A steady stream of public opinion polling reflects what common sense already tells thinkers. Americans want and need more affordable housing. News releases from the National Association of Realtors (NAR) and Fannie Mae’s Economic & Strategic Research (ESR) to MHProNews on 6.21.2024 provide information that may not find its equivalent from the Manufactured Housing Institute (MHI) to those who are not that latter association’s members, including to this pro-ethical organic industry growth trade platform. This post will provide three different sets of releases. The first is from the NAR directly to MHProNews in Part I. The second release is directly from Fannie Mae shown in Part II, which is also directly released to MHProNews. The third pair of items in Part III are statements by MHI via email, forwarded to MHProNews which MHI previously provided directly, but in recent years won’t give to this trade media. Which begs the question: why won’t MHI give such info, however biased or agenda-driven it may be? Why should MHI apparently be afraid of being transparent with MHProNews’s readers? As but one quick comparison from within the industry, the Manufactured Housing Association for Regulatory Reform (MHARR) provides their news releases and content to pro-MHI trade media that are routinely MHI members. MHARR content is made available to all who want it, not just MHProNews. Those MHI members that MHARR provides their content to may well be mostly, routinely, or even ‘all in’ for MHI. Meaning, MHARR is apparently confident enough in what they share that they provide it widely and broadly, not just to select outlets as MHI does. MHI apparently does so with the belief that other trade publishers and bloggers will uncritically parrot MHI talking points (which they often do). This contrast between MHI, MHARR, and other sources – like NAR and Fannie Mae – are so stark that left-leaning Bing’s artificial intelligence powered Copilot has pointed the concern out several times in response to certain inquiries. In its own words Copilot has said that MHARR is transparent, and MHI apparently is not. Links on such insights from Copilot are found further below.

The data provided by NAR and insights from Fannie Mae that follow are useful to MHProNews, and will be explored in Part IV of this report, analysis and MHVille expert commentary.

Part V today is our Daily Business News on MHProNews market report.

Part I – NAR Press Release

Key Highlights

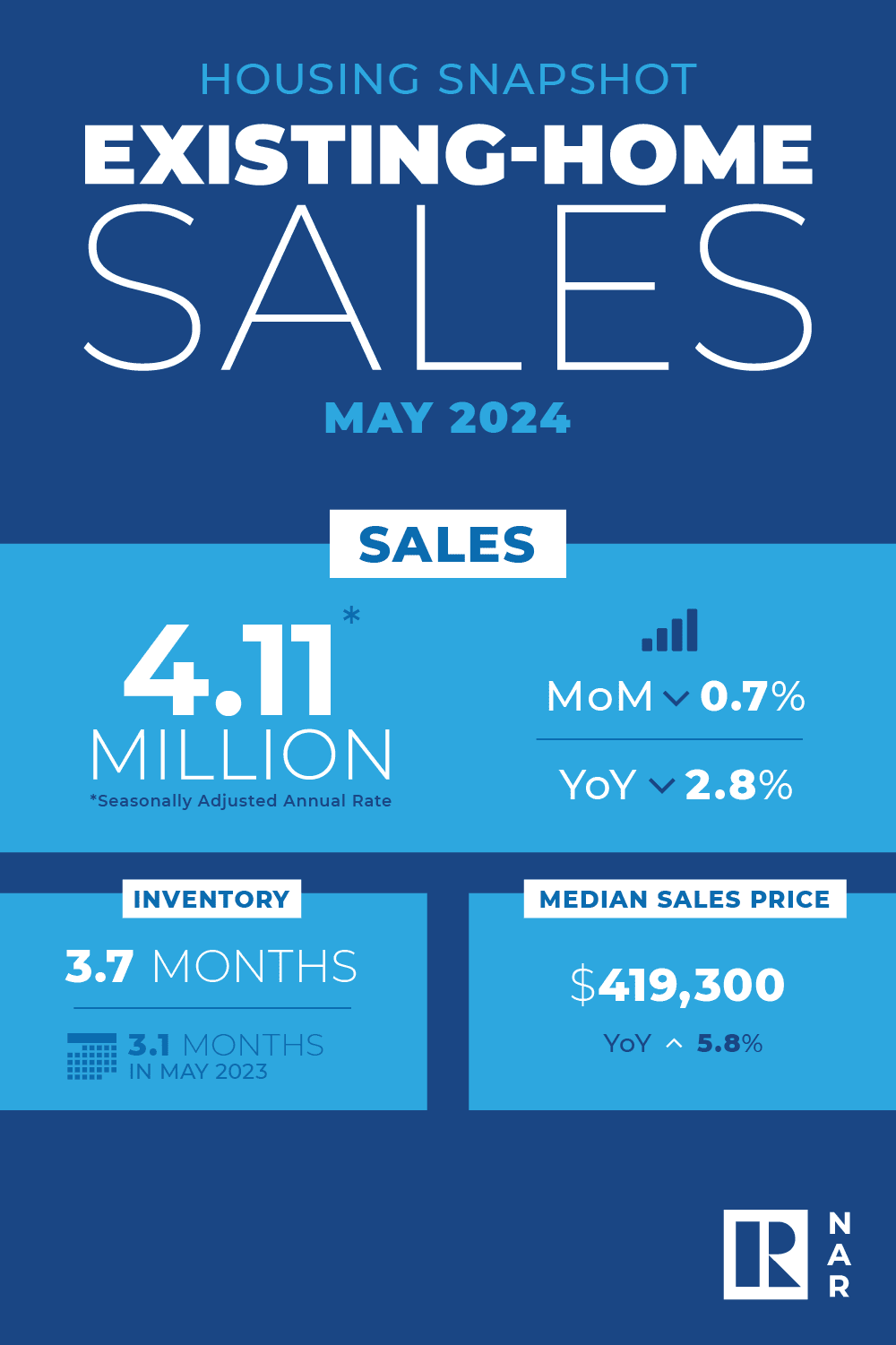

- Existing-home sales slipped 0.7% in May to a seasonally adjusted annual rate of 4.11 million. Sales descended 2.8% from one year ago.

- The median existing-home sales price jumped 5.8% from May 2023 to $419,300 – the highest price ever recorded and the eleventh consecutive month of year-over-year price gains.

- The inventory of unsold existing homes grew 6.7% from the previous month to 1.28 million at the end of May, or the equivalent of 3.7 months’ supply at the current monthly sales pace.

WASHINGTON (June 21, 2024) – Existing-home sales slightly declined in May as the median sales price climbed to a record high, according to the National Association of Realtors®. In the four major U.S. regions, sales slid month-over-month in the South but were unchanged in the Northeast, Midwest and West. Year-over-year, sales rose in the Midwest but receded in the Northeast, South and West.

Total existing-home sales[1] – completed transactions that include single-family homes, townhomes, condominiums and co-ops – retreated 0.7% from April to a seasonally adjusted annual rate of 4.11 million in May. Year-over-year, sales waned 2.8% (down from 4.23 million in May 2023).

“Eventually, more inventory will help boost home sales and tame home price gains in the upcoming months,” said NAR Chief Economist Lawrence Yun. “Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.”

Total housing inventory[2] registered at the end of May was 1.28 million units, up 6.7% from April and 18.5% from one year ago (1.08 million). Unsold inventory sits at a 3.7-month supply at the current sales pace, up from 3.5 months in April and 3.1 months in May 2023.

The median existing-home price[3] for all housing types in May was $419,300, the highest price ever recorded and an increase of 5.8% from one year ago ($396,500). All four U.S. regions registered price gains.

“Home prices reaching new highs are creating a wider divide between those owning properties and those who wish to be first-time buyers,” Yun added. “The mortgage payment for a typical home today is more than double that of homes purchased before 2020. Still, first-time buyers in the market understand the long-term benefits of owning.”

REALTORS® Confidence Index

According to the monthly REALTORS® Confidence Index, properties typically remained on the market for 24 days in May, down from 26 days in April but up from 18 days in May 2023.

First-time buyers were responsible for 31% of sales in May, down from 33% in April but up from 28% in May 2023. NAR’s 2023 Profile of Home Buyers and Sellers – released in November 2023[4] – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 28% of transactions in May, unchanged from April and up from 25% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in May, identical to April and up from 15% in May 2023.

Distressed sales[5] – foreclosures and short sales – represented 2% of sales in May, unchanged from last month and the previous year.

Mortgage Rates

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.87% as of June 20. That’s down from 6.95% the prior week but up from 6.67% one year ago.

Single-family and Condo/Co-op Sales

Single-family home sales declined to a seasonally adjusted annual rate of 3.71 million in May, down 0.8% from 3.74 million in April and 2.1% from the prior year. The median existing single-family home price was $424,500 in May, up 5.7% from May 2023.

At a seasonally adjusted annual rate of 400,000 units in May, existing condominium and co-op sales were unchanged from last month and down 9.1% from one year ago (440,000 units). The median existing condo price was $371,300 in May, up 5.1% from the previous year ($353,300).

Regional Breakdown

Existing-home sales in the Northeast in May were identical to April at an annual rate of 480,000, a decline of 4% from May 2023. The median price in the Northeast was $479,200, up 9.2% from the prior year.

In the Midwest, existing-home sales were unchanged from one month ago at an annual rate of 1 million in May, up 1% from one year ago. The median price in the Midwest was $317,100, up 6.4% from May 2023.

Existing-home sales in the South fell 1.6% from April to an annual rate of 1.87 million in May, down 5.1% from the previous year. The median price in the South was $374,300, up 3.6% from last year.

In the West, existing-home sales in May were equivalent to April at an annual rate of 760,000, a drop of 1.3% from one year before. The median price in the West was $632,900, up 5.5% from May 2023.

About the National Association of Realtors®

The National Association of Realtors® is America’s largest trade association, representing 1.5 million members involved in all aspects of the residential and commercial real estate industries. The term Realtor® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of Realtors® and subscribes to its strict Code of Ethics.

# # #

For local information, please contact the local association of Realtors® for data from local multiple listing services (MLS). Local MLS data is the most accurate source of sales and price information in specific areas, although there may be differences in reporting methodology.

NOTE: NAR’s Pending Home Sales Index for May is scheduled for release on June 27, and Existing-Home Sales for June will be released on July 23. Release times are 10 a.m. Eastern.

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

———

[1] Existing-home sales, which include single-family, townhomes, condominiums and co-ops, are based on transaction closings from Multiple Listing Services. Changes in sales trends outside of MLSs are not captured in the monthly series. NAR benchmarks home sales periodically using other sources to assess overall home sales trends, including sales not reported by MLSs.

Existing-home sales, based on closings, differ from the U.S. Census Bureau’s series on new single-family home sales, which are based on contracts or the acceptance of a deposit. Because of these differences, it is not uncommon for each series to move in different directions in the same month. In addition, existing-home sales, which account for more than 90% of total home sales, are based on a much larger data sample – about 40% of multiple listing service data each month – and typically are not subject to large prior-month revisions.

The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. Seasonally adjusted annual rates are used in reporting monthly data to factor out seasonal variations in resale activity. For example, home sales volume is normally higher in the summer than in the winter, primarily because of differences in the weather and family buying patterns. However, seasonal factors cannot compensate for abnormal weather patterns.

Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began. Prior to this period, single-family homes accounted for more than nine out of 10 purchases. Historic comparisons for total home sales prior to 1999 are based on monthly single-family sales, combined with the corresponding quarterly sales rate for condos.

[2] Total inventory and month’s supply data are available back through 1999, while single-family inventory and month’s supply are available back to 1982 (prior to 1999, single-family sales accounted for more than 90% of transactions and condos were measured only on a quarterly basis).

[3] The median price is where half sold for more and half sold for less; medians are more typical of market conditions than average prices, which are skewed higher by a relatively small share of upper-end transactions. The only valid comparisons for median prices are with the same period a year earlier due to seasonality in buying patterns. Month-to-month comparisons do not compensate for seasonal changes, especially for the timing of family buying patterns. Changes in the composition of sales can distort median price data. Year-ago median and mean prices sometimes are revised in an automated process if additional data is received.

The national median condo/co-op price often is higher than the median single-family home price because condos are concentrated in higher-cost housing markets. However, in a given area, single-family homes typically sell for more than condos as seen in NAR’s quarterly metro area price reports.

[4] Survey results represent owner-occupants and differ from separately reported monthly findings from NAR’s REALTORS® Confidence Index, which include all types of buyers. The annual study only represents primary residence purchases, and does not include investor and vacation home buyers. Results include both new and existing homes.

[5] Distressed sales (foreclosures and short sales), days on market, first-time buyers, all-cash transactions and investors are from a monthly survey for the NAR’s REALTORS® Confidence Index, posted at nar.realtor. ##

MHProNews note: one graphical item from NAR’s emailed report to MHProNews and others in media will be provided in Part IV, further below, as an illustration.

Part II – Per the Fannie Mae’s Economic & Strategic Research (ESR)

Unaffordability Expected to Remain Primary Constraint on Home Sales

Rise in Listings Likely Means Many Homeowners No Longer Willing to Delay Moving

WASHINGTON, DC – June 21, 2024 – Affordability constraints continue to limit the number of buyers willing and able to make home purchases, even as listings of for-sale homes rise, according to the June 2024 commentary from the Fannie Mae Economic and Strategic Research (ESR) Group. As such, the ESR Group downgraded its total home sales forecast to 4.82 million in 2024, representing a modest 1.3 percent annual gain compared to the previously projected 2.8 percent. Home sales have remained weaker than expected despite the recent rise in listings, which may indicate that many homeowners are no longer willing to delay moving due to the so-called “lock-in effect” – perhaps in part due to a general upward recalibration in mortgage rate expectations by consumers following the historically low mortgage rates of the pandemic. While the number of homes available for sale remains tight by historical standards, the months’ supply of inventory is gradually increasing, a dynamic the ESR Group sees as consistent with a deceleration in home price growth.

The ESR Group also downgraded its 2024 real gross domestic product (GDP) growth outlook to 1.6 percent on a Q4/Q4 basis due to downward revisions to Q1 2024 GDP data, as well as recent data showing slowing income and spending growth. While recent inflation prints have been encouraging, the ESR Group expects the Federal Reserve will likely need to see several consecutive cool reports to gain confidence that inflation is returning sustainably to its 2-percent target. Given ongoing resilience in nonfarm payroll growth and volatility in inflation readings, the ESR Group now believes the Fed will cut rates only once this year, in December, as opposed to the previously projected two rate cuts.

“The economy appears to be slowing, and recent readings offer hope that inflation is cooling after progress on that front stalled in the first quarter – a trend that will likely need to be sustained for the Fed to feel comfortable cutting rates,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “Additionally, the labor market is showing signs of a gradual slowdown, with the unemployment rate creeping up to 4 percent in the June report. Unfortunately, we’re still not forecasting a ramp-up in housing activity, which will require some combination of continued household income growth, a further slowing of home price appreciation, or a decline in mortgage rates to bring affordability within range of many waiting first-time and move-up homebuyers.”

Visit the Economic & Strategic Research site at fanniemae.com to read the full June 2024 Economic Outlook, including the Economic Developments Commentary, Economic Forecast, Housing Forecast, and Multifamily Market Commentary.

About the ESR Group

Fannie Mae’s Economic and Strategic Research Group, led by Chief Economist Doug Duncan, studies current data, analyzes historical and emerging trends, and conducts surveys of consumer and mortgage lender groups to provide forecasts and analyses on the economy, housing, and mortgage markets. The ESR Group was awarded the prestigious 2022 Lawrence R. Klein Award for Blue Chip Forecast Accuracy based on the accuracy of its macroeconomic forecasts published over the 4-year period from 2018 to 2021. ##

Part III – Per the Manufactured Housing Institute (MHI) Emails in June 2024

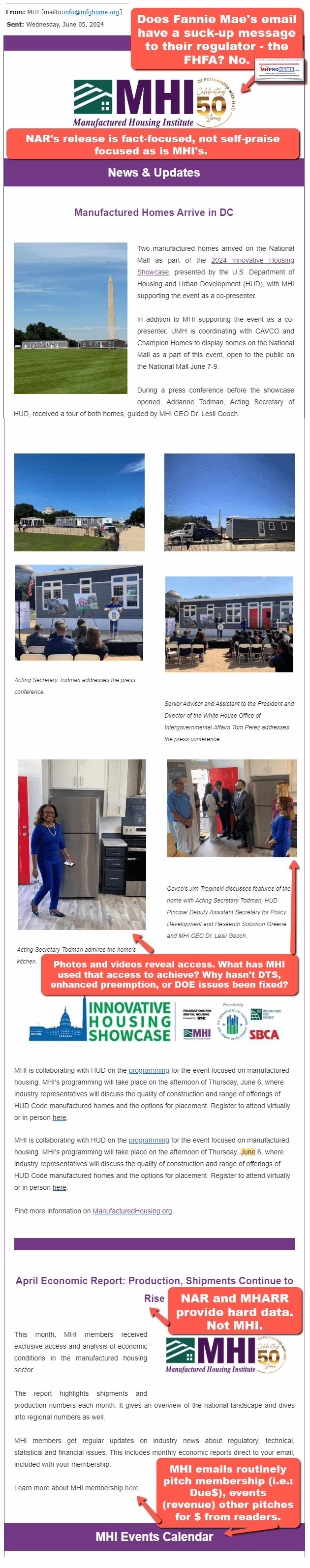

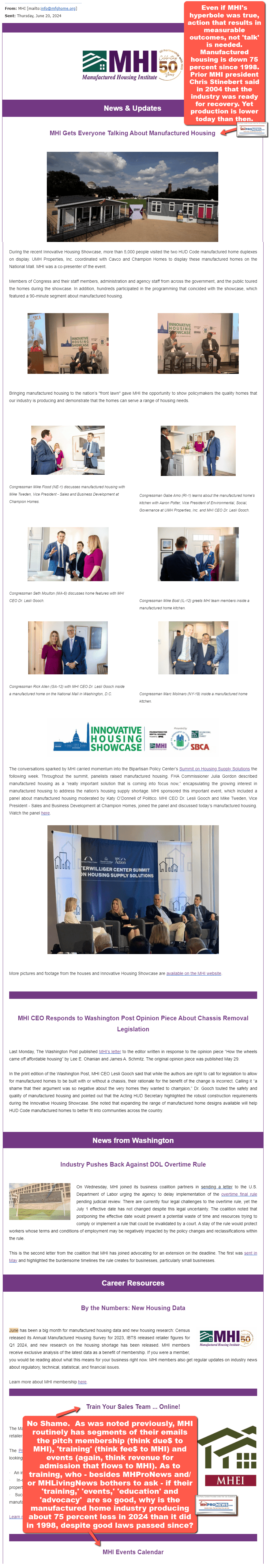

The press releases from Fannie Mae ESR and NAR’s media release should be contrasted with MHI’s communication and approach. In no particular order of importance are the following items, starting with the MHI emails for June 2024.

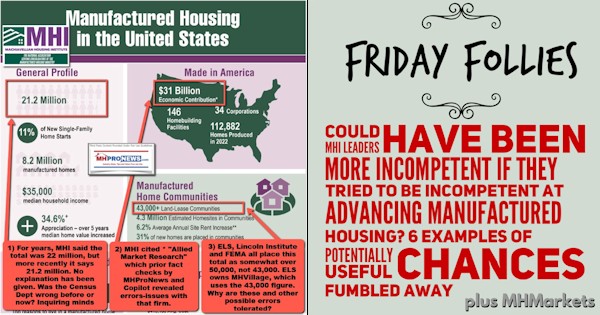

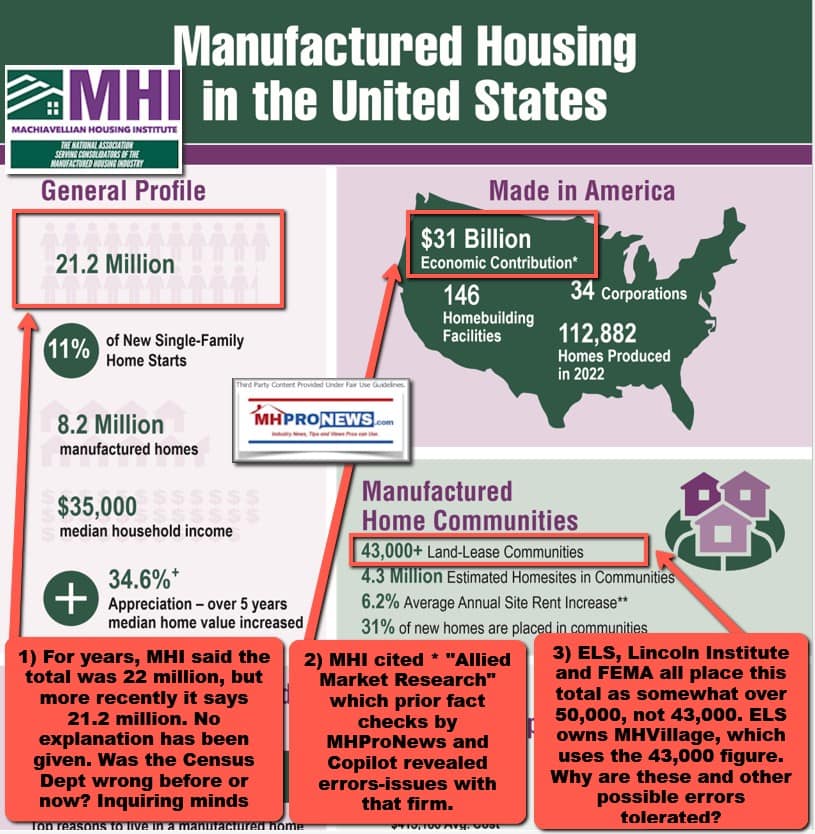

1) Screen captures of two recent emails (June 2024) are provided below. The callout boxes are remarks by MHProNews, but the base content is per MHI. As a notice to new readers and a reminder for regular readers, MHI’s communications methods can often be described as paltering, posturing, preening, and spin. While there are times that demonstrably incorrect information is provided by MHI, perhaps more common is a lack of information or important topics are omitted. For instance, there is no mention of the Department of Energy (DOE) litigation that MHI and the Texas Manufactured Housing Association (TMHA) have engaged in, following months of pressure by MHARR, MHProNews, and MHLivingNews. Yet there have been notable developments in the case. MHProNews plans an update, perhaps next week. In the meantime, the most recent update is linked here. That noted, even a cursory look at the following from MHI reveals NO HARD DATA on manufactured home production. By comparison, MHARR provides years of data at this link here. NAR (see Part I), the National Association of Home Builders (NAHB), and the Recreational Vehicle Industry Association (RVIA) each provide monthly data. MHProNews and/or MHLivingNews routinely provide fact-data-evidence-based updates for readers. MHI provides dues paying members data, but they do not provide data in this email nor on their website for the public at large. It is not just odd. It is a stark contrast between MHI and other trade groups that seek to promote their industry. By not providing data either on their site for non-members, and not providing data in their emails, MHI is able to posture more – oh, look at all these nice photos and videos. But the true measure of industry health – new manufactured home production totals! – are they going up or down? Those are missing. That apparently makes holding MHI accountable for those who may not be aware of sources like MHARR, MHProNews, or MHLivingNews much harder. And isn’t that likely the point of not sharing accurate data? What MHARR called “the illusion of motion” is thus maintained. Ironically, by spotlighting high level officials, MHI is obliquely revealing that they have access that they are not properly using.

In several devices the image that follows can be opened to a larger size.

Generally, you can click the image and follow the prompts to expand the image.

In several devices the image that follows can be opened to a larger size.

Generally, you can click the image and follow the prompts to expand the image.

2) As to MHI’s mention of the overtime rule, recall that MHProNews featured that in a report linked below. Our report was dated 6.4.2024, before the first email by MHI above. Not only was MHI more than ‘a day late and a dollar short,’ but they couldn’t even obliquely respond to MHProNews’ report in less than 2 weeks. MHI appears to be well aware that this platform has the runaway largest audience in MHVille. Several MHI leaders are per sources deemed reliable regular or periodic readers here. Indeed, MHI hired an outside attorney – John Griener, J.D. – some years ago to inform MHProNews that they were actively monitoring our publications. What a nice compliment, right?

Be that as it may, MHI may well continue to ‘run their game,’ but they periodically seem to believe that they have to do something to address issues raised on this and our sister platform. In this instance, it is apparently the MHProNews report linked below. Greiner, on MHI’s behalf, said: “Again, we demand that you immediately pull this material from your blog…” with “the material” being information MHI had published or emailed to others. Given that MHI’s own general counsel at the time, prior MHI Chairman Tim Williams, and others have publicly acknowledged that we are a news site, Griener’s stance was arguably laughable on its face. Greiner ominously stated what MHProNews has said for years, “We will monitor your site to ensure that you comply.” That much that Griener said appears to be true, they monitor our sites on a regular basis. And from time to time, MHI publishes something that may be construed as an oblique response to issues raised on our platform(s).

And that point reveals a pattern that MHI does ‘respond’ on some occasions to MHProNews’ reports, but when they do, it routinely appears to be an indirect response. For another example, see #3, below.

3) MHI’s letter to the Washington Post editor is in response to the remarks reported by MHProNews at the link below.

4) Apparently following that editorial, MHI’s CEO sent a letter to the editor of the Washington Post.

5) MHI uses a communication method that has been described as Orwellian by Copilot. Left-leaning Bing’s AI powered Copilot has said that some of MHI’s communications can be described as a ‘lie,’ ‘false and misleading.’

6) MHI’s quite public support for advocacy that benefits conventional housing has aptly been described as ‘letting the proverbial cat out of the bag.’ Instead of making the case for manufactured housing, either solo or with others – that could include MHARR if a pitch was deemed authentic – MHI has argued for stances that provide subsidies for conventional housing, instead of enforcement of existing legislation that MHI claims it wants to put into effect. See the details in the report linked below. MHI has declined direct comments on these topics.

7) By contrast to MHI’s curious, if not deceptive, communications methods, MHARR is straightforward. What MHARR emails out to their list, which most anyone can request to be included on, is what is posted publicly on their website.

8) The RVIA produces reports which apparently are deemed reliable. Would the NAR or NAHB risk publishing information that they knew to be inaccurate, as MHI has apparently and repeatedly done?

9) There may be an increase in testosterone among some, as inquiries and public challenges to MHI’s years of apparent failures at advancing the industry back toward the historic norms experienced in the 20th century are illustrated – directly or indirectly – by examples like those that are linked below.

10) Facts are stubborn things. Someone can hope that evidence can be wished away, but wishing away evidence is not a substantial strategy. There is ample evidence that much of the industry’s woes trace back to operations that are using MHI for what one MHI insider called their own ‘f-cking greedy’ purposes. Be that as it may, what is difficult for MHI supporters to respond to is that prior MHI President and CEO Chris Stinebert said was poised for a rebound in 2004. After one year of increase, often attributed to FEMA orders that could not be predicted nor regularly relied upon, the manufactured home industry has not returned to its 2004 level, much less to the levels of 1998.

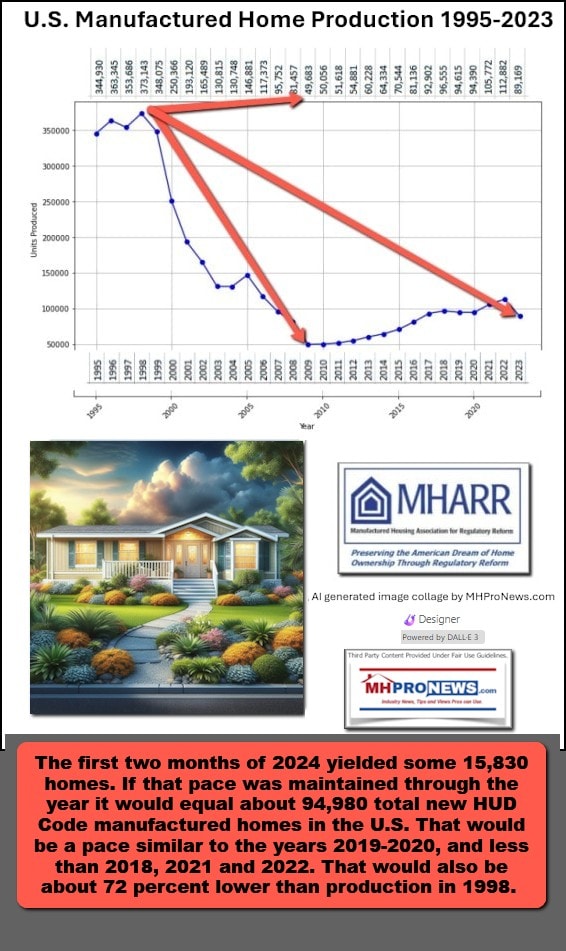

11) Manufactured housing industry production has been on a yo-yo under 100,000 shipments for more than a decade. After 14 years of sub-100,000 new HUD Code homes produced, there were two years – 2021 and 2022, when manufactured housing topped 100,000. Despite periodic proclamations by MHI that they had ‘momentum’ after each public such declarations, the industry went into yet another downturn.

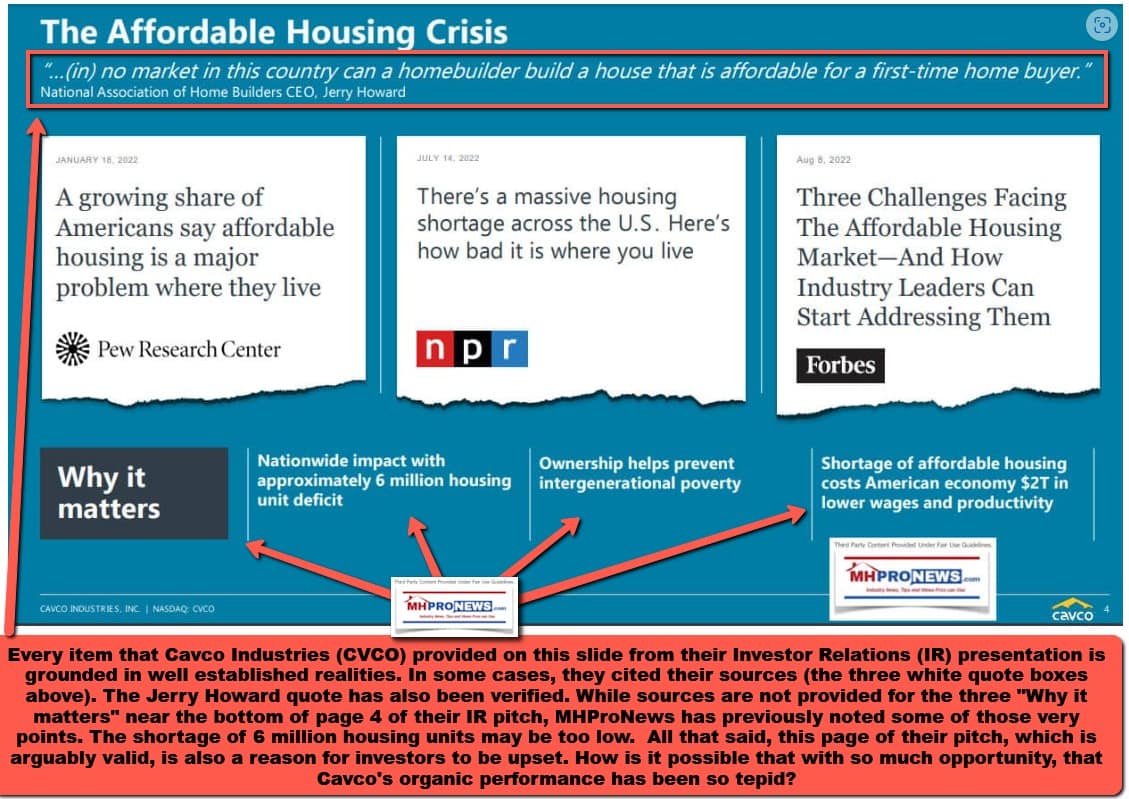

12) The disparity between annual manufactured home production at 1998 levels vs the actual production since then and the estimated 6 million new homes that are needed, per MHI member Cavco Industries (CVCO), are very similar totals. There appears to be materially misleading information being produced by several MHI member firms that are publicly traded and/or which are subsidiaries of publicly traded firms.

In several devices the image that follows can be opened to a larger size.

Generally, you can click the image and follow the prompts to expand the image.

13) Here is some key math for grasping the underlying causes of the affordable housing crisis. 373,143 x 26 = 9,701,718. That 9,701,718 represents how many new HUD Code manufactured homes would have been produced had the industry continued to produce homes at the same pace as was produced in 1998.

| Year | Manufactured Home Production |

| 1998 | 373,143 |

| 1999 | 348,075 |

| 2000 | 250,366 |

| 2001 | 193,120 |

| 2002 | 165,489 |

| 2003 | 130,815 |

| 2004 | 130,748 |

| 2005 | 146,881 |

| 2006 | 117,373 |

| 2007 | 95,752 |

| 2008 | 81,457 |

| 2009 | 49,683 |

| 2010 | 50,056 |

| 2011 | 51,618 |

| 2012 | 54,881 |

| 2013 | 60,228 |

| 2014 | 64,334 |

| 2015 | 70,544 |

| 2016 | 81,136 |

| 2017 | 92,902 |

| 2018 | 96,555 |

| 2019 | 94,615 |

| 2020 | 94,390 |

| 2021 | 105,772 |

| 2022 | 112,882 |

| 2023 | 89,169 |

| 3,201,984 |

Take that 9,701,718 – 3,201,984 = 6,499,734. That 9.7 million homes that could have been produced in 26 years – given the 1998 pace having hypothetically held annually – vs. the 3.2 million homes that were actually produced reveals a deficit or difference of about 6.5 million homes. While an argument can be made, as MHARR has done, and that Minneapolis Fed senior economist James Schmitz et al have argued, that there are multiple parties that have a hand in that disparity, certainly MHI appears to be part of that puzzling and problematic pattern. MHARR has repeatedly said so.

That simply math: 9,701,718 – 3,201,984 = 6,499,734, was part of our report linked here and further above.

If someone depended upon MHI alone for facts and figures, that would be difficult to discover, because those facts are not publicly available on MHI’s website. By hiding certain facts from the public (and thus mainstream media, public officials, and others researching the affordable housing crisis), MHI may be making a conscious decision to blur or obscure the understanding of the crisis from public view.

MHProNews has repeatedly asked MHI leaders, its outside attorney, and its most recently designated communications professional to respond to these concerns. MHI et al have remained silent. So the evidence stands uncontested at this time.

14) When a con job is employed, they are often more-or-less scams that operate in plain sight. According to author and film maker Dinesh D’Souza, an Indian-American commentator with millions of followers, criminals have a code. “Never give up the con.” Remarks on Reddit reflect a similar con artist principle. When confronted with something that may apparently expose fraud: “DOUBLE DOWN NEVER GIVE UP THE CON.”

15) Perhaps some gut sucked into this apparent con job involving MHI innocently. But an increasing number must be awakening to the reality of the apparent MHI-linked scam. From time to time, someone steps out and makes a public statement or inquiry that reveals the sobering reality that the manufactured home industry is underperforming during an affordable housing crisis, despite all of the apparent advantages that MHVille should have during said housing crisis. Analyst Greg Palm is just one such example.

16) NAR, Fannie Mae, RVIA, MHARR, NAHB, and others directly and/or indirectly provide comparisons that reflect on just how bizarre MHI’s behavior and performance has been in the 21st century. Bizarre, that is, if they were sincere in their claimed efforts. But if they are, as that insider has alleged, a tool that has been subsumed by “f-cking greedy” leaders, that’s a different story. As MHProNews routinely states, the fact that some at MHI are apparently colluding, doesn’t mean that everyone at the association is guilty of bad faith behavior.

In several devices the image that follows can be opened to a larger size.

Generally, you can click the image and follow the prompts to expand the image.

In several devices the image that follows can be opened to a larger size.

Generally, you can click the image and follow the prompts to expand the image.

17) But MHI’s board and senior staff are certainly, per Copilot and other sources, vulnerable to legal and other exposure as a result of their apparent failures.

This latest IHS marks year 5 since the inaugural event.

- a) What is changing as a result of these annual exhibits on the Washington Mall? For instance, are more local jurisdictions clamoring for manufactured homes and lifting zoning barriers? If so, where?

- b) Is HUD suddenly enforcing enhanced preemption?

- c) Has the FHFA prodded Fannie Mae and Freddie Mac to enforce chattel lending on mainstream HUD Code manufactured homes?

- d) Has Congress threatened to cut off funding to HUD or FHFA for failure to enforce federal laws meant to create more affordable housing by more robust use of HUD Code manufactured homes?

- e) What precisely is changing thanks to MHI’s sponsorship of IHS?

- f) What is MHI’s so-called “partnership” with HUD producing on a practical level as measured by new homes produced and sold?

These six bullets (17 a-f) are the kinds of pragmatic questions that must be asked and accurately answered. To learn more, see the linked and related reports. ##

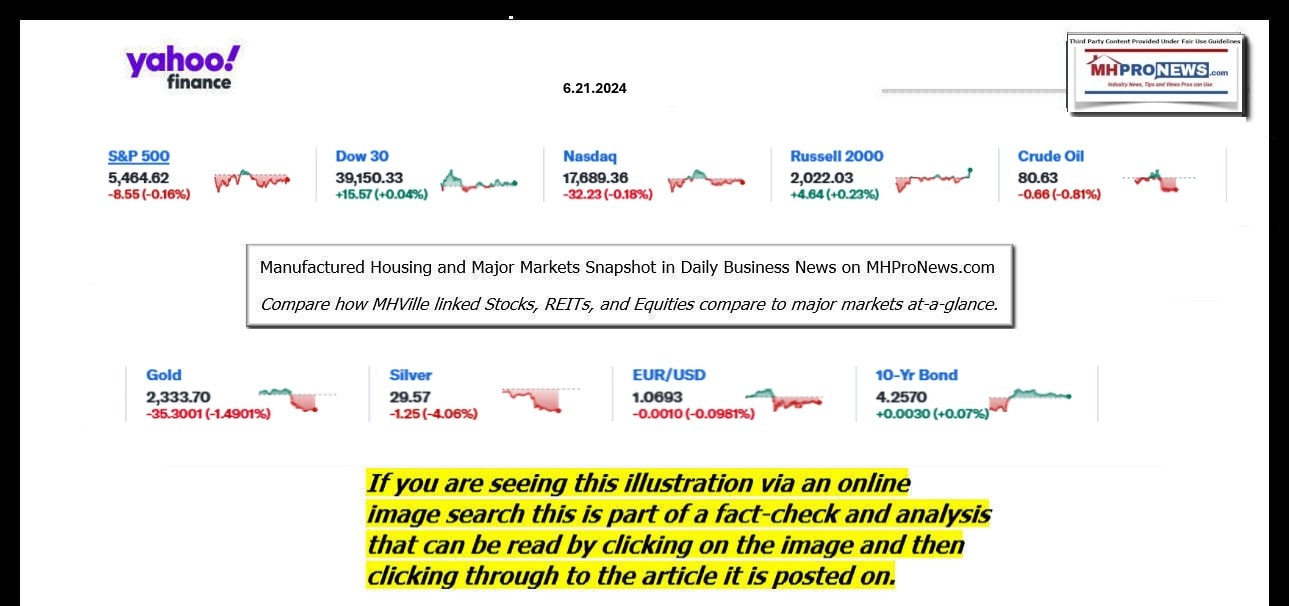

Part IV – Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 6.21.2024

- Apple’s new China problem: ChatGPT is banned there

- US home prices just hit a record high. Americans are still buying

- Europe’s richest man liked this Paris bistro so much his company bought it

- A phone screen displays the Truth Social app in Washington, DC, on February 21, 2022.

- Trump Media shares are in free fall

- Washington Post will not bring in Robert Winnett as its top editor after report raised ethical questions

- Jeff Bezos looks on from the sidlines before kickoff between the Kansas City Chiefs and Los Angeles Chargers at GEHA Field at Arrowhead Stadium on September 15, 2022 in Kansas City, Missouri.

- Jeff Bezos is under fire at the Washington Post as patience wears thin among staffers

- A housing project under construction in Nanjing in east China’s Jiangsu province on June 17, 2024.

- Chinese cities desperate for cash are chasing companies for taxes — some from the 1990s

- Amazon will stop using those little plastic pillows in its packaging

- Nvidia CEO Jensen Huang present NVIDIA Blackwell platform at an event ahead of the COMPUTEX forum, in Taipei, Taiwan June 2, 2024.

- Nvidia’s shares are on fire. The broader market looks less rosy

- Can I even buy a car? What to know about the massive auto dealer outage

- What’s to become of summer Fridays in the age of hybrid work?

- This fertility clinic is trying to democratize IVF, just as some groups are condemning it

- ‘You feel death at your doorstep but have no choice’: Extreme heat takes toll on outdoor workers

- Vitamix recalls almost 570,000 blender parts

- TikTok ramps up attacks on Biden administration in challenging prospective ban

- Bugatti’s new car is a $4 million, 1,800 horsepower hybrid

- New York governor signs bill regulating social media algorithms, in a US first

- These employees moved across the country for work, then Disney canceled the project. Now they’re suing.

- Massive computer outage at car dealerships could last for days, company says

- Why Olive Garden doesn’t want to give discounts

- Flying is getting scary. But is it still safe?

- Toyota is recalling 145,000 big SUVs for an airbag problem

- AI is replacing human tasks faster than you think

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

Headlines from right-of-center Newsmax – 6.21.2024

- Burgum and Vance Top Trump VP Picks; Rubio Is Also in Running

- From left: Vance, Rubio, Burgum (Getty)

- Israel at War

- Israeli Camp Strikes Near Rafah Kill 25, Wound 50: Gaza Health Officials

- Israeli Forces Intensify Attacks Across Gaza

- Armenia Recognizes Palestinian Statehood

- Netanyahu Meets Families of Deceased Hostages

- Lawlessness Impedes Israeli Vow to Guard Aid Route, but Lawlessness Blocks Distribution

- Fmr Diplomat Dennis Ross: Gaza Aid Must Be Protected

- Tensions Flare Between Israel Military, Netanyahu

- WSJ: No. of Surviving Israeli Hostages May Be as Low as 50

- WH: Netanyahu’s Comments on Weapons ‘Incorrect’

- Head of Lebanon’s Hezbollah Threatens Israel

- Newsmax TV

- Dershowitz: Judge in Trump Docs Case ‘Wonderful’

- Trump Lawyer: Court Must Rule on Presidential Immunity | video

- Judge Napolitano: Middle Ground’ Likely on Trump Immunity | video

- Perry: Biden Losing Support Among Democrats | video

- Mom of Slain Jogger: ‘Put Lives of American Citizens First’ | video

- FCC’s Carr: Sound Alarm on Soros Radio Takeover Bid | video

- Comer: NewsGuard’s Methods Must Be Probed | video

- More Newsmax TV

- Newsfront

- RFK Jr. Running Mate: Democrats Hate Democracy

- Nicole Shanahan, the running mate for independent presidential candidate Robert F. Kennedy Jr., said the current leadership of the Democratic Party hates democracy…. [Full Story]

- FCC’s Carr to Newsmax: Sound Alarm on Soros Radio Takeover Bid

- Brendan Carr, one of two Republican members of the five-member FCC, [Full Story] | video

- Texas Lt. Gov. Wants Ten Commandments in Schools

- Republican Texas Lt. Gov. Dan Patrick said Friday he intends to [Full Story]

- Reuters: Newsmax Is Top US News Brand

- A new Reuters study found that Newsmax is one of the influential news [Full Story]

- Related

- Trump Rips Fox, Urges Murdochs to Fire ‘Dog’ Paul Ryan

- Border Arrests Down 25% Since New Asylum Restrictions

- The number of arrests by Border Patrol agents of people illegally [Full Story]

- Ukraine Captures Russian Tank Adapted for Drone Threat

- The Ukrainians call it a “barn” tank, a bizarre-looking Russian [Full Story]

- Related

- Kremlin: Putin Open to Security Talks With US

- UN Chief Says Russia Must Uphold North Korea Sanctions

- Gov. Youngkin to Join Trump at Post-Debate Rally

- Building on his campaign’s assertion that Virginia is in play this [Full Story]

- Related

- Trump Promises to Release JFK Assassination Files

- Trump Fundraising Pounding Away at Biden’s Early Lead

- Mike Bloomberg Gives $20M in Effort to Boost Biden

- Reclusive Mellon Heir Gives $50M to Trump Super PAC

- Biden Attorney Preparing for 2024 Voter Fraud Claims

- Winklevoss Brothers Donate $1M in Bitcoin to Trump

- Burgum, Vance Top Trump VP Picks; Rubio in Running

- Comer to Newsmax: NewsGuard’s Methods Must Be Probed

- Republicans on the House Oversight Committee, who have launched an [Full Story] | video

- Supreme Court Upholds Federal Domestic-Violence Gun BanSupreme Court Upholds Federal Domestic-Violence Gun Ban

- The Supreme Court on Friday upheld a federal law that makes it a [Full Story]

- Related

- More Weighty Issues Await Supreme Court

- Supreme Court Rejects Settlement in New Mexico-Texas Water War

- Bannon Asks Supreme Court to Delay His 4-Month Prison Sentence

- Supreme Court Rules Against Tattooed Man Denied Citizenship

- Disclosures Reignite Calls for Release of School Shooter’s Full ‘Manifesto’

- A recent court filing added yet another twist in the ongoing story [Full Story] | Platinum Article

- S&P, Nasdaq End Lower as Nvidia Drags for 2nd Day

- The S&P 500 and Nasdaq closed marginally lower Friday, weighed down [Full Story]

- Ogles Unveils Bill to Shutter Biden’s EV Panel

- Andy Ogles, R-Tenn., introduced a bill that would eliminate the [Full Story]

- Top Doctor: If You Eat Eggs Every Day, This Is What Happens

- GundryMD

- Trump Lawyer Calls Special Counsel Jack Smith Too Independent

- Donald Trump’s lawyer argued Friday that the criminal case charging [Full Story]

- DOJ: No Decision Yet on Whether to Prosecute Boeing

- The Justice Department has made no decision on whether to pursue a [Full Story]

- Black Passengers Sue; American Airlines Workers on Leave

- American Airlines is putting some workers on leave for booting Black [Full Story]

- Cardiologist: Slim Down by Mixing This Into Your Morning Coffee (Watch)

- Natural Solutions

- Judge Dismisses Charges in Nev. Fake Electors Case Over Venue Question

- A Nevada state court judge dismissed a criminal indictment Friday [Full Story]

- Judge Judy: Trump’s N.Y. Charges, Conviction ‘Nonsense’

- TV’s outspoken “Judge Judy” Sheindlin says she doesn’t think Donald [Full Story]

- Gaetz Unveils Ad Blasting His GOP Opponent as a ‘Raging Liberal’

- Matt Gaetz, R-Fla. has launched an ad attacking his GOP primary [Full Story]

- AG Bailey Suing N.Y. for ‘Lawfare’ in Trump Trial

- Missouri Attorney General Andrew Bailey has announced his plans to [Full Story]

- IRS Expands Fraud Crackdown in Pandemic Tax Program

- The Internal Revenue Service is expanding a fraud crackdown in a [Full Story]

- Trump: I Love The Ten Commandments

- Former President Donald Trump expressed his support for the [Full Story]

- Proposal to Draft Women Troubles Vulnerable Dems

- A contentious provision in the annual defense bill requiring women to [Full Story]

- Rasmussen Poll: Only 32 Percent Want Newsom Over Biden

- Despite President Joe Biden’s low poll numbers and widespread [Full Story]

- Y. Prosecutors Urge Judge to Maintain Trump’s Gag Order

- Manhattan prosecutors are urging the judge overseeing Donald Trump’s [Full Story]

- Robert Winnett Won’t Join Washington Post as Editor

- British journalist Robert Winnett will not join The Washington Post [Full Story]

- Putin Remarks on Possible Weapons for NKorea ‘Incredibly Concerning,’ US Says

- Russian President Vladimir Putin’s comments on Thursday that Moscow [Full Story]

- Trump Says Foreigners Who Graduate From US Colleges Should Get Green Cards

- Republican presidential candidate Donald Trump in a podcast released [Full Story]

- DOJ to Sue TikTok Over Children’s Privacy Violations

- The U.S. Department of Justice is preparing to file a consumer [Full Story]

- New La. Law on Ten Commandments Churns Old Conflicts

- A bill signed into law this week makes Louisiana the only state so [Full Story]

- RFK Jr.: CNN Staff Face ‘Jail Time’ for Debate

- The presidential campaign for independent candidate Robert F. Kennedy [Full Story]

- Trans Daughter Played Sport; Fla. Woman Might Lose Job

- A Florida school district employee is on the brink of losing her job [Full Story]

- US Bans Russia’s Kaspersky Antivirus Software

- The United States on Thursday banned Russia-based cybersecurity firm [Full Story]

- More Newsfront

- Finance

- Wall St Week Ahead: Big Tech Rally May Be Reaching Limits

- A blistering rally in U.S. big tech stocks may be due for a breather, offering hope for market segments that have been more tepid this year…. [Full Story]

- FDA OKs First Menthol e-Cigarettes, Citing Potential to Help Adult Smokers

- Community Banks Facing Significant Challenges

- 3 Top Tech Stocks for Dividends

- Another EV Startup Bites the Dust

- More Finance

- Health

- Study: Walking Staves Off Lower Back Pain Recurrence

- If you’ve recovered from lower back pain, try walking away from a recurrence. New research out of Australia shows that folks who started a walking regimen kept recurrent back pain episodes at bay for much longer than people who didn’t. “We don’t know exactly why walking is so…… [Full Story]

- How High Temperatures Lead to Illness, Death

- Robust Gut Microbiome Can Help You Fight Infections

- US Gun Injury Rates Top Pre-Pandemic Levels

- Brain, Gut Microbiome Make Up of Resilient People

click the image and follow the prompts.