MHProNews has made the ‘stating the obvious’ argument before that the management of publicly traded firms have a fiduciary responsibility to their stockholders. For those who have not seen that report, grasped that legal point, or who simply want a refresher on that topic, you can access it by clicking the hot-linked text-image box below.

Fiduciary Responsibility to Corp Shareholders-MH Anti-Trust Concerns; Plus MH Market UPdate$

More Than Hypothetical…

Given the reportedly multiple million-dollar legal dramas playing out at Cavco Industries (CVCO), there are good reasons to consider this as more than a hypothetical subject for publicly traded manufactured home industry firms. A recent report on that is linked here. Ponder why Third Avenue bailed and Robert Robotti cut big on Cavco.

Given the fact that Cavco’s ‘former’ CEO is still holding the title of Manufactured Housing Institute (MHI) chairman, and inside sources at Cavco say that Stegmayer appears to be acting in a fashion that is more in keeping with the authority of his former title, it likewise brings MHI and publicly traded firms in the manufactured home industry into the picture.

For some 34 years, MHI and the Manufactured Housing Association for Regulatory Reform (MHARR) have co-existed in MHVille. For decades, the two nonprofits are the most recognized national trade groups.

Where the Two National Trade Groups Largely Agree

When it comes to the monthly HUD Code manufactured home production/shipment reports, while there are modest differences due in part to how each nonprofit handles ‘destination pending’ data, the two trade associations are quite close on those facts. See the most recent example, linked from the text/image box below.

That said, how those facts are presented by MHI and MHARR are often quite different, as that same report above reflected. Same basic information, yet different presentations.

When it comes to statistics on what percentage of manufactured home loans are closed using real estate secured loans (land/home loans) vs. home only or personal property loans (so-called ‘chattel’ loans), both MHI and MHARR will routinely say that the data reflects some 75 to 80 percent of manufactured homes financed are closed with home only, personal property or so-called ‘chattel’ loans.

Both trade groups generally state that local zoning and placement issues are problematic and limit the use of manufactured housing. That commonality noted, publicly to industry members until yesterday, how the two approach that – or other issues – are once again quite distinct.

Both trade groups in their communiques to their members agree that there is an affordable housing crisis. Both agree that manufactured homes ought to play a more prominent role in solving that crisis. While those may seem like stating the obvious, when some of what follows is noted, it is worth mentioning.

On paper, both Washington, D.C. based MHARR and Arlington, VA based MHI argue for reduced regulatory burdens. Both say on paper that they want to see more manufactured home lending, and so on.

Such similarities between MHI and MHARR noted, let’s look at issues that are more dramatic in their differences.

Where MHI and MHARR Widely Differ

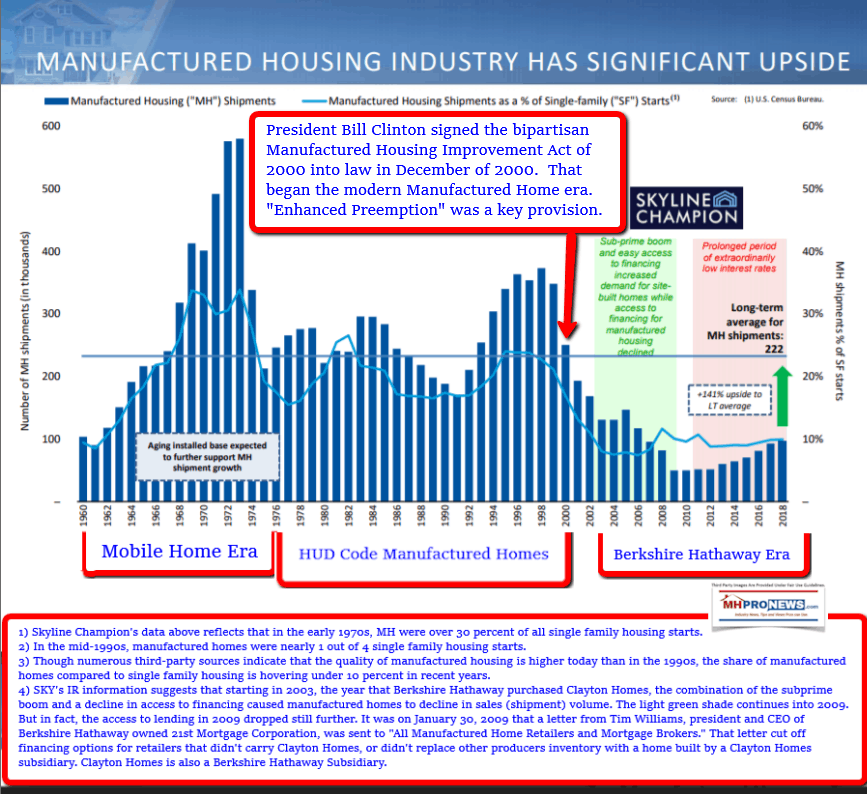

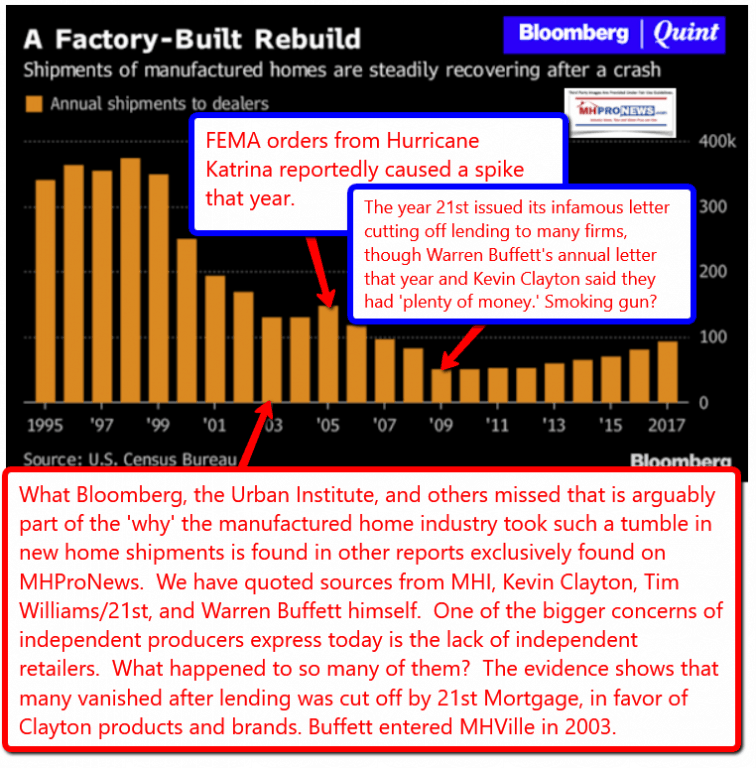

For whatever reasons, MHARR has been more alarmed at the now 9-month year-over-year decline in manufactured home shipments. MHI has been more muted.

Indeed, going into the now 9-month downturn, MHI was claiming “momentum” – when they arguably should have or did know better. That’s noted because MHI’s producing members make up some 80+ percent of the industry’s total production, noting that there are some dual members in MHI and MHARR. That means it is easy for MHI to obtain information on production. In fact, they could get the top 3 builders production, and can from that data infer the balanced of industry production fairly accurately. Thus, it is either odd and/or deceptive that MHI would claim “momentum” – as well as essentially touting their numerous publicity efforts on ‘behalf’ of the industry – when they knew, or should have, that a downturn was in fact underway.

Some months back, a MHI affiliated association leader, one who routinely acts as a surrogate for MHI, noted her concern that a down turn ‘might’ come. Which begs the question, why should a downturn occur in manufactured housing now? When both national manufactured home trade groups and scores of others agree that there is an affordable housing crisis, why would manufactured homes be in decline at all? Hold that thought.

Let’s note that MHI and MHARR are different trade groups. MHARR plainly states that: “The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.” They are a ‘production’ association, not a post-production – such as finance, retail, communities – trade association. They are there for member producers. That said, a report on the MHARR website linked here outlines their accomplishments, often on issues that are not strictly production focused.

By contrast, MHI describes themselves like this: “The Manufactured Housing Institute is the only national trade organization representing all segments of the factory-built housing industry. MHI members include home builders, retailers, community operators, lenders, suppliers and affiliated state organizations. Members are responsible for more than 85 percent of the homes produced each year.” So by their own definition, MHI is a production and post-production trade group. But they also claim to represent other types of factory building too. It is an ‘umbrella’ trade association.

Put differently, between the two, based upon their own stated mission, MHI is responsible for sales, education, promotion, media, or anything that is post-production related.

That noted, MHI’s most recent such publicity effort was dubbed “Homes on the Hill,” where two MHI member producers and an MHI member community supported the placement of 3 HUD Code manufactured homes on the National Mall during HUD Secretary Carson’s “Innovative Housing Showcase” co-sponsored by HUD and the National Association of Home Builders (NAHB). What Joe Stegmayer said in a video MHI is credited with is rather surprising. See that report, linked below.

Joe Stegmayer, Cavco Industries, MHI Chairman, Insights from Innovative Housing Showcase

As MHProNews has previously reported, and MHI has not denied, it was MHI members that pushed for involvement in that event. It was not MHI’s idea. Members reportedly wanted it, MHI pivoted, changing their “MHI Fly-In” date to accommodate the HUD/NAHB backed event. It is interesting to note that Clayton Homes did not participate in “Homes on the Hill,” but Cavco Industries, and Skyline-Champion both did. Those points noted, keep in mind that since the June event, MHI has masked on their own website their own involvement in it; why?

When a MHI sycophant blogger – or any others – claim that MHARR is not doing enough to promote manufactured homes, it’s ignorant at best, disingenuous, or deliberately deceptive at worst. MHI alone among national trade groups has claimed that mantle for industry promotion. That means that they alone have to bear the burden of 9 consecutive months of failure to perform. That’s deductive reasoning – common sense – based upon each group’s self-described mission.

How is Bad News Handled?

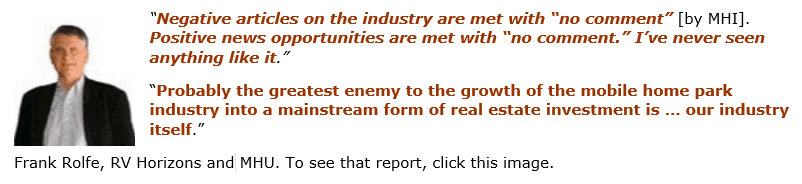

But let’s look one step further. How is industry blowback handled by MHI? What do their own members say? Let’s use the example of the controversies behind the viral John Oliver video, errantly dubbed “Mobile Homes.”

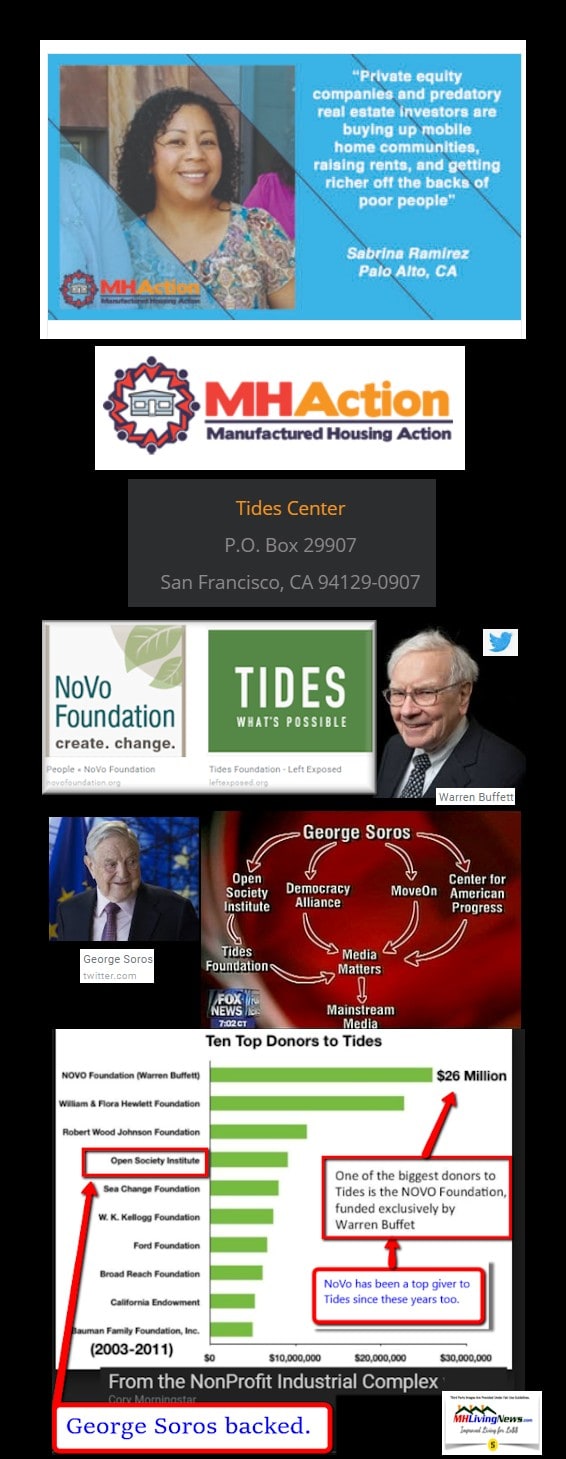

MHAction and the other two nonprofit groups that co-authored the report John Oliver showed spotlighted several MHI member companies. Among them was Havenpark Capital. Several of those firms were contacted by Senator Elizabeth Warren (MA-D), who is a 2020 presidential hopeful. Senator Warren’s letters to Havenpark and others are part of the report linked below.

Joanne Stevens is a leader at a Berkshire Hathaway owned commercial real estate brokerage brand, who made the following statement, which is cited from a longer one in the report linked above.

What Stevens didn’t say is that it was Berkshire’s Chairman Warren Buffett who provided the donations that flowed through various nonprofits to MHAction. see the report linked below which documents that money trail. The graphic below it is part of that more extensive report.

Prosperity Now, Nonprofits Sustain John Oliver’s “Mobile Homes” Video in Their Reports

From a Stockholders’ Perspective…

From a shareholders vantagepoint, ponder the implication of this report and the linked data and references. MHProNews readers should bear in mind that investors, federal officials, attorneys, media, and other researchers are a modest but significant part of our audience.

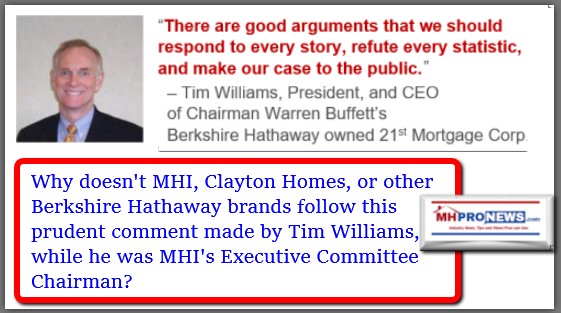

That said, what this report underscores is this concern. The biggest, best known backer of MHI are Berkshire Hathaway owned brands. MHI insiders have told MHProNews that if Berkshire withdrew its support from MHI, the organization would rapidly tip toward oblivion without dramatic cuts in staff and other expenses. Furthermore, Berkshire brands have long had one or more people on the MHI executive committee, which arguably holds the reins of power.

Put differently, what Berkshire wants at MHI, they get.

So, one is left with this troubling picture.

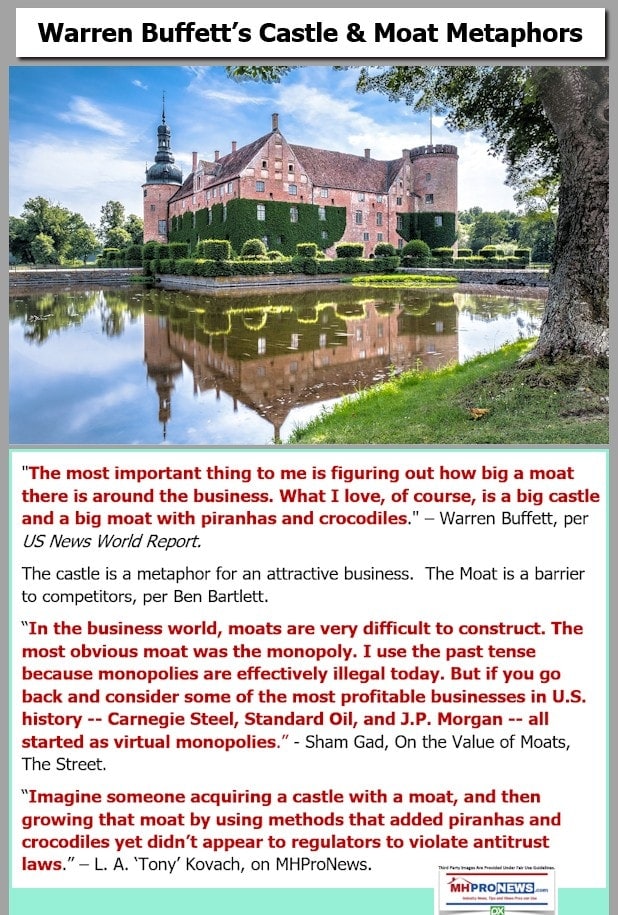

- Buffett has funded the ‘opposition’ of the industry companies, which reflects poorly on the industry as a whole, and did so while also funding the largest trade group; i.e.: MHI.

- On issue after issue, it is the opposition that seems to gain the upper hand publicly. Why is that so? One of several examples is the failure to pass the Preserving Access to Manufactured Housing Act into law. MHProNews publisher has said that based upon the evidence, in hindsight, as an expert he sees it now as a ‘rope-a-dope’ ploy, never intended to pass. It was meant to wear out smaller brands, that closed up or sold out at a discount. It is, per sources, a clever part of their strategic Moat.

- Most of this, says publisher and consultant L. A. ‘Tony’ Kovach, are the truth hiding in plain sight. One need but do the research to follow the money trail and the evidence.

That noted, what that may imply to investors in publicly traded companies is this. They too have been to some degree ‘played.’ How much more would their investments be worth if the company they are investing in was acting contrary to the will of MHI and Berkshire’s bosses?

Once reports like this and their linked details are digest, it should be no surprise if litigation, perhaps far more serious than what is gripping Cavco is at some point launched. After all, MHI is not doing what their own past chairman said they should do. Indeed, Buffett’s de facto backing of MHAction is arguably the opposite of what former MHI Chairman and Berkshire unit leader Tim Williams said they should do, isn’t it?

Furthermore, with antitrust fever taking hold on both sides of the political aisle in Washington, D.C., how long before Berkshire, Clayton Homes, and others in the MHI network get called to account? With Senator Warren, and other 2020 Democrats already on record seeking information from Clayton Homes and other MHI brands, will it be a surprise if some of those get called into testify, or face other investigative and legal issues?

‘Frank and Dave’ are well know industry personalities, MHI members, and have questioned and/or blasted the effectiveness of their own trade group for years.

The duo have likewise been targeted by MHAction and John Oliver’s video. But it hasn’t kept them from stating what many think is the obvious. Ponder the troubling point below, while considering the notion that a current MHI board member has a company with a ‘F’ rating with the Better Business Bureau.

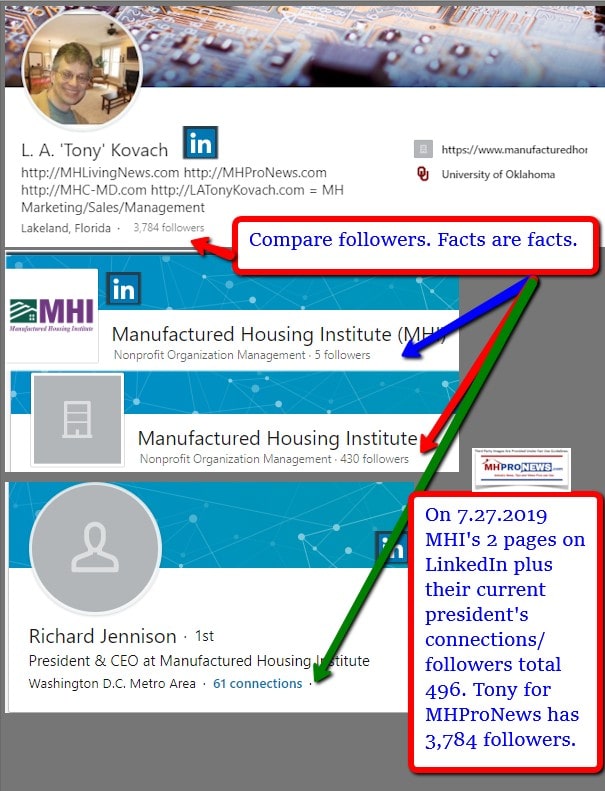

A glance at MHI’s two LinkedIn pages, plus their scheduled to leave president and CEO, Richard ‘Dick’ Jennison total number of followers, compared to that of our publication’s co-founder speaks volumes, doesn’t it? Which sources are more credible, and which information sources are more problematic?

When even MHI supporters and members won’t readily defend MHI, what does that say about the organization’s trustworthiness?

By contrast, MHARR is a fraction of MHI’s size, nor is anything beyond production related issues part of their stated mission. That said, with far more modest resources, MHARR is routinely reaching beyond their core mission, including addressing issues such as financing and zoning that MHI claims to do, precisely because MHI is arguably failing to do so. Not only has MHARR said so, but so has the MHI breakaway, the not-yet-online National Association of Manufactured Housing Community Owners (NAMHCO) has said similarly. There are no known smoke clouds hanging over MHARR, so why are there so many vexing issues hovering over MHI?

There are several indicators of the potential legal and other problems that could be coming to MHI – and by extension – to some of their members. See the report linked here. The fact that MHI only pivots – see the first link below the byline – slowly and under sustained pressure, isn’t that a warning to their publicly trade members too?

Digest the details. There are billions of dollars annually on the line.

As Senator Bernie Sanders, billionaire Tom Steyer, and President Donald J. Trump have all said, ‘the system is rigged.’ Other 2020 hopefuls have said so too.

If that is also so in manufactured housing, then publicly traded firms have a responsibility to do their best to navigate the rigged system issues. They should bear some responsibility for supporting organizations that support growth, instead of the operations that have a history of fostering consolidation. Given that 9 months of negative growth is the status quo today in manufactured housing, doesn’t that in itself say that something is wrong and needs to be done pronto? See the first related report, below the byline. That’s a wrap on this Saturday’s edition of manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Under Pressure, MHI Pivots “HUD Must Implement and Enforce its Enhanced Preemption Authority”

Manufactured Housing Institute – Seth Appleton, Hunter Kurtz Begin Key Roles at HUD – Analysis

NAR, Land Use, Property Rights, Declining Existing, New Housing Sales