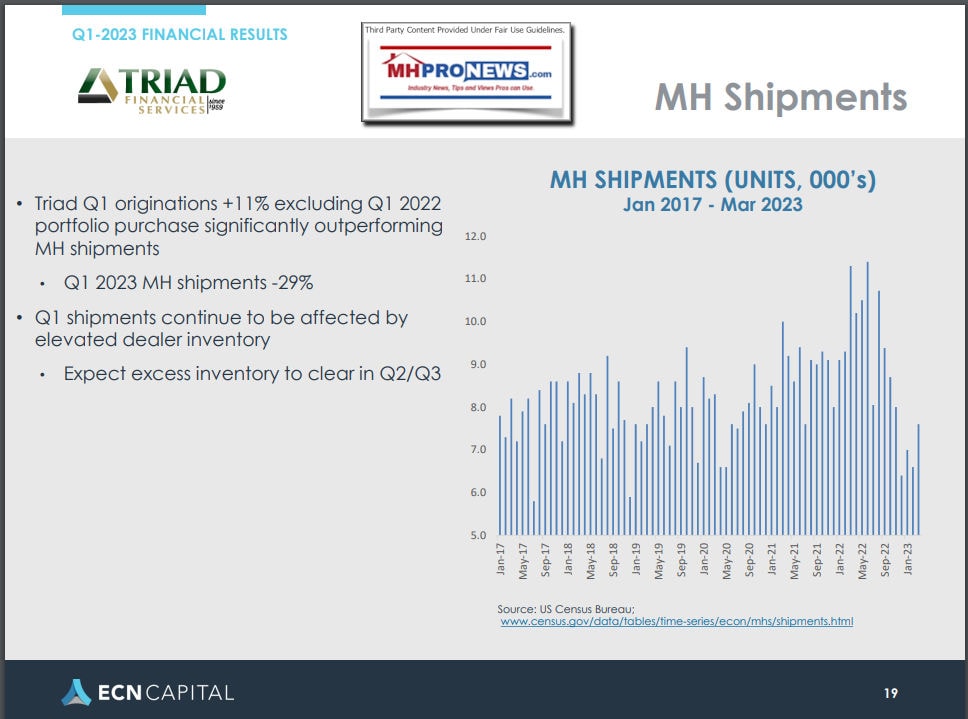

According to the information provided by ECN Capital (ECN) owned Triad Financial Services (TFS or Triad) company shown in this report: “Q1 2023 MH shipments -29%” (i.e.: down 29 percent)” which is in alignment with the data provided by the Manufactured Housing Association for Regulatory Reform (MHARR = “Cumulative production for 2023 is now 21,174 homes, a 28.6% decrease from the 29,670 homes produced over the same period during 2022”). That noted, ECN’s Triad notably boasts that “Triad Q1 originations +11%” “significantly outperforming MH shipments.” Given that Triad has a reputation for originating loans on generally higher quality credit score customers, it is one of several possible positive takeaways from the report that follows.

No two companies are exactly alike. Analogies between companies inevitably ‘limp’ at some point. Those stating the obvious disclaimers noted, Triad Financial Services and Legacy Housing – which to some extent are in different aspects of the manufactured housing industry – nevertheless have something in common. That would be that each is bucking the trends reported by the broader manufactured home industry. Both Triad and Legacy are Manufactured Housing Institute (MHI) members. But each have in some ways avoided some of the controversial aspects of that Arlington, VA based national manufactured housing trade association.

- Part I of this report will include pages of information from the ECN Capital (ECN) investor relations (IR) ‘pitch deck’ (PowerPoint presentation).

- Part II will provide additional information with more MHProNews analysis and commentary in brief.

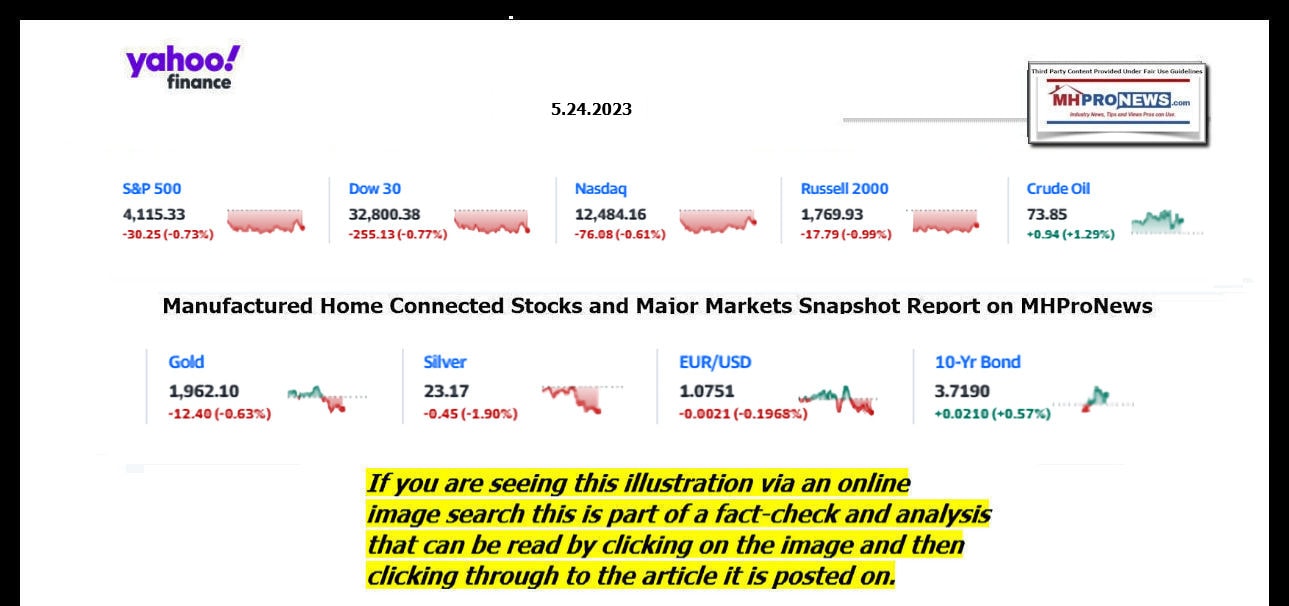

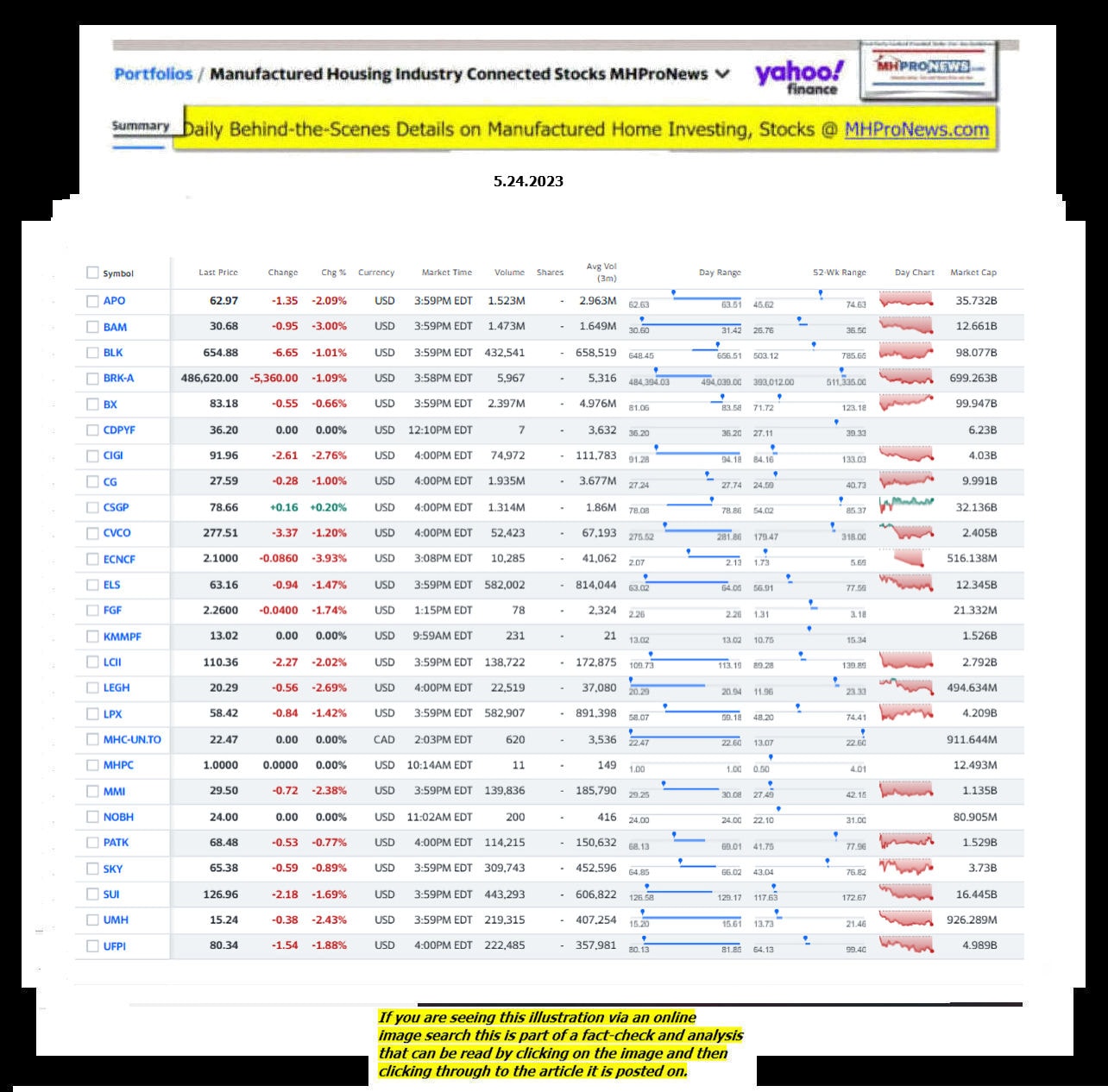

- Part III is our Daily Business News on MHProNews macro-markets and manufactured housing connected stocks update. Note that: “Dow drops for a fourth straight day on U.S. default worries as debt ceiling talks stumble,” per left-leaning CNBC.

With that outline for this report it is time to jump into insights per Triad’s parent company ECN Capital (ECN). Each of the quoted items are from the ECN Investor Relations pitch deck.

Part I – Official Financial Results, Per ECN’s 5.15.2023 1Q 2023 Report

In no particular order of importance are the following data points about Triad Financial Services (TFS) per their parent company ECN.

- Founded in 1959

- National lender licensed in 47 states

- 3,000+ dealer point-of-sale network

- Low-cost customer acquisition

- Only independent platform with a full product set

- Superprime/Prime – Core

- Near-Prime – Silver

- Subprime – Bronze

- ~$4.7 billion managed assets

- ~$1.5 billion annual originations

Manufactured Housing Highlights

| Select Metrics (US$, millions) | Q1

2023 |

Q1

2022 |

| Originations | 286.2 | 286.6 |

| Period end managed portfolios | 4,670.0 | 3,247.9 |

| Origination revenue | 18.0 | 19.8 |

| Servicing & other revenue | 24.7 | 10.4 |

| Revenue | 42.7 | 30.2 |

| Adjusted EBITDA | 24.5 | 15.3 |

| Adjusted operating income before tax | 11.2 | 12.6 |

Note that EBITDA means: earnings before interest, taxes, depreciation and amortization.

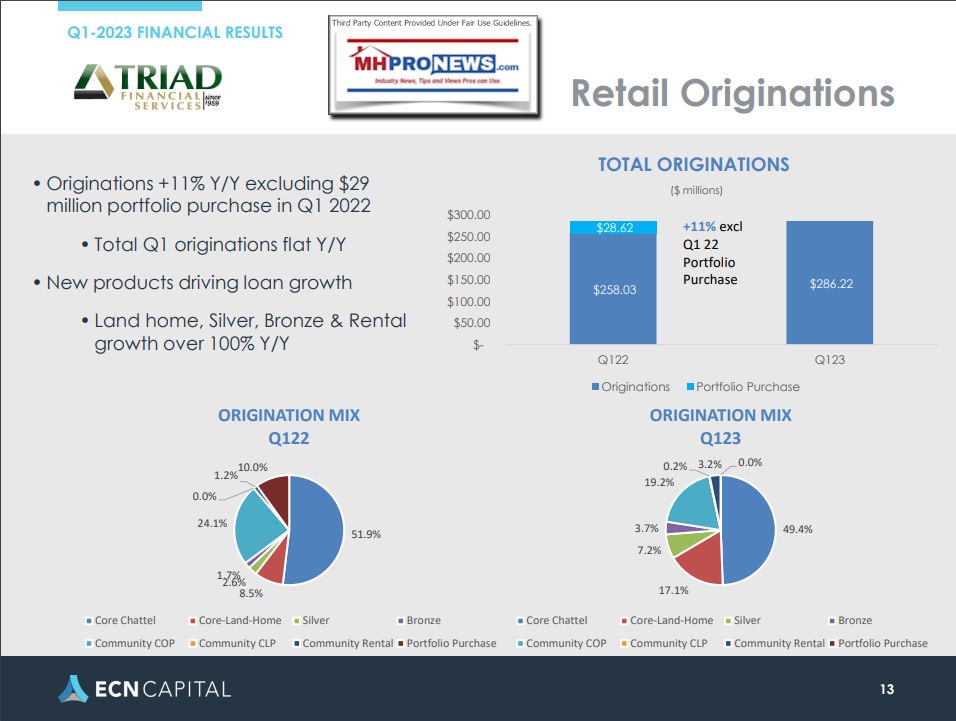

- Triad Q1 originations +11% Y/Y excluding portfolio purchased in Q1 2022

- New programs driving growth; Land home, Silver, Bronze & Rental up more than 100% Y/Y

- Lower gains on bulk loan sales reduced origination revenue by ~$6.3 million; Will normalize in Q3

- Managed assets increased 44% in 2023 to ~$4.7 billion with 83.4% fully serviced

- Fully funded for 2023 & into 2024

Q1 RESULTS

- Q1 Adj operating EPS of $0.01 MANUFACTURED HOUSING

- Triad Q1 originations +11% Y/Y excluding portfolio purchased in Q1 2022

- New programs driving growth; Land home, Silver, Bronze & Rental up more than 100% Y/Y

- Lower gains on bulk loan sales reduced origination revenue by ~$6.3 million; Will normalize in Q3

- Managed assets increased 44% in 2023 to ~$4.7 billion with 83.4% fully serviced

- Fully funded for 2023 & into 2024

Q1 Consolidated Operating Highlights

SUMMARY

- Total Originations were $465.1 million for the quarter, including $286.2 million of originations from Manufactured Housing Finance and $178.8 million from RV & Marine Finance

Balance Sheet

KEY HIGHLIGHTS

• Triad managed assets of $4.7 billion at the end of Q1

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

| Operating Expenses (US$, thousands) | Q1

2023 |

Q1

2022 |

| Manufactured Housing Finance | 18,158 | 14,831 |

- Q1 inventory finance assets (“IF”) at ~$467 million (MH IF & Red Oak) +112% Y/Y

- IF flow partner to launch in Q2 enabling accelerated growth

- Triad fully funded for 2023 & into 2024

- Additional funding partnerships in advanced discussions; launches expected in Q2/Q3 2023

The entire 1Q – 2023 ECN IR presentation is found as a download at this link here.

Part II – Additional Information with More MHProNews Analysis and Commentary

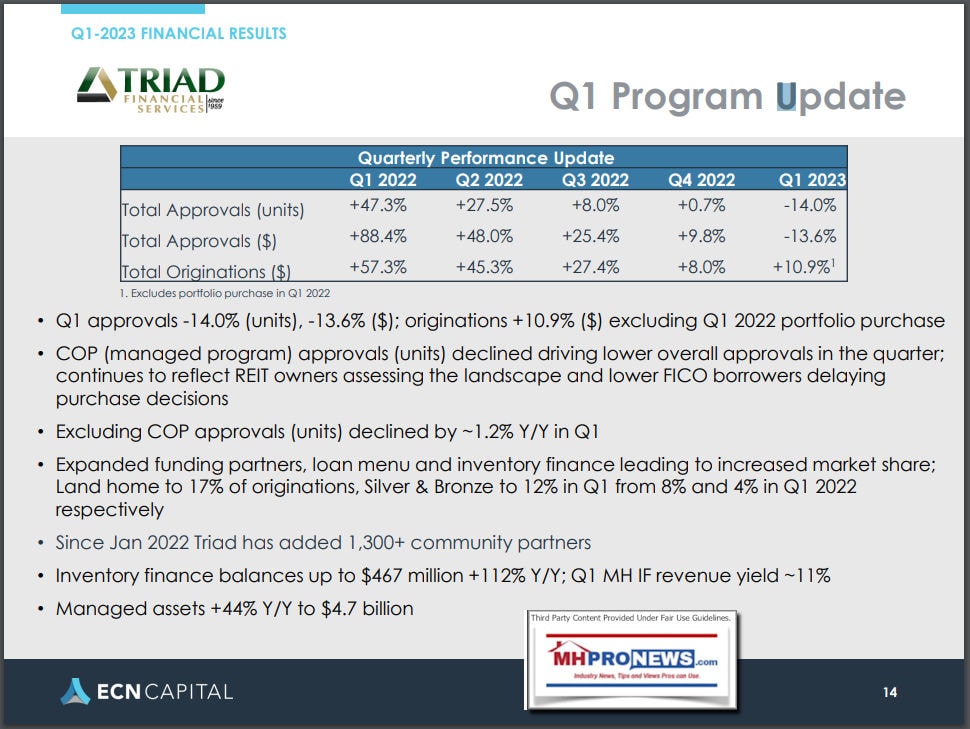

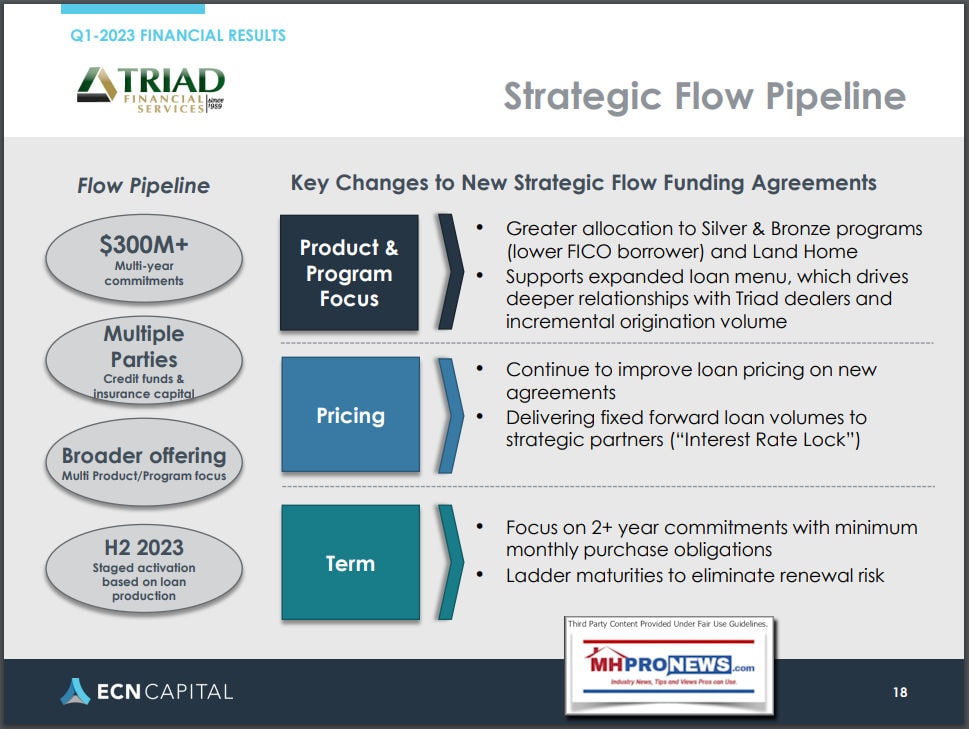

As was noted above, the following merits emphasis. Quoting ECN/Triad. Emphasis added by MHProNews. Note that COP for Triad means: Community Origination Program. As is noted below, these are land-lease communities that Triad has a “managed program” for manufactured home loans.

-

- COP (managed program) approvals (units) declined driving lower overall approvals in the quarter; continues to reflect REIT owners assessing the landscape and lower FICO borrowers delaying purchase decisions

- Excluding COP approvals (units) declined by ~1.2% Y/Y in Q1

- Expanded funding partners, loan menu and inventory finance leading to increased market share; Land home to 17% of originations, Silver & Bronze to 12% in Q1 from 8% and 4% in Q1 2022 respectively

- Since Jan 2022 Triad has added 1,300+ community partners

- Inventory finance balances up to $467 million +112% Y/Y; Q1 MH IF revenue yield ~11%

- Managed assets +44% Y/Y to $4.7 billion

Triad was asked by MHProNews to disclose the number of their ‘retail’ locations, but declined comment, perhaps because the request to the party contacted came too late in the business day. The fact that they have disclosed above adding 1300 new community partners could be understood as retail locations that are obviously not street retailers.

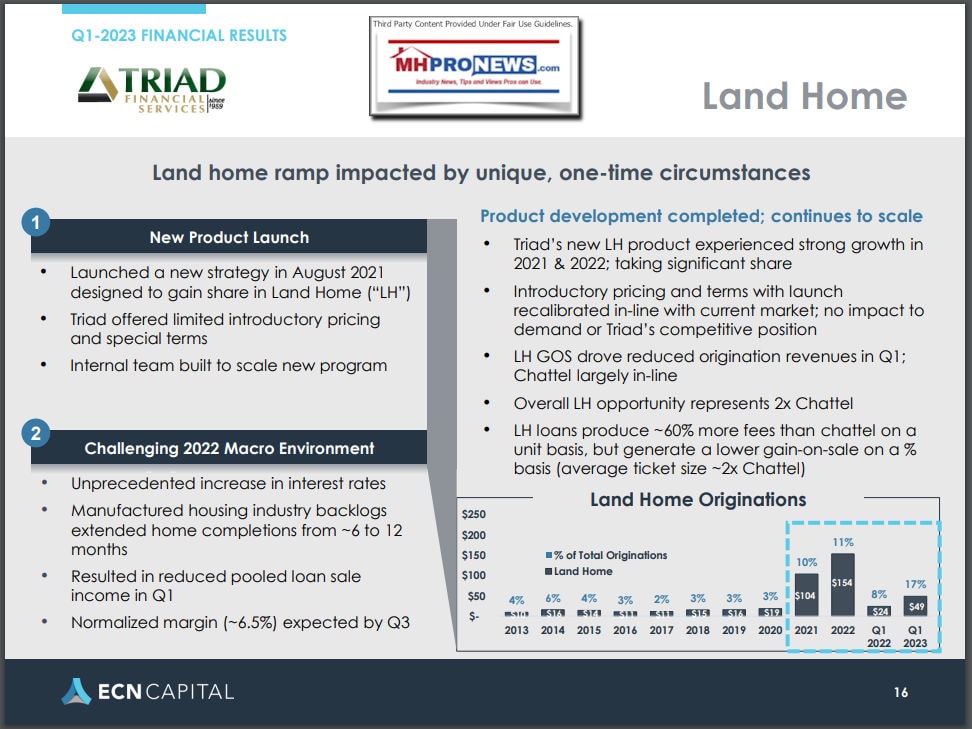

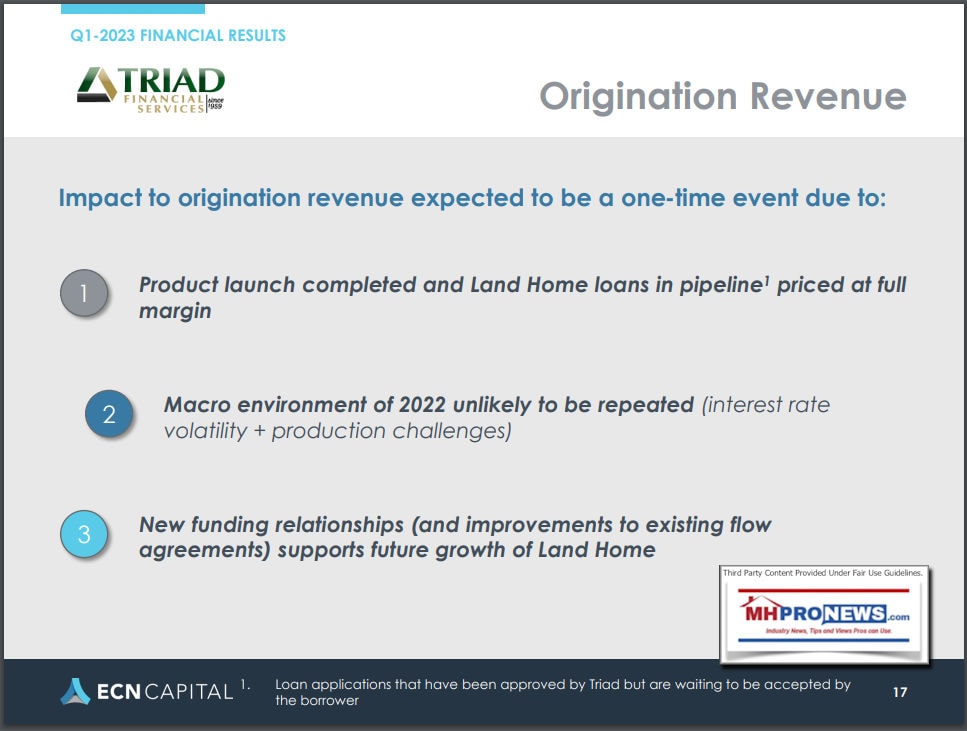

Also worth recapping from the above are these points from page 17 of ECN’s Triad segment of their IR pitch deck. Regarding their relatively recently launched land home loan program is the following, not necessarily in the order chosen by ECN/Triad.

- Launched a new strategy in August 2021 designed to gain share in Land Home (“LH”)

- Triad offered limited introductory pricing and special terms

- Internal team built to scale new program

Challenging 2022 Macro Environment

- Unprecedented increase in interest rates

- Manufactured housing industry backlogs extended home completions from ~6 to 12 months”

2022 ‘Production Backlogs’ and Related

Before pressing on, regarding the highlighted item above. MHProNews has heard from the manufactured home street retail segment of the industry. There are self-stated reports of location closures due in part to the long delivery times. Should Congress, state AGs, antitrust regulators, or others decide to actively probe the manufactured housing industry for possible market manipulation, this is an arena that might prove of interest. Vertically integrated firms – those retail centers that are owned by the factory that produced the HUD Code manufactured homes – could prove more resilient in any disruption of the marketplace, including those caused by ‘long delivery times.’

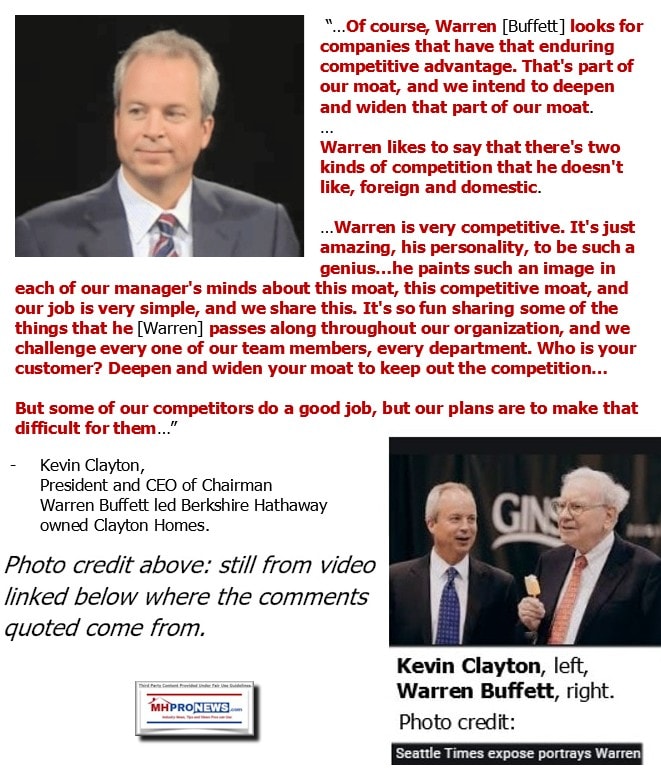

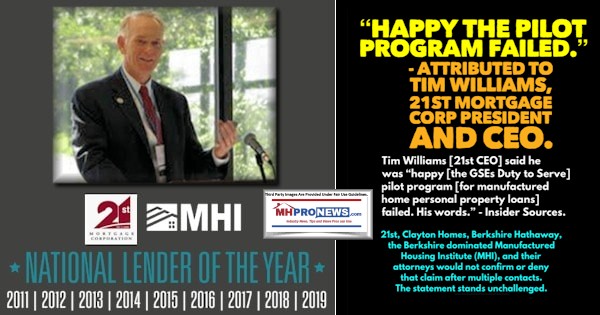

Longer delivery times pushed some so-called street retailers into buying more inventory. As rates rose and sales slowed due to what ECN/Triad identified as “borrowers delaying purchase decisions” pressures on marginal but previously profitable independently owned firms could tip them into selling out, closing, etc. Recall that tip to MHProNews regarding a well-placed source asserting knowledge that 21st Mortgage Corporation (BRK) keeps a close eye on cash flow and other developments for retailers. Market contractions – which to some extent could be artificially exacerbated by financial, zoning/placement, supply disruptions, etc. – can be used as part of a moat move by anyone willing to exercise that type of strategy. Recall Kevin Clayton’s video recorded remarks, during what could be described as a pro-Berkshire softball interview, quoted below. The fourth paragraph is the punchline, but every phrase quoted ought to be of keen interest to numbers of industry professionals, attorneys, and public officials.

As to interest rates, those with a critical eye to the purported and evidence-based machinations of the Manufactured Housing Institute (MHI) and the role that their ‘education’ programs may play in the steady consolidation of manufactured housing into ever fewer hands. As part of a May 24, 2023 email, MHI pitched to their readers the following.

“The Manufactured Housing Education Institute (MHEI) offers a wide variety of courses to further your knowledge and grow your business.”

“Whether selling homes as part of a land-home package or in a land-lease community, an educated sales staff is extremely important. The Professional Housing Consultant (PHC) program is essential for manufactured home retailers who need to know what motivates today’s home buyers and stay compliant with lending regulations, installation requirements, HUD Code regulations and more. Register for the PHC class here.” That word “here” links to a page on the MHI website that is NOT behind a “members only” login or paywall. Per MHI: “Registration Fee: $199.”

MHI’s 990 reveals several aspects of the organization that clarify that they get revenue from ‘education’ and ‘events.’

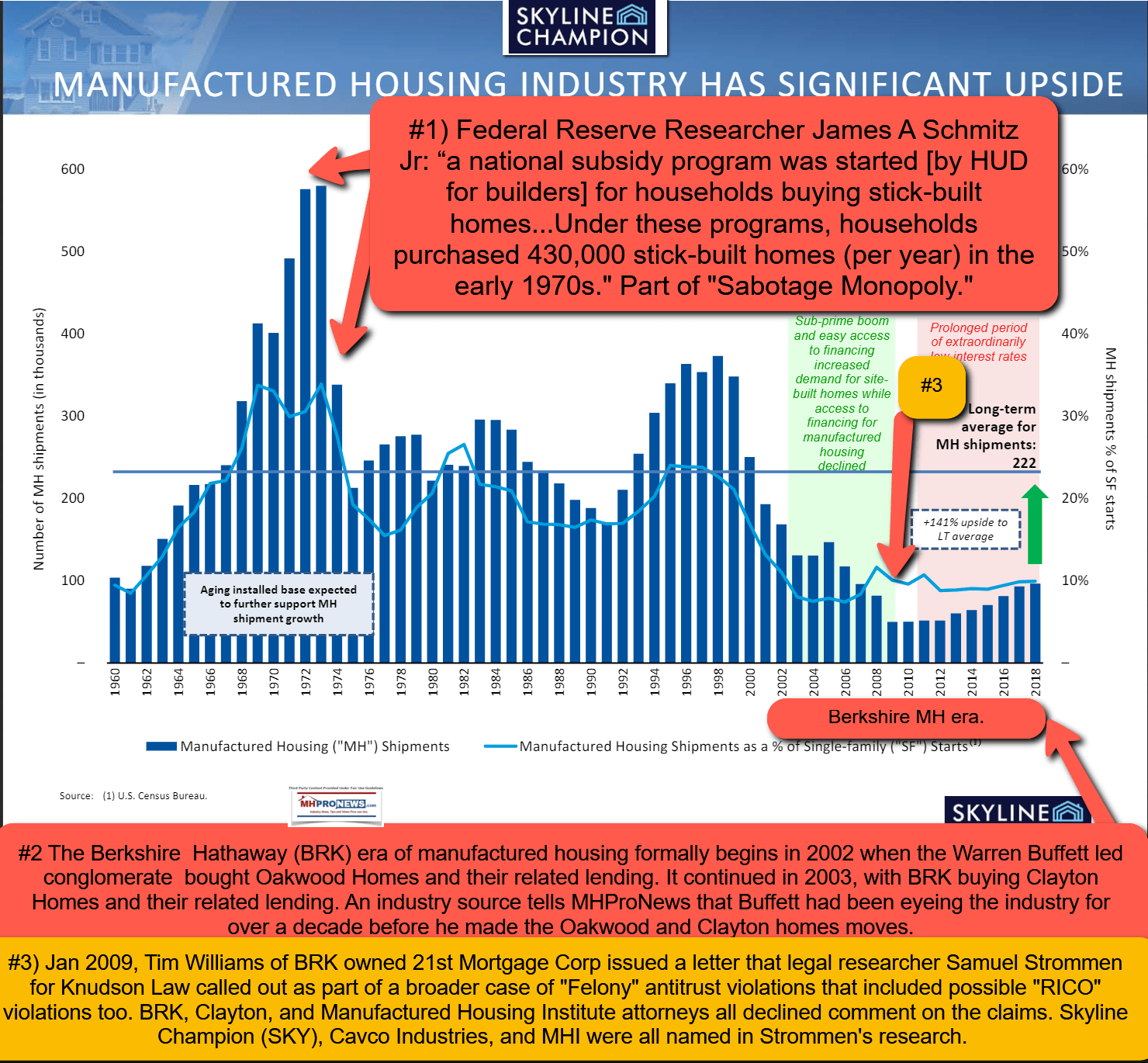

To the point of rising interest rates, anyone that recalls the President Jimmy Carter era and the 1980s know that interest rates were far higher then than now. Nevertheless, manufactured housing sales were much higher then than now.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Learning how to discuss with retail customers interest rates and other concerns they have is part of successful sales in manufactured housing, or any other industry for that matter that faces similar wrinkles. Yes, some people do delay purchases during periods of ‘uncertainty.’ But when a customer arrives at a retail center, they are to some degree asking to be sold. While all sorts of retailers – boat, RV, automotive, etc. – have day dreamers and ‘tire kickers,’ if someone is renting (for example) and rents are rising, it should be apparent that the proper guidance and engagement with a well trained sales professional should result in more closed deals.

In an arguably related remark, Legacy Housing’s President and CEO Duncan Bates remarked that sales people have gone in numbers of cases from being order takers to having to sharpen their sales skills once more.

Restated, each publicly traded firm that produces information relevant to the manufactured housing industry can be viewed on several different and interrelated levels. When public officials, for example, federal antitrust enforcement attorneys and staff, fail to intervene in a market when evidence of possible violations exists, over time, companies operating in that market recognize that they have to adapt to those market conditions. During the Trump era, per two different sources to MHProNews, top antitrust officials met to discuss the manufactured housing market. Antitrust enforcers have been mute on that point. To illustrate that point, Bing’s AI chat was asked the following.

Q: Did Trump Administration era antitrust officials meet to discuss manufactured housing industry?

The 4th link above is to this report linked below.

Pivoting back to ECN/Triad’s information. When Triad stated:

- Q1 shipments continue to be affected by elevated dealer inventory

That ought to be framed in the broader context. It can be argued that MHI has yet to address several internal industry issues in a meaningful and substantive way that might resemble the truth about the marketplace. As MHProNews has repeatedly pointed out, and others in the MHI ‘amen corner’ of what passes for much of the balance of MHVille trade media, the market shifted dramatically in the destination of manufactured housing orders in 2022 vs. 2021 and 2020, per MHI’s own data.

Quoting MHI’s “Quick Facts” for 2022, 2021, and 2020.

Production:

- 49% of new manufactured homes are placed on private property and 51% are placed in manufactured home

communities. (2022) - 69% of new manufactured homes are placed on private property and 31% are placed in manufactured home

communities. (2021) - 63% of new manufactured homes are placed on private property and 37% are placed in manufactured home

communities.

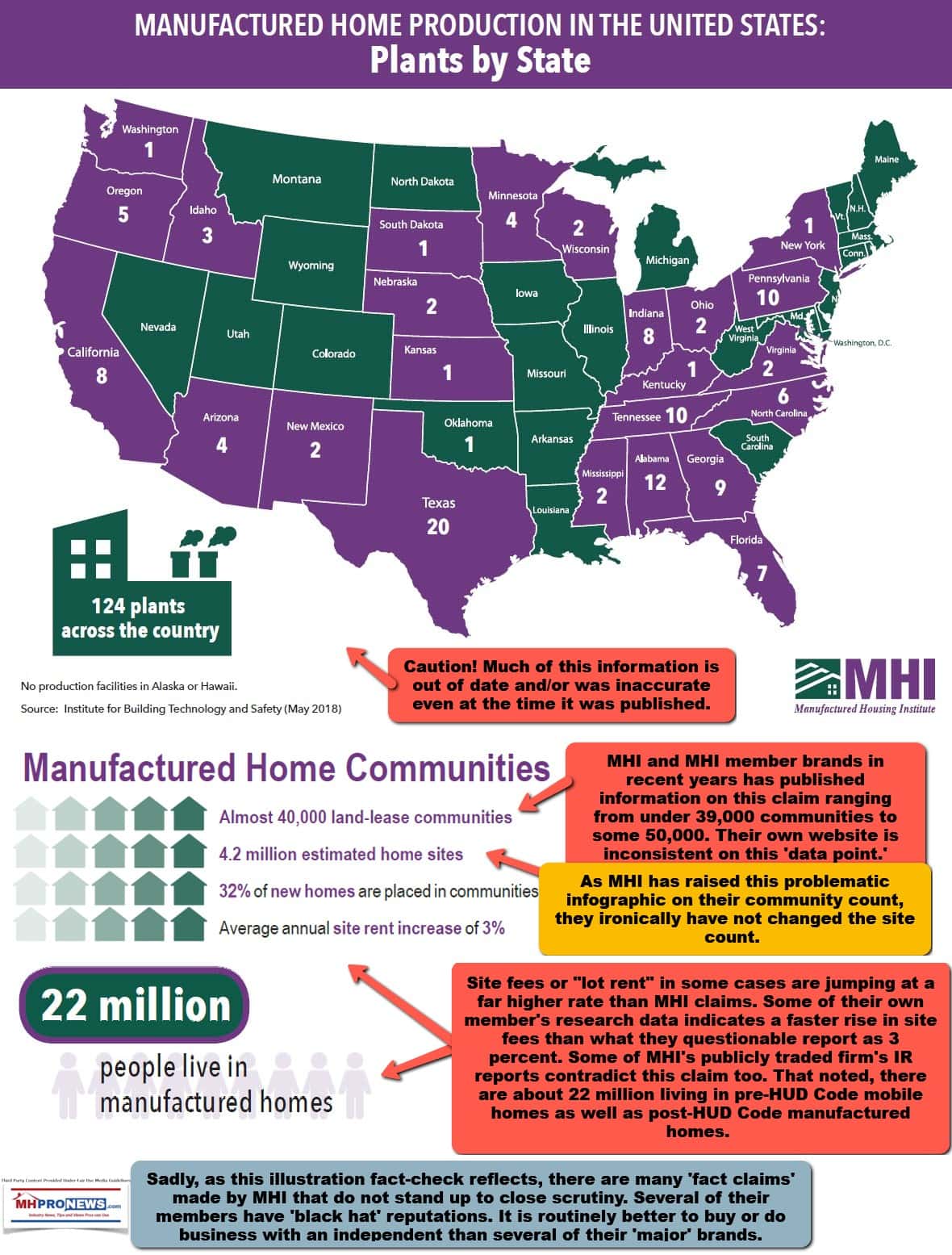

Of course, it must also be stressed that some ‘facts’ in MHI’s Quick Facts are arguably not accurate. It may take an expert to see what is or isn’t true, for instance, on the count of manufactured home communities, MHI has understated that count for years. For more on that see the linked reports below. It will be interesting to see if MHI will opt to correct those apparent inaccuracies on the community count in their 2023 ‘quick facts’ or not.

Federal officials have asserted that the total of manufactured home land lease communities (MHCs – sometimes inaccurately a.k.a. ‘mobile home parks’) of all sizes is over 50,000. Yet MHI has errantly reported totals of MHC locations in the thousands below that figure, including claiming in their 2020 quick facts that the total was some 40,000. Quoting MHI: “Almost 40,000 land-lease communities.” They had previously claimed that the total was 38,000. To those who monitor such ‘information’ but don’t have a solid understanding of manufactured housing in general, or the manufactured home community sector more particularly, it may appear that the MHC count is growing. But it is actually falling in the 21st century. It is but one more example of the problems associated with MHI and several specific MHI brands. This flashback below reflects several errors in MHI reporting. Oddly, MHI is at times contradicted by their own members published reports, which is why a careful look at figures from Triad or others is warranted. A company’s claims may be more accurate than MHI’s.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Triad is a potential example of a firm with a general ‘white hat’ reputation that is operating within a trade group that oddly hails so-called ‘black hat’ operations that have a poor reputation with the Better Business Bureau (BBB) or other consumer review organizations.

MHProNews may return to more insights from the ECN Capital (Triad parent) IR pitch and from other sources in the days ahead. But in summary, Triad’s data demonstrates that a firm can buck the trends successfully. Triad is also an example of why the Government Sponsored Enteprises (GSEs) of Fannie Mae and Freddie Mac arguably have no valid excuses for not fulling their Duty to Serve (DTS) manufactured housing, but that is another story for another time.

As with other manufactured housing industry tracked stocks, MHProNews has no position in this or other publicly traded firms. More to come from MHVille and beyond, stay tuned.

PS: a fair question is – how can any truth seekers believe MHI after they put out drivel like they did in this recent statement they made?

Part III – Daily Business News on MHProNews Markets and Headline News Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 5.24.2023

- The so-called X-date

- The US Treasury Department in Washington, DC, on May 8, 2023. – Treasury Secretary Janet Yellen said Monday that there is a “big gap” between the positions of US President Joe Biden and Republican leaders when it comes to a decision on raising the debt limit.

- Time is running out for a debt ceiling deal, yet one key player is still ‘confident’ disaster will be averted

- Fed officials debated need for rate hike at last meeting, minutes show

- Abercrombie & Fitch shares rise 30% on stellar earnings report

- Senate Democrats write to Google over concerns about abortion-seekers’ location data

- ‘It’s going to be catastrophic:’ The debt ceiling standoff is worrying for some Americans

- From Social Security to your investments, here’s how to prepare for a US default

- Filled Broadway seats hit pre-pandemic levels in first full season since Covid

- FTC investigates America’s baby formula shortages

- Don’t expect markets to rejoice if a deal is reached on the debt ceiling

- In a new BMW sedan, drivers can change lanes using just their eyes

- Meta’s business groups cut in latest round of layoffs

- Target removing some Pride merchandise after anti-LGBTQ threats against staff

- No surprises here: These are the top US consumer complaints, from cars to credit cards

- Lowe’s, scrambling for growth, has found a hot market: rural America

- Netflix begins password sharing crackdown in the US

- Will the debt ceiling debate finish the Fed’s inflation fight?

- Deutsche Bank and Citi admit anti-competitive activity in UK bond market

- UK inflation surprises for all the wrong reasons

- Cathay Pacific fires cabin crew over alleged discrimination against passenger from China

- Russia predicts trade with China will hit record $200 billion in 2023

- ‘Go to hell, Shell.’ Climate protests disrupt oil company’s shareholder meeting

- How the technology behind ChatGPT could make mind-reading a reality

- Former Fed Chair Bernanke argues economy must slow further to bring down inflation

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax 5.24.2023

- Jumping In: DeSantis Files Paperwork for GOP’s 2024 WH Primaries

- Rick Perry: DeSantis Twitter Announcement ‘Pretty Hip’

- Huckabee: DeSantis Must Explain 2024 Decision | video

- Whistleblower Attorney: Testimony Truthful | video

- Allen: Hard to Trust Biden Administration | video

- Meuser: Dems Want ‘Blank Check’ on Spending | video

- FBI Whistleblower: Agency’s Upper Echelon Must Go

- Megyn Kelly: Fox ‘Terrified’ of Losing Tucker Viewers | video

- Burgess: House Did Its Job on Debt Limit | video

- Steve Forbes: Massive Debt Crippling Economy | video

- Roger Stone: Trump ‘Existential Threat’ to Establishment | video

- Alford: Biden Must ‘Stay Off’ Farmers | video

- CNN Poll: 6 in 10 Say Cut Spending With Debt Limit Rise

- A majority 60% of Americans say spending cuts should accompany a debt ceiling increase, according to a CNN poll…. [Full Story]

- Biden Spending Freeze Would Save $1 Trillion: Treasury

- McCarthy Sends Debt Negotiators to White House; Sides ‘Far Apart’

- Steve Forbes to Newsmax: Massive Debt Crippling Economy

- Social Security, Health Care Likely Default Casualties

- Trump Lawyers Want AG Meeting Over Unfair Treatment

- Attorneys for Donald Trump complained to Attorney General Merrick [Full Story]

- Florida Gov. DeSantis Files ’24 GOP Primary Campaign

- Florida Gov. Ron DeSantis entered the 2024 presidential race [Full Story]

- DeSantis Launching ’24 Run Wednesday With Musk on Twitter |video

- Musk Wants Someone ‘Fairly Normal’ for President in ’24

- Allan Ryskind: The DeSantis-Trump Donnybrook |video

- Megyn Kelly to Newsmax: Fox News ‘Terrified’ of Post-Tucker Viewer Loss

- Journalist and commentator Megyn Kelly told Newsmax that her old [Full Story] | video

- Trump: Turn Off Laura Ingraham, Watch Greg Kelly

- Fox News Employee Handbook Embraces Woke Gender Rules

- Bongino: Fox Firing Tucker ‘Enormous Catastrophic Mistake’

- Wall Street Sinks as Investors Eye Debt Ceiling

- Wall Street fell again Wednesday as stocks tumbled worldwide on [Full Story]

- Catholics Slam MLB Team’s Capitulation to ‘Hate Group’

- The Los Angeles Dodgers took another swing and this time they [Full Story] | Platinum Article

- Pro-Life Group Hails DeSantis’ Record

- Susan B. Anthony Pro-Life America hailed Florida Gov. Ron DeSantis’ [Full Story] | video

- NAACP’s Florida Travel Ban ‘Pure Partisan Activism’

- Florida’s sunshine, beaches, and theme parks typically sell the [Full Story] | Platinum Article

- Tucker Carlson Rebuilds Studio Fox Dismantled

- Fox News reportedly dismantled Tucker Carlson’s Maine studio earlier [Full Story] | video

- WHO Condemns Russia’s Aggression in Ukraine

- The World Health Organization assembly passed a motion on Wednesday [Full Story]

- Related

- Viktor Orbán: ‘No Victory’ for Ukraine on ‘Battlefield’

- Pentagon: Ukraine Has ‘Strong Hand’ for Counteroffensive

- Kremlin: Ukraine Border Raiders Using Western-Made Military Hardware

- EU: On Track for 1M Ammo Rounds to Ukraine

- Medvedev: Western Arms to Ukraine Heighten Risk of ‘Nuclear Apocalypse’

- Fed Economists Still Expect ‘Mild Recession’

- US Federal Reserve economists still expected a “mild recession” at [Full Story]

- On Anniversary of Uvalde, Biden Urges More Gun Control

- As families and loved ones mourn the unimaginable loss of 19 children [Full Story]

- Ethics Committee Ends Swalwell Probe: No Action Taken

- The House Ethics Committee informed Rep. Eric Swalwell, D-Calif., [Full Story]

- Luna Seeks $16M Fine Against Adam Schiff

- Florida GOP Rep. Anna Paulina Luna has filed a privileged resolution [Full Story]

- Texas AG Paxton Likely Broke Laws: GOP Investigation

- A Republican-led investigation on Wednesday accused Texas Attorney [Full Story]

- IRS Opened Matt Taibbi Probe Amid Twitter Files Exposé

- Twitter Files journalist Matt Taibbi revealed he is under [Full Story] | video

- ‘Queen of Rock ‘n’ Roll’ Tina Turner Dies at 83

- Tina Turner, the singer who left a hardscrabble American farming [Full Story]

- MAGA PAC Ad: DeSantis Fought Trump’s Agenda

- The Make America Great Again PAC on Wednesday chided Florida Gov. Ron [Full Story]

- Inflation Not Declining as Fast as Fed Would Like

- Federal Reserve officials were divided earlier this month on whether [Full Story]

- CNN: 53 Percent of Republicans Support Trump

- More than half of Republican voters support former President Donald [Full Story]

- Convicted Murderer Murdaugh Faces New Charges

- Convicted murderer Alex Murdaugh is facing federal charges for the [Full Story]

- FTC Probing Abbott, Other Formula Makers for Collusion

- The U.S. Federal Trade Commission is investigating whether [Full Story]

- Musk Signals Twitter’s HQ May Leave San Francisco

- Twitter might not keep its headquarters in San Francisco forever, its [Full Story]

- Texas Ten Commandments Bill for Schools Dies in House

- A bill that would have required Texas public school classrooms to [Full Story]

- Oakland A’s Reach Tentative Deal on Las Vegas Stadium

- Nevada Republican Gov. Joe Lombardo announced Wednesday that his [Full Story]

- JPMorgan Can Sue Former Exec Over Epstein Ties: Judge

- A U.S. judge Wednesday rejected former JPMorgan Chase & Co. executive [Full Story]

- Haley Spot Pans DeSantis as ‘Echo’ of Trump

- Nikki Haley’s presidential campaign, through a new advertising spot, [Full Story]

- Biden Spending Freeze Would Save $1 Trillion: Treasury

- President Joe Biden offered to freeze government spending at current [Full Story]

- Target Says It’s Pulling Back Some Pride Merchandise

- Target said Wednesday that it’s removing some of its Pride Month [Full Story]

- Senior FBI Official Admits She Didn’t Read Durham Report

- A top FBI official appeared before a House panel and admitted that [Full Story]

- Trump May Benefit From Growing GOP Primary Field

- The more the 2024 Republican presidential primary field increases, [Full Story]

- Old Camera Found in the Deep Ocean Reveals Horrifying Titanic Photos

- DOJ to Clamp Down on Short Sellers

- Yellen Calls Greater Bank Concentration Unwise

- Bill Donohue: Drugs, Hard Core Criminals Real Threat to America

- Yields on Treasury Bills Maturing in June Jump to 7%

- More Finance

- Health

- Boost Your Health in Just 5 Minutes Daily

- We can all spare five minutes throughout the day. Instead of mindlessly scrolling through social media posts, simply moving and breathing instead can reap huge health benefits. While many people say their busy schedules don’t allow time for formal exercise, experts say a…… [Full Story]

- Women More Likely Than Men to Die After Heart Attack

- Illegal Use of Ketamine Rising Sharply in US

- New Study Links Daily Multivitamins to Memory Boost

- Jeff Bridges Reveals Tumor Has Shrunk to ‘Size of a Marble’

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

2022 was a tough year for many stocks. Unfortunately, that pattern held true for manufactured home industry (MHVille) connected stocks too.

See the facts, linked below.

====================================

Updated

-

-

- NOTE 1: The 3rd chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

- Manufactured housing, production, factories, retail, dealers, manufactured home, communities, passive mobile home park investing, suppliers, brokers, finance, financial services, macro-markets, manufactured housing stocks, Manufactured Home Communities Real Estate Investment Trusts, MHC REITs.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.