MHProNews contacted John Chang, Senior Vice President, National Director Marcus & Millichap Research Services last week for additional insights related to their first half of 2020 study of manufactured home community data and trends study.

The focus of the inquiry could be summed up in this manner: what would the anticipated impact be of the COVID19 outbreak on the manufactured home communities (MHC) sector?

Chang responded in part by engaging Michael L Glass, Senior Vice President / Division Manager of Marcus & Millichap (MMI) Real Estate Investment Services, Inc.

Glass provided MHProNews with the following on-the-record insights. The bold and brown text, as regular MHProNews readers know, is to highlight the quoted statement by making it ‘pop.’

- Unlike apartments, most of the people in MHC’s own their unit, so they have a vested interest in the home itself and are more likely to prioritize the lease on the space.

- Although many residents of MHCs are employed in hourly-wage positions that may have been impacted by the coronavirus, the CARES Act provides a $1200 per person supplement and enhanced unemployment benefits that will materially impact tenant’s ability to manage their finances and rent commitments.

- Age-restricted parks and units leased to seniors should face even fewer issues as these residents are typically retired and cover their rent expenses using Social Security which have virtually no vulnerability to the economic impact of the coronavirus. Naturally, a community with a large senior tenant base will want to ensure facilities are structured to enforce social distancing.

Risks over the longer term will be tied to the how long people need to shelter-in-place and the overall economic impact of the coronavirus pandemic. The longer the pandemic remains active, the higher the risks to the broader economy become. It’s likely that vacancies will not be materially affected, but if the current low-activity level extends longer than the stimulus packages, then the potential for non-payment of rents will rise.

Park owners with rental homes, especially in areas without a large and diverse economic base, may be more susceptible to a loss of rental income. If residents lose jobs and there are no other employment opportunities, rental units face more risk.” – Michael Glass, MMI SVP.

With that backdrop and per the communications with MMI, MHProNews next will present the MMI research report for the first half of 2020. That will be followed by additional MMI and other information, along with an MHProNews analysis and commentary.

Value Per Space Surge$ – Manufactured Home Community Data, Performance and Outlook 2020 – Marcus & Millichap Research Report

Marcus & Millichap Research Services recently provided MHProNews a report on their findings for the first half of 2020 on the manufactured home land-lease community sector.

Marcus & Millichap (MMI) also recently did what they said was the most widely attended webinar on the topic of the economy, commercial real estate, liquidity in the capital markets and related topics. That report is linked here and further below.

What follows pre-dated MMI research linked above. While their overall data is deemed accurate, per their disclosures, the evolving economic situation must be a logical caveat for what follows. MMI’s disclaimer statement reads as follows.

“The information contained in this report was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty or guarantee, express or implied may be made as to the accuracy or reliability of the information contained herein. This is not intended to be a forecast of future events and this is not a guaranty regarding a future event. This is not intended to provide specific investment advice and should not be considered as investment advice.”

MHProNews will provide numerous key points from the MMI research. As previously noted, this will be followed by additional information, plus an MHProNews analysis and commentary.

The growing need for lower-cost homes includes manufactured housing options. The reduced entry cost to buy a manufactured home continues to provide a more affordable path to homeownership. The recent decline in interest rates should afford more people to be able to purchase a manufactured home while rates remain low. Additionally, access to loans for new homes is available in local markets across the nation. Although these factors will keep new resident demand strong, long-term job losses due to the new coronavirus (COVID-19), especially in the hourly-wage segments of the employment market, may affect the ability of some current residents to pay lot rent, increasing turnover. Moving forward, if jobs are not reinstated within 2020, vacancy in some parks may increase and rent gains slip as the market adjust, especially in all-age communities.

Parks evolve to meet demand. Although demand for residences in manufactured home communities remains strong, the inventory of parks continues to decline. Some communities are removed as they are purchased and redeveloped for other purposes while new ones are not added as it can be difficult to obtain the necessary approvals required to build new parks. Within the remaining existing stock, to increase NOI, some existing owners are buying homes to fill empty slots and either offering the units for sale or renting them. Others are purchasing the surrounding land to enlarge the park, while a number are bringing in RVs or tiny homes to fill small vacant areas. Looking ahead, the growing need for quick options to provide more workforce housing has resulted in some jurisdictions reviewing zoning codes to ascertain if any revisions are needed to allow for the expansion of manufactured home communities. This may lead to regulation changes that will make it less cumbersome to build new parks or to expand existing sites. In 2020, additional lots are expected to be added in Florida, Michigan, Montana and Texas, while in Memphis, a redeveloped community has been transformed into an all rental community.

Investment Highlights

- Attractive yields compared with other property types are luring more investors to consider manufactured home communities, making it a highly sought asset class. The increase in competition has raised values and compressed yields about 40 basis points over the past year.

- Stabilized, turn-key assets on city services and within commuting distance to employment nodes are desired by many buyers. Robust competition for these properties, however, requires many investors to expand their geographic and quality expectations to make a successful offer.

- REITs and other major companies are focused at the top end of the market, targeting a limited supply of larger four- and five-star communities, mainly in Sunbelt and coastal metros. Cap rates for well-located assets in primary markets are generally in the 4 to 5 percent range but can dip below that in some locations.

- Many new private investors are active in the under $5 million price tranche. As competition remains robust for a limited supply of listings, more buyers are willing to search in secondary and tertiary locations to gain a foothold in the sector.

- Rent control remains a concern among park owners and investors as the growing need for lower-cost housing options has more jurisdictions considering implementing restrictions on rent growth.

Vacancy

Need for lower-cost homeownership options drops the vacancy rate. The shortage of affordable homes for many workers is bolstering demand for the lower-cost housing options available in many parks throughout the nation. However, with the number of communities dwindling and the price of single-family homes rising, more people are considering purchasing in a manufactured home community as a way to gain entry into homeownership. The vacancy rate is especially tight in areas of the country where the price of a site-built home is out of the reach of many people. During 2020, if widespread unemployment is sustained for a lengthy period, the vacancy rate in some communities could rise if homeowners cannot afford to pay lot rent and move-outs increase.

Highlights

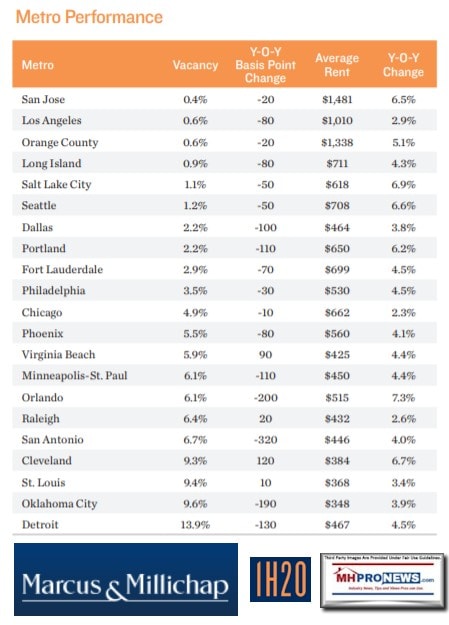

- By subregion, the vacancy rate is lowest along the Pacific Coast, mainly due to a sub-1 percent rate in many California markets. Among major California markets, Riverside-San Bernardino registered the highest vacancy at the end of 2019 at a mere 3.7 percent, having fallen 110 basis points during the year.

- The median price of a single-family home in many Midwest metros falls below the national average, providing additional alternatives for lower-cost housing. This factor contributed to the Midwest posting the highest vacancy rate in 2019 at 13.6 percent. Vacancy rates above 20 percent can be found in metros including Flint, Michigan; Kansas City; and Saginaw and Port Huron, Michigan.

- Miami-Dade County recorded the largest annual vacancy improvement, falling 610 basis points to 0.2 percent in 2019, the lowest rate in the South region. Tight vacancy in the metro produced one of the highest annual rent gains in the nation.

Rent

Tight vacancy in many metros promotes rent growth. Manufactured home communities are a large supplier of lower-cost homeownership options. As demand for this type of housing grows amid a contracting supply of spaces, the average lot rent is rising. During 2019, all but a few metros registered annual lot rent increases. By region, average rent is highest in the West at $773 per month, driven up by the elevated rents in many California metros. Meanwhile, more affordable home prices and a higher vacancy rate in the Midwest contributed to the lowest monthly rent among regions at an average of $423 during 2019. Rent growth in 2020 may be hindered by COVID-19’s impact on the economy that results in more people not being able to make house and lot payments.

Highlights

- The Pacific subregion posts the highest average lot rent at $903 per month. The rate in many coastal California markets is even higher, topping $1,300 per month in 2019 in Orange County, San Jose and Santa Cruz.

- Among subregions, the rate in the West North Central is the lowest at $400 per month. Among Midwest metros, the highest rent was found in Chicago at an average of $662 per month, while the average monthly rent in Fort Wayne, Indiana, and Ames, Iowa, was under $300.

- Smaller, more rural metros where the median price of a singlefamily home is attainable for more residents offer the most affordable rent. Average rates below $250 per month in 2019 were located in Greenville, South Carolina; Lynchburg, Virginia; and Albany, Georgia.

Sales

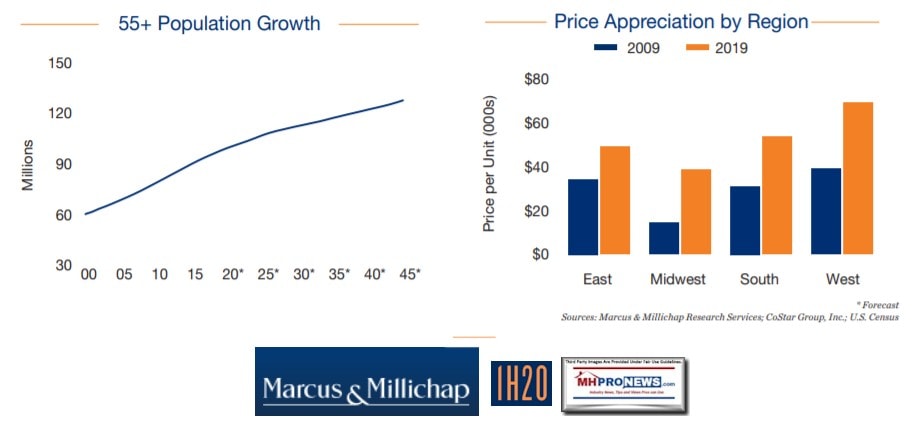

Higher yield potential captures investor interest. Manufactured home communities are receiving robust interest from a wider range of buyers. Many investors are new to park ownership, some moving out of securities into real estate, while others are coming from other asset classes in search of higher returns. Cap rates have been compressing over the past year and are typically in the 6 to 7 percent range, although some well-located premium communities or parks with a lot of upside potential are trading below 5 percent. Double-digit returns can still be found in all subregions but are harder to come by. The added competition for a limited number of listings pushed the average price nationwide up 13 percent in 2019 to $55,800 per unit. The coronavirus outbreak may slow transactions in the quarters ahead as deals take longer to close.

Highlights

- Sales surged in the East region in 2019, led by an increase in North Carolina and Pennsylvania. During this time, the average price jumped 32 percent to $48,900 per unit.

- In the Midwest, a boost in activity in Minnesota was not enough to offset fewer transactions in Michigan, lowering trading velocity in 2019. Over this period, assets transacted at an average of $38,800 per space, up 26 percent year over year.

- Robust trading activity in Florida in 2019 boosted sales velocity in the South. In the same period, the average price posted a 5 percent climb to $53,800 per lot.

- Strong buyer interest in California assets drove up sales volume in the West in 2019. More parks trading in the higher-priced Pacific subregion contributed to the average price jumping 18 percent, maintaining the highest price among regions at $69,300 per unit.

Higher

Surge in the population aging into retirement underpins demand in age-restricted parks. The age 55-plus cohort in the U.S. will swell by nearly 1.7 million people in 2020, and through 2025, another 7.6 million will reach this milestone. As these residents retire, some will consider purchasing manufactured homes in age-restricted communities, boosting demand, especially in the Sunbelt. Vacancy in 55-plus parks is already lower than all-age properties in all subregions of the nation except the Southwest, where new inventory in Texas nudged the rate higher. Market lot rent in this asset class varies widely, from $200 per month in older parks in smaller towns to more than $2,000 per month in some coastal California cities. These parks should not be as affected by rising unemployment as all-age communities.

Highlights

- Florida leads the nation in age-restricted inventory with more than 151,000 units. The only other states with more than 25,000 homes are also traditional retirement destinations: California and Arizona. \

- Among subregions, the highest vacancy rate is in the East North Central at 9.0 percent in 2019. Rates above 30 percent in Monroe, Michigan, and Gary, Indiana, keep the rate elevated. The ElkhartGoshen and Cincinnati metros had vacancy below 1.6 percent, the lowest rate in the subregion during this period.

- Market rent by subregion varies widely. Monthly rent above $1,000 in many California metros boosts the rate in the Pacific to the highest in the nation at $807 per month. Rent in the West North Central averaged $341 per month in 2019, slightly below the Southwest subregion, which clocked in at $366 per month.”

##

The entire MMI report with researcher team members and credits can be found linked here as a download.

Additional MMI Insights, plus MHProNews Analysis

MMI recently conducted a conference call that reportedly had a record attendance on the topic of the coronavirus pandemic’s impacts on commercial real estate. Their report included a largely non-political analysis of economic details going into the partial economic shutdown, as well as possible results from federal action to support a rapid recovery.

Glass’ comments above are best understood in the light of that deeper research. MHProNews’ report on that topic is linked below.

MHProNews made a follow up inquiry to MMI regarding their communities research which asked the following.

- As you may know, one of the bigger REITs in an investor relations call said that it is often now less costly to develop a new site/community on a cost per site basis than it is to buy an existing community. Your cost-per-pad data 1H 2020 report to my eye arguably underscores that point. If developing a site is in the 20 to 25K (+/-) range, then in many if not most parts of the U.S., your research makes the point that more developing can be economically justified. Feedback on that, on or off the record, is welcome. Thank you.

That topic is arguably more sensitive to numbers of professionals and investors engaged in the manufactured home communities space. It has not yet had a response, which if provided by MMI, MHProNews will plan to bring to the attention of industry readers and researchers. That noted, here is an example of the point made in the MHProNews inquiry. The comment below, as noted, is by Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO during the Q3 2019 Sun Communities Inc Earnings Call on October 29, 2019.

There could be volumes written on the implications of the data and statement above. But let us allow the facts, quotes and reserach showcased to simmer and sink in before we return to them at another time.

Additional insights into the coronavirus pandemic and its economic impacts – or manufactured housing specific items – are found in the related reports below the byline and notices.

That’s a wrap on this Monday, Monday installment of manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

February 2020, Latest National Manufactured Housing Production Data, MHI and MHARR Comparisons

Are Manufactured Housing Supply Chains in China Threatened by Coronavirus?