President-elect Donald Trump has put forward a number of aggressive initiatives to spur or grow the U.S. economy.

On the subject of taxes, questions about the ramifications from changes abound.

And, the opportunities for the manufactured housing industry come clearly into focus.

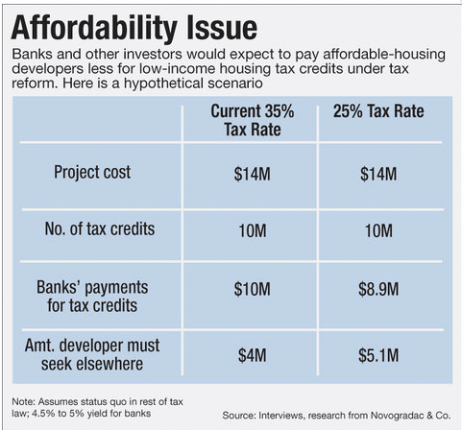

According to National Mortgage News, proposed corporate tax reform is said to be causing delays in bank-backed financing for low-income housing projects amid a severe U.S. shortage of affordable units.

Investments by banks in housing developments have hit snags in the two months since Republicans swept the elections, according to bankers, auditors and affordable-housing advocates.

“The sense that tax reform is within reach for the first time in decades immediately slowed things down,” said Rob Likes, national manager for community development at KeyBank.

“We’re hearing about that from our clients and from the market.”

One of the challenges that has been discussed is that the affordable housing market relies on subsides via the low-income housing tax credit program. Builders and developers use the credits to fund large portions of the cost of new housing projects.

Banks, in turn, make equity investments in the projects by buying the tax credits and in return claim a range of tax benefits over a period of 10 years. Some of those banks have told developers that they will reduce the amount of their investments in an effort to ensure the deals are profitable in the event that corporate tax rates drop.

Those moves create last minute gaps in financial plans that were potentially years in the making.

“Different banks are approaching this differently,” said Buzz Roberts, CEO of the National Association of Affordable Housing Lenders.

“Some banks have taken a ‘bit of a pause’ on making new investments, describing it as a ‘prudent’ move as banks wait for clarity on corporate rates.”

Housing advocates and bankers said that they are generally confident that the low-income housing credit will remain intact, noting bipartisan support for the program.

Another possibility: lawmakers may also expand the low-income housing tax credit program as part of a tax overhaul.

“The probability of [Congress scaling back the low-income housing credit] goes up if people take it for granted,” said Michael Novogradac, managing partner at the accounting firm Novogradac & Co. “A strong advocacy effort is underway.”

While things look promising, some banks are still scaling back their presence in the short term.

“This is an unusual situation,” Roberts said. “We haven’t really seen a moment where tax reform seemed this likely in quite a number of years.”

The Opportunity for Manufactured Housing

Offering consistent quality and effective pricing, the manufactured housing industry is well positioned to thrive under whatever tax reform plan ends up being implemented.

With Dr. Ben Carson on the way to confirmation as Department of Housing and Urban Development (HUD) secretary, doing everything possible to assure Americans have the ability to secure quality, affordable housing will be at the top of the list for HUD.

For a deep dive into Carson’s nomination, including views from the MH industry, click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.