Congressional Republicans are seeking to soften parts of the Dodd-Frank Act that was enacted five years ago, and as MHProNews knows, inadvertently erected barriers that hinder the buying and selling of manufactured homes. The spending bill must pass by Dec. 11 to avert a government shutdown.

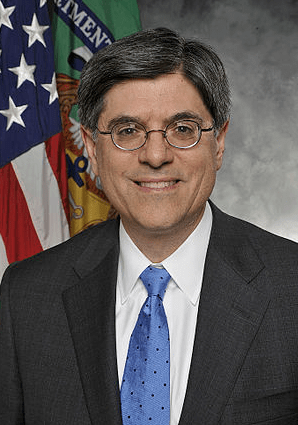

Reaffirming the administration’s objections to any meaningful alterations of Dodd-Frank, Jacob J. Lew, secretary of the Treasury, said in an email, “I have publicly made clear that my recommendation to the president would be that if there are legislative measures that will roll back the clock, that would take us back toward where we were before the financial crisis, I would recommend a veto.”

Some members of Congress believe the administration will allow more wiggle room on financial regulation than on, say, its signature health care overhaul. In any case, if only a few concessions are gained, a path will have been set for more changes to Dodd-Frank next year.

Lew adds it is unacceptable to amend Dodd-Frank at the last minute on a must-pass bill, but the door is “open to conversations about technical changes or improvements in Dodd-Frank, but frankly, there are a lot of things masquerading as technical changes that are not.”

In response, Jennifer Hing of the House Appropriations Committee that is helping to assemble the bill, said in an email, “The committee does not comment or speculate on funding levels or policy items that may or may not be included in future legislation.”

In the run-up to the financial crisis, regulators had failed to properly ascertain the weaknesses of financial firms and pinpoint where large losses might occur. Dodd-Frank said banks worth $50 billion or more were required to withstand stress tests to make sure they could withstand another downturn.

Sen. Richard Shelby (R- Ala.) proposed legislation that raises the threshold to $500 billion, which would exclude many smaller banks, but leave the door open to selectively examining some smaller banks as needed. But Jeff Sigmund, a spokesman for the American Bankers Association, said, “There is wide bipartisan agreement that some elements of Dodd-Frank warrant a second look. Regulation based solely — and arbitrarily — on asset size ignores careful risk management by banks, creating unnecessary costs and reducing services available to bank customers.”

But critics of Sen. Shelby emphasized that banks smaller than $500 billion can still create havoc for the system as a whole, noting that Countryside Financial had assets of $200 billion. Daniel K. Tarullo, a governor of the Federal Reserve, says he would consider supporting raising the threshold to $100 billion.

Some congressional members want to alter the Financial Stability Oversight Council, a new regulatory body that would look for red flags indicating dangerous risks that may be accumulating in the system, saying the council lacks transparency and accountability.

Writing in rollcall, as MHProNews posted Aug. 19, 2015, Manufactured Housing Institute’s (MHI) Senior Vice President for Government Affairs Dr. Lesli Gooch said, “The Dodd-Frank Act is preventing everyday Americans from accessing the financing they need to purchase quality manufactured homes they can afford in the communities where they live and work. This is occurring because many lenders had to stop making manufactured home loans when the Dodd-Frank Act classified the loans as ‘high-cost.’ Ironically, the loans receive this negative classification because they are small loans, reflecting the fact that manufactured homes are less expensive and more affordable.”

AS MHProNews posted Nov. 26, 2015, Dr. Gooch said,“The language (of S. 682) could catch a ride on the must-pass omnibus Appropriations package as a policy rider because the bill was included in the Senate’s Financial Services and General Government Appropriations bill (section 909 of S. 1910) in July.”

“In the midst of a national affordable housing crisis, it is unconscionable that federal rules are limiting access to credit for affordable, quality housing,” says Dr. Gooch, in the Aug. 19 post.

MHProNews will have a featured article on this topic in the December issue, scheduled to go live on the home page late Tuesday or Wednesday morning. A recently produced article and video interview on MHLivingNews.com – and picked up by mainstream media websites and advocacy websites – about this topic are linked here. ##

(Photo credit: wikipediacommons-Jacob Lew, Secretary of the U. S. Treasury)