David Ditch is a “Senior Policy Analyst, Budget Policy, Grover M. Hermann Center for the Federal Budget” at and per the Heritage Foundation. Ditch spoke with MHProNews on an affordable housing related topic on 12.19.2023. “The under-production of housing…has undermined the country’s prosperity and growth for decades,” said Ditch. More insights from Ditch at Heritage to MHProNews will be provided in the days ahead. That noted, per a new report from WND and the New York Post which quantified the impact of mortgage rates on housing and how that contributes to the affordable housing crisis is the focus of Part I of today’s report.

Part II will explore additional information with more MHProNews analysis and commentary.

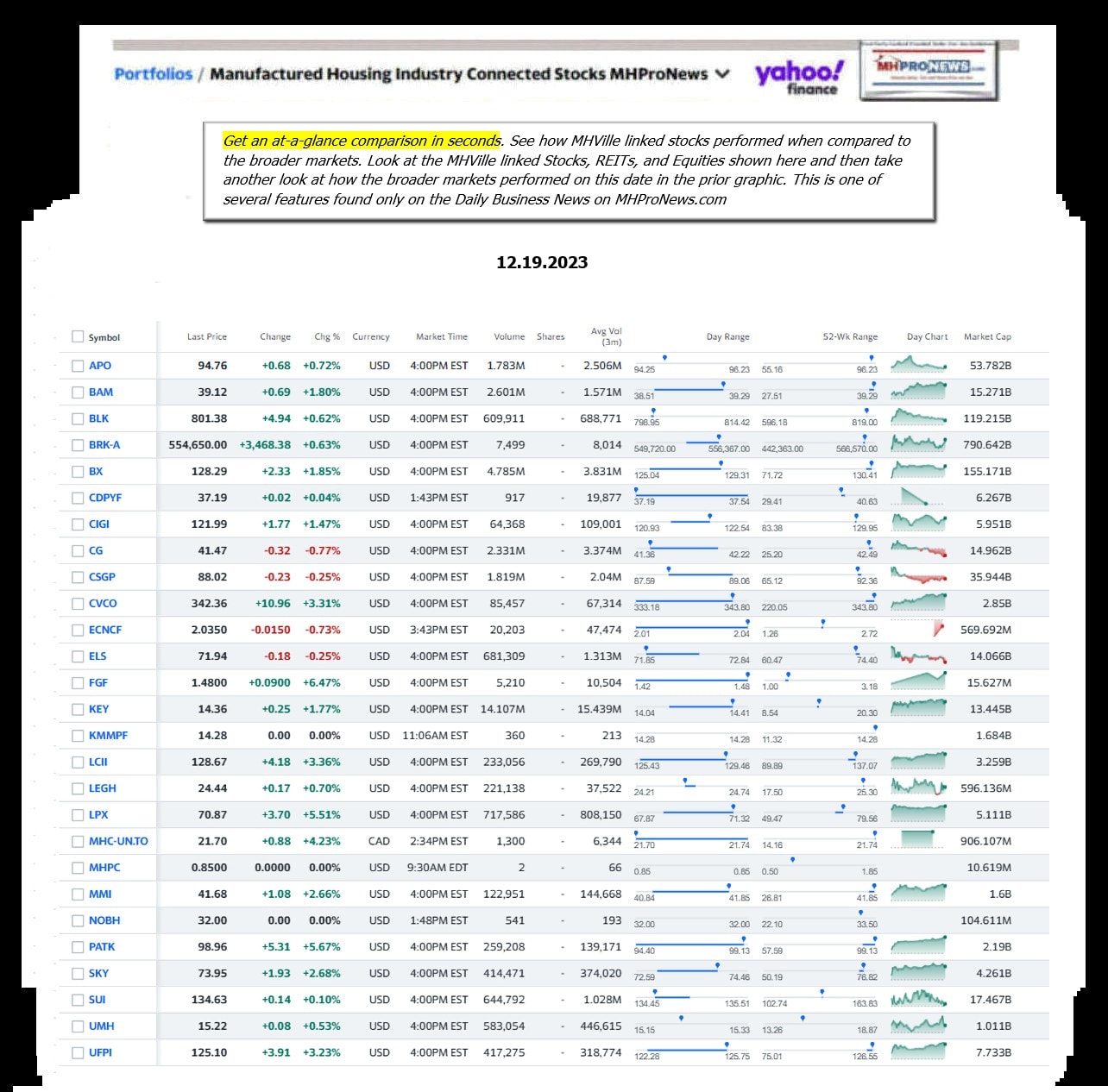

Part III provides a graphical ‘information at a glance’ that allows a professional and other readers to compare the performance of manufactured home connected stocks and equities vs. the broader stock markets. That segment also provides a left-right bulleted headlines recap, which shed light on ‘market moving’ mainstream and business news from CNN Business (left) and Newsmax (right).

Part I: from the WND News Center to MHProNews are the Following Insights on Eroding Housing Affordability

Bidenomics hits Americans: Mortgage payments UP 90%

Average explodes from $1,746 to $3,322

By Bob Unruh

Published December 14, 2023 at 5:00pm

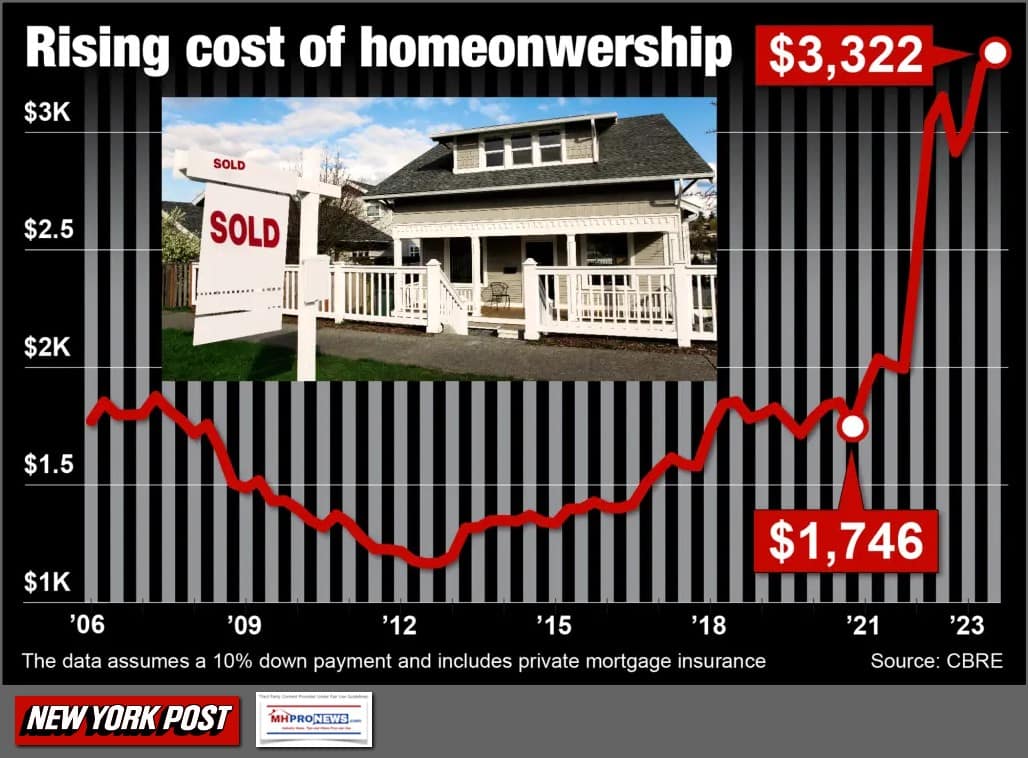

Before Joe Biden took over the White House, the average monthly payments across the nation on a new home were $1,746.

That was actually only a few years ago.

But data from real estate investment firm CBRE says that figure now is $3,322, a “staggering” 90% hike.

Joe Biden repeatedly has touted “Bidenomics” as a reason to re-elect him to be president until he’s close to 90 years old.

That’s the set of policies that gave Americans 9.1% inflation, gas at $6 a gallon in many locations, rocketing food prices and worse.

This includes mortgage payments, which now are up 90% on his watch.

The New York Post warns that, because of Biden, “The dream of owning a home in America is slipping farther away for many, with average monthly mortgage payments now nearly double what they were at the start of the Biden administration.

“As interest rates surge above 7% and housing prices continue their ascent, aspiring buyers are confronted with one of the most unaffordable markets in recent memory,” the report charged.

Part of the problem has been the ripple effect of the Democrats’ agenda to spend trillions of borrowed dollars in various programs sought by Biden and his cronies. That pushed inflation to levels as high as 9.1%, and the Federal Reserve, trying to pull that down, has raised interest rates so that home mortgages often now are close to 7%.

A report from the Post noted that Democrats like Biden’s economic work, but “for the most part, it seems that the average American is tired of it.” ##

Part II – Additional Information with More MHProNews Analysis and MHVille Commentary

1. “It’s important to note this calculation doesn’t incorporate a slight recent dip in home loan rates,” said the New York Post. Nor did WND note the obvious, and perhaps for that reason, that gas has fallen significantly, but that fall in gas cost arguably occurred for reasons other than the Trump-era ‘drill baby drill’ with ‘all of the above’ energy policies, and gas prices won’t be explored in this particular report. The focus is on the stunning rise of housing and mortgage payments since Joe Biden moved into the White House.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

2. Those points in Part II #1 above noted, the NY Post also said: “Hannah Jones, Senior Economic Research Analyst at Realtor.com, says she expects interest rates to come down by next year, which could take $200 to $400 off monthly mortgage payments.” But that would still leave mortgage rates near or above $3000 per month for the cost of an average new conventional house. The Post also noted that” “This analysis, centered on a $430,000 home with a 30-year mortgage, considering a 10% down payment, underscores the gravity of the situation.” Let’s further observe that even if rates fall, housing prices may continue to rise. Restated, barring a stunning economic shock that causes prices to fall, for several reasons, such higher costs and payments for conventional housing may continue for the foreseeable future.

3. As conventional housing becomes less and less affordable, by comparison, far less costly manufactured homes ought to be more affordable. As a Manufactured Housing Institute (MHI) affiliated state association executive told MHProNews, when someone or some family that previously could afford the payment on a conventional house no longer qualifies, what happens? In many if not most cases, that person or household that previously qualified for a mortgage on a conventional house, all else being equal, is still often able to qualify for a manufactured home on privately owned or purchased land. But when manufactured home prospects can no longer qualify to buy a manufactured home, they often fall off the housing ladder altogether, said that MHI linked state executive.

That’s an important point. What might be thought of as traditional manufactured home buyers, during an inflationary period marked by eroding purchasing power means that fewer of those Americans will qualify for our homes.

MHProNews previously made a similar point to that earlier this year. Historically, higher interest rates may have caused some that once qualified for a manufactured home to no longer qualify, but that was compensated by those who no longer qualified for a conventional house that may now only qualify for a manufactured home.

4. As a follow up to that report above with respect to the ‘inventory’ and ‘backlogs’ issues faced by retailers during the Covid19 housing boom were the insights from retailers like Chad Evens at Centennial Homes along with an array of cited sources. That report is linked below.

5. Because MHProNews appears to be the only manufactured home industry trade media that for some years has provided and unpacked the earnings call and other ‘official’ information from publicly traded firms, detailed information beyond press releases or the talking points of associations are thereby obtained and provided to our readers. When press releases, association, and other unquestioned remarks are organized in a jigsaw puzzle like fashion, what can emerge may include confirmation – and/or obvious disconnects – between what is said in one instance vs. what was said in another. Those complimentary and/or contradictory insights occur often just days apart and sometimes even contradicting earlier remarks from the same source. That pattern of often contradictory claims from people in the same or similar orbits begs its own questions, which truth seekers ought to be probing.

6. For example. To the point made by that MHI linked state association executive referenced above and the impacts of rising costs and interest rates on potential home buyers. That executive’s remarks strikes near the heart of the ‘priced out’ research that the National Association of Home Builders (NAHB) publishes annually. A snapshot of the 2023 priced out study by Na Zhao, Ph.D., for the NAHB said the following.

7. Per Zhao for the NAHB, every $1000 in higher prices means that 140,436 households were “priced out” in 2023. But as the above noted, the formula was created before higher mortgage interest rate increases kicked in. So, the bottom line is this. Roughly 1 million Americans that could have previously qualified to buy a new conventional house in 2022 couldn’t in 2023. Note that the figure used by the NAHB, about $426,000 is about the same figure used by CBRE research cited by WND and the New York Post that yielded the $3,322 monthly mortgage payment vs. $1746 it was just a couple of years ago. More specifically: “This analysis, centered on a $430,000 home with a 30-year mortgage, considering a 10% down payment…”

According to the U.S. Census Bureau’s latest data (12.6.2023), the average U.S. price for manufactured homes are as follows.

| United States | ||

| Total1 | Single | Double |

| 118,000 | 82,300 | 150,200 |

Using the average price for a multi-sectional HUD Code manufactured home ($150,200) and calculating $100,000 for a site and improvements, yields a total cost for a potential land-home package at $250,200. Per Bank Rate on 12.19.2023, the following are the rates for a new FHA Title II loan.

| Product | Interest Rate | APR |

|---|---|---|

| 30-Year Fixed Rate | 7.21% | 7.23% |

On a new manufactured home that rate is as follows.

| Type of loan | Average rates | Typical terms |

|---|---|---|

| FHA | 7.32% | Up to 30 years |

Using an FHA loan with 3.5 percent down payment, Mortgage Calculator says the following about a $430,000 new conventional house at 7.23 APR percent.

Mortgage amount

$414,950

Monthly mortgage payment

$2,825

Using an FHA loan with 3.5 percent down payment, Mortgage Calculator says the following about a $250,000 new conventional house at 7.32 APR percent.

Mortgage summary

Mortgage amount

$243,443

Monthly mortgage payment

$1,672

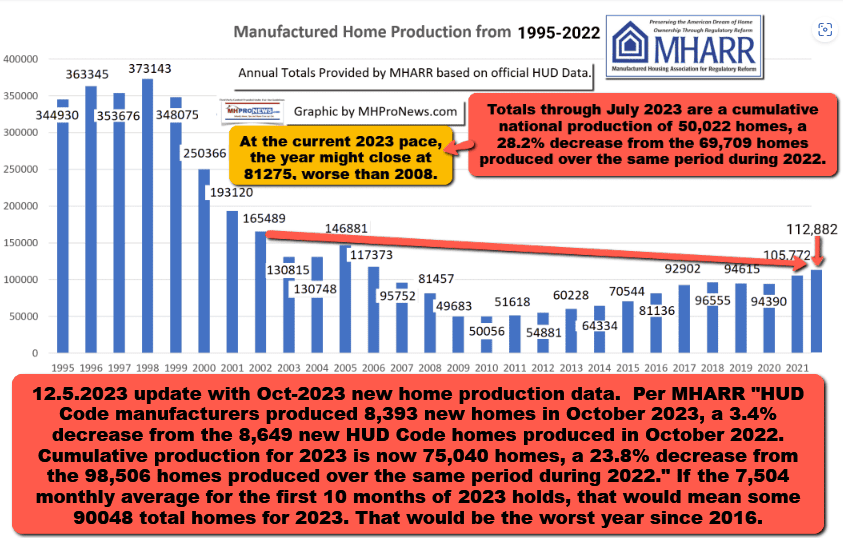

Note there will be closing costs, taxes, insurance plus mortgage protection insurance (MPI) that will be typically charged on such loans. Those will vary by location. So, using the above for simplicities sake, millions who could NOT qualify for a new conventional house COULD qualify for a new manufactured home. Indeed, if only 1 out of 10 who couldn’t qualify for a conventional house in 2023 bought a manufactured home instead, manufactured home production could have more than tripled this year. But that was not the case. Manufactured home production in 2023 has trailed 2022 all year, per data published and publicly available from the Manufactured Housing Association for Regulatory Reform (MHARR).

8. However, when the remarks made recently by several publicly traded firms that are Manufactured Housing Institute (MHI) members are explored, they have said that the percentage of single section manufactured home sales has increased. Millions of more people could qualify for the manufactured home than qualify for the conventional house. Millions who are ‘priced out’ of a conventional house could still buy a manufactured home. Yet, instead of larger and more costly multi-sectional homes being sold, what MHI member companies like Skyline Champion (SKY) and Cavco Industries (CVCO) revealed in their most recent quarterly statements and earnings call remarks is that buyers are turning to lower cost homes, including more single section manufactured homes.

9. So, part of the pitch those firms have made to investors – which can be construed as accurate in some cases – are nevertheless often misleading (see the reports above for the specifics). It is true that the affordable housing crisis is “intensifying,” as Cavco’s William “Bill” Boor said. But it is also apparently not true the potential home buyers who could have qualified for a conventional house perhaps a year or two ago but are now “priced out” – as NAHB said – those buyers appear not to be turning to manufactured housing in sufficient numbers to keep the sales of single section and less costly manufactured homes production share from growing. More on this in a planned report in the near term.

10. Those points noted, MHI ought to be making the pitch shared in Part II #7 above. They should be making the argument that millions who can no longer buy a conventional house can still qualify to buy a nice multi-sectional manufactured homes that rivals the features for about half the construction cost. That educational-informational message ought to be made to mainstream media via press releases, op-eds, and a positive, cohesive, and aggressive national campaign. In 2005, the MHI commissioned Roper Report suggested how a national campaign educational/image building campaign could help the industry tap into a larger audience. MHI claimed that CrossMod® homes would do that, but years later, it is now obvious when the facts are examined about that MHI trademarked product, that CrossMods has never done what it was sold to the industry as being able to do. When MHI claims something gives them “momentum” it seems that in the last decade, often the opposite occurs.

11. That noted, the potential pitch to grow the industry could include a focused message on the Manufactured Housing Improvement Act of 2000 (MHIA) and its federal “enhanced preemption” provision.

> “The Manufactured Housing Association for Regulatory Reform (MHARR) and the Manufactured Housing Institute colaborated to enact the Manufactured Housing Improvement Act of 2000, which included a so-called “enhanced preemption” provision, correct? That provision could be used to overcome zoning barriers, correct? Business Insider and Pew recently reported that YIMBYism has surpassed NIMBY sentiments. The Manufactured Housing Institute commissioned reserach called the Roper Report that indicated ways that the manufactured housing industry could emulate some of the success of the RV industries GoRVing campaign, correct? Is there any evidence you can find that the Manufactured Housing Institute has launched a national campaign aimed at better educating the public about manufactured housing, including the “enhanced preemption” clause of the MHIA that could be used to increase access to affordable manufactured homes?”

12. MHI leaders and followers take note. This (#11) pattern of saying one thing but doing or accomplishing another, and/or speaking out of both sides of MHI’s mouth, seems to parallel part of the foundational argument made by a state attorney general in its newly announced lawsuit of private equity behemoth BlackRock.

13. “The under-production of housing…has undermined the country’s prosperity and growth for decades,” Heritage’s David Ditch was quoted as saying to MHProNews. That “under production” of affordable and other housing merits a careful look at existing research, because an evidence-based argument could be made that much of the data and academic side of the research has already been performed. Despite HUD’s home page on this date declaring “HUD provides housing support and uplifts communities,” two HUD researchers said on 9.7.2021 that: “Federally sponsored commissions, task forces, and councils under both Democratic and Republican administrations have examined the effects of land use regulations on affordable housing for more than 50 years.” That HUD PD&R (Policy Development and Research) report was by: “Pam Blumenthal and Regina Gray discuss the impact of regulatory barriers on housing affordability.” Blumenthal and Gray noted: “home production has recently been on the rise, building permits, one indicator of new housing supply, remain below historical averages and far below the level needed to eliminate the deficit in housing.” Gray and Blumenthal also noted: “Without significant new supply, cost burdens are likely to increase as current home prices reach all-time highs…”

Regina C. Gray is the “Director, Affordable Housing Research and Technology Division” at HUD PD&R. On 9.19.2023, Gray said on the HUD website: “The drive to build housing more quickly, cheaply, and efficiently is a challenge that HUD has grappled with since its inception.” After mentioning Operation Breakthrough, Gray continued: “Despite the demonstration’s short-lived success, the program achieved its underlying objective: mass-producing tens of thousands of affordable units. Operation Breakthrough’s biggest accomplishment, however, was the adoption of the HUD Code, which introduced the industry and the world to manufactured housing.” That link on housing after the word “manufactured” said in part: “The term “manufactured housing” often is used interchangeably with “offsite construction” or “factory-built housing” and is characterized as housing that is constructed in a temperature-controlled factory and then shipped and installed onsite.” What isn’t specifically said at that hot linked definition is that all manufactured homes are “offsite construction” or “factory-built housing,” but not all offsite construction and factory-built housing are manufactured homes. That noted, Gray went on to say that: “HUD regulates manufactured homes. The HUD Code preempts state and local building code approval.” Those remarks by Gray merit a closer look, but an initial report on her thoughts are found linked below.

14. One of several takeaways from Blumenthal and Gray’s insights and remarks is how it tended to support the comments made by prior HUD Secretary Ben Carson. Consider part of what Dr. Carson said in the light of Ditch’s remarks quoted above.

And yet a serious challenge still persists: millions of hardworking Americans who seek affordable rents or sustainable homeownership simply cannot get their foot in the door. We have reached the point where many of our nation’s teachers, nurses, police officers, and firefighters struggle to live in or around the communities they serve.

What they face is a critical shortage in our country’s supply of affordable homes.

This is not just a housing crisis – it has a human face. Homes are at the heart of building strong families, strong communities, and ultimately, a strong country.

HUD’s mission is to ensure all Americans have access to safe, quality, and affordable housing. And we believe that manufactured housing has a promising role to play – especially in the area of quality affordable housing.

For that reason, one year ago, I announced that HUD was in position to usher in a “new era of cooperation and collaboration between our Department and the manufactured housing industry.” …

Note that in declaring a “new era of cooperation and collaboration” it may be understood to imply that manufactured housing was NOT being handled in a cooperative way previously. Yet the Manufactured Housing Improvement Act of 2000 (MHIA) said under the “purposes” part of the legislation the following.

(1) to protect the quality, durability, safety, and affordability of manufactured homes;

(2) to facilitate the availability of affordable manufactured homes and to increase homeownership for all Americans…”

MHARR’s Mark Weiss has noted that second item previously, because HUD was tasked by Congress “to facilitate the availability of affordable manufactured homes and to increase homeownership for all Americans.” But if that was the mission, then that mission has failed. Manufactured home production plunged since 2000. As MHARR’s Weiss, an attorney as well as that association’s president and CEO, said: ‘HUD’s Role in Manufactured Housing Not Just Structural.’ More specifically, Weiss wrote: “Again, the word “facilitate” [as part of the language used in the MHIA of 2000] was not an accident. It was chosen to reflect an affirmative statutory obligation, on the part of HUD, to use all of the powers and authorities available to it, to advance the availability and utilization of HUD Code manufactured homes across all areas of the United States, among all groups and populations, and among all income levels.” Weiss also said: “MHARR’s comments call on HUD to specifically include HUD Code manufactured homes within the categories of affordable housing that must be available within all communities to ensure a broad range of affordable housing choices for Americans. They also call on HUD to use…the enhanced federal preemption of the Manufactured Housing Improvement Act of 2000 to override and invalidate zoning mandates and processes that discriminatorily exclude or restrict the placement and utilization of HUD Code manufactured homes.” As MHProNews has periodically documented for years, despite MHI leaders periodically mentioning their support for the enforcement by HUD of “enhanced preemption,” MHI oddly has for years made no mention of the words “enhanced preemption” on their own website. By contrast, MHARR has used the phrase “enhanced preemption” in pages and pages of articles over the period of years on their website. Which ought to beg the question: why does MHI play ‘hide the ball’ with something that they claim to want to support and claim to potential and current members to be advocating to achieve?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

15. What this focused survey of growing unaffordability reveals is that the need for more scrutiny on why the kind of legal research, probes, and/or legal action such as was undertaken this week by a state attorney general (see report linked above in #12) hasn’t yet occurred. Class warfare was declared by billionaire Warren Buffett over 15 years ago. Buffett later said that his class had “won” that class war. He said that per left-leaning and prominent newspapers. Democrats and Republicans alike have said that the economic and political system is rigged. Fresh polls indicate that the vast majority of Americans – large segments of both Republicans, Democrats, and Independents – believe that monopolies are bad and that more must be done to reign monopoly power in. Popular author and historian Herland N. Herland has said in a new book and related articles that the Billionaires have been working with the Marxists for the billionaires and corporate class benefit and further enrichment. That and more are found in the more detailed report linked here and others linked below. The lack of affordable housing, as Ditch, Dr. Carson, and others have said, has an array of negative consequences. Said Carson about two of the obstacles to more affordable manufactured homes: “The first obstacle is that manufactured housing is often overlooked because it is misunderstood.” “The second obstacle is the presence of regulatory roadblocks that still stand in the way.” Carson also noted: “By housing families that average between $30,000 to $50,000 [dollars] per year in income, manufactured homes also allow more people and families to pursue an American Dream that may have once felt out of reach.” Carson stressed that manufactured homes appreciate in value, are safer and more energy saving than some have been led to believe, and that modern manufactured housing provides a good option for people of modest means to build intergenerational wealth. To the extent that corporate, nonprofits, or public officials are blocking those public goods from millions of citizens ought to be investigated as crimes. That’s what Samuel Strommen’s legal research asserted, that “felony” antitrust violations were occurring that caused a “Rube Goldberg Machine of Human Suffering.” See the linked reports to learn more.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the morning of 12.19.2023