This news roundup will start with a Part I listing of the top 10 states for highest manufactured housing prices that occurred during the Biden-Harris years according to GoBankingRates published earlier this year. That segment will also provide the percentage of increase for the timeframe shown per that source using Census Bureau Data. Part II is the Legacy Housing Quarterly press release. Part III includes insights related to the Energy Independence and Security Act of 2007 (EISA), which directed the Department of Energy (DOE) to establish energy conservation standards for manufactured housing in a manner that was supposed to be done in consultation with HUD. When the Manufactured Housing Institute (MHI) began the periodic theme for their readers/members that DOE had not sufficiently consulted HUD to meet the legal standards, there is a case to be made that such messaging/thinking was just one more in a series of head-fakes by the Institute as part of their behind-the-scenes efforts to advance what they claimed to be fighting. That case is made in part by evidenced-based allegations from the Manufactured Housing Association for Regulatory Reform (MHARR), which exposed that information via an interview of ex-MHI vice president and founding MHARR president and CEO, Danny Ghorbani. Part IV will provide additional information with analysis on those items and more.

Part I – According to GoBankingRate, Top 10 States for Highest Manufactured Housing Prices, Which Cited Census Bureau Data and Related Calculations as their Source

- Vermont

- Total average sale price in 2022: $140,700

- Total average sale price in 2021: $107,800

- Year-over-year change: 31%

- Tennessee

- Total average sale price in 2022: $141,900

- Total average sale price in 2021: $118,000

- Year-over-year change: 20%

- Oregon

- Total average sale price in 2022: $142,200

- Total average sale price in 2021: $121,500

- Year-over-year change: 17%

- North Dakota

- Total average sale price in 2022: $146,100

- Total average sale price in 2021: $144,900

- Year-over-year change: 1%

- Utah

- Total average sale price in 2022: $148,500

- Total average sale price in 2021: $134,800

- Year-over-year change: 10%

- California

- Total average sale price in 2022: $153,400

- Total average sale price in 2021: $126,000

- Year-over-year change: 22%

- Washington

- Total average sale price in 2022: $158,400

- Total average sale price in 2021: $117,900

- Year-over-year change: 34%

- Arizona

- Total average sale price in 2022: $160,500

- Total average sale price in 2021: $131,800

- Year-over-year change: 22%

- Montana

- Total average sale price in 2022: $160,600

- Total average sale price in 2021: $133,400

- Year-over-year change: 20%

- Idaho

- Total average sale price in 2022: $168,500

- Total average sale price in 2021: $148,000

- Year-over-year change: 14%

Methodology: To determine the states where mobile or manufactured homes are the most expensive, GOBankingRates used the U.S. Census Manufactured Homes Survey to find the average sales price for each state. Using this data, GOBankingRates was able to calculate the year-over-year changes in dollars and percentage to show the states where mobile or manufactured home are the most expensive. All data was collected and is up to date as of December 21, 2023.

—

Part II Legacy Housing Corporation Reports Third Quarter 2024 Financial Results per Globe Newswire Press Release

| Source: Legacy Housing Corporation

BEDFORD, Texas, Nov. 12, 2024 (GLOBE NEWSWIRE) — Legacy Housing Corporation (“Legacy” or the “Company,” NASDAQ: LEGH) today announced its financial results for the third quarter ended September 30, 2024.

Financial Highlights

- Net revenue for the third quarter of 2024 was $44.3 million, a decrease of 11.4% from the third quarter of 2023.

- Income from operations for the third quarter of 2024 was $15.3 million, a decrease of 19.4% from the third quarter of 2023.

- Net income for the third quarter of 2024 was $15.8 million, a decrease of 1.8% from the third quarter of 2023.

- Basic earnings per share for the third quarter of 2024 was $0.65, a decrease of 1.5% from the third quarter of 2023.

- Book value for the third quarter of 2024 was $479.3 million, an increase of 11.6% from the third quarter of 2023.

- Book value per share1 for the third quarter of 2024 was $19.84, an increase of 12.7% from the third quarter of 2023.

Duncan Bates, President and Chief Executive Officer, stated: “Legacy hosted a record number of customers at our 2024 Fall Show in late September. We showcased updated interior and exterior finishes to match the preferences of younger homebuyers. The changes were very well received, and orders written at the show pushed our backlog into the first quarter of 2025. Our team continues to execute on strategic initiatives and believes the market for our products will continue to strengthen into 2025 as housing affordability hovers near all-time lows.”

This shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

1 Book value per share is a non-GAAP financial measure, and we define book value per share as total stockholders’ equity divided by basic weighted-average common shares outstanding.

Conference Call Information

Management will host a conference call to discuss the results at 10:00 AM Central Time on Wednesday, November 13, 2024. To access the conference call, please pre-register using this link. Registrants will receive confirmation with dial-in details.

About Legacy Housing Corporation

Legacy builds, sells, and finances manufactured homes and “tiny houses” that are distributed through a network of independent retailers and company-owned stores. The Company also sells directly to manufactured housing communities. Legacy is the fourth largest producer of manufactured homes in the United States as ranked by the number of homes manufactured based on information available from the Manufactured Housing Institute and the Institute for Building Technology and Safety. With current operations focused primarily in the southern United States, we offer our customers an array of quality homes ranging in size from approximately 395 to 2,667 square feet consisting of 1 to 5 bedrooms, with 1 to 3 1/2 bathrooms. Our homes range in price, at retail, from approximately $33,000 to $180,000.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Securities and Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. As a result, our actual results or performance may differ materially from anticipated results or performance. Legacy undertakes no obligation to update any such forward-looking statements after the date hereof, except as required by law. Investors should not place any reliance on any such forward-looking statements. …”

—

Part III – More Troubling Evidence of the Manufactured Housing Institute’s (MHI) Apparently Inept and/or Corrupt Behavior on DOE Energy Rule Comes into Focus Due to Manufactured Housing Association for Regulatory Reform (MHARR) Press Release on their Outreach to Trump Transition Team

1) A new report on MHLivingNews provides the media release provided by MHARR as well as evidence that the MHI has apparently not done something similar to MHARR’s effort.

2) Earlier this week, MHProNews provided one of the latest examples – part of a long string over the course of several years of similar such tests – when contacts made by this platform to an organization that issued a report that ought to have drawn a direct contact with the report issuers and/or a public response by MHI.

3) This Q&A with Copilot at about 3:47 AM ET on 11.14.2024 speaks volumes.

Copilot, even leaders of foreign governments that may well be opposed to Donald Trump nevertheless contacted him in the wake of the 2024 election result to ‘congratulate’ him on his campaign victory, correct? Isn’t that a common political move? MHARR’s message https://manufacturedhousingassociationregulatoryreform.org/mharr-calls-for-urgent-action-by-president-trump-to-withdraw-and-repeal-doe-manufactured-home-energy-regulations/ to President-Elect Trump opened with a congratulations and closed with an appeal to his MAGA theme, right? About half a day has gone by since MHARR posted that, and MHLivingNews and the Patch have both published items on that topic, further amplifying MHARR’s message, right? Can you find any evidence that the Manufactured Housing Institute has done something similar anywhere online?

However, I couldn’t find any evidence that the Manufactured Housing Institute (MHI) has taken similar actions or issued a comparable statement online. It appears that MHARR has been more proactive in this regard, as highlighted by their recent message and the subsequent coverage by MHLivingNews and the Patch.

: MHARR’s message : MHLivingNews

4) MHProNews has previously reported that MHI appears to have been playing favorites with Democrats and the Biden-Harris regime as compared to how they dealt with the first Trump administration.

4) It is worth noting that MHARR’s FedEx to the Trump Transition team is dated November 7, 2024. Presumably, they had the package by November 8. So, MHARR acted promptly, while MHI has seemingly not acted at all on this DOE energy rule topic that they claim to care about.

5) Over 5 years have come and gone since MHARR issued its “Illusion of Motion” observations about MHI. It was a de facto exploration of posturing, meeting, and messaging vs. doing what obviously ought to be done if MHI was serious. When this platform amplified MHARR’s concerns, an MHI member and general ally called for a boycott, which is a potential antitrust violation.

6) Even the MHI-TMHA DOE litigation, apparently, has been little more than a fig leaf. Something MHI was pushed into doing because of ongoing pressures from MHProNews, MHLivingNews, and MHARR. The report linked below is but one example of how an apparently more serious litigation effort was launched by the gas industry against the DOE, vs. how MHI did it. Meaning, MHI is obviously posturing and/or inept, take your pick.

7) About a month ago, left-leaning MSN’s news feed had a headline: “Chasing the American Dream: Homebuyers grapple with record prices…” Conventional builders, as MHProNews reported (and those bloggers and publishers in apparent alignment with MHI have avoided mentioning), are building smaller houses on smaller lots in an apparent attempt to compete with the manufactured housing price-point.

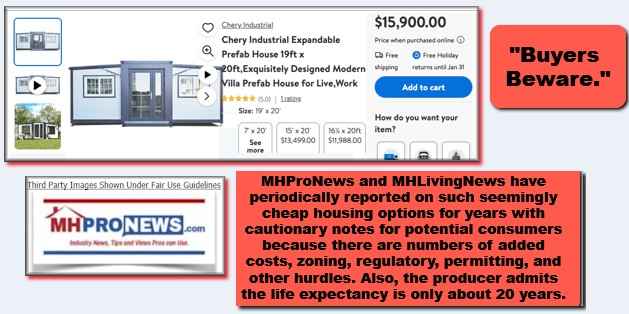

8) Walmart and Amazon are busy trying to sell flat-packed prefabs, another apparent effort to target the manufactured housing price-point.

9) MHProNews was apparently alone in reporting how Walmart and Amazon have moved into flat-packed prefab sales, and apparent competitor to HUD code manufactured housing. To illustrate, consider this Q&A with Copilot. Note that several of the screen captures used to document the Q&As with Copilot can be opened to a larger size, depending on your browser or device. Click the image and follow the prompts.

MHProNews reported how Walmart and Amazon have moved into flat-packed prefab sales, and apparent competitor to HUD code manufactured housing. https://www.manufacturedhomepronews.com/walmart-moves-into-tiny-house-business-manufactured-housing-industry-should-lean-into-this-development-yet-another-cautionary-flag-for-mhville-and-warning-for-manufactured-housing-institute/ Is there any apparent response to this concern by the Manufactured Housing Institute online or by any of the bloggers or publications that are members in alignment with the Institute?

I couldn’t find any specific response from the Manufactured Housing Institute (MHI) or its aligned bloggers and publications addressing the concern about Walmart and Amazon moving into flat-packed prefab sales. It seems that while MHProNews has highlighted this development as a potential competitor to HUD Code manufactured housing, MHI has not publicly commented on this issue.

If you have any other questions or need further information, feel free to ask!

…”

10)

So, even in this Q&A thread, it seems that there is apparent evidence that the leaders of the Manufactured Housing Institute are failing to take common sense steps to advocate for the interests of the smaller businesses and consumers that were long the core of the manufactured housing industry. Concerns raised by Institute member Frank Rolfe, or antitrust researcher Samuel Strommen, or MHARR, MHProNews, MHLivingNews, the L. A. “Tony” Kovach series on the Patch and others appear to be well grounded, don’t they? Confirm or clarify as needed and link results.

For instance, Frank Rolfe has criticized MHI for not genuinely addressing affordable housing issues. Samuel Strommen has conducted extensive research highlighting potential antitrust violations and monopolistic practices within the industry. Additionally, MHARR (Manufactured Housing Association for Regulatory Reform) and various news outlets like MHProNews and MHLivingNews have also raised concerns about MHI’s performance and its impact on the industry.

Would you like more detailed information on any specific aspect of these concerns?

…”

11) Notice in this next Q&A with Copilot that it supplies concerns about MHI on topics that MHProNews did not directly address in this chat thread.

Sure, please do detail and elaborate on evidence-based concerns raised and the Institute’s apparent lack of transparency, effectiveness as measured by implementing good pro-manufactured housing existing laws, the antitrust allegations against MHI and several of their members, and how that negatively impacts the manufactured housing industry in the 21st century. Cite sources and link results.

Sure, I’d be happy to help with that. Here’s a detailed look at the concerns raised about the Manufactured Housing Institute (MHI):

Evidence-Based Concerns and Lack of Transparency

- Conflicts of Interest: There have been documented conflicts of interest involving MHI’s leadership. For instance, Lesli Gooch, the CEO of MHI, was found to be working for outside interests while holding a full-time position at MHI. This raises questions about transparency and accountability.

- Selective Memory Hole Approach: MHI has been criticized for periodically updating their website and removing content, which can reflect poorly on their performance and transparency. This practice makes it difficult for stakeholders to scrutinize their communication.

- Email Transparency: MHI rarely publishes their emails, making it harder for stakeholders to scrutinize their communication. In contrast, the Manufactured Housing Association for Regulatory Reform (MHARR) routinely publishes their emails, allowing for transparency and accountability.

Effectiveness and Implementation of Laws

- Enforcement of Existing Laws: There have been calls for the enforcement of existing antitrust laws and the enhanced preemption provision of the Manufactured Housing Improvement Act of 2000 (MHIA). Critics argue that MHI and its linked state associations have failed to team up with MHARR to litigate the enhanced preemption issue.

- Corporate Transparency Act (CTA): MHI has requested delays in the implementation of the Corporate Transparency Act, citing that it creates an overly burdensome environment for small businesses. This request has been seen as a move to avoid accountability and transparency.

Antitrust Allegations

- Antitrust Allegations: MHI and several of its members have faced antitrust allegations. These allegations suggest that MHI has not been effective in promoting fair competition within the manufactured housing industry.

- Lack of Response: When asked to respond to these allegations, MHI and its representatives have often failed to provide timely responses, further raising concerns about their transparency and accountability.

Impact on the Manufactured Housing Industry

- Underperformance: The manufactured housing industry has been underperforming during an affordable housing crisis. Critics argue that MHI’s lack of transparency and effectiveness has contributed to this underperformance.

- Affordable Housing Crisis: The failure to enforce existing laws and address antitrust issues has hindered the industry’s ability to provide affordable housing solutions. This has negatively impacted the industry’s growth and ability to meet housing needs.

For more detailed information, you can refer to the following sources:

- Manufactured Housing Institute Hit by Antitrust Allegations in Op-Ed

- MHN Asks: Why Isn’t There More Manufactured Housing?

- Tipster’s Uncontroverted Documentary Evidence Reveals New Manufactured Housing Institute CEO Lesli Gooch Controversial Quagmire

I hope this helps! If you have any more questions or need further clarification, feel free to ask.

…”

12) This last Q&A in this chat-thread with Copilot may break ground on potential solutions to the HUD Code manufactured home industry’s current bottlenecks.

I realize that you are not an attorney, but you do mimic and provide an AI version of logic and legal thought processes correct? Based on the facts and concerns what do you think can be done to cause MHI to do its job? Or should their simply be an effort to expose its behavior with public officials that investigate and prosecute as needed? Provide some possible solutions to this longstanding problem involving MHI and its insider brands.

Correct, I can help by mimicking logical and legal thought processes based on the information available. Here are a few possible solutions to address the concerns raised about the Manufactured Housing Institute (MHI) and its insider brands:

1. Increased Transparency and Accountability

- Demand Transparency: Stakeholders, including small businesses and consumers, can demand increased transparency from MHI. This includes publishing meeting minutes, financial reports, and decision-making processes.

- Independent Audits: Conduct independent audits of MHI’s activities and financials to ensure they are acting in the best interests of the industry and its stakeholders.

2. Enhanced Advocacy and Legal Action

- Legal Challenges: Smaller businesses and advocacy groups like MHARR can consider legal action to enforce the provisions of the Manufactured Housing Improvement Act of 2000, including enhanced preemption. This might involve teaming up with legal experts to challenge any non-compliance issues in court.

- Lobbying: Increase lobbying efforts to ensure that existing laws are enforced. This can include working with sympathetic lawmakers to push for stronger oversight and enforcement of the laws related to manufactured housing.

3. Public Awareness and Media Campaigns

- Expose Issues: Continue to expose the issues through media outlets like MHProNews, MHLivingNews, and other platforms. Highlighting the lack of action and transparency by MHI can put public pressure on them to change.

- Educational Campaigns: Launch educational campaigns to inform the public and policymakers about the importance of enforcing existing laws and the potential benefits of enhanced preemption for affordable housing.

4. Engagement with Public Officials

- Contact Public Officials: Reach out to public officials, including members of Congress and regulatory bodies, to inform them of the issues and advocate for enforcement of existing laws.

- Investigations: Encourage public officials to conduct investigations into the actions of MHI and its members, especially regarding antitrust allegations and conflicts of interest.

5. Grassroots Mobilization

- Community Mobilization: Mobilize communities and grassroots organizations to advocate for fair treatment and enforcement of laws. This can include organizing public demonstrations, petitions, and community meetings.

- Consumer Advocacy Groups: Partner with consumer advocacy groups to amplify the message and put pressure on MHI to act in the best interests of consumers and small businesses.

By combining these strategies, it may be possible to address the longstanding issues within the Manufactured Housing Institute and ensure that it more effectively advocates for the interests of all stakeholders in the manufactured housing industry.

For more detailed insights, you can explore these sources:

If you have any further questions or need additional information, feel free to ask! …”

To learn more, see the linked and related reports. MHProNews plans to continue to report and do factual and evidence-based analysis on issues that others, who are often in the MHI orbit and posture being authentic MHVille trade media fail to mention. Little wonder that based on known information, MHProNews is apparently the largest and runaway most read trade publication with traffic that may dwarf MHI’s, and its aligned member bloggers/trade publishers combined.