In case you missed it, there was sweeping deregulation during the first 3 years of the Trump Administration. Certain economists and President Donald J. Trump himself have said that those deregulatory moves rivaled the importance of the tax cuts that were also targeted to boost investing and job creation.

A multi-decade record low unemployment rate with blacks, Hispanics, Asians, Native American, women, and all other demographic groups created a jobs market so tight, that over 7 million jobs were open, waiting to be filled. For the first time in years, working and middle class wages were rising instead of effectively falling when compared to the rate of inflation. With millions involved in the stock market through 401Ks or other investments, the wealth of Americans was surging in ways that certainly sounded much like the campaign slogan, “Promises Made, Promises Kept.”

On January 1, 2020 it would have been hard to imagine that President Trump and Vice President Mike Pence would have done anything other than cruise to re-election, expanding the “electoral college map” and likely bringing a sweep of the majority in the House and Senate with their coattails.

Then, came COVID19, also known as the Wuhan Virus, the Chinese Coronavirus, the CCP (Communist Chinese Party) Virus, and so on.

Much of American business benefited from the deregulatory thrust. But the reason some in the affordable manufactured home industry might have missed deregulation is because it hasn’t been in much evidence in our industry. Who says? Manufactured Housing Association for Regulatory Reform (MHARR) President and CEO Mark Weiss, J.D., in the October 2020 MHARR Issues and Perspectives rips the Manufactured Housing Institute (MHI) by name for “Wasted Manufactured Housing Opportunities.”

Said Weiss, “speculation regarding an uncertain and unknowable future [i.e.: regarding the looming election outcome], is not the focus of this article. Its focus, rather, is on the “known” – i.e., on what has occurred over the past four years under the Trump Administration in relation to the manufactured housing industry…”

Following the insightful MHARR assessment, there will be additional information provided, along with an MHProNews report and analysis. The pull quote from the headline for this article comes from the report below.

MHARR — ISSUES AND PERSPECTIVES

By Mark Weiss, J.D.

OCTOBER 2020

“Wasted Manufactured Housing Opportunities Mount As The Clock Ticks Down”

While the past four years under President Trump have featured policies that were at least designed to promote regulatory reform, the next four years (or more) could very well see those policies reversed. Whether – and to what degree – a more punitive regulatory perspective gains (or re-gains) traction in the nation’s capital, however, remains to be seen and will be a function of a number of political and administrative factors beyond the presidential election.

Given these polar opposites and the uncertainty inherent in the upcoming election, speculation regarding the outcome (and its potential impacts) becomes a significant and natural temptation. But speculation regarding an uncertain and unknowable future, is not the focus of this article. Its focus, rather, is on the “known” – i.e., on what has occurred over the past four years under the Trump Administration in relation to the manufactured housing industry, what can be learned from that information and analysis, and what lessons can and should be drawn from that experience going forward.

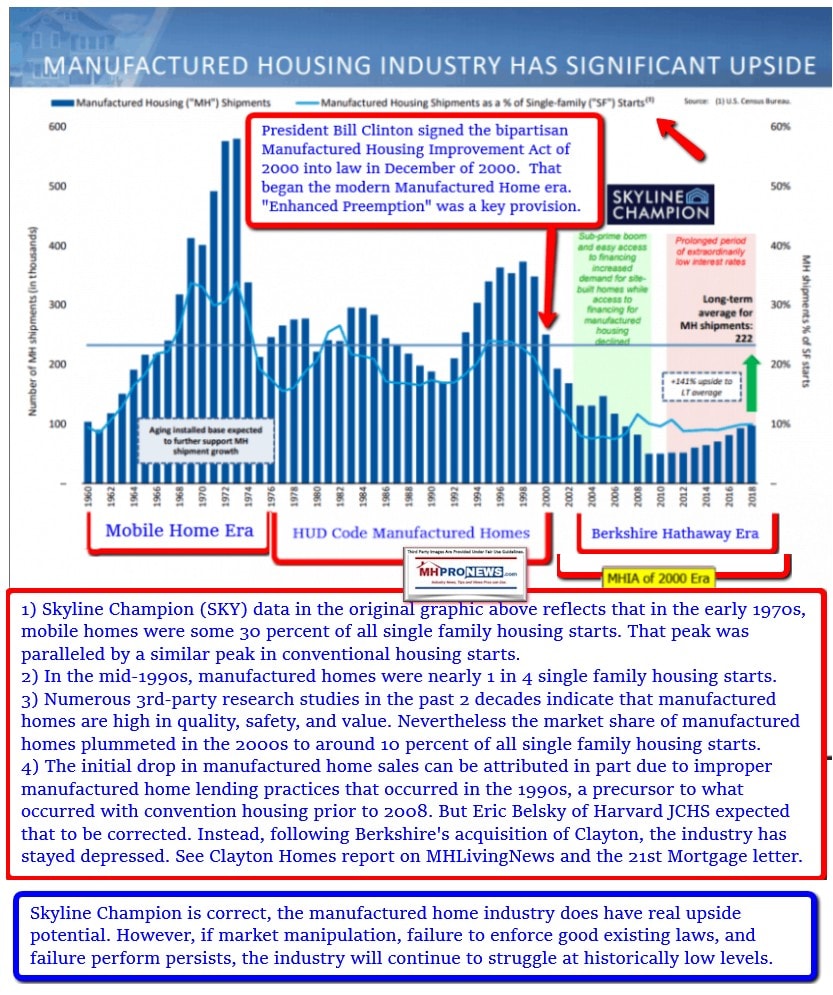

Certainly, the regulatory policies and outlook of the past four years have presented multiple — and, arguably, unparalleled — opportunities to achieve genuine and lasting reform in areas that have been major, long-term sore spots for both the industry and American consumers of affordable housing. Unfortunately, though, even an environment rich with opportunity does not guarantee results and sadly, after four years, it appears that those opportunities have largely been squandered. The question, then, is “why?” Why have those opportunities, after four years of highly favorable regulatory and administrative policies – and with good, beneficial laws for the industry and consumers already in place — failed to produce significant positive results for the industry and consumers? Why does HUD Code manufactured housing production remained mired at levels well below historic norms, while other segments of the housing industry experience significant growth? WHY?

MHARR, as a relatively small organization which – as committed by its founding Charter – specifically represents the manufacturing or “production” sector of the industry, has aggressively pursued regulatory and administrative reform under President Trump, and has arguably achieved successes disproportionate to its size including, but not limited to, the 2017 re-assignment of the former HUD manufactured housing program administrator – which was specifically and only sought by MHARR – and the 2017 withdrawal, by the U.S. Department of Energy, of egregious and potentially devastating proposed manufactured housing energy standards, the development of which were supported by the Manufactured Housing Institute (MHI) during an alleged “negotiated” rulemaking process. And while these successes were significant in and of themselves, much more could have been accomplished over the past four years – particularly (and even more importantly) with respect to the major post-production issues which continue to plague the industry (and have actually worsened in recent years) — if MHARR had been fully-supported in numerous other regulatory efforts (or at least not opposed) by MHI, the national industry association which consistently boasts that it represents all segments of the HUD Code industry.

No doubt, if a harsher regulatory climate does come to pass in 2021 – as it well may – the excuses from the usual quarters within the industry will rush forth like a swollen river, as will paeans to the need to “work with” the usual assortment of industry detractors in order to avoid, allegedly, the worst possible results.

But what about the missed opportunities of the past four years – such as those at HUD under Secretary Carson? Where did they go? What about that promised “top-to-bottom” regulatory review of the federal manufactured housing program? What about the hundreds of reform proposals submitted to the Office of Manufactured Housing Programs (OMHP)? What about the Executive Orders (13771 and 13777) requiring the re-evaluation of all agency regulations and the elimination or modification of those found to impair employment or the economy, among other things? What about the elimination of two existing regulations for each new one adopted? What about the publication or invalidation of sub-regulatory “guidance” under Executive Order 13891? And what about an appointed, non-career manufactured housing program administrator, as affirmatively required by law and as proposed by HUD and the Treasury Department in their housing finance “reform” plans? MHARR has consistently and aggressively pressed HUD on all of these matters at all levels, from the Secretary on down for the past four years, while the national representative of all industry segments has hosted speeches, tours and other confabs offering more in the way of … promises (as well as public relations and photo-ops), but no concrete results.

Needless to say, that’s a whole lot of “would have, could have and should have” right there, relating to existing HUD regulatory burdens and their damaging effects on the industry and its consumers. But what about the two major post-production issues that continue to severely restrict and limit the industry’s progress – i.e., discriminatory and exclusionary zoning mandates and HUD’s failure to act against them under its enhanced preemption authority as conferred by the Manufactured Housing Improvement Act of 2000, and the endlessly botched (or intentionally thwarted) implementation of consumer financing reform by Fannie Mae, Freddie Mac and the Federal Housing Finance Agency (FHFA) under the statutory “Duty to Serve Underserved Markets” (DTS) mandate?

What about those crucial issues? The 2000 reform law gives HUD all the power it needs to federally preempt state and local zoning provisions that discriminatorily exclude or restrict the placement of HUD Code manufactured homes in accordance with preemptive federal (i.e., HUD) standards and a statute which directs HUD, among other things, to “facilitate the availability of affordable manufactured homes and to increase homeownership for all Americans.” (Emphasis added). Apparently, though, “all” – at least to HUD regulators – somehow means far less than “all,” as HUD has consistently allowed state and local officials over wide areas of the country, through obviously discriminatory zoning mandates, to exclude or severely limit the placement of mainstream manufactured homes, which are the single most affordable source of homeownership. Clearly, if Congress had meant to say “some,” or “a few,” or “some, but not all,” it could have done so in this provision of the law. But it did not, it said “all,” adding yet another promise to be honored in the breach (at least for the last 20 years) by HUD and its federal manufactured housing regulators — albeit without firm and decisive pushback from the organization which claims to represent all segments of the industry.

And DTS? As was pointed out in the September 2020 issue of “MHARR – Issues and Perspectives,” some twelve years after Congress enacted the Duty to Serve the manufactured housing consumer financing market (among others), 94-95% of the manufactured housing market and manufactured housing consumers remain completely unserved by Fannie and Freddie, including the entirety of its largest market segment, financed through personal property loans. And the “new class” of more costly hybrid “Cross-Mod” homes touted by MHI, Fannie, Freddie and the industry’s largest corporate conglomerates? According to a DTS “compliance” report submitted to FHFA, a grand total of six such homes were financed by Fannie Mae (none by Freddie Mac) in 2019, and of those, a whopping two were reportedly eligible for DTS credit. So, more than a decade after Congress adopted DTS as a remedy for Fannie and Freddie’s failure to serve the mainstream manufactured housing market, Fannie and Freddie are still failing to serve the overwhelming majority of the HUD Code market and mainstream manufactured housing consumers. And where is the firm and decisive pushback from the organization which claims to represent all segments of the industry?

Worse yet, as time drags on and on, even the absolutely minimal commitment by Fannie and Freddie to the manufactured housing market set forth in their original DTS implementation plans, continues to be whittled away. Thus, in its latest proposed 2020 DTS Plan modifications – submitted to FHFA September 15, 2020 – Fannie Mae seeks approval to back away from any further 2020 loan purchases under its “enhanced manufactured housing loan product for quality manufactured housing and purchase loans,” and instead, “replace loan purchases with expanded outreach and education activity.” Sure! And Freddie Mac, in its proposed 2020 Plan modification and 2021 extension proposal, totally eliminates its previously proposed “chattel pilot” program for 2019-2020 and its previously proposed purchase of 800-2,000 manufactured home chattel loans over the same period. Not content with that, though, it also would cancel its alleged “outreach” and education programs related to chattel lending over the same period. Again, where is the firm and decisive pushback from the organization which claims to represent all segments of the industry?

And lest anyone be confused over FHFA’s intent to seriously consider DTS stakeholder input on these “proposed” revisions at a scheduled October 16, 2020 “listening session,” or in written comments (due October 23, 2020), FHFA, in its Request for Input (RFI) regarding the proposed modifications, helpfully notes that it “expects to issue Non-Objections to the Enterprises’ proposed modifications … after considering … public input … by January 11, 2021.” So, it sounds like that “public input” will get about as much “consideration” from Fannie, Freddie and FHFA as it has in the past, which is zero to none.

And who does this help? Certainly not consumers and especially not mainstream manufactured housing consumers who use personal property (home only) financing. According to federal data from 2018, 91% of those consumers paid “high-cost” interest rates for their home loans (as reported, among other places, at a November 5, 2019 Freddie Mac symposium, where MHI was a participant). And while the number of consumers excluded from the HUD Code market altogether by these “high-cost” interest rates is not reported, the industry’s dominant portfolio lenders, well, they’re smiling … all the way to the proverbial bank.

Consequently, it should come as a shock to absolutely no one that national industry representatives other than MHARR, have spent most of the last four years promoting the supposed “new class” of much-less affordable “manufactured home” under DTS, while DTS implementation within the mainstream HUD Code manufactured housing market, and especially the dominant chattel sector, has gone virtually nowhere. And even that promotion – as ill-targeted as it is – has failed to produce results, with only two “Cross-Mod” homes supported by Fannie Mae for DTS credit in 2019, and further purchases in 2020 eliminated by Fannie’s proposed 2020 DTS Plan modifications. Again, the excuses (and diversions) abound, while time drags on and consumers suffer.

With one month remaining, then, before the election, the industry has made little-to-no progress whatsoever toward a meaningful and lasting resolution of the discriminatory zoning and consumer financing issues that have long hobbled both the industry and its consumers, under what is undoubtedly the most business-friendly and regulation-averse administration in nearly 30 years. Absent a last-minute blizzard of activity, therefore – and, again, regardless of the final outcome of the election — it is difficult to see how this qualifies as anything other than a disappointing failure by the broader industry to capitalize on a potentially unsurpassed opportunity to significantly change the landscape for manufactured housing in Washington, D.C.

If President Trump is re-elected, the industry still has a chance to achieve positive, elemental change, despite the precious four years that have needlessly been wasted. But that, unlike the squandered opportunities of the past for years, is anything but certain.

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.”

###

Additional Facts, MHProNews Analysis and Commentary

As the August 2020 manufactured housing industry shipment data is just days away. What is known is that year-to-date manufactured housing is trailing the results compared to 2019.

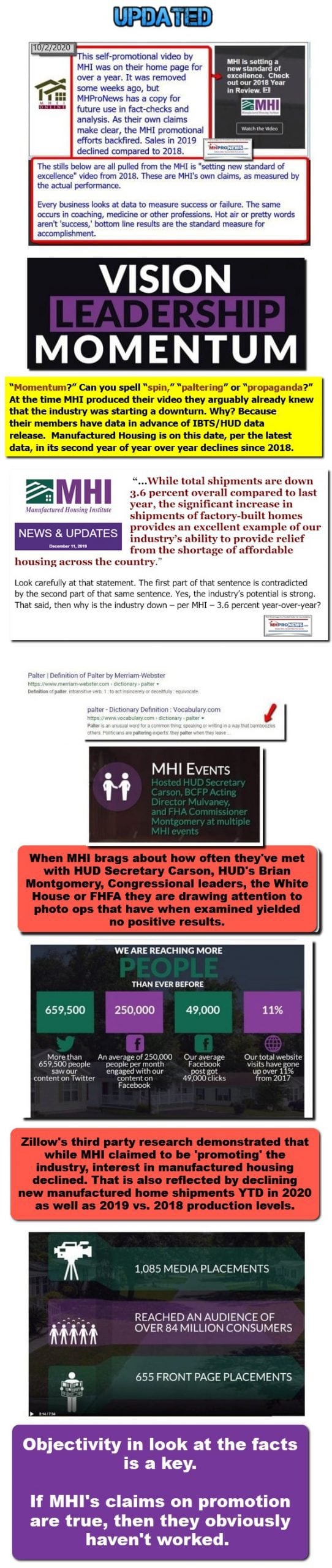

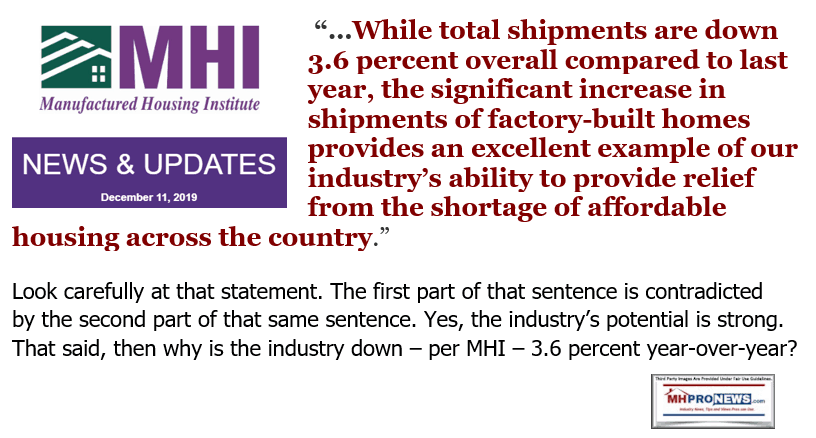

2019 was below 2018, something that MHI tried to spin, but had to admit to occurred.

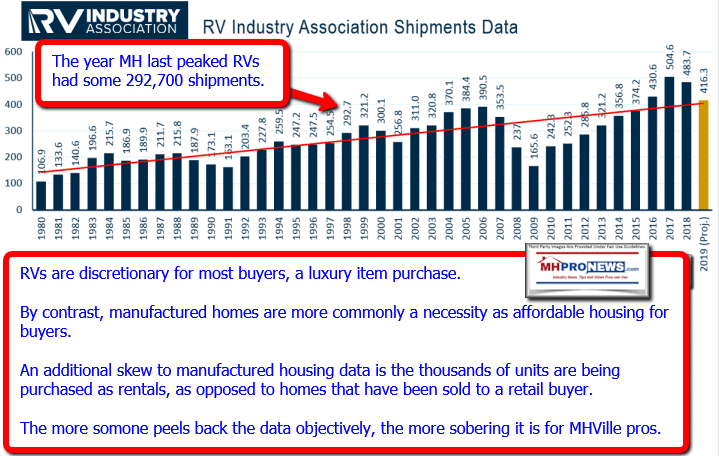

So, despite all of the ballyhoo by MHI in the later part of 2018 “momentum,” what has occurred since then has been a slip in 2019 and thus far in 2020. By contrast, the RV industry and mainstream housing are surging.

Who can forget this still from MHI’s self-praise video from 2018?

Common sense tells us that the industry isn’t making progress on Richard “Dick” Jennison’s pledge to re-achieve 500,000 shipments. Why is that promise never mentioned by MHI since it was publicly made in front of dozens of industry professionals at the Louisville Manufactured Housing Show?

MHI CEO Dick Jennison’s Pledge – 500,000 New Manufactured Home Shipments

Based on the industry’s historic trends, MHI’s own publicly traded members have said in their investor relations package that the industry is underperforming. Which begs the question, why are other industry progressing while manufactured housing slipped during an affordable housing crisis?

The bottom line is simple but sobering. MHARR’s analysis – from an inside the beltway vantagepoint – reflects the reason that MHI’s surrogates, staff or elected leaders continue to make excuses about debating their effectiveness. The contrast between the two graphics below tells the evidence-based tale at a glance.

To learn more from the industry’s runaway # number 1 most-read news, tips and views source, see the related reports linked herein and below the byline, offers, and notices.

There is always more to know. Stay tuned with the runaway largest and documented number one most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Alice Sparks, SSK Communities Partner, Dies Amidst Flagship Communities IPO Controversies

Manufactured Housing Lending 2020 Re-Examination – FEDs, Lenders, and Advocates

Nathan & Mary Lee Chance Smith, Leaders in ‘Anti-Trump Resistance,’ Manufactured Housing Impact?

Manufactured Housing Institute Warns Members – Pondering Legal Action, Insider Insights