Noteworthy headlines on CNNMoney – Auto CEOs: Trump is good for the industry. Trump on Dow 20k: “Now we have to go up, up, up.” Chinese giant buys MoneyGram. Warrant issued for fallen Brazilian billionaire.

Some bullets from Fox Business – President Trump: Our infrastructure is in serious trouble. Alibaba’s Ant Financial in overseas push with MoneyGram deal. Digital media darlings BuzzFeed, Vice & Vox losing their luster? Trump: I won’t allow taxpayers to fund cost of NAFTA.

In the wake of news from the Trump Administration on plans to move ahead with building a wall on the U.S./Mexican line, some are saying the markets in both nations will tank.

However, several professionals–both before and just after Donald Trump won the election–made similar predictions. They were wrong then (see sample video, above). Will the naysayers be wrong again?

“We Provide, You Decide.” ©

Key Commodities

Crude Oil 53.79 1.04 (1.97%) Gold 1,188.50 –9.30 (-0.78%) Silver 16.80 –0.18 (-1.06%)

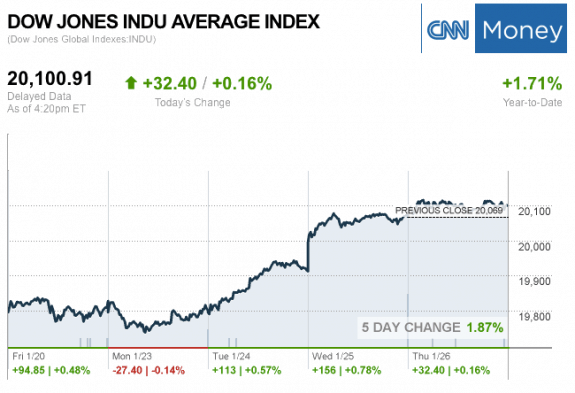

The markets at the Closing Bell Today…

S&P 500 2,296.68 –1.69 (-0.07%)

Dow 30 20,100.91 32.40 (0.16%)

Nasdaq 5,655.18 –1.16 (-0.02%)

Russell 2000 1,375.60 –6.84 (-0.49%)

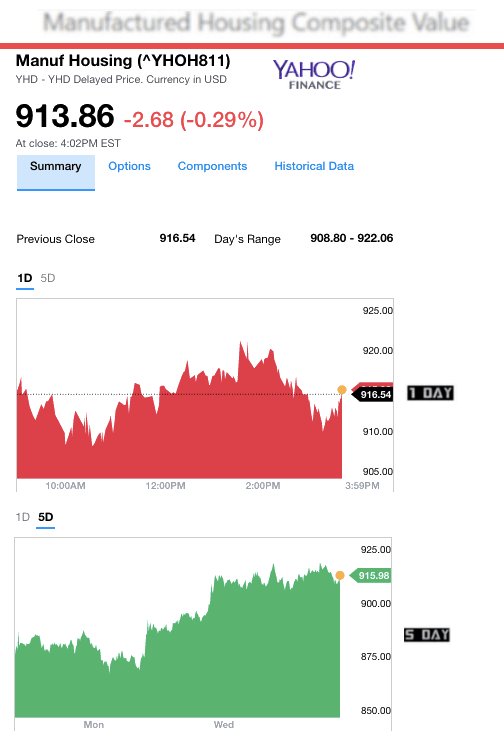

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Nobility Homes Inc. (NOBH) and The Carlyle Group (CG).

The top two sliders for the day were Universal Forest Products Inc. (UFPI) and Louisiana-Pacific Corp. (LPX).

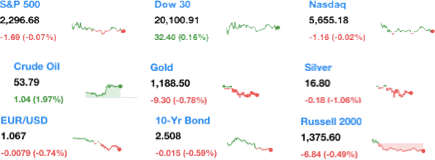

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.