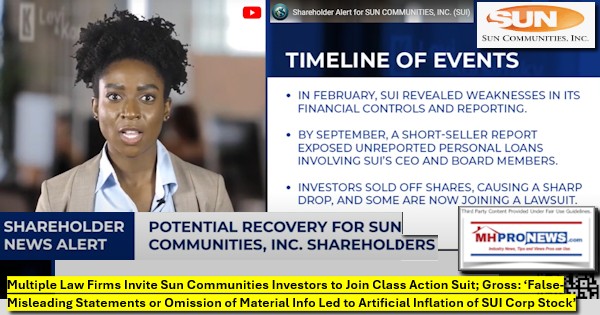

MHProNews has been reporting for several years that numbers of Manufactured Housing Institute (MHI) linked firms and that segment of the industry have arguably become a target rich opportunity for various types of legal action. Perhaps the latest piece of evidence for that is from multiple press releases from a range of law firms shown below that routinely have a track record of acting on behalf of investors in contingency litigation to protect shareholders rights. While there may be others, the firms shown below are The Gross Law Firm, Levi & Korsinsky, Bronstein, Gewirtz and Grossman, plus The Rosen Law Firm. The issue in focus appears to involve the Blue Orca research previously published by MHProNews and by this writer on the Patch. More on that in our additional information with more analysis and commentary as found in Part V.

Each press release is as shown below. Posting the media release statements of those various law firms should not be construed as an endorsement of that firm by this publication or its management. The statements made represent that of the law firm involved.

Part I

Class Action Filed Against Sun Communities, Inc. (SUI) – February 10, 2025 Deadline to Join – Contact The Gross Law Firm

News provided by

Jan 13, 2025, 05:45 ET

NEW YORK, Jan. 13, 2025 /PRNewswire/ — The Gross Law Firm issues the following notice to shareholders of Sun Communities, Inc. (NYSE: SUI).

Shareholders who purchased shares of SUI during the class period listed are encouraged to contact the firm regarding possible lead plaintiff appointment. Appointment as lead plaintiff is not required to partake in any recovery.

CONTACT US HERE:

https://securitiesclasslaw.com/securities/sun-communities-inc-loss-submission-form/?id=121993&from=4

CLASS PERIOD: February 28, 2019 to September 24, 2024

ALLEGATIONS: According to the complaint, defendants provided investors with material information concerning SUI’s accounting practices and internal control over financial reporting. On September 24, 2024, after market close, an investment research report emerged calling into question the integrity of SUI’s Board and the integrity of the Company’s governance, controls, and financial disclosures. Investors and analysts reacted immediately to SUI’s revelation. The price of SUI’s common stock declined dramatically. From a closing market price of $139.10 per share on September 24, 2024, SUI’s stock price fell to a low of $137.48 per share on September 25, 2024.

DEADLINE: February 10, 2025 Shareholders should not delay in registering for this class action. Register your information here: https://securitiesclasslaw.com/securities/sun-communities-inc-loss-submission-form/?id=121993&from=4

NEXT STEPS FOR SHAREHOLDERS: Once you register as a shareholder who purchased shares of SUI during the timeframe listed above, you will be enrolled in a portfolio monitoring software to provide you with status updates throughout the lifecycle of the case. The deadline to seek to be a lead plaintiff is February 10, 2025. There is no cost or obligation to you to participate in this case.

WHY GROSS LAW FIRM? The Gross Law Firm is a nationally recognized class action law firm, and our mission is to protect the rights of all investors who have suffered as a result of deceit, fraud, and illegal business practices. The Gross Law Firm is committed to ensuring that companies adhere to responsible business practices and engage in good corporate citizenship. The firm seeks recovery on behalf of investors who incurred losses when false and/or misleading statements or the omission of material information by a company lead to artificial inflation of the company’s stock. Attorney advertising. Prior results do not guarantee similar outcomes.

CONTACT:

The Gross Law Firm

15 West 38th Street, 12th floor

New York, NY, 10018

Email: dg@securitiesclasslaw.com

Phone: (646) 453-8903

SOURCE The Gross Law Firm

Part II

Shareholders that lost money on Sun Communities, Inc.(SUI) Urged to Join Class Action – Contact Levi & Korsinsky to Learn More

Sunday, 12 January 2025 09:00 AM

Levi & Korsinsky, LLP

Class Action

NEW YORK, NY / ACCESSWIRE / January 12, 2025 / If you suffered a loss on your Sun Communities, Inc. (NYSE:SUI) investment and want to learn about a potential recovery under the federal securities laws, follow the link below for more information:

or contact Joseph E. Levi, Esq. via email at jlevi@levikorsinsky.com or call (212) 363-7500 to speak to our team of experienced shareholder advocates.

THE LAWSUIT: A class action securities lawsuit was filed against Sun Communities, Inc. that seeks to recover losses of shareholders who were adversely affected by alleged securities fraud between February 28, 2019 and September 24, 2024.

CASE DETAILS: According to the complaint, defendants provided investors with material information concerning SUI’s accounting practices and internal control over financial reporting. On September 24, 2024, after market close, an investment research report emerged calling into question the integrity of SUI’s Board and the integrity of the Company’s governance, controls, and financial disclosures. Investors and analysts reacted immediately to SUI’s revelation. The price of SUI’s common stock declined dramatically. From a closing market price of $139.10 per share on September 24, 2024, SUI’s stock price fell to a low of $137.48 per share on September 25, 2024.

WHAT’S NEXT? If you suffered a loss in Sun Communities, Inc. stock during the relevant time frame – even if you still hold your shares – go to https://zlk.com/pslra-1/sun-communities-inc-lawsuit-submission-form?prid=122290&wire=1 to learn about your rights to seek a recovery. There is no cost or obligation to participate.

WHY LEVI & KORSINSKY: Over the past 20 years, Levi & Korsinsky LLP has established itself as a nationally-recognized securities litigation firm that has secured hundreds of millions of dollars for aggrieved shareholders and built a track record of winning high-stakes cases. The firm has extensive expertise representing investors in complex securities litigation and a team of over 70 employees to serve our clients. For seven years in a row, Levi & Korsinsky has ranked in ISS Securities Class Action Services’ Top 50 Report as one of the top securities litigation firms in the United States. Attorney Advertising. Prior results do not guarantee similar outcomes.

CONTACT:

Levi & Korsinsky, LLP

Joseph E. Levi, Esq.

Ed Korsinsky, Esq.

33 Whitehall Street, 17th Floor

New York, NY 10004

jlevi@levikorsinsky.com

Tel: (212) 363-7500

Fax: (212) 363-7171

https://zlk.com/

SOURCE: Levi & Korsinsky, LLP

Topic:

Class Action

Part III

2025-01-13 | NYSE:SUI) SUI INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Announces that Sun Communities, Inc. Shareholders Have Opportunity …

SUI INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Announces that Sun Communities, Inc. Shareholders Have Opportunity to Lead Class Action Lawsuit!

SUI | 5 hours ago

NEW YORK CITY, NY / ACCESSWIRE / January 13, 2025 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Sun Communities, Inc. (“Sun Communities” or “the Company”) (NYSE:SUI) and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Sun Communities securities between February 28, 2019 and September 24, 2024, both dates inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/SUI.

Case Details

The Complaint alleges that Defendants made false and misleading statements and/or failed to disclose material information regarding SUI’s accounting practices, internal controls, and financial disclosures. Specifically, the Complaint alleges that Defendants misled investors about the integrity of SUI’s Board and the accuracy of its financial reporting. When this information was revealed to the market on September 24, 2024, SUI’s stock price declined significantly, causing investors to suffer losses.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/SUI. or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in Sun Communities you have until February 10, 2025, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Follow us for updates on LinkedIn, X, Facebook, or Instagram.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

SOURCE: Bronstein, Gewirtz & Grossman, LLC

View the original press release on accesswire.com

Part IV

ROSEN, SKILLED INVESTOR COUNSEL, Encourages Sun Communities, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – SUI

New York, New York–(Newsfile Corp. – January 12, 2025) – WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Sun Communities, Inc. (NYSE: SUI) between February 28, 2019 and September 24, 2024, both dates inclusive (the “Class Period”), of the important February 10, 2025 lead plaintiff deadline.

SO WHAT: If you purchased Sun Communities securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Sun Communities class action, go to https://rosenlegal.com/submit-form/?case_id=32347 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than February 10, 2025. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

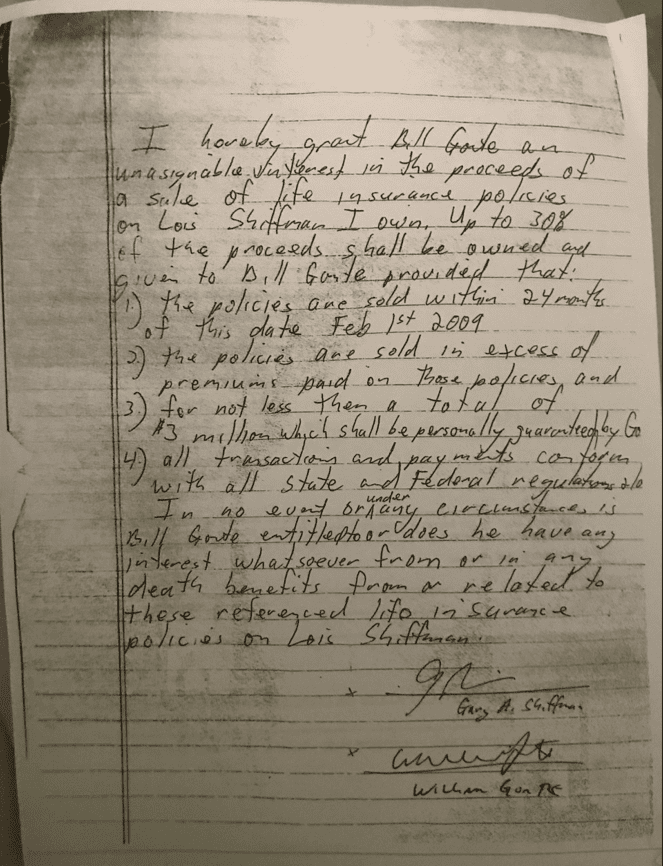

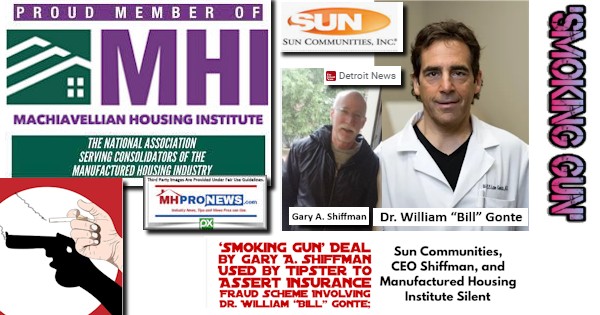

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants created the false impression that they were presenting a complete and accurate picture of SUI’s financial reports and accounting pertaining to Sun Communities’ projected revenue outlook and anticipated growth. At no point did defendants state or even allude to the DH Bingham Farms LLC mortgage, signed by Chief Executive Officer (“CEO”) Gary Shiffman, or the multiple undisclosed loans CEO Gary Shiffman received, including one from Company Board Member Arthur Weiss. Defendants misled investors by providing the public with materially flawed statements of confidence and growth projections throughout the Class Period, which did not account for these variables. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Sun Communities class action, go to https://rosenlegal.com/submit-form/?case_id=32347 call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm or on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/236857

Part V – Additional Information with More MHProNews Analysis and Commentary

1) With respect to Blue Orca, no one in MHVille has provided more coverage to their research, which is obviously still having ripple effects in the manufactured housing industry realm.

2) There has been a surge in interest in articles related to Gary Shiffman, Blue Orca and related on MHProNews per site metrics.

3) There will likely be a collective yawn, ignoring, or no serious reporting about Sun’s latest legal challenge. Latest? Yes, because Sun has been named in several antitrust actions launched on behalf of residents that also named several other MHI members.

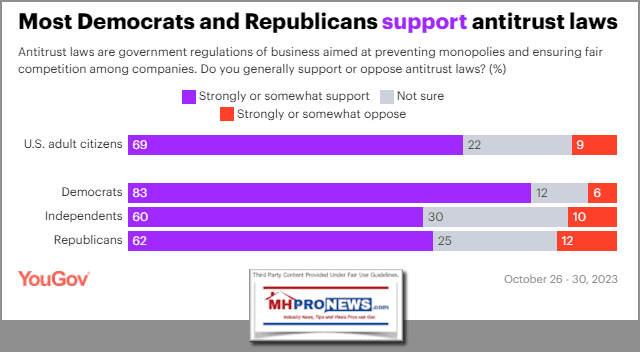

4) There are apparently good reasons why MHI and MHI linked personalities are unable or unwilling to engage with MHProNews on key topics. There is an increasing shift, per surveys like the one shown below, that the public is becoming more aware of the ‘monopoly power’ of big corporate interests.

5) To better grasp the details and nuances of the manufactured housing industry landscape, the following articles walk readers step-by-step through the current realities.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’