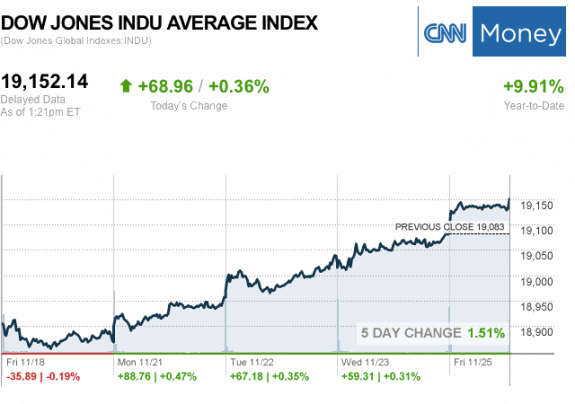

Noteworthy headlines on CNNMoney – Record-setting finish to holiday-shortened trading week. Dow, S&P 500 and Nasdaq at all-time highs. Trump store launches Black Friday sale. Wells Fargo tries to kill fake account lawsuit. Lufthansa forced to cancel 2,755 flights.

Some bullets from MarketWatch – Biogen in promising but risky limelight after Eli Lilly’s Alzheimer’s drug fails. U.S. online sales tally more than $1 billion on Thanksgiving Day. Dollar rally takes a breather as investors cash in on gains. Measure of U.S. service-sector growth is second highest in last 12 months.

Oil down 3.11%. Gold down 0.92.

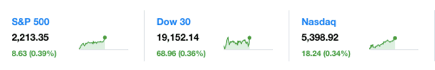

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2,213.35 8.63 (0.39%)

Dow JIA 19,152.14 68.96 (0.36%).

Nasdaq 5,398.92 18.24 (0.34%).

The major U.S. stock indexes have been setting records, based on optimism that President-elect Donald Trump’s proposed policies would stimulate economic growth.

Post-election consumer sentiment is also surging, per the still above from the video below.

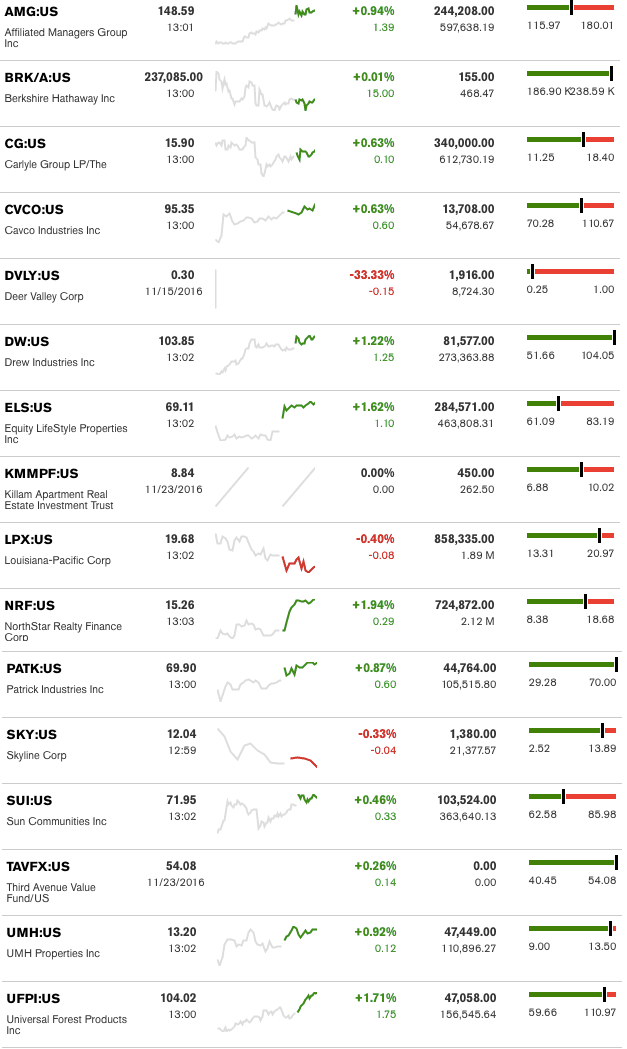

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were NorthStar Realty Finance Corp. (NRF) and Universal Forest Products Inc. (UFPI). The top two sliders for the day were Louisiana-Pacific Corp. (LPX) and Skyline Corp. (SKY). Deer Valley and Killam held steady today, as the stocks are only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

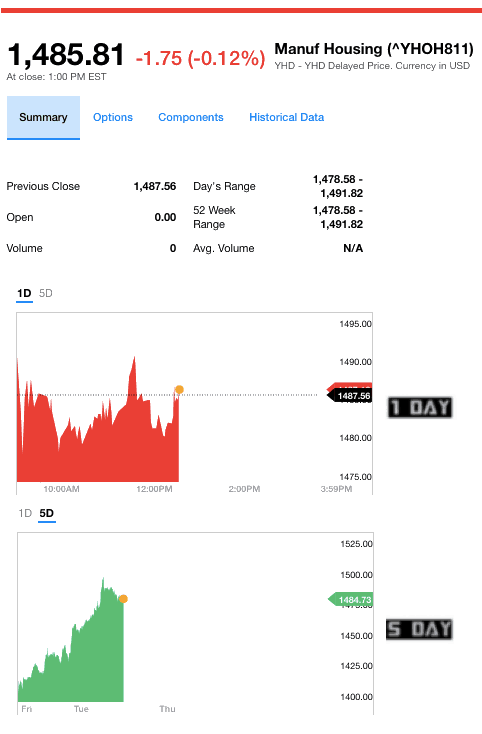

Manufactured Housing Composite Value Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.