Tying together the latest Cavco Quarterly Earnings Call on 2.3.2024, provided below, with the famous line from the hit action movie National Treasure: “If there’s something wrong, those who have the ability to take action have the responsibility to take action” uttered by Nicholas Cage’s fictional character Benjamin Franklin Gates is a bit of fun. But the topic herein is arguably serious, not humorous. The challenge at times is that the behavior of some corporate and Manufactured Housing Institute (MHI) leaders is arguably so comic, so ludicrous, that it is tempting to merely lampoon them. For an informed manufactured housing industry professional, some of what is said is laughable. A case can be made that both factual takes, and satirical ones, can be useful. This video clip from National Treasure where character Gates utters that line was used by an Australian group to illustrate a point in their own nation in our times.

As with many such earnings calls, what is unsaid that logically should have been addressed is relevant. But some of what is said is not only relevant, it is remarkable. Those remarks along with what was not said in this earnings call but was said by Cavco and/or others previously will be unpacked in Part II, further below.

Cavco’s leadership has a fiduciary duty to its shareholders. The Manufactured Housing Institute’s board also has a fiduciary duty to all of the members, not just corporate insiders. Are each body exercising that fiduciary duty properly? If not, what steps are those who have the ability to act taking to correct it?

Part I

Highlighting and bracketed edits as shown are by MHProNews, the base transcript is per the source as shown.

Q3 2024 Cavco Industries Inc Earnings Call

Thomson Reuters StreetEvents

Sat, February 3, 2024 at 4:56 AM EST·33 min read

Participants

Mark Fusler; Director of Financial Reporting & IR; Cavco Industries, Inc.

Bill Boor; President, CEO; Cavco Industries, Inc.

Allison Aden; EVP, CFO & Treasurer; Cavco Industries, Inc.

Paul Bigbee; CAO; Cavco Industries, Inc.

Daniel Moore; Analyst; CJS Securities, Inc.

Gregory Palm; Analyst; Craig-Hallum Capital Group LLC [MHProNews note: per edited transcript, this was Danny Eggerichs in for Palm]

Jay McCanless; Analyst; Wedbush Securities Inc.

Camden Roberts; Analyst; University of South Carolina

Presentation

Operator

Good day, and thank you for standing by, and welcome to the Third Quarter Fiscal Year 2024 for Cavco Industries Inc. Earnings Call Webcast. At this time, all participants are in a listen only mode. After the speakers’ presentation, there will be a question and answer session to ask a question. During the session, you will need to press star one one on your telephone. You will then hear an automated message advising that your hand is raised. To withdraw your question, please press star one one again. Please be advised that today’s conference is being recorded.

I would now like to hand the conference over to your speaker, Mark Butler, Corporate Controller and Investor Relations.

Please go ahead.

Mark Fusler

Good day, and thank you for joining us for Cavco Industries Third Quarter Fiscal Year 2024 earnings conference call. During this call, and you’ll be hearing from Bill Boor, President and Chief Executive Officer, Allison Aden, Executive Vice President and Chief Financial Officer, and Paul Dickie, Chief Accounting Officer.

Before we begin, we’d like to remind you that the comments made during this conference call by management may contain forward looking statements, including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or use cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions. All forward-looking statements involve risks and uncertainties which could affect Cavco’s actual results and could could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco encourage you to review Cavco’s filings with the Securities and Exchange Commission, including without limitation, the Company’s most recent Forms 10-K and 10-Q, which identify specific factors that may cause actual results or events to differ materially from those described in any forward-looking statements in this conference call also contains time-sensitive information that is accurate only as of the date of this live broadcast Friday, February second, 2024. Cavco undertakes no obligation to revise or update any forward-looking statement, whether written or oral to reflect events or circumstances after the date of this conference call, except as required by law.

I will now like to turn the call over to Bill Boor, President and Chief Executive Officer.

Bill.

Bill Boor

Welcome and thank you for joining us today to review our third quarter results. While the earnings release focuses on year-over-year comparisons in this market, I believe that to quarter developments are more relevant to understanding current market dynamics. It’s not to disregard any insights and bigger picture takeaways regarding the dynamics a year ago relative to day last year. We were a couple of quarters into the effect of rising interest rates. Industry backlogs were higher than now, but they were declining rapidly and the pace and direction of backlogs is generally more important than the level as we wrapped up this third quarter.

Great. In fact, on a same plant basis, we have now seen five quarters of increasing net orders and backlogs are stabilized, albeit at low capacity utilization. So while economic uncertainty remains, the trends are pointed in the right direction as we emerge from the typically slower winter and holiday months. The positive trending we are seeing in the market is coming from the dealer channel. Their traffic remains healthy and conversions are improving. Buyers are adjusting to the now steadier interest rates and to the reality of how much home they can afford. The underlying need for affordable housing is coming to the forefront and driving modest but meaningful quarter-to-quarter order improvements as discussed over the past few quarters, community orders continued to be off considerably as industry backlogs decreased in the latter part of 2022. Deliveries to communities accelerated, which resulted in excess community inventories going into calendar 2023. The issue is not whether there are buyers or renters once a given unit is put into service, it’s how quickly the units can be permitted and set to reduce the inventory and resume more normal orders. In other words, placements are occurring at a much higher pace than orders until balances reestablished the natural question is when will this balance be achieved? Of course, varies by operator and location. However, the outlook for this calendar year is considerably better than last. Based on our discussions with community operators and developers. We expect we will see increased community orders as the year unfolds.

Against that market backdrop, we’ve stabilized our backlog over the past three quarters by matching production to the pace of orders or capacity utilization remained steady this quarter, about 60%. And while the value of orders in the backlog declined from $170 million last quarter to 160 million in Q three. The number of units in the backlog increased 3%. Quarter Ending backlog represents five to seven weeks of production, consistent with last quarter at stability is an important point coming through the winter months and heading into what we typically would expect to be better selling months. We have a number of plants operating at reduced schedules that are looking to increase when the market supports.

On the margin side, pricing has been relatively stable while our overall factory-based housing gross margin declined 0.8% sequentially. This was driven more by the cost side and how cost of goods sold flowed through our manufacturing and retail sales. Big picture margins remain healthy at 22.4% in our housing segment and prices are continuing to hold for the most part. Overall, our quarterly revenue was down about 1% sequentially to $447 million and pretax income dropped from $52 million last quarter to $44 million before repurchases. And after acquisitions, cash flow was about positive $25 million. We used $50 million to repurchase shares, which resulted in our cash balance being down $24 million relative to last quarter. Before handing the call over, it was good to see many of you at the Louisville show a couple of weeks ago among a number of other innovative homes. We brought our new Anthem series duplex to Louisville, the Anthem as the first nationally available HUD approved multifamily unit. We’re very excited about the affordability benefits these homes offer and the interest level has been tremendous, particularly with developers and community operators. I also wanted to recognize and welcome Dustin Ewing and the people from Kentucky Dream Homes to the Cavco family. Kentucky Dream Homes operates five well-managed sales centers in Kentucky and Florida and we joined forces through an acquisition in the third quarter. Thus and his team are strong operators and great people to be associated with. And we’re very excited to be on the same team.

With that, I’d like to turn it over to Alison to discuss the financial results in more detail.

Allison Aden

Thank you, Bill. Net revenue for the third fiscal quarter of 2024 was $446.8 million, down $53.8 million or 10.8% compared to $500.6 million during the prior year. Sequentially, net revenues decreased $5.3 million, driven by a reduction in units sold, partially offset by higher revenues in financial services within the factory-built housing segment net revenue was $427 million, down $54.2 million or 11.3% from $481.2 million in the prior year quarter. The decrease was primarily due to a 13.7% decline in base business unit volume and a 5.3% decline in average revenue per home sold, partially offset by the Solitaire acquisition, which contributed $33 million during the quarter. The decrease in average revenue per home revenue per home was primarily due to more single wides in the mix and to a lesser extent, a decline in product pricing sequentially.

For the factory-built housing segment, net revenue was down $7.1 million or 1.6% from $434.1 million. The decrease was primarily due to a 2.1% decline in units sold, partially offset by higher average revenue per home, primarily due to more double wides in the mix and a higher proportion of homes sold through our Company owned stores. Factory utilization for Q3 of 2024 was approximately 60% when considering all available production days, but with nearly 70% excluding scheduled downtime for market or whether this utilization level was consistent with the past three quarters.

Financial Services segment net revenue increased 2.1% to $19.8 million from $19.4 million, primarily due to more insurance policies in force, partially offset by fewer loan sales.

Consolidated profit in the third fiscal quarter as a percentage of net revenue was 23.1%, down 330 basis points from 46.4% in the same period last year. In the factory-built housing segment, the gross margin decreased 310 basis points at 22.4% in Q3 of 2024 versus 25.5% in Q3 of 2023, driven by lower average selling prices and volumes, partially offset by lower input costs per floor comparing to the sequential fiscal Q2 of 2024, while average selling prices increased due to a higher proportion of homes sold through company-owned retail stores, cost per unit sold also increased with a net effect in an 80 basis point reduction in factory built housing gross margin. Gross margin as a percentage of revenue in financial services decreased to 36.8% in Q3 of 2024 from 46.6% in Q3 of 2023 from higher insurance claim activity.

Financial services gross margin increased sequentially 90 basis points to 36.8% from 35.9% due to higher net insurance premiums earned, selling, general and administrative expenses in Q3 of 2024 were $63.3 million or 14.2% of net revenue compared to $58.9 million or 11.8% of net revenues during the same quarter last year. Sequentially, SG&A increased $1.8 million increase in both periods is primarily due to higher costs in Q3 of 2024 related to the ongoing litigation between indemnified former officer of the NESCC., as well as higher compensation expense from acquisitions.

Interest income for the third quarter was $5.2 million, up 46.2% from the prior year quarter and down 9.9% over the sequential quarter. The increase over the prior year is primarily due to higher interest rates, whereas the sequential decrease is related to a lower average cash balance over the period.

Interest expense this quarter was $0.8 million compared to $0.2 million in the prior year quarter. Interest relates to adjustments of our redeemable non-controllable interest in Craftsman home LLC. Net other expense this quarter was $0.2 million compared to $0.3 million in the prior year quarter. Pretax profit for Q3 2024 was $43.9 million, down $32.2 million from the prior year period. Effective income tax rate was 18% for the third fiscal quarter compared to 21.7% in the same period last year. The change between periods is primarily the result of higher benefits from stock option exercises.

Net income attributable to Cavco shareholders was $36 million compared to net income of $59.5 million in the same quarter of the prior year. And diluted earnings per share in Q3 of 2024 was $4.27 per share versus $6.66 per share in last year’s third quarter.

Before we discuss the balance sheet, I’d like to take a minute to talk further about capital allocation. As announced with our press release, the Company’s Board of Directors approved a new $100 million stock repurchase program that can be used to purchase its outstanding common stock. This increases the total available to $139 million, including the amount remaining under the program announced in 2023 after our purchase of $50 million this quarter, our strategic capital allocation priorities remain an improvement, further acquisitions and ongoing evaluation of the opportunities in our lending operation. We continue to use stock buybacks as a tool to responsibly manage our balance sheet. Now I’ll turn it over to Paul to discuss the balance sheet.

Paul Bigbee

And Callison.

So I’m going to cover the changes in the December 30th, 2023 balance sheet from April first, 2023, our cash balance was $352.8 million, up $81.4 million or 30% from $271.4 million at the end of the prior fiscal year. The increases are primarily due to net income adjusted for noncash items such as depreciation and stock compensation expense and working capital adjustments, including the following inventory decreases, which provided $51.2 million from lower balances of raw materials at our production facilities and finished goods at our retail locations, decrease in accounts receivable of $18.2 million. Prepaid, another asset decreases provided $9.9 million. Primary uses of cash for the nine months. Offsetting the above include decreases in accounts payable, accrued expenses and other liabilities of approximately $23 million, our acquisition of five retail stores and associated inventory for $19.7 million in share repurchases for $96.8 million outside of cash, consumer and commercial loans decreased from the paydown of the associated loans that were greater than the amount of new loan originations, prepaid and other assets was lower due to lower prepaid income taxes and a reduction in delinquent Fannie Mae loans. The remaining change is due to normal amortization of prepaid property, plant and equipment net is down from the sale of unutilized equipment acquired with Solitaire home accrued expenses and other current liabilities are down from lower accrued bonuses, customer deposits and commission taxes.

Lastly, stockholders’ equity exceeded $1 billion, up $32.4 million from $976.3 million as of April first, 2023.

Now I’ll turn it back to Bill.

Bill Boor

Thanks.

Thanks, Paul. Tony, why don’t we just go ahead and turn it over for questions.

Question and Answer Session

Operator

Certainly, ladies and gentlemen, if you do have a question at this time please press star one one on your telephone and wait for your name to be announced. To withdraw your question, please press star one again. Please stand by while we compile the Q&A roster. And one moment for our first question, which will come from Daniel Moore, CG. and securities. Your line is open.

Daniel Moore

Good morning, Bill Allison, Paul.

Good afternoon. I should say off the East Coast, but thanks for the time and taking the questions on maybe start with your kind of outlook, what are your expectations for sequential growth in production and shipments in terms of both modules as well as the number of homes as we look to the March quarter relative to December and a similar question, what are your expectations for average selling price.

Bill Boor

And then um, so you know, we don’t give guidance. And I guess every time we get asked that question, I always feel like we’re in a at a point. It always feels like we’re in a point where it could go one way or the other rate. I think of you probably took from some of my comments that the general feeling is pretty positive going into the spring, the that’s mostly coming from just how well the dealer channels going. And so we feel like we’re in a position to respond to the upside and that’s where most of our most of our energies are at this point is getting ready for that upside. But we don’t have the specifics and our expectation to share at this point.

Daniel Moore

Understood. I guess what would it maybe talk about when you would expect to have a better sense of the true underlying demand right now?

It’s been improving sequentially and certainly strong kind of seasonal perspective. But you know, by April May, when do you have a better sense for whether you might be in position to start to ramp production?

Bill Boor

Yes, absolutely are. We’re sitting here beginning of February, always making very general statements when we do a market locally, as I always remind everyone. But I think internally we’re kind of looking until late February, March timeframe, too. And we see an uptick see the normal selling season and how that develops. And so we garner in that waiting mode right now coming out of the winter and the holidays. So in the next couple of months, we’ll know whether we saw the meaningful improvement that we’re hoping for in the spring or whether there’s some other issues online up. I feel like as I said in my comments, I think the buyers there via interest rates have stabilized and they’re higher than they were a bit ago and that’s hard for people, but they are kind of acclimating to that. In some cases. I think we’ve got good room for good indications there, and they recognize they can’t buy as big at home as they could have, but if they had done so a couple of years ago, but they’re adjusted to all that. So the underlying demand and I would include, as my comments said, I would include the communities as well. And as you can get a home said they’ve got a renter or a buyer for that home. So we should see some improvement from or we’re hoping we’ll be watching to see some improvement in the selling season. And as the year end skews and as the year unfolds.

We’re also looking for that community order pattern to start improving.

Daniel Moore

And just based maybe it’s more anecdotal Bill, but based on your conversations with some of the community operators and where are we now fits the baseball analogy in that, you know, getting through the inventory trouble issues or the set and finish challenges? Or I know it’s market by market, but Tom?

Yes, in general, we have quarters to go. We know getting to tag ends and waiting on orders. What are you hearing?

Bill Boor

Yes, this is completely anecdotal and field based on those discussions and your I’ll make an analogy. You remember when we were coming out of the retail inventory issue, it wasn’t sudden, right? I mean, it just kind of happens individually and it builds off the next thing. You know, you’re not talking about the problem anymore. So I think it’s going to feel like that. But in our discussions in my discussions with folks that the larger community operators, they definitely are projecting higher order rates for calendar year ’24 than ’23. And so I think in order for that to take place, we should see some improvement in the next couple of quarters.

Daniel Moore

Helpful. Last one, I’ll jump out. Thanks for the color, Alison as well on gross margin front and the timing of kind of how COGS are rolling through on kind of current levels, just speak to your confidence around holding gross margins where we are at these levels and what kind of potential upside we might have on if and when as the demand comes back and capacity utilization improves?

Thanks again.

Allison Aden

Yes, sure, Dan. Thanks for the question. Is just you know, as we said big picture, the factory-built housing margins remain very healthy at 22.4% this quarter. And prices are continuing really to hold for the most part and well we know as ground based on our products for the comments, it’s really hard to speculate on price as a company and as the pricing and costs are obviously going to be the key elements determining future margins and from a company and the price we’re seeing some regions for pressure is becoming more apparent and some where it’s not. So it’s some mixed bag. Also the from a cost perspective, we’ve seen the movement in commodities can be a little volatile and hard to predict. And so we continue to watch lumber and OSB as we said last quarter, we believe that we’re doing a good job of really merit now managing on our cost of sales. And if we see the top line increase, we certainly have leverage still of absorption costing within our cost of goods and also added SG&A level.

Daniel Moore

Pedro back with any follow-ups. Thank you.

Bill Boor

Thanks, Dan.

Operator

And one moment front question and our next question will be coming from Greg Palm of Craig-Hallum Capital Group. Your line is open.

Gregory Palm [Per edited transcript and company website, it was Danny Eggerichs]

Thanks. This is Danny Eggerichs on for Greg today. I’m hoping to just kind of go back and touch on on what you’re seeing in fiscal Q4 again. And can you maybe just remind us, I know it’s kind of jumped during the past the seasonality from December to March quarter? And maybe on top of that on any impacts that you felt from maybe adverse weather in the month of January?

Bill Boor

Let me take the second part first. We did have on some pretty isolated down days due to the weather. I know in Texas, we had some in the Northwest, but I think it was to an extent that we’re hoping we can make it up and over the course of this quarter, if that makes sense because we are running at a reduced overall rate. And so while we did have some down days. It shouldn’t really knock us off where we would end the quarter otherwise on a production basis.

If that makes sense on the seasonality, I know we’ve looked at that Mark might have a comment on the percentages. But what I’ll say before we say that is we look at seasonality over a long period of time in many years and you can kind of glean from that what a average seasonal change will be. And yet I think when you look at any given year, it never really plays out that way. Because the macroeconomic factors probably weigh heavier than the seasonality at times. But given that markup checkmark, my recollection at most 10%.

Yeah. As I say, around 5%, probably.

5% to 10%. But again, we are hitting the better part of that from a seasonality perspective.

Danny Eggerichs

Okay, got it. And then maybe just touching on ASPs again, you kind of commented that within the backlog, you’re seeing some lower ASPs. So I guess is that a good proxy for this current quarter on ASPs and And within that, is that just kind of mix then? Or what are we seeing there?

Bill Boor

Yes. What I would say is on we’ve kind of had a movement and we’ve talked about in previous quarters that if you looked on a year over year basis, we’re selling more single section units and [SIC? i.e.: not “and” but “than”] multi-section units. So I would suggest and I look around I see your reaction to I would suggest that our lower value in the on the backlog is more driven by that change than it is by the fundamental pricing that we’ve given you.

I think that’s your question, but let me note.

And as I said to your question.

Danny Eggerichs

Yes, yes, you just kind of mentioned that pricing was holding steady, but but backlogs ASPs were kind of coming down. So I was just wondering if that was mix or what says.

Yes, to answer that.

Bill Boor

Yes, the backlog moves more to a character. It’s gotten more single wides and [SIC? i.e.: not “and” but “than”] multi-section than you’re going to naturally see that value per unit go down, right. Yes.

Danny Eggerichs

Okay. That makes sense.

And maybe just one last more on on maybe the Anthem product arm, just kind of initial interest and you’re showing that off of the Louisville show and and how big you think that could be and what the market could potentially be like that for that a certain product.

Bill Boor

Yes, we’re obviously really excited about.

I mean, this is a change has been made after a lot of work at the industry level, basically with HUD to allow multifamily units to be coded under the HUD Code and we are excited about it. We had a launch event, one of our lead, basically our lead plan on this is the Rocky Mountain Virginia plant. And we had a launch event in early December. And I was there and I was really impressed by the support we’re getting not only from dealers and community operators, but also from municipalities showing up looking for solutions to their density and affordability issues. And so we’ve talked about as being a nationally available, we’re going to produce that variations of the Anthem product and there’s more than one floor plan, the variations that we’re going to produce in plants across the country. So yet I don’t have any numbers for you to share at this point, but we’ve been really excited about the interest level. And if you think about it, if you’re running, let’s just take the example, the community operator, the opportunity to get some density, you’re going to get more revenue essentially from a given life. And at the same time, those two residences or households are going to both benefit from the density with lower cost. And so that’s what that’s what solving the affordability issues all about.

So I appreciate you asking because obviously, we’re pretty excited about it.

Danny Eggerichs

Yes.

Sounds like sounds like a lot of good stuff. So I’ll leave it there. Thanks.

Bill Boor

Thank you.

Operator

And one moment for our next question. And our next question will be coming from Jay McCanless of Wedbush Your line is open.

Andre.

Jay McCanless

Good morning and warm. So Bill, could you maybe talk about the Kentucky Dream acquisition? How many owned stores is that take Cavco to now? And what’s kind of your outlook for more acquisitions like this come in the coming year?

Bill Boor

Yes, we had a bit of an increase in our total owned stores, some and it came a big chunk of that came through the Solitaire acquisition a year ago, and we were in the low 40s before that solitary, I think brought us 22. And then with a few greenfields. And then the Kentucky Dream Homes acquisition were 72 now. And so I think you’re asking for a little more detail on those assets as they reach it.

Jay McCanless

We are just yes.

Are there are there other larger dealer change [SIC – i.e.: “chains” not “change”] out there that you might be looking at from an M&A perspective? And if there are what kind of is the goal to get to 100, 150.

What’s what’s kind of your long-term vision for the retail stores.

Bill Boor

Yet on updating back and tell you how we think about retail real quickly. We have not generally had a strategy is trying to grow retail for its own sake. We’ve had a strategy has been very clear that we want to look at every one of our plants in a local market and make sure we’ve got the right access to market. So if we look down the road and we see, for example, others on integration by competitors and that increases our risk of distribution. That’s when we tried to figure out a good solution. That solution could be a good thing from developing a closer partnership with the existing dealer independent dealer two on greenfield and two acquisitions in the example that Kentucky Dream on. So we don’t have a goal to reach a certain level we’re not pushing growth in the retail segment necessarily. We’re only happy to make a good acquisition when it’s on both the good investment and improves our distribution, Kentucky Dream. And this is a great example of that. I mean, does run a great business. They’ve built a great business and really thrilled at the fact that he stay on board and as management team stay on board because they’re here what they do. They have five stores in Kentucky and in Florida and some that we folded them or we purchase them during the third quarter.

Jay McCanless

Got you.

And the other thing I wanted to ask about is what you’re talking about before, Allison, with the increased cost of goods sold, is it still just OSB? Or are you starting to see some some wage inflation kick in? Maybe what are the drivers that are driving the COGS line?

Allison Aden

Yes. So from the coast is largely the commodities, as we mentioned last quarter with the focus, of course on that would be in lumber and we ship pretty close to it. And now currently, it looks like it’s up similar trends to what we talked about last quarter.

Jay McCanless

That’s all I had, thank you.

Bill Boor

Thank you.

Operator

Then one moment for our next question. And our next question will be coming from Camden Roberts of the University of South Carolina. Camden. Your line is open.

Camden Roberts

Hey, guys. Thank you for the great earnings call. I’m calling from South Carolina. We were actually just at the Hamlet factory in North Carolina, and we had a great tour. And I just wanted to ask you what are you what should we be looking at in 2024, are you optimistic about Anthem and those duplex sales? I’m sure there’s a lot of pent-up demand for that, or should we be looking more at the recent Solitaire acquisition? What are you most optimistic about? And what should we be focusing on in 2024?

Bill Boor

Big question, I’m glad to hear you’re at him, Pamela knew that that was a good tour. We’re pretty proud of that new plant and now it’s come up and we think that’s targeted at the right point in the market for what’s going on from an industry dynamics perspective, they’re making kind of at a lower price point products and on bottom, and they really come out very quickly towards most excited. I mean, we talked about Anthem. We think that’s I think that’s going to be good business for us also, to be honest, I also think that from a broader perspective, those are the kinds of solutions that can move the ball forward on affordability. So I’m really excited about the potential of the industry, taking advantage of those changes and code could get better solutions for affordability.

You touched on Solitaire. We’ve had a year now with Solitaire. We’re excited about that acquisition I mean, I know it is open-ended. I mean, there’s a lot to be excited about. So I just wanted to know what where the midpoint is down, but those read up the community sales, two of those have exciting. So thank you very much.

Bill Boor

Alright, thank you.

Operator

And again, if you’d like to ask a question, please press star one one on your touchtone telephone. And our next question will be a follow up from Daniel Moore of CJS Securities. Daniel, your line is open.

Daniel Moore

Thank you again. And just wanted a quick question or two on kind of update on on financing and availability. So any meaningful change in spreads over the last 90 plus days, both for chattel as well as land home versus traditional stick-built mortgage rates? And how would you describe the lending environment today relative to a year ago, are you seeing more community banks exit from stable or others backfilling? Any kind of color you might give there would be helpful.

Thank you.

Bill Boor

Okay.

Daniel Moore

Yes, I’ll start with the expanse of the rates for just home only. Loans quoted rates are in the high 8%, low 9% range. Still and that’s pretty in pretty consistent these past 90 days.

Bill Boor

And picking up on your question that I hope I rephrase it accurately kind of the investors in MH loans, for example, community banks and are and like regional banks and credit unions type investors, they going to be finicky. And and I tell you that I don’t want this to be alarmist at all because it shouldn’t be, but it’s tightened up a little bit, but I think we’ll work through that. I don’t think it’s a major issue from the perspective of lending availability to the consumers. And why I say it is there are a lot of folks in that market and they’re not all heavily dependent on those on those outlets or those final investors. And one thing we’ve talked about over the past, I’m losing track of time, but it’s been a while is that for a while, GSE loans, the conforming loans had really kind of gone out of the market. And basically what happened is GSEs raised their their requirements, raised their terms and interest rates. And the investors we’re talking about is that the regional banks, credit union type investors really didn’t respond as quickly. I think that’s because they had a lot of capital put in place. Now what we’re seeing is that the regional the calm, the nonconforming investors as increased their requirements. But what happens is GSEs become more competitive in the market, and we’ll probably see a swing back to that.

That final funding source for the loans as usual?

I think I’m giving a long answer to a short question, but we are not we’ll watch those dynamics, but we are not really seeing anything it gives us concern about the consumers access to reasonably priced loans.

Daniel Moore

No, that’s good color. I appreciate it. And I’m going to ask one more and maybe it’s maybe it’s a variation on the prior question, maybe not let you judge, but and at this stage, we’re stable pretty stable at 60 percent-ish capacity utilization, plus or minus. Would you be looking to add capacity. When you think about the opportunity set and the lack of affordability, no availability in terms of affordable homes over the next two, three, five years or we do more let’s kind of stick where we are wait and see and see how the demand builds over the coming quarters.

Thanks.

Bill Boor

Yes, that’s a really good question, actually, on I guess I would say it’s the latter or the announcement. It’s the former customers or restated, um, I would not I don’t think Cameco [SIC? i.e.: Cavco] would hesitate to add capacity in this industry, given what we see strategically when you look at a strategic timeframe, which I define as three plus years from now, it takes time to put capacity in place. This country has depending on your favorite economist, a f housing unit deficit to be filled and so long strategically, we look great through the many cycles like the one we’re operating in right now. And we know that there’s an opportunity to continue doing more to bring down to it, increase the availability of affordable housing.

Daniel Moore

Very helpful.

And thanks again, and look forward to catching up soon.

Allison Aden

Thanks, Dan.

Bill Boor

Thanks, Dan.

Operator

I would now like to turn the conference back to Bill for closing remarks.

Bill Boor

Thank you.

From I mentioned Louisville show in my opening comments. We showcased 15 homes from nine Cavco plants at the show. We also had our lending company, CountryPlace Mortgage there. They were there to talk to customers about how we can meet their commercial and consumer lending needs. So it was a great effort to trying to get out there and and so we can do from a partnership perspective.

I want to take a quick moment to thank everyone at Cavco who has been involved in our development and launch of the Anthem duplex line. And in all that went into the Louisville show from the folks who are designing and building these homes for the marketing and sales teams. The commitment and teamwork have really been outstanding at both events. It was great to see the strength of our organization coming to the forefront. Our drive during this downturn has been to keep focused on getting better in every way. So we’re ready to run when the inevitable market upswing occurs. And I’m very confident we’re doing just that.

So I want to thank you as always, for your interest in Cavco, and we look forward to keeping you updated on our progress.

Operator

If this concludes today’s conference call. Thank you for participating. You may now disconnect.

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance from the above, consider the following remarks and topics raised based in part on this earnings call transcript.

1). Retail. Among the rather stunning remarks by Bill Boor are these about retail: ” We have not generally had a strategy is trying to grow retail for its own sake.”

On one level, that may appear to make sense. They don’t want to grow retail for its own sake. Fair enough. If production can’t support retail, then retail could be a drain.

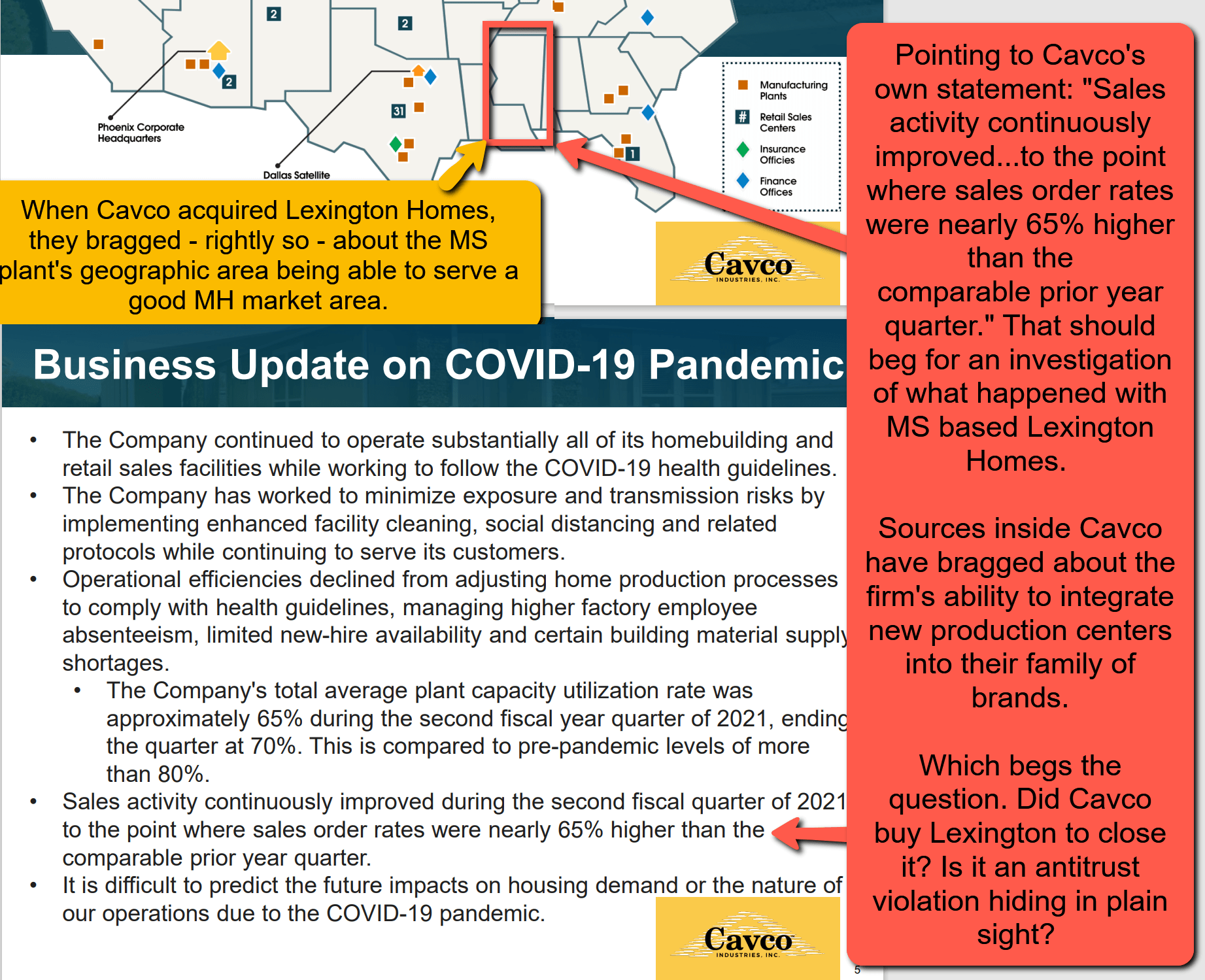

But on another level, Cavco admits that they are underutilizing their plant capacity. While not mentioned, they bought Lexington Homes, and the recent remarks from Skyline Champion in Mississippi cast doubts on their prior remarks on that and raise concerns that Lexington may have been a so-called “killer” acquisition which has antitrust and legal concerns. Per Mark Yost: “So Louisiana year-over-year during the quarter grew 79% in terms of year-over-year shipments. Mississippi was up 45% year-over-year in terms of industry shipments.” Lexington was located in MS.

Another part of the problem, per their own transcript, is that the “communities channel” cut back on orders in 2023 and is expected to slowly increase in 2024. That appears to be a strategic and costly error. In Boor’s words: “If you could almost look at the difference in the peak of sales to this industry compared to the most recent seasonally adjusted level in December based on higher shipments and pretty much can be explained by the drop-off in community orders this past year.” The drop in orders from communities can ‘pretty much explain’ the lower production, he said.

Once a HUD Code manufactured producer makes the decision to become ‘vertically integrated’ then the question should be how much more distribution can be added to support a particular production center (a.k.a. plant, factory, building center, etc.). So, Boor’s comments are partially correct. The need to ‘feed the factory’ is a reasonable basis of measure.

But once committed to retailing, and once they have witnessed their own production slide due to a drop from the “community channel,” aren’t they then wasting resources?

Furthermore, while they are talking about allocating more capital to repurchase stocks, they are obviously able to do “greenfield” retail distribution additions. Or, Cavco could also in theory do what Legacy Housing began to do. Namely, develop their own land-lease communities or HUD Code manufactured home developments.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

Wrenched out of context, this remark by Boor may look ridiculous: “So we don’t have a goal to reach a certain level we’re not pushing growth in the retail segment necessarily.”

But when even briefly unpacked, that and other statements about retail, their dependency on communities – which they claim is essentially a vulnerable spot in terms of production capacity – still should be of concerns to stockholders, stakeholders, public officials, and thus board members and senior corporate officers.

That means the people listed below ought to be on the front lines of the defense of shareholders’ and other stakeholders’ interests.

2). From the Cavco Industries (CVCO) website on 2.11.2024 the following are shown to be their board of directors.

- Steven G. Bunger: Chairman of the Board of Directors, Cavco Industries, Inc. and President and Chief Executive Officer, Pro Box Storage, Inc.

- William C. Boor: President and Chief Executive Officer, Cavco Industries, Inc.

- Susan L. Blount: Retired Executive Vice President and General Counsel, Prudential Financial Inc.

- David A. Greenblatt: Retired Senior Vice President & Deputy General Counsel, Eagle Materials Inc.

- Richard A. Kerley: Retired Senior Vice President and Chief Financial Officer, Peter Piper, Inc.

- Steven W. Moster: President and Chief Executive Officer, Viad Corp

- Julia W. Sze: Impact Investment Strategy, Julia W. Sze Consulting”

- William C. Boor: President and Chief Executive Officer

- Allison K. Aden: Executive Vice President, Chief Financial Officer & Treasurer

- Mickey R. Dragash: Executive Vice President, General Counsel, Corporate Secretary & Chief Compliance Officer

- Steven K. Like: Senior Vice President, Corporate Development

- Colleen J. Rogers: Senior Vice President, Marketing and Communications

- Brian Cira: President, Manufactured Housing

- Matthew A. Niño: President, Retail

- Gavin M. Ryan: President, Standard Casualty Company

- Jack Brandom: President, CountryPlace Mortgage”

- Paul Bigbee: Chief Accounting Officer

- Anthony R. Crutcher: Chief Information Officer

3). Lending.

Per the transcript with bold and highlighting added, Boor said: “And and I tell you that I don’t want this to be alarmist at all because it shouldn’t be, but it’s tightened up a little bit, but I think we’ll work through that. I don’t think it’s a major issue from the perspective of lending availability to the consumers.” That’s a stunning remark. Where is the sense of urgency to get the GSEs to step up and fulfill their Duty to Serve (DTS) mandate? Isn’t it now more apparent than it already was before that MHI CEO Lesli Gooch is apparently not off the MHI ‘big boy’ reservation at all when she said what she did last summer? See how MHARR President and CEO Mark Weiss, J.D. swatted Gooch publicly for her stunning remarks on DTS in the report linked below. Weiss said Gooch’s remarks were ‘inexcusable and a major problem.’ But Boor is acting nonchalant about less access to lending. Is Boor waiting for a storm before acting? In the framework of what MHARR’s Weiss was reacting to from Gooch, Boor was MHI’s vice chairman at that time and now Boor is MHI’s current chairman.

4). “Really Excited…” Speaking about their new duplex line of HUD Code homes, Boor said: “So I’m really excited about the potential of the industry, taking advantage of those changes and code could get better solutions for affordability.” On the one hand, an addition of a new product that may attract more buyers is part of what every factory should be striving for, and what factory producers did for decades. Balcony bedrooms, ‘sunken baths,’ slide outs or tip outs, raised kitchens, hinged roofs, Cape Cods that could have the second level finished on site – these are just some of the features that have been deployed over the decades that attracted customers.

The duplex unit has been talked about for some time. It ought to do well.

But lest we forget, there was hype, hype, hype by MHI and the big three producers, including Cavco Industries regarding the CrossMod ® home. That has turned out to be a dud in terms of market penetration. There should now be more of a ‘fool me once, shame on you, fool me twice, shame on me’ view by stakeholders, shareholders, and all others after some 6 years of failures, right?

5) About 9 months ago during a prior earnings call Gregory Palm, missing from this earnings call, called into question ‘the industry’ and by extension, Cavco’s issues in diminished sales and production. Why is manufactured home industry production so weak, Palm aptly asked. That question could have been used in this most recent earnings call.

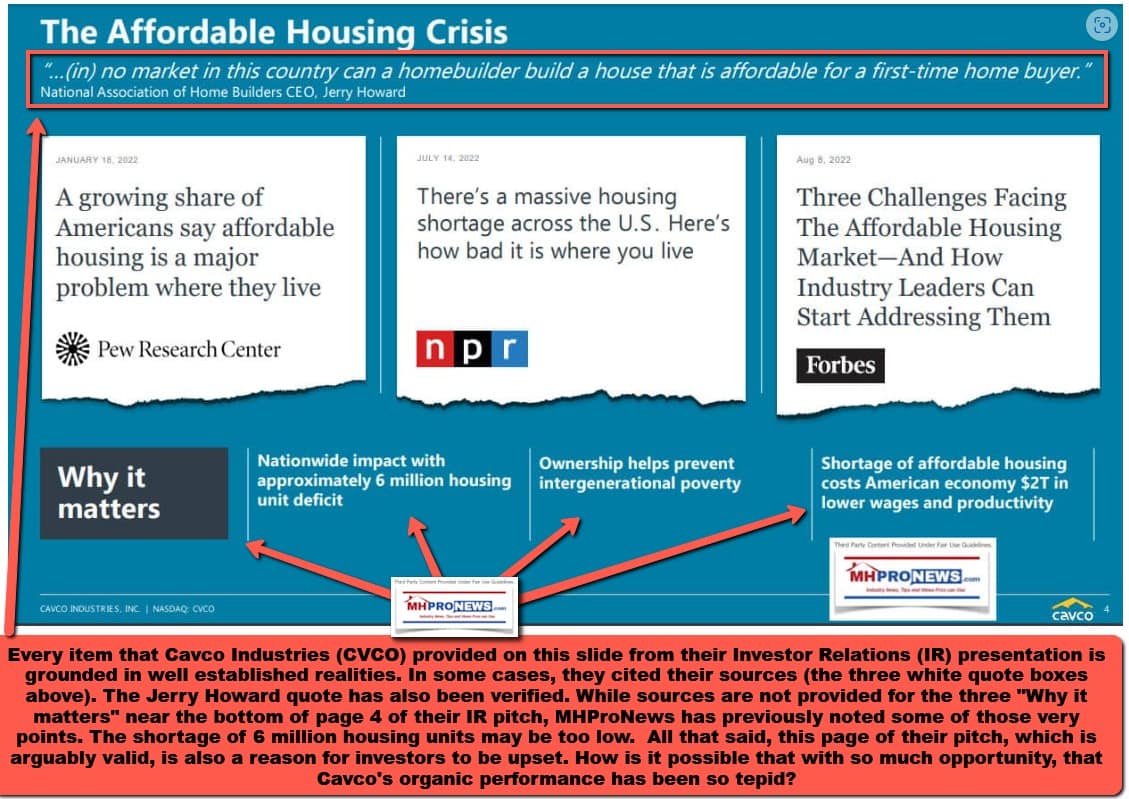

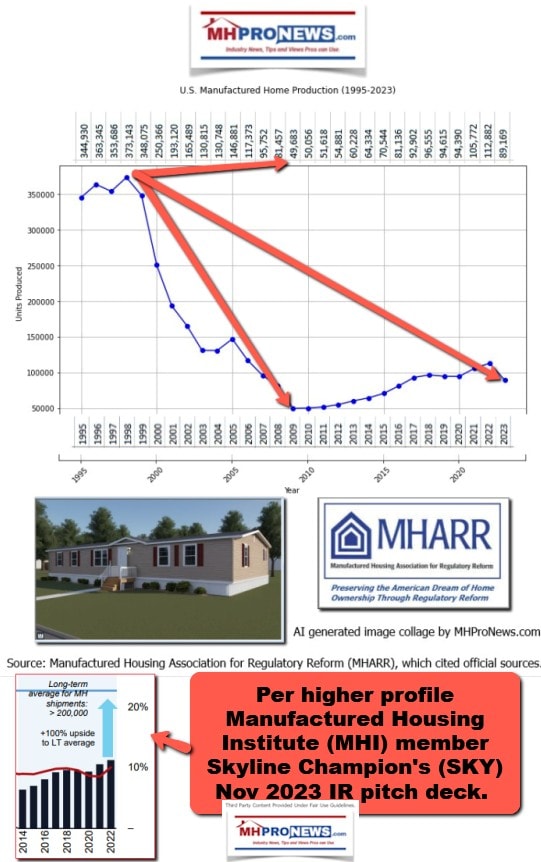

Cavco itself has made the pitch to their investors (see below) that there are millions of housing units needed. Boor stressed that lack of affordable housing in this earnings call too.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

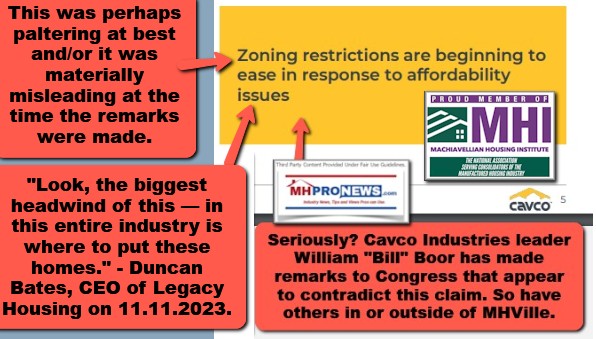

But then, a closer look appears to suggest that Cavco is on both sides of the zoning barriers topic.

In July 2024, Boor told Congress that HUD needed to enforce the enhanced preemption provision of the Manufactured Housing Improvement Act of 2000. That was logical. Which means that the above from their pitch deck was not.

These kinds of ‘disconnects’ point to arguable legal vulnerabilities. Failure to disclose or explain this properly could be a material issue. Those board members and officers named in Part II #2 above are logically the responsible parties then, right? At the MHI level, something similar could be observed with respect to their board and senior staff, right? For more on that, see #10 and #11 below.

6). From the deeper dive into the national numbers, consider this report below.

MHARR said this in the above.

Boor is MHI’s chairman. Boor is Cavco’s CEO and sits on their board of directors. They can’t have it both ways, pointing (see Part II #5) in their pitch deck to the need for 6 million more homes, and then acting like the lull from the ‘communities’ channel’ explains the downturn in 2023. What kind of double talk is that? It appears to be paltering. A half-truth. To some extent the shortfall in the communities’ channel may have some truth in it. But that too is oversimplified. The reports linked below help round out the fuller picture on the manufactured home communities’ side of the industry and thus to illustrate what is lacking in the remarks about “communities.”

To say that the lack of orders from communities largely explains the drop in manufactured housing sales, production orders, and thus their low plant utilization also logically fails to explain why Cavco (and by extension, MHI) failed to press the enforcement of preemption and DTS/financing issues. And where was Boor and Cavco on MHI’s role in the DOE energy standards? These are standard fare topics, which Boor and the board should be well aware of and keenly focused on addressing.

7). To more fully illustrate how Cavco’s leadership are apparently failing their shareholders and stakeholders, from the report linked here, consider these pull quotes.

- “the U.S. population has grown by approximately 23.92% from 1998 to 2024.”

- HUD Code manufactured home production in 1998 was 373,143 dwellings.

- HUD Code manufactured home production in 2023 was 89,169 dwellings.

- Doing the math (see the report for details) “if manufactured housing production had grown at the same rate as the population, it would be approximately 446,117 dwellings today.

That math has implications for shareholders and others. Instead of discussing how much the board should allocate toward stock repurchases, the board should be focused on the kinds of issues highlighted in the last two Sunday recaps.

Third parties, as well as Cavco itself, are saying that manufactured housing should be performing better. Merely keeping up with the growth in population, the manufactured housing industry – and thus Cavco in it – should be performing better. But instead, manufactured housing is performing only at about 25 percent of its last high in 1998. Where is the board’s call for accountability? In fairness, it isn’t just Cavco’s board, it is also the board of Skyline Champion, Equity LifeStyle Properties, and several other key MHI members that needs to be called into question. When modest by comparison Nobility Homes manages to navigate the industry’s challenges and have what Terry Trexler explained was a record year, why isn’t Cavco or Skyline able to say the same?

Charts like the above ought to be used to press the case with the leadership of Cavco and several other MHI members that they are arguably not doing their respective jobs properly.

8) Let’s be clear. Per sources deemed reliable, several in management at Cavco are said to be regular readers of MHProNews. The same is true at MHI. They already know, or should, that we fact check and probe quarterly reports and other corporate and association documents for contradictions and inconsistencies. We do so from the perspective of a professional with decades of in the trenches experiences in manufactured housing. As the Sunday postscript and a report linked here revealed, our analysis has been deemed ‘accurate,’ ‘astute’ and ‘expert.’

Errors caught by MHProNews in their respective IR pitches, or association documents, may have led to changes being made in those pitches, their website, etc.

That said, if the industry was producing 446,117 total HUD Code manufactured homes in 2023 vs. the actual 89,169, potentially how many thousands of more homes would Cavco’s retailers have sold? How many more thousands of more homes would Cavco’s factories have produced? How much higher would profit margins be as a result? And that isn’t presuming improvement over past performance. That is just presuming if the manufactured home industry had kept up with the U.S. population growth curve.

Put differently, the case can be made that numbers (not all) of manufactured home industry leaders are failing and failing badly. For more evidence, consider the following.

9) Former MHI president and CEO Chris Stinebert said in 2004 that the industry was poised to rebound. Why is that only mentioned by MHProNews? Why is Stinebert’s name forgotten by almost all save MHProNews and/or MHLivingNews? As MHI’s Stinebert said years ago: “During my time at MHI, I was often asked the same question, “What must happen for business to return – for manufactured housing to begin growing again?” My stock answer would usually start with ‘financing’ and end with a general comment about the need to bring ‘value’ to our customers.” Today, Stinebert might add the words “zoning” and the DOE, even though a proper application of existing federal laws would suggest otherwise.

10). Let’s bring this into a sharper legal focus. Consider this Q&A with Bing’s AI powered Copilot, which cited its sources below.

> “Per SEC or other federal regulations that govern the conduct of corporate leaders in publicly traded firms, are officers allowed to palter in the context of earnings calls, investor relations pitches, or other official remarks?”

Learn more

Note this line per Copilot: “Paltering undermines investor trust and can lead to legal consequences.”

11). Next consider this Q&A with Copilot.

> “Hypothetically speaking, imagine that a small group of corporate leaders is working in a publicly traded company to limit competition within the manufactured housing industry. They have a high ranking official at the Manufactured Housing Institute. They have hundreds of millions of dollars of capital that could be deployed to address zoning, financing, or image/education issues. They aren’t doing a bad job of managing the company within the framework of the status quo. But the manufactured home industry is only operating at about 25 percent of its last high in 1998. The industry isn’t keeping up with population growth. Isn’t their some measure of duty to shareholders and stakeholders for corporate officials in that scenario to deploy sufficient capital to address the underlying issues that one of their own leaders said needs to be addressed? When the CEO of the firm tells Congress that he wants the Manufactured Housing Improvement Act of 2000 and its enhanced preemption clause enforced, but then does nothing to deploy legal resources to make that actually come to pass, isn’t that a kind of leadership failure by those who are supposed to safeguard investments and corporate performance?”

- The Dilemma of Corporate Leaders:

- These corporate leaders find themselves at a crossroads. On one hand, they have a fiduciary duty to shareholders, which includes maximizing profits and ensuring the company’s financial health.

- On the other hand, they are aware of broader issues affecting the manufactured housing industry, such as zoning challenges, financing hurdles, and public perception.

- Their current management within the status quo keeps the company afloat, but it doesn’t address the industry’s long-term sustainability.

- Balancing Profit and Purpose:

- Corporate leaders must weigh short-term gains against long-term viability. While maximizing shareholder value is crucial, it shouldn’t come at the expense of the industry’s future.

- Deploying capital to address zoning, financing, and education issues could benefit both the company and the industry. However, it might not yield immediate returns.

- Leadership Failure or Strategic Decision?:

- When the CEO expresses support for enforcing the Manufactured Housing Improvement Act of 2000, it signals a commitment to industry improvement.

- However, if they fail to follow through with legal resources, it could be seen as a leadership failure. Investors and stakeholders may question their sincerity.

- The CEO’s actions (or lack thereof) impact not only the company’s performance but also the industry’s overall health.

- Stakeholder Expectations:

- Beyond shareholders, corporate leaders have a duty to other stakeholders: employees, customers, suppliers, and the community.

- Addressing underlying issues aligns with stakeholder interests. It demonstrates responsible leadership and contributes to the industry’s growth.

- Ethical Considerations:

- Corporate leaders should consider the greater good. If the industry struggles, it affects not only their company but also countless homeowners and workers.

- Deploying capital strategically—whether through legal efforts, education, or advocacy—can be an ethical imperative.

In conclusion, leadership isn’t just about managing the status quo; it’s about envisioning a sustainable future. While profit matters, so does purpose. Corporate leaders who balance both effectively contribute not only to their company’s success but also to the well-being of the industry and society as a whole. 🌟

Ironically, Cavco’s ESG document suggests that they have responsibilities and want to be held to account on some of the same levels that Copilot suggested.

Note this line from Copilot:

- “Deploying capital strategically—whether through legal efforts, education, or advocacy—can be an ethical imperative.”

Or these lines:

- When the CEO expresses support for enforcing the Manufactured Housing Improvement Act of 2000, it signals a commitment to industry improvement.

- However, if they fail to follow through with legal resources, it could be seen as a leadership failure. Investors and stakeholders may question their sincerity.

12). As Cavco put it in their blue gray “The Affordable Housing Crisis” illustration (see #5 above) under “Why it Matters” “Nationwide impact with approximately 6 million unit deficit.” “Ownership helps prevent intergenerational poverty.” “Shortage of affordable housing costs American economy $2T [two trillion dollars annually in lost GDP] in lower wages and productivity.” Each of those claims can be supported by third-party research. That means they are well grounded arguments. But that also means that Cavco should be selling, producing and financing through their lending arm more HUD Code manufactured homes. Instead, they are around 60 percent plant capacity utilization? Where is their board? What are the officers thinking?

“If there’s something wrong, those who have the ability to take action have the responsibility to take action” said Nicholas Cage’s fictional character Benjamin Franklin Gates in National Treasure. Potentially for millions, the treasure of our nation ought to be HUD Code manufactured homes. Those leaders in Part II #2 above are apparently the responsible parties. Why have they failed to act in the manner that ethics, fiduciary duties, and other responsibilities requires them to do?

MHProNews plans a follow up on Cavco in the near term. We will begin to apply a similar look at some of the other larger firms at MHI that are publicly traded, as we have already done with respect to corporate reporting of key MHI members linked here and here. Stay tuned for that and more from the leading source for “Intelligence for Your MHLife” © here at the biggest and most-read trade publication providing manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’