Still at number 3 among the metro areas that are interacting with our emailed headlines is Washington, D.C. That has been the steady for recent messages.

Additionally, third-party Webalizer data tells us that ‘hits’ from .gov and .org extensions are in the thousands monthly. As we’ve noted before, MHProNews doesn’t ‘see’ a specific reader, but software detects what sort of device, browser and some ‘generic’ data. Additionally, there are an array of very specific data on the kinds of articles that are the ones generating the most reader interest.

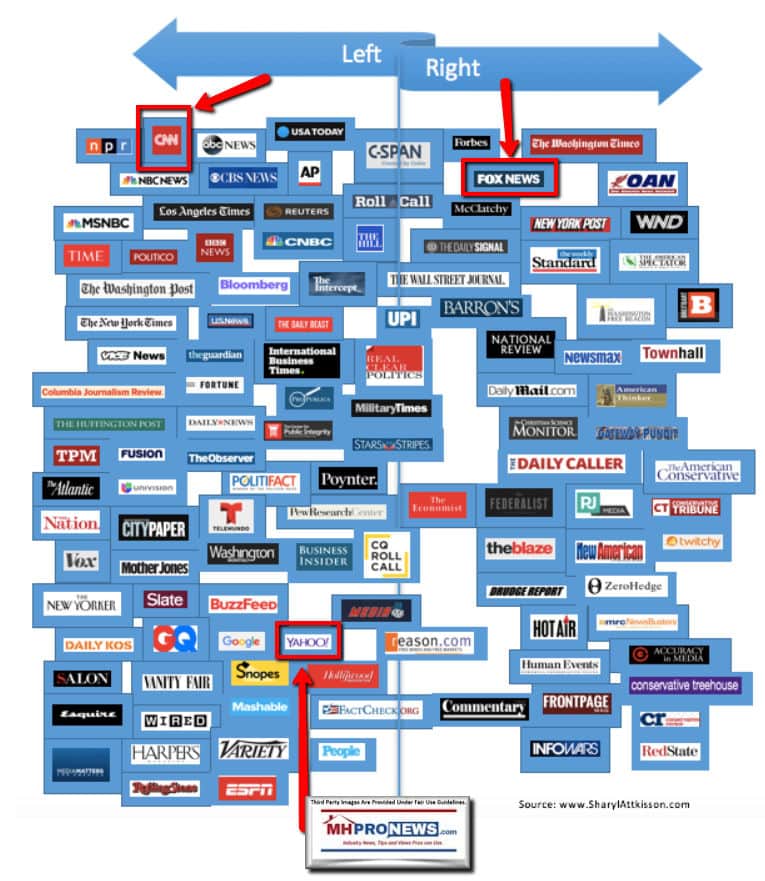

Next, a significant amount of that interest is drawn to items related to reports we’ve published on the behind the scenes items related to the coronavirus pandemic. Our latest report on MHLivingNews on that topic is linked below. While our crystal ball is broken, we have reasons to think that this will get a lot of traffic for some time to come from readers across the left-center-right spectrum. It may be of interest to those who could care less about politics because the focus is on facts, facts, and more facts.

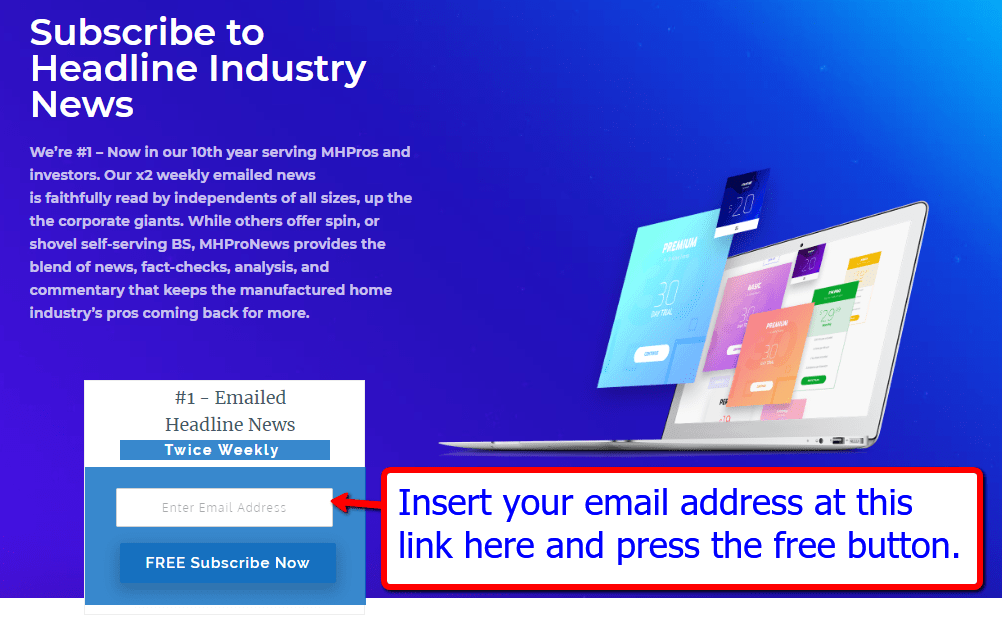

For those who are not yet signed up for our industry-leading headline news, click here. You only need an email address to sign up in seconds. The landing page will look like the screen capture below, and you just insert your email and push enter.

A manufactured home community resident who is a reader of MHLivingNews said the following today with respect to COVID19 and its impact on their lives. Typos are in the original.

However, to date we do not have any indication that anyone has been infected, so that status could change over night. Locally, some barbershops and beauty parlors have opened, which, based on my personal opinion, may become major sources of infection. Many of the older ladies are already flocking to them… Given that my wife is diabetic and 25% of the deaths in the UK were people with diabetes, that makes me a bit nervous.

The worse thing about this virus, from my perspective, is the fact that there is as much as two weeks after exposure before you find out you have it. Yet, you can start infecting others during that time. So, if a barber gets infected, he could end up infecting many others before he gets sick. Worse case scenario would be him being one of those that doesn’t show the symptoms.”

Shifting gears to the management/ownership side of the fence, never count out Frank and Dave in their ability to turn a pandemic into a reason for tuning into their latest pitch.

“If you watch the news it would appear that the world is ending due to Covid-19. But it does not have the same impact across all industries, and even inside the housing niche.” You don’t have to guess much to believe that the bulk of what they will say is going to support their business model, do you?

Which is sufficient to pivot to this evening’s left-right media headline bullets, graphical market snapshots, thought provoking quotes, and the balance of the headlines in our MHProNews ‘featured focus’ segment, further below.

Quotes That Shed Light…

Headlines from left-of-center CNN Business

- Not so fast

- NEW YORK, NY – APRIL 20: The Charging Bull is seen on an empty Wall Street on April 20, 2020 in New York City. United States. U.S. President Trump is looking to get many Americans back to work as soon as possible, but also he recognizes that cities like New York will need to go slow.

- Stocks are signaling a rapid recovery from the coronavirus crisis. Wall Street isn’t so sure

- Stocks snap 3-day winning streak

- Opinion: The entire economy will sink if the government doesn’t bail out states

- EasyJet hackers stole data on 9 million customers

- People are flying again … sort of

- For small businesses, survival may hinge on closing streets

- Home Depot’s expanded worker benefits took a huge bite out of its profit

- Pier 1 wants to close all its stores for good

- What employees need to know about returning to work

- Why big brands are jumping on the face mask bandwagon

- Cyber attacks are increasingly all about financial gain, report says

- Van Jones: Black businesses can still get government help. But they need to act fast

- These folks are working from their cars, and loving it

- Amazon’s latest game could be a ‘Fortnite’ rival

- They’re famous for their investments. But Warren Buffett and Masa Son are striking out

- City landscape in Quincy, Illinois, 1969

- In pictures: The history of JCPenney

- The owner of Peet’s Coffee presses ahead with $2.2 billion IPO

- MARKETS

- WORKING IN A PANDEMIC

- NEW YORK CITY- MAY 12: A restaurant stands empty and closed in a shuttered business district in Brooklyn on May 12, 2020 in New York City. Across America, people are reeling from the loss of jobs and incomes as unemployment soars to historical levels following the COVID-19 outbreak. While some states are beginning to re-open slowly, many business are struggling to find a profit with the news restrictions and a population that is fearful of the contagious virus.

- Restaurant and bar owners say social distancing could wipe out their industry

- These workers are helping GM build ventilators

- How Uber rides are about to change

- All employees face mental health risks now

- Amazon reopens French warehouses after worker dispute

- WHAT WE’RE WATCHING NOW

- Michael Jordan (L) and Chicago Bulls head coach Phil Jackson (R) Most Valuable Player trophy (L) and the Larry O. Brian trophy (R) 14 June after winning game six of the NBA Finals with the Utah Jazz at the Delta Center in Salt Lake City, UT. The Bulls won the game 87-86 to take their sixth NBA championship.

- ‘The Last Dance’ was an unexpected savior for ESPN during coronavirus

- How ESPN is hosting SportsCenter without sports

- Disney streaming chief to become CEO of TikTok

- Disney+ is a blessing and a burden for Disney

- Coronavirus is crushing India’s Bollywood

Headlines from right-of-center Fox Business

- MARKETS

- Johnson & Johnson to discontinue talc-based baby powder amid legal battle over alleged cancer, asbestos links

- Johnson & Johnson said it will discontinue its talc-based baby powder due to dropping demand.

- Stocks reverse course as investors take profits

- CHINA

- Trump may drop the hammer on Chinese stocks trading in the US after rampant fraud accusations

- Ivanka Trump workforce policy group pushes tech boost to help American workers

- Trump signs executive order to cut regulations on biz, boost coronavirus recovery

- MONEY

- McCarthy: PPP loan recipients may get 8-week extension window to use funds

- TECH

- Chinese tech giant accused of fraud by US researchers blames misunderstanding

- OPINION

- Commerce Sec. Ross: 3 reasons why this economy will recover faster than it did in ’08

- COLA CANNED?

- PERSONAL FINANCE

- Coronavirus could wipe out Social Security COLA for 2021

- PRIVATE SECTOR FINAL FRONTIER

- SPACE BUSINESS

- Pence: SpaceX astronaut launch marks ‘new era’ in space exploration

- STEAKS ARE HIGH

- FOOD & DRINKS

- How one of America’s most famous steak houses is adapting to coronavirus

- CALCULATED RISK

- TRAVEL

- Las Vegas casino reveals new safety measures, starts taking reservations

- SLAM DUNK

- NBA

- Michael Jordan memorabilia market surges after smash hit documentary

- ‘THERE WILL BE NOTHING LEFT’

- CORONAVIRUS

- ‘Unlock New Jersey’ calls for reopening of small businesses

- JUMP RIGHT IN

- LIFESTYLE

- Coronavirus lock down has people seeking out this home commodity

- CHINA’S COMPETITION HEATS UP

- APPLE

- Apple’s new headphones may not be made in China

- PODCAST KING

- MEDIA

- Joe Rogan’s podcast to go exclusive to one platform

- ‘WORKING HARDER THAN EVER’

- LIFESTYLE

- Citi CEO slips employees surprise day off

- CLASS ACTION

- LEGAL

- High school seniors demanding graduation ceremony sue governor

- MONEY

- Mom in cheating scheme gets light sentence after serving time in Spain

- REAL ESTATE

- Housing market will rebound from coronavirus: Barbara Corcoran

- LIFESTYLE

- Michigan stay-at-home order threatens to crush vital industry

- MONEY

- Americans support small businesses during coronavirus with online classes, takeout

- MONEY

- Mom in cheating scheme gets light sentence after serving time in Spain

- MARKETS

- Jamie Dimon sounds alarm over coronavirus economic carnage

- Las Vegas hotel, casino operators will benefit from China reopening: Steve Wynn

- LIFESTYLE

- Las Vegas hotel, casino operators will benefit from China reopening: Steve Wynn

- RETAIL

- Pier 1 seeks to wind down operations as pandemic foils search for buyer

- MARKETS

- Landlords fume as Starbucks, other chains seek extended rent cuts

- LIFESTYLE

- Krispy Kreme to give free doughnuts to graduates

- MONEY

- Gamblers drive hours and wait in lines, as casinos reopen amid coronavirus

- CRIME

- Coronavirus pandemic delays Harvey Weinstein’s LA extradition: Report

- ECONOMY

- Kudlow to Bartiromo: Why Beijing won’t sell US debt despite coronavirus feud

- MARKETS

- Nasdaq informs Luckin Coffee it must delist after fraud bombshell

- LIFESTYLE

- Visa CEO may extend coronavirus-initiated work from home through end of year

- PERSONAL FINANCE

- How to retire on time despite virus crisis derailing finances, businesses

- TECHNOLOGY

- Alphabet CEO Sundar Pichai expects to be at 20-30% office capacity by end of year

- LIFESTYLE

- Olive Garden sales rebounding as more dining rooms reopen

- TECH

- AT&T exits Venezuela as US sanctions force it to defy Nicolas Maduro

- MEDIA

- Cuomo avoids tough questions from brother’s network on disastrous policy

- MARKETS

- New company to make coronavirus drugs in US after Trump awards contract

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus – Where Business, Politics and Investing Can Meet

Zacks reported recently on Patrick Industries, among others, as a supplier to various industries including manufactured housing.

UFPI is a supplier to builders in general, including those in manufactured housing. Snapshots from their respective recent reports follow.

…

Companies in this industrial cohort also rent equipment to a diverse customer base that includes construction and industrial companies, manufacturers, utilities, municipalities, homeowners and government entities.

Prominent stocks in this industry are United Rentals, Inc. (URI) and Masco Corporation (MAS).

Let’s take a look at the industry’s three major themes:

- The industry is expected to bear the brunt of the COVID-19 pandemic in the near term. The industry’s prospects are highly correlated with the U.S. housing market condition and repair and remodeling (R&R) activity. Now the bleak near-term prospects of the housing market amid the coronavirus-induced high unemployment and supply-side challenges are eating into the industry participants’ profits. Weak demand for new commercial and residential buildings is anticipated to continue affecting the product pipelines of firms in the industry. Also, shelter-in-place orders and other end-market restrictions have affected many industrial activities, thereby hurting top lines of the industry players.

- Continued volatility in material costs, owing to tariff-related issues, have been a pressing concern. The lingering trade conflict between the United States and China is taking a toll on U.S. business activities and hence margins. Rising labor costs are also compressing margins further. Moreover, the challenging oil and gas market scenario has been affecting demand for the industry players’ services and products.

- Nonetheless, the industry stands to benefit from strong gains from repair and remodeling activity and increased government spending on infrastructure projects. Despite the uncertainties arising from the pandemic, the repair and remodel market has been going strong. Under “working-from-home” or “stay-at-home” orders, consumers are prioritizing home improvement projects which is driving demand. Meanwhile, cost-saving initiatives like business consolidation, system implementations, plant/branch closures, improvement in the global supply chain and headcount reductions are supporting bottom-line growth. The industry participants have also been strategically investing in new products, sales and support services, digitally-enabled solutions and advanced manufacturing capabilities to boost revenues. The companies are also following a systematic acquisition strategy to enhance domestic and international portfolios.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Building Products – Miscellaneous industry is a 27-stock group within the broader Zacks Construction sector. The industry currently carries a Zacks Industry Rank #221, which places it at the bottom 13% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates gloomy near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. Since January 2020, the industry’s earnings estimates for 2020 and 2021 have been revised 39.6% and 30.5%, respectively, downward.

Despite the industry’s dull near-term prospects, we will present a few stocks that one can buy or hold on to. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Outperforms Sector, Lags S&P 500

The Zacks Building Products – Miscellaneous industry has outperformed the broader Zacks Construction sector but lagged the Zacks S&P 500 composite over the past year.

Over this period, the industry has lost 1.9% compared the broader sector’s 9.7% fall. Meanwhile, the Zacks S&P 500 composite has risen 0.7% during the period.

Patrick Industries, Inc. (PATK): This Elkhart, IN-based company manufactures and distributes building products and materials for the recreational vehicle, marine, manufactured housing, and industrial markets in the United States and Canada. This Zacks Rank #5 (Strong Sell) company’s 2020 earnings per share are expected to decline 51.2%.

Price and Consensus: PATK

The UFPI Earnings Call from 5.7.2020 is as follows. UFPI is a supplier to several manufactured home producers.

Q1 2020 Universal Forest Products Inc Earnings Call

GRAND RAPIDS May 7, 2020 (Thomson StreetEvents) — Edited Transcript of Ufp Industries Inc earnings conference call or presentation Thursday, May 7, 2020 at 12:30:00pm GMT

TEXT version of Transcript

================================================================================

Corporate Participants

================================================================================

* Dick Gauthier

UFP Industries, Inc. – VP of Business Outreach

* Matthew Jon Missad

UFP Industries, Inc. – CEO & Director

* Michael Richard Cole

UFP Industries, Inc. – CFO & Treasurer

================================================================================

Conference Call Participants

================================================================================

* Jay McCanless

Wedbush Securities Inc., Research Division – SVP of Equity Research

* Julio Alberto Romero

Sidoti & Company, LLC – Equity Analyst

* Ketan Mamtora

BMO Capital Markets Equity Research – Analyst

* Paul T. Betz

Stifel, Nicolaus & Company, Incorporated, Research Division – Associate

* Reuben Garner

The Benchmark Company, LLC, Research Division – Research Analyst

================================================================================

Presentation

——————————————————————————–

Dick Gauthier, UFP Industries, Inc. – VP of Business Outreach [1]

——————————————————————————–

The first quarter 2020 conference call for UFP Industries. Hosting the call today are CEO, Matt Missad; and CFO, Mike Cole. Matt and Mike will offer prepared remarks, and then the call will be opened up for questions.

This conference call is available simultaneously and in its entirety to all interested investors and news media through our webcast at ufpi.com. A replay will also be available at that website through June 7, 2020.

Before I turn the call over to Matt Missad, let me remind you that the April 22 press release, yesterday’s quarterly filing and today’s presentation include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations and projections. These risks and uncertainties include, but are not limited to, those factors identified in the press release and in the filings with the Securities and Exchange Commission.

Now I would like to turn the call over to Matt Missad.

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [2]

——————————————————————————–

Thank you, Dick, and good morning, everyone. We appreciate you taking the time to listen to our first quarter 2020 investor call. We delayed our normal call due to our desire to try to get more accurate information about the probable impacts of COVID-19 on our 2020 results. While we definitely have more information than we did 2 weeks ago, the picture remains far from clear today. What is clear to me is the strength and experience of our leadership group, the incredible work ethic of all of our team members and a bright future once the virus and its impacts are behind us.

I will briefly review our first quarter and trust that you have already had time to digest the numbers. First, I’d like to congratulate UFP family members who had outstanding performance through mid-March when the responses to COVID began to impact our operations. Our team members produced record net sales, record net profits, and we’re well positioned to continue our growth trajectory. These individuals have worked tirelessly to make sure we have safe working conditions while providing the products and services our customers need.

By market, the retail market saw unit sales growth of 9% in the quarter. Our ProWood branded treated products, UFP-Edge products, which consist of siding, pattern and trim items, and dimensions, which is home and decor products, all had strong double-digit unit sales growth.

Outdoor Essentials, which consists of fence and lawn and garden products had 8% unit sales growth. The Deckorators branded products lagged 2019 unit sales by 14% due to the initial stocking orders of 2019 and the lower inventory positions established by our largest Deckorators customer in 2020, the customer increased the inventory targets after quarter end, and we still expect to achieve our unit sales targets for Deckorators for 2020.

Earnings in retail were up 40%, well in excess of unit sales growth. Overall, retail has been holding strong as an essential business in the current environment. And given some sawmill curtailments, the strong sales have caused product shortages in some items. We expect the sales trends to continue and are grateful for our vendor relationships in times like these, which are a great advantage as we serve our customers.

The construction market saw unit growth of 6% and sales growth of 4%. Concrete forming grew 15%, factory build grew 12%, commercial grew 3%, and site-built was up 1% in unit growth. Earnings were up 12.2%, more than double the unit sales growth. Construction order files remained strong. Since many states delay new starts, we expect the backlog to decline after the economy reopens and anticipate a recovery once new starts catch up.

The industrial segment had flat unit sales in the first quarter. Earnings declined 4% versus 2019 as SG&A cost increases were larger than the gross profit increases. In the new operating structure, the industrial segment will be expected to better leverage their sales teams, their design and engineering teams and their management teams as they grow sales.

The industrial segment experienced COVID impacts in March and saw a decline in customer demand from existing customers at the end of the quarter. International business sales were flat versus 2019. However, profitability improved as the product makes the customer screening improved. The international operations are affected by COVID too, and the sales will be impacted in quarter 2, particularly in Australia.

We continue to push for more and better new products. Our dimensions project panels and our new Outdoor Essentials picnic table are examples of products seeing strong sales growth. New product sales for the quarter were $97.6 million and are in line with our target for the year of $450 million.

The lumber market increased slightly during the quarter as the Random Lengths Composite Index rose 8% from the beginning of the quarter, and the Southern Yellow Pine index rose 5%. As the COVID shutdowns took greater effect in early April, the lumber markets dropped as Random Lengths Composite fell nearly 14%, and Southern Yellow Pine fell over 8%.

Over the last few weeks, both indices have rebounded. Currently, the composite index is a little over 2% above 2019 levels, while Southern Yellow Pine is down a little over 8% from a year ago. Sawmill curtailments and COVID shutdowns have helped the market recover, and we are monitoring the reopening time lines. Our inventory positions are in line with our sales forecast and capital management focus. We do not currently have excess safety stock in most of our product lines.

So with the first quarter in the rearview mirror, what does it look like going forward? Fortunately, most of our business has been deemed essential by the various state governments, and we have been able to operate most of our facilities, albeit at a lower capacity utilization. Our labor force has declined 10% with a combination of temporary labor, temporary layoffs and some permanent layoffs. We hope to be able to bring back all of our employees who are on temporary layoff, assuming they’re willing to come back. Some have already indicated they prefer to stay out until the CARES benefits expire at the end of July.

We have established a variety of contingency plans, which would further rightsize our business in the event additional state and home orders are enacted, existing orders are extended or other restrictions are placed on our ability to operate. Our best guess contemplates a reopening of the majority of the U.S. economy outside the high COVID concentration areas on June 1, 2020. We expect a phased rather than a full opening at that time. Based on what we are seeing through April, we expect the financial impact on our industrial segment will be the greatest, while the retail solutions segment should show the smallest impact.

Looking at end customer impacts in agriculture, durable goods, outdoor equipment and certain OEM furniture manufacturers to give us a good indication of the impacts on our industrial business. At present time, we hope for a full reopening of the economy by August 15. Once businesses are reopened, we expect some modest supply chain impacts as companies begin to rebuild inventories. If these scenarios hold true and we are able to operate within those parameters, our internal modeling shows that we will still generate significant cash flow and net income in 2020, and we will be very well positioned for a full recovery in 2021.

Our models take into account our highly variable cost structure in both our manufacturing operations and SG&A based in part on the alignment of our incentive programs to PBOP and ROI. As you know, we have a very strong balance sheet and have increased our capital availability during the last several weeks. While we keep a logical eye on the financial strength of our customers, we still see several opportunities to execute our strategic plan and continue on our long-term path to improving sales growth, profit growth and shareholder returns.

We still maintain our capital allocation philosophy of returns to shareholders and expenditures for growth, new products and manufacturing efficiency. We are reducing our capital expenditure budget by $20 million as delays in getting equipment, coupled with the opportunity to consolidate existing capacities, will either to defer the spend or eliminate the need for the spend. Yet, we still have an ample pipeline of acquisition opportunities. We are optimistic that some targets within our strategic plan will become available on more favorable terms over the next 12 to 18 months, and our capital availability puts us in a strong position to take advantage of those opportunities.

We continue to pay a modest cash dividend, including the $0.125 per share quarterly dividend payable in June. This amounts to a 25% increase over the dividends paid in the first half of 2019, and we also repurchased shares at a favorable price relative to their recent issuances under our share-based compensation plans.

Some investors look at 2020 as a pause year and look at 2021 as the new base from which to grow. In my almost 42 years with the company, I’ve seen that our teams have not been good at pausing. We do understand that some things are out of our control, so we will focus on the things that we can control. Our efforts will be focused on executing our strategic plan, and we aren’t waiting for 2021 to do that. If the economy waits until 2021 to catch up, so be it, but we are moving forward now.

For those of you weary of having every conversation or broadcast centered on COVID, I want to change topics for a minute and talk about the great non-COVID things that have happened and continue to happen at UFP. We celebrated our 65th birthday as a company in February 2020. Unlike many people that retire at age 65, we decided to go for a rebirth. The shareholders approved our name change to UFP Industries in April. We think the new name more appropriately describes who we are today and where we are headed in the future. More importantly, we reorganized our company to better position our future success. Our reorganization into a market based rather than a geography-based model has gone very well. We anticipate short-term increases in SG&A expense while we drive deeper business unit growth and expertise and believe that these increased investments will yield significant positive results far in excess of the investment amount. While no structure is perfect, we are seeing even more opportunities for improvement than we initially identified.

And now I’d like to turn it over to Mike Cole to review the first quarter financial results.

——————————————————————————–

Michael Richard Cole, UFP Industries, Inc. – CFO & Treasurer [3]

——————————————————————————–

Thanks, Matt. Starting with highlights from the income statement. Overall, net sales for the quarter increased 2%, with a 5% increase in units offset by a 3% decline in selling prices primarily due to lower lumber prices for Southern Yellow Pine. Organic growth was 4% and was driven by an 8% growth rate in our retail segment and 6% growth in our construction segment. Developing new products continue to be a key strategy for growth and margin improvements, and new product sales grew 7% this quarter, an increase of $6.3 million over last year.

Breaking down our sales by segment, sales to the retail segment increased 6%, resulting from a unit increase of 9% offset by a 3% decrease in selling prices. Acquisitions contributed 1% to our unit growth. Our unit growth was strong with big box and independent retail customers, reflecting strong consumer demand.

New product sales for the retail segment were up 9%, but would have been higher if not for an anticipated sales decline of certain Deckorators branded products. If you recall, we faced a tough comparison this year as there were large first-time inventory builds at stores that took place in Q1 last year.

Sales to the industrial segment declined 7%, driven by a drop in prices as unit sales remained flat. Recently acquired companies contributed 2% to unit growth but this was offset by a 2% decline in sales out of existing locations. Sales to new customers contributed to $5 million to our sales this quarter and helped mitigate the decline in demand of our existing customers. We continue to focus on enhancing our product mix to maximize sales of higher margin value-added products, and we’re pleased to have maintained our margin improvements in this segment.

Our sales to the construction segment increased 4% due to a 6% organic unit increase offset by a 2% decline in selling prices. Within this segment, unit sales increased 15% to concrete forming, 12% to factory-built housing, 3% to commercial and 1% to site-built construction. Our strong unit growth of country forming was due to market share gains with existing customers, and our increase in shipments to producers of factory-built homes was due to an increase in industry production.

Moving down the income statement, our first quarter gross profits increased by $13 million or 8%, exceeding our 5% growth in unit sales as our profit per unit improved. The overall gross profit increase was comprised of a $9 million improvement in retail and a $2 million improvement in construction. Our gross margins increased 100 basis points to 16.2% this quarter. We believe 50 basis points of the increase was due to the pass-through impact of lower lumber prices. The remaining 50 basis point improvement was due to a combination of effective inventory positioning, favorable changes in product mix and strong organic growth in our retail segment, which allowed us to leverage fixed costs.

Continuing to move down the income statement, SG&A expenses increased $4 million or 4%, which was less than our 5% increase in unit sales and was better than our internal plan. The dollar increase was primarily due to — $2 million increase in accrued bonus expense to $14 million for the quarter due to our profitability increase, a $1.5 million increase due to acquired businesses and $1.5 million due to compensation-related costs and sales incentives. These increases were offset by decreases in a variety of accounts. We continue to focus on lowering our SG&A as a percentage of gross profit, and we’re pleased to report a drop from 68% last year to 65% this year.

Driven by these positive factors, we’re pleased to report that our operating profits increased by 21% or more than 4x our increase in unit sales. Below the operating profit line, Ardellis, our insurance captive, recorded a $3.2 million unrealized loss and equity investments held in its portfolio in the first 3 months of 2020 compared to a $1.3 million gain in the same period of the prior year. Fortunately, we’re benefiting from the rebound in equity prices in April.

Moving on to our cash flow statement, our operating cash flow this year improved by almost $10 million compared to the same period last year, primarily due to an improvement in earnings and an increase in noncash expenses as our additional investment in net working capital since year-end was comparable in both periods. We measure our cash cycle to assess our working capital management, and for the first quarter it improved to 59 days compared to 65 days last year due to a reduction in our days supply of inventory.

Investing activities primarily consisted of capital expenditures totaling $27 million, including expansionary and efficiency CapEx totaling $10 million. We’ve also spent nearly $19 million on business acquisitions, primarily for quest design and architectural millwork in March. Financing activities consisted of $3 million in net debt repayments, almost $8 million of quarterly dividends and $29 million of share repurchases as we were very active returning capital to shareholders during the quarter.

With respect to our balance sheet, our net debt at the end of March was $131 million compared to $268 million in net debt last year. And we’re pleased to report our total liquidity was $392 million at the end of March, consisting of $32 million in cash and $360 million in availability under our revolving credit facility. At the end of April, our liquidity improved to $433 million, providing us with ample resources to operate our business and take advantage of wise investment opportunities during this challenging time. While we’re very pleased with our Q1 results and the strong performance of our people, we understand your primary interest is in our forward outlook, and we provided some information in our 10-Q we hope is helpful to you. I’ll provide some highlights here.

As you’d expect, the demand of our customers has declined. But fortunately, the vast majority have been deemed to be essential businesses and our plants that serve them are essential as well. As a result, we found it necessary to only close 3 of our 150 operations during this crisis. Given the amount of uncertainty in the economy, and our end markets, we don’t believe we can provide an accurate target for unit sales growth in upcoming quarters. At times like this, we feel the diversity of our business is a strength, and we believe you should consider our key end market indicators when evaluating forecasts of future demand.

With respect to profitability, we’ve analyzed our variable and fixed-cost structure, our current business mix and a variety of other factors to evaluate the impact of a material decline in sales volume on our earnings from operations. Based on our evaluation, we believe our decremental operating margin and a decline in sales is in the low to mid-teens. However, there are a variety of factors that impact this estimate, which are listed in our 10-Q and should be considered.

We’ve reduced our capital expenditure budget to $80 million from $100 million this year as we reevaluate the necessary timing of certain maintenance and expansionary CapEx. Our managers have been diligent in managing receivables and inventory, and we believe we can maintain a cash cycle consistent with historical performance. When considering all of these factors, we’re confident we can maintain our strong liquidity position during this challenging time and continue to position UFP for continued success in the future.

That’s all I have on the financials. Matt?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [4]

——————————————————————————–

Thank you, Mike. Now I’d like to open it up for any questions you may have.

================================================================================

Questions and Answers

——————————————————————————–

Operator [1]

——————————————————————————–

(Operator Instructions)

Your first question comes from the line of Ketan Mamtora with BMO Capital Market.

——————————————————————————–

Ketan Mamtora, BMO Capital Markets Equity Research – Analyst [2]

——————————————————————————–

Just first question, and I appreciate it’s difficult to give out sort of forward-looking volume guidance when things are so fluid and changing, but is it possible at all to give us some sense of how demand trends have been in April so far? And are there any particular bright spots or weak spots in terms of what you are seeing?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [3]

——————————————————————————–

Yes. I think that’s a good question, Ketan, and I would try to point to some objective standards that are out there. So obviously, you can keep an eye on what the retailers are doing. And I would say, as we mentioned before, that is a — certainly, a bright spot in this time. And I would also say that on the industrial side, we called that out, and there’s been fewer of the businesses there are operating compared to, like, retail, for example. So the bigger impact on industrial and then on the construction side, that’s somewhere in the middle at this point. And again, where it’s been essential, it’s been fairly close to business as usual. Where it’s deemed nonessential, obviously, it’s impacted. So hopefully that gives you a little bit better color, but…

——————————————————————————–

Ketan Mamtora, BMO Capital Markets Equity Research – Analyst [4]

——————————————————————————–

No. That’s helpful. And Matt, on the industrial side, is it possible at all to kind of quantify how April has been so far?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [5]

——————————————————————————–

I think, obviously, anything is possible. I think the challenge that we have, Ketan, as we look at it, is that really a good indicator for what it should be going forward. We don’t want anyone to take kind of the wrong view, whether it’s either more positive or more negative. So I think that’s the challenge. So what we are trying to do is take a look at what the end markets look like and what those called out customer types look like. And based on, again, available information out there, we think that you can get a pretty good idea about which markets are going to suffer a little bit more and which ones are still remaining strong.

——————————————————————————–

Ketan Mamtora, BMO Capital Markets Equity Research – Analyst [6]

——————————————————————————–

Okay. That’s fair. And then just switching to CapEx for 2020, just give us some sense of kind of how — what you think is the sort of core maintenance expense? And within that sort of $80 million, are there any big buckets of discretionary CapEx, which you could defer in case things were to worsen?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [7]

——————————————————————————–

I’ll let Mike address kind of the maintenance CapEx piece of it. And I guess what I would call out is there’s still a significant amount of automation and manufacturing efficiency spend that we have in the remaining amount. But Mike can you cover the kind of the maintenance?

——————————————————————————–

Michael Richard Cole, UFP Industries, Inc. – CFO & Treasurer [8]

——————————————————————————–

Sure. Normalized maintenance, Ketan, would be in the neighborhood of depreciation on a $60 million to $65 million range. But in times like this, we can always defer some of that and tighten that up a little bit. So perhaps 3/4 of that from past experience, we’ve been able to tighten about a little bit and push those off.

——————————————————————————–

Ketan Mamtora, BMO Capital Markets Equity Research – Analyst [9]

——————————————————————————–

So just to be clear, so 3/4 quarters of that $60 million to $65 million you can defer it. Is that the right interpretation?

——————————————————————————–

Michael Richard Cole, UFP Industries, Inc. – CFO & Treasurer [10]

——————————————————————————–

Correct.

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [11]

——————————————————————————–

And that’s incorporated within the $80 million revised forecast that we’re talking about for 2020. So we’ve already considered (inaudible) for the $80 million.

——————————————————————————–

Ketan Mamtora, BMO Capital Markets Equity Research – Analyst [12]

——————————————————————————–

I see. Understood. And then just a quick one, what is left by way of the authorization in terms of share repurchases?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [13]

——————————————————————————–

A little over 1 million shares, Ketan.

——————————————————————————–

Operator [14]

——————————————————————————–

Your next question comes from the line of Paul Betz with Stifel.

——————————————————————————–

Paul T. Betz, Stifel, Nicolaus & Company, Incorporated, Research Division – Associate [15]

——————————————————————————–

I hate to harp on April. I understand you don’t want to give qualitative numbers, but can you comment maybe on the weekly trends in April?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [16]

——————————————————————————–

So I guess what I would say, it’s fairly predictable, based on when the closures occurred, so I would say that early April, obviously, was the toughest part. And then if you kind of follow the trend in the lumber market that also gives you a good trend for kind of business demand. So beginning of April, we started to see the markets fall and fall pretty significantly in — by the end of April, it kind of come back, as I mentioned in my remarks. One of the things that I would point to you that helped that was some rationalization of supply by some of the sawmills. So — you have to take that into consideration. But if you want to look at trend lines that would be a good way to do it is that it was improving at the month end.

——————————————————————————–

Paul T. Betz, Stifel, Nicolaus & Company, Incorporated, Research Division – Associate [17]

——————————————————————————–

Okay. And the restructuring, can you provide an update on that? Does this environment make it more difficult or easier? I think you originally said you may — you found like $20 million of savings and your prepared remarks said you maybe found larger opportunities. Does that mean more savings than the $20 million?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [18]

——————————————————————————–

Yes. I think that’s a good question. So first of all, on the whole, I think our reorganization has gone extremely well. Our people have embraced it and are really driving the type of change that we were hoping for. I think some of the things that are coming out of it, Paul, there are things that we didn’t think we would get to right away partly because of our individuals having time not being able to travel as much as they normally would, they’ve been able to focus on some other issues. And I think in terms of building out their strategic plans, giving more definition to it and finding ways to help leverage our existing cost structure to drive greater sales in the future. I think those are the types of things that we haven’t really looked at. So in terms of kind of cost savings, we’re really not driving so much that part of it. We’re driving the leverage of our existing personnel and our existing facilities better than we thought we’d be able to. And I think that’s going to help us as we grow sales to keep our costs lower.

——————————————————————————–

Paul T. Betz, Stifel, Nicolaus & Company, Incorporated, Research Division – Associate [19]

——————————————————————————–

Okay. And you mentioned M&A pipeline pretty full. Are you able to make acquisitions in this environment? Or is that kind of delayed as well?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [20]

——————————————————————————–

Yes. What we are doing is that, obviously, we have a consistent pipeline of activity, and we’ve continued to work on those targets that are in the pipeline. And we’re prepared to move forward and complete those acquisitions. We also have new targets entering the pipeline. Obviously, the timing of those is going to depend on the availability to do due diligence and travel and do the types of things that we would need to do to complete them. But we are still moving forward in this environment, and we’re very optimistic that we should be able to accomplish them again, assuming valuation and everything works out the way that we expect.

——————————————————————————–

Operator [21]

——————————————————————————–

Your next question comes from the line of Reuben Garner with The Benchmark Company.

——————————————————————————–

Reuben Garner, The Benchmark Company, LLC, Research Division – Research Analyst [22]

——————————————————————————–

First, I missed a good portion of the prepared remarks, had some technical difficulties getting on, so sorry if I repeat anything. Maybe I’ll start on the retail side, a lot of talk about how the DIY portion of the construction industry is doing pretty well in this environment. Can you provide us any kind of color on maybe what portion of your retail business you think is exposed to that part of the market?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [23]

——————————————————————————–

Yes. I think if you kind of look at the DIY piece of it, a very significant portion of our overall business is DIY on the retail segment. And there are, obviously, our individual independent retailers that are continuing to operate, having been deemed essential businesses as well. So overall, if you kind of look at the whole retail area that’s been very good through this process. So whether that continues or not, obviously, we can’t forecast that. But that’s been good to date. And that would cover all of our product lines. As I laid out in Q1 gives you a good indication of that information.

——————————————————————————–

Reuben Garner, The Benchmark Company, LLC, Research Division – Research Analyst [24]

——————————————————————————–

Okay. And on the decking side, in particular, with you guys providing both the substrate and the deck board themselves, whether it’s treated lumber composite or your other materials, does — do you have any sense of how many or how much of the decking industry is kind of refacing an existing substrate versus building an entirely new deck off of the house? I’d imagine that refacing is something that’s a lot easier for a consumer to do at home if they’re looking for a project versus having to pour concrete and actually build a structure?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [25]

——————————————————————————–

Yes. That’s a great question, Reuben. And I recently saw some information on that. And I hesitate to give out the information because I’m not sure of the accuracy of it. But I will tell you that it was roughly 65% to 70% of decks are really resurfacing and replacement. So to the extent that, that is helpful to you, I think there is a third-party source for that, too. But I think that was kind of the number I heard.

——————————————————————————–

Reuben Garner, The Benchmark Company, LLC, Research Division – Research Analyst [26]

——————————————————————————–

Okay. That’s very helpful. And I understand that. It’s a guess, like — but definitely helpful. And then, okay, the last question I have is on the industrial exposure. Can you give us — and I know you’ve done a little bit in the past, but just given the environment, is there anything you can do to help us kind of break down your end market exposure within industrial? It’s obviously a pretty broad category. I know you’ve got some ag in health care and some other categories, just so we can try to follow the end markets as closely as we can.

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [27]

——————————————————————————–

Reuben. Yes. I — you already know the answer, which is probably why you’re signing up. But — I’m in the baby step phase. We provided all the segment information and trying to get to the individual kind of end-user type of information is much more difficult. So I don’t think we’ll be able to provide that any time soon. But I think if you kind of take the groups that Mike laid out there and that I talked about, you’ll be able to get an overall picture of what that looks like.

——————————————————————————–

Operator [28]

——————————————————————————–

Our next question comes from the line of Julio Romero with USCI.

——————————————————————————–

Julio Alberto Romero, Sidoti & Company, LLC – Equity Analyst [29]

——————————————————————————–

So my first question is just on the SG&A. You had some good improvement on the SG&A as a percentage of gross profit year-over-year for the consolidated UFP. But on the Q shows the industrial side, the SG&A as a percentage of gross profit rose year-over-year. So I guess would the implication be that, at least for the first quarter, the other 2 segments might have seen some better headway on the cost-control initiatives than industrial?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [30]

——————————————————————————–

Yes. I think one of the things I tried to point out is within industrial itself, you have to look at — there’s a couple of different pieces to it. One is, from the industrial part, that’s positioned much more for accelerated leverage of existing personnel. So we expect them to be able to grow significantly without as much of an increase in SG&A. So — and I think part of it is product mix and where we’ve gone from last year to this year with respect to the individuals involved in industrial. So part of the characterization of customers and other things that we did as part of our reorganization I would expect that there’s an opportunity in industrial going forward to, again, better leverage those costs that are there.

——————————————————————————–

Julio Alberto Romero, Sidoti & Company, LLC – Equity Analyst [31]

——————————————————————————–

Okay. That’s helpful. And I guess on the op margins for the segments, I mean, do you feel those — the first quarter op margins are reflective of kind of the segment op margins for the full year? Or — and if not, maybe if you could give us a sense of what op margins have been in the past?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [32]

——————————————————————————–

Yes. I think if you kind of look at, Julio, in terms of kind of relative margins, that’s probably a reasonable way to look at things. I think one of the things that’s called out in the Q is the conversation regarding the impact of lumber market. You’re talking about margins in that gross profit dollars per unit. So if you’re looking at margins, there is an impact of lumber market in there as well. Mike, do you have any other color on that?

——————————————————————————–

Michael Richard Cole, UFP Industries, Inc. – CFO & Treasurer [33]

——————————————————————————–

Yes. I think the only other thing I would add to that, Julio, is seasonality. And so industrial tends to be an area that tends to be a little less seasonal, a little more steady from quarter-to-quarter. Retail is an area that’s — one of the more seasonal construction is too. And so in the busier season, they’ll leverage the fixed costs a little better in the second and third quarters. So that might make Q1 maybe a little — not representative of what the full year might look like.

——————————————————————————–

Julio Alberto Romero, Sidoti & Company, LLC – Equity Analyst [34]

——————————————————————————–

Okay. And I guess just my last one here is from a strategic standpoint. Was the sudden disruption of the pandemic maybe creating any opportunities for you in any of your businesses?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [35]

——————————————————————————–

Yes. That’s a good question. And obviously, we don’t want to use this type of a negative situation to wish anybody ill. But I know there are some other companies out there that aren’t as particularly well capitalized and may have deeper struggles than we do. So I do believe there will be opportunities out there over the next year or so. And as I mentioned before, we’ll be seeking them out.

——————————————————————————–

Operator [36]

——————————————————————————–

Your next question comes from the line of Jay McCanless with Wedbush.

——————————————————————————–

Jay McCanless, Wedbush Securities Inc., Research Division – SVP of Equity Research [37]

——————————————————————————–

So first question, customer health, how are you thinking about your customers’ balance sheet? What’s going on with receivables? And if you are seeing some issues, is there a skew to one segment versus another?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [38]

——————————————————————————–

Yes. That’s a terrific observation. And one of the things I know that Mike and his team are doing with our operations guys is meeting weekly on large customers and taking a look at exactly what you’re talking about. Obviously, customer health is very, very important. And there are some customers who have not been deemed essential and unfortunately they’re going to struggle. I think we have a very good plan and a very good process for managing that risk. But nonetheless, there is a risk out there, and we’re definitely aware of it.

So overall, we’re keeping a close eye on things. I don’t think it’s based on any individual segment so much as it is based on whether they’re essential or nonessential. And clearly, as we said in the earlier remarks, retail has been deemed essential in most areas. A lot of industrial customers have not been deemed essential, so.

——————————————————————————–

Jay McCanless, Wedbush Securities Inc., Research Division – SVP of Equity Research [39]

——————————————————————————–

And then let me flip it on to your suppliers. How are you feeling about the financial health of your suppliers? Are there any opportunities you’re seeing maybe to vertically integrate, a little color on that would be great? And if there is a skew where you’re worried more about being able to keep one segment running versus another?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [40]

——————————————————————————–

Yes. I think at this point we feel very good about our suppliers. We are a very large, usually a top-5 customer of most of the major mill providers to us. And so I think they’re in reasonably good shape. They have a decent balance sheet. So I don’t think that’s a big — it’s a big issue. I think the other part of the — you talk about vertical integration, that’s not something that’s really on our radar. We like the position that we’re in today. There may be other products and things that we would look at, but certainly not for the lumber side. We’re not looking at vertically integrating. So hopefully that answers your question. But at this point it’s really more about getting supply from the mills who have curtailed and are reopening and trying to make sure that we can get ample supply. But it doesn’t favor one segment over another.

——————————————————————————–

Jay McCanless, Wedbush Securities Inc., Research Division – SVP of Equity Research [41]

——————————————————————————–

Got it. Two more for me. And just to follow on that curtailment topic, what are you seeing from that? Have those curtailments picked up? Or are they starting to slow down?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [42]

——————————————————————————–

We’re actually hearing that a couple of mills are planning reopenings, and that will help. And one of my other comments, which may sound like an editorial comment, but it’s real, is we also have had mills who — their employees did not want to come back to work until after July 31. And so that put a little bit of a damper on their ability to come back. So — but I do think they are looking at reopening in a number of different areas.

——————————————————————————–

Jay McCanless, Wedbush Securities Inc., Research Division – SVP of Equity Research [43]

——————————————————————————–

Good. And then the last question I had, when you’re looking at construction and maybe some projects being pushed out, are you seeing more pushback or delays on resi construction or on commercial projects?

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [44]

——————————————————————————–

Yes. I think that’s a — it’s probably a mixed view there, Jay, because I think on the residential side, I think the homebuilders have not been continuing forward with a lot of their land development plans. So it’ll take them a little bit of time to reboot.

On the commercial construction side, you’re seeing where it’s essential that business is continuing on, where it’s not essential, it’s been stopped, so. And then on the concrete forming side, that’s been a bright spot. That continues to show a lot of traction, and that’s been deemed essential in most markets. So if I kind of look at it that way, that’s why I think it’s a mixed outlook, but I think there will be, at some point in time, they’ve got to restock the inventory of land.

——————————————————————————–

Operator [45]

——————————————————————————–

And I am showing no further questions at this time. I will turn it back over to Matt Missad for closing remarks.

——————————————————————————–

Matthew Jon Missad, UFP Industries, Inc. – CEO & Director [46]

——————————————————————————–

Once again, I would like to thank you for spending your time with us on the call this morning. We are deeply saddened by the loss of life caused by COVID-19, and we are equally sensitive to the loss of livelihood suffered by those impacted by the response to COVID-19. We look forward to a common sense, risk-based reopening of business and livelihoods as rapidly as possible. And we love policymakers act with the same urgency in removing barriers to business activity as they did in putting them up.

The massive shutdown of business and opportunities with predictable economic harm followed by massive government intervention in an attempt to offset that harm will be written about and talked about for years. The actual virus will be a footnote.

Instead of a negative story line, we want to write and talk about USP responding well to adversity and protecting its employees, serving its customers and safeguarding the investment of its shareholders. As I recently read, we might all be in the same storm, but we definitely are not in the same boat. Let’s take care to protect the most vulnerable and allow the other to safely return to work and life. Life and livelihood need not be mutually exclusive.

I expect brighter days ahead. My forecast calls for increasing UV rays rates, higher temperatures and higher humidity, which not only kill viruses but can make life more enjoyable. Thank you. And have a great day.

——————————————————————————–

Operator [47]

——————————————————————————–

Ladies and gentlemen, this concludes this conference call. Thank you for participating. You may now disconnect.

Related Reports:

https://www.manufacturedhomepronews.com/levenfeld-pearlstein-llc-law-provides-updated-guidance-on-sbas-ppp-economic-necessity-certification-plus-manufactured-housing-investing-stock-updates/

https://www.manufacturedhomepronews.com/small-business-bailout-data-driven-updates-on-ppp-and-eidl-sba-loans/

https://www.manufacturedhomepronews.com/frank-rolfe-impact-communities-admissions-ripped-by-quad-cities-report-on-manufactured-home-operations/

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

Spring 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our tenth anniversary and is in year 11 of publishing.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

https://www.manufacturedhomepronews.com/celebrating-10-years-of-goal-and-solution-oriented-manufactured-home-industry-innovation-information-and-inspiration-for-industry-professionals/

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.https://www.manufacturedhomepronews.com/2019-year-end-totals-reveals-decline-in-new-hud-code-manufactured-home-production-shipments/

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

http://latonykovach.com Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

AEI Flash Housing Market Indicators