Unless otherwise noted, the sources for the information that follows are from Nobility Homes (NOBH) 2018 annual report and/or their company’s website, YouTube page, or other company information. It is being provided here under fair use guidelines.

Rephrased, this is our report, uses information from their firm, but is not commissioned by their company.

The Daily Business News on MHProNews has reported recently on Cavco Industries, Skyline Corporation, Legacy Housing, and Deer Valley Homebuilders, among other publicly traded manufactured home producing companies. It has been a while since we’ve spotlighted Nobility, which is being rectified by this report.

While Cavco Industries (CVCO) and Skyline-Champion (SKY) had declining performance in their share value during the reported period MHProNews covered using Bloomberg-supplied data, Nobility (NOBH) has witnessed an ever-so-modest lift in their share value, year-over-year (YoY).

The closing tickers for the most recent manufactured home connected tracked stocks on the evening/nightly Daily Business News on MHProNews report are linked here.

As investors know, public firms must meet Securities and Exchange Commission (SEC) reporting requirements. The information they present is deemed to be accurate and is audited.

In principle, that makes it more useful for not only investors pondering the industry, but also for the industry’s professionals in general. In the USA today, anyone can say almost anything they wish, true or not. By contrast, in publicly traded corporate reports, while the data is ‘dry’ in the sense that it is not written as soaring poetry or prose, it is valuable on several levels.

MHProNews has made extensive use of pull-quotes in Nobility’s statements in what follows.

The Daily Business News on MHProNews has skipped certain sections, and have not herein specifically identified those bypassed portions below, for the sake of easier reading. Those who want to read the entire document can download it at the end of this report.

Our rules-of-thumb for determining what we’ve published below vs. what was omitted is simple.

- What would be of the greatest interest to the most industry readers?

- What would give more insights to both insiders and outsiders keen on manufactured housing who are looking in?

That said, let’s dive into their interwoven narratives.

Photos are generally from their website and or are video stills that are not part of their 2018 annual report.

The Bloomberg ticker as shown above included our comments on their data.

Nobility Homes, Inc., a Florida corporation incorporated in 1967, designs, manufactures and sells a broad line of manufactured and modular homes through its own retail sales centers throughout Florida. Nobility also sells its manufactured homes on a wholesale basis to independent manufactured home retail dealers and manufactured home communities.

We pride ourselves on providing well-designed and affordably-built homes that are comfortable, pleasantly decorated, energy efficient and engineered for years of carefree living. The Company’s manufacturing plant and corporate headquarters are located in Ocala, Florida.

Our homes are available in approximately 100 active models sold under the trade names “Kingswood”, “Richwood”, “Tropic Isle”, “Regency Manor” and “Special Editions”. Our home sales are single and multisection, range in size from 431 to 2,650 square feet and contain from one to five bedrooms.

Prestige Home Centers, Inc., our wholly-owned subsidiary, operates ten retail sales centers in north and central Florida: Ocala (two), Chiefland, Auburndale, Inverness, Hudson, Tavares, Yulee, Panama City, Punta Gorda and executive offices are located at our corporate headquarters in Ocala, Florida. Prestige has executed a lease and is in the process of opening an eleventh retail sales center in north Florida. Each of Prestige’s retail sales centers is located within 350 miles of Nobility’s Ocala manufacturing facility.

The primary customers of Prestige are homebuyers who generally purchase manufactured homes to place on their own home sites. Prestige operates its retail sales centers using a model home concept. Each of the homes displayed at its retail sales centers is furnished and decorated as a model home.

In an effort to make manufactured homes more competitive with sitebuilt housing, financing packages are available through 21st Mortgage Corporation and other outside financing sources that provide financing to retail customers who purchase the Company’s manufactured homes at Prestige retail sales centers.

Mountain Financial, Inc., a wholly-owned subsidiary of Prestige Home Centers, Inc., is an independent insurance agent and licensed loan originator. Mountain Financial provides automobile insurance, extended warranty coverage and property and casualty insurance to Prestige customers in connection with their purchase and financing of manufactured homes.

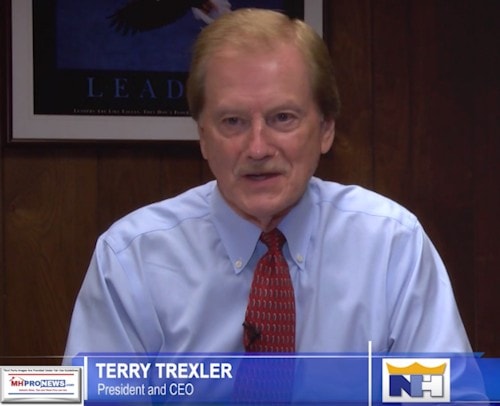

To Our Shareholders

Your Company’s results for fiscal year 2018 continue to reflect an improving environment in the manufactured housing industry and the State of Florida. The improving housing, financial and credit markets of our country and market area, coupled with the lower unemployment and better consumer and business confidence had a positive effect on the Company’s results.

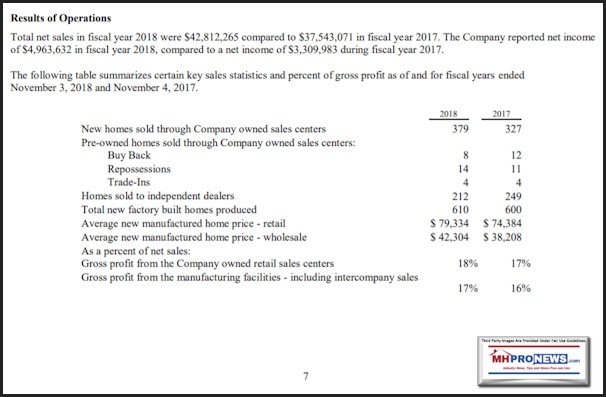

Net sales for Nobility during fiscal year 2018 were up 14% to $42,812,265 as compared to $37,543,071 recorded in fiscal year 2017. Income from operations for fiscal year 2018 was up 31% to $5,722,826 versus $4,355,874 in the same period a year ago. Net income after taxes was $4,963,632 as compared to $3,309,983 for the same period last year. Diluted earnings per share for fiscal year 2018 were $1.24 per share compared to $0.83 per share last year.

Nobility’s financial position during fiscal year 2018 remains very strong with cash and cash equivalents, certificates of deposit and short-term investments of $34,936,721 and no outstanding debt. Working capital is $38,128,057 and our ratio of current assets to current liabilities is 5.8:1. Stockholders’ equity is $49,066,501 and the book value per share of common stock is $12.67.

The demand for affordable manufactured housing in Florida continues to improve. According to the Florida Manufactured Housing Association, shipments in Florida for the period from November 2017 through October 2018 were up approximately 19% from the same period last year. Our sales for fiscal year 2019 continue to look positive. The Company’s Prestige Home Centers, which contributed strong operating results in the 2018 fiscal year, is expected to experience another good year. Material and labor cost increases are ongoing challenges facing the manufactured housing industry, including your Company. This year Nobility plans to continue making improvements in our manufacturing plant and Prestige model centers to increase efficiency and productivity.

Constrained consumer credit and the lack of lenders in our industry, partly as a result of an increase in government regulations, still affects our results by limiting many affordable manufactured housing buyers from purchasing homes. However, recent legislation may help improve this situation in the future.

We understand that maintaining our strong financial position is vital for future growth and success. Because of very challenging business conditions during economic recessions in our market area, management will continue to evaluate all expenses and react in a manner consistent with maintaining our strong financial position, while exploring opportunities to expand our distribution and manufacturing operations.

Our many years of experience in the Florida market, combined with home buyers’ increased need for more affordable housing, should serve the Company well in the coming years. Management remains convinced that our specific geographic market is one of the best long-term growth areas in the country.

On June 5, 2019 the Company will celebrate its 52nd anniversary in business specializing in the design and production of quality, affordable manufactured homes. With multiple retail sales centers, an insurance agency subsidiary, and an investment in a retirement manufactured home community, we are the only vertically integrated manufactured home company headquartered in Florida.

We gratefully acknowledge the wise counsel of the Board of Directors, officers and friends of the Company and express our appreciation to all employees for their dedication in continuing your Company’s profitable operating results. Our appreciation is also extended to our retail distribution network, customers and suppliers for their support and loyalty. We sincerely thank our stockholders for their continued investment confidence in Nobility and pledge our efforts to maintain and guard that trust. With this confidence and support, we enter fiscal year 2019 with full awareness of the challenging opportunities that lie ahead and with renewed enthusiasm and determination to achieve the goals for higher sales and operating results that have been set for your Company.

Manufactured Homes

Nobility’s homes are available in approximately 100 active models sold under the trade names “Kingswood,” “Richwood,” “Tropic Isle,” “Regency Manor,” and “Special Edition.” The homes, ranging in size from 431 to 2,650 square feet and containing from one to five bedrooms, are available in:

- Single-wide widths of 12, 14 and 16 feet ranging from 35 to 72 feet in length;

- Double-wide widths of 20, 24, 26, 28 and 32 feet ranging from 32 to 72 feet in length;

- Triple-wide widths of 42 feet ranging from 60 to 72 feet in length; and

- Quad-unit with 2 sections 28 feet wide by 48 feet long and 2 sections 28 feet wide by 52 feet long.

Our floor plans can be built as an on-frame modular home. We have been approved to build A.N.S.I. (American National Standards Institute) Park models less than 400 square feet and exposure D homes.

Nobility’s homes are sold primarily as unfurnished dwellings ready for permanent occupancy. Interiors are designed and color coordinated in a range of decors. Depending on the size of the unit and quality of appliances and other appointments, retail prices for Nobility’s homes typically range from approximately $30,000 to $130,000. Most of the prices of Nobility’s homes are considered by it to be within the low to medium price range of the industry.

Nobility’s manufacturing plant utilizes assembly line techniques in manufactured home production. The plant manufactures and assembles the floors, sidewalls, end walls, roofs and interior cabinets for their homes. Nobility purchases, from outside suppliers, various other components that are built into its homes including the axles, frames, tires, doors, windows, pre-finished sidings, plywood, ceiling panels, lumber, rafters, insulation, gypsum board, appliances, lighting and plumbing fixtures, carpeting and draperies. Nobility is not dependent upon any one particular supplier for its raw materials or component parts, and is not required to carry significant amounts of inventory to assure itself of a continuous allotment of goods from suppliers.

Nobility generally does not manufacture its homes to be held by it as inventory (except for model home inventory of its wholly-owned retail network subsidiary, Prestige Home Centers, Inc.), but, rather, manufactures its homes after receipt of orders. Although Nobility attempts to maintain a consistent level of production of homes throughout the fiscal year, seasonal fluctuations do occur, with sales of homes generally lower during the first fiscal quarter due to the holiday season.

The sales area for a manufactured home manufacturer is limited by substantial delivery costs of the finished product. Nobility’s homes are delivered by outside trucking companies. Nobility estimates that it can compete effectively within a range of approximately 350 miles from its manufacturing plant in Ocala, Florida. Substantially all of Nobility’s sales are made in Florida.

Retail Sales

Prestige Home Centers, Inc., our wholly-owned subsidiary, operates ten retail sales centers in north and central Florida. Its principal executive offices are located at Nobility’s headquarters in Ocala, Florida. Sales by Prestige accounted for 76% and 72% of Nobility’s sales during fiscal years 2018 and 2017, respectively.

Each of Prestige’s retail sales centers are located within 350 miles of Nobility’s Ocala manufacturing facility. Prestige owns the land at six of its retail sales centers and leases the remaining four retail sales centers from unaffiliated parties under leases with terms between one and three years with renewal options.

Prestige has executed a lease and is in the process of opening an eleventh retail sales center in north Florida.

The primary customers of Prestige are homebuyers who generally purchase manufactured homes to place on their own home sites. Prestige operates its retail sales centers with a model home concept. Each of the homes displayed at its retail sales centers is furnished and decorated as a model home. Although the model homes may be purchased from Prestige’s model home inventory, generally, customers order homes which are shipped directly from the factory to their home site. Prestige sales generally are to purchasers living within a radius of approximately 100 miles from the selling retail lot. The Company’s internet-based marketing program generates numerous leads which are directed to the Prestige retail sales centers to assist a potential buyer in purchasing a home.

The retail sale of manufactured homes is a highly competitive business. Because of the number of retail sales centers located throughout Nobility’s market area, potential customers typically can find several sales centers within a 100 mile radius of their present home. Prestige competes with over 100 other retailers in its primary market area, some of which may have greater financial resources than Prestige. In addition, manufactured homes offered by Prestige compete with site-built housing.

Prestige does not itself finance customers’ new home purchases. Financing for home purchases has historically been available from other independent sources that specialize in manufactured housing lending and banks that finance manufactured home purchases. Prestige and Nobility are not required to sign any recourse agreements with any of these retail financing sources.

Wholesale Sales to Manufactured Home Communities

Nobility also sells its homes on a wholesale basis through two full-time salespersons to approximately 35 manufactured home communities and independent dealers. Nobility continues to seek new opportunities in the areas in which it operates, as there is ongoing turnover in the manufactured home communities as they achieve full occupancy levels. As is common in the industry, most of Nobility’s independent dealers sell homes produced by several manufacturers. Sales to one publicly traded REIT (Real Estate Investment Trust) which owns multiple retirement communities in our market area accounted for $2,097,200 or 5% of our total sales in fiscal year 2018 and $1,602,185 or 4% of our total sales in fiscal year 2017. Other companies which own multiple retirement communities in our market area accounted for $1,195,155 or 3% of our total sales in fiscal year 2018 and $2,155,575 or 6% of our total sales in fiscal year 2017.

Nobility does not generally offer consigned inventory programs or other credit terms to its dealers and ordinarily receives payment for its homes within 15 to 30 days of delivery. However, Nobility may offer extended terms to park dealers who do a high volume of business with Nobility. In order to stimulate sales, Nobility sells homes for display to related manufactured home communities on extended terms and recognizes revenue when the homes are sold to the end users. The high visibility of Nobility’s homes in such communities generates additional sales of its homes through such dealers.

Competition

The manufactured home industry is highly competitive. The initial investment required for entry into the business of manufacturing homes is not unduly large. State bonding requirements for entry in the business vary from state to state. The bond requirement for Florida is $50,000. Nobility competes directly with other manufacturers, some of whom are both considerably larger and possess greater financial resources than Nobility. Nobility estimates that of the 18 manufacturers selling in the state, approximately 10 manufacture homes of the same type as Nobility and compete in the same market area. Nobility believes that it is generally competitive with most of those manufacturers in terms of price, service, warranties and product performance.

Employees

As of January 11, 2019, the Company had 149 full-time employees, including 36 employed by Prestige. Approximately 86 employees are factory personnel compared to approximately 85 in such positions a year ago and 63 are in management, administrative, supervisory, sales and clerical positions (including 33 management and sales personnel employed by Prestige) compared to approximately 62 a year ago. In addition, Nobility employs part-time employees when necessary.

Nobility makes contributions toward employees’ group health and life insurance. Nobility, which is not subject to any collective bargaining agreements, has not experienced any work stoppage or labor disputes and considers its relationship with employees to be generally satisfactory.

Item 3. Legal Proceedings

We are a party to various legal proceedings that arise in the ordinary course of our business. We are not currently involved in any litigation nor to our knowledge, is any litigation threatened against us, the outcome of which would, in our judgment based on information currently available to us, have a material adverse effect on our financial position or results of operations.

The Company does not maintain casualty insurance on some of its property, including the inventory at its retail centers, its plant machinery and plant equipment and is at risk for those types of losses.

Holders

At January 28, 2019, the approximate number of holders on record of common stock was 99 (not including individual participants in security position listings).

Nobility has a product line of approximately 100 active models. Although market demand can fluctuate on a fairly short-term basis, the manufacturing process is such that Nobility can alter its product mix relatively quickly in response to changes in the market. During fiscal years 2018 and 2017, Nobility continued to experience increased consumer demand for affordable manufactured homes in Florida. Our three, four and five bedroom manufactured homes are favored by families, compared with the one, two and threebedroom homes that typically appeal to the retirement buyers who reside in the manufactured housing communities.

In an effort to make manufactured homes more competitive with site-built housing, financing packages are available to provide (1) 30- year financing, (2) an interest rate reduction program, (3) combination land/manufactured home loans, and (4) a 5% down payment program for qualified buyers.

On June 5, 2019 the Company will celebrate its 52nd anniversary in business specializing in the design and production of quality, affordable manufactured homes. With multiple retail sales centers, an insurance agency subsidiary, and an investment in a retirement manufactured home community, we are the only vertically integrated manufactured home company headquartered in Florida.

Insurance agent commissions in fiscal year 2018 were $273,747 compared to $267,933 in fiscal year 2017. We have established appropriate reserves for policy cancellations based on numerous factors, including past transaction history with customers, historical experience and other information, which is periodically evaluated and adjusted as deemed necessary. In the opinion of management, no reserve was deemed necessary for policy cancellations at November 3, 2018 and November 4, 2017.

Gross profit as a percentage of net sales was 25% in fiscal year 2018 compared to 23% in fiscal year 2017. Our gross profit of $10,680,027 for 2018 increased 23% compared to $8,661,079 for 2017. The increase in gross profit percentage is primarily due to the increase in the average retail and wholesale selling price on each home sold.

The Company earned $100,137 from its joint venture, Majestic 21, in fiscal year 2018 compared to $103,533 in fiscal year 2017. The earnings from Majestic 21 represent the allocation of profit and losses which are owned 50% by 21st Mortgage Corporation and 50% by the Company.

The Company currently has no line of credit facility and does not believe that such a facility is currently necessary to its operations. The Company has no debt. The Company also has approximately $3.4 million of cash surrender value of life insurance which it may be able to access as an additional source of liquidity though the Company has not currently viewed this to be necessary. As of November 3, 2018, the Company continued to report a strong balance sheet which included total assets of approximately $57 million which was funded primarily by stockholders’ equity of approximately $49 million.

Looking ahead, the Company’s strong balance sheet and significant cash reserves accumulated in profitable years has allowed the Company to remain sufficiently liquid so as to allow continuation of operations and should enable the Company to take advantage of market opportunities when presented by an expected improvement in the overall and the industry specific economy in fiscal 2019 and beyond. Management believes it has sufficient levels of liquidity as of the date of the filing of this Form 10-K to allow the Company to operate into the foreseeable future.

Investments in Retirement Communities

The Company has a 31.3% investment interest in Walden Woods South LLC (“Walden Woods South”), which owns and operates a 236 residential lot manufactured home community named Walden Woods South located in Homosassa, Florida. The majority owner of Walden Woods South is the Company’s President (see note 4 to the financial statements included herein). The investment in Walden Woods South is accounted for under the equity method of accounting and all allocations of profit and loss are on pro-rata basis. Since the Company’s maximum exposure is limited to its investment in Walden Woods South, management has concluded that the Company would not absorb a majority of Walden Woods South’s expected losses nor receive a majority of Walden Woods South’s expected residual returns; therefore, the Company is not required to consolidate Walden Woods South with the accounts of Nobility Homes in accordance with the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) No. 810, “Consolidations” (ASC 810).

On March 31, 2016, the Company sold its 48.5% limited partnership interest in CRF III, Ltd. (“Cypress Creek”) for $3,990,000. Cypress Creek is a retirement manufactured home community located in Winter Haven, Florida. The Company received $960,000 cash, net of $40,000 cost paid and a note receivable for $3,030,000 that accrued interest at 3.0%. The Company received a $500,000 payment in June 2016, a $1,000,000 payment in January 2017 and a $1,651,924 payment in April 2018 which included all of the remaining principal and interest on the note.

###

Last year’s report is linked via the text-image box below. Their full 2018 report is found here as a download.

If not for purported market machinations of firms that are often owned by Berkshire Hathaway, the negative headlines sparked by ‘predatory’ firms that are often members of the Manufactured Housing Institute, or are tied to nonprofits that have had dark money funding from Warren Buffett, one could make the case that operations like Nobility’s would soar.

See the related reports for more industry-connected information.

This this Monday, Monday pre-dawn edition of “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

MHARR Calls on HUD Secretary to End Discriminatory And Exclusionary Zoning of HUD-Regulated Manufactured Homes | Manufactured Housing Association Regulatory Reform

Washington, D.C., April 30, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR) in an April 24, 2019 communication to U.S. Department of Housing and Urban Development (HUD) Secretary, Ben Carson (copy attached), has called on the Department to federally preempt local zoning ordinances which discriminatorily exclude manufactured homes regulated by HUD pursuant to the National Manufactured Housing Construction and Safety Standards Act of 1974 and the Manufactured Housing Improvement Act of 2000.

MHCC Addresses Multiple Issues, HUD Secretary Carson Praises Manufactured Homes at Meeting | Manufactured Housing Association Regulatory Reform

MHCC ADDRESSES MULTIPLE REGULATORY ISSUES MHCC CITES “MAJOR INACCURACIES” IN DOE-NODA SUBPART I TO BE REVIEWED AGAIN MHCC CALLS FOR WITHDRAWAL OF FROST FREE IB MHARR PROPOSAL ON MHCC ROLE ADVANCES PD&R REPORT OFFERS ON-SITE CHANGES HUD SECRETARY PRAISES MH IN ADDRESS TO MHCC The Manufactured Housing Consensus Committee (MHCC) held its most recent in-person meeting in Washington, D.C.

“Lead, Follow … Or Get Out of The Way” | Manufactured Housing Association Regulatory Reform

The last decade-plus has not been especially kind to the manufactured housing industry and consumers of affordable housing. The 21 stCentury began with a great deal of promise for the industry and consumers alike.

HUD Study, Analysis of Zoning Discrimination Against Manufactured Housing Sought | Manufactured Housing Association Regulatory Reform

MHARR SEEKS HUD STUDY AND ANALYSIS OF ZONING DISCRIMINATION AGAINST MANUFACTURED HOUSING Washington, D.C., April 8, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR), in an April 4, 2019 meeting with HUD policy, analysis and research officials, called on the Department to conduct nationwide research – and follow-up analysis – concerning local zoning mandates that discriminatorily exclude or drastically restrict the placement of federally-regulated manufactured homes to the detriment of lower and moderate-income American families in large areas of the country.