Over a dozen law firms and scores of attorneys on all sides of the Joe Stegmayer controversy have poured over what has transpired before, during, and since Cavco Industries announced on November 8, 2018 the Securities and Exchange Commission (SEC) subpoena that sent their stock’s (CVCO) value plunging.

The Daily Business News on MHProNews routinely hears from a variety of well-placed sources related to this matter.

Among them, an attorney sent the following.

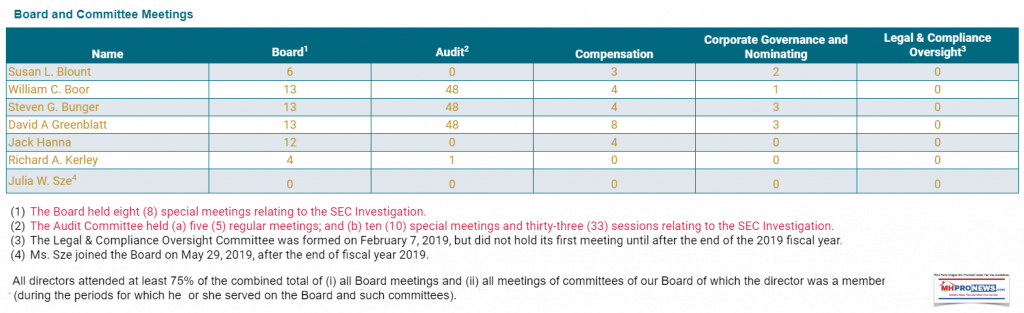

“Checking the SEC-EDGAR system, Cavco has filed an amendment to their 2019 Shareholder meeting proxy form relating to the Board and Committee meetings attended by each Board member — no substance, just numbers — but look at the number of meetings and “sessions” related to the SEC Stegmayer investigation…

The entire tip, which is according to information submitted to the SEC, follows. A key line, not to be missed in what follows, is this pull-quote:

- “…the Board and the committees of the Board held during fiscal 2019. Page 13 of the Original Proxy Statement included disclosures that there thirty-three (33) Audit Committee meetings in fiscal year 2019 for both regular or SEC Investigation matters, of which eighteen (18) were Sessions. This disclosure was incorrect; there were forty-eight (48) Audit Committee meetings in fiscal year 2019 for both regular or SEC Investigation matters, of which thirty-three (33) were Sessions.”

With that tee up, here is the formal Cavco supplemental proxy statement, as provided.

____________________________

This Proxy Statement Supplement (“Supplement”) provides additional, clarifying and corrective information with respect to the Cavco Industries, Inc. (“Cavco” or the “Company”) 2019 Annual Meeting of Stockholders, to be held on July 9, 2019 at 9:00 AM (local time), at the Company’s corporate offices located at 3636 North Central Avenue, Suite 1200, Phoenix, Arizona 85012.

On or about June 6, 2019, the Company filed with the SEC and mailed to our stockholders of record as of May 24, 2019 a proxy statement (the “Original Proxy Statement”) describing the matters to be voted on at the Annual Meeting. All capitalized terms used in this Supplement and not otherwise defined herein have the meaning ascribed to them in the Original Proxy Statement. This Supplement should be read in conjunction with the Original Proxy Statement.

The Original Proxy Statement included various disclosures and tables describing and disclosing the number of meetings of the Board, the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee that were attended by each of the Company’s directors during fiscal 2019.

This Supplement is being provided to supplement, clarify and correct certain of these disclosures relating to the number of total meetings of the Board and the committees of the Board held during fiscal 2019. Page 13 of the Original Proxy Statement included disclosures that there thirty-three (33) Audit Committee meetings in fiscal year 2019 for both regular or SEC Investigation matters, of which eighteen (18) were Sessions. This disclosure was incorrect; there were forty-eight (48) Audit Committee meetings in fiscal year 2019 for both regular or SEC Investigation matters, of which thirty-three (33) were Sessions.

The table and narrative below replaces in its entirety the table and narrative on page 16 of the Original Proxy Statement under the heading “Board and Committee Meetings” to: (i) provide corrected information with respect to the number of Audit Committee meetings in 2019 consistent with the previous paragraph, (ii) provide the total number of meetings for the Board, the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee and the Legal Compliance & Oversight Committee, and (iii) provide supplemental clarifying disclosure about the directors attendance at Board and committee meetings during fiscal 2019.

— ## —

MHProNews asked one of the attorneys to comment, and received this response: “…what’s especially interesting is the large number of meetings and “sessions” of the audit committee relating to the investigation…Also speculation, but I have to think that what’s happening is potentially serious, based on the amount of time that’s obviously being put into it and other steps they’ve taken.”

Put differently, there is a lot of defense going on, which implies that there is plenty of offense facing Cavco by shareholder plaintiff’s attorneys, the feds, and perhaps others at play too.

Oddly, Stegmayer has continued on as MHI Chair.

For added context and history, see the related reports, further below the bylines and notices.

That’s today’s second installment of “News through the lens of manufactured homes, and factory-built housing,” © where “We Provide, You Decide.” ©. ## (News, fact-checks, analysis, commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two browsers do.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

New Investigation, Insider Trades, Hedge Fund Dumps Cavco Industries (CVCO)

Joe Stegmayer, Cavco Industries, MHI Chairman, Insights from Innovative Housing Showcase