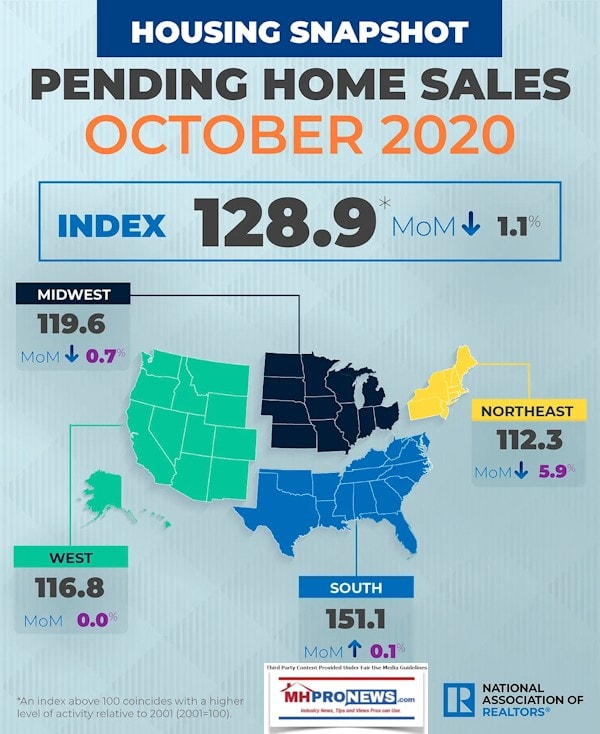

Pending conventional housing sales fell slightly in October, according to the National Association of Realtors (NAR) in a release to MHProNews and others in media. Contract activity was mixed among the four major U.S. regions, with the only positive month-over-month growth happening in the South, although each region achieved year-over-year gains in pending home sales transactions.

“The Pending Home Sales Index (PHSI),* www.nar.realtor/pending-home-sales, a forward-looking indicator of home sales based on contract signings, fell 1.1% to 128.9 in October, the second straight month of decline. Year-over-year, contract signings rose 20.2%. An index of 100 is equal to the level of contract activity in 2001,” said the NAR statement.

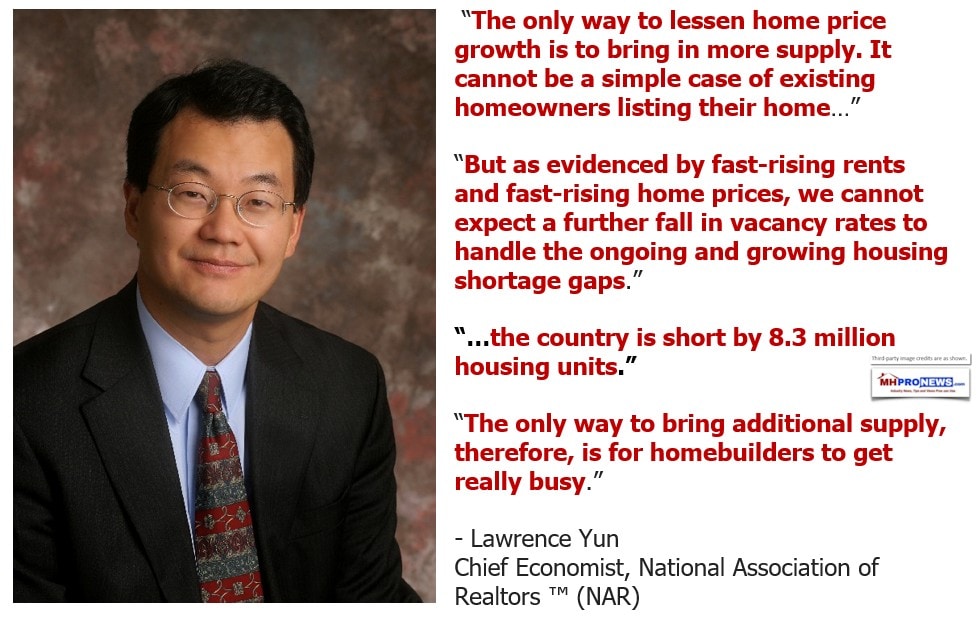

“Pending home transactions saw a small drop off from the prior month but still easily outperformed last year’s numbers for October,” said Lawrence Yun, NAR’s chief economist. “The housing market is still hot, but we may be starting to see rising home prices hurting affordability.”

Both inventory of homes for sale and mortgage rates are now at historic lows, according to Yun.

“The combination of these factors – scarce housing and low rates – plus very strong demand has pushed home prices to levels that are making it difficult to save for a down payment, particularly among first-time buyers, who don’t have the luxury of using housing equity from a sale to use as a down payment,” said Yun. “Work-from-home flexibility has also increased the demand for both primary and secondary homes.”

October Pending Home Sales Regional Breakdown

- The Northeast PHSI slid 5.9% to 112.3 in October, a 18.5% increase from a year ago. In the Midwest, the index fell 0.7% to 119.6 last month, up 19.6% from October 2019.

- Pending home sales in the South increased 0.1% to an index of 151.1 in October, up 21.0% from October 2019. The index in the West remained the same in October, at 116.8, which is up 20.8% from a year ago.

- The National Association of Realtors® is America’s largest trade association, representing more than 1.4 million members involved in all aspects of the residential and commercial real estate industries, according to the NAR.

The NAR produced this infographic snapshot, shown above, of the U.S. housing market trends. They also provided the following additional information.

- *The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

- The index is based on a large national sample, typically representing about 20% of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly sales contract activity parallels the level of closed existing-home sales in the following two months.

- An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.

- NOTE: Existing-Home Sales for November will be reported December 22. The next Pending Home Sales Index will be December 30; all release times are 10:00 a.m. ET.

Additional Information, MHProNews Analysis and Commentary

Dr. Yun has been saying for some years that the heating up of housing prices could best be remedied by builders getting real busy.

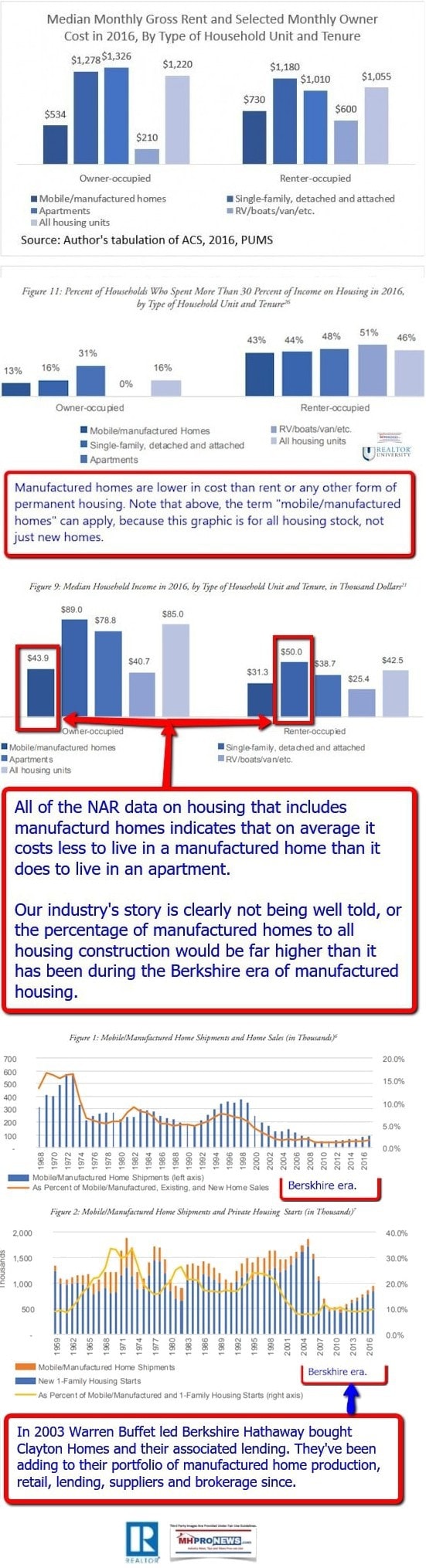

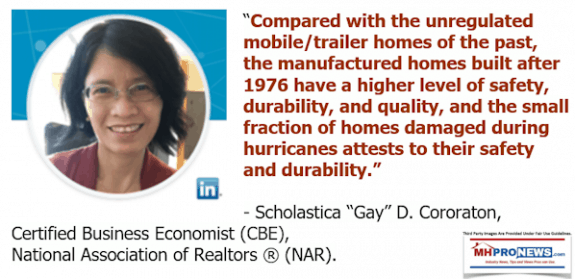

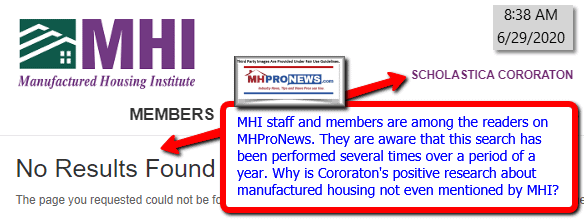

Yun subsequently asked Scholastica “Gay” Cororaton to do a research study on manufactured housing. That research ought to be front and center in manufactured housing’s broader market appeal. But she and others have made strong, third-party cases. Why is it that manufactured housing’s so-called ‘leaders’ are failing to publicize such useful third-party research?

Some of the findings in Cororaton’s research for the NAR linked above are summarized in a few of her many data-driven graphics shown below.

Summing up some Key Highlights from the NAR:

- Pending home sales declined slightly in October, slipping 1.1% from September. Only the South had month-over-month gains.

- Nationally, contract signings are up 20.2% compared to a year ago.

- All regions experienced double-digit year-over-year increases.

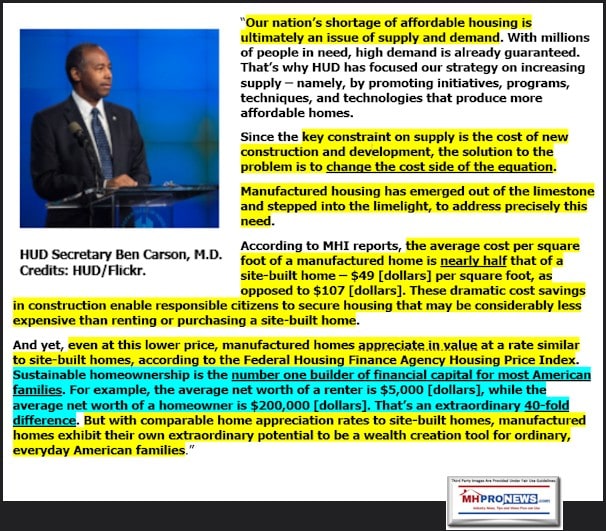

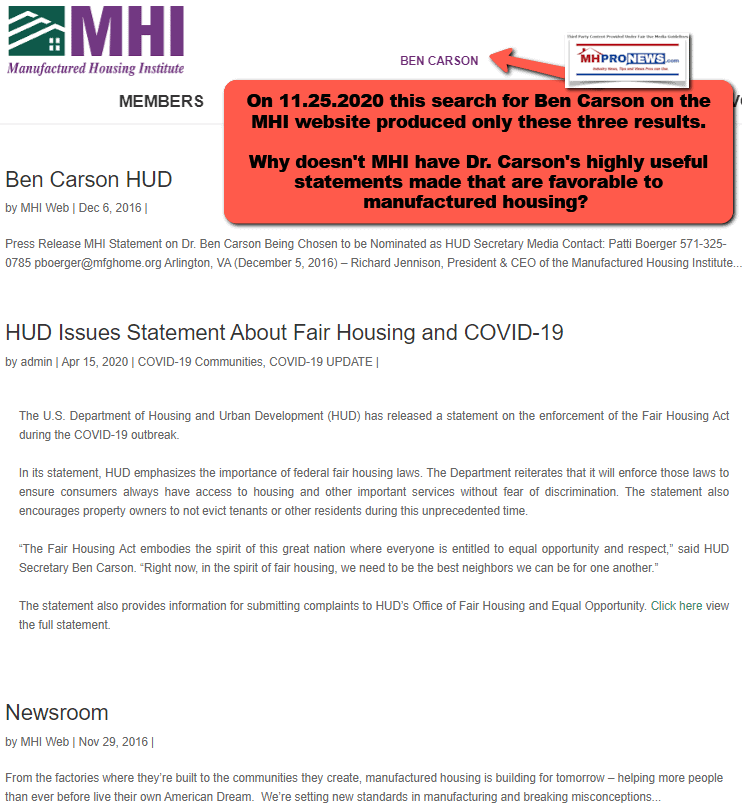

It isn’t just Dr. Yun that has said that only more supply can correct the supply-demand imbalance in housing. HUD Secretary Ben Carson made a similar argument and then pointed to manufactured housing being the solution to that problem.

Neither Dr. Yun’s or Dr. Carson’s comments ought to be seen as some earth shattering revelations. Rather, they are both ‘stating the obvious,’ because it is economics 101 as it relates to the law of supply and demand. Put differently, what they said would only be disputed by someone that is ignorant or ignoring the law of supply and demand.

What that means on a practical level is that claims that ‘rent control’ or anything else other than more supply could be a true solution.

These facts – overheated pricing caused by insufficient supply to meat demand – should all point to what Yun, Carson, and others in or out of manufactured housing have argued for – the pressing need for more manufactured homes.

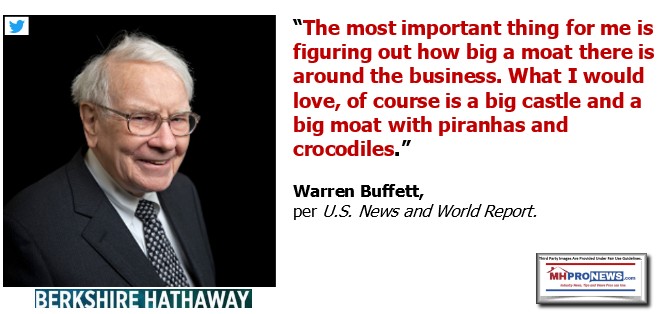

The normal behavior of corporations or investors who spot a lack of supply in a truly free market is to move in to profitably meet that demand.

- But when ignorance – market and media manipulation – are at work,

- Or when certain: trade groups, public officials, corporate or media interests

are each failing in their normal, logical, legal, or even stated mission than the types of imbalances that are obviously arising become more problematic.

Uncorrected, these issues can in time lead to precisely the kind of housing market implosion that AEI’s Housing Center Director Edward Pinto warned about recently.

The solution? The obvious is that independent-minded manufactured home professionals and investors should be promptly moving toward the vacuum that is being created as the dominating companies in manufactured housing stay focused on consolidation. This is the time for an end-around, to use a football metaphor. When the center of the field is jammed by an array of defensive forces that are thwarting robust manufactured housing growth, the option of going around that cluster should be taken.

There are many ways that this could be addressed. That includes, but is not limited, to the establishment of a new post-production trade group. This is a stance that the Manufactured Housing Association for Regulatory Reform (MHARR) has taken for some years.

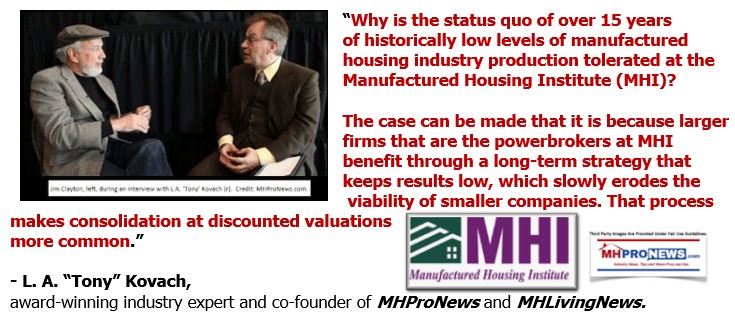

Later this week, the newest national data from HUD Code manufactured housing will be released. What it will not show is that the industry’s biggest corporate ‘leaders,’ who are generally Manufactured Housing Institute (MHI) members, are doing what common sense and economics 101 logically demands.

Cui bono? Who benefits from this mind-numbing multiple year status quo?

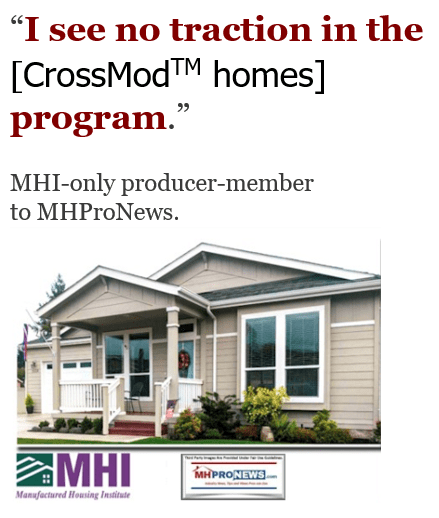

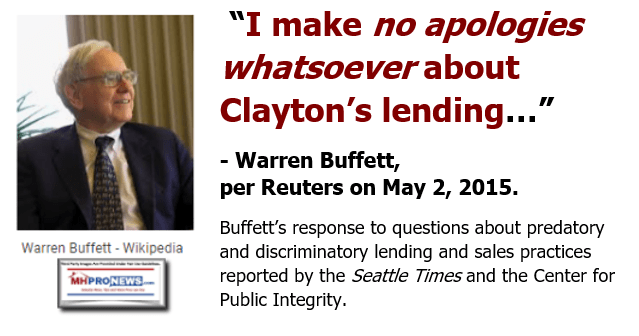

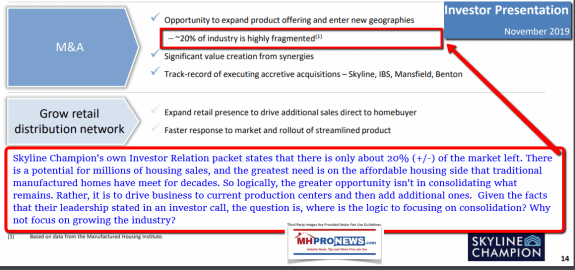

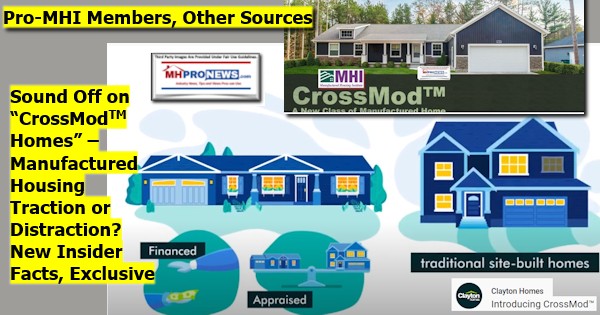

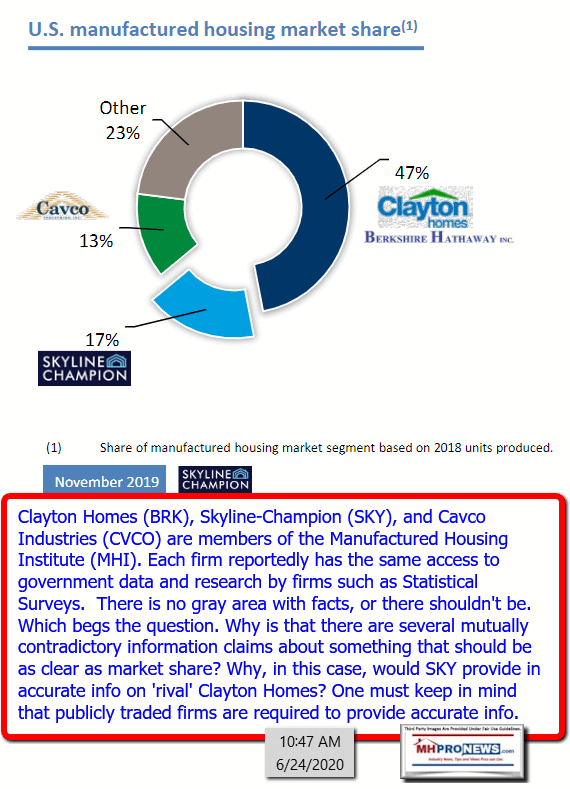

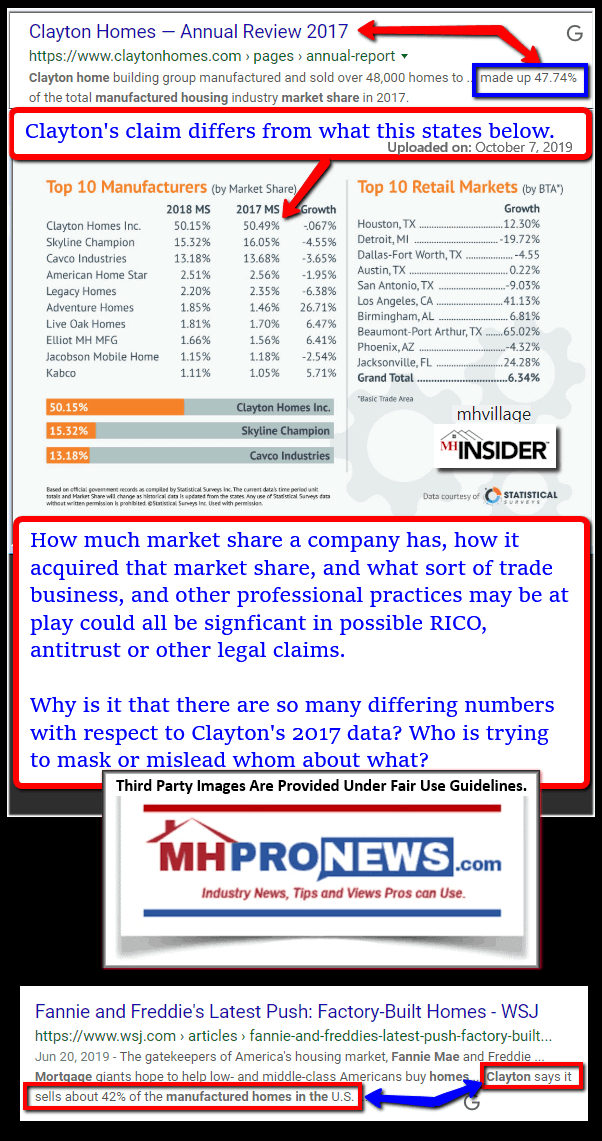

A few years ago, Kevin Clayton, president and CEO of Berkshire Hathaway owned Clayton Homes, stated the obvious. He said, ‘you dance with the one that brought you.’ In the case of HUD Code manufactured homes, the ones that ‘brought’ manufactured homes to the housing ‘dance’ was the affordable side of the industry. Even today, as Clayton Homes, Skyline Champion, and Cavco Industries apparently continue to push MHI on the seemingly mindless pursuit of the “new class of manufactured homes” called “CrossModTM homes,” that play stands as a living contradiction to what Clayton learned the costly way with the iHouse fiasco.

It is an open question if MHI staff are just ‘following orders’ from the MHI executive committee, which is led by Clayton’s general counsel, Tom Hodges. Or are they are these educated individuals at MHI really so foolish as to believe that after two years of evidence that debunk their numerous claims about “CrossModTM homes” will someday magically fix itself?

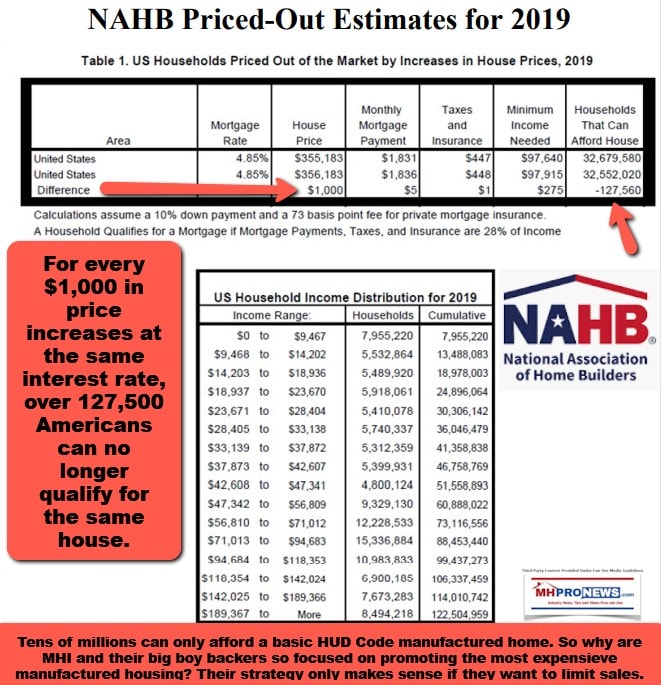

The National Association of Homebuilders published their “priced out” study that is rarely mentioned in manufactured housing industry circles, save most notably here on MHProNews, on MHLivingNews, or occasionally by MHARR.

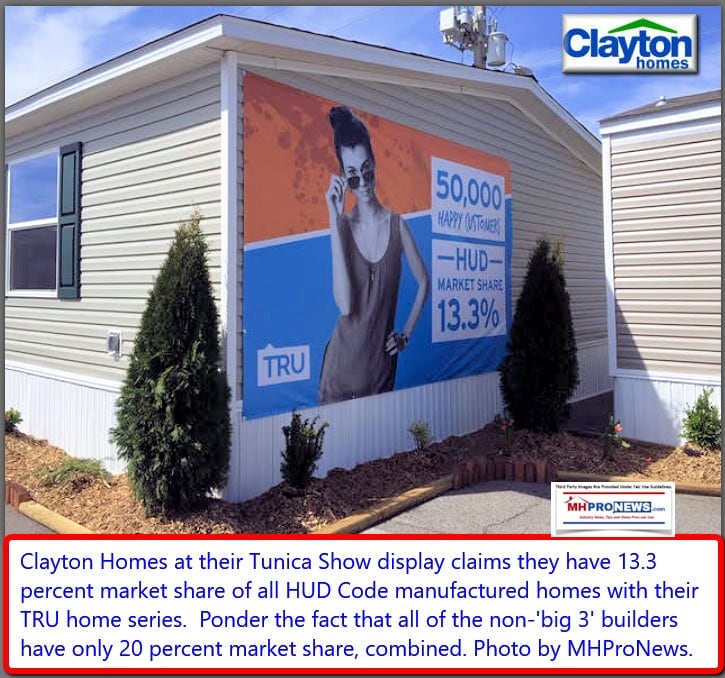

As mainstream housing prices soar, that “priced out” research logically means that the opportunities to serve ever more Americans in the affordable side of the housing market are growing. It is indirectly confirmed by the largest segment of Clayton Homes sales, which would be their TruMH series.

MHI and their big boy backers are trying to play ‘follow the leader’ and ‘rope a dope.’ They can afford to lose some money, if in doing so that cripples and finishes off still more competitors.

Opportunity is knocking, but mainly for the true contrarians who dare to think thoughts not being shoveled out of the Omaha-Knoxville-Arlington axis. To learn more, see the related reports linked herein and below the bylines and notices.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.