In a recent release to the Daily Business News on MHProNews, “Lifshitz & Miller announces investigation into possible securities laws violations in connection with a previously received subpoena [by Cavco Industries, Inc. (CVCO)] from the SEC,” said the law firm.

The firm said “If you are a Cavco investor, and would like additional information about our investigation, please complete the Information Request Form or contact Joshua Lifshitz, Esq. by telephone at (516) 493-9780 or e-mail at info@jlclasslaw.com.”

They are one of the latest in a series of law firms that have announced this type of “investigation” on behalf of CVCO shareholders. See below the byline, offers, and notices further below for other shareholder investigation examples by a number of lawfirms.

Cavco has reportedly set aside millions of dollars in connection with their defense against such shareholder litigation efforts.

Insider Trading…

“We’ve lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance,” said Simply Wall Street, in the tee-up to their report on insider trading in the last year at Cavco Industries (CVCO), which added, “It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, rules govern insider transactions, and certain disclosures are required.”

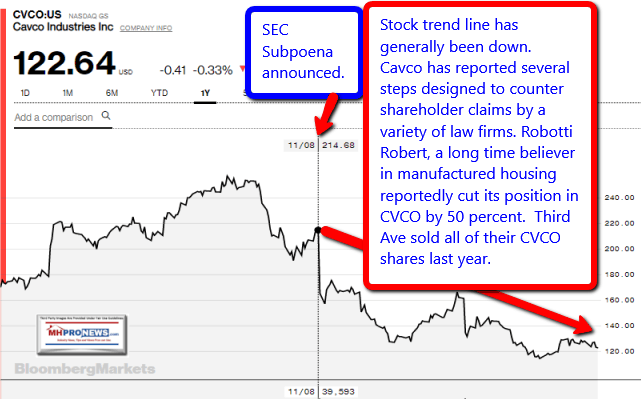

“In the last twelve months, the biggest single sale by an insider was when Joseph Stegmayer sold US$2.8m worth of shares at a price of US$240 per share. Although we don’t gain confidence from insider selling, we note that this large sale was at well above current price of US$129,” in an April 7th statement.

The share value of CVCO have slipped further since that report.

“Cavco Industries insiders own about US$72m worth of shares. That equates to 6.1% of the company. We’ve certainly seen higher levels of insider ownership elsewhere,” per that same source.

Not all of the news for Cavco has been bad of late, as there are some investors and hedge funds that have taken new positions in a firm they may now think is undervalued. Meanwhile, others have cut their stakes in a firm that an insider told MHProNews last year had suffered a “debacle.” ICYMI, or need a refresher, see the related report, below the byline and notices for that report.

Among those that have sold shares of Cavco is Robotti Robert, an investment firm that has long believed in manufactured housing, which reportedly dumped half of their portfolio in CVCO, per EnHerald. “Robotti Robert decreased its stake in Cavco Inds Inc Del (CVCO) by 50.43% based on its latest 2018Q4 regulatory filing with the SEC. Robotti Robert sold 56,415 shares as the company’s stock declined 19.50% while stock markets rallied. The institutional investor held 55,462 shares of the basic industries company at the end of 2018Q4, valued at $7.23 million, down from 111,877 at the end of the previous reported quarter. Robotti Robert who had been investing in Cavco Inds Inc…for a number of months, seems to be less bullish one the $1.16B market cap company.”

Third Avenue Value Fund last year completely sold off their shares in Cavco, not long before the SEC subpoena was made public. Coincidence?

Joe Stegmayer stepped down as Chairman and CEO in 2018, in the wake of the announcement of the SEC Subpoena. When contacted by MHProNews, the SEC would neither confirm nor deny that Cavco Industries was being investigated for possible collusion, antitrust, or other improprieties involving Clayton Homes.

If so, that could lead SEC investigators back to other concerns that have been raised in connection with other ‘big boy’ members of the Manufactured Housing Institute (MHI).

Stegmayer and MHI finally announced that he will be stepping down from his role as MHI Chairman. More on that and related in an upcoming report.

See ‘White Hat, Black Hat’ and other Cavco related reports in the related reports, linked below. Cavco is one of the stocks that are tracked in our MHProNews evening manufactured housing industry’s daily market report. Friday’s closing tickers are linked here.

It’s Monday, Monday and that’s the latest edition of “News through the lens of manufactured homes, and factory-built housing” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

“Out-Performing the Market” Robert Robotti, Value Investing, and Manufactured Housing

Manufactured Housing Institute on Cavco Industries, ex-Chairman Joe Stegmayer SEC “Debacle”