The following news release was provided by the Washington, D.C. based Manufactured Housing Association for Regulatory Reform (MHARR) to MHProNews. It will be followed by the attached comments letter to the Federal Housing Finance Agency (FHFA) regarding instructions sought to the Government Sponsored Enterprises (GSEs or Enterprises) of Fannie Mae and Freddie Mac. It will be followed by related information and an MHProNews analysis and commentary in brief.

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

MHARR Comments To FHFA Seek Full

Compliance With “DUTY TO SERVE” Mandate

Washington, D.C., August 27, 2020 – The Manufactured Housing Association for Regulatory Reform (MHARR) has filed comments (attached) on a proposed Federal Housing Finance Agency (FHFA) rule concerning regulatory capital requirements for the two Government Sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac. The proposed rule, published in the Federal Register on June 30, 2020 (as reported by MHARR), would establish new capital requirements for the GSEs, focused on their anticipated exit from the FHFA conservatorship that has been in place since September 2008.

As MHARR noted when the proposed rule was published, its primary concern was – and continues to be – focused on the GSEs’ near-total failure, after some twelve years, to fully implement the statutory “Duty to Serve Underserved Markets” (DTS) mandate with respect to mainstream federally-regulated manufactured housing and, more particularly, on: (1) any potential negative impacts of a final FHFA Regulatory Capital rule on future DTS compliance by the Enterprises or, worse yet; (2) a de facto nullification of DTS by a final Regulatory Capital Framework rule.

MHARR is particularly wary of the proposed Regulatory Capital Framework rule and its potential adverse impacts on full, market-significant DTS compliance by the GSEs, based on a number of specific factors. These include the near-total failure of Fannie Mae and Freddie Mac to implement DTS with respect to mainstream, affordable HUD Code manufactured housing over the course of more than a decade, the GSEs’ clear desire to divert DTS support from those mainstream affordable manufactured homes to much more costly “hybrid” homes produced by the industry’s largest corporate conglomerates, and the demonstrated willingness of the GSEs’ erstwhile federal regulators at FHFA to accommodate, overlook, excuse and provide “cover” for that failure with both Congress and the Administration.

Rather than overlooking or serving as cheerleaders for this abject failure, as the industry’s supposed post-production representation has done, MHARR, representing the industry’s smaller businesses, is the only collective industry organization in Washington, D.C. actively seeking to hold both Fannie and Freddie accountable for full compliance with the mandatory DTS law, and to have both those entities and FHFA go back to the proverbial “drawing board” in order to develop approaches and programs for mainstream manufactured housing under DTS that actually work for lower and moderate-income consumers and the industry.

At a time when the overall housing market is experiencing significant growth, the mainstream manufactured housing market continues to be significantly hobbled by baseless zoning discrimination and a lack of fully-competitive consumer financing – especially for the industry’s most affordable homes financed as personal property. This only underscores and enhances DTS’ importance as a crucial remedial measure. As a result, the gamesmanship that has undermined DTS must end and, after 12 wasted years, DTS must be fully and effectively implemented.

As part of its efforts to hold Fannie and Freddie accountable for their failure to comply with DTS, MHARR has recently been engaged in a process with senior FHFA officials designed to provide accurate and factual information showing Fannie Mae and Freddie Macs’ broad defiance of DTS that, over the course of more than a decade, has left well over 90 percent of the mainstream manufactured housing market completely unserved. Meanwhile, both entities, with the support of the industry’s largest conglomerates, persist in trying to twist, distort and alter the DTS mandate by seeking to divert its focus from mainstream, affordable, federally-regulated manufactured housing, to much more costly, non-affordable hybrid type homes.

MHARR thus continues to seek the full, market-significant implementation of DTS as one of its key objectives going forward, and will provide additional information to industry members as developments warrant.

— 30 —

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: manufacturedhousingassociation.org

##

The attached comments letter from MHARR to Alfred Pollard, General Counsel to the FHFA, is as follows.

August 26, 2020

VIA FEDERAL EXPRESS

Hon. Alfred M. Pollard

General Counsel

Federal Housing Finance Agency

Eighth Floor

400 Seventh Street, S.W.

Washington, D.C. 20219

Re: Enterprise Regulatory Capital Framework – RIN 2590-AA95

Dear Mr. Pollard:

The following comments are submitted on behalf of the Manufactured Housing Association for Regulatory Reform (MHARR). MHARR is a Washington, D.C.-based national trade association representing the views and interests of producers of manufactured housing subject to federal regulation by the U.S. Department of Housing and Urban Development (HUD) pursuant to the National Manufactured Housing Construction and Safety Standards Act of 1974 (42 U.S.C. 5401, et seq.) as amended by the Manufactured Housing Improvement Act of 2000. MHARR’s members are primarily smaller businesses, located in all regions of the United States.

Twelve years ago, Congress, pursuant to the remedial “Duty to Serve Underserved Markets” (DTS) mandate incorporated within the Housing and Economic Recovery Act of 2008 (HERA), directed the two Government Sponsored Enterprises (GSEs or Enterprises) – Fannie Mae and Freddie Mac – and the Federal Housing Finance Agency (FHFA), as the GSEs’ federal regulator, to specifically serve, in a market significant manner, three historically “underserved” housing markets, including the market for mainstream, affordable, federally-regulated manufactured housing.

As described by MHARR in previous comments submitted to FHFA, “the DTS mandate represents both a congressional finding that the two Government Sponsored Enterprises … Fannie Mae and Freddie Mac (and by extension FHFA), have not – and still do not — properly serve the manufactured housing market, despite their existing Charter obligations to support home ownership opportunities for very low, low and moderate-income Americans, as well as a remedy, designed to materially increase the participation of the Enterprises in the manufactured housing market. DTS, accordingly, is a mandatory directive to the Enterprises to, among other things: “develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low, low and moderate-income families” (see, 12 U.S.C. 4565(a)). Moreover, to ensure that the term “mortgages” is not misconstrued to limit the scope of DTS to manufactured home real estate “mortgage” loans, the same section of HERA expressly provides that “in determining whether an Enterprise has complied” with DTS, FHFA — as the Enterprises’ regulator – “may consider loans secured by both real and personal property” (i.e., manufactured home-only “chattel loans”) (see, 12 U.S.C. 4565(d) (3)) (emphasis added).[1]

As has been thoroughly documented by MHARR, however, DTS, more than a decade after its enactment, remains an unfulfilled promise for the overwhelming majority of the mainstream HUD Code manufactured housing market and the millions of lower and moderate-income American families who rely upon manufactured homes as the nation’s leading source of inherently affordable, non-subsidized homeownership.[2] Thus, today, the nearly 80 percent of the HUD Code consumer market financed through personal property (i.e., “chattel”) loans, remains completely unserved under DTS, and the manufactured housing real estate market, which comprises a much smaller (and more costly) segment of the overall HUD Code market, has fared little better.

Accordingly, based on FHFA’s own DTS statistics,[3] it appears that only 7 percent – or less – of the existing HUD Code consumer market is being served today under DTS after 12 years of evasion and outright defiance of the congressional DTS mandate by Fannie and Freddie, including a disingenuous effort to shift and divert DTS away from mainstream affordable manufactured housing and mainstream manufactured housing consumers, through the so-called “MH Advantage” and “Choice Home” programs for much more costly, “hybrid” factory-built homes with prices that are double and triple those of mainstream, affordable HUD Code homes.[4] Conversely, some 93 percent of the manufactured housing market – and manufactured housing consumers – remain unserved by the GSEs, notwithstanding Congress’ DTS directive. This blatant failure to implement DTS and establish a fully-competitive secondary market for mainstream manufactured housing consumer loans under DTS, leaves manufactured housing purchasers at the mercy of a relative handful of “portfolio” lenders affiliated with the manufactured housing industry’s largest corporate conglomerates — including Berkshire Hathaway, Inc. subsidiary, Clayton Homes, Inc. — which charge consumers disproportionately higher interest rates. Thus as confirmed by Freddie Mac’s own research, in the absence of GSE support for the manufactured housing consumer lending market pursuant to DTS, “more than 90% of the [manufactured home] personal property loans reported in … 2018” were “higher-cost originations.”[5]

Now, following the GSEs’ long-term (and continuing) failure to implement DTS for HUD Code manufactured housing on anything even approaching a market-significant – or even market-adequate – basis, FHFA, through the rule proposed in the instant docket, is seeking to establish a new regulatory capital framework for the Enterprises. As described by FHFA, the current proposed rule is designed to “establish a post-conservatorship regulatory capital framework that ensures that each Enterprise operates in a safe and sound manner and is positioned to fulfill its statutory mission to provide stability and ongoing assistance to the secondary mortgage market across the economic cycle [and] particularl[y] during periods of financial stress.”[6]

While the proposed Enterprise Regulatory Capital Framework rule, in its current form as published by FHFA, does not specifically reference or take cognizance of the statutory DTS mandate, any final rule adopted through this proceeding should not – and must not – be structured or phrased in such a way as to subvert or impinge upon any aspect of either the DTS mandate or the Enterprises’ ability and obligation to fully and effectively comply with that affirmative statutory directive.[7] Accordingly, any final rule published in this docket by FHFA should:

- Take specific cognizance of the existence of the DTS statutory mandate;

- Take specific cognizance of the binding and mandatory nature of the DTS directive with respect to each and every DTS-identified market;

- Affirmatively provide that the GSEs’ responsibilities and obligations pursuant to DTS are not, will not and must not be altered or affected by the Regulatory Capital Framework;

- Affirmatively provide that, if necessary, full DTS compliance to provide market-significant support for each enumerated DTS market, including mainstream HUD Code manufactured housing, constitutes a statutory exception to — or “carve-out” from — the remainder of the Enterprise Regulatory Capital Framework as proposed; and

- Insofar as it has been proven that the alleged “implementation” of the DTS manufactured housing mandate has primarily benefited the industry’s largest corporate conglomerates, any final rule in this docket should include an affirmative directive requiring Fannie Mae and Freddie Mac to fully comply with the DTS mandate in a market-significant manner with respect to all segments of the mainstream manufactured housing market, including both real estate and chattel-based manufactured home consumer loans.

Accordingly, for all of the foregoing reasons, FHFA must ensure that any final Enterprise Regulatory Capital Framework rule is structured and worded in such a way that the said rule does not subvert or impinge upon – in any way – the GSEs’ separate and severable statutory duty to fully and properly serve the manufactured housing market under DTS in a market-significant manner. Therefore, MHARR asks that FHFA incorporate appropriate and necessary protections (and/or waivers if applicable), as summarized above, for the DTS obligations of the two Enterprises pursuant to the DTS statutory mandate.

Sincerely,

Mark Weiss

President and CEO

cc: Hon. Mark Calabria

Hon. Michael D. Crapo

Hon. Maxine Waters

Hon. Ben Carson

Ms. Sandra Thompson

[1] See, MHARR Comments to FHFA, “Enterprise Duty to Serve Underserved Markets,” RIN 2590-AA27, March 15, 2016.

[2] See, e.g., MHARR comments to FHFA “Proposed Modifications: 2018-2020 Duty to Serve Plans,” November 12, 2019, attached hereto as Attachment 1.

[3] See, FHFA DTS “Dashboard.”

[4] See, MHARR correspondence to FHFA Deputy Director, Sandra Thompson, “Correcting the GSEs’ Noncompliance with the Duty to Serve Mandate for Manufactured Housing,” August 18, 2020, attached hereto as Attachment 2.

[5] See, “Manufactured Home Loan Performance – 2009-2019,” Freddie Mac (2020) at p. 7.

[6] See, 85 Federal Register, No. 126, Proposed Rule – “Enterprise Regulatory Capital Framework,” (June 30, 2020), p. 39274 at p. 39275.

[7] For example, Table 14 of the proposed rule, addressing single-family “risk multipliers,” would continue and seek to falsely legitimate the GSEs’ longstanding discrimination against mainstream manufactured housing consumer loans by assigning even “performing” manufactured housing loans a significant 1.3 “risk multiplier,” and assigning manufactured housing “Non-modified RPLs” and “Modified RPLs” the highest risk multipliers in those categories – i.e., 1.8 and 1.6 respectively. In order to facilitate full compliance with the DTS mandate, these risk multipliers for mainstream manufactured housing should be reassessed and significantly reduced or eliminated – i.e., conformed to the “1 unit” base multiplier of 1.0 in any final rule in this docket. See, 85 Federal Register, supra at p. 39309, Table 14 – “Risk Multipliers.”

###

Additional, Related Information plus MHProNews Analysis and Commentary in Brief

Outsiders looking in as well as manufactured housing industry professionals – particularly independents, non-corporate investors, and affordable housing advocates – have good reason to ask:

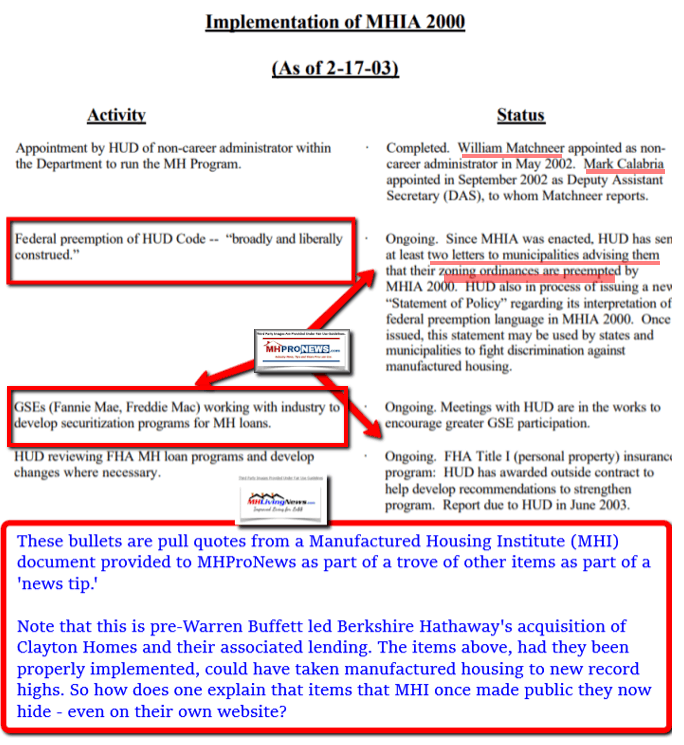

- why isn’t the Manufactured Housing Institute (MHI) and their “affiliates” pressing for the full and proper implementation of the Duty to Serve (DTS) provisions that would provide more competitive and favorable financing for all manufactured homes?

- Why is MHI instead continuing to push for the market-failed support for so-called “CrossModTM” manufactured homes? Those far more costly Clayton Homes and their allies at MHI backed “CrossModTM” have had negligible sales, barely into double digits, per Fannie and Freddie. A source at MHI told MHProNews that there is no visible traction to the program.

If MHI was truly interested in representing “all aspects” of manufactured housing, not just their major corporate supporters, then they would have been pushing along-side MHARR for implementation of DTS.

Additionally, MHI would be pressing along side MHARR as well as for implementation of the Manufactured Housing Improvement Act (MHIA), notably, on topics like zoning and placement.

Instead, MHI postures support, paying lip service to DTS and “enhanced preemption” while de facto working against the industry interests, as MHProNews has previously documented.

Despite the ballyhoo over “MHI 2.0,” what it has arguably proven is purported conflicts of interest and corruption at MHI is worse under Lesli Gooch and Mark Bowersox than it was under Jennison.

Manufactured housing is fighting its own version of the “deep state” in the federal government and within several of the trade associations that are supposed to represent the industry interests. That stands in stark contrast with the tandem efforts that caused the MHIA to be passed into law.

The fact that MHI has purged its site of references to MHARR, when the document above used to be available on the MHI website, is revealing. It goes to the point that MHI has created an illusion that postures efforts that never in fact come to pass. The logic of the facts vs. their claims point to either incompetence, corruption, or some combination of those. They can’t have it both ways.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Warren Buffett Would be Okay With Clayton Homes Losing Money, Says Kevin Clayton – But Why?