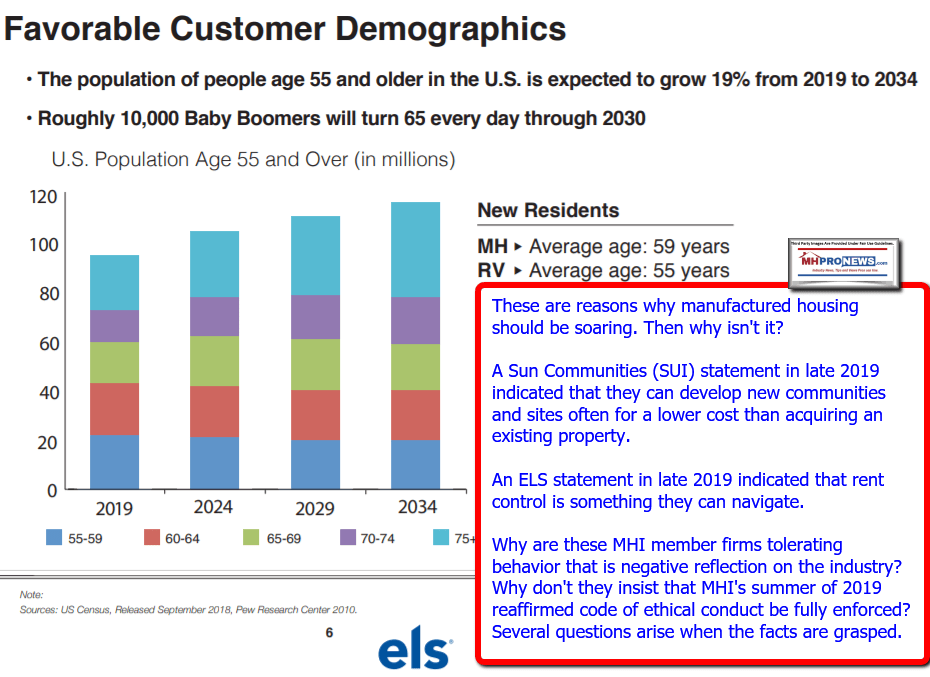

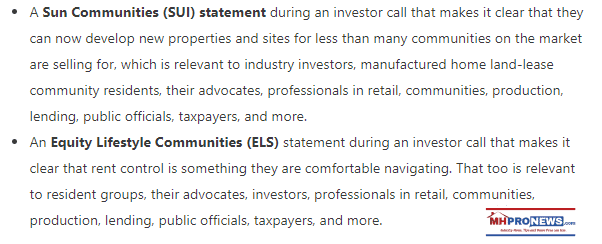

Equity LifeStyle Properties (ELS) and Sun Communities are the two largest operators of manufactured home land-lease communities in the country, as many industry professionals know. What is less understood by those engaged in the industry, investors or other observers are the meaning of statements being made by the firm.

Those insightful statements by ELS leaders are hiding in plain sight.

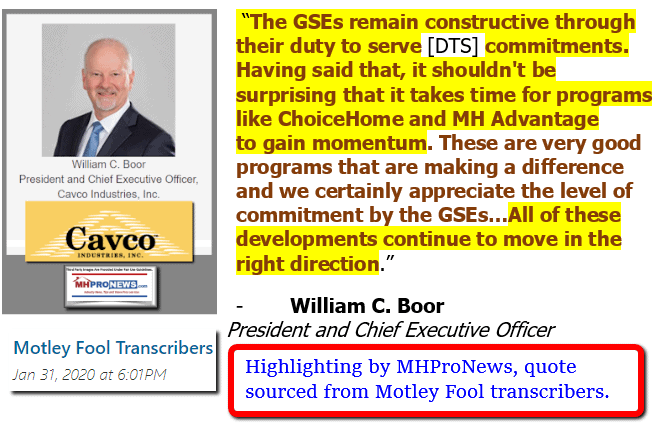

While the facts from ELS Q4 conference call, shown below, don’t have quite the surprise admissions that were noted previously, nevertheless additional statements emerged that speak to issues that industry professionals should be aware of for benchmarking as well as comparisons to other industry claims – such as those made by the Manufactured Housing Institute (MHI) or others.

Owner-operators of so-called ‘4 or 5 star’ properties – such as ELS, Sun Communities (SUI) or others that have sharp communities in their portfolios -provide a useful image of what manufactured home community living can have higher curb appeal. That’s why MHI or state associations usually show nicer 4 to 5 star locations in their literature, videos or website images. As a relevant aside, what that misses from an industry perspective is the need to address public concerns related to news about aggressive rate hikes on site or other fees, as well as the benefits that could accrue to the industry when the image of ‘1 to 3 star properties’ is addressed in a positive fashion.

Rephrased, manufactured housing has a number of potentially positive talking points that cover a range from oversold, missed, to ignored – all to the detriment of total credibility.

Today’s report about ELS on MHProNews will use this sequence in the content and analysis.

- Part 1. The full ELS Q4 2019 Earnings Call Transcript. Note: this is the longest segment of the report. For those pressed for time, you can skip to the pull quotes and circle back for their precise context.

- Images and data from ELS and other sources will be inserted that were not part of the original transcript by the Motley Fool transcribers of the call.

- Part 2. Pull quotes from the ELS’ call that MHProNews will focus on in an analysis that compares facts and insights that may contrast with MHI or claims made by others. While these quotes are a few weeks old, they are still quite relevant to the ongoing topics of interest to professionals and investors.

- Part 3. Among the reasons for the hold on this topic is that MHProNews asked ELS for specific comments about a related issue that will also be noted below, and we allowed ample time for their non-response.

- Part 4. Closing wrap up and related reports.

Part 1. Equity Lifestyle Properties Inc (ELS) Q4 2019 Earnings Call Transcript

Equity Lifestyle Properties Inc (ELS) Q4 2019 Earnings Call Transcript

ELS earnings call for the period ending December 31, 2019.

Motley Fool Transcribers

(MFTranscribers)

Jan 28, 2020 at 6:00PM

Equity Lifestyle Properties Inc (NYSE:ELS)

Q4 2019 Earnings Call

Jan 28, 2020, 11:00 a.m. ET

Contents:

Prepared Remarks

Questions and Answers

Call Participants

Prepared Remarks:

Operator

Good day, everyone, and thank you all for joining us to discuss Equity LifeStyle Properties’ Fourth Quarter and Year-end 2019 Results. Our featured speakers today are Marguerite Nader, our President and CEO; Paul Seavey, our Executive Vice President and CFO; and Patrick Waite, our Executive Vice President and COO.

In advance of today’s call, management released earnings. Today’s call will consist of opening remarks and a question-and-answer session with management relating to the Company’s earnings release. [Operator Instructions]

Certain matters discussed during this conference call may contain forward-looking statements in the meanings of the Federal Securities Laws. Our forward-looking statements are subject to certain economic risks and uncertainty. The Company assumes no obligation to update or supplement any statements that become untrue because of subsequent events.

In addition, during today’s call, we will discuss non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are included in our earnings release, our supplemental information and our historical SEC filings.

At this time, I’d like to turn the call over to Marguerite Nader, our President and CEO.

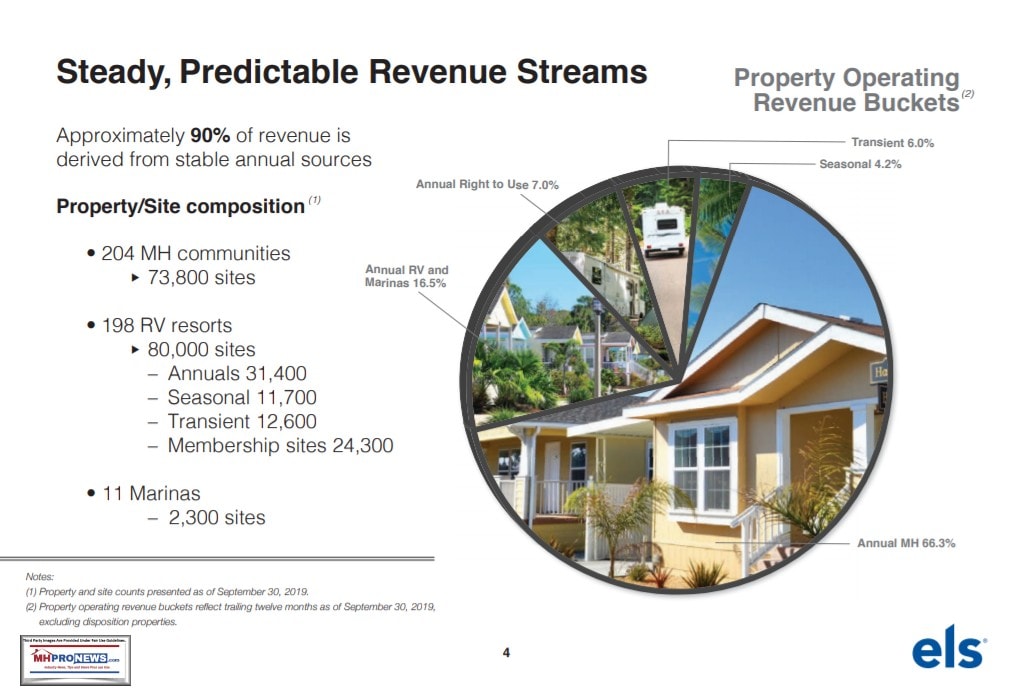

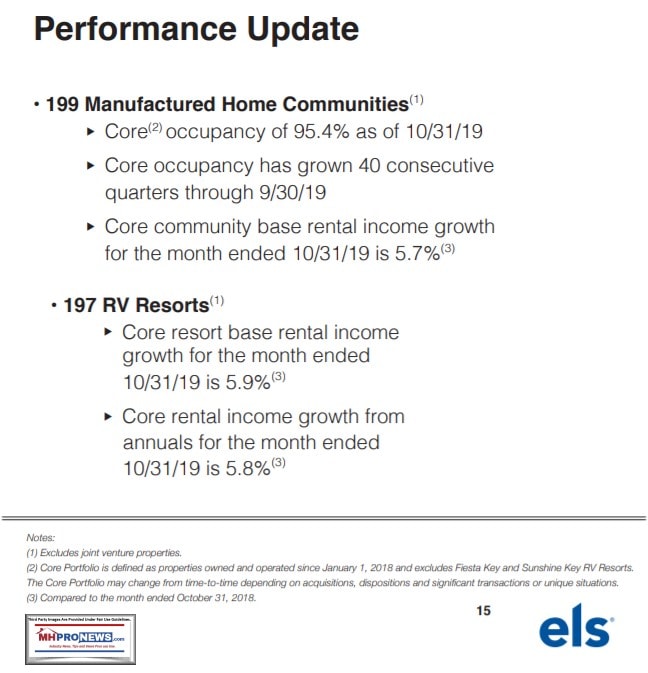

Good morning, and thank you for joining us today. I am pleased to report the final results for 2019. We continued our record of strong core operations and FFO growth with an 8.2% growth in normalized FFO per share. The fundamentals of our business remained strong with demographic and economic trends creating tailwinds for future growth. While baby boomers are our core customer for both manufactured housing and RV, we see a steady influx of younger customers.

2019 was a year marked by solid demand. Our MH portfolio increased occupancy by 401 sites for the year. We saw continued strength in our MH properties with a full-year rate growth of 4.7%. The rental program is being used as a trial prior to home-ownership. It is a low barrier entry point into our community. The key to the conversion from a renter to a homeowner is community engagement. We finished the year with a conversion rate of 33%.

Our RV resorts, including Thousand Trails, performed well this year with a 6% overall growth in income. The demand is strong for RV sites across the country. We completed our 50th year anniversary of our Thousand Trails portfolio with a 40,000 member count increase and a 7% increase in annual revenue. Our RV resorts are primarily dedicated to accommodating long-term customers with 80% of our revenue coming from annual and seasonal customers. We have seen an increase in appetite for upgrades within our Thousand Trails portfolio. Our customers see the value in having increased access to our properties.

Our product is in demand and the demographic trends are in our favor. Over the past five years, there has been a steady increase in Gen X and millennial campers. The popularity of the outdoor lifestyle and increasing younger RV buyers and new unique accommodations in our properties, including renting a tiny house or cabin, should continue to contribute to growing demand for our offering.

Our guidance for 2020 reflects the strength in our business — Excuse me. Someone needs to go on mute, I believe. Operator?

Thank you. Our guidance for 2020 reflects the strength in our business. Each market is evaluated to arrive at our proposed rental rate increases. The individual market surveys provide support for our views and incorporate all housing indication options in the local area. Our customers are increasingly completing their travel plans online. We have seen significant growth in online bookings, driven by greater use of mobile devices to book a stay. Since the beginning of smartphone technology in 2007, we have increased our total online reservation activity to represent 43% of all transient RV bookings. Our marketing team is focused on eliminating point-of-sale barriers for our customers. Processes have been streamlined with a focus on conversion through self-service. In 2019, we increased our social media fan base to over 650,000.

Finally, I would like to thank our employees for delivering another great year in 2019, as well as a strong start to 2020.

I will now hand it over to Paul to walk through the numbers in detail.

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

Thanks, Marguerite, and good morning, everyone. I will review our fourth quarter and full-year 2019 results, update our full-year 2020 guidance, then discuss our detailed first quarter guidance.

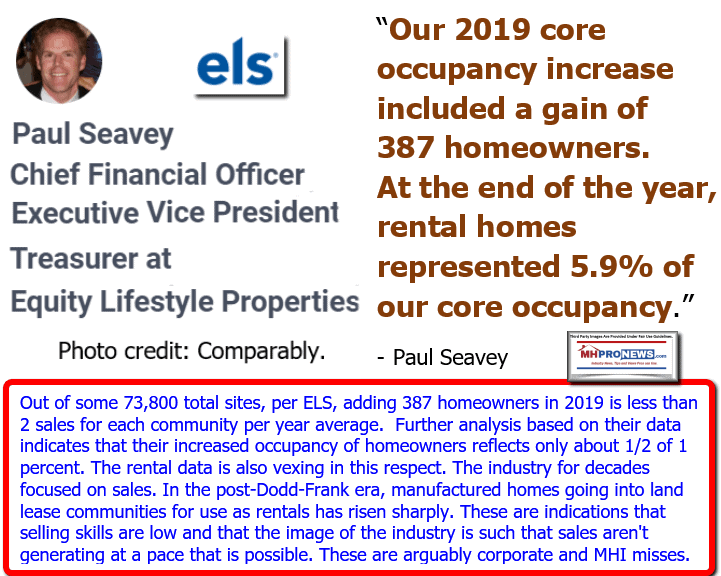

Core portfolio NOI for the fourth quarter was in line with guidance and contributed to 5% growth for the full year. Fourth quarter normalized FFO was $0.52 per share, $0.01 ahead of guidance. Full-year core community base rental income growth was 5.3% with 4.7% coming from rate and 60 basis points coming from occupancy. Our 2019 core occupancy increase included a gain of 387 homeowners. At the end of the year, rental homes represented 5.9% of our core occupancy. Fourth quarter core resort-based rental income growth was 5.3%, compared to prior year.

During the fourth quarter, seasonal revenues were higher than expected and reflect strong demand for our Southern resorts as we transition into the winter season.

Full-year growth of 6% in annual revenues includes approximately 40 basis points from occupancy gained at properties with expansion sites. For the full year, net contribution from our membership business was $4.1 million higher than 2018, an increase of more than 8%. Dues revenues increased 6.8%, mainly as a result of the 6.3% increase in our paid member count. We continue to see strong demand for our upgrade products. During the fourth quarter, we sold 32% more upgrades in the prior year, and the average sale price of our upgrades was approximately 6% higher than the fourth quarter of 2018. Core utility and other income was higher than guidance, mainly because of insurance proceeds related to prior insured losses. As we’ve mentioned in the past, it’s difficult to predict the timing of receipt of insurance proceeds during the claims settlement process.

Fourth quarter core property operating, maintenance and real estate taxes were approximately $2 million higher than guidance. Approximately half of that variance resulted from real estate tax increases in Florida. As I mentioned on our call in October, we received notices of assessed value increases, and we appealed those assessments. Though most of the appeals remain open, we have accrued our estimate of the taxes for the properties impacted. Keep in mind that Florida sends tax bills in the fourth quarter for the full year, so the accrual represents an adjustment for the full calendar year even though the additional expense posted in the fourth quarter. Aside from the real estate tax increase, we experienced higher-than-planned repairs and maintenance expenses and utility expenses in the fourth quarter.

In the fourth quarter, our core revenue growth was 5.3% and core NOI growth was 4.6%. Full-year core revenue growth was 4.7% and core NOI increased 5%. Our non-core properties contributed $7.5 million in the quarter and $24.2 million for the full year. Overall, the properties included in non-core performed as expected. Property management and corporate G&A were $21.7 million for the fourth quarter. Interest and amortization expenses were $26.3 million in the quarter.

The press release and supplemental package provide 2020 full year and first quarter guidance in detail. As I discuss guidance, keep in mind my remarks are intended to provide our current estimate of future results. All growth rates and revenue and expense projections represent midpoints in our guidance range. Our guidance for 2020 normalized FFO is $426.7 million or $2.22 per share at the midpoint of our range. The main changes to 2020 guidance since our release in October, relate to updated core MH and RV annual revenues based on truing up rate and occupancy following the end of the fourth quarter. For the year, growth in core NOI before property management is expected to be approximately 5.5%.

We have seen flat occupancy in our MH properties for 2020. Base rent is expected to grow 4.4% with 4% from rate and 40 basis points from occupancy as we realize the full year impact of sites filled in 2019. In our core resort business, we project revenue growth of 5%. We see continued strong demand for our RV properties, and we continue to see opportunities to increase rate as we focus on occupancy across the portfolio. We expect 5.5% growth in our annuals for 2020.

Our full-year guidance for seasonal and transient has been adjusted to reflect strong seasonal demand that we anticipate will have an impact on sites available for transient stays in the first quarter. We have reviewed our first quarter reservation pace for our seasonal and transient businesses, and incorporated that pacing into our guidance update. Our membership business, which includes annual membership subscriptions, membership upgrade sales, and sales and marketing expenses, shows a net contribution of $57.3 million. We’ve increased our upgrade sales assumptions based on the continued success of this program. Page 15 of our supplemental package shows aggregate revenue generated by our Thousand Trails properties. We project $118.6 million in 2020 from membership subscriptions, annual seasonal and transient stays, upgrade sales and other income.

The midpoint of our core utility and other income guidance is approximately $95.1 million. The increase from prior guidance reflects the pass-through income we expect as a result of the real estate tax increases I mentioned earlier. This revenue increase is offset by our increased real estate tax expense, and therefore has no impact on core NOI.

Core expenses are approximately $421.8 million at the midpoint of our guidance range. The main driver of the increase from prior guidance is real estate tax expenses I just mentioned. Keep in mind that the increase was effective for the full-year 2019, but the expense adjustment was booked in the fourth quarter. Quarterly guidance for 2020 assumes the increased expense will be accrued each quarter. Membership sales and marketing also increased along with the increased revenue assumptions. As a reminder, we don’t make assumptions regarding expenses we may incur to recover from property damage events.

Our guidance includes $11.9 million dollars of NOI from our non-core properties. As a reminder, our properties in the Florida Keys will be included with our core properties during 2020. We expect $96 million in property management and corporate expenses in 2020 and $10.2 million of other income and expense. The full-year guidance model makes no assumptions regarding capital events and the use of free cash flow we expect to generate in 2020. Our first quarter normalized FFO guidance is approximately $114.8 million or $0.60 per share at the midpoint of our guidance range. We expect our core to generate revenue growth of 5.4%, expense growth of 4.9% and NOI growth of 5.7% in the first quarter. Our first quarter core base rent growth of 4.9% assumes a 4.3% rate increase and 60 basis points related to occupancy gains we achieved in 2019. We do not assume incremental first quarter occupancy gains in our guidance.

With the first month of the quarter almost complete, we expect growth of 6% from our core RV business in the first quarter. Revenues from annuals are expected to grow 6.6% in the quarter. As previously mentioned, our current reservation pace is driving our expectation of 6.8% and 2.8% growth in seasonal and transient revenue, respectively in the first quarter. First quarter guidance assumes core expense growth of 4.9%. The main drivers of expense growth are real estate taxes and payroll. As a reminder, our annual insurance renewal occurs April 1st. So expense growth in the first quarter includes the impact of our 2019 renewal last April. We expect to provide an update on our 2020 renewal during our call in April to discuss first quarter results. We expect our non-core properties to contribute approximately $2.7 million of NOI in the first quarter, consistent with prior guidance.

I’ll now provide some comments on the financing market and our balance sheet. Current secured debt terms are 10 years at coupons between 3.5% and 4.5%, 60% to 75% loan to value and 1.4 times to 1.6 times debt service coverage. We continued to see strong interest from life companies GSEs and CMBS lenders to lend at historically low rates for terms 10 years and longer. High-quality age-qualified MH assets continued to command best financing terms. We have approximately $48 million of secured debt maturing in 2020.

At year-end, our $400 million line of credit had $160 million outstanding. Our ATM program has $140 million [Phonetic] of available liquidity. Our weighted average secured debt maturity is more than 13 years. Our debt-to-adjusted EBITDA is around 4.8 times and our interest coverage is 4.9 times. We continue to place high importance on balance sheet flexibility, and we believe we have multiple sources of capital available to us.

Now we would like to open it up for questions.

Questions and Answers:

Operator

Certainly. [Operator Instructions] And our first question comes from the line of Nick Joseph with Citi.

Nick Joseph — Citi — Analyst

Thanks. It looks like it was a quiet fourth quarter in terms of transactions. So just wondered if that is a result of the timing of closing of deals or if it’s anything on the size of the pipeline versus what you’ve talked about in the past?

Marguerite Nader — President and Chief Executive Officer

Sure, Nick. So, yes, you’re right. We didn’t close on any new communities in the quarter, but we have a very engaged acquisitions group that’s consistently underwriting deals. We are in active discussions with sellers and have properties in all stages of the acquisition process. And — but consistent with what we’ve seen over the last few years, there’s a lot of interest for our product type. So there are some options going on out there. But at this time, we didn’t close anything in the fourth quarter.

Nick Joseph — Citi — Analyst

Thanks. Maybe just specific to Marinas. Are you seeing any opportunities to add exposure there? And if so, is that something that you would look to do?

Marguerite Nader — President and Chief Executive Officer

Sure. I mean, we — the loggerhead portfolio that we bought has continued to operate in line with our expectations. As you know, 80% of that revenue is from annual cash flow, and the occupancy rate was really high. And we’re pleased with the demand as we still — as we see, and we’re — don’t have very many vacant sites as we head into our high season now. There are certainly opportunities, but each Marina is unique and some have a highly transient base with a significant amount of ancillary revenue, and we’re focused on assets that fit our acquisition criteria, and we’ll close on deals that make sense to us in our closer to that loggerhead portfolio than not.

Nick Joseph — Citi — Analyst

Thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks, Nick.

Operator

Thank you. And our next question comes from the line of Drew Babin with Baird.

Drew Babin — Baird — Analyst

Hey, good morning.

Marguerite Nader — President and Chief Executive Officer

Good morning, Drew.

Drew Babin — Baird — Analyst

Just wanted to dig in a little bit more on transient. I think for the past few quarters, the pace of transient RV revenue growth has been a little more have CPI plus. And I guess, you mentioned in the past, that there is kind of a strategic move to push more of that business either into longer-term channels, whether it’d be seasonal or annual or just in the membership program. I guess, is it strategic what we’re seeing? Or is there anything in the booking pace, it might indicate that just that pace is kind of normalizing due to economic factors?

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

Well, I think — I think couple of things we keep in mind. We’ve long talked about the limited visibility on the transient business. The first quarter represents about 20% of the total. So it’s not the biggest quarter for us. And as we think about the winter season, the snowbird customers that we’re attracting in that season, we have, as I mentioned in my remarks, seen increased demand in the seasonal side, which is driving a bit of the reduction in the expectations for growth in the transient just in the first quarter. But definitely 65% roughly of that transient revenue comes in the second and third quarters, so as we get through the rest of the year, we’ll be watching that activity closely.

Marguerite Nader — President and Chief Executive Officer

And Drew, from a strategy standpoint, I think we prefer to keep our transient business to a small percentage, really spread across many properties, so that we provide access to new customers, who may decide to stay with us on a longer-term basis, because we’re really focused on that conversion rather than the transients today.

Drew Babin — Baird — Analyst

Great. That makes complete sense. And just one more from me, the tick up in recurring capex in the first quarter was pretty large year-over-year. I think you’ve talked about before using free cash flow to kind of fund revenue enhancing capex and things like that. I guess, was there anything lumpy in the first quarter or are those year-over-year increases in capex likely to persist through the rest of the year?

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

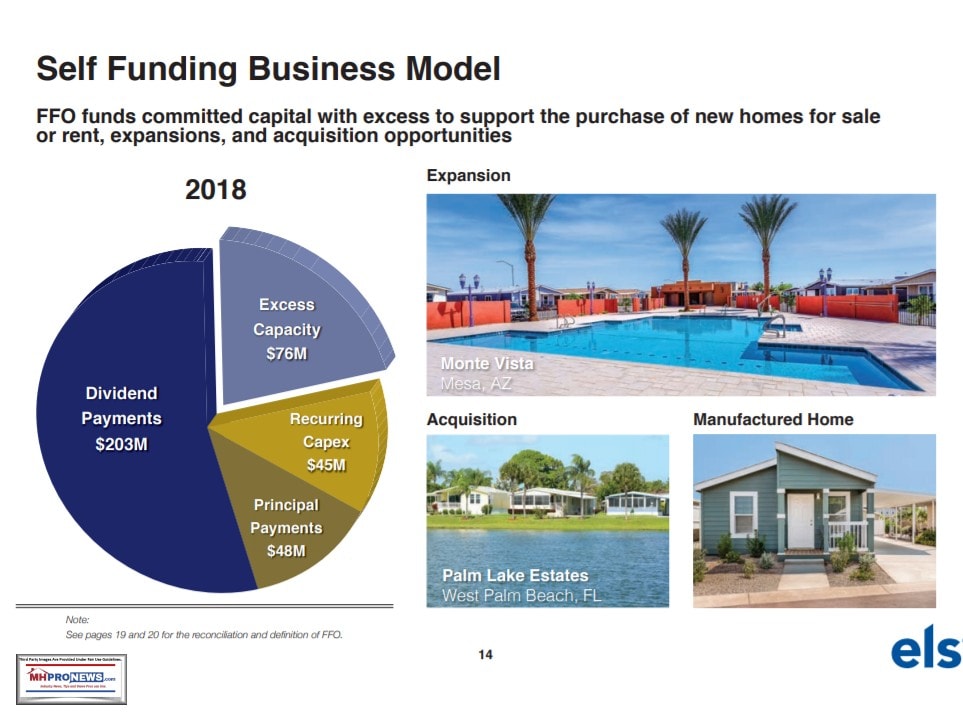

I think for 2019, I’ll just talk about that full year, we had $52 million in recurring capex, and we define that recurring capex as items that exclude site development related to placing new homes in our properties, our expansion investment, the storm-related and other non-recurring. I’ll say the team is focused on conservation efforts. And in 2019, we identified opportunities to invest in infrastructure improvements mainly electrical, water, sewer systems. We think this is going to reduce our energy usage and resource consumption and potentially reduce utility expenses going forward.

Drew Babin — Baird — Analyst

Okay. Appreciate the color. That’s all for me [Phonetic]. Thanks.

Marguerite Nader — President and Chief Executive Officer

Thanks, Drew.

Operator

Thank you. And our next question comes from the line of Samir Khanal with Evercore.

Samir Khanal — Evercore — Analyst

Hey. Hi, good morning, everybody. So, Paul, when I — I know you’re forecasting expenses a lower than 3% now. I guess, with the revision yesterday, M&A, what gives you that confidence that rates achievable, because I look at four — when you look at last year in 2019, you were up over 4%. You started the year with being up 1%. So is there something that kind of gives you that confidence? Just trying to see if there is a sort of pass-through to the customer or anything that we’re missing here?

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

I think, a couple of thinks to keep in mind; one, just as you look at the rate of increase, we provide our guidance in the fall of — of the prior year. So followed last year, and we didn’t have full-year actual results. So, though, it looks like there is a reduction because the rate went down, there is actually an increase in overall expenses expected in the budget for next year. As it relates to that 2-9 percent growth expectation, the assumption is the same as our 10-year average core expense growth rate. We have discussed in the past volatility resulting from cost to recover from storm events, as well as utility and payroll pressures. That long-term average of 2.9% includes the volatility associated with those items and provides a benchmark for our expectations of core expense growth.

Samir Khanal — Evercore — Analyst

Okay. Got it. And I guess, as a follow-up or second question here, you guys weren’t active on the acquisition side, as we kind of heard before. I know you’re active on looking at assets, but can you maybe even just elaborate a little bit, talk about sort of pricing of assets, sort of what you’re seeing out there?

Marguerite Nader — President and Chief Executive Officer

Sure. I mean the pricing, I think first in 2019, we closed on about $150 million of transactions, roughly in 5%, 5.5% [Phonetic] cap range. And I haven’t seen — there has been some compression in that — in those cap rates over the last year, but it’s consistent. And — so we are — I would say, more globally, while we don’t talk about specific deals. The industry really has progressed to a point where broker market is now institutional grade and that means really the vast majority of the deals are professionally marketed with a bidding and an auction process. So as means to say, we’re involved in all of that activity.

Samir Khanal — Evercore — Analyst

Got it. Okay. Great. Thanks so much.

Marguerite Nader — President and Chief Executive Officer

Thanks, Samir.

Operator

Thank you. [Operator Instructions] And our next question comes from the line of John Pawlowski with Green Street.

John Pawlowski — Green Street — Analyst

Thanks. Paul, maybe just a follow-up on the expense growth comments. Could you share what your base case assumption for the insurance premium increases for 2020?

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

Yeah. We have a, call it, mid-teens assumption in there for that increase. Last year, we saw closer to 20% increase. We don’t have great visibility, because we’re really in the early stages of those discussions, but that’s what our assumption is.

Marguerite Nader — President and Chief Executive Officer

And I think John, Paul mentioned that that would be something we would update on the next quarter’s call, because it comes up — the renewal comes up at the end of March, beginning in April.

John Pawlowski — Green Street — Analyst

Sure. Okay. And then a quick one on the site counts at the end of the year. I think this is the first time in several years where you saw a slippage from annuals going down and seasonal and transient going — or at least transient going up. Just curious if you can give any color on why the transient account mix actually increased this quarter?

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

I think that — John, that’s really a function of us truing up — we true up on an annual basis, those numbers. And as we went through and identified there were some changes in just the mix broadly across the portfolio, but I don’t think it’s reflective of anything as far as strategy.

John Pawlowski — Green Street — Analyst

Okay. And then last one from me. Marguerite or actually Patrick, I actually want to go back to the dispositions of the five all age communities this time last year in Indiana and Michigan. I understand there from the hometown portfolio, and they are lower quality. But curious if you can give some comments on what specifically about the underlying real estate and the dirt in those markets that looked like longer-term laggards from our lens, from miles and miles away. There is still some assets you own in like a Minnesota, Wisconsin, a rural Pennsylvania that shares some similarities to the lower growth Indiana and Michigan, at least than demographic story. So what’s specifically about those five assets sold a year ago cause you to sell them?

Marguerite Nader — President and Chief Executive Officer

Sure. So for those they were all age properties and there were a lot of moving parts that really don’t exist on the age restricted side. And looking at the local areas around those properties, and as we did that and we did an analysis, we thought it was a good time. And if you remember, as we did that in January of last year, there was also a trade into Florida location. So it was really looking at — I think it was about $100 million transaction, a disposition and $100 million acquisition roughly covering it. So it was our view that we thought we could grow more in that space in the acquisitions that we bought, and those were properties that were — you’re correct that they were from the hometown transaction and something that we had been considering selling for a while. And if I remember correctly, I think they were inside of some debt pool that had just — kind of the window had just opened, so it was an appropriate time for us.

John Pawlowski — Green Street — Analyst

Okay. Thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks, John.

Operator

Thank you. And our next question comes from the line of Steve Sakwa with Evercore.

Steve Sakwa — Evercore — Analyst

Hi, good morning. I guess for Paul or Marguerite, as it relates to insurance, not so much on pricing, but are you seeing anything from the insurance companies as it relates to actual coverage of properties and whether there is any sort of change in the types of properties. I guess, I’m thinking more specifically, places like the Florida Keys and given the storms that have come through and just rising sort of see levels in general, is there anything that’s come out of the insurance companies about coverage and deductibilities, that’s a little bit more of a systemic change?

Marguerite Nader — President and Chief Executive Officer

I mean, certainly, the carriers are very familiar with our portfolio. They are very familiar with the storms that have taken place certainly within our portfolio, and the — and a more larger global effect of what’s happened. But we do not see the carriers having other than the increase as we’ve discussed here, we don’t see them stepping away in any sense. They are engaged. They understand our asset class more than they did before. So I think that’s a positive. And it’s always helpful for us to have some storms behind us. We had a good year in 2019, and we hope to continue that trend.

Steve Sakwa — Evercore — Analyst

Okay. Thanks.

Marguerite Nader — President and Chief Executive Officer

Thanks, Steve. Thank you. And our next question comes from the line of John Kim with BMO Capital Markets.

John Kim — BMO Capital Markets — Analyst

Thank you. Can you provide an update on what you delivered as far as expansion sites in 2019, and also what you’re expecting for this year?

Patrick Waite — Executive Vice President and Chief Operating Officer

Sure, John. It’s Patrick. For 2019, we delivered 723 sites that was six projects about equally split between MH and RV. We had another two projects with more than 200 sites come online in the first few weeks of January. So call it roughly a 1,000 sites delivered for 2019. And as we look forward to 2020, we expect somewhere in the neighborhood of 10 to 12 projects with 1,100 to 1,200 sites. That will be a little bit overweight MH, but it is continues to be a mix of MH and RV.

Marguerite Nader — President and Chief Executive Officer

And just as a reminder, John, we have those 5,000 acres of vacant land adjacent to our properties. So we have room to continue to grow.

John Kim — BMO Capital Markets — Analyst

Okay. So the 1,100 to 1,200 being delivered this year, does that include what you delivered in January?

Patrick Waite — Executive Vice President and Chief Operating Officer

The 1,000 overall includes what we delivered in January. So that would be 2019. And then the 1,100 to 1,200 is a look forward to 2020 and that excludes the contribution for the overall 1,000 where we’re looking at — the first few weeks of January is inclusive in 2019.

John Kim — BMO Capital Markets — Analyst

So for the 1,100 to 1,200, would that include January 2021 deliveries? Or was this year just a unique year?

Patrick Waite — Executive Vice President and Chief Operating Officer

No.

John Kim — BMO Capital Markets — Analyst

Okay. And I think, Paul mentioned that this contributed 40 basis points to revenue growth last year. Can you provide that same figure for what it will contribute this year revenue growth?

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

Yeah. It’s — the one thing to keep in mind as I provide that on the MH side, we do hedge out that occupancy. So we exclude that incremental occupancy gain from our guidance assumptions. But we do have in 2020 about similar number, 40 basis points, about 20 basis point contribution to NOI overall inside the core coming from those expansion sites.

John Kim — BMO Capital Markets — Analyst

And that’s to overall growth as well as same-store results?

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

That’s to same store. [Indecipherable]

John Kim — BMO Capital Markets — Analyst

Okay. And then I know — just a follow-up on the investment activity for — I was wondering for this year, can you provide any color on what you expect as far as the volume of acquisitions in 2020 versus last year and also the mix? Is it going to be a similar mix of Marinas RV and MH?

Marguerite Nader — President and Chief Executive Officer

Yeah. I can’t really provide you a color on where we’re going to end the year in 2020 on acquisitions. I would say it would be an even mix between RV and MH, and to the extent there is a Marina deal or portfolio that looks good and is similar to the assets we already own. We would be interested in that, but I would think it skews more toward the RV and MH.

John Kim — BMO Capital Markets — Analyst

Got it. Okay. Thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks, John.

Operator

Thank you. And since we have no more questions on the line. At this time, I would like to turn the call back over to Marguerite Nader for closing comments.

Marguerite Nader — President and Chief Executive Officer

Thank you very much. We look forward to updating you on next quarter’s call.

Operator

[Operator Closing Remarks]

Duration: 31 minutes

Call participants:

Marguerite Nader — President and Chief Executive Officer

Paul Seavey — Executive Vice President, Chief Financial Officer and Treasurer

Patrick Waite — Executive Vice President and Chief Operating Officer

Nick Joseph — Citi — Analyst

Drew Babin — Baird — Analyst

Samir Khanal — Evercore — Analyst

John Pawlowski — Green Street — Analyst

Steve Sakwa — Evercore — Analyst

John Kim — BMO Capital Markets — Analyst

##

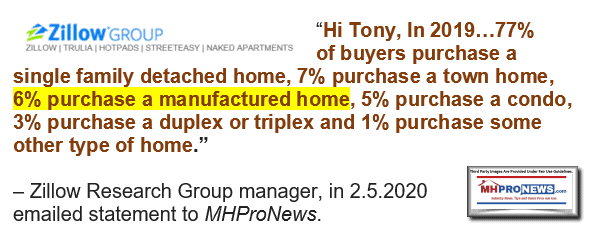

Part 2. Pull Quotes from ELS and Related

First for this part of the report, let’s stress again that compared to several stocks, ELS has a strong track record. That’s not in question. What ought to be questioned is are they giving their best effort to investors? If this is the best, then what do some of their own statements reveal about certain MHI claims? For example, ELS says that their increase in site fees are at a 4.0 or higher annual rate. MHI’s literature claim that the industry average is 3 percent. What does MHI base that claim on, if not on their publicly traded members? Is MHI deliberately understating the rate of increase in a deceptive fashion that might mislead consumers?

Then consider these pull-quotes.

Prior to diving into the next segment, ponder this data from Zillow Group Research to MHProNews.

Part 3: Email to Patrick Waite and ELS’ General Counsel

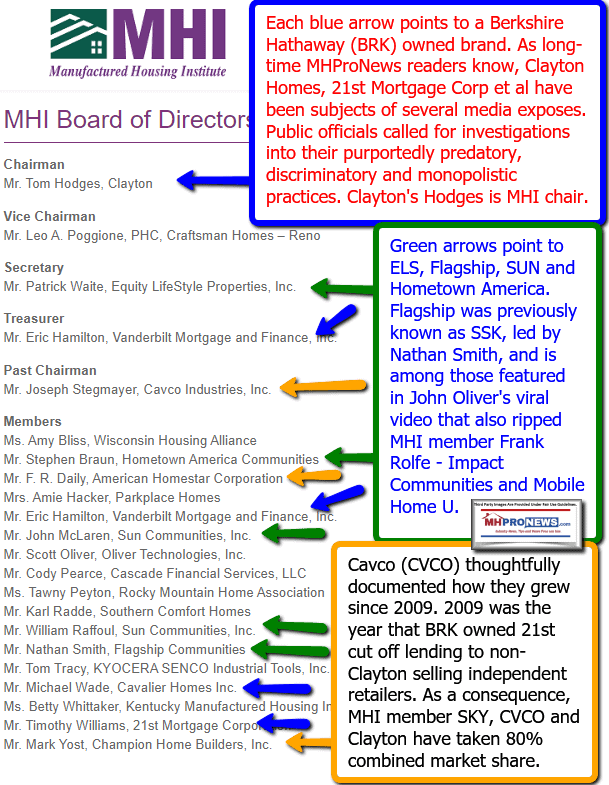

Patrick Waite was identified on the conference call with investor analysts as the “Executive Vice President and Chief Operating Officer” for ELS. He is also listed on this date as the Secretary for the Manufactured Housing Institute’s Board of Directors, more specifically known as the “MHI Executive Committee.”

David Eldersveld’s business profile reflects that he is the Executive Vice President & General Counsel & Corporate Secretary at Equity LifeStyle Properties Inc.

An emailed message was sent to Patrick Waite which copied David Eldersveld at the date and time as shown. Spacing and punctuation, etc. is corrected in what follows, but it is otherwise as transmitted. The links and image were in the original message.

| from: | L. A. Tony Kovach, MHProNews |

| to: | Patrick Waite <patrick_waite@equitylifestyle.com> |

| cc: | David_Eldersveld@equitylifestyle.com |

| date: | Dec 29, 2019, 4:26 PM |

| subject: | Patrick, ELS, Sam Zell related |

Patrick,

Let’s start with a disclosure prior to diving into our request for your and/or ELS’ formal reply to what follows further below.

Beyond third party metrics, direct communications with federal officials tells us that MHProNews has attracted a actively engaged audience of various elected and appointed federal and state officials.

It is our working plan to publish this inquiry and your reply tomorrow morning and feature it in our next emailed headline updates to industry professionals, which includes investors. Knowing first-hand that the community’s sector of the industry is 7 days a week, it is my hope that your reply will be emailed prior to publication. But a reply afterwards is acceptable too.

Just email your/ELS’ comments for our mutual accuracy in handling. If some part is off the record, please clearly so indicate in your message.

With that backdrop, the following inquiries. Please type replies below each question.

1) Sam Zell said in Chicago with Nathan Smith posing the first question the following.

“What the best thing for us as an industry to do to grow?” Sam Zell’s immediate reply was “Create a credit base for the industry.”

ELS Chairman Zell elaborated, “No competitive financing is a serious impediment to growing.”

“There is no bigger issue than having an established credit base.”

“We as an industry should have created that [credit base] a long time ago.”

Many in the industry would agree with that, but that begs this question.

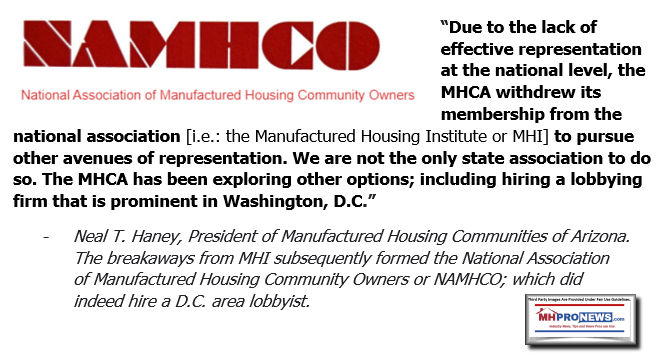

1) Why is it that the Manufactured Housing Institute (MHI), on which ELS has an executive committee board seat, failed in their written comments to the FHFA to push for the full and proper implementation of the Duty to Serve manufactured housing lending by the Government Sponsored Enterprises?

Depending on your reply, I may have a follow up question. I want to remind you of Howard Walker’s statement about transparency too, which as a publicly traded firm, you are already aware of most certainly.

Next, there are obviously other controversies involving MHI. One is that the discussion around DTS were held behind closed doors with no minutes of the meeting released.

2) Will you call for a release of those minutes and a public inquiry into MHI’s failure to properly promote DTS?

Kindly email your replies below each question for our accuracy in handling them. Thank you.

Tony

—

L. A. ‘Tony’ Kovach

MHLivingNews.com | MHProNews.com | LATonyKovach.com |Office 863-213-4090 |

##

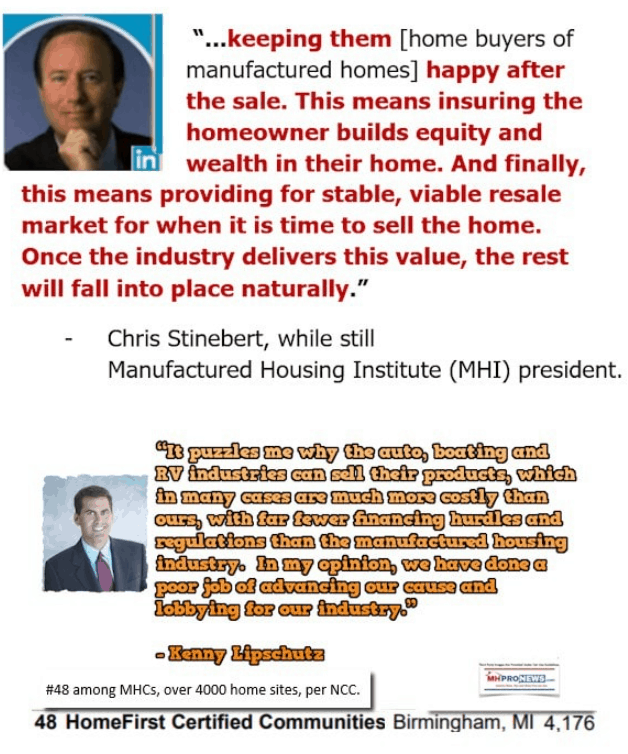

MHProNews is not aware of any replies to that communications. It should be carefully considered in the light of the report linked immediately below, plus others that follow the byline or are otherwise found in this report. These quote Warren Buffett, sources with Berkshire Hatchway owned brands leaders with firms such as Clayton Homes and 21st Mortgage, as well as several other personalities associated with MHI. The short version might be that the industry’s leaders arguably know what is needed, have for many years and have nevertheless failed to act properly.

Part 4: MH Industry Snapshot Summary, Closing Analysis and Related MHProNews Commentary

There are a variety of data points, quotes from MHI, their members and other sources that all reflect that the industry is performing poorly. For example, there are fewer manufactured homes produced in 2019 than there was in 2003 – when Warren Buffett led Berkshire Hathaway bought Oakwood and Clayton Homes and their related lending. Given Berkshire’s resources, how is that possible unless they wanted it to be so?

When one considers what ELS and other ‘big boy’ MHI members have said and done, there are a range of evidence-based concerns that arise. Sun Communities has said that communities and sites can be developed at a lower cost in many cases than purchasing an existing property. That being so, why are they, ELS or others so focused on acquisitions? Why would savvy professionals want to pay the same amount per site for a property that will need updates and maintenance vs. one that is brand new with lower maintenance costs?

To be objective, a community investor argued that when you buy an existing property, you are buying cash flow. If you get a good deal, then you don’t have to work as much to bring it to capacity. Fair enough, but that still begs several questions. Because if the industry’s products are in demand, then filling a property should not be so difficult. Look at the pace that new housing developments or new multifamily housing projects are filling. When there are some 7 million affordable housing units needed, per the National Low Income Housing Coalition’s (NLIHC) 2019 Gap Report, then there should be plenty of demand. HUD Secretary Carson has made a similar argument. The demand is ‘guaranteed,’ said Carson given the need for housing.

But what is taking place could reasonably be summed up like this.

- There are problems that often arise from the communities sector, with allegations of aggressive or predatory behavior.

- By limiting the number of new sites being created, arguably larger community operators may think that they are keeping control over the market and thus propping up pricing.

- Further, by fueling negative media, it keeps the industry’s sales and thus demand depressed.

- By not successfully achieving a full implementation of the Duty to Serve (DTS), other existing single-family housing lending programs for manufactured homes, or the implementation of the Manufactured Housing Improvement Act (MHIA) of 2000, the industry’s growth is being artificially stunted. That benefits on some levels consolidators, but harms start ups and smaller firms.

While MHI reportedly deputized a surrogate to attack MHProNews in an effort to undermine our credibility, that party and MHI are unwilling to debate or discuss these allegations in public. ELS’ general counsel and COO Patrick Waite also declined to answer key questions on these issues. If they are right, what is there to hide? If the MHProNews analysis is wrong, then why would they hesitate to publicly disprove our concerns? Another MHEC member – the Manufactured Housing Executives Council – said this.

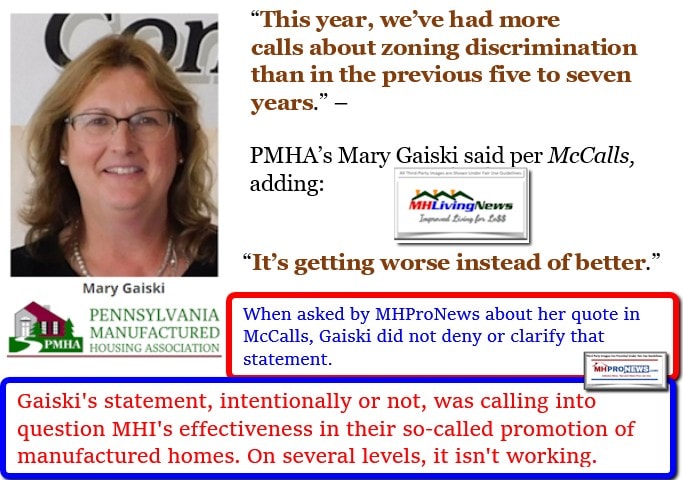

As we reported previously, some of MHI’s own current or past members question their effectiveness.

This updated screen capture with thumbnail facts and commentary provides a snapshot of what is arguably a veritable rogues gallery of black hat firms that are nestled among white hat companies. Why hasn’t ELS or others asked for the MHI code of ethical conduct to be invoked, and problematic members ejected?

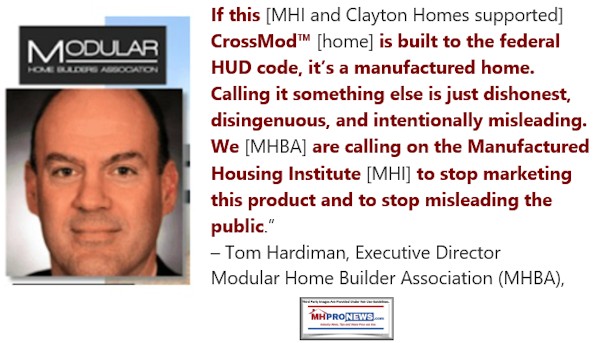

Last for today, even though there is much more linked below the byline and notices, is the broadside from the Modular Home Builders Association (MHBA) Executive Director Tom Hardiman.

Hardiman aptly stated that MHI has essentially turned its back on millions of existing manufactured homes. That can’t help those homeowners values. Is there a class action lawsuit possible, based on such problematic behaviors? Or perhaps more important, would lawmakers, regulators and attorneys generals probe these practices for various deceptive, antitrust or other legal issues?

Manufactured Home Communities Targeted by Lawmakers, AG Plans – Manufactured Housing Industry Alert

The powers that be in manufactured housing can run from the facts but they can’t hide from them forever, so long as enough people of good will hold them to account for the actual performance instead of what some have called ‘razzle dazzle.’ Photo ops with public officials are not the same as measurable results. Never forget that razzle dazzle is a con-game method, see that report linked here. For prior reports that delve deeper on the 2020 campaign related issues that MHI or other industry sources fail to mention, see reports linked above or further below. That’s a wrap for this report on manufactured housing “Industry News Tips and Views Pros Can Use“ © – MHVille’s runaway #1 news source, where “We Provide, You Decide.” © (News, fact-checks, analysis, and commentary.) Notice: all third party images or content are provided under fair use guidelines for media.

Submitted by Soheyla Kovach for MHProNews.com. Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

“Scorched Earth” Reply-Lesli Gooch, Tim Williams, and Manufactured Housing Institute (MHI) Claims