“Sales of new U.S. single-family homes rose less than expected in December, likely restricted by a jump in home prices,” wrote Lucia Mutikani 1.28.2021 for Reuters.

Mutikani said that “New home sales increased 1.6% to a seasonally adjusted annual rate of 842,000 units last month, the Commerce Department said on Thursday. November’s sales pace was revised down to 829,000 units from the previously reported 841,000 units.”

The conventional housing market is supported by cheaper mortgage rates – 2.77 percent for 30-year fixed rates, per Fannie Mae – plus the exodus from city centers to suburbs and other low-density areas. More companies are allowing employees to work from home, and schools shifting to online classes because of the coronavirus pandemic were factors she said contributed to the trends.

- The median new house price surged 8% to $355,900 in December from a year ago.

- There were 302,000 new homes on the market last month, up from 290,000 in November.

- At December’s sales pace it would take 4.3 months to clear the supply of houses on the market, up from 4.2 months in November.

- The government reported last week that housing starts soared in December to their highest level since September 2006.

- Permits for future homebuilding were also the highest since August 2006.

- About 23.7% of the labor force is working from home.

- Lower-wage earners in the services sector have borne the brunt of the COVID-19 crisis.

- Economists polled by Reuters had forecast new home sales would rebound 1.9% to a rate of 865,000 units in December.

- New home sales are drawn from a sample of houses selected from building permits and tend to be volatile on a month-to-month basis.

- New home sales jumped 15.2% on a year-on-year basis. Sales totaled 811,000 in 2020, up 18.8% from 2019.

- In December, new home sales rose in the Midwest and West, but fell in the Northeast and South.

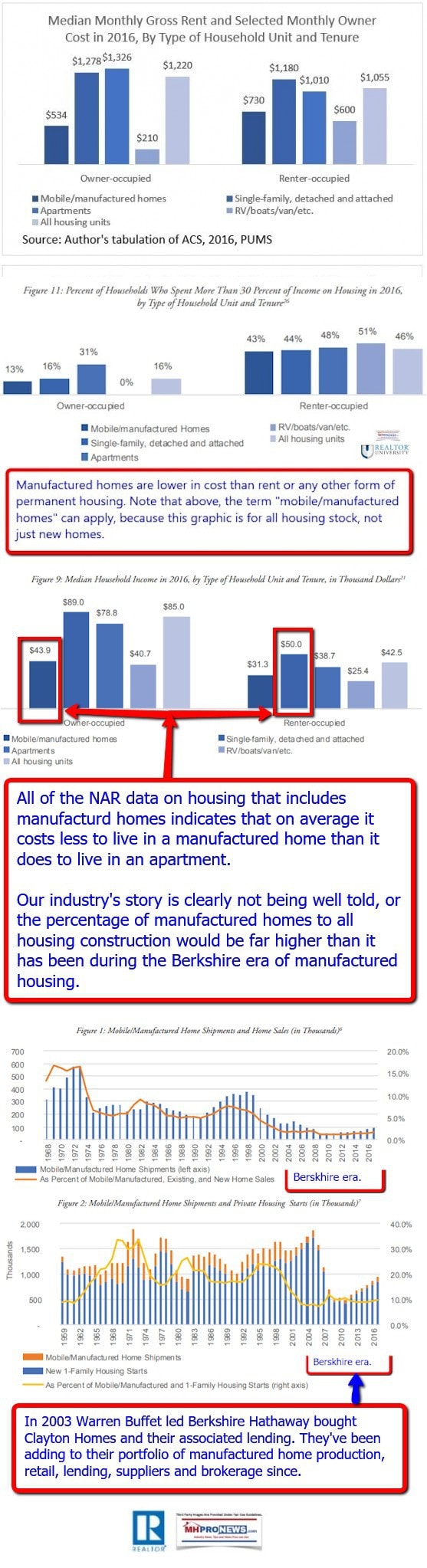

Several of these factors cited by Mutikani, who pointed to federal Commerce Department data, plus the details below from the National Association of Realtors (NAR) point to significant opportunities for the manufactured home industry, its retailers, communities, and developers. More on that further below.

Data Reported by the National Association of Realtors (NAR)

According to Markwatch and MSN (Microsoft News, launched by Bill Gates founded company), reported on 1.29.2021 the following.

ECONOMIC REPORT

The numbers: The index of pending home sales dropped 0.3% in December, marking the fourth consecutive month of declines, the National Association of Realtors (NAR) said Friday. Their index measures real-estate transactions in which a contract is signed, but the sale had not yet closed.

Compared to 2019, pending sales were still up 21%, a sign of how strong the market is right now despite the recent weakness.

Quote What happened: Pending sales didn’t fall across all regions, as was the case in November.

In fact, the Midwest was the only region to experience a decline, with a 3.6% drop. Pending sales were flat in the West and rose by 3.1% in the Northeast and 0.1% in the South.

The big picture: In the months to come, the story will be whether the number of listings of homes for sale will grow to meet demand. ##

“Pending home-sales contracts have dipped during recent months, but I would attribute that to having too few homes for sale,” said Lawrence Yun, Ph.D., the NAR’s chief economist, per MSN.

Yun said that “There is a high demand for housing and a great number of would-be buyers, and therefore sales should rise with more new listings.”

MarketWatch said it is not clear what has held sellers back from putting their homes on the market. But the problem could be a self-perpetuating. Some buyers might be seeing the dearth of homes for sale and be reluctant to list their own for fear of not finding somewhere to move.

MarketWatch said with the caption, What they’re saying: “Demand for existing homes remains strong but supply is likely restraining sales figures,” said Ruben Gonzalez, chief economist at Keller Williams real estate brokers.

Gonzalez said that “We expect to see continued price acceleration in the near term as a result of record-low inventory levels that have persisted for several months now.”

Additional Information, plus MHProNews analysis and commentary

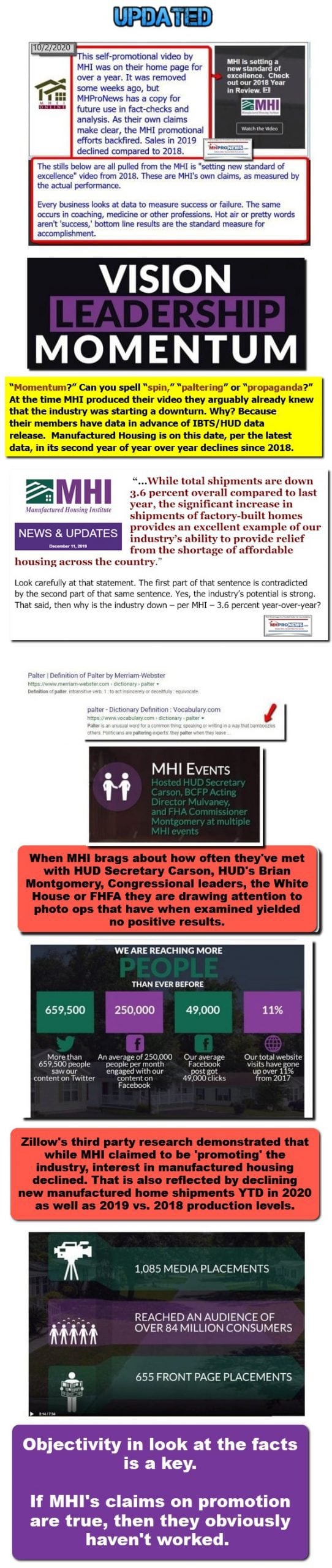

Over two years have elapsed since the Manufactured Housing Institute (MHI) in the later part of 2018, with support from the industry’s three largest HUD Code manufactured home producers, claimed that the industry had “momentum.” Those dominating producers, Clayton Homes (BRK), Skyline Champion (SKY) and Cavco Industries (CVCO) supported MHI’s move to push a “new class” of manufactured homes that MHI finally trademarked the name “CrossModTM” homes.

Touting their own controversial advertorial campaign, MHI claimed millions of exposures of their marketing to the homebuying public. The video these MHI claims were taken from is no longer visible from their home page.

But if so, that only underscored just how the post-production side of the MHI association ineffective their marketing has been.

From Investor Standpoint…

The GameStop/Reddit Rebellion is spotlighting what several in media are calling an example of how a ‘rigged system’ is being exposed.

MHProNews has previously reported on each of the ‘big three’ producers – each of which has various scandals associated with the ‘big three’ – plus purported conflicts of interest documented with respect to Lesli Gooch, CEO of MHI.

MHProNews has said for some time reported the concern that manufactured housing investors in these firms are getting shortchanged. So too thousands of are manufactured home professionals. In a recent exclusive Q&A by MHProNews, additional history and evidence of such concerns are factually laid out, step-by-step.

Last but not least, the Pallet Shelter report below reflects related concerns.

The federal data from the Commerce Department and NAR in this report point to reasons why the HUD Code manufactured home industry should be soaring.

MHI and their major members can run, duck, deflect, but can not hide from the facts, evidence, and patterns that this publication and others in or out of MHI have made.

The bottom line? There are reasons why MHI and generally the big three, duck actual accountability. When the data is looked at, when the need for home is compared to the tepid volume being produced by manufactured housing, the case for their failure in leadership becomes obvious.

To learn more, see the related reports.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.