR A LEGITIMATE BASIS FOR MH ENERGY STANDARDS

The International Energy Conservation Code (IECC), as acknowledged by DOE,[2] is not and never has been a code for manufactured homes. Whereas the Federal Manufactured Housing Construction and Safety Standards (FMHCSS) and FMHCSS energy standards developed and maintained by the U.S. Department of Housing and Urban Development (HUD) are specifically tailored to the unique size, affordability and construction imperatives of manufactured homes based on a balance between homeowner protection and affordability expressly mandated by federal law,[3] the IECC standards are not now – and never have been – developed for manufactured homes or the affordability needs of actual and potential manufactured home consumers. Nor have they ever been developed, voted-on, or approved (including in their 2021 iteration) by individuals with a direct knowledge of either manufactured housing or the unique construction and affordability challenges required to comply with federal manufactured housing law. The IECC, accordingly, is fundamentally contrary to applicable federal manufactured housing law and cannot be transformed into an appropriate code for affordable manufactured homes through arbitrary, piecemeal DOE modifications.

Because the IECC is not developed based on the specific construction and affordability aspects of manufactured housing, the IECC would devastate the affordable manufactured housing market. For example, the 2015 IECC — the basis for DOE manufactured housing energy standards initially proposed in 2016 — would have resulted in retail level purchase price increases of $4,601.00 for a single-section manufactured home, and $5,825.00 for a double-section manufactured home as calculated by MHARR members.[4] These amounts included industry-standard builder and retailer profit margins,[5] but did not include regulatory testing, compliance or enforcement costs, which were not estimated or considered by DOE in the June 2016 manufactured housing energy rulemaking.

Consistent with MHARR’s 2016 findings, a June 2021 Home Innovation Research Labs (HIRL) report,[6] found that the 2021 IECC, as published, would result in an incremental construction cost increase of $6,548.00 to $9,301.00 for a specified site-built reference home of 2,500 square feet, depending on the compliance mechanism selected.[7]The same analysis shows a national simple construction cost payback period ranging from 32 to 67 years, again based on the compliance mechanism. Prorating these amounts to the smaller size of an “average” single-section and double-section manufactured home, as defined by the U.S. Census Bureau, and including industry-standard profit margins identical to those used in MHARR’s 2016 calculation, the 2021 IECC, in unmodified form, would yield a minimum incremental retail-level price increase of $7,958.00 for an “average” single section manufactured home and a minimum incremental retail-level price increase of $12,908.00 for an “average” double-section manufactured home.[8]These amounts, though, are necessarily partial and incomplete, in that: (1) they do not include regulatory testing, compliance or enforcement costs; and (2) do not include costs attributable to future changes to the IECC and the costs of compliance with such future modifications – which are, and would be, totally unnecessary for today’s modern, already energy cost-efficient, HUD Code manufactured homes.

The fundamental incompatibility between the IECC and standards that would be appropriate for HUD Code manufactured housing is due, in part, to the absence of a statutory purchase price affordability mandate for the IECC,[9] comparable to the 1974 Act as amended by the 2000 reform law. It is also due to the nature and composition of the IECC committee and the IECC development process, through and including the 2021 IECC used by DOE as the basis for its proposed standards. Specifically – and unlike FMHCSS standards under the 2000 reform law — all iterations of the IECC through the 2021 version, were subject to a “governmental consensus” process, in which local government building code officials with no responsibility for the regulation of manufactured housing and no sensitivity to the affordability concerns implicated by extreme price increases, were exclusively empowered to consider and approve the final standards.[10] Indeed, there is no evidence or indication that the IECC committee – through its 2021 iteration — has ever had any members representing manufactured housing producers or stakeholders with specific knowledge of the industry, its homes, its consumers, its market characteristics, or the consumer financing of its homes. This stands in sharp contrast with the MHCC process, where proposed standards are considered and recommended by a congressionally-mandated consensus committee, with members “qualified by background and experience to participate in the work” of the Committee (emphasis added),[11] representing all relevant categories of stakeholders.

The National Association of Home Builders (NAHB), moreover, has maintained (with supporting evidence) that this “governmental consensus” process was “manipulated” and “abused” by energy special interests during the 2021 revision cycle. While this charge has led to significant changes in the IECC process for the 2024 cycle, those changes do not even come close to a cure for the fatal flaws that make the IECC inappropriate and unacceptable as a basis for any manufactured housing energy standards.

Specifically, the 2021 IECC revision process saw multiple high-cost proposals previously rejected by IECC committees, reinstated and adopted, during the final government-official-only vote, after a behind-the-scenes campaign by energy special interests to lobby and pressure government officials to cast votes in favor of those previously-rejected proposals. A site-builder group, Leading Builders of America (LBA), explained this “manipulation” of the IECC process in a January 26, 2021 letter, stating: “For the building community, the 2021 [IECC] update is a cause for serious concern. Multiple code changes were approved that will increase the cost of a new home by up to $10,000 with only modest savings for consumers. Some of the new requirements have payback periods over 100 years. Each of these ‘high-cost-low-benefit’ code changes were twice rejected during the code development process. They were approved as a result of an unprecedented effort to manipulate the ICC’s governmental online consensus vote.” (Emphasis added). To support these claims, LBA provided recordings of conference calls with special interest activists lobbying government official voters to follow a “voting guide” showing the previously-rejected proposals the activists sought to have reinstated in the final IECC vote.

As a result of this “political manipulation,” the ICC Board of Directors, in March 2021, voted to convert the IECC from a government code process to an American National Standards Institute (ANSI)-based consensus process. Under the Board’s decision, however, this change will not become effective until the 2024 revision process begins. And even though the 2024 (and beyond) process will change because of the special interest “manipulation” implicitly confirmed through the decision of ICC Board, the Board incongruously decided to keep in place not only the “politically manipulated” and thus tainted 2021 revisions adopted through the “government only” system then in place, but all of the IECC provisions previously approved through that same tainted and flawed system. The Executive Summary of the ICC Board’s decision thus states: “The 2024 IECC will start from the content of the 2021 IECC.” (Emphasis added).[12] While thus effectively acknowledging the validity of the claims of a fundamentally-tainted IECC 2021 process, the ICC decision will leave the results of that tainted process in place as a springboard to further contaminate future IECC revisions that would build upon a fundamentally-tainted “foundation.”

The ICC Board’s decision concerning the nature of the IECC is relevant to the August 26, 2021 DOE proposed rule in that it affirmatively confirms that the IECC, through the 2021 iteration specifically utilized and relied-upon by DOE, was: (1) not only approved in its final form by land use officials with no background whatsoever in manufactured housing; but (2) that it was developed and approved through a process that was “abused” and “manipulated” to impose measures that are excessively-costly and produce no positive results for consumers over a normal homeownership tenure period. Consequently and particularly in light of the extreme purchase price impacts documented by the HIRL report, it is not – and should not be — surprising that the 2021 IECC, to date, has not been adopted for site-built or modular homes by any jurisdiction in the United States.[13]More importantly, though, such a code, that since its inception has been under the exclusive control of state and/or local governments officials that: (1) exclude or otherwise discriminate against manufactured homes and manufactured homebuyers;[14] and (2) have no direct experience, knowledge, or expertise regarding manufactured home construction or regulation — is not now, never has been, and never could be a proper or legitimate basis for manufactured housing energy standards.

Moreover, even after the IECC process changes for the 2024 revision cycle, the IECC would remain a fundamentally unsuitable and unacceptable code for supposedly “affordable” manufactured housing. First, there continues to be no purchase price affordability mandate for IECC standards comparable to that contained in the 1974 Act as amended. Second, an official statement published by the ICC Board states that local building officials with no involvement whatsoever with any other aspect of manufactured housing regulation – and often opponents of equitable zoning and placement for manufactured homes – “will continue to have a leading voice” in the IECC development process.[15]Third, ICC appointments to the 2024 IECC residential committee exclude any representatives of smaller, independent manufactured housing producers or businesses, but do include representatives of “climate change” special interest groups with no conceivable knowledge of manufactured housing, its construction, its consumers, or its market.[16] Fourth, the same official ICC statement makes it clear that the focus and primary purpose of the IECC is related to the supposed effects of “climate change,” not to ensuring the availability of affordable housing and combating the devastating economic and societal impacts of homelessness or housing insecurity. The ICC Board statement thus asserts, in relevant part: “The Code Council will build on the technical solutions provided by the International energy Conservation Code … to create a portfolio of advanced mitigation solutions to battle the impacts of our changing climate. This portfolio will provide a menu of options for jurisdictions, from a strong and increasing set of minimum requirements, to pathways to net zero energy and additional greenhouse gas reduction policies.”[17] The IECC’s purposes, objectives and processes, consequently, are in conflict with and violate the affordable housing and housing availability requirements and policies of pre-existing federal manufactured housing law.

Accordingly, (and for the additional reasons set forth in MHARR’s initial September 15, 2021 comments) the MHCC should reject the August 26, 2021 proposed DOE standards based upon the 2021 IECC.

- B. DOE’S COST “ANALYSIS” IS INCOMPLETE AND MISLEADING AS

IT FAILS TO REFLECT THE FULL COST OF THE PROPOSED RULE

DOE’s August 26, 2021 SNPR contains an alleged cost-benefit analysis of its proposed manufactured housing energy conservation rule. That supposed analysis, however – which is affirmatively required by both EISA and the 1974 Act, as amended – is flawed, incomplete and misleading for multiple reasons, as explained in the following sections. And because that statutorily-required cost-benefit analysis is flawed, incomplete and misleading, the DOE August 26, 2021 proposed rule: (1) violates the substantive mandate of EISA section 413 (42 U.S.C. 17071) and section 604(e)(4) of the 1974 Act as amended (42 U.S.C. 5403(e)(4)); but is also (2) “arbitrary, capricious and not in accordance with law” in violation of the federal Administrative Procedure Act (APA).[18] As a result of this inherent, fatal and fundamental defect in the August 26, 2021 proposed rule, the MHCC should reject the proposed rule and recommend its withdrawal as published.

- DOE’S COST CALCULATIONS ARE – AND HAVE

BEEN — MATERIALLY FALSE AND DEFECTIVE

As an initial matter, it should be noted that the cost-benefit “analysis” offered by DOE in support of its now supposedly-withdrawn 2016 proposed rule,[19] was materially false and defective, as is the cost-benefit analysis for the 2021 DOE proposed rule. DOE, for example, maintained in its June 17, 2016 Notice of Proposed Rulemaking (NPR) that its proposed standards would add up to $2,422 to the retail price of a single-section manufactured home (with a national average of $2,226) and up to $3,748 to the cost of a new multi-section manufactured home (with a national average of $3,109).[20] The reality, however, as calculated by MHARR, with a specific focus on smaller, independent manufacturers, was that the 2016 DOE proposed manufactured housing energy standards would have added a minimum $4,601.00 to the retail price of a new single-section manufactured home,[21] and a minimum of $5,825.00 to the cost of a double-section manufactured home. Consequently, the actual purchase price cost-impact of DOE’s 2016 proposed rule would have been 90% higher than DOE’s estimate for single-section manufactured homes, and 55% higher than DOE’s partial estimate for double-section homes.

Significantly, the same material flaw is incorporated within DOE’s 2021 proposed rule. Thus, according to DOE, its “Tier 2” IECC-2021-based standards would result in a national average $3,914.00 price increase for single-section manufactured homes (again, excluding likely significant costs related to enforcement, testing and regulatory compliance) and a $5,289.00 price increase for double-section manufactured homes. As calculated by HIRL, however, the prorated purchase price impact of the unmodified 2021 IECC, would be $7,958.00 for a single-section manufactured home and $12,928.00 for a double-section home – a full 103% and 144% higher than DOE’s 2021 estimate. Even if the HIRL figures were reduced to correspond to the same differentials illustrated by the 2016 data however (i.e., actual cost impacts 90% higher than DOE-estimated for single-section homes and 55% higher for double-section homes) in order to account for the potential impacts of DOE modifications to the 2021 IECC in the August 26, 2021 proposed rule, the resulting purchase price increases would still be devastating for the affordability-based manufactured housing market, with a $7,436.00 average retail price increase for single-section homes and a $8,197.00 average retail price increase for double-section manufactured homes. These higher amounts, moreover, under DOE’s own analysis, would impact at least 75% of all manufactured homes produced annually under DOE’s “tiered” approach and, obviously, 100% of all manufactured homes under the un-tiered, “Tier 2-only” approach.[22]

- DOE’S COST ANALYSIS FAILS TO CONSIDER THE PRICE

IMPACT OF ONGOING REGULATORY COMPLIANCE COSTS

DOE’s August 26, 2021 SNPR asserts that proposed manufactured housing energy conservation standards will result in net “life-cycle” operating cost savings to manufactured housing purchasers that would offset and exceed projected purchase price increases attributable to the proposed standards.[23]The findings of DOE’s cost analysis are necessarily flawed, skewed and materially inaccurate, however, in that they do not reflect, consider or account for key cost information. As a result, the claimed benefits of the proposed rule are netted against incomplete and/or inaccurate cost data, thereby yielding alleged “payback” amounts and timeframes that are distorted and biased in favor of the proposed rule. This distortion includes several aspects, which are addressed in this and subsequent sections, below.

Most significantly, the DOE cost-benefit analysis fails to include or consider significant additional costs that will be incurred by manufacturers – and inevitably passed to consumers in the purchase price of new manufactured homes – for: (1) testing, certification, inspections and other related activities to ensure compliance with any new DOE standards; (2) enforcement compliance and activity; and (3) ongoing regulatory compliance. Although such expenses are – and are recognized as — an integral component of the ultimate consumer-level cost of any mandatory rule, they are totally excluded from DOE’s cost-benefit and life-cycle cost (LCC) analyses in this rulemaking.[24] Those analyses, as a result, are skewed toward greater alleged benefits from the proposed rule and shorter consumer LCC “payback” times than would be the case if all applicable costs were included and considered. Indeed, as it stands now, under DOE’s fundamentally flawed and incomplete LCC analysis, the projected consumer “payback” period – i.e. 10.9 years for a single-section home and 10.6 years for a multi-section home under “Tier 2”[25] — is already longer than many consumers will live in a new manufactured home.[26] The addition of testing, enforcement and regulatory compliance costs (and other additional uncaptured costs set forth below), would extend that payback period even longer, meaning that even fewer homebuyers (i.e., those not excluded from the market altogether due to prohibitive purchase price increases attributable to the proposed rule) will ever recapture purchase price increases necessitated by the proposed rule.

This deceitful bifurcation of direct standards-generated costs on the one hand and testing, enforcement and regulatory compliance costs on the other – notwithstanding the fact that all such costs, as well as further costs for compliance with existing HUD Procedural and Enforcement Regulations,[27] will represent additional consumer-level costs under any final DOE rule – began during the sham “negotiated rulemaking” process, where DOE, via its “Designated Federal Official,” barred discussion or consideration of any aspect of enforcement or regulatory compliance, or their associated costs. The absurd and misleading bifurcation was continued in DOE’s initial June 17, 2016 NPR,[28] and is now incorporated in the 2021 SNPR.[29] The intentional omission of such cost data, however, represents an admission by DOE that its cost-benefit analysis and LCC “calculations” are necessarily inaccurate, incomplete and not reflective of the true and complete costs of the proposed rule.

DOE’s consumer-level cost-benefit analysis, therefore, compares “apples to oranges,” netting out all conceivable “savings” against only part of the costs that will be added to the price of the home. As a result, there is no basis, whatsoever, for DOE to conclude – in connection with this rule — that consumer benefits exceed costs, because the full costs of the proposed standards are not known and cannot be known until DOE, at a minimum, settles on a compliance and enforcement system, which – it admits – has not occurred. Nor can a cost-recovery period be accurately calculated because costs — again – are not known and not fully quantified as of now, and cannot even be accurately estimated with so many unknowns. Indeed, the attempt to pass this off as any kind of legitimate cost-benefit analysis is itself disingenuous. Therefore, DOE’s analyses are neither credible nor legitimate and, per se, cannot be – and are not – sufficient to satisfy the substantive cost-benefit directive of EISA section 413, the 1974 Act as amended, or the “arbitrary, capricious or abuse of discretion” standard of the APA.

- DOE’S COST “ANALYSIS” IS DEFECTIVE IN THAT IT FAILS CONSIDER THE IMPACT OF SUBSEQUENT IECC CHANGES

By requiring DOE to constantly update manufactured housing standards to keep pace with the “latest version” of the IECC – which is revised every three years without regard to cost-benefit — EISA not only discriminates against manufactured homebuyers vis-à-vis other types of homes regulated under earlier, less stringent and less costly versions of the IECC,[30] but also adds an element of ongoing regulatory uncertainty that will further increase manufacturer compliance costs and the cost of manufactured homes to potential consumers that are not captured within DOE’s NOPR cost-benefit analysis.

The significant negative impact of ongoing regulatory uncertainty within regulated industries – and, in particular, on regulated industry participants, such as manufactured housing producers – has been addressed extensively by economists, with studies showing that regulatory uncertainty has a pronounced negative impact on investment, growth, and competitiveness, resulting in both consumer, industry and national-level costs that are not addressed, considered or reflected in DOE’s cost-benefit analysis.[31]

These negative impacts, that are not addressed, considered, or accounted-for in the August 26, 2021 SNOPR,[32] will not only increase the cost of manufactured housing beyond the amounts projected by DOE – thereby extending DOE-estimated LCC cost-payback timeframes that already exceed the period that significant numbers of manufactured homeowners will remain in their homes – they will also: (1) increase the numbers of lower and moderate-income Americans excluded from the manufactured housing market and homeownership altogether; and (2) reduce the availability of affordable manufactured housing, contrary to the mandate and purposes of existing federal manufactured housing law. The failure to consider such ongoing impacts further demonstrates that DOE’s proposed action is arbitrary , capricious and not otherwise in accordance with applicable law.

- DOE’S COST ANALYSIS FAILS TO CONSIDER THE PROPOSED

RULE’S DISPROPORTIONATE IMPACT ON SMALL BUSINESSES

While DOE acknowledges that its proposed rule would have a significant negative impact on the manufactured housing industry – an industry that has seen production contract by 75% since 1998,[33] with corresponding reductions in the number of producers – its cost analysis fails to fully or properly quantify the likely anti-competitive effects of its proposed rule and the resulting highly-negative impacts on industry small businesses and consumers.

DOE alleges in its August 26, 2021 SNPR that its proposed two-tier proposed rule would result in a decline in “industry net present value” of $276 million to $325 million, while its un-tiered so-called “alternative” proposal would result in a reduction of $340 million to 390 million.[34] This “calculation,” however, using a government “regulatory impact” model with data inputs provided by DOE,[35]would necessarily be skewed significantly lower by DOE’s reliance on unrealistically low IECC regulatory cost impacts — as demonstrated above and in MHARR’s September 15, 2021 MHCC comments — as well as by DOE’s failure to include significant additional regulatory cost elements (i.e., enforcement, testing and regulatory compliance costs and the costs of constantly more stringent IECC standards, as detailed above) in its SNPR cost analysis. Thus, for example, DOE’s purchase price impact data under “Tier 2” indicates a consumer level “national” price increase of $3,914.00 for a single-section home and $5,289.00 for a double-section home. These amounts, however, are respectively, some 90% and 55% lower than the modified-case IECC 2021 cost increases (i.e., $7,436.00 and $8,197.00) estimated by MHARR based on the above-described HIRL IECC 2021 cost analysis. Based, again, on the NAHB market exclusion data, purchase price increases of this magnitude would exclude millions more potential purchases than would have been considered by DOE under its GRIM model. Again, therefore, that model would necessarily significantly under-estimate the total impact on manufactured housing industry businesses and, more specifically, the disproportionately negative impact that those cost increases would have on smaller industry businesses.[36]

Over time, moreover, such disproportionate price impacts will result in further consolidation within an industry that – since its major production decline began in 1998 — has already seen a substantial reduction in the number of producing companies and an emerging concentration of the manufactured housing market in the hands of a few large corporate conglomerates.[37]Again, though, DOE’s cost-benefit analysis fails to address, consider or account-for these negative impacts – and their related costs — on consumers, the industry and the nation as a whole. This type of extreme negative economic and societal impact was correctly explained in comments previously submitted to DOE by the Mercatus Center of The George Mason University: “[T]his regulation will disproportionately burden small businesses and benefit large manufacturers. This regulation will become an income transfer scheme as small businesses go out of business competing with large manufacturers, giving large manufacturers access to a larger consumer base and increasing their income. This is an income transfer scheme that will produce unintended consequences, including causing an industry to be dominated by a few large firms.” And, in fact, specific evidence presented by MHARR in its comments on the 2016 DOE proposed manufactured housing energy rule, detailed apparent coordination by DOE with large industry conglomerates regarding more stringent energy standards.[38]

DOE’s August 26, 2021 SNPR, however, fails to – and, in fact, refuses — to address this disproportionate impact issue and its collateral effects on competition, industry consolidation and consumer prices, stating: “Section 413 of EISA does not require consultation with the [Department of Justice] regarding potential anti-competitive effects of a rule, as would be required for an appliance standard rulemaking. As such, DOE did not consult with DOJ regarding potential anticompetitive impacts of the proposed rule.”[39]This statement, however, conveniently mischaracterizes the issue raised by the expected disproportionate impact of the DOE proposed rule. That issue is not the proposed rule’s “anticompetitive impact,” per se, but rather, its ultimate impact on consumer prices within the manufactured housing market, which are rising, and would rise even further – and more rapidly as a matter of basic economics – with fewer independent manufacturers.

Insofar as none of these significant cost impacts and factors are considered by DOE in the cost analysis for the August 26, 2021 proposed rule, that rule is fatally deficient, unsupported by proper and sufficient evidence, and legally unsustainable. Moreover, insofar as DOE has the “affirmative burden of promulgating and explaining a non-arbitrary, non-capricious rule,”[40] DOE’s failure to fully and accurately quantify the effect of its proposed rule on small industry manufacturers is, per se, a fatal defect that should invalidate the August 26, 2021 proposed rule.

C. THE $55,000 DEMARCATION BETWEEN DOE’S PROPOSED

“TWO-TIER” STANDARDS IS ARBITRARY AND CAPRICIOUS

DOE’s proposed “two-tier” energy standards system is based on a retail purchase price dividing line between the two tiers, with “Tier 1” comprising homes with a retail purchase price up to $55,000.00 and “Tier 2” comprised of manufactured homes with a purchase price in excess of $55,000.00. This proposed demarcation between the two “tiers,” however, is arbitrary, capricious and not based in fact, and, indeed, is becoming more arbitrary by the day.

First, the $55,000.00 demarcation, as proposed, is not tied to any discernable relevant statistic, data or fact. While the “average” sales price of a single-section manufactured home was $53,200.00 in 2019 according to U.S. Census Bureau data,[41]that average price rose to $57,300.00 in 2020 and, at the same rate of growth, would be $61,712.00 today.[42]Thus, while DOE’s $55,000.00 demarcation line, in 2019, would have left the “average” single-section manufactured home within its proposed (and supposedly less-costly) “Tier1” energy standards, that same demarcation line, with “average” price increases in both 2020 and 2021 (estimated), would place the “average” single-section home within the much more costly “Tier 2” standards. More specifically, while DOE, as noted above, estimates in its August 26, 2021 SNPR that the $55,000.00 demarcation point would place 25% of all manufactured homes within “Tier 1,” the rate of increase of the “average” cost of a manufactured home in 2020 and 2021 would inevitably reduce that figure well below 25%[43]— and likely below 20% — with correspondingly more severe negative impacts on the manufactured housing market and home ownership in the United States.

Second, all manufactured housing is deemed “affordable housing” under federal law and is specifically protected as “affordable housing” under the 1974 Act as amended. Further, as shown by Consumer Financial Protection Bureau data, the overwhelming majority of manufactured housing is purchased by lower, moderate and fixed-income purchasers. Consequently, a rule that would reserve its only allegedly “affordable” treatment for less than 20% of the total market – a number that would inevitably be further eroded over time based on cost increases paid by manufacturers for construction materials, increased transportation costs and increases in the stringency of the IECC standards – would: (1) violate existing federal law; (2) devastate the manufactured housing market; (3) exclude significant additional numbers of Americans from the benefits of homeownership; and (4) unlawfully discriminate against manufactured housing and manufactured housing consumers.

As a result, DOE’s proposed “two-tiered” standards system would not protect the affordability of manufactured housing or its availability to lower and moderate-income consumers as DOE maintains and is inherently arbitrary and capricious. Accordingly, DOE’s August 26, 2021 proposed rule, which relies on this arbitrary demarcation, should be rejected by the MHCC. DOE, moreover, at a minimum, should either: (1) increase its “Tier 1” versus “Tier 2” demarcation line substantially; (2) select another legitimate, technically-practicable demarcation mechanism (other than purchase price) that does not exclude the overwhelming majority of the HUD Code market; or (3) develop an un-tiered proposed standard that would legitimately ensure the continuing purchase price affordability of all manufactured housing.

D. THE PROPOSED STANDARDS ARE TECHNICALLY INFEASIBLE

In addition to the foregoing cost-related issues, there are aspects of the DOE proposed standards that have been flagged by MHARR manufacturers as being technically or practically infeasible and/or erroneous. These include, but are not limited to:

- Re-design of trusses, with corresponding cost increases;

- Increased heel heights resulting in increased shipping height of the home, with transportation costs;

- Changes to in-plant assembly procedures, with corresponding costs;

- Changes to other production processes, with corresponding costs;

- Changes in installation parameters, with corresponding costs.

All of these – and other — issues will be further addressed in MHARR’s third set of MHCC comments.

- CONCLUSION

For all the foregoing reasons, as well as those set forth in MHARR’s initial September 15, 2021 comments, and those that will be further delineated in MHARR’s third and final set of MHCC comments, the MHCC should reject the proposed manufactured housing energy standards set forth in DOE’s August 26, 2021 SNPR as being inappropriate for manufactured housing, excessively costly in violation of applicable law, destructive of the affordable manufactured housing market, not cost-justified, and fundamentally arbitrary, and should submit comments reflecting that rejection (and its bases) to DOE in advance of the existing (or any extended) comment deadline.

Sincerely,

Mark Weiss

President and CEO

cc: Hon. Jennifer Granholm

Hon. Marcia Fudge

Hon. Shalanda Young (OMB)

HUD Code Industry Producers, retailers and Communities

Footnotes:

[1] MHARR’s September 15, 2021 comments are hereby incorporated herein by reference.

[2] See, 86 Federal Register, No. 163 (August 26, 2021) “Energy Conservation Standards for Manufactured Housing,” p. 47744, at p. 47754, col. 3: “DOE notes that the IECC is designed for building structures that have a permanent foundation. Manufactured housing structures, however, are not built on permanent foundations but are built on a steel chassis to enable them to be moved or towed when needed. As a result, because they present their own set of unique considerations that the IECC was not intended to address, some aspects of the IECC are unable, or highly impractical, to be applied to manufactured housing.” (Emphasis added).

[3] See e.g., 42 U.S.C. 5403(e)(4): “The consensus committee … and the Secretary, in establishing standards … under this section shall – consider the probable effect of such standard on the cost of the manufactured home to the public.” (Emphasis added).

[4] See, MHARR August 8, 2016 written comments to DOE (2016 DOE Comments), at p. 15, note 42.

[5] Industry-standard builder and retailer profit margins were calculated as multiples of 2.0 and 1.4 by MHARR, based on input from smaller, independent producers.

[6] See, Attachment 4 to MHARR’s September 15, 2021 MHCC comments.

[7] See, HIRL Report at p. 14.

[8] I.e., for a single-section home: $6,548.00/2,500 square feet = $2.619 per square foot x 1,085 square feet (for an “average” single-section manufactured home) = $2,842.00 x 2 (builder profit) = $5,684.00 x 1.4 (retailer profit) = $7,958.00 retail level price increase. For a double section home: $6,548.00/2500 square feet = $2.619 per square foot x 1,760 square feet (for an “average” double-section manufactured home) = $4,610.00 x 2 (builder profit) = $9,220.00 x 1.4 (retailer profit) = $12,908.00 retail level price increase.

[9] The absence of a purchase price affordability mandate for the IECC is reflected in its Statement of Intent (R-101.3) (2021), which provides: “This Code shall regulate the design and construction of buildings for the effective use and conservation of energy over the useful life of each building. This code is intended to provide flexibility to permit the use of innovative approaches and techniques to achieve this objective. This code is not intended to abridge safety, health, or environmental requirements contained in other applicable codes or ordinances.” (Emphasis added).

[10] Under the IECC “governmental consensus” process, final votes on proposed changes and additions were cast exclusively by ICC-approved state and/or local government officials (i.e., other interest groups had no say whatsoever, in the final provisions of the code). In a February 2, 2021 letter to Congress, ICC explained the IECC process as follows: “[V]olunteer government officials with experience and expertise exercise by far the most control in the process. Volunteer [state and local] government officials have the final vote on any proposed code change.” (Emphasis added). Thus, while industry and consumer stakeholders could participate in the IECC committee process, they had no vote at all on the final code.

[11] See, 42 U.S.C. 5403(a)(3)(B)(i).

[12] See, International Code Council, “Path Forward on Energy and Sustainability to Confront a Changing Climate.” (2021), attached hereto as Attachment 1.

[13] See, IECC adoption chart, attached hereto as Attachment 2. As a result, under the August 26, 2021 DOE proposed rule, manufactured homes with a list retail price over $55,000.00 would be built to stricter and much more costly energy standards than million dollar-plus site-built homes located anywhere.

[14] The same local governments that have controlled the IECC, have – for years – used zoning ordinances, which they exclusively control, to either discriminatorily exclude or restrict the placement and use of manufactured homes.

[15] See, Attachment 1, supra. According to state energy code adoption data maintained by DOE, seven states do not have any type of statewide energy code, and another 30 states have adopted the 2009 (or earlier) version of the IECC. See, Attachment 2, hereto. Requiring manufactured homes to comply with a 2021 IECC that, according to ICC itself, is 40% more stringent than the 2009 IECC and only 10% below net-zero energy for residential buildings, not only imposes drastic, costly and market-destructive mandates on manufactured housing, but also discriminates against manufactured homes (comprising just 6% of the nation’s housing stock), manufactured housing consumers and manufactured housing industry businesses.

[16] For example, the 2024 IECC residential committee has no manufactured housing small business representatives but does include a “Senior Energy Policy Advocate” from the Natural Resources Defense Council (NRDC) an extremist “environmental” group. It also includes a representative from Clayton Homes, Inc. the largest manufactured housing corporate conglomerate, owned by Berkshire Hathaway Corp. (which also, coincidentally, also owns Johns Manville Corp., a major insulation producer).

[17] Id. Indeed, in March 2021 “Frequently Asked Questions” published by ICC with respect to changes implemented for the 2024 IECC cycle, ICC states: “The 2021 IECC will be the starting point for revisions for the 2024 IECC. The 2021 IECC base efficiency requirements are only 10% from net zero for residential buildings; the new framework requires future IECC editions to increase base efficiency requirements….” (Emphasis added).

[18] See, 5 U.S.C. 706(2)(a): “[A] reviewing court shall — hold unlawful and set aside agency action, findings, and conclusions found to be … arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law.” See also, Department of Homeland Security v. Regents of the University of California, 591 U.S. ___, 140 S. Ct. 1891 (2020) regarding application of the “arbitrary, capricious, or abuse of discretion” standard.

[19] See, 86 Federal Register, supra at p. 47746, stating that “both” proposed 2021 DOE manufactured housing energy standards (i.e., “Tier 1” and “Tier 2”), “replace DOE’s June 2016 proposal.”

[20] See, 81 Federal Register, No. 117, (June 17, 2016) “Energy Conservation Standards for Manufactured Housing” at p. 39757.

[21] Not including enforcement, testing and regulatory compliance costs which were not estimated by DOE in 2016 and still have not been quantified.

[22] See, 86 Federal Register, supra at p. 47760, col.2: “Using this [$55,000] threshold, Tier 1 consists of approximately 25 percent of the total sales (single-section and multi-section) of manufactured homes. Tier 2 consists of approximately 75 percent of the sales total (single-section and multi-section) of manufactured homes.” These percentages, however, as is demonstrated in MHARR’s September 15, 2021 MHCC comments, are based on outdated U.S. Census Bureau information. The most recent (2020) U.S. Census Bureau data, shows that the average sales price of a single-section manufactured home has increased to $57,300 (see, Attachment 5 to MHARR’s September 15, 2021 MHCC comments) and, today, is likely even higher, given subsequent and continuing increases in the cost of construction materials. As a result, even under a “tiered” standards system, fewer than the previously-estimated 25% of manufactured homes would fall under Tier 1, and more than the previously-estimated 75% would fall under Tier 2, necessarily resulting in greater levels of market exclusion that claimed by DOE.

[23] See e.g., 86 Federal Register, supra at p. 47746, col. 3: “… DOE tentatively estimates that benefits to manufactured homeowners – in terms of lifecycle cost (‘LCC’) savings and energy cost savings of the requirements as proposed in both proposals [i.e., “Tier 1” and “Tier 2”] – could outweigh the potential increase in home price for manufactured homes.” (Emphasis added). This phraseology is somewhat remarkable in its failure to state a firm, specific and evidence-supported conclusion regarding the supposed cost-benefit justification for the proposed rule.

[24] Id. at p. 47759, col. 1: “DOE is not proposing any testing, compliance or enforcement provisions at this time. DOE has also not included any potential associated costs of testing, compliance or enforcement.”

[25] These periods are, as noted above, already materially skewed and too short because DOE’s analysis underestimates the purchase price impact of the substantive standards themselves. A larger increase in a home’s purchase price necessarily results in a longer “payback” period.

[26] See, 86 Federal Register, supra at p. 47747, Table 1.4. While the same table indicates a “simple payback period” of 3.7 years under “Tier1” for a single-section home, and 3.5 years for a double-section home, these figures are misleading in themselves, in that: (1) the final DOE rule, as DOE admits in its SNPR, may impose the “Tier 2” standards alone – without any “Tier 1;” and (2) few if any double-section homes will qualify for “Tier 1” treatment in any event, if DOE maintains its current proposed $55,000.00 retail purchase price demarcation.

[27] See, 24 C.F.R. 3282.1, et seq. describing HUD’s manufactured housing inspection, monitoring and enforcement program. Regardless of whether energy standards developed by DOE pursuant to EISA section 413 are enforced by DOE or HUD, or some combination of both, the changes to HUD-regulated homes that will be required by the proposed DOE standards will result in separate and additional compliance costs under the Part 3282 regulations. These inevitable additional costs will include, but will not be limited to, costs for the re-design of homes; costs for the approval and certification of such new or modified designs; costs for new or additional materials needed to support the inclusion of energy efficiency measures required by the proposed rule; and costs related to the certification and approval of such materials, among others. Nor does DOE’s analysis consider the cost impact of compliance with HUD’s lifetime home recall provisions – Part 3282, Subpart I — which would be significant if HUD adopts the DOE standards as part of the HUD Code.

[28] See, 81 Federal Register, No. 117, supra at p. 39783, stating: “DOE is not considering compliance and enforcement in this proposed rule…. As a result, the costs … resulting from any compliance and enforcement mechanism are not included in the economic impact analysis that is included in this rulemaking.” (Emphasis added).

[29] See e.g., 86 Federal Register at p. 47759, col.1: “DOE acknowledges that it has not fully enumerated testing and enforcement costs at this time.”

[30] See, Note 14, supra and Attachment 1, hereto.

[31] See, e.g., “The Impact of Regulation on Investment and the U.S. Economy,” The Mercatus Center, The George Mason University, at pp. 3-4. (“ [I]nvestment may be temporarily withheld when there is uncertainty about the size and scope of new regulatory initiatives. This is particularly true for investments that cannot be easily reversed — i.e., reselling capital for its purchase price. Investment in new capital is inevitably accompanied by the hiring of new labor. For firms that must rely on a constant source of financial capital — i.e., smaller firms, one current source of uncertainty is how the new financial rules will affect their abilities to borrow. About 1/3 of small firms rely on regular borrowing to finance capital. *** Two types of uncertainty can affect decisions by firms to invest: (a) uncertainty about demand for their products demand uncertainty and (b) uncertainty about factor costs — labor and capital – [i.e.,] factor uncertainty. Major regulations—such as those recently authorized regarding financial services, health care, or greenhouse gas rules—can affect both demand and factor uncertainty. *** [O]ne key type of factor uncertainty is whether firms will have access to credit in the future. Uncertainty about access to credit has a greater impact on firms, small firms in particular, that need continuous access to credit in order to finance investments.”

[32] Nor was this ongoing regulatory cost factor considered or addressed in the initial DOE June 17, 2016 NOPR.

[33] I.e., 2020 annual production of HUD Code homes was 94,390, as contrasted with 373,143 HUD Code homes produced in 1998, according to HUD data.

[34] See, 86 Federal Register, supra at p. 47807, col. 1.

[35] DOE alleges that its August 26, 2021 SNPR utilized a Government Regulatory Impact Model (GRIM) to assess the industry business impacts of its proposed rule. According to DOE, “the key GRIM inputs are: industry financial metrics, manufacturer production cost estimates, shipments forecasts, conversion costs and manufacturer markups.” See, 86 Federal Register, supra at p. 47805, col.1. DOE fails to specify, however, where it obtained that underlying data, the initial source(s) of that underlying data, and what that raw data showed.

[36] See, U.S. Small Business Administration, “The Impact of Regulatory Costs on Small Firms,” (Nicole V. Crain and W. Mark Crain) September 2010 at p. 8: “[Regulatory] costs per employee thus appear to be at least 36% higher in small firms than in medium-sized and large firms.”

[37] See, “2015 Home Buyers’ Outlook,” The Grissim Guides to Manufactured Homes and Land (“[T]the MH industry contraction during the recession brought with it a lot of bankruptcies, closures, mergers and acquisitions. As a consequence the industry landscape today is markedly different than it was as recently as January 2008 when more than 60 companies nationally were building homes in 195 production facilities around the country. Currently, only 46 active corporations remain, and the number of factory production lines has dropped to 125 (a loss of 70). One upshot of this shake-out is that roughly 68% of the MH industry is now dominated by three major producers and their subsidiaries: Clayton Homes, Inc. (with a market share of 41%), Champion Home Builders, Inc. (15%) and Cavco Industries (12%).”

[38] See, MHARR 2016 DOE Comments, supra at pp. 16-17.

[39] See, 86 Federal Register, supra at p. 47807, col. 3.

[40] See, Small Refiner Lead Phase-Down Task Force v. Environmental Protection Agency, 705 F.2d 506 (D.C. Cir. 1983).

[41] See, Attachment 5 to MHARR’s September 15, 2021 MHCC comments.

[42] The $57,300.00 average sales price in 2020 represented a 7.7% increase over the 2019 average sales price of $53,200. A 7.7% increase over $57,000.00 yields an estimated 2021 average sales price of $61,712.00.

[43] I.e., if the reduction in number of homes with a purchase price below the $55,000.00 demarcation line mirrored the rate of increase in average purchase price (7.7%), then the proportion of homes under the $55,000.00 demarcation line would fall to 17.3% (25% – 7.7%). ##

Additional Information, More MHProNews Facts and Analysis

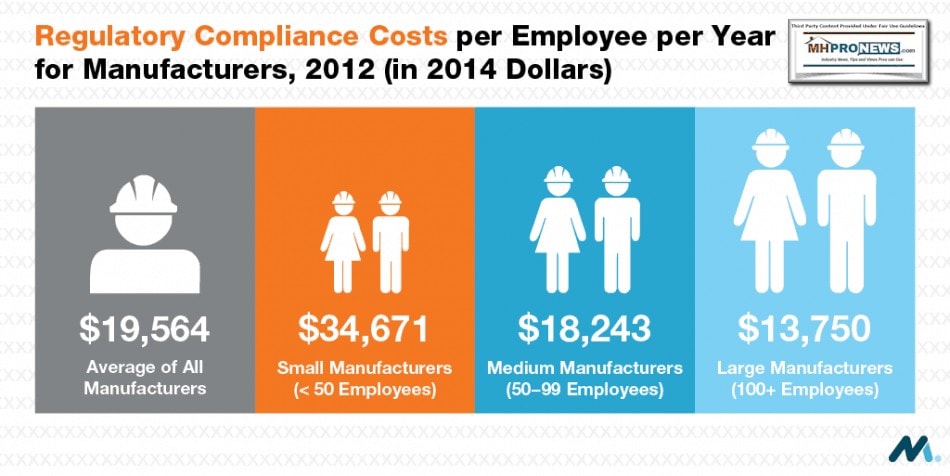

MHARR did not provide this infographic image, but it happens to support their contention that smaller firms, per a manufacturers association, pay more per employee than larger firms for regulatory compliance.

Additionally, author and small business expert/advocate Carol Roth has made similar observation, as has the Jobs Creators Network (JCN), or the National Federation of Independent Business (NFIB).

As has been made clear in our ‘read hot’ new deep dive report on MHI and their stance on enhanced preemption, their methodology is being laid bare. Those insights should be applied to the DOE to see if they apply their too.

When the money-trail is followed on the cause for the DOE energy rule being revived, one finds that money trail leading back to deep pockets on the left, such as Warren Buffett and Michael Bloomberg.

When the evidence is examined, MHARR worked with third-parties to the industry to challenge and stop the last iteration of the DOE energy rule threat. For much of that time, as the report above which cites what MHI said reflected, it becomes clear that MHI had to be defeated by MHARR to protect manufactured housing independents.

The conclusion? MHI is demonstrably not on the side of industry independents. Who says? Marty Lavin, Samuel Strommen, Neal Haney, Doug Ryan, MHARR, and others.

##

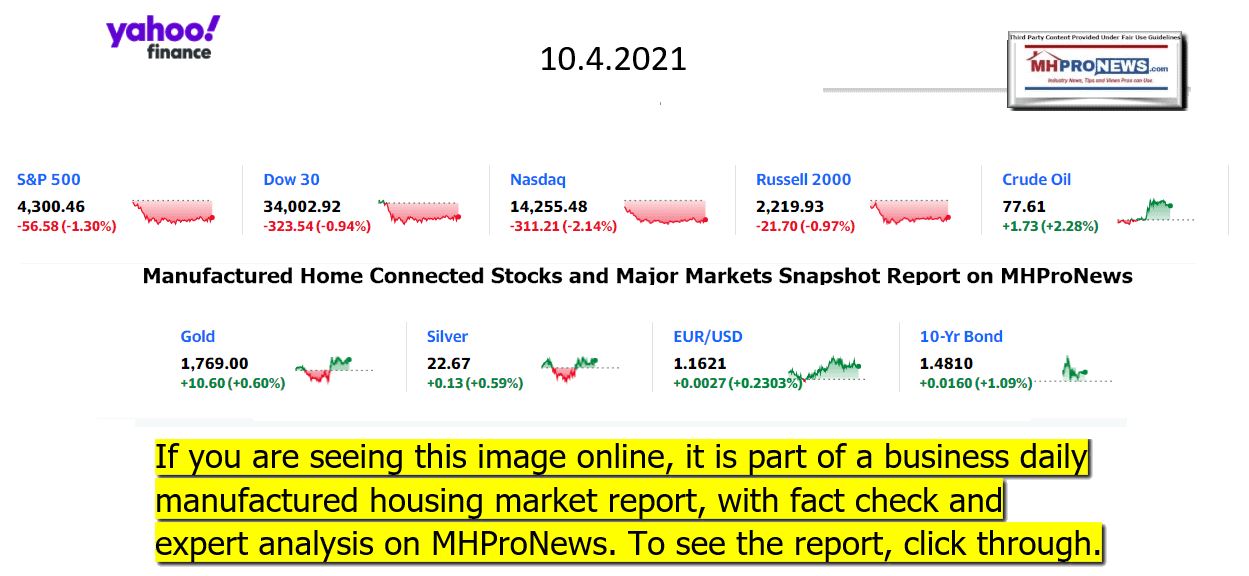

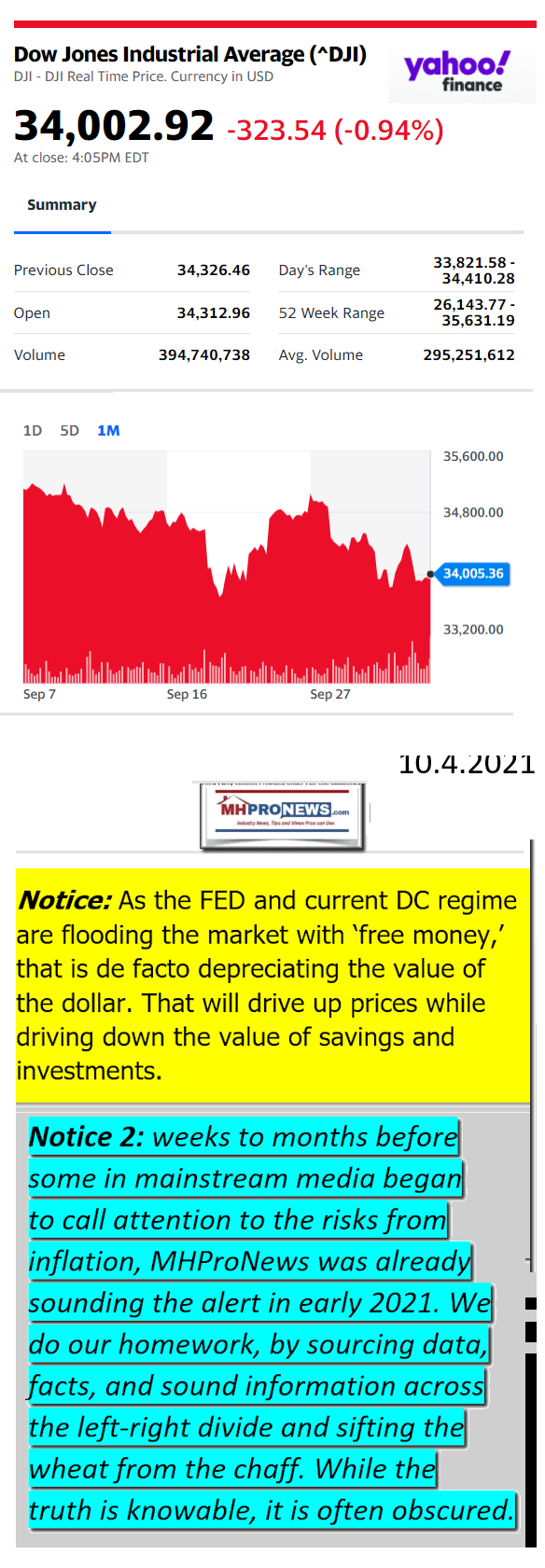

Next up is our business daily recap of yesterday evening’s market report, related left-right headlines, and manufactured housing connected equities.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left (CNN) – Right (Newsmax) Headlines Snapshot. While the layout of this daily business report has been evolving over time, several elements of the basic concepts used previously are still the same. For instance. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market-moving’ news items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business – from the evening of 10.04.2021

- Facebook’s bad week

- Services including Instagram and WhatsApp are down after explosive whistleblower interview

- ‘We need to admit reality,’ says former Facebook exec. Here’s what’s next

- Here are 5 takeaways from the Pandora Papers

- Stocks tumble on inflation and debt ceiling worries

- See who tops this year’s list of Fortune’s Most Powerful Women

- Big Oil is going all-out to fight climate rules in Build Back Better

- This underwater concrete could help marine life, and get stronger at the same time

- There’s no excuse anymore. Here are 3 things companies can do to reduce carbon emissions

- This movement says to help the climate crisis, fix your old iPhone

- This electric car can go 520 miles on a charge but the CEO says that’s not important

- How America ruined Christmas

- Soldiers are delivering fuel in Britain as shortages persist

- Bill Gross is in trouble for tormenting his neighbors with loud music — again

- Why a hand gesture has South Korean companies on edge

- China’s Korean War propaganda movie smashes box office record

- Content by Quicken Loans

- Why You Should Refi ASAP

- Vehicles in a nearly empty lot at a car dealership in Richmond, California, U.S., on July 1, 2021. The global semiconductor shortage that hobbled auto production worldwide this year is leaving showrooms with few models to showcase just as U.S. consumers breaking free of pandemic restrictions are eager for new wheels.

- Car stocks are surging as sales fall. Here’s why

- Oil is shown washed up in Huntington Beach, Calif., Sunday, Oct. 3, 2021. One of the largest oil spills in recent Southern California history fouled popular beaches and killed wildlife while crews scrambled Sunday to contain the crude before it spread further into protected wetlands. At least 126,000 gallons (572,807 liters) of oil spilled into the waters off Orange County, according to a statement from the city of Huntington Beach.

- Here’s who owns the pipeline that caused the Southern California oil spill

- Amazon driver Shawndu Stackhouse delivers packages in Northeast Washington, on April 6, 2021.

- Amazon is starting Black Friday deals early. Like, now

- BILLIONAIRES

- Marc Benioff, Chairman and co-CEO of Salesforce.com, Inc. (Salesforce) speaks during an event in Washington, D.C., on October 18, 2019.

- Tech billionaire: Facebook is what’s wrong with America

- Forget inflation. This investor worries about democracy

- Which billionaire is winning the space race? It depends

- Rihanna is now officially a billionaire

- Abigail Disney has a lot to say about American executives

- REAL ESTATE

- A housing market so hot that a burned-out home listed for $400,000

- So long, pandemic pricing. Rents are skyrocketing

- Black Americans priced out of housing boom

- Goldman Sachs says 750,000 households could be evicted

- Home sales have slowed, but prices are still ludicrous

Headlines from right-of-center Newsmax – evening of 10.04.2021

- Record-High Favorability Numbers for Trump in Iowa Ahead of Rally

- President Donald Trump arrives to speak during the Republican Party of Iowa Annual Dinner at the Ron Pearson Center in West Des Moines, Iowa, two years ago. (Getty Images)

- Newsmax TV

- T. McFarland: China Aims to Intimidate, Not Attack Taiwan | video

- Kash Patel: Durham’s Subpoenas Show He’s Following the Money | video

- Mark Morgan: Supreme Court Showdown Needed About Border | video

- Gordon Chang: US Must Show ‘Real Action’ to Deter China | video

- Jha: School Vaccine Mandates Should Not Be at Federal Level | video

- Missouri AG Schmitt: Mandates About Power, Not Science | video

- Stuart Scheller Sr.: Son’s Imprisonment ‘an Outrage’ | video

- More Newsmax TV

- Newsfront

- Top Vatican Cardinal: Don’t Deny Biden Communion, Eucharist Not a ‘Weapon’

- A top Vatican cardinal says President Joe Biden shouldn’t be denied Communion, pushing back at U.S. bishops who want to withhold the sacrament because of Biden’s support of abortion rights…… [Full Story]

- Record-High Favorability Numbers for Trump in Iowa Ahead of Rally

- Former President Donald Trump heads to Iowa this Saturday for the [Full Story]

- COVID Vaccine Mandate Takes Effect for NYC Teachers, Staff

- A COVID-19 vaccination requirement for teachers and other staff [Full Story]

- Related

- Pence Blasts Biden’s COVID Vaccine Mandate at Oregon GOP Dinner

- DeSantis Says His Wife Casey Has Breast Cancer

- Florida Gov. Ron DeSantis announced Monday that Casey DeSantis, his [Full Story]

- US Trade Rep to Push China on Practices

- S. Trade Representative Katherine Tai on Mondayvowed to press China [Full Story]

- Eco-Terror Attacks Pose Next Threat to Critical Infrastructure

- Calls seeping into the mainstream that encourage environmentalists to [Full Story] | platinum

- Taiwan Scrambles as Dozens of Chinese Aircraft Penetrate Airspace

- Taiwan’s air force scrambled again on Monday to warn away 52 Chinese [Full Story]

- Related

- Gordon Chang to Newsmax: US Must Show ‘Real Action’ to Deter China |

- Taiwan Foreign Minister: We’re Preparing for War With China

- Facebook, WhatsApp, Instagram Suffer Worldwide Outage

- Facebook and its Instagram and WhatsApp platforms were down across [Full Story]

- New York Mourns Irish Pub King Jimmy Neary

- Legendary Irish restaurateur Jimmy Neary, owner of the iconic Neary’s [Full Story]

- Taliban Say Forces Destroy ISIS Cell Hours After Kabul Blast

- Taliban government forces destroyed an Islamic State cell in the [Full Story]

- Star Trek’s Captain Kirk Rocketing Into Space Next Week

- Star Trek’s Captain Kirk is rocketing into space this month – boldly [Full Story]

- Why Netflix’s ‘Squid Game’ Is Such a Sensation

- “Squid Game” has become a massive sensation on Netflix. The [Full Story]

- USPS Introduces Paycheck-Cashing Service in Select Areas

- The U.S. Postal Service began offering paycheck-cashing services at [Full Story]

- Assertive Thomas Asks First Question of Supreme Court Term

- With the opening of the new Supreme Court term on Monday, Justice [Full Story]

- The States Where Americans Don’t Want to Live Anymore

- Sarl Made IN Marketing

- Fauci Tears Up Talking About AIDS Crisis, Calls It PTSD, in New Documentary

- Anthony Fauci – who became both a lightning rod and leading voice [Full Story]

- Mick Jagger Recalls Keith Moon Breaking Into His Motel Room Dressed as Batman

- Rock stars are known for their shenanigans and The Who’s Keith Moon [Full Story]

- McConnell Tells Biden to Raise Debt Ceiling Without GOP

- Senate Minority Leader Mitch McConnell, R-Ky., on Monday sent a [Full Story]

- Newt Gingrich: Infrastructure Bill Held ‘Hostage’ by Progressives

- Former House Speaker Newt Gingrich on Monday morning accused [Full Story]

- Critics Slam Biden’s ‘Zero-Cost’ Claim for Spending Agenda

- President Joe Biden and supporters continue to insist his Build Back [Full Story]

- House Republican: FBI Prosecuting Me on ‘Bogus Charge’

- Jeff Fortenberry, ranking member on the House Appropriations [Full Story]

- Philadelphia Nurse Kills Co-Worker, Wounds 2 Officers in Shootout

- A Philadelphia nurse on Monday shot and killed his co-worker at a [Full Story]

- Pence Blasts Biden’s COVID Vaccine Mandate at Oregon GOP Dinner

- Former Vice President Mike Pence criticized President Joe Biden over [Full Story]

- His Agenda Unraveling, Biden Begs GOP to ‘Get Out of the Way’

- President Joe Biden on Monday told Republican senators to “get out of [Full Story]

- Andrew Yang ‘Breaking Up With Democratic Party’

- The leading voice for the $1,000 a month freedom dividend, Andrew [Full Story]

- Stocks Slammed on Tech Slide; Oil Hits Highest Level Since 2014

- Stocks fell in morning trading Monday as Wall Street comes off its [Full Story]

- US Supreme Court Opens Its Momentous New Term

- S. Supreme Court justices donned their black robes and sat once [Full Story]

- Jha to Newsmax: School Vaccine Mandates Should Not Be at Federal Level

- COVID-19 vaccine mandates in the nation’s schools would be a [Full Story] | video

- Foreign Law Cited in Mississippi Abortion Case Headed to Supreme Court

- Supreme Court justices considered to be conservative have not always [Full Story]

- Poll: Most People in US Favor Afghan Ally Refugees

- Most people in the U.S. want to see Afghans who worked with Americans [Full Story]

- J&J to Seek FDA Authorization of Booster Shot This Week – NYT

- Johnson & Johnson is planning to ask U.S. federal regulators this [Full Story]

- Nobel Prize Honors US Discoveries of Temperature, Touch Receptors

- Two U.S.-based scientists were awarded the Nobel Prize in physiology [Full Story]

- Fighting Diabetes? This Discovery Leaves Doctors Speechless!

- Shoppers Game

- More Newsfront

- Finance

- Japan’s New PM Kishida Vows to Bolster Trade, Security Ties With US

- Japan’s new prime minister, Fumio Kishida, on Monday called a parliamentary election for Oct. 31 and vowed to bolster the country’s response to the coronavirus pandemic, shortly after being formally confirmed by lawmakers in the top job. Kishida, a 64-year-old former… [Full Story]

- TREASURIES-Short-end Yields Spike amid Debt Ceiling Conflict

- Stocks, Dollar Ease on Growth, Inflation Concerns

- Facebook ‘Accountable to No One,’ Whistleblower to Testimony

- GlobalFoundries Reveals Revenue Jump in IPO Filing as Chip Demand Surges

- More Finance

- Health

- Study Highlights Difficulty of Stopping Antidepressants

- A study of British patients with a long history of depression highlights how difficult it can be to stop medication, even for those who feel well enough to try. Slightly more than half the participants who gradually discontinued their antidepressants relapsed within a year…. [Full Story]

- 10 Natural Therapies That Lower Blood Pressure

- Lung Cancer in Nonsmokers: Effective Treatment

- What You Need to Know About the Antiviral Meds for COVID

- J&J to Seek FDA Authorization of Booster Shot This Week – NYT

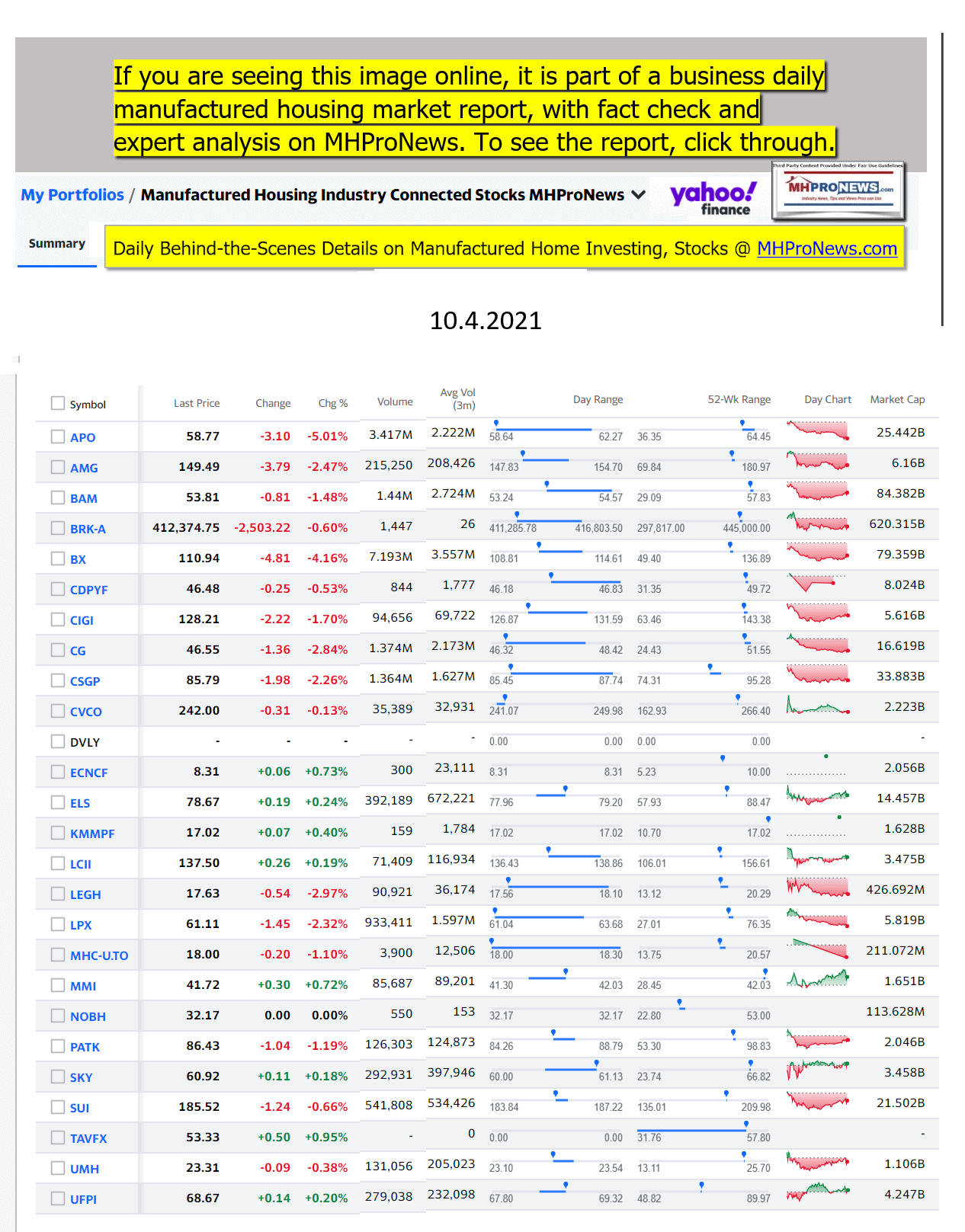

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

As the Summer of 2021 draws to a close…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12th year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.