If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

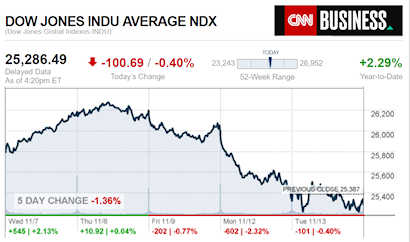

- The Dow falls another 100 points

- Citi to move 1,100 New York employees next year to make room for Amazon

- Next up: Tesla vs the world

- CNN sues President Trump and top White House aides for barring Jim Acosta

- LIVE UPDATES Before filing lawsuit, CNN first reached out to John Kelly

- WeWork is getting $3 billion more from Softbank

- Don’t panic about iPhone sales just yet

- What housing slowdown? Home Depot posts strong sales

- GE to raise $4 billion by selling chunk of Baker Hughes

- How diverse should diversity be?

- Flipkart CEO resigns after misconduct investigation

- Japan’s economy has a $5 trillion problem

- Why a US hedge fund is taking on one of Europe’s media giants

- The US and China have reportedly restarted trade talks

- E-Commerce Guide by CNN Underscore

- Amazon’s Pre-Black Friday Sale starts now

- Amazon’s next challenge

- The tech behemoth will need to find 25,000 workers for its Crystal City HQ

- Splitting up: NYC and Virginia both chosen as Amazon’s second HQ

- First person: What one Long Island City resident says Amazon should know

- What about the losers? These cities didn’t land HQ2. Why they still won

- A new name: Virginia welcomes Amazon by rebranding Crystal City

- Shockwaves: Amazon HQ2 rattles New York and DC real estate markets

- Burger King wants to move into the future, but it’s stuck in the past

- Chick-fil-A is trying to get into your home

- McDonald’s has a new breakfast sandwich

- Panera wants you to know exactly what’s in your bread

- Dunkin’ is serious about high-end espresso

- Fixing GE ‘is the challenge of a lifetime,’ CEO says

- GE changed our lives. Why is it struggling?

- Its stock could plunge to $6, JPMorgan warns

- The company’s debt headaches grow

- GE slashes 119-year old dividend to a penny

Select Bullets from Fox Business…

- Juul stops sale of flavored e-cigarettes in stores, halts social media presence

- New York, Virginia gave Amazon these incentives for its new headquarters

- Amazon officially selects Queens and Northern Virginia for HQ2

- Stocks mixed in volatile session, oil craters

- Inside Amazon’s HQ2 decision

- Amazon HQ2 turned down these enticing offers

- Amazon ‘duped’ New York into ‘bad deal’ for HQ2: Politicians

- Amazon picked its HQ2 locations but what about the 18 other finalists?

- Paul Krugman’s unwitting case for the electoral college

- This is not your father’s Republican Party: Varney

- America is winning the energy game: Varney

- El Chapo heads to court, his cartel is thriving without him

- Oil on track for longest losing streak on record

- Americans’ dream job would pay this much

- GE turns to Wall Street to reorganize as Blackstone eyes assets

- Boeing CEO: 737 MAX jets are safe

- Permanent tax cuts for middle class becoming more doubtful

- CNN has a good case against White House over Acosta’s revoked press pass: Judge Napolitano

- Amazon HQ2 decision: Why residents may face challenges

- Uber redefines sexual misconduct in public memo

- Obama memoir ‘Becoming’ released as part of $60M book deal

- Democrat turns to Civil War-era scheme to build up tech jobs for middle-Americans

- US debt payments will soon exceed military spending

- Lazy Americans weigh on health care system costing hundreds of billions

- Starbucks to cut 5% of workforce in restructuring effort

- Petco removes pet food with artificial ingredients

- Boeing CEO sees US defense budget remaining strong

- Gov: Amazon ‘largest jobs commitment’ in Tennessee history

- CNN sues Trump, demanding return of Acosta to White House

- Amazon goes bicoastal: will open HQs in New York, DC suburb

- Here’s how big Wall Street’s bonuses will be in 2018

- This is why the DOJ could probe Comcast

- Here’s how most Americans raise the value of their homes

Today’s markets and stocks, at the closing bell…

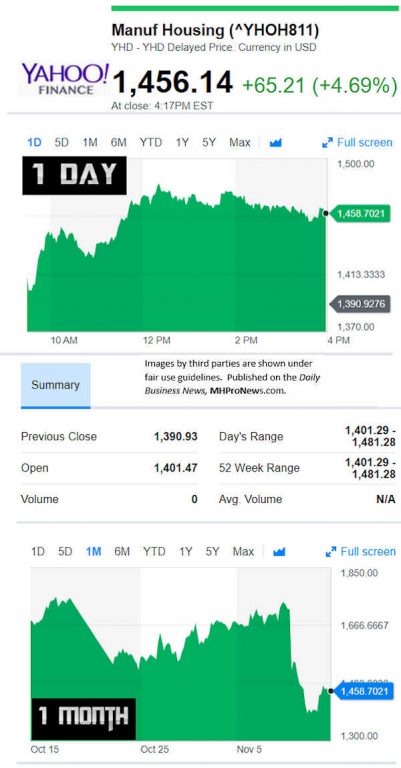

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

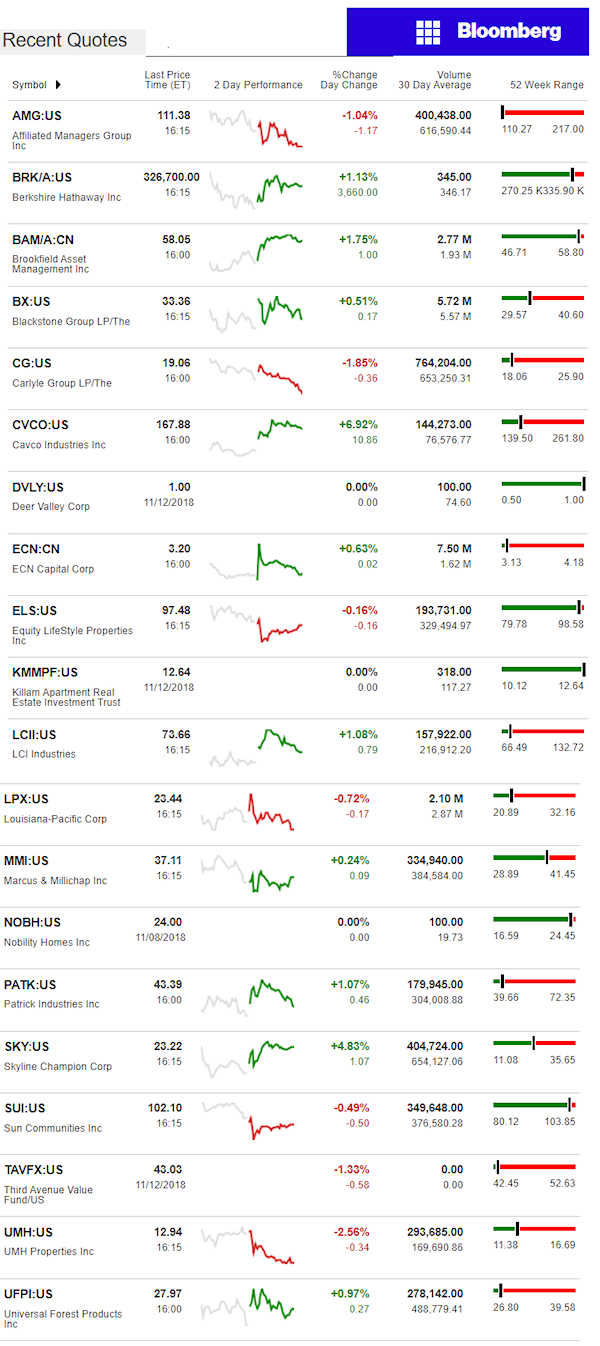

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Stuart Varney on Fox Business touts the fracking revolution as a key reason why fuel prices are dropping.

“No less an authority than the International Energy Agency [IEA] says half the growth in oil and gas output will be coming from America by 2025,” says Fox Business. “A few short years ago, our production was falling and imports are rising. Now we’re pumping 11.6 million barrels of oil a day, and Interior Secretary Ryan Zinke, on this program, forecast 14 million barrels a day very soon.”

CNBC looks at a broader, more global view of the oil market as well today, with three experts sounding off on what is happening, and what the outlook could be.

Iran is a question mark right now, not unlike how Venezuela was previously. There is discussion that the Trump Administration could start squeezing Iran’s oil production via sanctions, and if so and successful, that could cause Iran’s production – per sources – to go as low as “zero,” says CNBC.

That frankly, seems unlikely today, but that’s part of the scuttle butt.

Oil is an important, but not the only component in U.S. energy production. The Trump Administration has reversed several policies put in place under President Obama. As a result, the coal industry has come roaring back. There’s not been much buzz about nuclear – yet – under the Trump administration, but there has been a broad discussion of an “all of the above” plan to encourage all sorts of energy.

The economic math is simple. The lower energy costs are, the more money there is available for other things. The cost of production in manufactured housing, or all other factory production, is reduced with lower energy costs. The cost of living obviously goes down with lower energy costs too.

All of this is economics 101. But regrettably, there is a generation or two that has not had the law of supply and demand properly explained to them. Some of those young “democratic socialists” are now entering the House of Representatives. How will they impact the national debate on energy? What will it do to the U.S. economy that has enjoyed steady, even strong growth in the first 21 months of the Trump Administration?

Time will tell. But if you didn’t notice, presumptive House Speaker Nancy Pelosi met with returning Democratic mega-backer Michael Bloomberg. Bloomberg is said to have given $110 million to Democrats in the 2018 cycle. He’s exploring a run for the White House in 2020.

The campaign for control of Washington, D.C. never stops. It only hits pause while votes are being counted.

Energy needs never stop either. But if the winds in Washington blow too far left, it won’t be a surprise if energy costs rise again, as they did under the 8 years of the Obama Administration. That’s where political policy and economics meet.

The economic giants in the U.S. never stop their lobbying and political efforts. That’s why engagement by small to midsized businesses must not end for 21 months out of 24. Otherwise, you’re handing an advantage to those who want to grow their moats at your expense.

Related Reports:

Tariffs, Tech, Fed, Oil, Commodities and Today’s Tumble, Plus MH Equities Updates

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.