Noteworthy headlines on CNNMoney –Fed eyes raising rates “relatively soon.” Samsung sending safety gloves to Note 7 users. Ex-Wells Fargo worker: denied bathroom breaks. Clinton’s tax plan might raise less money than expected.

Some bullets from MarketWatch – Why China’s banks may eventually need a $2 trillion capital infusion. Fed held steady in September despite ‘reasonable argument’ for interest-rate hike. Hiding cash during the Trump-Clinton clash? Why that won’t work.

Oil down 1.04%. Gold up 0.02.

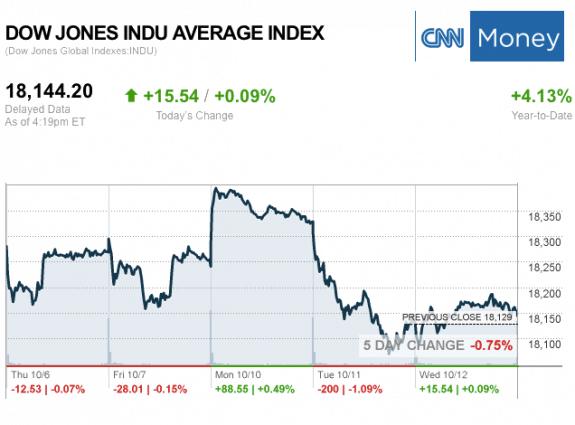

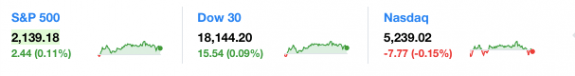

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2,139.18 2.44 (0.11%)

Dow JIA 18,144.20 15.54 (0.09%).

Nasdaq 5,239.02 –7.77 (-0.15%).

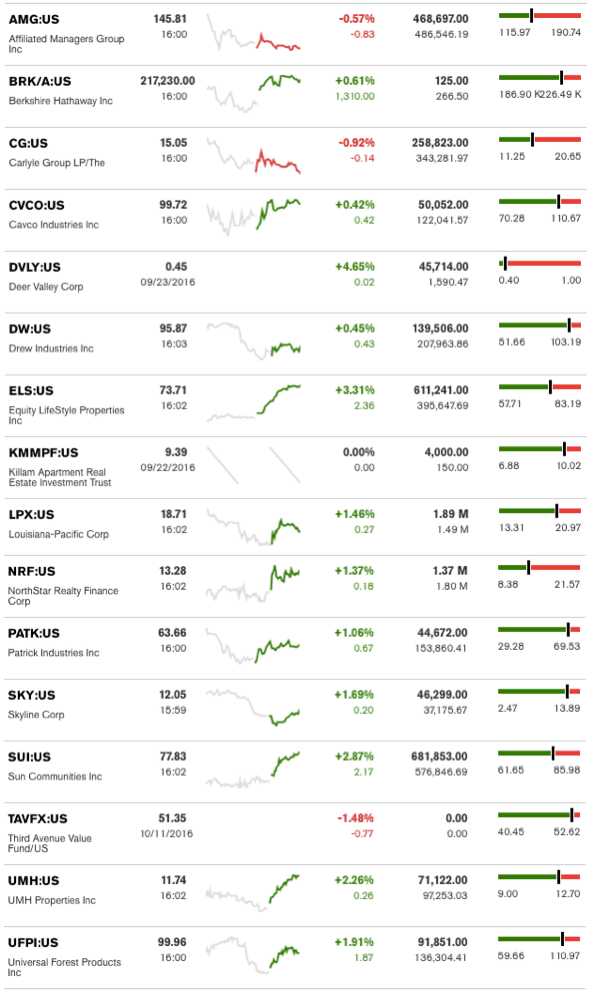

The MH Industry – Today’s Risers and Sliders

Top two gainers for the day were Equity LifeStyle Properties Inc. (ELS) and Sun Communities Inc. (SUI). The top two sliders for the day were Affiliated Managers Group Inc. (AMG) and Carlyle Group LP (CG). Killam and Deer Valley held steady, as those stocks are only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

ELS spotlighted in a report linked here.

Sun Communities spotlighted in a report linked here.

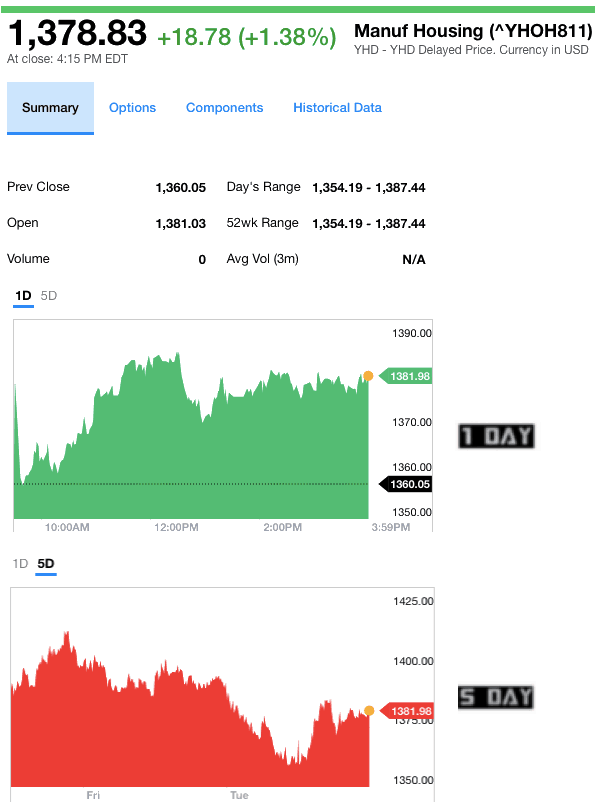

Manufactured Housing Composite Value Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.