“The Covid-19 health and economic crisis is entering its fourth month. Almost all small businesses continue to be negatively impacted by the crisis although by varying degrees. Economic conditions are still challenging for most but less so than a month ago. About 40% of respondents reported that their current sales volume is 75% or more of pre-crisis levels, a significant improvement from 28% reporting the same in NFIB’s May 18th survey. Ten percent reported their current sales volume as 1% – 25% of pre-crisis levels, compared to 16% roughly one month ago.”

So said the National Federation of Independent Business (NFIB) in a report to MHProNews and others in media on June 23, 2020.

“Most states have started to ease business restrictions and stay at home orders and many small business owners have experienced stronger sales as a result. Twenty-seven percent of respondents reported experiencing a significant or moderate increase in sales due to eased restrictions. Another 27% of respondents have experienced a slight increase. Sales levels did not change for 42% of small business owners.”

That is from a recent NFIB survey, which includes SBA PPP and EIDL loan insights from small businesses.

That NFIB survey will be our featured focus this evening.

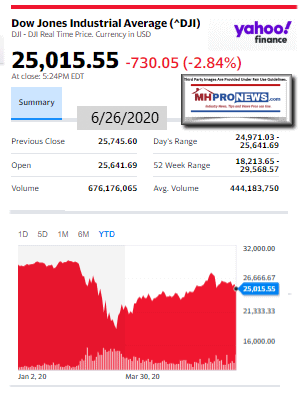

The featured focus is found beyond the left-right news headlines, two of our three market summary graphics, and our thought-provoking quotable quotes. The third of our three market summary graphics at the closing bell of manufactured home industry connected stocks is found following the featured focus and related reports, nearing the end of this article.

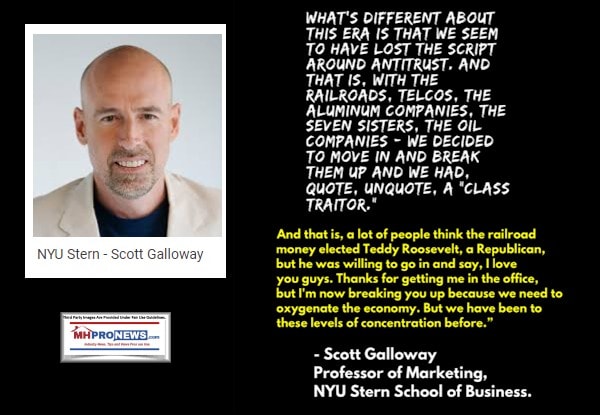

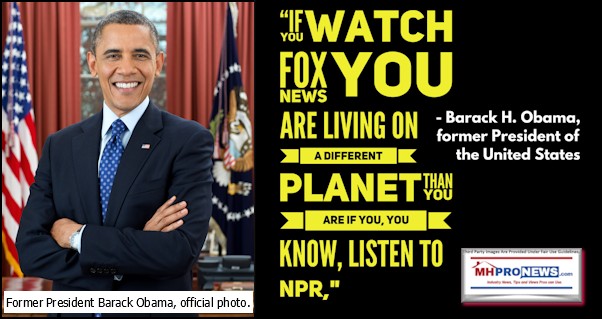

Quotes That Shed Light – American Social, Industry, National Issues…

Headlines from left-of-center CNN Business

- Markets tumble

- A pedestrian passes in front of the New York Stock Exchange (NYSE) in New York, U.S., on Wednesday, June 3, 2020. After more than two months in lockdown, this heart of global capitalism, the biggest city in the worlds biggest economy, faces a moment that couldnt feel more fraught or have higher stakes.

- Dow slides as investors grow increasingly worried about the economic outlook

- Expect stock market fireworks in the next few months. Here’s how to survive

- SPECIAL REPORT Why police and insiders say Dollar General stores are robbery magnets

- Facebook will label more controversial content and tighten advertising policies

- Facebook and Twitter stocks dive as Unilever halts advertising

- Verizon is pulling its advertising from Facebook

- Fed suspends share buybacks for banks, caps dividends

- Americans’ paychecks are getting smaller, but their spending is soaring

- Whole Foods workers sent home for wearing Black Lives Matter masks

- Microsoft is closing all of its stores

- INTERACTIVE Track America’s recovery

- Gap will sell Kanye West’s Yeezy line. Its stock is soaring 36%

- These people bought homes without ever stepping inside

- A staff works in a Luckin Coffee outlet in Hangzhou in east China’s Zhejiang province Friday, April 03, 2020. The Chinese coffee brand admitted it falsified revenue by 2.2 billion yuan last year.

- Chinese coffee company Luckin will be delisted after defrauding investors

Headlines from right-of-center Fox Business

- STOCK MARKET AILS

- MARKETS

- Dow tumbles 730 points as coronavirus spike threatens economic recovery

- Stocks plunged Friday as a rebound in COVID-19 infections began to slow America’s reopening.

- US jobs recovery plateaus as coronavirus case surge threatens economy

- Microsoft scraps physical stores amid coronavirus

- HEALTH

- Bars ordered to stop selling alcohol as new virus cases surge in Sunshine State

- Texas governor shutters bars, clamps down on businesses as virus explodes

- Commerce Sec. Ross: Economy will see ‘little interruptions’ as US emerges from virus

- TESLA

- Musk calls Bezos a copycat after tech kingpin steps up Tesla’s competition

- Because of Coronavirus Tesla workers stayed home, fired for not returning to work

- RETIREMENT

- Almost half of retirees will have to make big cuts within 5 years of leaving work: report

- OPINION

- Barstool founder: Wall Street suits are mad because I’m beating them at their own game

- ‘DIRTY DIESEL’

- LIFESTYLE

- CA tells truckers to ditch diesel in groundbreaking mandate

- GROWING BOYCOTT

- SOCIAL MEDIA

- Unilever is latest company to yank ads off Facebook, Twitter

- SUPPLY AND DEMAND

- AIRLINES

- American Airlines will soon get fully packed again

- OUT WITH THE OLD

- SPORTS

- Oregon, Oregon State discontinue ‘Civil War’ nickname for college sports rivalry

- ALL EYES ON BOEING

- BOEING

- Boeing 737 MAX certification flight test expected soon

- CASH FOR THE CAUSE

- POLITICS

- Black Lives Matter, affiliated groups see donations surge amid racial tensions

- HGTV STAR WEIGHS IN

- REAL ESTATE

- 4 costs homebuyers overlook most often: Millionaire builder

- NBA OUTBREAK

- SPORTS

- At least 16 pro basketball players test positive for coronavirus

- RAIN CHECK

- TRAVEL

- Major airlines to refund tickets if passengers fail temperature check

- TWEET VICTORY

- LEGAL

- Judge dismisses Twitter from lawmaker’s lawsuit

- INDIE 250?

- LIFESTYLE

- Indianapolis 500 will run with 50% fan capacity at speedway

- BIG IDEA

- MEDIA

- BET founder Johnson makes push for $14T in slavery reparations

- LIFESTYLE

- Alabama reopening schools in fall, but coronavirus prompts virtual options

- POLITICS

- NYC to enter ‘Phase 3’ of reopening in early July, de Blasio says

- LIFESTYLE

- Coronavirus giving at-home summer camps a boost

- SPACE

- Astronaut loses personal item during spacewalk, watches it float into galaxy

- REAL ESTATE

- JFK’s Palm Beach ‘Winter White House’ sells for $70M

- NEWS

- Zoos reopen in Chicago, but they now require reservations

- VIDEO

- John Bolton on big paycheck for book: Making money not my only objective

- MARKETS

- Trump will overhaul federal hiring to prioritize this over college education

- SPORTS

- NFL team owner commits huge sum of money toward ending discrimination

- MONEY

- How much money local governments will need to avoid cutting 4 million jobs

- NEWS

- Six Flags reacts after employee confronts family wearing BLM shirts

- TECHNOLOGY

- Justice Dept. preparing major lawsuit against Google over alleged abuses

- HEALTH CARE

- Trump targets ObamaCare amid coronavirus pandemic

- RETAIL

- SEE IT: Kanye West teases new clothing line after signing massive deal with Gap

- VIDEO

- US economy will ‘fall off a cliff’ unless there’s another stimulus bill: Greycroft’s Patricof

- FOOD & DRINKS

- Why fast-food chains have been able to navigate coronavirus pandemic so well

- MEDIA

- Country music reckons with racial stereotypes — and its future

- RETAIL

- Whole Foods workers taking stand over chain’s Black Lives Matter mask policy

- SPORTS

- NHL not planning to quarantine players for training camps

- VIDEO

- WATCH: Summer gas prices will likely be cheapest since early 2000s, analyst predicts

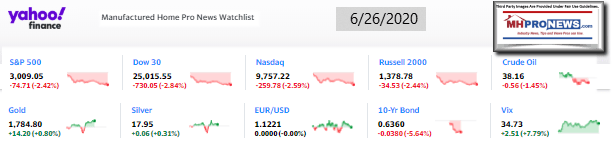

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

“Small businesses are entering the fourth month of economic crisis and are still experiencing a heavy amount of uncertainty and complications,” said Holly Wade, NFIB Director of Research & Policy Analysis. “Now that owners have more flexibility in using their PPP loan, they can focus on adjusting business operations accordingly as states loosen business restrictions.”

Key findings from the survey include:

The number of small business owners applying for a Paycheck Protection Program (PPP) loan increased slightly over the last two weeks.

- Eighty-one percent of respondents reported applying for a loan compared to 77% as of May 29th.

- Of those who have not applied, only 3% anticipate applying for a loan before the program ends for new applicants.

- Most PPP loan applicants (85%) applied through the bank that they normally use for their business.

Nearly all PPP applications (97%) have received their loans.

- Most PPP borrowers are still using their loan but over the next few weeks, more will have exhausted their funds and will be ready to apply for loan forgiveness.

- Currently, only 3% of PPP loan borrowers have applied for forgiveness.

Over half (59%) of PPP loan borrowers are taking advantage of the extended 24-week forgiveness period.

- Forty percent of borrowers find the new flexibilities (including allowing more of the loan to go towards non-payroll expenses and new FTEE exemptions) very helpful in maximizing loan forgiveness, another 19% find them moderately helpful.

- One-in-ten reported that the original terms were fine for their purposes and 9% of borrowers were not familiar with the recent changes.

Some owners report having to adjust their workforce to reflect the economic environment with 14% of PPP loan borrowers anticipating having to lay off employees after using the loan.

- Half of those who anticipate reducing staff levels expect to lay off one or two employees.

- About 12% will likely reduce their staff by 10 or more employees.

Over one-third of owners (35%) have applied for an Economic Injury Disaster Loan (EIDL) and most are still waiting for their loan to be processed.

- Only 38% of applicants have had their loan deposited.

- Small business owners have experienced faster processing with the EIDL emergency grant advance with 72% of those who requested the grant advance receiving it.

Economic conditions have improved for many small business owners over the last month as states have eased business restrictions and stay at home orders.

- However, of those small business owners who have applied for a PPP loan, an EIDL, or both, nearly half of them anticipate needing additional financial support in some form over the next 12 months.

The economic and health crisis is lasting much longer than the PPP’s initial design of primarily supporting two months of payroll and limited non-payroll expenses, and of the EIDL’s reduced loan distributions.

- Most owners (56%) expect they will need less than $50,000 to support business operations in the near term and just over one-in-four (27%) anticipate needing more than $100,000.

About 41% of respondents are familiar with the new tax deferment provision and about 6% of respondents have taken advantage of it.

- Of those who have not yet deferred their tax payments, about 5% plan to do so, and 31% responded “maybe.”

- Almost two-thirds of small business owners are not planning to defer their tax payments.

Most small business owners have had to adjust their business operations to some degree due to the COVID-19 health crisis.

- The crisis has required a significant change in business operations for 23% of respondents and a moderate change in operations for 32% of owners.

- About 30% of owners have had to modify their operations slightly and 16% of businesses have not changed any business operations.

The full survey is available here.”

MHProNews Analysis and Commentary

NFIB was highly engaged in the efforts to pass the 2017 Tax Cuts and Jobs Act. They reportedly have as many manufactured housing connected firms as the Manufactured Housing Institute (MHI) does, but also have hundreds of thousands of other members too. So, they have ‘clout’ and there are no known questionable antics with data or advocacy, as is often attributed to MHI.

When the NFIB publishes a report, the media and Washington listen.

Related and Recent Reports:

MHVillage, MHI Present 2020 Manufactured Housing Industry Trends, Statistics – Fact Check Part II

Leaked Secret Democratic Memo On Black Lives Matter Emerges; “Haven’t Seen Sh-t Like This Before”

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

Summer 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our tenth anniversary and is in year 11 of publishing.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

https://www.manufacturedhomepronews.com/celebrating-10-years-of-goal-and-solution-oriented-manufactured-home-industry-innovation-information-and-inspiration-for-industry-professionals/

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

http://latonykovach.com Connect on LinkedIn: http://www.linkedin.com/in/latonykovach