The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Harvey Weinstein accusers now more than 40

- Cities make last-ditch effort for Amazon headquarters

- Ethics case against Trump awaits green light from judge

- NFL: Players not trying to be ‘disrespectful’ to flag’ Trending

- Gretchen Carlson: ‘The floodgates have opened’

- 5 ways to improve your credit — fast

- Inequality among America’s seniors is getting worse

- World’s biggest tech fund isn’t investing at home

- Trump’s perfect pick for Fed chair: Janet Yellen

- Mnuchin to Congress: Cut taxes or market will dive

- Trump’s tweets lead to bad news coverage: Pew

Selected headlines and bullets from Fox Business:

- Dow closes above 23,000 as IBM surges

- Stock market crash inevitable, financial historian says

- U.S. economy hums along, still few signs of pickup in inflation

- Dow stays above 23,000-mark on IBM surge

- Oil slips from earlier gains as US gasoline, diesel stocks rise

- Trump slams new bipartisan health care deal: What’s in it?

- George Soros bet against S&P 500, Nasdaq, now stocks hitting records

- NFL ratings declines could impact CBS profits, Wall Street analyst says

- Obama’s EPA derailed Alaskan mine for years: Pebble Partnership CEO

- How Delta, Bombardier could circumvent the 300% US tariff on C Series jets

- Judge Napolitano: New evidence will lead DOJ to Hillary Clinton indictment

- Richard Branson says he was the target of a $5 million scam

- IRS refuses to return $59,000 to vet after seizing his business cash

- Virgin Hyperloop One expected to break ground this year, co-founder says

- Americans will earn $4,000 more annually with 20% corporate tax rate, Trump economic advisor says

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

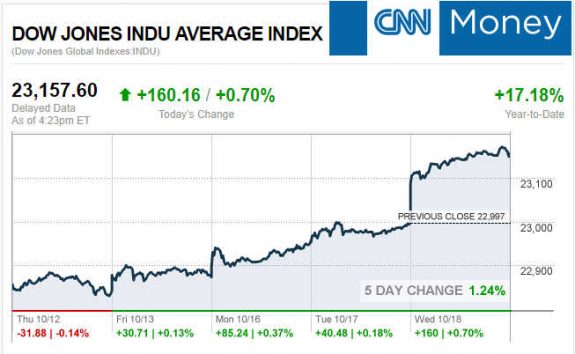

Today’s markets and stocks, at the closing bell…

S&P 500 2,561.26 +1.90(+0.07%)

Dow 30 23,157.60 +160.16(+0.70%)

Nasdaq 6,624.22 +0.56(+0.01%)

Crude Oil 52.01 +0.13(+0.25%)

Gold 1,282.70 -3.50(-0.27%)

Silver 17.02 -0.02(-0.12%)

EUR/USD 1.1793 +0.0027(+0.23%)

10-Yr Bond 2.34 +0.04(+1.78%)

Russell 2000 1,505.14 +7.65(+0.51%)

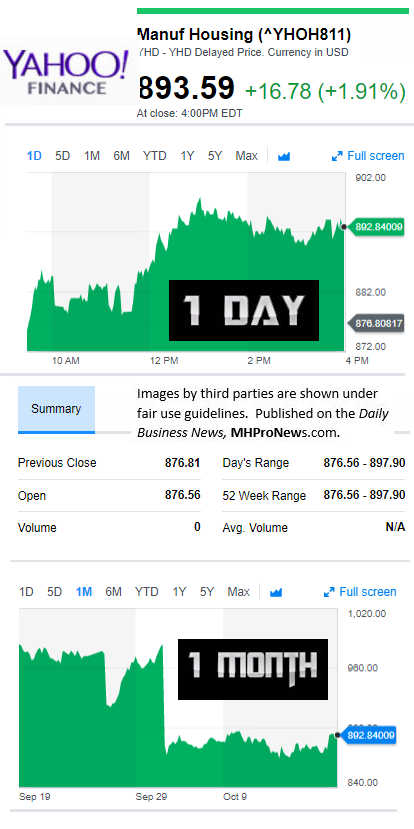

Manufactured Housing Composite Value

Today’s Big Movers

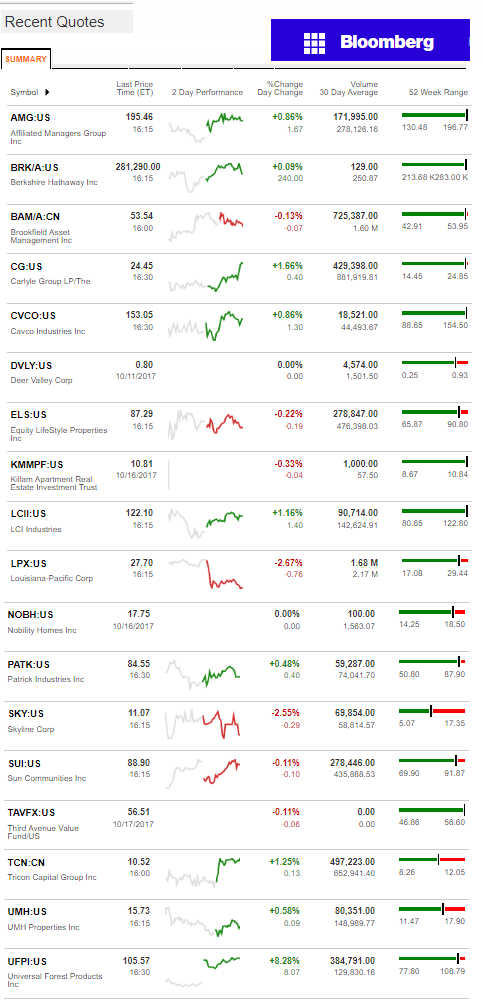

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Hans Olsen, Stifel on Economy, Markets. 18 to 24 months, POTUS’ Heritage Remarks, Videos

The never Trump voices in the media, and those who are afraid to give the president and his policies credit for the record growth, business and consumer confidence, have a problem.

It’s the numbers.

The economy is moving in a healthy direction. So says Stifel’s Hans Olsen, who gives his 18 to 24 month market projections and insights.

Here on the Daily Business News market report our take is nuanced. Growth is a natural result of the right policies, and other conditions. If meaningful tax reform gets passed, the market recovery can be sustained, or may accelerate. Without that, even voices in the Trump Administration admit the markets could turn if the anti-tax reform segments win the battle now underway.

The following from CNBC.

Investment flows show that investors typically get it wrong when they try to predict which direction the market will head, said Cory Clark, director at Dalbar, a Boston-based market research firm.

In 2016, investors guessed wrong about the market’s direction — such as by selling shares, in aggregate, right before a winning month — in seven months out of the year, according to Dalbar. Over the past 20 years through 2016, after accounting for poor timing of fund flows, the average equity investor has earned 4.79 percent annualized, or almost 3 percentage points fewer than the Standard & Poor’s 500 index each year, on average, according to Dalbar.

“A year ago there was a lot of uncertainty and fear, and concerns over a potential market top,” Clark said. “And we just saw the markets keep on keeping on.”

Investors who sell now risk missing a “melt-up,” such as if stocks quickly notch additional double-digit gains, said Thomas Yorke, managing director of Oceanic Capital Management in Red Bank, New Jersey.

If the market does top out soon, investors who sell run the risk of not getting back into stocks at the right time.

“Most investors do very poorly when selling in anticipation of a correction,” said Bishop. “It never feels ‘right’ to buy back in.”

One of Bishop’s clients went to cash in the summer of 2008 — successfully dodging the market collapse that followed Lehman Brothers’ bankruptcy — but still hasn’t gotten back into the market, he said.

Investors generally experience their worst underperformance, compared with the market, during times of market turmoil for just that reason, Clark said. They pull their money out of stocks and fail to get back in as the market recovers.

Even missing out on a few days of market gains can have devastating effects on an investor’s long-term performance.”

Heritage Foundation Remarks by President Trump on Economy, Tax Reform

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)