The affordable housing crisis can be boiled down to a few relatively simple issues that include the clear-eyed application of the law of supply and demand. With demand rising, the need for more supply becomes self-evident. That could be good news for manufactured housing producers. A Bloomberg/Washington Post editorial published several weeks ago (linked below) made the point that manufactured housing could be a solution to the types of issues that Lawrence Yun, senior economist with the National Association of Realtors (NAR) has raised. “We need to build more homes,” Yun told the DCNF. “Otherwise, institutional investors with deep pockets can corner the single-family rentals market.” As the Bloomberg editorial framed it, the U.S. can solve its housing crisis but it just needs to start building more homes. The potential for manufactured housing to solve that need more swiftly and economically than conventional builders can accomplish should be obvious.

With that brief preface, Part I of today’s report is courtesy of the WND News Center to MHProNews. Part II will provide additional information with more MHProNews analysis and commentary. Part III will be our Daily Business News on MHProNews signature manufactured housing industry (MHVille) connected stocks and left-right market moving headlines report.

Part I

Wall Street investors snatching up single-family homes and taking over rental market

‘It’s time to stop home prices from going through the roof’

By WND News Services Published February 27, 2023 at 10:59am

Daily Caller News Foundation

- Institutional investors, such as banks and large real estate firms, are on track to own 40% of single-family rentals in the U.S. by 2030, MetLife Investment Management predicted last fall, according to CNBC.

- National Association of Realtors Chief Economist Lawrence Yun told the Daily Caller News Foundation that the ongoing shortage of housing will make it easier for banks and other Wall Street investors to buy up and rent out single-family homes.

- “We need to build more homes,” Yun told the DCNF. “Otherwise, institutional investors with deep pockets can corner the single-family rentals market.”

An ongoing shortage of housing will make it easier for banks and other Wall Street investors to take control of the market for single-family rental homes, National Association of Realtors Chief Economist Lawrence Yun told the Daily Caller News Foundation.

Institutional investors, such as banks and other large investors, are on track to own 40% of single-family rentals in the U.S. by 2030, MetLife Investment Management predicted, according to CNBC. An ongoing shortage of single-family homes in the U.S. would normally limit growth potential for Wall Street firms looking to buy single-family rentals, but it is also making it easier for them to tighten their grip on the market, Yun told the DCNF.

“We need to build more homes,” Yun said. “Otherwise, institutional investors with deep pockets can corner the single-family rentals market.”

Through last August, institutional investors owned roughly 700,000 single-family rentals, roughly 5% of the 14 million such units in the U.S., according to commercial property firm Costar, citing MetLife. The industry was kickstarted in 2012, when the U.S. government began a program allowing big banks to purchase hundreds of thousands of foreclosed homes from Fannie Mae, according to The Atlantic.

Wall Street has been attracted to single-family rentals thanks to “rising rent, easy to find tenants and rising property values,” Yun said. In contrast, families have been struggling to buy homes thanks to a combination of high mortgage rates, climbing home prices and low inventory.

Existing home sales fell 36.9% year-over-year from January 2022 to January 2023, after twelve straight months of falling sales, the NAR reported Tuesday. Current inventory of 980,000 unsold homes is enough to supply just three months of demand, a pinch that contributed to home prices rising year-over-year for the record-breaking 131st month in a row in January.

A major player in the space is Home Partners of America, a rental-property manager who purchases homes and rents to tenants who can eventually buy the home outright, according to Fortune. The company announced a pause on home purchases in 38 regional markets last fall after citing “several factors” including demand and climbing prices.

“Home Partners’ platform enables access to single family homes for people who would otherwise be locked out of the market,” a Home Partners of America spokesperson told the DCNF. “Our unique business model enables people to choose a home they love and provides transparent pricing and flexibility at every stage of the process.”

The pause represented less than 5% of acquisitions activity at the time, according to Home Partners of America.

However, even with this pause, the company — which is a wholly-owned subsidiary of major investment bank Blackstone and managed 26,000 units as of last August — still intends to continue home purchases in 20 high-growth markets, a Home Partners of America spokesperson told Costar.

Blackstone claims to be the largest owner of commercial real estate in the world.

The company — and other Wall Street-backed firms — may simply be waiting for a widely predicted decline in home prices, brought on by an expected U.S. recession, to get a better deal on properties in these regions, Fortune reported.

Some landlords have taken steps to address the national shortage by building homes — in some cases entire neighborhoods — to be used as rentals, CNBC reported. Last January, investment firm Pretium Partners launched a $600 million joint venture with home-builder Onyx+East to construct 2,000 homes for rent, building upon the firm’s portfolio of 70,000 single-family rentals, Bloomberg reported.

“It’s almost a captive market,” Jordan Ash, housing director at the Private Equity Stakeholder Project told CNBC. “They’ve been very explicit about how people are shut out of the homebuying market and are going to be perpetual renters.”

Even if the U.S. government took action to reduce the influence of institutional investors, these landlords do not control enough of the market to alleviate issues of housing affordability, Heritage Foundation Economist Joel Griffith told the DCNF.

Federal subsidization of mortgages and local regulations have driven up the cost of housing more so than Wall Street firms, who control a smaller proportion of the market than smaller-scale “mom and pop” investors, Griffith said.

“In short, blaming real estate investors for the resulting misery may score political points,” Griffith told the DCNF. “But demagoguery does nothing to alleviate it. Lawmakers can start to restore this bedrock of the American dream by removing federal subsidies from the housing market, restricting the Federal Reserve’s power to purchase a limitless quantity of mortgages, and eliminating the artificial barriers to housing supply erected by local leaders. It’s time to stop home prices from going through the roof.” ##

This story originally was published by the Daily Caller News Foundation.

Part II Additional Information with More MHProNews Analysis and Expert Commentary in Brief

The DCNF article doesn’t mention or link to the Heritage Foundation Economist Joel Griffith’s post on their nonprofit website linked here and entitled, “Who’s to Blame for the Priciest Housing in History?” Griffith’s article offered these three topline takeaways.

- Home prices are increasing far greater than family income growth is.

- Who are the main culprits? Government mortgage subsidies, the Federal Reserve and local regulations.

- Blaming real estate investors for the resulting misery may score political points. But demagoguery does nothing to alleviate it.

One could debate the claims of the various economists, including Griffith. But his point that “eliminating the artificial barriers to housing supply erected by local leaders” is an issue that Congress addressed in a widely bipartisan fashion with the enactment of the Manufactured Housing Improvement Act of 2000 (MHIA). As regular and detail-minded MHProNews readers know, the MHIA included a clause commonly known as “enhanced preemption” by industry insiders. That clause provided HUD with the legal tool to overcome local zoning and placement barriers to manufactured homes.

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic or click the image and then follow the prompts.

Griffith’s points have some similarities to those HUD researcher Pamela Blumenthal and Regina Gray. Gray and Blumenthal noted that for 50 years, during Democratic or Republican administrations, zoning and regulatory barriers have been key factors thwarting more affordable housing. Those two HUD Policy Development and Research (HUD PD&R) team members pointed to short supply, strong demand, and the harms caused by rising interest rates too.

That said, despite high demand and low supply, manufactured housing has already experienced 3 months of falling production. Cavco Industries (CVCO) top man, William “Bill” Boor, stressed in his recent remarks that January traffic is back up at retail centers. Cavco management stressed the ‘dire need for new housing.’ Boor said that traffic and quotes are leading indicators for new orders. Time will soon tell if that ‘leading indicator’ showed up in the January 2023 production and shipment report and how that 1-2023 data compared to 1-2022. The most recent production levels will be known within a week from official sources acting on behalf of the federal government’s data collection on manufactured housing statistics.

Yes, Virginia, that Cape Code in the featured image below is a

two-level HUD Code manufactured homes.

Until that new data is available, one can only look with wonder at what on the surface may seem like the bizarre behavior of the Manufactured Housing Institute (MHI) in the long 21st century runup to this point in time. For example. MHI having belatedly filed suit against the Department of Energy (DOE) to slow the implementation of their ‘costly and harmful’ manufactured housing energy rule, why hasn’t MHI similarly filed suit against localities and/or HUD to get the MHIA of 2000’s enhanced preemption provision enforced? Their smaller Washington, D.C. based rival – the Manufactured Housing Association for Regulatory Reform (MHARR) – has raised that notion for much of the 21st century, when it became apparent that HUD was declining to use their newly delegated authority.

For instance. MHARR warned that MHI appeared to be ‘running out the clock’ on the Trump Administration, which featured publicly pro-manufactured housing HUD Secretary Ben Carson.

While Dr. Carson is not known to have sounded off on the MHIA in a public forum, his Biden regime successor, HUD Secretary Marcia Fudge has done so during a CSPAN recorded hearing. Fudge bluntly said that the current situation would not change. Where was MHI’s outrage?

On the surface, MHI’s behavior – i.e.: years of delay without legal action to enforce federal laws that former MHI VP and founding Manufactured Housing Association for Regulatory Reform (MHARR) President and CEO Danny Ghorbani – said are one of the key issues constraining the manufactured housing industry’s robust growth. In deep dives, like the MHARR White Paper, or in shorter articles and interviews, MHARR has noted that promises that never ‘reach the ground’ – i.e.: actually achieve measurable implementation – may be useful for public relations purposes. But the failure to deliver the goods in terms of measurable production and sales results ought to be a warning sign.

As if to document MHARR’s allegations, and those of HUD’s Blumenthal and Gray, left-leaning CNN and the NAR reported that despite the tall talk and big promises that included support for manufactured housing, the share of first time buyers among recent homeowners has declined.

To better grasp possible motivations for why MHI hasn’t yet filed suit to enforce existing federal laws that could benefit consumers of affordable housing and thereby boost the manufactured housing industry too, one should explore the publicly traded MHI corporate member statements to investors. Quarterly report, earnings calls, and investor PowerPoint pitches often point out that manufactured housing reveal several statements that indicate that consolidation is a priority. While there is mention of organic growth, the evidence strongly suggests that there is far more M&A (mergers and acquisition) activity than there are the development of new manufactured home communities or new production centers.

It should be obvious that when some of the corporations with the deepest pockets in America are involved in manufactured housing, and yet the industry is underperforming, that there are reasons – motivations – for that collective MHVille underperformance. While oversimplification often has certain risks, it can also be clarifying. By underperforming, consolidators can create a ‘moat’ around their interests in MHVille and around the manufactured housing industry itself. Fewer entries into the profession and more exits results. The flip side is that more regulations and stalling production can mean more exits for smaller firms. Put differently, historically low production means the pace of consolidation (mergers and acquisitions) rises. Who says? Consider the remarks from Minneapolis Federal Reserve researchers or the sharp remarks of Samuel “Sam” Strommen from Knudson Law.

No surprise that neither Schmitz nor Strommen’s research can be found on the MHI website.

MHI has publicly ducked responding to concerns about the steady oligopoly style of manufactured housing monopolization for years.

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic or click the image and then follow the prompts.

So, there is evidence of MHI seemingly saying the correct things – think paltering – while their measurable behavior reveals something quite different.

Watch for new reports being developed that will provide fresh insights from various sources on related issues, which will include fats related to new manufactured housing production, retail, and manufactured home community (MHC) related. See the various linked reports to learn more.

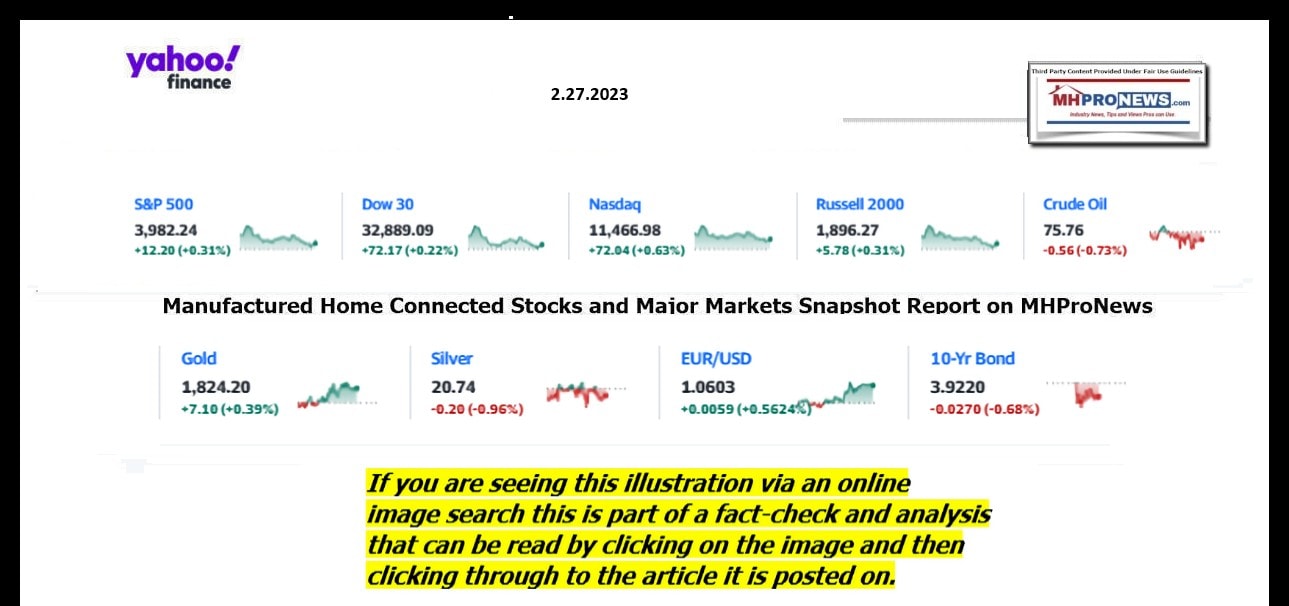

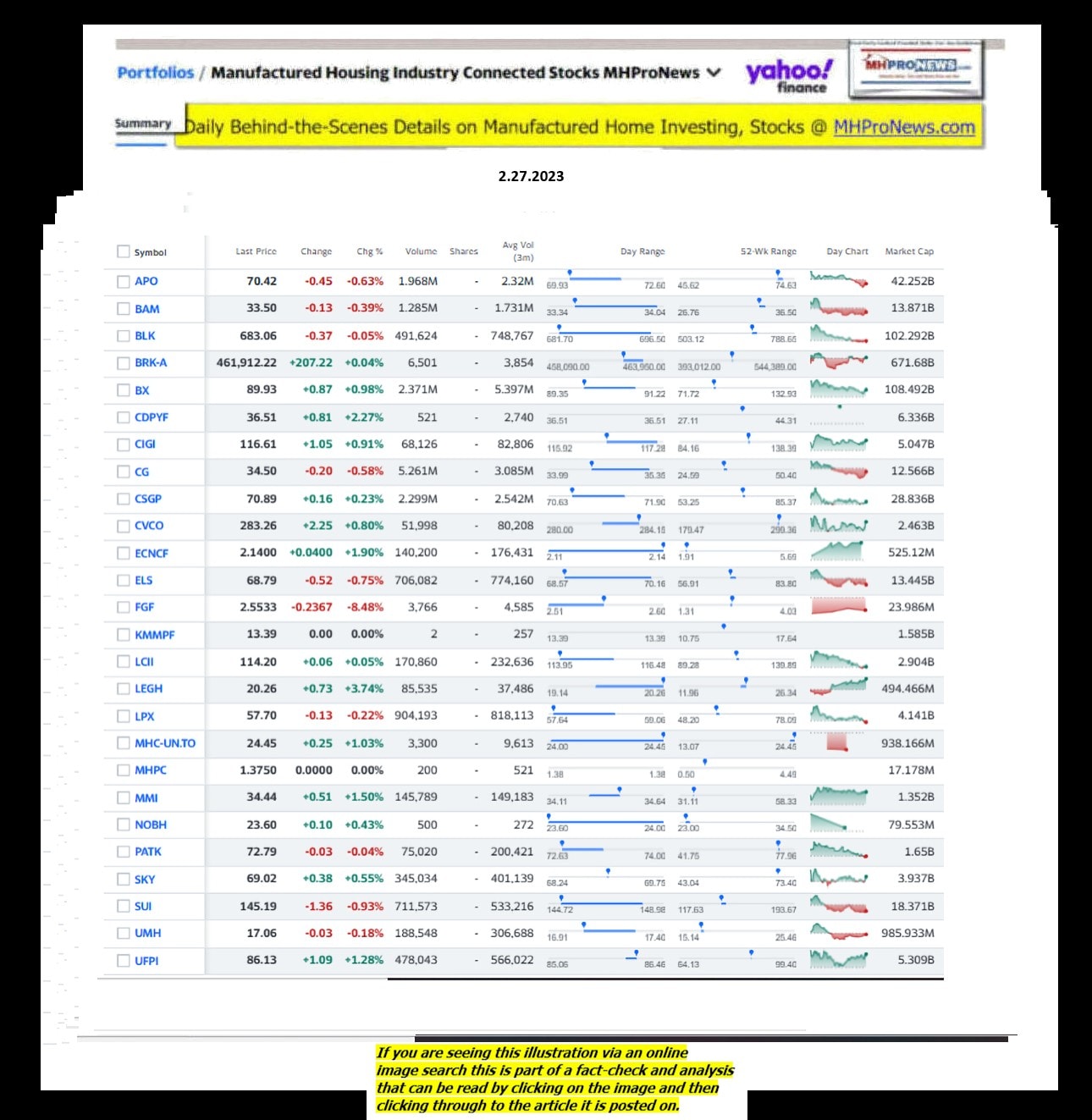

Part III. Daily Business News on MHProNews Markets Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 2.27.2023

- Canceled comic

- Scott Adams, creator of Dilbert, works on his comic strip in his studio in in Dublin, Calif., on Oct. 26, 2006. Syndication company Andrews McMeel announced they were severing ties with Adams after he made comments about race on his YouTube show, “Real Coffee with Scott Adams.”

- ‘Dilbert’ distributor and book publisher drop creator Scott Adams over his racist remarks

- Rupert Murdoch acknowledged that Fox News hosts endorsed stolen election claims

- TD Bank reaches $1.2 billion settlement in Ponzi scheme lawsuit

- Meta cracks down on a growing crime against teenagers

- Why the 2023 stock market rally may be over already

- Canada bans TikTok on government devices

- Union Pacific CEO to leave after push from activist shareholder

- Pending home sales blew past expectations last month as buyers pounced on lower rates

- CNN exclusive: Yellen says ‘so far, so good’ in US inflation battle

- ‘South Park’ lawsuit: Warner Bros. Discovery sues Paramount for $500 million

- Nokia redesigns iconic logo to remind the world it’s not a phone company anymore

- Elon Musk tweets support for ‘Dilbert’ creator after racist tirade

- Hundreds of newspapers drop ‘Dilbert’ comic strip after racist tirade from creator Scott Adams

- Demand has surged — not slumped — for Kanye West’s Yeezy sneakers, one CEO says

- Why the Fed is increasingly flying blind on the economy

- New York Times: Twitter lays off another 10% of staff

- China approved equivalent of two new coal plants a week in 2022, report finds

- Economists’ crystal balls are growing cloudier. But they still expect a recession

- Missing Chinese billionaire CEO assisting authorities in investigation, company says

- Web-based kissing device horrifies Chinese social media users

- There are new rules about severance agreements. Here’s what you need to know

- Larry Summers: Why sanctions on Russia aren’t effective

- Inflation is doing a crab walk and Fed officials fear its pinch

- China is helping to prop up the Russian economy. Here’s how

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic or click and follow the prompts.

Headlines from right-of-center Newsmax 2.27.2023

- Ambassador Burns: China Must ‘Be More Honest’ About COVID

- S. Ambassador to China Nicholas Burns said on Monday that Beijing must “be more honest” about how COVID-19 originated, Burns, speaking at an event for the U.S. Chamber of Commerce, said that China must “be more honest about what happened three years ago in Wuhan with the origin of the COVID-19 crisis” in order to have a working relationship with the U.S. [Full Story]

- DirecTV Censors Newsmax

- Ted Cruz: End Corporate Censorship, Bring Newsmax Back

- D’Esposito: Direct TV Dropping Newsmax Is ‘Insane’ | video

- Dick Morris: DirecTV, Censorship Will Be ‘Major Topic’ at CPAC

- Ramaswamy: Private-Govt Censorship Makes ‘Blood Boil’ | video

- Steube: ‘Double Standard’ in DirecTV Actions | video

- Burchett: Repubs Should Boycott Liberal Media | video

- Cruz: ‘Viewers Ought to Have a Choice’ for News | video

- Comer: DirecTV Needs to Work This Out ‘or Else’ | video

- Hageman: AT&T’s Deplatforming Violates Free Speech | video

- Fry: DirecTV’s Actions Should Be ‘Wake-Up Call’ | video

- More Stories on AT&T DirecTV Censorship

- Newsmax TV

- Fallon: COVID Lab Theory Not ‘Fringe’ Now

- Dershowitz: Calls for Fauci Prosecution Misguided | video

- Blaine Holt: US Must Send ‘Clear Message’ to China | video

- D’Esposito: Give Border Patrol More Resources | video

- Hogan Gidley: ‘Drama’ Over Loyalty Pledge ‘Inevitable’ | video

- Gordon Chang: Biden, Blinken Must Act on China, Russia | video

- Ramaswamy: Solutions Needed From GOP Hopefuls | video

- Davidson: Trump Finally Drew Help for East Palestine | video

- Self: Ukraine ‘Must Go on Offensive,’ End The War

- More Newsmax TV

- Newsfront

- House Committee to Probe EPA Response to Ohio Derailment

- The House Transportation and Infrastructure Committee said on Monday it is opening an inquiry into the Environmental Protection Agency’s (EPA) actions following the Feb. 3 East Palestine, Ohio derailment of a Norfolk Southern operated train.The Republicans on the committee…… [Full Story]

- China Urges Peace in Ukraine After US Warns Against Aiding Russia

- China said on Monday it sought dialog and a peaceful solution for [Full Story]

- Related

- Yellen Visits Ukraine, Underscores US Economic Support

- Belarus Partisans Say They Blew up a Russian Military Aircraft

- Kremlin: China’s Ukraine Peace Plan Should Be Studied in Detail

- McCaul: ‘Unfortunate’ That Biden Won’t Send Ukraine F-16s

- CIA Director: Putin Too Confident He Can Grind Down Ukraine

- GOP Lawmakers Assail Biden for Not Sending F-16s to Ukraine

- On Ukraine Front, Civilians Cling on as Troops Repel Russia

- House Foreign Affairs Chair McCaul: Putin, Xi in Unholy Alliance

- Comer Accuses Treasury of Hindering Probe Into Biden Family Dealings

- Comer Accuses Treasury of Hindering Probe Into Biden Family Dealings

- The GOP-led House Committee on Oversight and Accountability is [Full Story]

- Carter Has Complicated Legacy, but Integrity Earns ‘High Marks’

- Former President Jimmy Carter may have racked up more accomplishments [Full Story] | Platinum Article

- Tennessee House Passes Bill to Ban Gender Transition Care for Minors

- The Tennessee state House recently passed a bill that would prohibit [Full Story]

- Ambassador Burns: China Must ‘Be More Honest’ About COVID

- S. Ambassador to China Nicholas Burns said on Monday that Beijing [Full Story]

- Related

- Republicans Push to Declassify Docs on COVID-19 Lab Leak

- Russia-China Relationship Tested Amid US Concerns of Beijing Arming Moscow

- Russia’s ambassador to China, Igor Morgulov, told a Chinese state [Full Story]

- House GOP Appears Set to Settle for Moral Victory on Border

- Immigration experts say the passage of a border security bill by the [Full Story] | Platinum Article

- Fox Poll: Trump Trounces Field of GOP Candidates for 2024

- Former President Donald Trump owns a commanding lead over a [Full Story]

- Stocks Edge Higher Following Last Week’s Rout

- Stocks Edge Higher Following Last Week’s Rout

- Stocks closed slightly higher, clawing back some of the losses from [Full Story]

- New DeSantis Book Outlines His Blueprint for Election Success Nationally

- Florida GOP Gov. Ron DeSantis writes he believes a Republican can win [Full Story]

- ‘Sedition Panda’ Arrested in Connection with Jan. 6 Attack

- The FBI arrested a man who wore a panda costume while allegedly [Full Story]

- Amazon Hates when You Do This but They Can’t Stop You

- Online Shopping Tools

- Gooden Restates Concerns on Democrat Chu’s US ‘Loyalty’

- Lance Gooden, R-Texas, isn’t backing down from his recent [Full Story]

- US Watchdog to Audit Buttigieg Government Jet Use

- A U.S. government watchdog will audit Transportation Secretary Pete [Full Story]

- TikTok Banned on All Canadian Government Mobile Devices

- Canada announced Monday it is banning TikTok from all [Full Story]

- Putin Bestows Friendship Award on Actor Steven Seagal

- Russian President Vladimir Putin on Monday bestowed a state [Full Story]

- US Awards $1 Billion for Airport Infrastructure

- The Federal Aviation Administration said Monday it is awarding nearly [Full Story]

- Tom Cruise Recalls Emotional ‘Top Gun’ Reunion With Val Kilmer

- Tom Cruise was overcome with emotion when he reunited with fellow [Full Story]

- Cuellar: Biden’s New Asylum Rule ‘Reasonable’

- A new asylum rule proposed by the Biden administration is a [Full Story]

- NH Dem Lawmaker Blasts Biden For Changing State’s Primary Status

- The Democratic Party’s decision to end New Hampshire’s [Full Story]

- GOP Reshapes Crime, Opioids Messaging Before 2024 Election

- GOP Reshapes Crime, Opioids Messaging Before 2024 Election

- Republicans reportedly aretaking a cue from Lee Zeldin, last year’s [Full Story]

- DeSantis Signs Bill Giving Him New Powers Over Disney

- Florida Gov.Ron DeSantis signed a billon Monday that gives him new [Full Story]

- Milley to Congress: Pentagon Needs More Ukraine Money by June

- Milley to Congress: Pentagon Needs More Ukraine Money by June

- S. Army Gen. Mark Milley, chairman of the Joint Chiefs of Staff, [Full Story]

- House Republicans Aim to Quash ‘Woke’ Spending-Bill Projects

- House Republicans Aim to Quash ‘Woke’ Spending-Bill Projects

- House Republicans are reportedly gearing up to quash local projects [Full Story]

- DeSantis Defends Going ‘on Offense’ With Media

- Florida GOP Gov. Ron DeSantis is a stalwart believer that the best [Full Story]

- Kerry to Remain as Envoy Through Climate Summit

- John Kerry told The Boston Globethat he toldPresident Biden he plans [Full Story]

- Bush Marries Campaign Security Guard in Private Ceremony

- Cori Bush, D-Mo., married Cortney Merritts, an Army veteran who [Full Story]

- McLaughlin Poll: Biden Numbers Even Worse Than Thought

- The negative trends against President Joe Biden even extend into his [Full Story]

- Supreme Court to Hear Fight on Consumer Watchdog Agency’s Funding

- The U.S. Supreme Court agreed to decide whether the Consumer [Full Story]

- House Oversight Wants to Question All Border Sector Chiefs

- The House Oversight Committee is extending its investigation into the [Full Story]

- Source: Britain, EU Strike Deal on Northern Ireland Post-Brexit Trade

- Britain and the European Union reached an agreement over post-Brexit [Full Story]

- American Shoppers Should Think Twice Before Buying from These 2 Stores

- Online Shopping Tools

- More Newsfront

- Finance

- US Watchdog to Audit Buttigieg Government Jet Use

- A U.S. government watchdog will audit Transportation Secretary Pete Buttigieg’s use of government airplanes for some trips as part of a broad review dating back to 2017…. [Full Story]

- Meta Creating New Top-Level AI Product Group

- Altria in Talks to Buy NJOY for $2.75 Billion

- ‘Best Chef in the World’ Guy Savoy Stripped of Michelin Star

- Yellen Visits Ukraine, Underscores US Economic Support

- More Finance

- Health

- Too Little Dietary Salt Can Mean Trouble for Heart Failure Patients

- It may seem counterintuitive, but a new study review suggests that consuming too little salt could be harmful to heart failure patients…. [Full Story]

- New Study Finds For-Profit Hospices Often Deliver Worse Care

- Artificial Sweetener Linked to Heart Attack and Stroke

- Study: Daily Marijuana Use Increases Heart Risks

- Air Pollution Exposure May Speed Bone Density Loss

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic or click and follow the prompts.

2022 was a tough year for many stocks. Unfortunately, that pattern held true for manufactured home industry (MHVille) connected stocks too. See the facts, linked below.

====================================

Updated

-

-

- NOTE 1: The 3rd chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.