“Get ready.” “Pucker up buttercup” is a phrase that can have different meanings depending on the context. According to one source, it means “get ready” and is used sarcastically to show something negative is going to happen1…” So said Bing in the top response to the inquiry, “What does pucker up buttercup mean?” Matthews Real Estate Investment Services credits two sources for much of its information. Per their document, linked here, and from their website are the following pull quotes. “Additionally, based on the data presented in the MHInsider 2023 “State of the Industry” report, which highlights trends and statistics in the manufactured housing sector, it is evident that manufactured homes are effectively addressing the demand for affordable housing in the U.S.” Seriously? Matthews also said the “Manufactured Housing Institute” (MHI) was a source, which cited 2022 data. Award-winning reporter for left-leaning CNN turned award winning-pundit for his flagship WMAL nationally syndicated radio show that bears his name, Chris Plante periodically mentions ‘a circle fest in a hot tub‘ as a way to describe a cozy relationship. For instance, that description has been applied by Plante to the relationship between some in mainstream media and certain governmental and organizational players who are seemingly in, ahem, forbidden intimate relationships.

Plante also refers to the mainstream media’s ‘greatest power is the power to ignore.’

Plante’s descriptive meanings are often witty, factual, thus are insightful.

Regarding the power to ignore exercised by many in media, it is a reference to their ability to ignore facts that don’t fit the preferred political or other narrative.

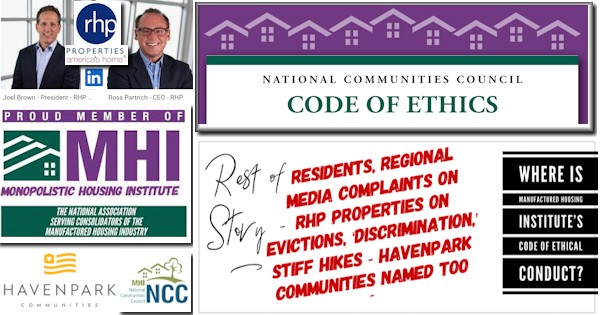

While his points are about macro-U.S. issues, and not about manufactured housing, it is worth seeing if they fit some of the escapades that occur with respect to narrative creation in MHVille. Because the ‘circle fest in a hot tub’ and ‘the power to ignore’ are arguably routinely manifested in matters related to the oligopoly style of governance between what Manufactured Housing Institute award winner Marty Lavin, J.D., called ‘the big boys’ of the industry that run the organization for their own benefit.

Such a proverbial circle fest in a hot tub and narrative control are arguably part of what is visible to keen observers of contemporary manufactured housing. MHI, MHInsider, and at least in this report, Matthews apparently share that ‘intimacy.’ What Matthews does in the wake of this fact check and analysis may speak volumes about their leadership.

Which brings someone back to the second Bing definition to Pucker Up Buttercup: “Another source suggests that it is a term of endearment and means “whoever said it wants you to pucker your lips for a kiss”2.” For those who can imagine some of the various personalities involved in some of those organizations, ahem, that may not be a pretty mental picture.

MHInsider is owned by Equity LifeStyle Properties (ELS). ELS is on the MHI “Executive Committee” board of directors. A review of that MHI board reveals several of the corporate interests that have been the target of multiple manufactured housing industry antitrust lawsuits, including ELS and Datacomp, a sister brand to MHInsider. Did Matthews know that was brewing before they published? More of that circle fest in a hot tub comes into focus for those with open and keen minds who follow the money trail.

Here are some pull quotes from Matthew’s uncritical document’s quotes from MHI and MHInsider, noting that MHI has “endorsed” MHVillage, and that MHInsider is a subset of MHVillage’s website. Yet another circle fest in that proverbial hot tub. Pucker up. Note to new readers. Quoting a source or naming a source is not to be construed as any sort of endorsement of that source, as what follows will make clear.

Get ready.

Part I – Remarks from Matthews Real Estate Investment Services and Analysis in Brief

1)

Per Matthews is the following.

In the ever-evolving commercial real estate landscape, one sector has quietly but significantly risen to prominence over the past decade: the manufactured housing industry. What’s the secret behind this surge in popularity? The answer lies in the dependable and consistent revenue stream manufactured housing communities generate. As a result of this, many institutional investors have been actively entering this market segment. The asset type has also proven to demonstrate significant resilience in times of economic unpredictability.

Additionally, based on the data presented in the MHInsider 2023 “State of the Industry” report, which highlights trends and statistics in the manufactured housing sector, it is evident that manufactured homes are effectively addressing the demand for affordable housing in the U.S. As of June 2023, 11% of new single-family home starts have been manufactured housing, and the industry has a $31 billion economic contribution. The report also indicates further growth in the industry for years to come.”

The original linked to the MHInsider’s 2023 “State of the Industry,” which was removed above but which was carefully explored in the fact check shown below. Bing’s AI powered Copilot has previously noted that MHInsider’s article, after examining our report and analysis, has several problematic aspects to it. MHVillage, including Patrick Revere, declined to respond to inquiries about that fact check. So too MHI and their leaders, including one of their outside attorney‘s, David Goch, have declined remarks about several fact checks with expert analysis regarding items that they have published or said which are incongruous, seemingly mistaken, or apparently deceptive. Bing’s AI powered Copilot has issued several keen insights about MHI’s messaging, some of which have been explored in the headlines for the week that was further below Part I.

Copilot credited MHProNews for apparently forcing MHI to correct the previously – and erroneously reported – MHI data point about how much the economic impact is for the HUD Code manufactured housing industry. So, from one of those prior MHProNews fact-checks of MHI seemingly influenced Copilot’s analysis of why MHI finally changed from mistakenly saying that manufactured housing was making a $3 billion GDP a year annual contribution to GDP vs. their more recently claiming that said economic contribution of manufactured housing to the U.S. economy is now supposedly $31 billion. Hmm…$3 billion to $31 billion, with no explanation. What does that do for MHI’s credibility? Matthews and MHInsider don’t mention it, but perhaps they don’t care. Pucker up, buttercup.

2)

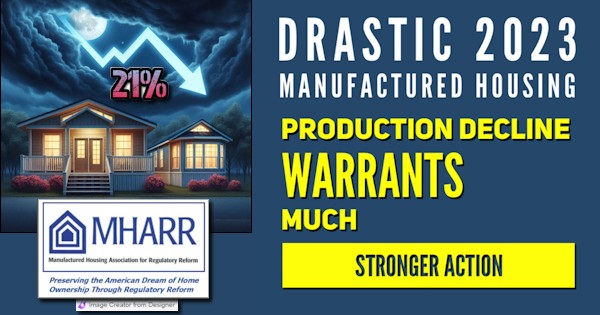

A glance at this infographic above sets a context that Matthews either missed or opted not to mention. Namely, that in 2023, production fell below the level that occurred in 2018, one of the references to the information above. Will Matthews make necessary corrections, as did the National Association of Realtors (NAR) after errors were brought to their attention about a report involving manufactured housing? Time alone will tell. The incorrect (flawed) and the corrected reports by NAR are linked accordingly. It was input from MHProNews that they candidly said, along with information from MHARR, that brought them to make the changes that were needed. NAR did what the Society for Professional Journalists (SPJ) Code of Ethical Conduct required, and good for them for doing so. People and organizations can error. The question is what happens after the errors are pointed out? Those points noted, back to Matthews’ description of the Manufactured Housing Industry, which might have more aptly been called their report on the manufactured home community (MHC) sector, but it was a bit of both.

3)

According to Matthews:

Manufactured housing refers to dwellings constructed in sections within a factory setting and then transported to the final location for installation. Nowadays, manufactured homes can vary in size, ranging as small as 500 square feet to as large as 3,000 square feet.

To learn more about Manufactured housing, please click here.”

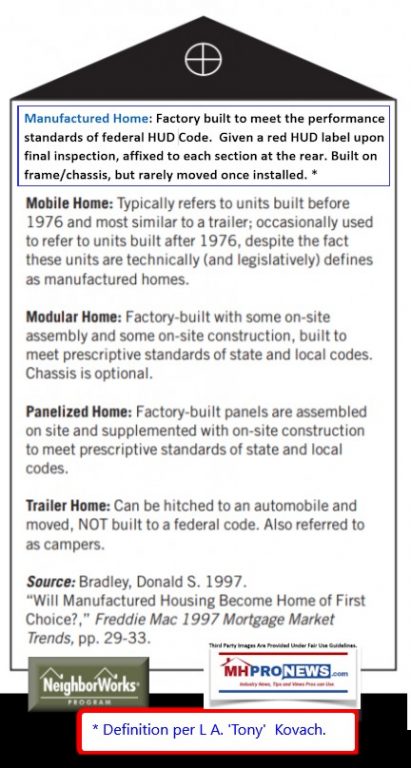

That segment had two links to the Matthews’ report from 2022. But that report also arguably had factual flaws. The very first paragraph had a factual error: “Manufactured housing (MH) can also be referred to as “modular homes” or homes separated into sections that are generally constructed in an off-site factory before being moved to where the property will be set.” Ask the Modular Home Builders Association if the terms manufactured housing or manufactured homes are interchangeable with “modular homes” and they will sharply push back, “no.” See the definitions provided below. Steve Duke, J.D., made the correct point in the second illustration that follows. That noted, a HUD Code home can be as small as an 320 square feet, so long as it is built to the HUD Code standards. In fairness to Matthews, unless someone goes to the HUD website, several sources have this minimum square footage for a manufactured home incorrect. Some say it is 400 square feet. But on this date the HUD website says the following: Here is what the HUD website says: “HUD Manufactured Home Construction Standards Manufactured homes are homes built as dwelling units of at least 320 square feet in size with a permanent chassis to assure the initial and continued transportability of the home.” Depending on how the square footage of a home is calculated, that 3000-foot maximum figure provided by Matthews is apparently wrong too. Several statements, and now several documented errors by Matthews Real Estate Investment Services.™

4)

According to Matthews:

(Source: Manufactured Housing Institute)

- In 2022, the manufactured housing industry witnessed the production of 112,882 new homes, accounting for approximately 11% of new single-family home starts. During the same year, the average sales price of a new manufactured home, excluding land, was $127,250.

- Manufactured homes have been constructed in compliance with the federal HUD Code since 1976. This code ensures that homes adhere to design, construction, strength, durability, fire resistance, and energy efficiency standards. In the early 1990s, HUD revised the building code to further enhance energy efficiency, ventilation standards, and the wind resistance of manufactured homes, particularly in areas prone to hurricane-force winds.”

More specifically, the HUD Code went into effect on June 15, 1976. Some homes before that date could, in theory, have been built to different standards than the HUD Code.

According to iPropertyManagement, are the following comparisons to the conventional housing sector for 2022 and then for 2023.

The first bullet below is confirmed by U.S. Census Bureau data.

- In 2023, there were 1.413 million nonseasonally adjusted new house starts; seasonally adjusted housing starts totaled 1.460 million.*

- House starts in 2023 were down 9.01% year-over-year (YoY).

- 66.8% of new house starts were single family homes, up 3.31% YoY.

- Single-family home builds are down 20% from 2005 (as a share of all house starts).

- The ratio of new house starts to permits issued was 97.2%.”

943884 x 97.2% = 917,455. In 2023, HUD Code manufactured housing only produced a total of 89,169 of all sizes and types across the U.S. There are several ways to slice and dice those facts. Here is one of them. 89,169/917455 = 0.09719168787. So, in 2023, U.S. manufactured housing represented only the equivalent of about 9.7% of the total single-family conventional housing starts.

One of the possible takeaways from these facts is this. That’s hardly a robust industry by its own prior historic achievements or as measured by a logical comparison to far more costly conventional housing. Even the case that Matthews is apparently seeking to make about the interest in the land-lease community segment of the manufactured housing industry has several serious question marks hovering over it. Some of those are found in mainstream media, but far more on sites like this one, the Manufactured Housing Association for Regulatory Reform (MHARR), or MHLivingNews. Each of those entities (MHARR, MHProNews, MHLivingNews) issue press releases. Others in media pick those up. The information found here or there are not secret. Which begs the question. What is the purpose, besides marketing as a possible example, for Matthews in their own words (cited above) is this.

That is both accurate and inaccurate. That may fit the definition of words like paltering or spin.

What about the lessons learned from Capital First Realty? Where debt on properties had to be sustained by every higher site fees? While some of the industry players certainly have relatively low debt, are all of those among this wave of consolidators that Matthews refers to going to be able to say the same? While the history of Capital First is complex, Richard “Dick” Klarchek and the rise and fall of those properties do offer several possible lessons for manufactured housing pros.

5)

Per Matthews.

The demand for affordable housing has reached unprecedented levels. Modern manufactured homes offer exceptional quality while priced up to 50% lower per square foot than traditional site-built homes. To put this into perspective, the typical price per square foot for a site-built home is $139.20, whereas a manufactured home averages $72.46 per square foot. This significant cost advantage enables a growing number of Americans to achieve homeownership, bridging the widening gap in housing affordability.

It is estimated that there are around 4.3 million sites for manufactured homes in the U.S. About 27% of new manufactured homes are located within communities, and the country boasts approximately 43,000 such communities. Notably, a third of these communities were developed between the 1950s and 1990s.

Approximately 21.2 million individuals reside in manufactured or mobile homes across the country. These homes represent 11% of the total new home starts each year. Source: MHInsider”

It doesn’t take a lot of research to realize that the claim that “About 27% of new manufactured homes are located within communities, and the country boasts approximately 43,000 such communities” has at least two factual errors. See the reports linked below for details.

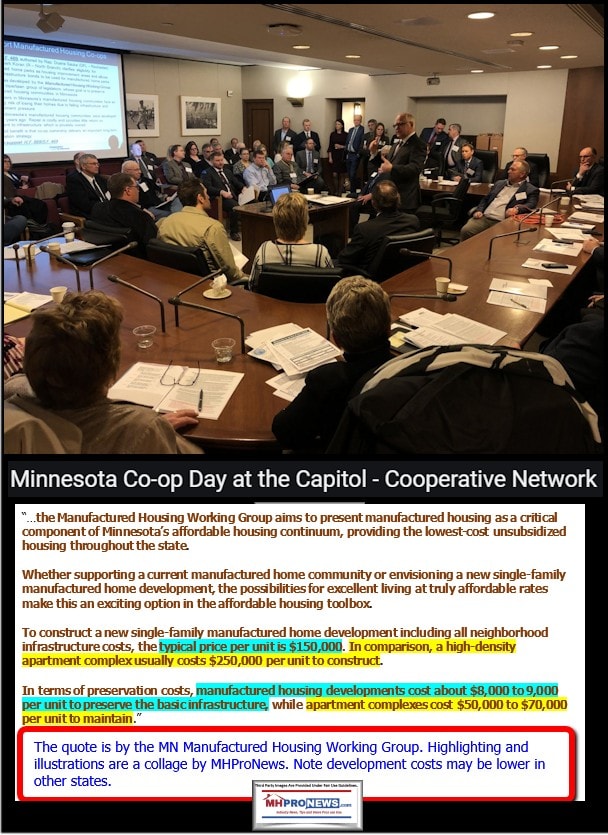

The Lincoln Institute has emerged as an important source of information about manufactured home communities (MHCs). Their media releases should hit several of the key words that serious and objective researchers are looking for in doing a report like the one Matthews produced. So, even if Matthews’ report writer(s) innocently trusted the Manufactured Housing Institute (MHI) and/or sources like MHInsider in 2022, surely by 2023 they would have stumbled upon this platform, and/or the Manufactured Housing Association for Regulatory Reform (MHARR), or MHLivingNews, or the Lincoln Institute. And that list of de facto skeptics of MHI linked-claims and their amen corner goes on.

Matthews’ must ask themselves. Are they one more jumping into that proverbial circle fest in a hot tub, or are they going to publish objectively accurate information?

6)

With elevated costs associated with conventional multifamily development and ongoing economic uncertainty, the demand for manufactured housing will continue its upward trajectory for the remainder of 2023. However, due to the limited availability of for-sale properties, competition is expected to intensify among institutional owners and operators in the market.

According to MultiHousing News, the fastest growing states are highly sought-after regions for investment in manufactured homes. The Sunbelt and Southeastern states are experiencing significant demand for manufactured housing assets, while the Gulf Coast is emerging as a promising market in this sector.

Top Markets for Manufactured Housing

Source: MHInsider

- Houston, TX

- Dallas-Fort Worth, TX

- Detroit, MI

- Austin, TX

- San Antonio, TX

- Jacksonville, FL

- Tampa-St. Petersburg, FL

- Clearwater, FL

- Birmingham, AL

- Knoxville, TN

- Phoenix, AZ…”

In no particular order of importance are the following concerns about the above.

- A) One must wonder, did the report writer grasp what looks like the conflation of two different realms of manufactured housing? The top markets aren’t necessarily the top markets for land lease communities, they are retail markets. At a minimum, given that this appears to be a document aimed as an introduction to outsiders looking in, that sort of detail should be clarified so that newcomers ‘get it.’

- B) Ironically, a potential lack of health of the manufactured home community (MHC) market is precisely in its failure to do the kind of robust developing that is found in the MHC sector. When Matthews said: “elevated costs associated with conventional multifamily development and ongoing economic uncertainty,” it points to information that should reflect hundreds of thousands of new apartment/multifamily units being developed every year. For those who have watched those structures rise in areas near where they work, live, shop, worship or go for other purposes, it is obvious that they fill up rather quickly. Where is the MHC equivalent of that parallel phenomenon? Several of the reports linked below in the headlines for the week in review (on both MHLivingNews and on MHProNews) address that directly or obliquely. Gannett, Yahoo News, and MSN are among those who have picked up on an op-ed that once more pulls back the veil on just how out of whack the MHC land has become.

- C) What are the implication of this from Matthews? “However, due to the limited availability of for-sale properties, competition is expected to intensify among institutional owners and operators in the market…”? See the report on Flagship communities below for numerous related insights in detail.

7)

Matthews used the following graphic. Compare it to the one above in Part I #1.

The Matthews document this report is exploring linked here included this disclaimer.

As was noted in the MHProNews remarks below their graphic: Perhaps Matthews’ grasps aspects of the game in MHVille that is being played? Quote sources ‘deemed reliable’ but then admit you have not verified the information. Of course, they don’t warranty or guarantee the information, completeness, or accuracy. An argument could be made that it would be rare to find a sizable manufactured housing connected operation that is not at least a periodic reader of our MHProNews/MHLivingNews platforms if not a regular reader. That includes numbers of federal and state officials, per sources deemed reliable, including contacts with said officials.”

Note that MHProNews has evidence from Matthews that indicates there are reasons to believe that some at Matthews are among those readers of MHProNews.

MHProNews could go on, but perhaps useful to all involved are a look at reports like the one linked below that looks at research by Marcus and Millichap (MMI).

Or this one.

What’s missing from Matthews, and what is questionable if not outright wrong are brought into focus by even this relatively brief fisking.

Part II

Don’t miss today’s postscript (Part III), which will shed more light on the above. Several of the headlines for the week in review reveal insights that might have been mentioned by Matthews that could have sent their ‘research’ into an entirely different direction.

With no further adieu, here are headlines for the week in review, from 2.25 to 3.3. 2024.

What’s New on MHLivingNews

What’s New from Washington, D.C. from MHARR

What’s New and Recent on the Masthead

The Latest from Tim Connor and the Words of Wisdom

What’s New on the Daily Business News on MHProNews

Saturday 3.2.2024

Friday 3.1.2024

Thursday 2.29.2024

Wednesday 2.28.2024

Tuesday 2.27.2024

Monday 2.26.2024

Sunday 2.25.2024

Postscript (Part III)

Stating the obvious can bring clarity.

Matthews is just one of several ‘research’ reports that is a mix of accurate and inaccurate information. Often such erroneous reports are a form of marketing. What is necessary, for the observer or reader of such ‘research,’ is to ask the tough questions. What is the goal or purpose of a given document? Is there any hidden or thinly veiled agenda? Is paltering involved? Meaning, is there a series of relatively accurate facts that are potentially useful, but are nevertheless diminished because relevant information has been omitted or missed?

Manufactured housing is underperforming as an industry during an affordable housing crisis. An initial inquiry about manufactured housing put to Bing’s AI powered Copilot may simply regurgitate some Manufactured Housing Institute (MHI) talking points, sometimes word for word and uncritically from the MHI website. But when pointed follow up questions are asked and answered by Copilot that challenge some MHI claim, Copilot has repeatedly pivoted and in various modes of expression confirmed the disconnects. In doing so, Copilot will generally focus on information from MHARR, MHProNews, MHLivingNews, and perhaps from researchers that have raised similar concerns.

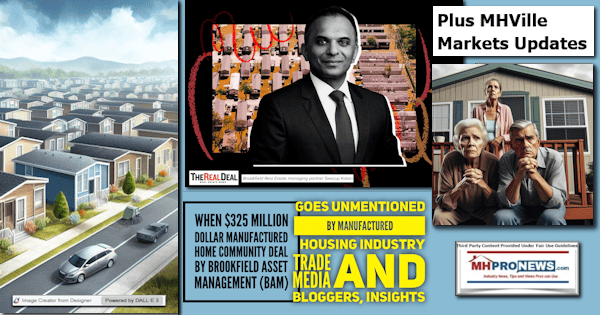

There is a sense in which – despite the factual errors pointed out above – that some of what Matthews reported are nevertheless potentially accurate. For instance. Yes, as far as commercial real estate is concerned, and as far as manufactured home communities are concerned, there is a documentable trend of more and more ‘institutional investors’ and consolidators entering that space. But there are red flags too. One of those was reported some weeks ago when MHProNews explored the sell off of a chunk of Brookfield’s manufactured home community portfolio. Do at least some insiders see the seemingly rising risks of serious and costly litigation or other regulatory/legal actions?

Matthews – or any other serious research source – have to ask and answer certain questions for themselves before they publish something for the investor community or others. Among those business and ethical questions?

- Are we (a given company, nonprofit, media outlet, university, governmental entity, etc. ) looking to give accurate information? Or is an organization only going to share information that pushes a certain narrative?

- There are risks from the truth and risks from half-truths or thinly veiled deception. The advantage of the truth is that it should be easier to remember. The risk of half-truths or other forms of misdirection is that over time, it may become harder and harder to keep the narrative together.

- Abraham Lincoln put that (#2) as follows, per Quora. “You can fool all the people some of the time and some of the people all the time, but you cannot fool all the people all of the time,” is a remark by Abraham Lincoln that demonstrates a deep understanding of skepticism, human nature, and the limitations of deceit.”

4) The narrative of MHI and those linked in their apparent “circle fest in a hot tub” has arguably fallen apart. It doesn’t take much to punch holes in their omitted or misinformation. So what is a firm like Matthews to do?

5) Ethically, there are options that can still lead to profits. Perhaps higher profits, with less risk, than what those who are facing growing legal, regulatory, and public scrutiny face. Ironically, Sun Communities Gary Shiffman pointed out the obvious some years ago. Why is it that others in MHVille trade media, besides MHProNews/MHLivingNews, don’t highlight this quote by Shiffman on a periodic basis? Because Shiffman’s point quoted below is significant. If a developer of a new manufactured home community can develop a property at a higher rate of return for investors, and if doing so would also be better for residents, then why aren’t they doing so in a more robust fashion? See the report linked above and here on MHLivingNews linked here that explores that point.

Consider this search Q&A via Copilot.

> “Drew, it’s Gary. There certainly is and it’s certainly the West Coast, certainly right up to the Northwest is area of concentration where we feel, we can actually develop communities to a better return for our shareholders than buying them at the cap rates that they’re trade at currently.” That is by Gary Shiffman at Sun Communities. Who has cited that in manufactured housing? Link the results.”

Tipsters? Forward or Submit items at this link here.

Employees of a “predatory” MHI brand? Click here.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’