Nicole Friedman and Ben Eisen were the co-authors on a story for the Wall Street Journal entitled, “Fannie and Freddie’s Latest Push: Factory-Built Homes,” with a subtitle: “Mortgage giants hope to help low- and middle-class Americans buy homes but programs’ narrow reach and consumer bias impede progress.”

This will be part one of a planned multiple part fact-check and analysis of that article.

Headlines are not always written by the reporter(s). Headlines and subheadings are often provided or tweaked by editors. Indeed, when an article is published, editors bear some level of responsibility for the contents and accuracy of that article.

Ben Eisen’s Twitter feed includes these pull quotes from last week:

- “Fannie and Freddie are making a push into the opaque world of manufactured housing, a surprisingly complex task”

- “The gatekeepers of America’s housing market want to make it more affordable to buy a manufactured home. So far, they have found it a tough sell.”

Those statements are fair enough. Indeed, they merit more reflection in upcoming reports on MHProNews. For example, why is manufactured housing “opaque” – isn’t that a fair question?

Indeed, the subheading cited above itself sets up a clear contradiction.

Congress mandated lending on manufactured homes by the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac. What Congress didn’t do is tell the GSEs that they could force manufactured home producers to create a so-called ‘new class’ of more expensive HUD Code manufactured homes, and offer competitive lending only on those units.

The ‘new class’ of manufactured homes that the GSEs are lending on is a type of costlier HUD Code manufactured housing that Clayton Homes and their association mouthpiece, the Manufactured Housing Institute (MHI), has supported. So, whomever at the WSJ is responsible for that subheading wittingly or not set up a contradiction that is not clearly addressed.

Congress wanted lending on all types of manufactured homes precisely to promote affordable housing. But Clayton Homes – which is well known for moving into conventional housing – with the cover of MHI support, is promoting an entirely different kind of home that is NOT available to those ‘low and lower-middle class’ buyers’ that Congress had in mind when enacting the Housing and Economic Recovery Act (HERA) of 2008. Is there a conflict of interest at play between MHI’s claimed mission and Clayton Homes desire to sell more expensive housing?

There are millions today who believe in fake news. In fairness, there are some reports that are reasonably agenda-free. Others are heavily tainted by spin, a hidden, or sometimes obvious agenda. Therefor, the prudent reader must approach each article with a degree of skepticism. Some questions that a truth-seeking reader ought to ask in discerning a report or article could include: is the article or report balanced? Are several points of objectively view represented?

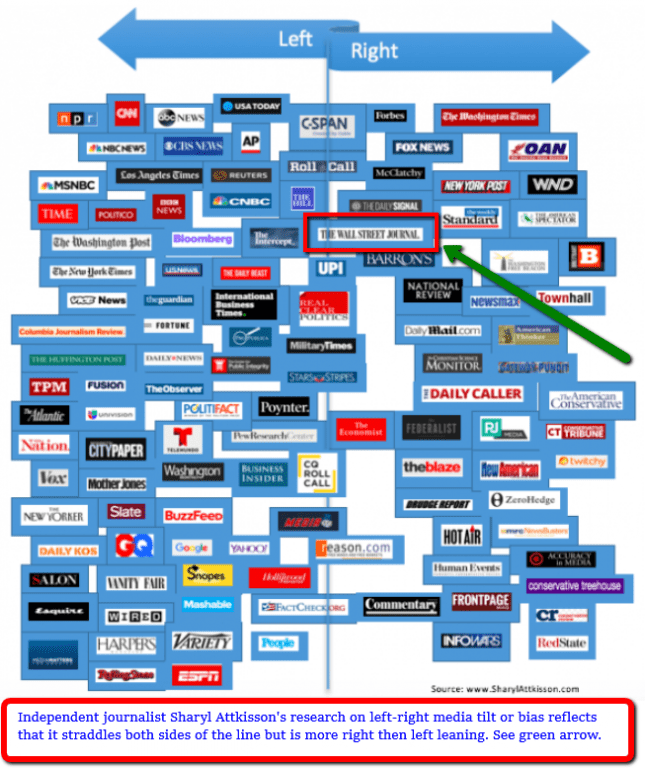

With those points and tests for bias understood, the Daily Business News of MHProNews will do the first of what promises to be a multiple part fact-check and analysis of a new report by Nicole Friedman and Ben Eisen of the mildly right-of-center Wall Street Journal (WJ).

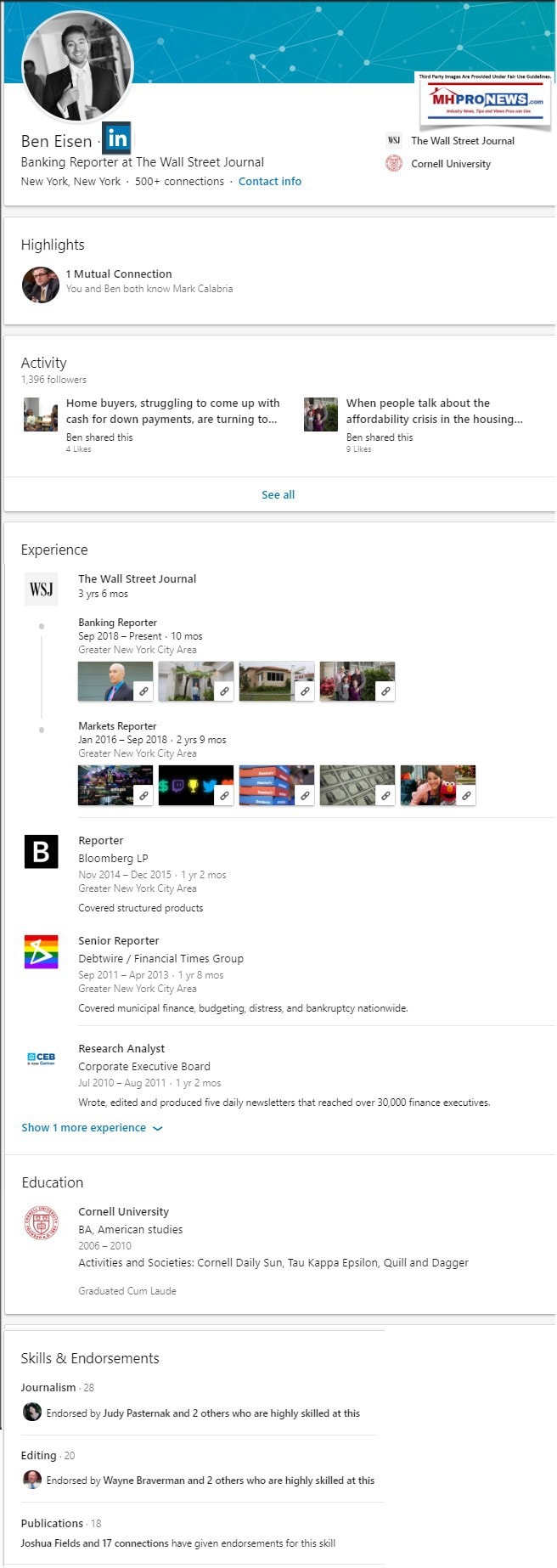

Eisen’s LinkedIn profile reflects the following.

The 411 according to the Wall Street Journal on Nicole Friedman is as follows.

“Nicole Friedman covers Berkshire Hathaway and insurance for The Wall Street Journal.” A headline from that same search reveals this by Friedman, “Berkshire Hathaway has underperformed the S&P 500 for a decade, forcing Warren Buffett into a position he rarely resides: on the defensive.”

Friedman’s Twitter feed includes the following pull quote:

- “Manufactured-home builders are trying to erase their industry’s stigma, and they’re hoping Fannie Mae and Freddie Mac can help. Warren Buffett’s Clayton Homes has a lot at stake.”

For first-time readers, let’s note that MHProNews for some years has often turned direct quotes bold and brown to make them pop but otherwise the text is as quoted.

Friedman’s LinkedIn profile is shown below.

Senator Tina Smith Urges Republican, Democratic Senators to Provide Greater Financing Access to Affordable Manufactured Homes – manufacturedhomelivingnews.com

In a letter dated June 6, 2019 obtained by MHLivingNews, Senator Tina Smith (MN-D) wrote Senators Mike Crapo (ID-R) and Sherrod Brown (OH-D) to urge greater support for lending on affordable housing, particularly naming manufactured homes. Senator Crapo is the chairman and Senator Brown is the ranking member of the Committee on Banking, Housing, and Urban Affairs.

Let’s look at some pull quotes from their WSJ article:

- “This [loan] product hasn’t been about volume. It’s about changing expectations,” said Jonathan Lawless, vice president of product development and affordable housing at Fannie Mae. “We’re going to get to volumes, but given all that has to change, it is going to take a frustratingly long period of time.”

- “A precrisis [the 2008 housing/mortgage crisis] effort by Fannie Mae to treat manufactured homes like site-built properties fizzled. In 2008, when Congress put the two companies into government conservatorship, it told them to promote affordable housing, including by taking a more active role in this market.”

The first bulleted statement above citing Lawless is surprising on several levels. That will be unpacked in a future report.

The second one is equally noteworthy. There have indeed been several prior efforts for the GSEs to get involved in manufactured housing. To say that they “fizzled” leaves one asking, why? What happened that caused lending on manufactured homes to ‘fizzle’ for the GSEs, when 21st Mortgage Corp, Vanderbilt Mortgage and Finance (VMF), ECN owned Triad Financial Services (TFS), Credit Human and others lending on manufactured homes could get loan performance and volume, and the GSEs could not?

Eisen and Friedman don’t explain that phrase to their readers. Nor do they clearly address the question above.

Lack of Balance in Sourcing?

Nor does Eisen and Friedman disclose that they never contacted the National Association of Manufactured Housing Community Owners (NAMHCO), per an official with that organization to MHProNews. Given that Eisen and Friedman mentioned that a ‘new class’ manufactured home was delivered into a land-lease community from the National Mall and the Innovative Housing Showcase earlier this month, one might wonder why they failed to contact that trade group?

But more troubling is the fact that Eisen and Friedman, per sources, contacted the Manufactured Housing Association for Regulatory Reform (MHARR). Why was MHARR not mentioned at all in the WSJ story, given that they interviewed MHARR President Mark Weiss, JD, for about an hour?

MHProNews asked the Wall Street Journal writers about those questions. They replied on other points they were asked about, but not yet on those concerns regarding NAMHCO and MHARR. A WSJ editor was also contacted and has not yet replied. In fairness, it was getting late in the day. So they may still provide follow up replies to our inquiries.

It must be noted that MHLivingNews reported on Saturday about a letter from Senator Tina Smith (MN-D) to a bipartisan group of Senate lawmakers, urging a broader application of lending on manufactured homes by the GSEs in the upcoming housing reform. That report is linked below.

Senator Tina Smith Urges Republican, Democratic Senators to Provide Greater Financing Access to Affordable Manufactured Homes – manufacturedhomelivingnews.com

In a letter dated June 6, 2019 obtained by MHLivingNews, Senator Tina Smith (MN-D) wrote Senators Mike Crapo (ID-R) and Sherrod Brown (OH-D) to urge greater support for lending on affordable housing, particularly naming manufactured homes. Senator Crapo is the chairman and Senator Brown is the ranking member of the Committee on Banking, Housing, and Urban Affairs.

While Senator Smith doesn’t mention MHARR, and cites different examples, it is noteworthy that Smith and MHARR – from different vantagepoints – share a similar concern. Namely, that the GSEs are not living up to their Congressional mandate to properly support manufactured home lending. MHARR argues that after over a decade of delays, that sad fact of a ‘flawed’ roll out of the GSEs Duty to Serve (DTS) mandates merit congressional inquiries.

It is one of several points that the WSJ story as published missed or failed to flesh-out in a meaningful fashion.

Part two of this planned multiple part analysis and fact check of the Eisen and Friedman article on manufactured housing is planned for later this week, to give the pair and their editors an opportunity to respond to follow up questions from MHProNews.

That today’s second installment of manufactured home “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” ©. ## (News, fact-checks, analysis, and commentary.)

1) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com. Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

Related Reports:

You can click on the image/text boxes to learn more about that topic.

“We as a Nation Can Solve the Affordable Housing Crisis,” Says Secretary Ben Carson, Spotlighting Manufactured Homes, Other Emerging Housing Technologies – manufacturedhomelivingnews.com

” Let’s make sure people understand what’s available,” said HUD Secretary Ben Carson about affordable housing, as he spotlighted manufactured homes as a key part of the Innovations in Housing display on the National Mall in Washington, D.C. ” You can get one of these manufactured houses, for instance, for 30 percent less, and they are very, very resilient.

“Time to Investigate Fannie And Freddie’s Mishandling Of DTS” | Manufactured Housing Association Regulatory Reform

It’s been more than ten years since Congress enacted the Housing and Economic Recovery Act of 2008 (HERA) and its “Duty to Serve Underserved Markets” (DTS) mandate. DTS directs both Fannie Mae and Freddie Mac to “develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low, low and moderate-income families.”