If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

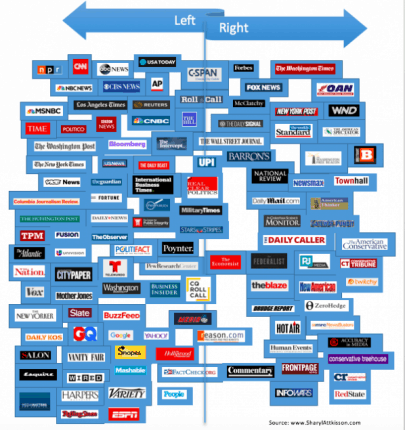

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- FROM RIYADH Saudi Arabia signs $50 billion worth of business deals at ‘Davos in the desert’

- SoftBank’s Masayoshi Son is a no-show at Saudi conference

- Who’s at the summit and who’s staying away

- Aurora Cannabis shares tank in NYSE debut

- iPhone XR review: Apple’s secret weapon

- A new app can help you stop buying bottled water

- This colorless, odorless powder could help solve the global food waste problem

- PERSPECTIVES Sears stood still during the retail revolution. Here’s what other brands can do differently

- McDonald’s hopes new breakfast food will draw more customers

- Walmart and Target try to sell better cheap wine

- Seattle is a guinea pig for $15 minimum wage. Here’s what the latest research shows

- Megyn Kelly takes heat for defending blackface Halloween costumes

- NEW YORK, NY – OCTOBER 15: Traders work on the floor of the New York Stock Exchange (NYSE) on October 15, 2018 in New York City. Following a week of steep losses and modest gains, the Dow Jones Industrial Average was down only slightly in morning trading. (Photo by Spencer Platt/Getty Images)

- Stocks rally after a 500-point plunge

- Warning: 14 of 19 bear market signals triggered, Bank of America says

- Caterpillar, 3M sink on weak outlooks

- Tesla’s stock soars after notorious short seller changes his tune

- Ford will test self-driving cars in Washington DC

- Dyson will build its electric cars in Singapore

- BMW’s vision for a self-driving electric car

- Honda teams up with GM on self-driving cars

- SoftBank and Toyota want driverless cars to change the world

Select Bullets from Fox Business…

- Stocks pare losses after profit outlooks rattled Wall Street

- What to watch for in Tesla’s earnings report

- Democrats, not stock volatility, biggest risk to economic recovery: Larry Kudlow

- Caterpillar’s forecast disappoints, shares tumble

- Left-leaning billionaires Soros, Bloomberg, Steyer trying to ‘buy’ Congress: Kevin McCarthy

- Amazon’s new headquarters will be in one of these cities

- Apple subscription TV platform to receive global launch: Report

- Trump says ‘major tax cut’ on the way for middle class

- Court affirms Roundup verdict against Monsanto, cuts damage award

- Kennedy: The reasons why the caravans keep coming

- Lottery jackpot winners face big IRS tab

- The lottery’s hidden secret: Billions in unclaimed prizes

- Lottery luck? The most and least drawn numbers

- America’s ‘good’ jobs going to these workers

- Harley-Davidson sees tough road ahead as US sales sputter

- China’s WTO membership cost US 3.4 million jobs

- 10 mistakes that can sabotage your retirement savings

- Social Security falling short? Top tips to maximize benefits

- How to tell if your company retirement plan is a good one

- Ford Ranger production returns to US at Michigan factory

- Have a sweet tooth? This mint can curb your cravings for sugar

- Barcade: A modern twist on a classic arcade

- After Trump push, Germany to invest in US gas imports

- Amy Schumer takes aim at NFL advertisers, won’t appear in Super Bowl ads

- Social Security falling short? Top ways to supplement retirement income

- Major Facebook shareholders want Mark Zuckerberg out as chairman

- Toys ‘R’ Us bankruptcy hits Hasbro

- Amazon pitched ICE on facial recognition technology: Report

- Invest like a millionaire: Top strategies and concerns of the wealthy

- Nearly 50% of women stress out about repeating outfits at work

Today’s markets and stocks, at the closing bell…

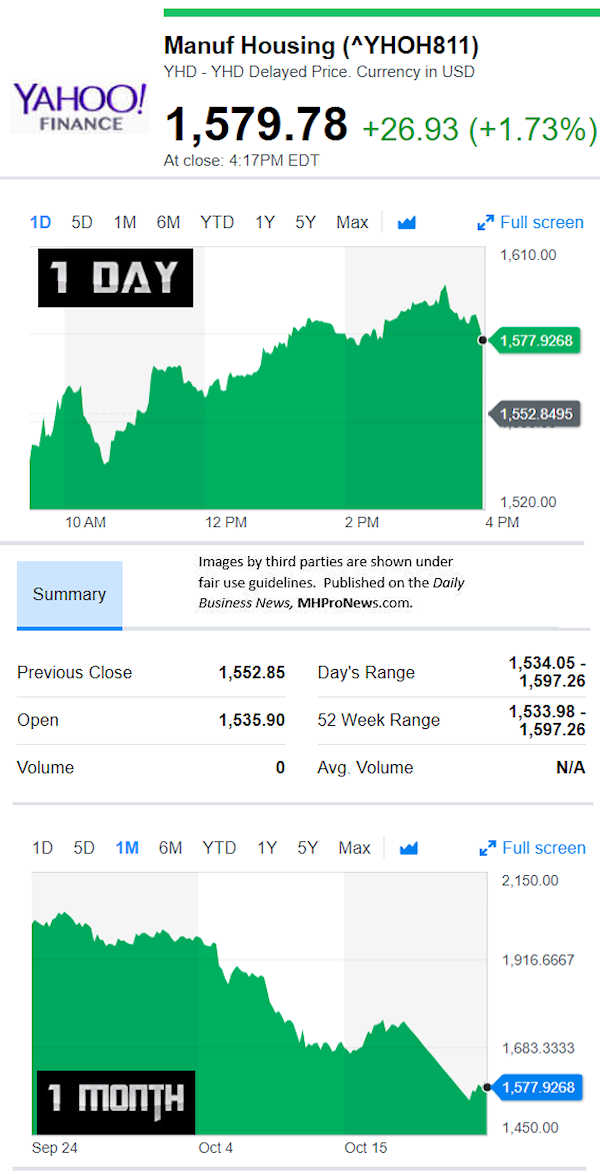

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

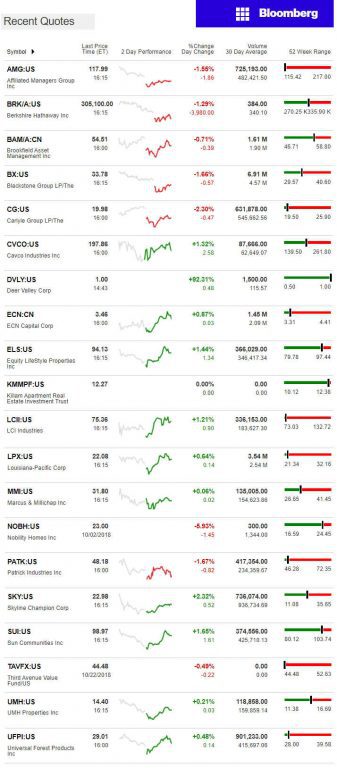

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

“I count 62 panic attacks” in this bull market, say Ed Yardeni, in the video below. He thinks today’s roller coaster ride was just another panic attack.

There is a level of political and media driven ‘fear,’ or uncertainty. If the GOP holds the House and expands in the Senate, there are some smart analysts that think the markets will soar anew.

There are mixed signals. Which ought to make those on both sides of the political aisle want to turn out for the midterm voting.

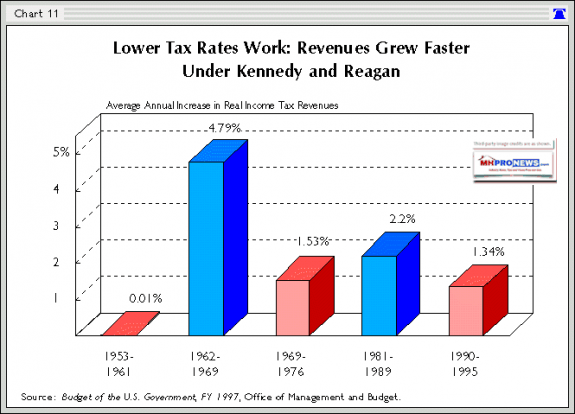

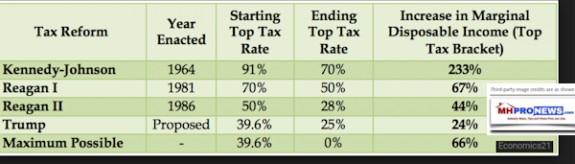

But we’re history-minded. The Kennedy and the Reagan tax cuts – one a Democrat, the other, a Republican president and administration – both resulted in strong, sustained growth. Federal revenues eventually grew.

That’s already happening with the Trump tax cut, which is less than a year old. Those who claim that the ‘sugar high’ is over don’t know, or are ignoring, history.

On the hard numbers, hear is what left-of-center CNBC said.

- “Stocks fell on Tuesday as corporate results from Caterpillar and 3M disappointed investors, but the market managed to recover most of its losses later in the session as investors rotated into McDonald’s and defensive stocks like Procter & Gamble.”

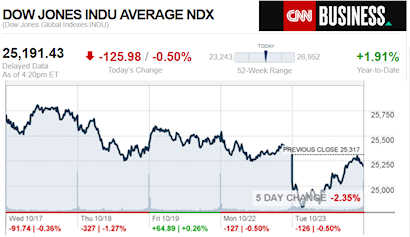

- “The Dow Jones Industrial Average closed 125.98 points lower at 25,191.43 while the S&P 500 fell 0.55 percent to 2,740.69. The Nasdaq Composite, meanwhile, closed 0.4 percent lower at 7,437.54. The small-caps Russell 2000 dropped 0.8 percent and turned negative for the year.”

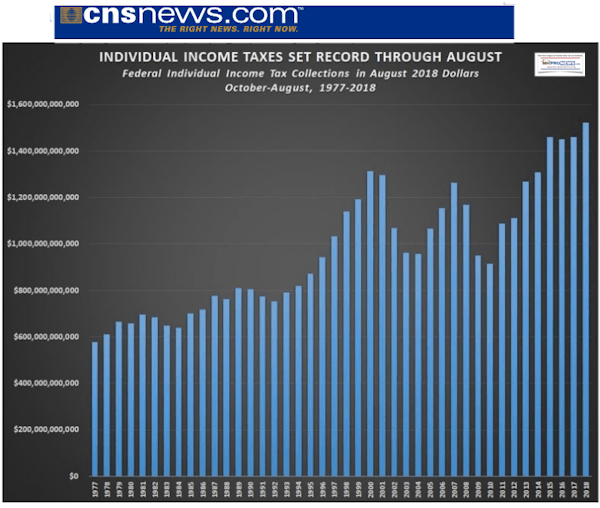

Tax revenues are already at a historic high, after a tax cut.

The president has announced that having dealt with the many needs of defense, he is now ready to deal with deficits.

Foreign investments are pouring into the U.S.

The nation is once more the leading global economy.

By the way, when you look at the graphic below, you realize that stocks were essentially flat during the tail end of the Obama era, and they have taken off since the election of President Trump. The claim by the 44th president that he is responsible for this economy are the cause for chuckles among those who know better.

Experts and others are looking to the midterms. If the GOP holds the House, and expands in the Senate, it could be a strong signal that the markets will continue their historic ride. We think that is possible, but it all comes down to turnout.

See last night’s research, among the related reports, further below.

Related Reports:

Goldman Memo on Midterms: How Will Voting Outcomes Affect Stocks? Plus, MH Market Updates

Cruz Lights Up Houston Trump Rally, in Key Race in Manufactured Housing Leading State of Texas

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.