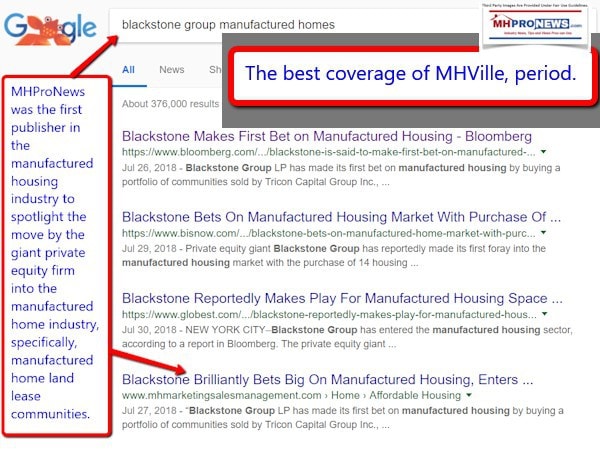

MHProNews led the way in reporting last summer about the entry of the private equity giant – the Blackstone Group, LP – into the manufactured home community space of the industry. We’ve tracked their stock, along with others, ever since in our evening market closing ticker. Blackstone themselves have largely been mum on the topic of their entry into manufactured home communities, across all media. But today, the giant firm made headlines again by landing a $20 billion dollar deal. That will be our focus for this evening.

MHProNews led the way in reporting last summer about the entry of the private equity giant – the Blackstone Group, LP – into the manufactured home community space of the industry. We’ve tracked their stock, along with others, ever since in our evening market closing ticker. Blackstone themselves have largely been mum on the topic of their entry into manufactured home communities, across all media. But today, the giant firm made headlines again by landing a $20 billion dollar deal. That will be our focus for this evening.

If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

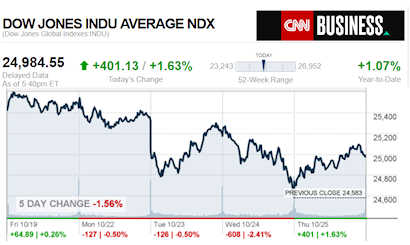

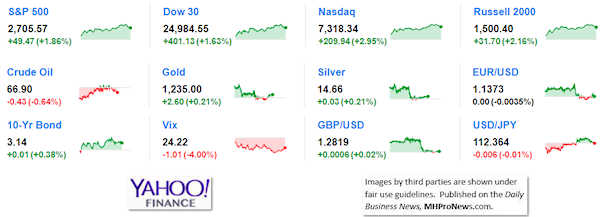

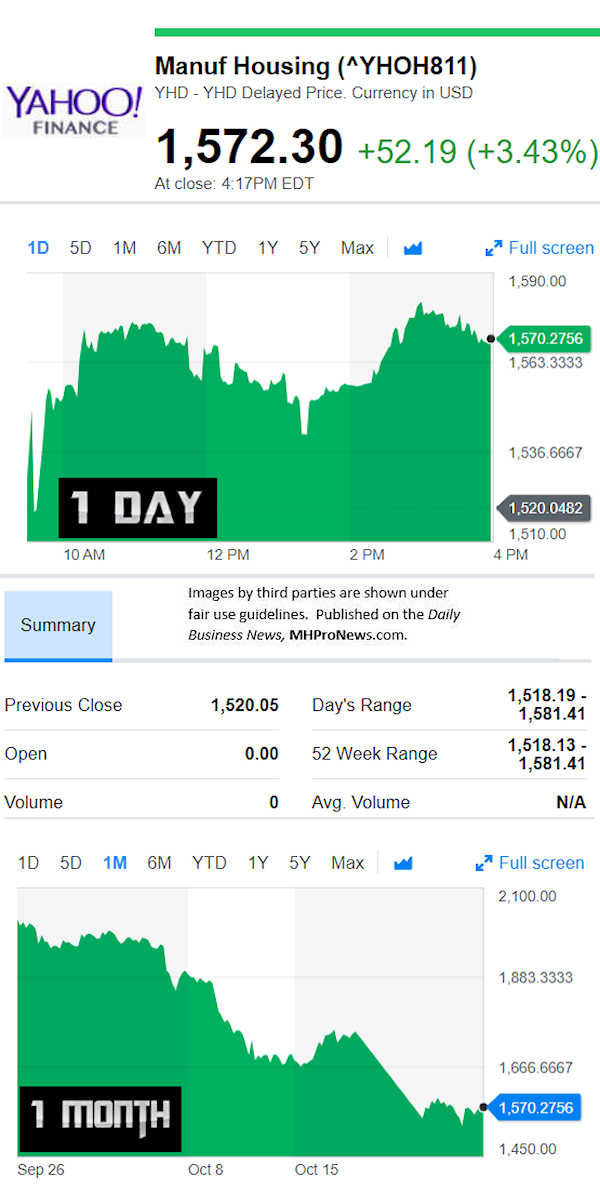

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Sears needs money. And time is running out

- PERSPECTIVES What developing countries can teach America about banking

- Megyn Kelly is negotiating her exit from NBC News

- WWE will hold Saudi Arabia event as planned

- Alphabet misses revenue expectations

- Mattel gets a boost from Barbie

- Snapchat earnings could show more trouble ahead

- Stocks bounce back after a sharp drop Wednesday

- Market may be scary but now is not the time to panic and run away

- What an anti-Ted Cruz meme page says about Facebook’s political ad policy

- Fox Business Network host Lou Dobbs peddles conspiracy theory about mail bombs

- ANALYSIS The president’s attacks on the media have real-life consequences

- American wages go up in the third quarter

- Amazon stock stumbles

- Amazon and Blue Origin founder Jeff Bezos provides the keynote address at the Air Force Association's Annual Air, Space

- It posted a record quarterly profit, but shares slipped 9%

- Walmart’s strategy to solve the Amazon puzzle is working

- eBay sues Amazon, accusing it of poaching sellers

- Who needs brand names? Now Amazon makes the stuff it sells

- Staffing up for the holidays was already tough. Then came Amazon

- Facebook gets maximum fine over its big data scandal. It won’t even notice

- Amazon can sell you stuff. But can it clean your house?

- Twitter is making more money with fewer users

- Microsoft stock climbs on sales jump as market falls

- The Chinese app taking the social media world by storm

- Hershey's chocolate bars are offered for sale on July 16, 2014 in Chicago, Illinois.

- Hershey will raise chocolate prices next year

- Americans sour on drinking mass produced beers

- Dunkin’ is serious about high-end espresso

- McDonald’s adds its first new breakfast sandwich in 5 years

- Walmart and Target are trying to capitalize on Trader Joe’s ‘Two-Buck Chuck’ success

Select Bullets from Fox Business…

- Amazon sinks as revenue growth disappoints

- Stocks rebound over 400 points as tech makes comeback

- Why brick-and-mortar retail may never make a comeback

- California’s $77B bullet train will be an embarrassment: Ellison

- Facebook leadership is ‘lipstick on cancer’: NYU professor

- Democrats are locked into contempt and hate: Varney

- Sears’ bankruptcy may boost Craftsman sales: Stanley Black & Decker

- Despite IRS warnings, taxpayers slow to check withholding

- Widespread food recalls hit Whole Foods, Walmart and Trader Joe’s

- Wells Fargo suspends executives as investigations roll on

- MLB commissioner: White House visit won’t be issue for World Series champs

- Steelers star Le’Veon Bell has forfeited $6M this season. Here’s why

- Tiger Woods, Phil Mickelson $9M match’s PPV price revealed

- The Trump tax cut benefit Americans may have overlooked

- Dow swoons make October most volatile month in 118 years

- White House eyes 3.5% GDP growth in 3Q

- USPS price hikes could cost Amazon this whopping amount

- Tesla to compete against Uber, Lyft, says Elon Musk

- Ford recalls 1.5M vehicles

- Chevy, Ford, Tesla slip in Consumer Reports’ reliability survey

Today’s markets and stocks, at the closing bell…

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

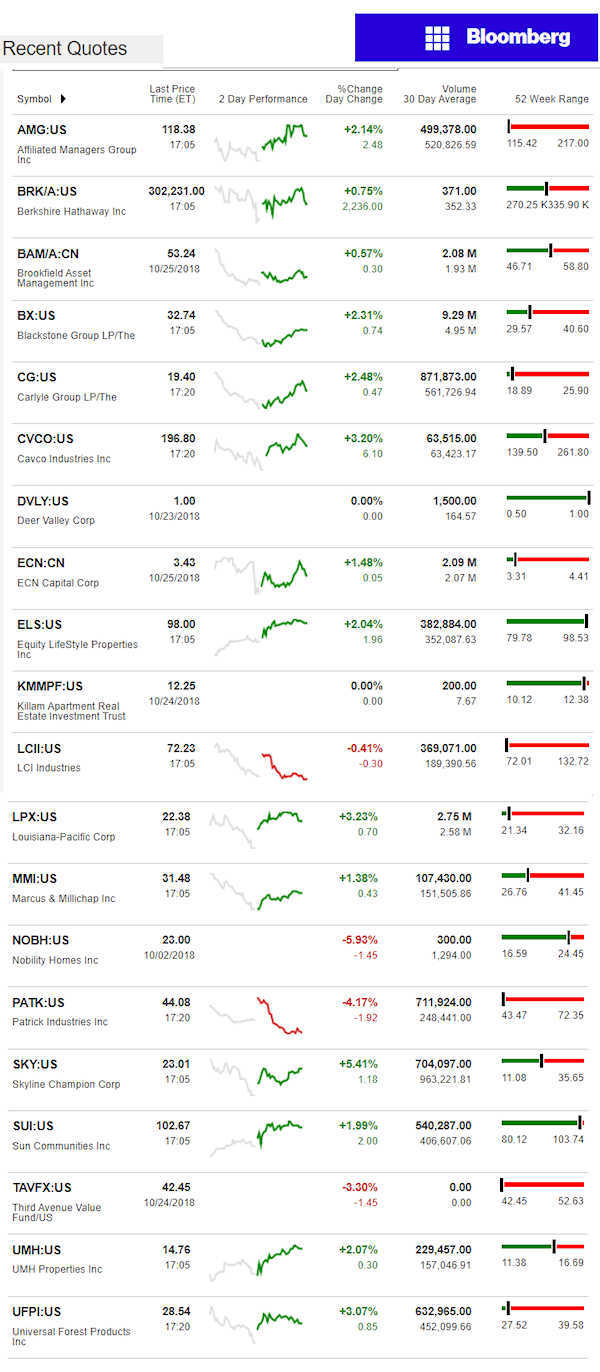

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

The Saudis are the big name in the Blackstone deal, as the two videos from Bloomberg today will highlight.

<iframe src=”https://www.bloomberg.com/api/embed/iframe?id=42d7fc86-e5bb-4def-9eb4-7d68399d9a05″ allowscriptaccess=”always” frameborder=”0″></iframe>

What you learn in part from the first video is that the Saudis have also invested with Softbank.

<iframe src=”https://www.bloomberg.com/api/embed/iframe?id=36411186-20d6-4464-9d42-2616f46afb95″ allowscriptaccess=”always” frameborder=”0″></iframe>

Keep in mind that Softbank has bet big on the U.S. modular builder, Katerra.

Billion Dollar Startup Modular Builder, Using Robotics, Could Soon Rival Clayton Homes’ Total Sales

Softbank is investing billions in other parts of the U.S. economy too.

For whatever reasons, Blackstone has remained relatively mute on the buyout of the Tricon portfolio, that MHProNews first reported last summer.

Blackstone has also been in MHVille news because MHAction has targeted them, among others, for protests.

There are numerous threads at play in these developments. One of them is the higher profile that factory-built homes in general is gaining.

But another is the reality that foreign capital, as MHProNews reported, is flowing into the nation, thanks in large part to the Trump Administrations policies, including the tax cut.

These moves have made the U.S. the hottest economy in the world, per third party research.

While there are increasing indicators that the Republicans will expand control of the Senate, and may hold or even expand their control of the House in the November 6, 2018 midterms, it all comes down to voters turning out and casting their ballots.

The capital to do more in housing, and more in manufactured housing, is coming into the country. The industry could potentially cut itself free from the purportedly numerous ways that Berkshire Hathaway, and their varied political/economic tentacles have limited the industry’s growth.

As political independents, it seems clear that voting on November 6 for Democrats is much like voting for Berkshire Hathaway. Voting for GOP/Republican party members who back the pro-growth POTUS Trump agenda is like voting for more opportunities for independent businesses, and home owners too.

Our publisher walks the talk and went to early voting today. Have you?

Related Reports:

Transparency – What Manufactured Housing Industry Pros Have Proclaimed

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.