In Allenstown, New Hampshire, officials have formally approved the sale of 166 acres of town-owned land to a Canada-based manufactured home developer, Hynes Group.

The company, which already manages the 300 unit Holiday Acres community in town, plans to expand it by an additional 210 units, which will be age-restricted.

Per the Concord Monitor, the Allenstown select board okayed the sale by a 2-1 vote this week, with selectman Jeff Gryval voting against the measure and selectmen David Eaton and Jason Tardiff in favor.

The Hynes Group says that the new homes will be larger than the current homes in the Holiday Acres community, with additional extras such as garages.

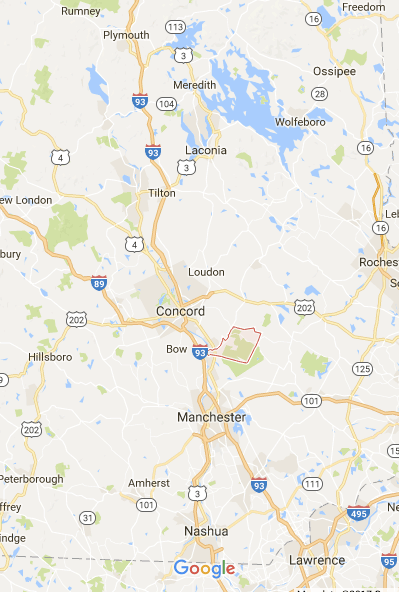

“The major factor to take into the study was that it was age-restricted. And the impact of that is that it reduces the number of school-aged children dramatically,” said Russ Thibeault of Laconia-based Applied Economic Research.

Based on an estimated average valuation of $141,068, Thibeault says that the new development would add about $29 million in property value to the tax rolls, and Allenstown could expect a net increase of about $500,000 in new tax revenues once all the homes are built.

Thibeault’s analysis also projected about $1 million in revenues from one-time sewer and water hookup fees.

Mark Fougere, of Fougere Planning & Development Inc., in an analysis submitted to town officials, thought that the revenue number could be even higher.

“The estimated positive fiscal impact of $513,000 outlined on page 29 is, again, very conservative and we would expect actual positive revenues to the community to be higher than this finding,” said Fougere.

Even with the positive report, many residents who were at the meeting this week have expressed concerns that the development will burden the town’s services and contribute little in terms of revenue.

And, the issue of just how many students the development might bring made for some strong responses, including one from a unique source.

NIMBY Strikes Again?

“Our schools are currently struggling to financially meet the needs of the existing student population. They are not prepared to accommodate a large influx of additional students. School taxes will increase as a result,” said Kathleen Pelissier, the town’s clerk and tax collector, in a letter sent to certain residents urging them to contact the select board before the vote.

“I hope I’m wrong. But only time will tell.”

Pelissier’s letter also said that manufactured homes depreciate quickly in value, and she worried many property owners in the planned age-restricted development might apply for exemptions on their taxes based on age and income.

As a part of the sale, the Hynes Group agreed to upgrade the area around the new development, including installing a sidewalk along the turnpike to the entrance of the new development.

For more on cases of NIMBY (Not-In-My-Back-Yard), including a recent case in Glendale, Arizona, click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.