Financial analysts, investors and of course manufactured home professionals are among those who tune in by the thousands to this evening investing and market recap. Beyond graphic snapshots of the broader markets, industry connected stocks and our left-right headline news bullets, every business-nightly report includes a ‘featured focus.’

Tonight’s is a look at the National Association of Realtors (NAR) pending sales report, juxtaposed with some insights from the Manufactured Housing Institute (MHI) and Manufactured Housing Association for Regulatory Reform (MHARR).

At the heart of all that occurs on MHProNews and our MHLivingNews sister site are evidence-based insights complimented by expert analysis and commentary. It has made and kept us the runaway number one. As an upcoming report will reflect, beyond our core professional audiences mentioned above, there are also federal officials, nonprofits and academics who are demonstrably turning to MHProNews at significantly heightened rate of engagement and reading.

For reasons our morning report linked here and further below reflects, that should be seen as logical causes for both interest and concern for specific companies. Those researchers find the information relevant. What they are finding relevant often relates to a core contention that MHProNews has made for some time.

It’s this.

The manufactured home industry is underperforming despite record opportunities and favorable laws. How can that be? What are the causes and cures for that phenomenon?

That will be part of our featured focus, following some of our standard evening graphics, bulleted headlines and other linked data.

Periodic readers of this business-nightly feature should note there are a few tweaks to some of the standard portions of our evening market/investing report. Read carefully as some changes of the ‘standard text’ that follows before our left-right headlines and also in other features near the end of tonight’s reports.

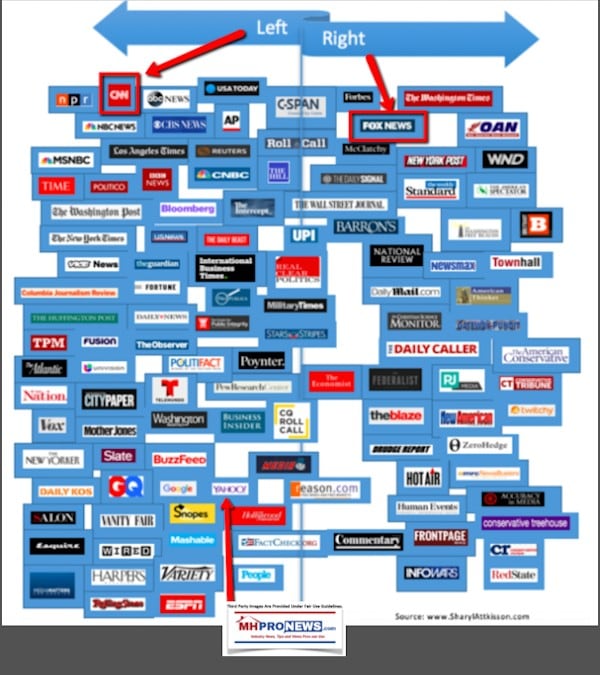

Every evening our headlines that follow provide snapshots from two major media outlets on each side of the left-right news spectrum that reflect topics that influence or move investor sentiment. In moments on this business evening report, you can get ‘insights-at-a-glance.’

This report also sets the broader context for manufactured housing markets, in keeping with our mantra, “News through the lens of manufactured homes and factory-built housing” ©.

We begin with headlines left-of-center CNN followed by right-of-center Fox Business. We share closing tickers and other related data courtesy of Yahoo Finance, and more. 5 to 10 minutes reading this MHProNews market report every business night could save you 30 minutes to an hour of similar reading or fact-gathering elsewhere.

Perhaps more important, you will get insights about the industry from experts that care, but also dare to challenge the routine narrative that arguably keeps manufactured housing underperforming during an affordable housing crisis.

Newsy, Peeling Back Media Bias, Manufactured Housing Sales, Investing, Politics, and You

Headlines from left-of-center CNN Business.

- Microsoft hack – cybercrime, hacking and technology concept – male hacker in dark room writing code or using computer virus program for cyber attack; Shutterstock ID 1083511010; Job: –

- North Korean hackers stole ‘highly sensitive information’ from the US, company alleges

- Tesla’s stock drops sharply after a weak sales forecast

- Elon Musk says Las Vegas tunnel will ‘hopefully’ be ready in 2020

- Tesla delivers first China-made Model 3s to its own workers

- Dow slides nearly 200 points

- The best day of the year for stocks might surprise you

- Smart camera maker hit with customer data breach

- 6 ways to be a better boss and a happier one

- January 2 will be an epic day of holiday gift returns

- Marc Benioff bought Time Magazine to help address a ‘crisis of trust’

- 24 states will raise the minimum wage in next year

- The 7 biggest business of space moments of the year

- Jennifer Aniston, Adam Sandler in 'Murder Mystery'

- ‘Murder Mystery’ tops Netflix’s most-popular titles of 2019

- Stocks had a stellar year in 2019

- The McLaren GT: A $210,000 supercar for everyday driving

- For Spotify, music might not actually be the key to success

- TikTok might try to conquer streaming music

- Amazon bets users will pay for high-quality audio

- Spotify now has more than 100 million paid subscribers

- How Alibaba could challenge China’s music streaming king

- Signage on a Sears store being closed in Las Vegas, Nv., on Thurs., Feb. 28, 2019. (Larry MacDougal via AP)

- Could this be the last holiday shopping season for Sears?

- Target’s Brian Cornell is the top CEO of 2019

- Marshalls opens its first online store

- SPECIAL REPORT How a cheap, brutally efficient grocery chain is upending America’s supermarkets

Headlines from right-of-center Fox Business.

- Stocks give up record highs during sleepy holiday trading session

- The losses came despite Peter Navarro, White House assistant for trade and manufacturing policy, telling Fox News the US-China phase one trade deal could be signed within the week.

- WATCH: These stocks will do well in 2020, expert says

- American military members set to receive biggest pay raise in years

- Major US companies infiltrated, robbed in years-long Chinese hack attack

- TRUMP’S TO-DO LIST: 5 of the White House’s top goals for 2020

- 2020’s ecomonic boom is the perfect time to tackle our debt — and spending

- How to grab free post-New Year’s recovery kit

- Nationwide egg recall scrambling into more products

- Controversial sex toy could win prestigious electronics award

- Netflix reveals most-watched shows and movies of 2019

- SEE IT: Star rapper buys Bugatti for staggering amount

- FDA approves treatment for patients with advanced pancreatic cancer

- How to maximize your 401(k) with 2020 contribution changes

- PUSH IT TO THE LIMIT

- How leasing can be a surprisingly cheaper option than buying used cars

- McDonald’s new CEO looks to be making a huge mistake, expert warns

- Amazon employees freaked out by ‘nerve-wracking’ robotic co-workers

- Doorbell camera recorded ex-college football player’s admission to sister’s murder: reports

- Trump tax cuts are helping the middle class, do the math: Grover Norquist

- US-China phase one trade deal could be signed within the week

- ‘Star Wars: The Rise of Skywalker’ box office haul boosts Disney’s record year

- UPS, FedEx raise fees during red-hot shipping war

- China’s Tesla competitor faces a deep problem

- SEE PICS: Inside Beach Boy’s fun, fun, fun, oceanfront mansion

- New travel trend taking off among women over the age of 55

- Pizza restaurant sharing Christmas profits with employees

- FOX to rank No. 1 in TV ratings, crushing rivals

- Hasbro finalizes $3.8B Entertainment One acquisition

- Congressman John Lewis says cancer is his latest battle

- Sharon Stone gets Bumble invite for ‘profile prep’ after dating app blocked her profile

- How much the disgraced WeWork exec got paid to leave the company

- More than 1 million workers eligible for overtime pay next year

- Cristiano Ronaldo spotted wearing Rolex’s most expensive watch ever made

- Jeff Bezos, nerd no more, hunks around in St. Barths

- China convicts scientists selling gene-editing human babies service

- Hearst heiress’s $4M Hamptons home destroyed in massive fire

- These 5 fast food chains are the most lucrative in America

- Online sales tax ruling challenges small businesses

- Avis Budget Group names interim CEO amid search for permanent chief

- Organic Valley fined big time over spilled milk

- California takes lead on laws affecting gig economy, privacy

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus – Where Business, Politics and Investing Meet

This evening’s report will take a three-part approach.

- Part 1 – the NAR release, including some related graphics.

- Part 2 – MHARR and MHI reported data in December 2019.

- Part 3 – MHProNews’ skinny analysis plus related information.

With that plan of attack, let’s begin.

WASHINGTON, Dec. 30, 2019 /PRNewswire/ — Pending home sales increased in November, rebounding from the prior month’s decline, according to the National Association of Realtors®. The West region reported the highest growth last month, while the other three major U.S. regions saw only marginal variances in month-over-month contract activity. Pending home sales were up nationally and up in all regions compared to one year ago.

The Pending Home Sales Index (PHSI),* www.nar.realtor/pending-home-sales, a forward-looking indicator based on contract signings, rose 1.2% to 108.5 in November. Year-over-year contract signings jumped 7.4%. An index of 100 is equal to the level of contract activity in 2001.

“Despite the insufficient level of inventory, pending home contracts still increased in November,” said Lawrence Yun, NAR’s chief economist, noting that housing inventory has been in decline for six straight months dating back to June 2019. “The favorable conditions are expected throughout 2020 as well, but supply is not yet meeting the healthy demand.”

At the recent NAR Real Estate Forecast Summit, the consensus forecast called for 2.0% GDP growth, a 3.7% unemployment rate and a 3.8% average mortgage rate in 2020. Home prices were projected to rise by 3.6% in 2020 after a 5% gain in 2019.

“Sale prices continue to rise, but I am hopeful that we will see price appreciation slow in 2020,” said Yun. “Builder confidence levels are high, so we just need housing supply to match and more home construction to take place in the coming year.”

November Pending Home Sales Regional Breakdown

The regional indices had mixed results in November. The Northeast PHSI slid 0.1% to 96.3 in November, 2.6% higher than a year ago. In the Midwest, the index rose 1.0% to 102.5 last month, 5.0% higher than in November 2018.

Pending home sales in the South decreased 0.2% to an index of 125.0 in November, a 7.7% increase from last November. The index in the West grew 5.5% in November 2019 to 98.4, an increase of 14.0% from a year ago.

The National Association of Realtors® is America’s largest trade association, representing more than 1.4 million members involved in all aspects of the residential and commercial real estate industries.

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The index is based on a large national sample, typically representing about 20% of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.

NOTE: Existing-Home Sales for December will be reported January 22. The next Pending Home Sales Index will be January 29; all release times are 10:00 a.m. ET.

##

Part 2

According to the Manufactured Housing Association for Regulatory Reform (MHARR).

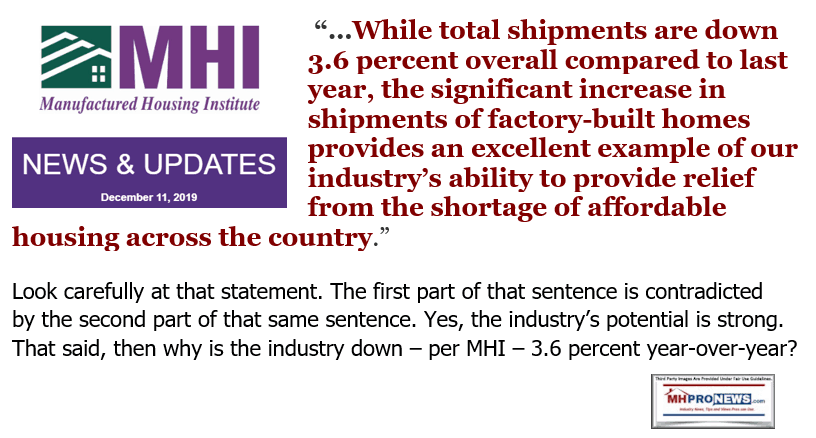

Per MHI:

Part 3 – MHProNews Skinny Analysis

As 2019 draws to a close, a wide array of third-party insights reflected the points that:

- affordable housing is in high demand,

- entry level homes demand is outstripping supply,

- manufactured homes are superior to what many believe, with that claim based upon several third-party research reports.

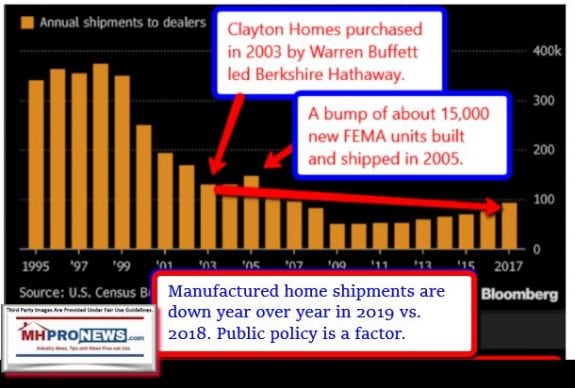

- Nevertheless, manufactured housing is underperforming.

- Based upon various estimates, manufactured housing should be doing 500,000 new units per year (a statement made by outgoing MHI President Richard ‘Dick’ Jennison) to 1 (+/-) million new units per year, which would still not meet the total needs and demands; meaning those estimates are still below the industry’s potential.

It is MHI that claims to represent ‘all segments of manufactured housing.’ In making that claim, it comes with responsibilities. Based on their own claims vs. the data of declining manufactured home sales during an affordable housing crisis, here is what logic and deductive reasoning suggests.

Either:

- MHI and their big boy companies like Clayton Homes are incompetent, based upon the opportunities. (Note, these are educated and experienced professionals, with plenty of resources to meet the potential. We editorially don’t believe they are incompetent.

- MHI and their big boy companies routinely fumble good opportunities (same analysis as above).

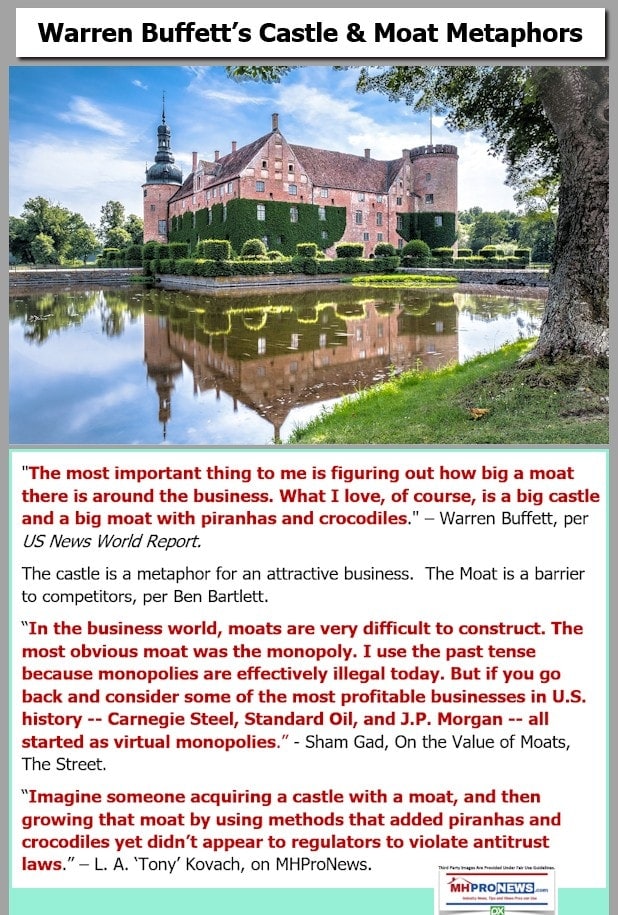

- MHI and their big boy companies are causing, by accident or design, negative news that are part of the headwinds that have sparked a decline in interest and thus sales of manufactured homes.

- MHI and their big boy companies are intentionally allowing certain opportunities and good laws to be thwarted to foster consolidation. The ‘good’ promotional items that are currently dwarfed by bad news are window-dressing to blunt criticism, as are their photo ops and videos with various public officials.

- Some combination of the above.

If MHI and their big boy members were truly interested in moving the needle, third party data reveals the opportunities are there. It is difficult to square fumbling so often with the education and skills of those involved. That arguably suggests that they are working to consolidate the industry.

That deduction opens the door to numerous legal and ethical issues.

See the related reports, below.

Related Reports:

Manufactured Double Talk? Analyzing New Land-Lease Manufactured Home Community Developments

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

Winter 2019…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has now celebrated our tenth anniversary.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach, co-managing member of LifeStyle Factory Homes, LLC and co-founder for MHProNews.com, and MHLivingNews.com.

Connect with us on LinkedIn here and here.