Before diving into the quarterly “Eye on Housing” by National Association of Home Builders (NAHB) report by Rose Quint, the following tweet from the NAHB helps set the stage with respect to current housing-relevant data.

Last week, initial jobless claims declined to the lowest level since the end of March. Continuing claims continued on its downward trend. The labor market has been gradually recovering from the pandemic over the past eight months. https://t.co/hlAQyeU35S #jobs #unemployment

— NAHB (@NAHBhome) December 3, 2020

The data above should be paired with the following from the NAHB, summarized in their tweet below.

Home buyers’ recent shift to the #suburbs is accelerating as telecommuting is providing more flexibility to live further out within large metros or relocate to more affordable metro areas, per the NAHB Home Building Geography Index (#HBGI) for Q3 2020. https://t.co/ANJVcxCLWM

— NAHB (@NAHBhome) December 1, 2020

NAHB also tweeted out their average cost per square foot by region, as shown below.

The West Coast and New England saw the highest sale prices for new homes in 2019 at $165 and $158 per sq. ft., respectively, while two regions in the South Central division saw new home sale prices under $100/sq. ft. last year. https://t.co/lxF4baPmll #realestate #homeprices

— NAHB (@NAHBhome) December 3, 2020

With that backdrop, on the day before the 2020 election, Rose Quint posted the following on “Eye on Housing” from the NAHB. There are several relevant factoids that could be useful to manufactured housing professionals and investors in what follows. The NAHB report will be followed by additional information, MHProNews analysis and commentary.

Share of Home Buyers Getting Outbid Almost Doubles

By Rose Quint

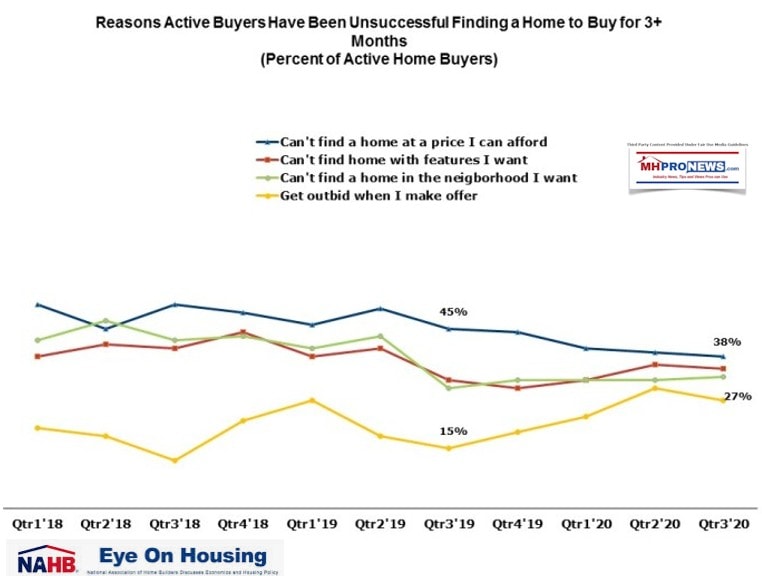

An earlier post revealed that 62% of buyers who were actively engaged in the process of finding a home in the third quarter of 2020 have spent upwards of 3 months searching for a home without success. Although the top reason long-time searchers haven’t pulled the trigger continues to be the inability to find an affordable home (38%), that share is lower than a year ago (45%). In contrast, the share who blame it on getting outbid by higher offers from other buyers almost doubled in the last year, from 15% to 27%.

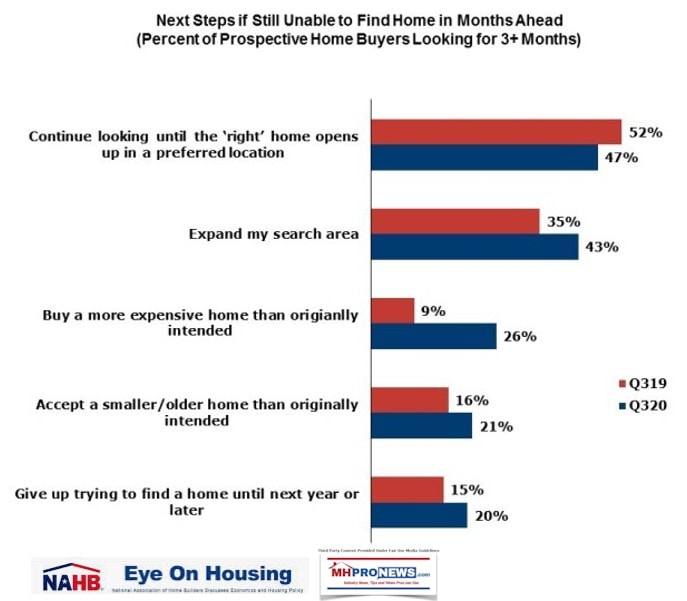

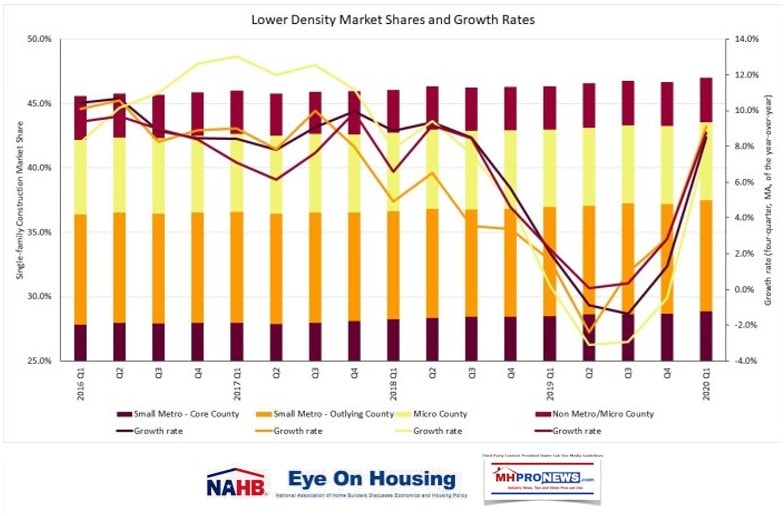

When asked what they’ll do next if still unable to find a home in the next few months, 26% of these veteran house hunters say they’ll buy a more expensive home than originally intended, three times the share with that strategy a year earlier (9%). The share who will expand their search area is also higher, up from 35% to 43%, which is consistent with findings showing increased home building in lower-density markets. The one thing long-term active buyers are less likely to do than a year ago is continue looking for the ‘right’ home in the same preferred location, down from 52% to 47%.

Difficulties finding a home to buy is having another consequence: more buyers are choosing to wait until next year or later to try again. In the third quarter of 2020, 20% of long-term active buyers said they would give up, compared to 15% a year earlier. The increase marks the third consecutive year-over-year gain in the share of buyers who are likely to quit searching for a home until the inventory situation improves.

* The Housing Trends Report is a research product created by the NAHB Economics team with the goal of measuring prospective home buyers’ perceptions about the availability and affordability of homes for-sale in their markets. The HTR is produced quarterly to track changes in buyers’ perceptions over time. All data are derived from national polls of representative samples of American adults conducted for NAHB by Morning Consult. Results are not seasonally adjusted due to the short time horizon of the series and therefore only year-over-year comparisons are statistically valid. A description of the poll’s methodology and sample characteristics can be found here. This is the fifth and final in a series of posts highlighting results for the third quarter of 2020…

##

The report above linked to other data that included the following, also from NAHB’s “Eye on Housing.” This data is from their June 2, 2020 post.

“Given expected impacts of the virus on housing preferences, we expect these trends to continue. In general, the hardest hit areas in terms of reported positive cases and deaths were those where population-density was the highest, i.e., major metropolitan areas. This will lead to more construction in low- and medium-density markets in the quarters ahead, as households seek out single-family homes further from urban cores, particularly as telecommuting continues in elevated numbers.”

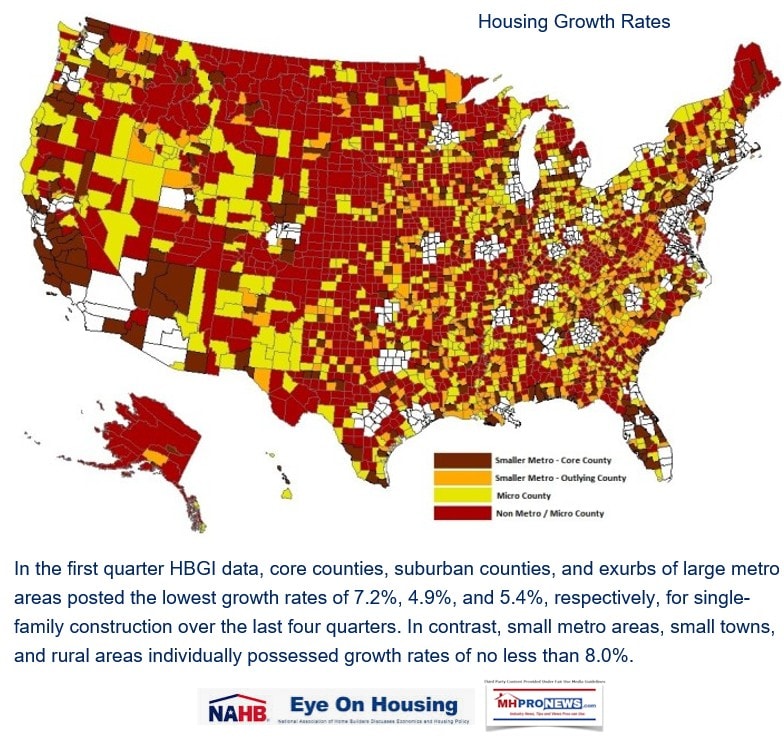

“In the first quarter HBGI data, core counties, suburban counties, and exurbs of large metro areas posted the lowest growth rates of 7.2%, 4.9%, and 5.4%, respectively, for single-family construction over the last four quarters. In contrast, small metro areas, small towns, and rural areas individually possessed growth rates of no less than 8.0%.”

Much of this information should be ‘good news’ for manufactured housing. How so?

- Given the status quo in recent years, there are generally more opportunities to place mainstream HUD Code manufactured homes in rural, exurbs, or some suburban settings than urban scenarios. That fits neatly into the housing market trends.

- A lack of affordable housing and/or housing supply are key challenges. But those are areas that properly operated manufactured home producers can address now and/or in rapid fashion.

- Since conventional builders are not able to meet the price points and/or supply demands being sought, that too fits into the potential opportunities for manufactured housing professionals.

As the National Association of Realtors (NAR) Chief Economist Lawrence Yun has said once more recently, there is not enough supply in existing housing to meet demands. That has resulted in a modest dip on sales, despite the demand.

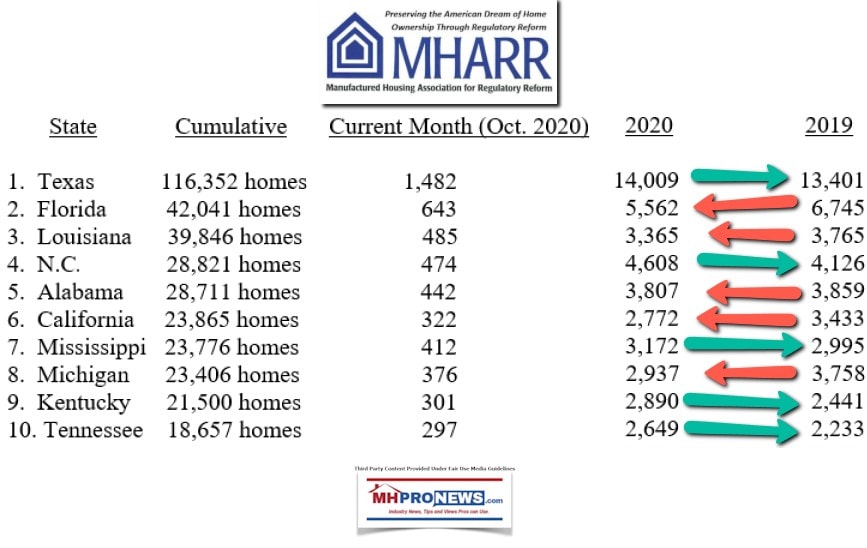

Those data points linked herein and/or shown above should then be compared to the HUD Code manufactured home industry’s reality.

While conventional housing can’t keep up with the demand, manufactured housing continues its second “year over year” (YoY) slide in both monthly and cumulative annual activity.

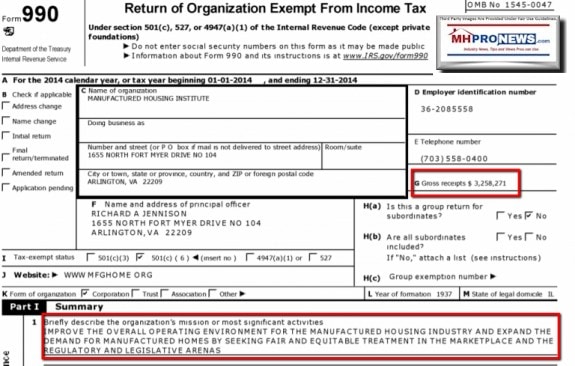

How can anyone with a shred of integrity, self-awareness, and willingness to speak the truth regardless of how some may dislike reality look at the facts presented above or linked from this report say anything other than the obvious? Manufactured housing is doing poorly by a variety of metrics. It is the Manufactured Housing Institute (MHI) that claims to be the umbrella organization for the industry. MHI formally went so far as to attempt to eliminate Manufactured Housing Association for Regulatory Reform (MHARR) some years ago, in an effort to present the industry with “one voice” to Washington, D.C. and other lawmakers/regulators at the state and local levels. Yet, instead of admitting the obvious, MHI continues to produce content that is arguably little more than gaslighting, spin, and propaganda for those who might not read beyond MHI generated content.

Given the opportunity to defend their performance, MHI board and staff leaders routinely stay mute. They attempt to pretend that MHProNews, MHLivingNews, and MHARR don’t exist. But that very ploy only underscores the weakness of their claims. After all, as several Manufactured Housing Executives Council (MHEC) members have told MHProNews, if MHI was confident enough if their data and performance, then why don’t they simply attempt to publicly disprove our evidence-driven contentions?

Instead of a direct effort, perhaps MHI member Andy Gedo was acting as an unofficial capacity to try to publicly debate and disprove MHProNews’ thesis that explains over 15 years of historic underperformance.

But as the Gedo-Kovach online public debate demonstrated, he ended up reinforcing our claims, instead of undermining them. Once that became evident to hundreds of observers of the online debate on LinkedIn, and thousands of more readers on MHProNews when that debate was posted as linked above, Gedo tossed in the towel. Let’s note that Gedo is an intelligent and informed professional. He is to be commended for the effort, and we respected several of his arguments. But at the end of the day, his efforts kept coming up short of evidence that was publicly presented to Gedo with hundreds and later thousands ‘looking on.’

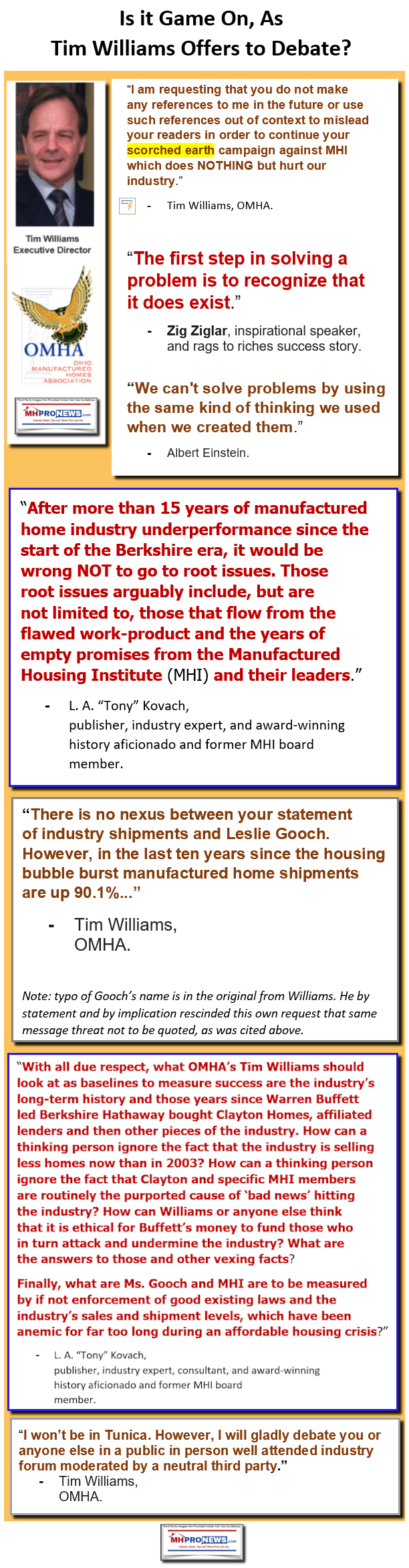

Tim Williams, executive director of the Ohio Manufactured Homes Association, attempted this year to claim that he would be able to successful defend MHI’s record. But given repeated opportunities to do so online, or to do so with a third-party university moderated debate, Williams failed to pick up the challenge.

Additionally, the other Tim Williams, former MHI chairman, and the President and CEO of 21st Mortgage Corporation has made a stunning statement that confirmed numerous concerns raised by MHProNews, MHLivingNews, and the Manufactured Housing Association for Regulatory Reform.

Put differently, there is a prima facie case that MHI, corporate leaders from companies like Clayton Homes, Skyline Champion, or Cavco Industries (CVCO) – among others – are unwilling to defend publicly in the manufactured housing professional arena.

That there are so many apparent scandals and purported conflicts of interest involving MHI and several key members only illustrates the fact that the group in recent years is more window dressing that aims to give preferred members cover than an honest trade group that actually seeks to advance industry growth, as they have claimed in their IRS Form 990 filings.

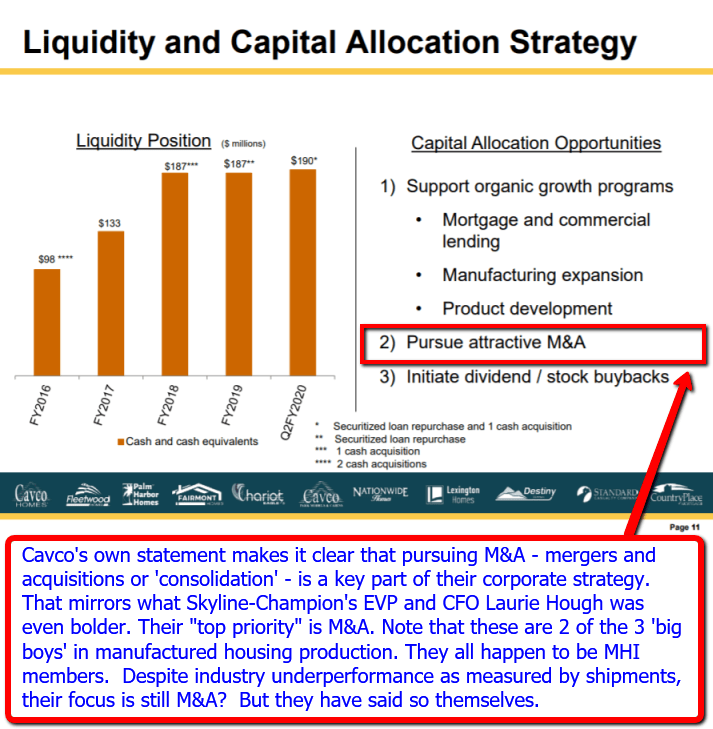

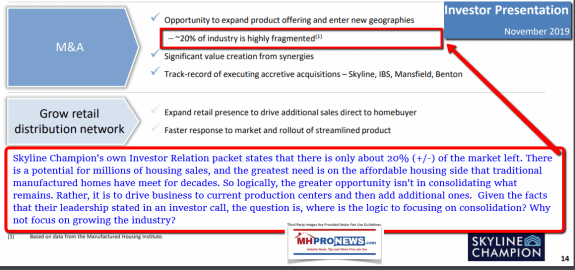

The answer to ‘why would they do that?’ question is simple to answer. Thwarting growth has resulted in the failure of literally thousands of manufactured housing industry independents since Warren Buffett led Berkshire Hathaway entered the industry. The number of producing factories has plummeted. The market share of Clayton Homes rose dramatically. So too have apparent ‘allies’ of Clayton, Skyline Champion and Cavco Industries. Neither have made it a secret that industry consolidation is their primary aim. They have said so publicly in earnings calls and in their own investor relations documents.

If a Biden-Harris administration gets the keys to the White House on January 20, 2021, there is reason for concern among manufactured housing independents. Former VP Biden cozied up to his billionaire backers. He also cozied up pre-election publicly to Warren Buffett, chairman of Clayton Homes/21st Mortgage Corp parent company Berkshire Hathaway.

If the Trump-Pence team gets to renew their lease on the Oval Office and the levers of the federal government for “four more years,” there are reasons to think that antitrust activity and other reforms that could bring relief for smaller companies will continue.

But if not, MHARR’s concerns could prove to be a sobering reality ahead.

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider

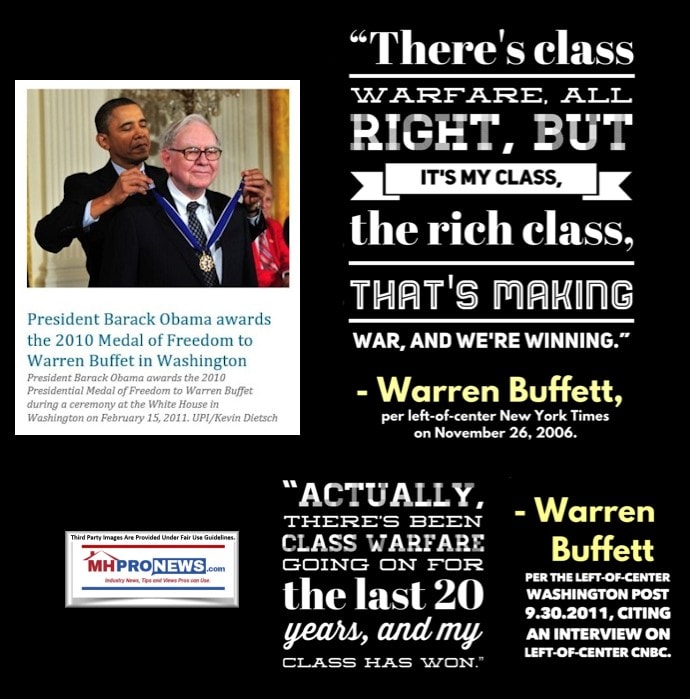

It’s war. Who said? Warren Buffett.

As several thinkers have said over the years, sometimes the best place to hide is in plain sight.

Our industry-leading breadth of readers have said it. There is no one that covers the industry with the information or insights like MHProNews.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.