In an email to MHProNews, the National Federation of Independent Business (NFIB) states that “a new federal rule starting January 1, 2024, requires more than 32 million businesses to report the personal information of business owners to a new federal database.” Like it or not, that rule may well seem to apply to numbers of manufactured home industry businesses. In Part I of this report, is information from the NFIB which is also planning on a webinar next week on this topic. Part II of this report will include a federal download from a division of the U.S. Treasury Department which provides pages of Q&As and explanations of who and which type of firms are required to report and who and what firms are not required. That document was issued on 1.12.2024, so appears to be the most complete general information available from a federal source.

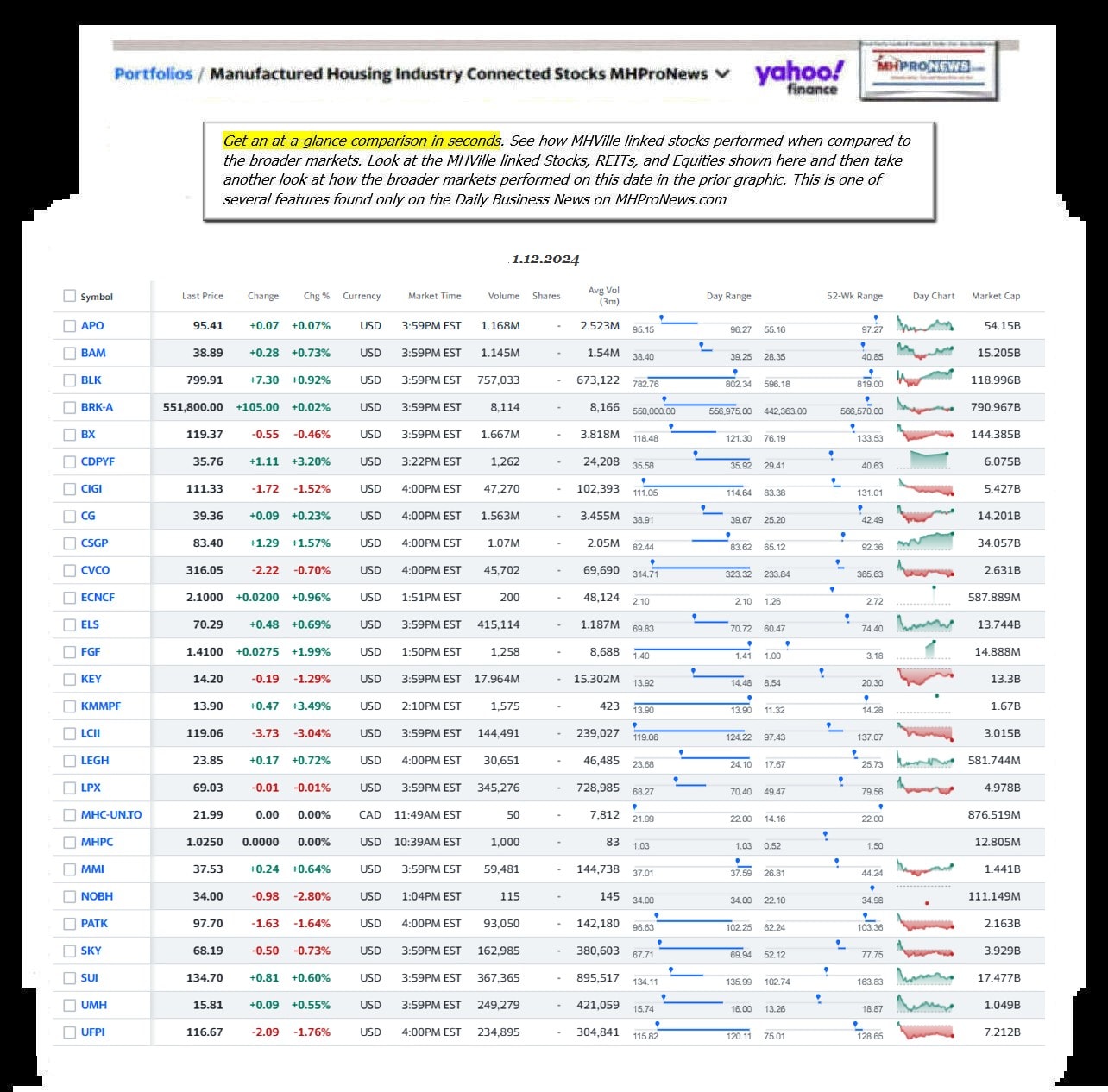

Part III of this article will be our Daily Business News on MHProNews manufactured home industry connected equities, stocks, REITs, and broader macro-market reports.

Part I From the NFIB on 1.12.2024

NFIB Says: ‘Beneficial Ownership Reporting Is Here: What Small Business Owners Need to Know About the New Reporting Requirements’

|

|

Part II – Financial Crimes Enforcement Network – U.S. Department of the Treasury

Updated: January 12, 2024

Beneficial Ownership Information Reporting Frequently Asked Questions

These Frequently Asked Questions are explanatory only and do not supplement or modify any obligations imposed by statute or regulation. Please refer to the Beneficial Ownership Information Reporting Rule, available at www.fincen.gov/boi, for details on specific provisions. FinCEN expects to publish further guidance in the future. Questions on any of this content can be directed to https://www.fincen.gov/contact.

A. General Questions

A.1. What is beneficial ownership information?

Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company. [Issued March 24, 2023]

A.2. Why do companies have to report beneficial ownership information to the U.S Department of the Treasury?

In 2021, Congress passed the Corporate Transparency Act on a bipartisan basis. This law creates a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures. [Issued September 18, 2023]

A.3. Under the Corporate Transparency Act, who can access beneficial ownership information?

FinCEN will permit Federal, State, local, and Tribal officials, as well as certain foreign officials who submit a request through a U.S. Federal government agency, to obtain beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement. Financial institutions will have access to beneficial ownership information in certain circumstances, with the consent of the reporting company. Those financial institutions’ regulators will also have access to beneficial ownership information when they supervise the financial institutions.

FinCEN published the rule that will govern access to and protection of beneficial ownership information on December 22, 2023. Beneficial ownership information reported to FinCEN will be stored in a secure, non-public database using rigorous information security methods and controls typically used in the Federal government to protect non-classified yet sensitive information systems at the highest security level. FinCEN will work closely with those authorized to access beneficial ownership information to ensure that they understand their roles and responsibilities in using the reported information only for authorized purposes and handling in a way that protects its security and confidentiality. [Updated January 4, 2024]

A.4. How will companies become aware of the BOI reporting requirements?

FinCEN is engaged in a robust outreach and education campaign to raise awareness of and help reporting companies understand the new reporting requirements. That campaign involves virtual and in-person outreach events and comprehensive guidance in a variety of formats and languages, including multimedia content and the Small Entity Compliance Guide, as well as new channels of communication, including social media platforms. FinCEN is also engaging with governmental offices at the federal and state levels, small business and trade associations, and interest groups.

FinCEN will continue to provide guidance, information, and updates related to the BOI reporting requirements on its BOI webpage, www.fincen.gov/boi. Subscribe here to receive updates via email from FinCEN about BOI reporting obligations. [Issued December 12, 2023]

B. Reporting Process

B.1. Should my company report beneficial ownership information now?

FinCEN launched the BOI E-Filing website for reporting beneficial ownership information (https://boiefiling.fincen.gov) on January 1, 2024.

- A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025, to file its initial BOI report.

- A reporting company created or registered in 2024 will have 90 calendar days to file after receiving actual or public notice that its creation or registration is effective.

- A reporting company created or registered on or after January 1, 2025, will have 30 calendar days to file after receiving actual or public notice that its creation or registration is effective.

[Updated January 4, 2024]

B.2. When do I need to report my company’s beneficial ownership information to FinCEN?

A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025 to file its initial beneficial ownership information report.

A reporting company created or registered on or after January 1, 2024, and before January 1, 2025, will have 90 calendar days after receiving notice of the company’s creation or registration to file its initial BOI report. This 90-calendar day deadline runs from the time the company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

Reporting companies created or registered on or after January 1, 2025, will have 30 calendar days from actual or public notice that the company’s creation or registration is effective to file their initial BOI reports with FinCEN. [Updated December 1, 2023]

B.3. When will FinCEN accept beneficial ownership information reports? FinCEN will begin accepting beneficial ownership information reports on January 1, 2024. Beneficial ownership information reports will not be accepted before then. [Issued March 24, 2023]

B.4. Will there be a fee for submitting a beneficial ownership information report to FinCEN?

No. There is no fee for submitting your beneficial ownership information report to FinCEN.

[Updated January 4, 2024]

B.5. How will I report my company’s beneficial ownership information?

If you are required to report your company’s beneficial ownership information to FinCEN, you will do so electronically through a secure filing system available via FinCEN’s BOI E-Filing website (http s://boiefiling.fincen.gov).

[Updated January 4, 2024]

B.6. Where can I find the form to report?

Access the form by going to FinCEN’s BOI E-Filing website (ht tps ://boiefiling. fincen.gov) and select “File BOIR.” [Updated January 4, 2024]

B.7. Is a reporting company required to use an attorney or a certified public accountant (CPA) to submit beneficial ownership information to FinCEN?

No. FinCEN expects that many, if not most, reporting companies will be able to submit their beneficial ownership information to FinCEN on their own using the guidance FinCEN has issued. Reporting companies that need help meeting their reporting obligations can consult with professional service providers such as lawyers or accountants.

[Issued November 16, 2023]

B.8. Who can file a BOI report on behalf of a reporting company, and what information will be collected on filers?

Anyone whom the reporting company authorizes to act on its behalf—such as an employee, owner, or third-party service provider—may file a BOI report on the reporting company’s behalf. When submitting the BOI report, individual filers should be prepared to provide basic contact information about themselves, including their name and email address or phone number. [Issued December 12, 2023]

C. Reporting Company

C.1. What companies will be required to report beneficial ownership information to FinCEN?

Companies required to report are called reporting companies. There are two types of reporting companies:

- Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

- Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office.

There are 23 types of entities that are exempt from the reporting requirements (see Question C.2). Carefully review the qualifying criteria before concluding that your company is exempt.

FinCEN’s Small Entity Compliance Guide for beneficial ownership information reporting includes the following flowchart to help identify if a company is a reporting company (see Chapter 1.1, “Is my company a “reporting company”?”).

The balance and the entire FAQ is provided at this link here.

In a Q&A with Bing Copilot is the following.

> “Who is required to report under new Beneficial Ownership rule that went into effect on 1.1.2024?”

If you have further questions about the reporting deadlines, how to file, or whether you qualify for an exemption, you can visit the FinCEN website 1. They have a FAQ page that provides more information on the topic 1. You can also chat with them directly if you need more information 1…”

> “Under what law or regulatory regime did this new Beneficial Ownership rule get established? When did that occur?”

Note that per the Treasury’s document linked here and above, questions can be directed to federal officials on this topic via the link below.

https://www.fincen.gov/contact

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 1.12.2024

- Major travel disruptions: Highest number of US flight cancellations in six months

- A Boeing Co. building near Los Angeles International Airport (LAX) in Los Angeles, California, US, on Monday, Jan. 8, 2024. Boeing took the first step toward returning its grounded 737 Max 9 jetliners to service, issuing guidance to airlines on the inspections required following a mid-air structural failure late last week.

- The FAA is auditing Boeing’s 737 Max 9 production

- Citigroup to cut 20,000 employees

- Quaker Oats recall: Cap’n Crunch cereal, granola bars and more pulled over possible salmonella risk

- Sherrod Brown speaks during a Senate Banking, Housing and Urban Affairs Committee oversight hearing on Capitol Hill in Washington, DC, in 2022.

- Lawmakers call on federal regulators to review Navy Federal over mortgage approval disparities, citing CNN investigation

- This photograph shows the Paris 2024 Olympics Games flag next to European Union and French flag at the presidential Elysee Palace in Paris, on January 12, 2024.

- The Olympics tap its first-ever global beer sponsor

- A still from a video shows multiple explosions in Saada province, north of Sanaa, Yemen, on January 12, local time.

- Oil prices rise as US-led strikes in Yemen raise fears of wider conflict

- NEW YORK, NY – JANUARY 3: Employees stand in an Apple retail store in Grand Central Terminal, January 3, 2019 in New York City. U.S. stocks dropped again on Thursday after Apple warned that its first-quarter sales would be less than expected. (Photo by Drew Angerer/Getty Images)

- Apple knew AirDrop users could be identified and tracked as early as 2019, researchers say

- NEW YORK, NEW YORK – MARCH 07: People walk by the New York Stock Exchange (NYSE) in the Financial District on March 07, 2023 in New York City. Stocks fell in early trading on Tuesday after comments from Federal Reserve Chair Jerome Powell suggested that interest rates may need to go higher to fight inflation.

- 5 charts that explain why stocks took off last year

- Bank earnings look really bad this quarter. Here’s why

- US wholesale inflation closes out 2023 with 1% annual rate in December

- Tesla to idle German plant for 2 weeks as Red Sea attacks delay supplies

- Why stocks paying juicy dividends could make a comeback this year

- Cheddar News, the business-focused startup, has been hollowed out. ‘It feels like the end,’ sources say

- The Fed’s latest balancing act: cutting rates too soon vs. waiting too long

- Renters are being hit harder by inflation than homeowners are

- How the Red Sea crisis could clobber the global economy

- China’s double whammy: Exports fell for the first time in 7 years, as domestic demand dips

- Class action lawsuit filed against Boeing after last week’s Alaska Airlines incident

- CVS will close some Target pharmacy locations

- Al Gore is officially too old to serve on Apple’s board

- eBay to pay $3 million after former employees sent live insects and a bloody pig mask to harass a couple

- Credit card delinquencies surpass pre-pandemic levels