While the Manufactured Housing Institute (MHI) recently touted HUD’s publication of “Evidence Matters,” as if it was some breakthrough for the long underperforming-industry, prominent member Equity LifeStyle Properties (ELS) was warning investors about the “impact of government intervention to stabilize site-built single-family housing and not manufactured housing.”

Additionally, in a formal 8K federal filing to the Securities and Exchange Commission (SEC), publicly-traded ELS sounded another cautionary note, saying “results from home sales and occupancy will continue to be impacted by local economic conditions, lack of affordable manufactured home financing and competition from alternative housing options including site-built single-family housing…”

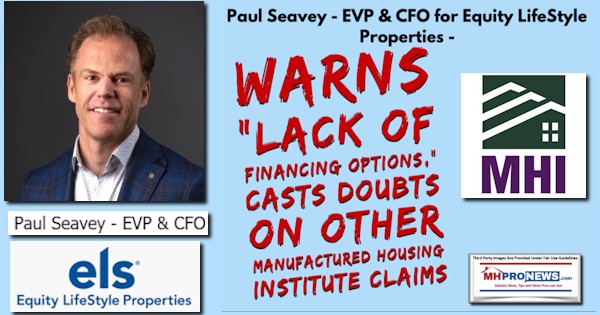

“In addition, these forward-looking statements are subject to risks related to the COVID-19 pandemic, many of which are unknown, including the duration of the pandemic, the extent of the adverse health impact on the general population and on our residents, customers, and employees in particular, its impact on the employment rate and the economy, the extent and impact of governmental responses, and the impact of operational changes we may implement in response to the pandemic,” said the ELS federal filing dated June 12,2020, which was signed by Paul Seavey, Executive Vice President and Chief Financial Officer for Equity LifeStyle Properties, Inc. (ELS).

In formal corporate statements published on Seeking Alpha, ELS also provided these updates for their investors. The below was dated June 12, 2020.

- Equity Lifestyle Properties (NYSE:ELS) declares $0.3425/share quarterly dividend, in line with previous.

- Forward yield 2.22%

- Payable July 10; for shareholders of record June 26; ex-div June 25.

Returning to the ELS 8K filing are these pull quotes, noting that they also included the typical corporate disclosures required by the SEC. Highlighting is added by MHProNews.

The Company also announced an operational update for May and June 2020, which included extending its rent deferral program, and continuing to suspend eviction proceedings, defer MH rent increase notices, waive fees for late rent payment and RV reservation cancellations and allow extended stays for Thousand Trails members. All northern RV properties with delayed openings and all marina properties are now open.

…

These forward-looking statements are subject to numerous assumptions, risks and uncertainties, including, but not limited to:

- our ability to control costs and real estate market conditions, our ability to retain customers, the actual use of sites by customers and our success in acquiring new customers at our properties (including those that we may acquire);

- our ability to maintain historical or increase future rental rates and occupancy with respect to properties currently owned or that we may acquire;

- our ability to attract and retain customers entering, renewing and upgrading membership subscriptions;

- our assumptions about rental and home sales markets;

- our ability to manage counterparty risk;

- our ability to renew our insurance policies at existing rates and on consistent terms;

- in the age-qualified properties, home sales results could be impacted by the ability of potential home buyers to sell their existing residences as well as by financial, credit and capital markets volatility;

- results from home sales and occupancy will continue to be impacted by local economic conditions, lack of affordable manufactured home financing and competition from alternative housing options including site-built single-family housing;

- rimpact of government intervention to stabilize site-built single-family housing and not manufactured housing;

- effective integration of recent acquisitions and our estimates regarding the future performance of recent acquisitions;

- the completion of future transactions in their entirety, if any, and timing and effective integration with respect thereto;

- unanticipated costs or unforeseen liabilities associated with recent acquisitions;

- ability to obtain financing or refinance existing debt on favorable terms or at all;

- the effect of interest rates;

- the effect from any breach of our, or any of our vendors’, data management systems;

- the dilutive effects of issuing additional securities;

- the outcome of pending or future lawsuits or actions brought against us, including those disclosed in our filings with the Securities and Exchange Commission; and

- other risks indicated from time to time in our filings with the Securities and Exchange Commission.

In addition, these forward-looking statements are subject to risks related to the COVID-19 pandemic, many of which are unknown, including the duration of the pandemic, the extent of the adverse health impact on the general population and on our residents, customers, and employees in particular, its impact on the employment rate and the economy, the extent and impact of governmental responses, and the impact of operational changes we may implement in response to the pandemic…”

###

MHProNews Analysis and Commentary

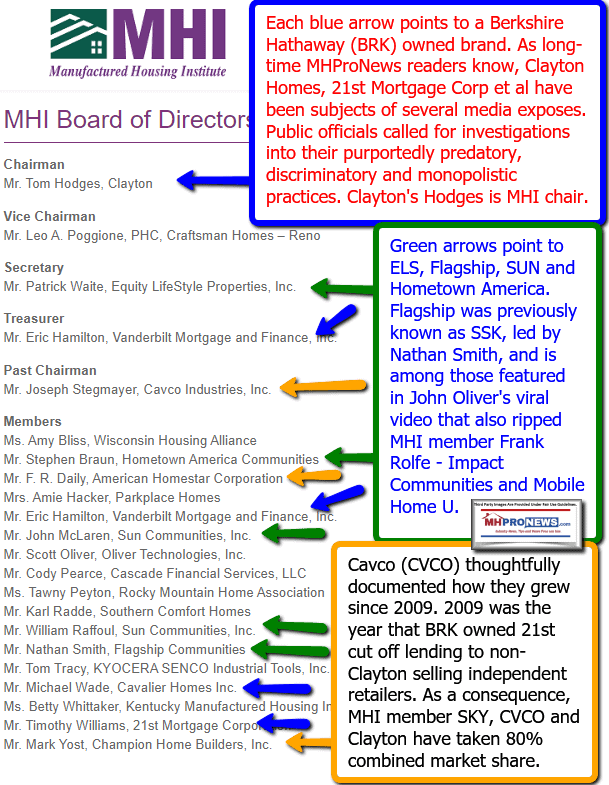

ELS has a seat on the Manufactured Housing Institute (MHI) board of directors held by Patrick Waite. That seat on MHI’s so-called “executive committee” was previously held for years by the late Howard Walker, J.D.

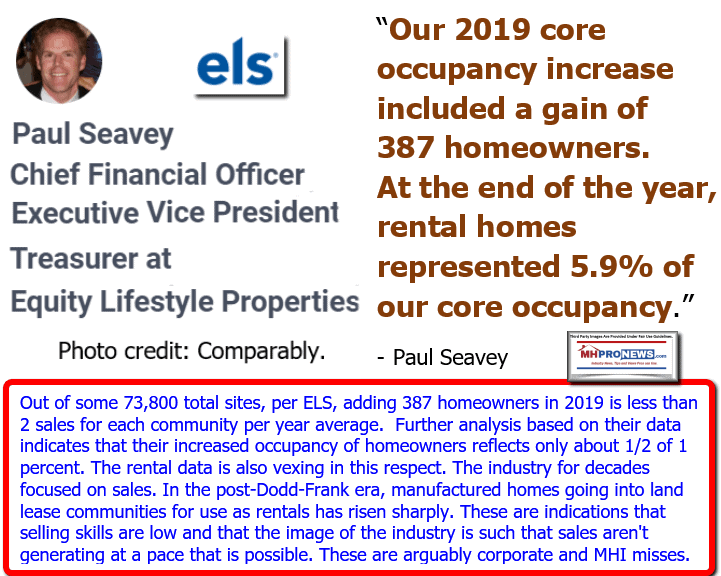

ELS is one of the largest land-lease community operators in the manufactured home industry.

Sam Zell, their chairman and founder, is a billionaire with ready access to mainstream media. When Zell speaks, numerous investors and public officials listen.

So, when ELS notes as a limiting factor for business “lack of affordable manufactured home financing and competition from alternative housing options including site-built single-family housing…” those ought to be a cause for close scrutiny. After all, aren’t they clearly in a position to influence MHI and their lobbying?

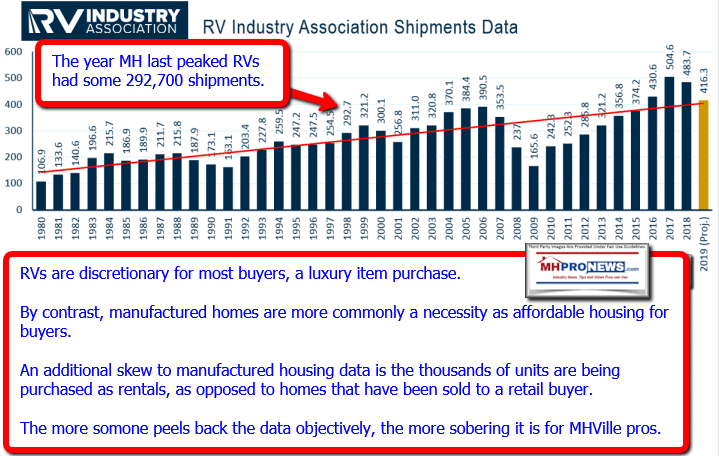

Manufactured housing has the potential benefit of favorable federal legislation. As MHProNews and others in the industry, including the production-focused Washington, D.C. based Manufactured Housing Association for Regulatory Reform (MHARR) have noted, the Duty to Serve (DTS) manufactured housing, rural and underserved markets was made federal law in 2008 as part of the Housing and Economic Recovery Act (HERA). Which begs the question, why isn’t that law and others like it specifically designed to support manufactured home lending being fully and properly implemented?

That topic was posed to Danny Ghorbani, a former MHI vice president and the founding president of what today is MHARR. Ghorbani, an engineer by training, developed thousands of manufactured home sites during his career. Like some other professions, engineers have to be meticulous and precise in their thinking. Ghorbani and the trade group he previously led before turning over the reigns to Mark Weiss, J.D., was keenly involved in the passage of the DTS law.

The ELS statements signed by EVP Seavey contain several statements that either confirm prior reports by MHProNews and/or undermine certain posturing and claims made by MHI and some key member companies. It defies reason and logic for MHI – which claims that they represent “all segments of manufactured housing” or “all segments of factory-built housing” routinely fails to take the most direct path to industry growth. Namely, to press along side MHARR and others for the full and proper implementation of existing federal laws.

Given ELS role on the MHI board, that should logically call into question their arguable failure to properly serve their shareholders interests. They clearly know about DTS, yet they say that there is a lack of financing which limits themselves and the industry?

Such disconnects were underscored in other official statements by another top MHI member, Skyline Champion (SKY). See that new report below.

The last two for today are the potentially related issues of market manipulation in a fashion that may violate antitrust and other federal or state laws.

Cavco Industries “Killer Acquisition,” CVCO’s New Controversy Tests Antitrust Resolve

It must be noted that these efforts routinely involve larger MHI member companies.

As Congress, the Department of Justice (DOJ), the Federal Trade Commission (FTC) and others push on antitrust, as are certain states, and affordable housing remains a key topic nationally, these warning flags only underscore the necessity of formally investigating MHI and several of their top member firms.

Programming note. MHProNews is in the process of revamping our industry-leading x2 weekly emailed headline news updates. The revisions should be completed by late June or early July. Watch for it.

See the related reports following the byline and notices.

An attorney with long ties to MHI with no similar ties to MHARR told MHProNews recently about his view that there is ‘significant fraud and corruption evident in manufactured housing.’ The point is that the warning signs are there for those willing to look. There are known federal and state investigations for the same reasons.

The industry is underperforming. There has to be a logical reason for that during an affordable housing crisis. The reason this site is so highly read by MHPros is arguably because we gather the facts, data and provide analysis that no one else in the industry’s trade media dares publishing. That’s likely why were are the documented runaway #1 most read and largest.

That’s a wrap on this installment of manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

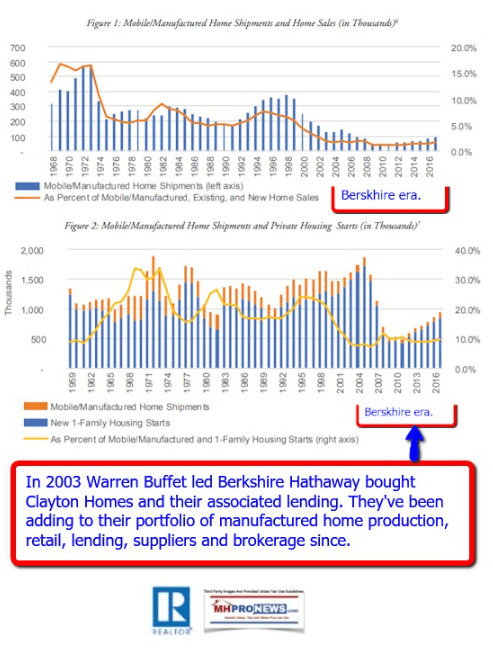

“MHI Lies, Independent Businesses Die” © – True or False? – Berkshire’s Joanne Stevens Strikes Again