Sometimes the more compelling way to illustrate trends that are occurring in the manufactured home industry is to reveal how others in media are reporting on it, or not. Provide an article – like this one – which will offer several ‘mainstream’ or specialty housing news items in one report with MHVille style facts-evidence-analysis (FEA). The clarity of the concerns may be apparent even without an analysis, but in order to make third-party content truly ‘transformative‘ it is necessary, and frankly useful to professionals and those probing this sector of the housing market more deeply. With that in mind, Part I of this report will provide examples of statements by various media outlets that will be identified and linked that offer details on Canadian based QuadReal’s expansion of their land-lease community interests into the United States (U.S.) in sums that eclipsed $500 million (i.e.: over half a billion) dollars in total investments. Part II will provide insights from ShelterForce, which was republished by Planetizen, which has previously featured this writer for MHProNews’ in a report that specifically cited the potential for the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, MHIA 2000, 2000 Reform Law, 2000 Reform Act), a fact that the specific articles considered didn’t explicitly mention, though Planetizen’s linked the Kovach commentary on that as a related topic.

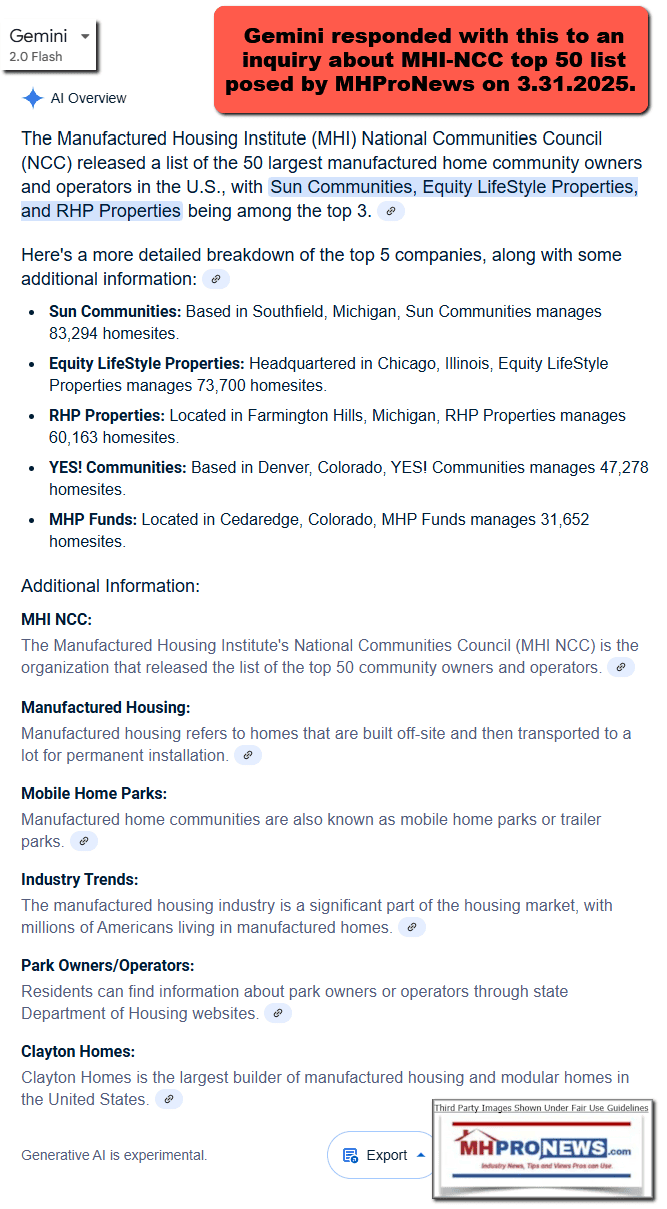

Part III will provide additional information with more MHProNews analysis and commentary that will include AI based fact-checks too. One of those fact checks using left-leaning Google’s AI powered Gemini said the following in part, which helps frame what follows in Part I and Part II.

Key Takeaways:

- There is a significant disconnect between MHI’s stated ethical standards and the actions of some of its members.

- MHI’s publications tend to downplay or ignore the concerns raised by resident advocacy groups.

- MHProNews and MHLivingNews have played a crucial role in providing critical coverage of the industry.

- The consolidation of the manufactured housing sector raises serious concerns about affordability and resident protection.

It’s evident that the issues surrounding private equity investment and consolidation in the manufactured housing sector are complex and require careful scrutiny.

With that focused preface, let’s dive into the headline topics and related issues and insights.

Part I

1) From Multi-Housing News (MHN), which previously published the interview of MHI CEO Lesli Gooch (see this link here).

“Our recent manufactured housing acquisitions in the U.S. are a natural extension of our Canadian portfolio, which totals over 13,100 pads,” Daniel Gliksman, managing director, Americas-East at QuadReal, told Multi-Housing News. “We continue to have strong conviction in the Canadian manufactured housing market, which benefits from the same fundamentals identified in the U.S.”

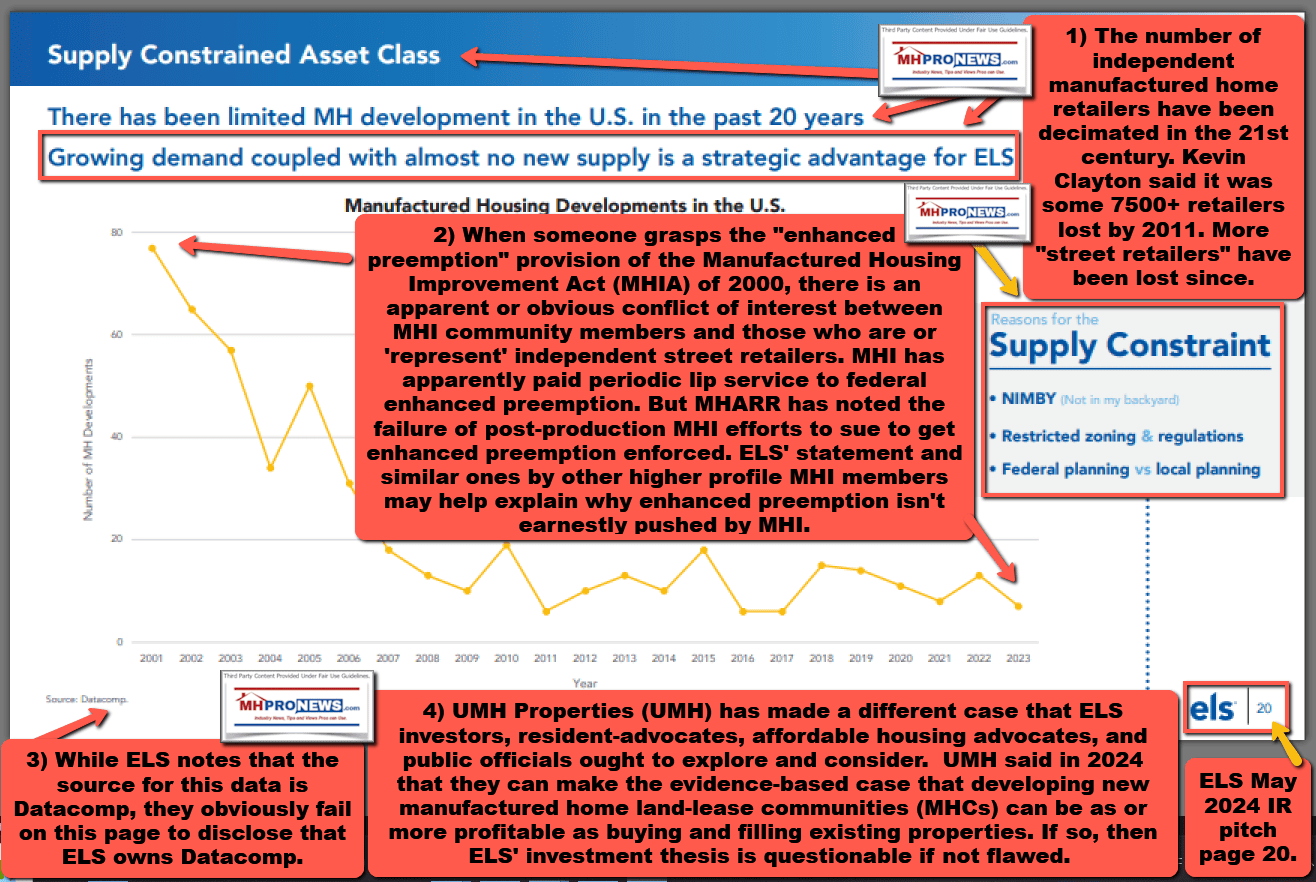

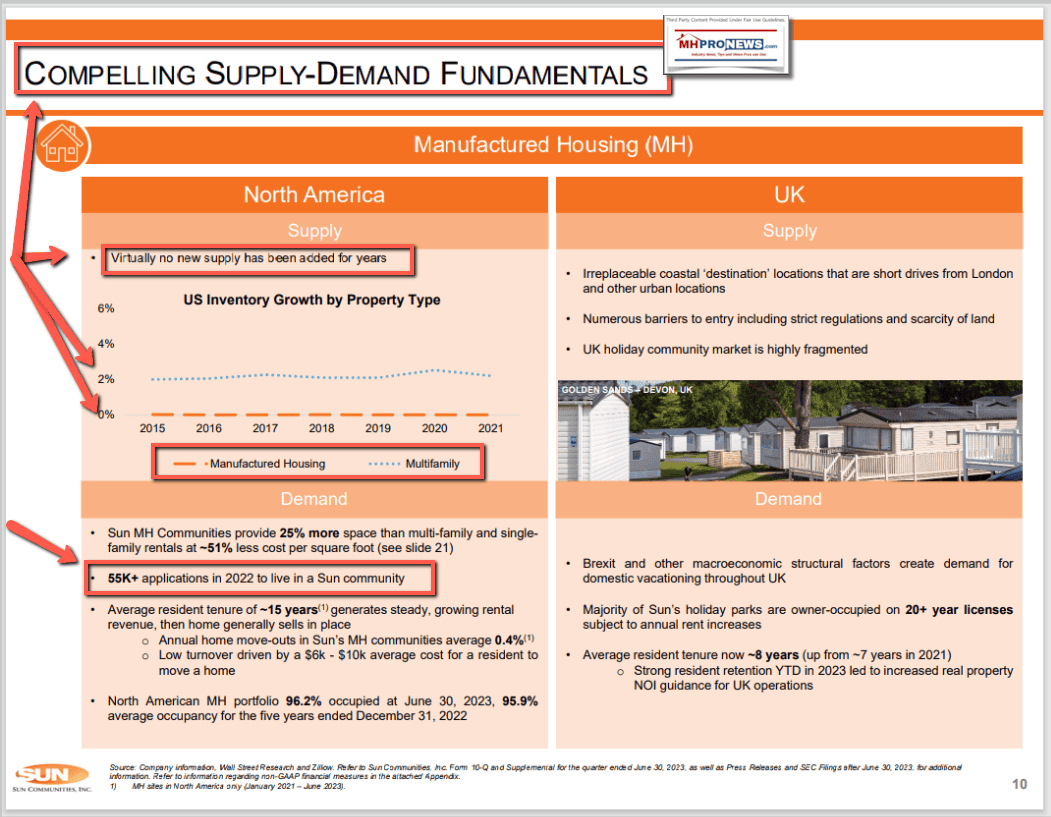

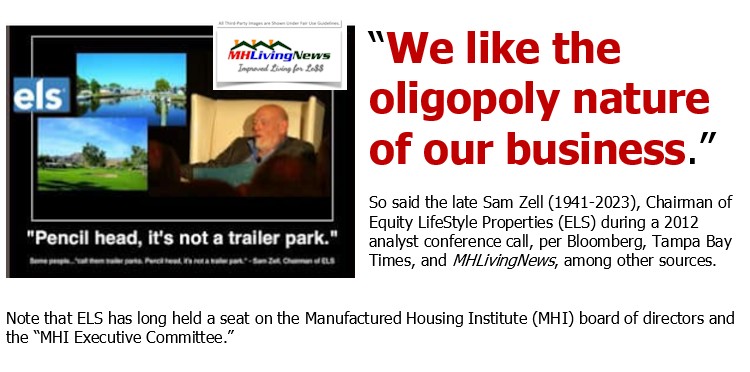

2) What are those unstated by MHN fundamentals? MHProNews notes that according to prominent MHI members Equity LifeStyle Properties (ELS) and Sun Communities (SUI) have said includes NIMBYism that includes a lack of new community developments which is a factor that is driving existing communities’ costs ever higher.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

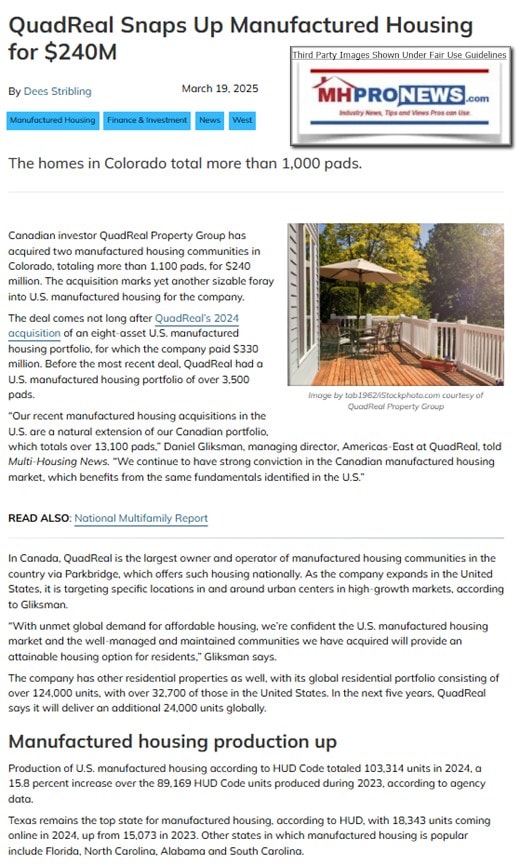

Canadian investor QuadReal Property Group has acquired two manufactured housing communities in Colorado, totaling more than 1,100 pads, for $240 million. The acquisition marks yet another sizable foray into U.S. manufactured housing for the company.

The deal comes not long after QuadReal’s 2024 acquisition of an eight-asset U.S. manufactured housing portfolio, for which the company paid $330 million. Before the most recent deal, QuadReal had a U.S. manufactured housing portfolio of over 3,500 pads.

4) As a reminder, MHProNews quoting or providing third party content should not be construed as an endorsement. In order to properly understand facts and trends, a range of sources and information is useful.

QuadReal invests $343m in U.S. manufactured homes

Deal builds on an eight-asset acquisition in November

5) Per the QuadReal website’s “about us” page is this.

QuadReal is a global real estate investment, operating and development company committed to delivering strong, stable returns and creating spaces and communities that enhance the lives of the people we serve.

From the QuadReal news segment is their following press release.

QuadReal bolsters US manufactured housing portfolio with $240 million acquisition

Latest acquisition brings global residential portfolio to over 124,000 units

QuadReal Property Group (“QuadReal”), a global real estate investment, development, and operating company acquired 100% direct interest in two manufactured housing communities, both located in key submarkets of Colorado. The purchase price was USD $240 million.

This acquisition adds to QuadReal’s U.S. manufactured housing portfolio of over 3,500 pads and follows the recent USD $330 million purchase of an eight-asset manufactured housing portfolio in 2024.

“As a leading provider of housing globally, QuadReal is committed to expanding its portfolio of quality housing options across a variety of residential types,” said Daniel Gliksman, Managing Director at QuadReal. “This latest acquisition enhances our growing U.S. manufactured housing portfolio and reflects our strong residential conviction, globally.”

Located in Colorado, these well-managed, high-quality, stabilized communities offer residents large community centers, pools and other outdoor recreation amenities.

The firm’s high-conviction investment strategy and international experience have established QuadReal as a top 20 real estate investor globally. Presently, QuadReal’s global residential portfolio consists of over 124,000 units with over 32,700 located in the U.S. In the next five years, QuadReal will deliver an additional 24,000 units globally.

About QuadReal Property Group

QuadReal Property Group is a global real estate investment, development and operating company headquartered in Vancouver, British Columbia. Its assets under management are $89 billion. From its foundation in Canada as a full-service real estate operating company, QuadReal has expanded its capabilities to invest in equity and debt in both the public and private markets. QuadReal invests directly, via programmatic partnerships and through operating platforms in which it holds an ownership interest.

QuadReal seeks to deliver strong investment returns while creating sustainable environments that bring value to the people and communities it serves. Now and for generations to come.

QuadReal: Excellence lives here. …”

—

These purchases catapulted QuadReal into the top 20 of all the largest MHC operators in the U.S., per information from MHPHOA. More on that in Part III.

Part II – This article is republished from Shelterforce Magazine.

Manufactured Crisis: Losing the Nation’s Largest Source of Unsubsidized Affordable Housing

Manufactured housing communities have long been an affordable housing option for millions of people living in the U.S., but that affordability is disappearing rapidly. How did we get here?

By Shelterforce | March 25, 2025, 5:00 AM PDT

Derald Ketels sorts through a rumpled pile of late fee reminders, rent hike notifications, vehicle tow warnings, eviction notices, and other official-looking communication from his landlord. He’s lived in Hickory Village Mobile Home Park for 40-plus years, renting until he bought his single-wide in 1997, where he’s lived ever since. He raised his kids there. He’s now raising his two adolescent granddaughters in the same house, which he’s spent countless hours fixing up over the decades. Ketels paid his place off so long ago he’s not sure exactly when it was. These days, Ketels is unsure about several things—including whether he’ll be able to hang onto his home for much longer.

Derald Ketels has kept file of tow warnings, eviction notices, and other communications from his landlord, Havenpark Communities. The company, which operates more than 80 manufactured housing communities in the U.S., has faced complaints from residents, housing advocates, and even policymakers for its business practices. Staff photo by Shelby R. King

It wasn’t always this way. In fact, every warning and notice in Ketels’s stack of paperwork is dated 2021 or later—the year Hickory Village, a 204-space manufactured housing community on the north end of Fort Collins, Colorado—was sold to Havenpark Communities LLC.

Before the Utah-based manufactured housing owner and operator bought the property, rent increases were predictable and the amounts were sustainable. Property management was easy to get along with, Ketels says. He even worked for the park’s former owner in exchange for a discount in his lot rent—the monthly fee homeowners pay to site their home in the park, hook it up to utilities, and access community amenities.

But those days are long gone.

When Havenpark bought Hickory Village, lot rent was around $500 per month, according to a Colorado Public Radio story. By 2022, base rent for most of the folks living in Hickory Village ranged between $555 and $600 per month—except for Ketels, who was charged $795. Ketels complained, and in October 2024, the Colorado Department of Local Affairs ruled in his favor, determining he’d been subject to retaliatory rent increases because of a 2021 complaint he filed against Havenpark about utility fee disclosures (the department determined that complaint was unfounded). Havenpark was fined, instructed to reimburse Ketels for the excess rent he’d been charged, and told to align his rents with his neighbors’.

As of February 2025, Ketels hasn’t received any compensation from Havenpark, which is disputing the judgment. What he did get is another rent increase notice: $1,059 per month starting March 1.

Years of fighting Havenpark have been rough on Ketels, a septuagenarian who lives off his Social Security check. His adult son helps with money when he’s able, and the family gets food stamps. But at the rate Havenpark is increasing lot rents and utility fees, Ketels worries he won’t be able to afford Hickory Village much longer. And if that happens, he’ll lose his largest asset: his home.

“I’ll probably just have to leave it,” he says. “There’s no place to put it, and it’d cost me $15,000 to move it even if there was.”

Ketels faces the same dilemma many manufactured home owners have found themselves in recently: Even if he could afford to move his house, there’s a good chance he’d face a similar future in a different park.

Before Havenpark Communities bought Hickory Village Mobile Home Park in 2021, Ketels’s rent was around $600 per month. As of mid-2024, he’s paying nearly $980 including utilities, which eats up most of his Social Security check—his family’s only income source. Staff photo by Shelby R. King

Ketels’s situation is increasingly common in manufactured housing communities nationwide. At least a dozen homeowners from several parks who Shelterforce spoke with in the last two years say their lot rents and other housing-related fees skyrocketed after their communities were bought by investment companies. Many of these businesses, including Havenpark, have repeatedly been called out for rent gouging, strong-arming residents, and creating untenable rules. Dozens of media outlets have reported for years on lot rent increases and unchecked fee hikes at manufactured housing communities across the nation as ownership changes hands—often from small, family-run outfits to large out-of-state businesses. (That is, if the new owners keep the park open at all; over the years, dozens of parks have been purchased and closed, displacing entire communities at once.)

But none of this stops Havenpark or many other manufactured housing community owners with similar “acquire-and-improve” ownership strategies from taking credit for preserving housing affordability.

In an email to Shelterforce (the only on-the-record statement the company provided for this story), a Havenpark representative wrote that Havenpark follows all fair housing laws when processing and enforcing leases, adding that “each year we invest millions of dollars back into our properties to upgrade aging infrastructure such as water and lighting, improve curb appeal with new landscaping and new signage, and add amenities like dog parks, pickle ball courts, and clubhouses, among other ways we work to create enduring value while preserving affordability.”

But scores of residents, including Ketels, who under Havenpark ownership can barely afford homes they once thought they’d live in forever, wonder: preserving affordability for whom?

Manufactured housing: Then and now

About 22 million Americans live in manufactured homes, which are the nation’s largest source of unsubsidized affordable housing. More commonly referred to as “mobile home parks” or “trailer parks,” manufactured housing communities typically attract older residents and those who have lower or fixed-incomes, like Ketels. While some residents rent their homes, many more own them.

Factory-built homes like these are more affordable than traditional single-family homes for many reasons. They’re cheaper to build, and therefore buy, partly due to logistics—smaller size, lower-priced materials, mass production, and reduced construction labor costs. As a result, brand-new manufactured houses list at less than $150,000, on average, and used ones can go for as little as a few grand—significantly less than a typical single-family home, which hit a nationwide median sales price of $420,400 in October 2024, according to data published by the Federal Reserve Bank of St. Louis.

Manufactured housing has also historically been more affordable because it’s sold separately from real estate—meaning owners don’t have to factor in the cost of land, although many do. In fact, nearly half of homeowners site their manufactured home on property they own, while 40 percent live on land they lease from a property owner.

And that’s where manufactured housing communities come in. Most of these communities were built decades ago by small mom-and-pop outfits and were often located on the outskirts of town or on otherwise lower-valued land, which kept prices down. (It’s worth mentioning that more nefarious factors also played a role in Americans’ opinion of manufactured homes, including classism, stigma around poverty, and “trailer trash” stereotypes, which kept them cheaper for decades while also pigeonholing them as inferior or substandard.)

But while the land-lease homeownership structure for so long provided an affordable path to purchase for many, that same contract type is today being weaponized against low-income residents. They’re able to afford a “cheap” manufactured housing unit, only to find themselves increasingly cost burdened by new and/or increasing fees, untenable rent increases, unpredictable rule changes, and other issues.

[Manufactured housing owners are] even more vulnerable than a traditional renter because they have their largest asset—all of their housing equity, and, for many of them, the bulk of their household wealth—installed on land they don’t own.”

Esther Sullivan, University of Colorado Denver

“In a sense, [manufactured housing owners are] even more vulnerable than a traditional renter because they have their largest asset—all of their housing equity, and, for many of them, the bulk of their household wealth—installed on land they don’t own,” says Esther Sullivan, an associate professor at the University of Colorado Denver whose research focuses on poverty, spatial inequality, housing, and the built environment.

Why is this happening? In the last decade, private-equity firms, real estate firms, and other types of investors and speculators have zeroed in on the industry. They’ve realized that manufactured housing communities are “a relatively untouched sector” that provides stable returns with low overhead costs, loose operating regulations, and lax enforcement of the protections that do exist.

Seeing the potential for big profits, private equity–backed companies in the mid 2010s began making multimillion-dollar, often multi-park, purchases of manufactured housing communities in several states. In fact, institutional investors accounted for 23 percent of manufactured housing community purchases in 2020 and 2021, up from 13 percent between 2017 and 2019, according to New York Times reporting. Three of the nation’s four largest private equity firms have manufactured housing communities in their investment portfolios. The Lincoln Institute of Land Policy estimates that institutional investors purchased 800,000 lots between 2014 and 2022.

But therein lies one major problem: The data are just estimates. There is no definitive tally of how many manufactured housing lots have been bought and sold in the United States, because no one truly knows how many manufactured housing communities even exist, according to George W. “Mac” McCarthy, president and CEO of the Lincoln Institute. He calls the inventory issue “mind numbing.” Several incomplete maps exist, but when McCarthy’s team uses geospatial mapping to cross-reference other data, nothing lines up the way it should. “The problem that our people have is that in every state, the way they record manufactured housing communities is different,” he says. For example, “in some places, the whole community is listed as one piece of land. In other places, it’s all subdivided and listed as owned separately.”

This lack of reliable information makes it difficult to accurately track the industry shift from mostly mom-and-pop ownership to investor-owner dominated. But the data does show that many of today’s major players in the manufactured housing community industry were already powerful forces in the single-family residential sector. For example, Warren Buffett’s Berkshire Hathaway owns the nation’s largest manufactured housing production company, and has since 2003. Apollo Global Management, Blackstone, and the Carlyle Group—three of the nation’s five largest private-equity firms—have all made enormous investments in manufactured housing communities. In 2020 alone, Blackstone dropped $550 million on 40 such communities in a business move that online real estate magazine TheRealDeal called “recession-proof.” Carlyle shelled out $230 million for four parks in Mesa, Arizona, the same year.

Ketels’s landlord, Havenpark, follows a business model that (so far) includes acquiring dozens of parks in multiple states and hiring local property managers to operate those parks. The company is owned and managed by Havenpark Capital Partners LLC, a private investment firm that specializes in manufactured housing community acquisition and ownership. Havenpark buys older, often-neglected manufactured housing communities where once-cheap land is fetching ever-higher prices.

Havenpark’s newly acquired communities are often due for upgrades—sometimes superficial and other times quite substantial (which is one reason their rents are typically below-market rate). It’s these improvements that trigger the rent increases—ostensibly to offset the cost of needed upgrades. In most states, annual (or more frequent) lot rent increases, unpredictable rule changes, and expensive maintenance requirements are the norm.

In many places, park owners can and do legally refuse to renew a lease without cause, even on a lot where the resident owns the home. Fran Quigley, a housing rights attorney and professor at Indiana University, has represented manufactured home owners fighting attempted evictions by multiple property management companies that refused to renew their leases. (Havenpark was not among the companies Quigley has met in court.)

Although the problem is clear, well documented, and worsening, few federal policies exist to protect manufactured housing community residents. The federal protections that do exist are weak, housing advocates argue, and who knows how they will fare in Trump’s administration. State-level rules to protect manufactured housing residents vary, and firms like Havenpark tend to purchase in places where protections are lacking, says Yvonne Maldonado, executive director of MHAction, a national nonprofit coalition of manufactured housing community residents.

“In many states, we don’t have protections for families in manufactured homes, so Havenpark and many other predatory real estate speculators are taking advantage of that,” she says. “Where there is no law, residents complain, and [the owners] turn around and basically say, ‘You don’t like it? Leave.’”

But just telling folks who live in manufactured housing to “move” or “leave” is unrealistic. Despite being called “mobile homes” for much of their existence, this type of housing isn’t easily movable—and a full one-third of it is too old to be legally moved. That means if a person owns their home but is evicted from their lot, they’ve got no choice but to abandon their home. To add to the indignity, the “abandoned” home can then be re-rented or re-sold by the property owner.

“The housing vulnerability of the residents is really part of the business model for many manufactured home community owners because a large part of their profit comes from increases in rents, increases in fees that they understand residents will be forced to tolerate because they can’t move their home,” Sullivan says. “It’s either extremely expensive to move or, oftentimes, it’s simply impossible to move because it’s structurally unsound.”

These homeowners are, in essence, a captive audience. And given the current housing shortage, as low-income tenants find themselves unable to afford higher lot rents and new fees, they’ll simply be replaced by renters who may be in a higher income bracket but who are no less vulnerable than the tenants before them, says Dave Anderson, executive director of the National Manufactured Home Owners Association.

“Every element of the housing market is under pressure, seeing upward scarcity and upward pressure in values,” he says. “People are being shifted out of buying single-family homes and into renting, and people are being shifted away from rental options they might have done in the past into manufactured housing, which they might not have considered before.”

Missing data, limited protection policies

Just how big is the problem? It’s impossible to know.

No system of tracking manufactured housing–specific tenant or ownership issues exists. Comprehensive information about the number of parks sold or closed each year also doesn’t exist, nor does a roster of the homeowners who’ve been evicted. No one knows how many communities have been sold to private-equity firms, real estate investment firms, and other types of investors. None of the experts Shelterforce spoke with while reporting this story could point toward a single source for mapping and tracking manufactured housing community transactions.

The U.S. Department of Homeland Security (DHS) has a Homeland Infrastructure Foundation-Level Data website with a national tally of manufactured housing communities, but Sullivan’s team determined that it’s “highly inaccurate,” she wrote in an email. “It fails to record some parks and includes many non-park uses (like storage facilities and semi-truck parking lots).” DHS did not return requests for comment.

Though national data isn’t available, data published by Eileen Divringi from the Federal Reserve Bank of Philadelphia in June 2024 reports on these types of communities in Delaware, New Jersey, and Pennsylvania. Divringi and her team’s findings echoed years of complaints from park residents all over the country: The land-lease model is ripe for exploitation, leaving low-income residents at great risk of displacement and facing diminished wealth-building potential compared to traditional homeownership methods.

Manufactured housing communities are our last source of affordable housing, and it’s becoming unaffordable for many, many families.”

Yvonne Maldonado, MHAction

Even without complete data at the national level, the situation is alarming enough that it’s drawn intense scrutiny from residents, housing activists, legislators, and policymakers. For instance, in 2019, Rep. Dave Loebsack (D-Iowa) and Sen. Elizabeth Warren (D-Mass.) wrote a letter questioning Havenpark and other firms about “their use of predatory practices to boost profits in the communities they own.” Havenpark co-managing partners J. Anthony Antonelli (who died in 2024) and Robison “Robbie” Pratt (Antonelli’s son-in-law) issued a statement in response to the lawmakers’ letter reiterating their commitment to preserving affordable housing.

The letter claims that in two cases if they hadn’t purchased specific parks themselves, they “almost assuredly would have been sold to a developer that would have closed those communities.” The letter claimed that given market prices, Havenpark had no choice but to raise rents, and noted that despite rent increases, “these two communities provide among the most affordable units in their respective markets.”

Residents must be able to afford their home, but they aren’t averse to all rent increases. For example, when Hickory Village went up for sale, many residents committed willingly to bumping up their monthly payments to around $950 over the course of five years—if it meant they could buy the park. A contingent of Hickory Village residents organized a collective purchase effort, and got some traction in an ambitious scramble to buy Hickory Village, but Havenpark outbid them.

Colorado is one of several states that passed a tenant opportunity to purchase (TOPA) law, which gives tenants the first right to purchase their manufactured housing community when it goes on the market. Had they been successful, the lot rent increase would have been a stiff jump for most of the residents—but it would have been gradual and, more importantly, they would have benefited in perpetuity from the protections, stability, and agency that ownership provides.

Although the affordability and displacement issues are well known, the ongoing scrutiny hasn’t produced much protective action. In 2021, the Federal Housing Finance Agency (FHFA) implemented rules that require manufactured housing community owners to give 30 days’ notice to residents before increasing rents, among other protections. Those rules aren’t strong enough, says Caroline Nagy, senior policy counsel for housing at the Americans for Financial Reform Education Fund. FHFA’s protections only apply to borrowers who use government-backed loans, meaning a huge chunk of buyers with access to private equity aren’t subject to the rules. Also problematic: The rules only apply to transactions closed after the announcement was made.

More importantly, the 30-day notice doesn’t protect tenants from unchecked rent increases. “FHFA, Fannie Mae, Freddie—they’re still unwilling to impose rent increase restrictions as a condition of financing, and I don’t really think you can have meaningful tenant protections without that,” Nagy says. “Because if you can increase someone’s rent, if you can double someone’s rent for no reason at all, then you can evict people freely.”

While TOPA laws certainly help in states that have them, buying a park is an enormous undertaking—one that doesn’t always work out. Residents must organize, agree, and fundraise quickly, securing millions of dollars from lenders and investors in a short time and under immense pressure. In Colorado, for example, Ketels’s neighbors worked with Thistle Community Housing, a nonprofit that helps residents buy their communities, to access Colorado’s TOPA law, in their bid to buy their park. But the law only requires owners to prioritize “good faith” consideration of resident offers; it didn’t require them to choose the residents’ offer over Havenpark’s higher one.

“Manufactured housing communities are our last source of affordable housing, and it’s becoming unaffordable for many, many families,” MHAction’s Maldonado says. “The business models of Havenpark and many others are targeting the most vulnerable people—our seniors, our veterans, our low-income families. This is a crisis.”

Havenpark: “One of the most aggressive”

Even amid an ever-expanding pool of profit-seeking buyers, Havenpark stands out, says Paul Bradley, former president of ROC USA, a nonprofit that helps residents organize to purchase their manufactured housing communities.

“There are hundreds of private-equity buyers trying to build individual parks and portfolios,” he says. “But Havenpark over the last four or five years has been one of the most aggressive.”

And it’s no wonder why: The business model has been incredibly successful. Founded just eight years ago, Havenpark today operates 80-plus manufactured housing communities with more than 22,000 homesites. It’s privately owned, so the company’s assets, debts, and value aren’t publicly available, but Havenpark closed 6,000 deals between 2019 and 2021. Its revenue comes in at just more than $27 million per year, according to one estimate.

Havenpark claims it invests heavily in its newly acquired properties, many of which are aging and have not been well maintained by previous owners. Because these communities were typically developed by private owners, often 30 years ago or longer, their infrastructure—i.e., roads, sewers, and electrical—aren’t on city or county systems. Instead they’ve often been privately maintained on a shoestring budget by the property owner. By the time Havenpark buys them, the properties are often in need of major updates. “We’ll pour in a lot of capital in the first few years and on an ongoing basis to kind of raise the profile and quality of the community,” Pratt said in a 2023 interview with HousingWire.

Havenpark also tries to distinguish itself as an agent of social betterment; it sponsors scholarships and won a humanitarian award in 2023, for example. The company trumpets both its neighborhood improvement projects and its commitment to providing affordable ownership and rental opportunities. Havenpark invested $35 million in its parks in 2023, according to the company website. Pratt also insists the improvements and accompanying rent increases are not only for the betterment of the parks, they’re largely welcomed by many of the locals.

Shea and Heather Henke at home in Hickory Village Mobile Home Park in Fort Collins, Colorado. Staff photo by Shelby R. King

“I don’t think anybody wants a kind of, quote, trailer park,” Pratt told HousingWire. “The city doesn’t want it. The administrators don’t want it. Politicians don’t want it. The neighbors across the street don’t want it. I don’t really think investors want it. And I don’t think our residents want it.”

In interviews, Pratt touts Havenpark communities as an affordable homeownership option. But he fails to specify who they’re affordable for. Havenpark’s Hickory Village is no longer affordable for Ketels. And it’s becoming increasingly less affordable for Shea and Heather Henke, who own a single-wide in Hickory Village. They, too, say they’ve watched their lot rent creep up while services degraded. In 2021, before Havenpark bought the park, the Henkes’ lot rent was $555. It’s increased each year since, according to documents shared with Shelterforce. Starting in February 2025, they’ll be paying $856 per month, a total increase of 54 percent since Havenpark took over. (Havenpark in an email told Shelterforce rents have only increased 35 percent at Hickory Park since the company took over, and that Havenpark’s total investment into the park has been greater than the amount collected via rent increases.)

When asked if he felt Havenpark completed capital improvements dramatic enough to justify the rent increases, Shea Henke wrote in an email that Havenpark had resurfaced the roads and completed a significant tree trimming project, “but those were years ago, and I believe were budgeted into the purchase price. Earlier this year they finally finished installing streetlights mandated by the city after a year of delays, and they are working on the outdated water infrastructure.” The Henkes’ home and the homes around theirs had the water lines fully replaced in 2024. “So, they are partially addressing infrastructure needs, at least,” he wrote, adding that he and his wife feel they’re at an advantage compared to some of their neighbors—they’re both employed, educated, and empowered to advocate for themselves. “We’re in a financial position not a lot of our neighbors are in,” Heather says. But they’ve watched others at Hickory Village struggle since Havenpark took over.

And many of the Henkes’ neighbors, like Ketels, say their services have degraded since Havenpark took over, despite the company’s capital improvements. It’s worth noting that Hickory Village, like many manufactured housing communities, isn’t serviced by municipal utilities. Electricity, water, and sewer services are billed to the property owner, which then charges residents as part of their lot rent or as added service fees. Because of this, roads in mobile home parks aren’t maintained by the local government, nor are signage and lighting.

It’s not just Hickory Village. Havenpark horror stories from other properties are easy to find. In fact, a 1,000-plus–member “Stop Haven Park” Facebook group serves as a forum for people who live in Havenpark communities to air grievances, ask questions, and get advice from one another.

Gary Devereaux is part of that Facebook group. He fought Havenpark for years after the company bought Meadowlark Mobile Home Park in Billings, Montana, alleging that the company failed to fix the community’s aging water infrastructure—which was already deteriorating when Havenpark bought Meadowlark in 2020. Devereaux documented months of coffee-colored water full of sludge coming from his faucets; he filed a class action lawsuit in 2022. Havenpark denied any negligence or wrongdoing, noting that the EPA had found the water potable and that the water system was fixed as of 18 months ago. The company also pointed out that residents were not charged for water while the system was being fixed. The parties settled via court-ordered mediation and the settlement is confidential. Devereaux has since moved.

Even Stop Haven Park’s founder and administrator, Carla Hill, gave up. In the first three years with Havenpark as her landlord at Cherry Creek Mobile Home Park, also in Billings, Montana, Hill’s rent went from $425 per month in 2020, including water and garbage, to about $540 per month by the time her family moved away in August 2023. As of January 2025, one five-year Cherry Creek resident pays $643 per month for lot rent (including water and garbage), up from $485 in 2023.

MHAction’s Maldonado claims that in states without rent increase rules, she’s seen Havenpark increase rents by 50 percent. “They tell you it’s affordable,” she says. “Once you’re in, they start tacking on extra fees.” (A Havenpark representative in an email stated the company denies increasing rents by 50 percent upon purchase at any of its properties, and that it abides by all fair housing rules.)

Havenpark residents who want to move out have found it difficult to leave on their own terms. When Hill sold her home to an acquaintance, she says the property manager first told her the buyer didn’t qualify to live in the park. When the buyer called the office to clear up the issue, Hill says the property manager tried to sell him a different home in the park. When asked about this transaction, the Havenpark representative wrote in an email that all potential residents are subject to a standard lease application process, which park management conducts in accordance with fair housing laws, and that Hill’s accusations of the management trying to sell the applicant a different home were unsubstantiated.

“Havenpark believes in continuous improvement, and we are always open to feedback from our residents, without retaliation,” the representative wrote in an official statement. When asked about the Colorado Department of Labor Affairs’ retaliation determination and demand that the company reimburse Ketels, the representative replied only that the case “remains ongoing” and declined to provide additional details. Ketels says Havenpark is disputing the decision.

But these accusations about Havenpark’s tactics don’t surprise Alexander Kornya, an attorney and the former director of litigation at Iowa Legal Aid (ILA). Kornya began getting complaints about Havenpark around 2019, when the company bought its first property in Iowa. The state’s protections for manufactured housing residents at the time were weak, allowing the company to initially notify some residents that their rent was going to increase by 70 percent almost immediately. (Havenpark backed off following a media outcry.)

While at ILA, Kornya worked with about two dozen Havenpark residents who alleged the company included provisions in its leases that didn’t adhere to state code. He has since left ILA. Although a representative for the firm could not share additional information, citing attorney-client privilege, they supported Kornya’s legal expertise. (It should be noted that including lease provisions that don’t adhere to state rules is common—usually followed at the end of the lease by a provision declaring that anything not conforming to state law is void, leaving tenants unsure which parts of their leases are enforceable. Havenpark in an emailed statement reiterated that it follows all fair housing laws.)

Kornya called Havenpark’s leases “massive,” confusing, and often rife with provisions that he believed were legally unenforceable. “Every time they would propose a new lease, we would have these community meetings where we would basically point out all the things that were wrong with the lease,” he says.

Considering all the ongoing problems and uncertainty Ketels continues to deal with from the management at Hickory Village, he’s flat refusing to sign a new lease. He’s barely scraping enough together for rent each month and bracing for the big jump to $1,059 per month. “We’re still hanging in there,” he says. “But it’s just going to keep going up. It could be $50. It could be $150.”

—

Part III – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following.

1) Per the resident-rights and interests focused MHPHOA website is the following.

A-Z Partial Listing of MHC Owners in the United States

AKA: Mobile Home Park Owners, Trailer Park Owners, RV Park Owners

Data Note: This table of 155 Investors, Park Owners and/or Park Management Companies is a work in progress as of Monday, March 31, 2025. The number of Sites data may not be accurate and is rounded up to the nearest quarter (25, 50, 75, 00). The MHPHOA are performing ongoing research in this area to see if we can accurately account for the total number of Sites for each entity listed. Address and Website information are accurate based on recent audits performed for data verification against publicly available records.

Table Note: Click/tap on table headings to sort ascending or descending, click/tap the # column to reset. Click/tap the Sites heading (or Prop heading) to sort by largest to smallest, this will reveal our Top 50 Manufactured Home Community Owners in the United States as of Monday, March 31, 2025.

|

#

|

Name

|

Address

|

City

|

State

|

Zip

|

Prop

|

Sites

|

Verified

|

Website

|

|---|---|---|---|---|---|---|---|---|---|

| 1 | Sun Communities Inc

|

27777 Franklin Road, Suite 200 | Southfield | Michigan | 48034 | 667 | 179,325 | 2024-03-25 | SunCommunities.com JensenCommunities.com |

| 2 | Equity LifeStyle Properties Inc

|

Two North Riverside Plaza | Chicago | Illinois | 60606 | 451 | 172,475 | 2024-06-08 | EquityLifeStyleProperties.com MyMHCommunity.com |

| 3 | RHP Properties

|

31200 Northwestern Highway | Farmington Hills | Michigan | 48334 | 371 | 79,725 | 2025-02-07 | RHP.com BayshoreHomeSales.com |

| 4 | YES! Communities

|

1900 16th Street, Suite 950 | Denver | Colorado | 80202 | 266 | 74,775 | 2024-06-13 | YESCommunities.com |

| 5 | Roots Management Group

|

16400 Dallas Parkway | Dallas | Texas | 75248 | 239 | 37,800 | 2024-06-13 | RootsMG.com |

| 6 | Hometown America

|

150 North Wacker Drive, Suite 2800 | Chicago | Illinois | 60606 | 76 | 26,225 | 2024-06-13 | HometownAmerica.com |

| 7 | UMH Properties Inc

|

3499 Route 9 North, Suite 3-C | Freehold | New Jersey | 07728 | 135 | 25,800 | 2024-04-02 | UMH.com |

| 8 | MHP Funds LLC

|

110 Northwest 2nd Street | Cedaredge | Colorado | 81413 | 165 | 25,000 | 2024-08-01 | MHPFunds.com |

| 9 | The BoaVida Group LP

|

1914 Terracina Drive, Suite 130 | Sacramento | California | 95834 | 236 | 24,850 | 2023-12-11 | TheBoaVidaGroup.com |

| 10 | Horizon Land Management

|

2138 Espey Court, Suite 1 | Crofton | Maryland | 21114 | 169 | 24,000 | 2024-06-13 | HorizonLandMgmt.com |

| 11 | Inspire Communities

|

11335 Gold Express Drive, Suite 100 | Gold River | California | 95670 | 115 | 23,600 | 2024-06-13 | InspireCommunities.com |

| 12 | Stonetown Capital

|

720 South Colorado Boulevard, Suite 1150-N | Denver | Colorado | 80246 | 150 | 23,000 | 2024-05-28 | StonetownCapital.com |

| 13 | Crow Holdings

|

3819 Maple Avenue | Dallas | Texas | 75219 | 114 | 20,000 | 2024-03-25 | CrowHoldings.com |

| 14 | Havenpark Communities

|

51 West Center Street, Suite 600 | Orem | Utah | 84057 | 64 | 19,125 | 2024-06-13 | HavenparkCommunities.com |

| 15 | Newport Pacific Capital

|

17300 Red Hill Avenue, Suite 280 | Irvine | California | 92614 | 120 | 18,125 | 2024-05-28 | NewportPacific.com |

| 16 | QuadReal Property Group LP | 100 Wilshire Boulevard, Suite 940 | Santa Monica | California | 90401 | 17,000 | 2024-11-29 | QuadReal.com | |

| 17 | Bessire and Casenhiser Inc

|

430 South San Dimas Avenue | San Dimas | California | 91773 | 84 | 16,875 | 2025-01-13 | Bessire-Casenhiser.com |

| 18 | Investment Property Group

|

18006 Sky Park Circle, Suite 200 | Irvine | California | 92614 | 122 | 16,150 | 2024-01-04 | IPGLiving.com |

| 19 | Zeman Homes

|

6547 North Avondale Avenue | Chicago | Illinois | 60631 | 40 | 14,000 | 2025-01-13 | ZemanHomes.com |

| 20 | Flagship Communities REIT

|

467 Erlanger Road | Erlanger | Kentucky | 41018 | 74 | 13,725 | 2023-09-30 | FlagshipCommunities.com |

| 21 | Cove Communities | 2999 North 44th Street, Suite 200 | Phoenix | Arizona | 85018 | 38 | 13,000 | 2024-11-04 | CoveCommunities.com |

| 22 | Alden Global Capital

|

885 Third Avenue, 34th Floor | New York | New York | 10022 | 138 | 10,175 | 2024-06-13 | AldenGlobal.com |

| 23 | Riverstone Communities

|

6400 Telegraph Road | Bloomfield Township | Michigan | 48301 | 54 | 10,050 | 2024-06-13 | Rivstone.com |

| 24 | Commonwealth Real Estate Services

|

18150 Southwest Boones Ferry Road | Portland | Oregon | 97224 | 101 | 10,000 | 2024-03-30 | CWRES.com |

| 25 | Gelt Ventures

|

18751 Ventura Boulevard, 2nd Floor | Tarzana | California | 91356 | 28 | 9,875 | 2024-05-28 | GeltVenturePartners.com |

| 26 | ParkLand Ventures Inc

|

4501 Highwoods Parkway, Suite 270 | Glen Allen | Virginia | 23060 | 48 | 9,875 | 2024-03-30 | ParkLandVenturesInc.com |

| 27 | Continental Communities

|

2015 Spring Road, Suite 600 | Oak Brook | Illinois | 60523 | 31 | 9,300 | 2024-05-28 | ContinentalCommunities.com |

| 28 | Ascentia Real Estate Holding Company LLC

|

2 West Dry Creek Circle # 200 | Littleton | Colorado | 80120 | 39 | 8,600 | 2024-01-02 | Ascentia.us |

| 29 | J & H Asset Property Management Inc

|

22880 Savi Ranch Parkway | Yorba Linda | California | 92887 | 79 | 8,175 | 2024-05-28 | JandHMgt.com |

| 30 | Four Leaf Properties

|

600 West 22nd Street, Suite 101 | Oakbrook | Illinois | 60523 | 8,000 | 2024-01-02 | FourLeafProp.com | |

| 31 | Nodel Parks LLC

|

38505 Woodward Avenue, Suite 275 | Bloomfield Hills | Michigan | 48304 | 33 | 8,000 | 2024-05-28 | NodelParks.com |

| 32 | Carlyle Group Inc

|

1001 Pennsylvania Avenue NW | Washington | District of Columbia | 20004 | 22 | 7,550 | 2024-06-13 | Carlyle.com |

| 33 | Garden Homes Management Corporation | 29 Knapp Street | Stamford | Connecticut | 06907 | 102 | 7,350 | 2024-05-28 | GardenHomesManagement.com |

| 34 | Kort and Scott

|

320 North Park Vista Street | Anaheim | California | 92806 | 43 | 7,200 | 2025-01-15 | KortandScott.com |

| 35 | Cook Properties | 90 Airpark Drive, Suite 400 | Rochester | New York | 14624 | 100 | 7,000 | 2025-01-13 | CookPropertiesNY.com |

| 36 | Windward Communities | 380 Park Place Boulevard, Suite 225 | Clearwater | Florida | 33759 | 20 | 7,000 | 2024-06-13 | LiveWindward.com |

| 37 | Three Pillar Communities

|

221 Main Street, Suite 2039 | Los Altos | California | 94023 | 71 | 6,925 | 2023-11-05 | ThreePillarCommunities.com |

| 38 | Affordable Communities Group LLC

|

2054 Kildaire Farm Road # 413 | Cary | North Carolina | 27518 | 44 | 6,200 | 2024-01-24 | ACGMHC.com |

| 39 | Hurst & Son LLC

|

585 Bethel Avenue, Suite 202 | Port Orchard | Washington | 98366 | 93 | 6,150 | 2025-02-20 | HurstSonLLC.com |

| 40 | Harmony Communities Inc

|

6653 Embarcadero Drive, Suite C | Stockton | California | 95219 | 84 | 6,000 | 2024-10-09 | HarmonyCom.com |

| 41 | Santiago Communities Inc | 1920 East Warner Avenue | Santa Ana | California | 92705 | 43 | 6,000 | 2024-05-28 | SantiagoCorp.com |

| 42 | Choice Properties Inc | 2265 Livernois, Suite 500 | Troy | Michigan | 48083 | 12 | 5,850 | 2024-03-30 | ChoiceProperties.com |

| 43 | Les Frame Management | 1635 Aviation Boulevard | Redondo Beach | California | 90278 | 47 | 5,400 | 2025-01-13 | LFMgmt.com |

| 44 | Monte Christo Communities

|

3308 El Camino Avenue, Suite 300, Room 608 | Sacramento | California | 95821 | 90 | 5,100 | 2025-01-15 | MonteChristoCommunities.com |

| 45 | Pacific Current Partners

|

1400 East 4th Street | Santa Ana | California | 92701 | 35 | 5,050 | 2024-09-20 | PCPEquity.com See Saunders Property Company See Star Management |

| 46 | Murex Properties LLC | 12629 New Brittany Boulevard, Building 16 | Fort Myers | Florida | 33907 | 22 | 5,000 | 2024-05-28 | MurexProperties.com |

| 47 | Ravinia Communities LLC | 900 Skokie Boulevard, Suite 213 | Northbrook | Illinois | 60062 | 5,000 | 2024-05-28 | RaviniaCommunities.com | |

| 48 | Star Management

|

1400 East 4th Street | Santa Ana | California | 92701 | 36 | 4,975 | 2024-05-28 | StarManagement.com See Pacific Current Partners See Saunders Property Company |

| 49 | Thesman Communities | 11100 Santa Monica Boulevard | Los Angeles | California | 90025 | 11 | 4,775 | 2024-05-28 | Thesman.com |

| 50 | Caritas Affordable Housing

|

3 Park Plaza, Suite 1700 | Irvine | California | 92614 | 32 | 4,525 | 2024-03-30 | CaritasCorp.org |

| 51 | Millennium Housing

|

611 Anton Boulevard, Suite 890 | Costa Mesa | California | 92626 | 19 | 4,500 | 2024-05-28 | MillenniumHousing.net |

| 52 | Western Management LLC

|

1654 The Alameda, Suite 100 | San Jose | California | 95159 | 28 | 4,350 | 2024-03-25 | WesternM.com |

| 53 | Storz Management Company

|

9152 Greenback Lane | Orangevale | California | 95662 | 34 | 4,125 | 2025-01-13 | StorzCo.com |

| 54 | GMF Group

|

401 South County Road #3406 | Palm Beach | Florida | 33480 | 43 | 4,000 | 2025-02-05 | GMFGroup.com |

| 55 | Monolith Properties Inc

|

8801 Folsom Boulevard, Suite 295 | Sacramento | California | 95826 | 40 | 3,850 | 2025-03-26 | MonolithParks.com |

| 56 | Laguna Asset Management

|

PO Box 2308 | Laguna Hills | California | 92654 | 34 | 3,800 | 2024-03-25 | LagunaAssetManagement.com |

| 57 | Brandenburg Properties | 1122 Willow Street, Suite 200 | San Jose | California | 95125 | 14 | 3,500 | 2024-03-30 | Brandenburg-Properties.com |

| 58 | FollettUSA | 3600 American River Drive, Suite 215 | Sacramento | California | 95864 | 16 | 3,450 | 2024-05-28 | FollettUSA.com |

| 59 | Manufactured Housing Properties Inc

|

136 Main Street | Pineville | North Carolina | 28134 | 58 | 3,150 | 2024-06-24 | MHProperties.com |

| 60 | Cabrillo Management Corporation

|

1495 Pacific Highway, Suite 450 | San Diego | California | 92101 | 16 | 2,800 | 2024-03-30 | CabMH.com |

| 61 | HCA Management Company LLC | PO Box 7 | Novato | California | 94948 | 15 | 2,750 | 2024-05-28 | HCAMgmt.com |

| 62 | GSC Investments

|

Los Angeles | California | 35 | 2,500 | 2024-04-05 | GSCInvestments.com | ||

| 63 | ALS Properties

|

5501 Lakeland Avenue North | Crystal | Minnesota | 55429 | 12 | 2,400 | 2023-09-27 | ALS-Hart.com |

| 64 | American Mobile Home Communities

|

PO Box 414 | Barrington | Illinois | 60011 | 15 | 2,100 | 2023-09-27 | AmericanMobileHomeCommunities.com |

| 65 | Comfort Communities

|

2081 North Marshall Avenue | El Cajon | California | 92020 | 24 | 2,100 | 2023-11-05 | ComfortCommunities.com |

| 66 | Parkbridge Investment Group Inc | 139 Walnut Boulevard | Rochester | Michigan | 48307 | 15 | 2,100 | 2024-05-28 | ParkbridgeHomes.com |

| 67 | FR Community | 1420 West Canal Court | Littleton | Colorado | 80120 | 7 | 2,000 | 2024-05-28 | FRCommunity.com |

| 68 | The Requity Group

|

1032 East Brandon Boulevard #2636 | Brandon | Florida | 33511 | 19 | 2,000 | 2025-01-13 | TheRequityGroup.com |

| 69 | FG Communities Inc

|

108 Gateway Boulevard, Suite 206 | Mooresville | North Carolina | 28117 | 42 | 1,800 | 2025-03-05 | FGCommunities.com |

| 70 | Nella Invest | 2360 Lindbergh Street | Auburn | California | 95602 | 12 | 1,525 | 2025-01-13 | NellaInvest.com |

| 71 | Park Place Communities | 1176 East Warner Road, Suite 201 | Gilbert | Arizona | 85296 | 20 | 1,500 | 2024-05-28 | ParkPlaceCommunities.com |

| 72 | TREAD Companies | Richmond | Virginia | 23220 | 8 | 1,500 | 2024-05-05 | MHPAmerica.com | |

| 73 | Community Management Group

|

19803 1st Avenue South, Suite 200 | Normandy Park | Washington | 98148 | 28 | 1,450 | 2024-07-10 | CMGParks.com |

| 74 | Discover Properties LLC | 17602 17th Street, Suite 102 # 289 | Tustin | California | 92780 | 14 | 1,450 | 2024-05-06 | DiscoverPropertiesLLC.com |

| 75 | Cohron’s Manufactured Homes | 9622 Pendleton Pike | Indianapolis | Indiana | 46236 | 7 | 1,425 | 2024-03-30 | CohronHomes.com |

| 76 | James Goldstein | Angelo View Drive | Los Angeles | California | 90210 | 4 | 1,350 | 2024-04-29 | JamesFGoldstein.com |

| 77 | Flood Homes Inc | N7559 North Pioneer Road | Fond du Lac | Wisconsin | 54937 | 11 | 1,325 | 2024-05-06 | FloodHomesInc.com |

| 78 | Living Well Communities

|

647 Camino De Los Mares, Suite 108/70 | San Clemente | California | 92673 | 20 | 1,075 | 2024-05-28 | |

| 79 | Goldfinch Communities | 1905 Sherman Street, Suite 835 | Denver | Colorado | 80203 | 10 | 1,025 | 2024-05-28 | GoldfinchCommunities.com |

| 80 | Affordable Communities Inc

|

7420 Greenhaven Drive, Suite 125 | Sacramento | California | 95831 | 13 | 925 | 2023-09-27 | AffordableCommunitiesInc.com |

| 81 | Iron Oak Properties | 660 4th Street, # 471 | San Francisco | California | 94107 | 7 | 375 | 2024-05-28 | IronOakProperties.com |

| 82 | Affordable Communities Fund I, LLC, ACF II, ACF III, ACF IV, ACF V | 2023-09-27 | See Havenpark Communities | ||||||

| 83 | Affordable Housing Affiliates

|

465 South Orlando Avenue, Suite 213 | Maitland | Florida | 32751 | 43 | 2024-04-25 | AHAMHP.com | |

| 84 | Apex Residential Management Inc | 2025-01-15 | See Kort and Scott | ||||||

| 85 | ARC Investments

|

9597 Central Avenue | Montclair | California | 91763 | 12 | 2023-09-27 | ARCInvestments.com | |

| 86 | Ashwood Communities | 2023-09-27 | See Flood Homes Inc | ||||||

| 87 | Bedrock Communities

|

57 Wilton Road | Westport | Connecticut | 06880 | 28 | 2025-01-13 | Bedrock-Communities.com | |

| 88 | Broadview Communities | 520 South Dixie Highway, Suite 305 | Hallandale Beach | Florida | 33009 | 16 | 2024-08-15 | BroadviewCommunities.com | |

| 89 | Brookfield Asset Management Inc | 2023-09-27 | See RHP Properties | ||||||

| 90 | Cal-Am Properties Inc

|

385 Clinton Street | Costa Mesa | California | 92626 | 2025-01-15 | Cal-Am.com | ||

| 91 | Cambridge Investors | 3001 West Big Beaver Road, Suite 324 | Troy | Michigan | 48084 | 2025-01-15 | CambridgeInvestors.com | ||

| 92 | Carefree Communities Inc | 2023-09-27 | See Sun Communities Inc | ||||||

| 93 | Cascade Corporate Management Inc | 2023-09-27 | See The BoaVida Group LP | ||||||

| 94 | Centerbridge Partners LP | 2023-09-27 | See Sun Communities Inc | ||||||

| 95 | Chesapeake Homes | 7519 Lincoln Highway | Abbottstown | Pennsylvania | 17301 | 10 | 2024-03-30 | ChesapeakeMobile.com | |

| 96 | Cobblestone Real Estate

|

17W220 22nd Street, Suite 220 | Oakbrook Terrace | Illinois | 60181 | 68 | 2024-04-19 | CobblestoneAssets.com | |

| 97 | Collective Communities | AZ, CO, ID, MI, OR, UT, WA | Washington | 32 | 2024-04-05 | CollectiveMHC.com | |||

| 98 | Commercial Real Estate Investors Inc | 151 North California Avenue, Top Floor | Oakdale | California | 95361 | 13 | 2024-03-30 | CRICommercial.com | |

| 99 | Crown Communities LLC

|

1712 Pioneer Avenue, Suite 2117 | Cheyenne | Wyoming | 82001 | 16 | 2024-03-25 | IgniteMHC.com KodiakPM.com |

|

| 100 | Elevation Capital Group | 255 South Orange Avenue, Suite 1550 | Orlando | Florida | 32801 | 2025-01-15 | ElevationCapitalGroup.com | ||

| 101 | Federal Capital Partners | 2023-09-27 | See Horizon Land Management | ||||||

| 102 | First Commercial Properties NW | 2020 Maltby Road, Suite 7 | Bothell | Washington | 98021 | 31 | 2024-09-27 | FCPNW.com | |

| 103 | Fischer Investment Group | 3812 Scottsdale Drive | Irvine | California | 92606 | 2025-01-15 | |||

| 104 | Forrest Street Partners

|

935 Forrest Street, Suite C | Roswell | Georgia | 30075 | 5 | 2025-01-13 | Forrest-Street.com | |

| 105 | Garber Communities | PO Box 580 | Winter Park | Florida | 32790 | 10 | 2025-01-13 | GarberCommunities.com | |

| 106 | Good Life Communities | 2023-09-27 | See The BoaVida Group LP | ||||||

| 107 | Happy Home Communities | 2023-09-27 | See Gelt Inc | ||||||

| 108 | Havenpark Capital Partners | 2023-09-27 | See Havenpark Communities | ||||||

| 109 | Heartwood Partners | 301 Merritt 7 | Norwalk | Connecticut | 06851 | 2025-01-13 | HeartwoodPartners.com | ||

| 110 | HomeFirst Communities | 2023-09-27 | See Windward Communities | ||||||

| 111 | Homes of America LLC | PO Box 483 | Bergenfield | New Jersey | 07631 | 2023-09-27 | See Alden Global Capital | ||

| 112 | Impact Communities | 2023-09-27 | See MHP Funds LLC | ||||||

| 113 | Inland Venture Partners | 2901 Butterfield Road | Oak Brook | Illinois | 60523 | 12 | 2025-01-13 | Inland-Investments.com | |

| 114 | Jensen Communities | 2023-09-27 | See Sun Communities Inc | ||||||

| 115 | KDM Development Corporation

|

1080 Pittsford Victor Road, Suite 202 | Pittsford | New York | 14534 | 28 | 2024-05-28 | KDMDevelopment.com | |

| 116 | Keith Management LLC | 1775 E Queen Creek Road #3 | Chandler | Arizona | 85286 | 15 | 2024-05-28 | KeithManagement.com | |

| 117 | Kingsley Management Corporation

|

4956 North 300 West | Provo | Utah | 84604 | 2024-05-28 | KMCMH.com | ||

| 118 | Kodiak Property Management | 2023-09-27 | See Crown Communities LLC | ||||||

| 119 | Lakeshore Communities Inc

|

8800 North Bronx Avenue | Skokie | Illinois | 60077 | 2024-05-28 | LakeshoreMHC.com | ||

| 120 | Lautrec Ltd

|

31550 Northwestern Highway, Suite 200 | Farmington Hills | Michigan | 48334 | 32 | 2024-05-28 | LautrecLtd.com | |

| 121 | Leasco Management Company

|

1001 Dove Street, Suite 185 | Newport Beach | California | 92660 | 7 | 2025-01-15 | LeascoManagement.com | |

| 122 | Legacy Communities LLC

|

32313 Broadway Street, Suite 101 | Sebring | Florida | 33870 | 75 | 2024-06-19 | LegacyMHC.com | |

| 123 | M. Shapiro Real Estate Group

|

31550 Northwestern Highway, Suite 220 | Farmington Hills | Michigan | 48334 | 2024-05-28 | MShapiroRealEstate.com | ||

| 124 | McDougall-Weiner Investments | 2023-09-27 | See The BoaVida Group LP | ||||||

| 125 | Meritus Communities (Inframark)

|

32255 Northwestern Highway | Farmington Hills | Michigan | 48334 | 2024-05-28 | Inframark.com | ||

| 126 | MHC Property Management LP | 2023-09-27 | See Equity LifeStyle Properties Inc | ||||||

| 127 | Newby Management

|

3310 US Highway 301 North | Ellenton | Florida | 34222 | 40 | 2025-01-15 | NewbyManagement.com | |

| 128 | North Highland Partners | 2023-09-27 | See Roseland Communities | ||||||

| 129 | Open Door Capital LLC

|

1450 West Peachtree Street, Suite 200 | Atlanta | Georgia | 30309 | 2025-01-15 | ODCFund.com | ||

| 130 | Parakeet Communities

|

10221 River Road, Suite 59831 | Potomac | Maryland | 20859 | 46 | 2024-03-30 | ParakeetCommunities.com | |

| 131 | Park Street Partners | 27762 Antonio Parkway L1-435 | Ladera Ranch | California | 92694 | 2025-01-15 | ParkStreetPartners.com | ||

| 132 | Philips International

|

40 Cutter Mill Road, Suite 405 | Great Neck | New York | 11021 | 42 | 2024-04-02 | RVMHP.com | |

| 133 | Platinum Acquisitions LLC | 2025-01-15 | See Kort and Scott | ||||||

| 134 | Resident Owned Parks Inc | 2023-09-27 | See Affordable Communities Inc | ||||||

| 135 | Roseland Communities | PO Box 42074 | Arlington | Virginia | 22204 | 17 | 2025-01-13 | RoselandCommunities.com | |

| 136 | RV Horizons Inc | 2023-09-27 | See MHP Funds LLC | ||||||

| 137 | Santefort Real Estate Group LLC | 732 North Cass Avenue | Westmont | Illinois | 60559 | 10 | 2024-05-28 | SantefortNeighborhoods.com | |

| 138 | Saunders Property Company

|

4040 MacArthur Boulevard # 300 | Newport Beach | California | 92660 | 2025-01-15 | CoreRealtyHoldings.com See Pacific Current Partners See Star Management |

||

| 139 | Sierra Corporate Management Inc | 2025-01-15 | See Kort and Scott | ||||||

| 140 | Silver King Companies | 10679 North Frank Lloyd Wright Boulevard # 103 | Scottsdale | Arizona | 85259 | 13 | 2024-05-28 | SilverKingCo.com | |

| 141 | Skya Ventures Inc | 2023-09-27 | See Gelt Inc | ||||||

| 142 | Smith Management LLC | 1 Engle Street, Suite 201 | Englewood | New Jersey | 07631 | 2023-09-27 | See Alden Global Capital | ||

| 143 | Steiner Communities | 401 South Albany Avenue | Tampa | Florida | 33606 | 8 | 2024-05-28 | SteinerCommunities.com | |

| 144 | Stockbridge Capital Group | 2023-09-27 | See YES! Communities | ||||||

| 145 | Strive Communities | 2023-09-27 | See MHP Funds LLC | ||||||

| 146 | Tarrant Capital IP LLC | 2023-09-27 | See MHP Funds LLC | ||||||

| 147 | Tecolote Investors LLC

|

2023-09-27 | See FollettUSA | ||||||

| 148 | The Blackstone Group LP | 2023-09-27 | See Roots Management Group | ||||||

| 149 | Treehouse Communities | 2023-09-27 | See Roots Management Group | ||||||

| 150 | Uniprop | 280 Daines Street, Suite 300 | Birmingham | Michigan | 48009 | 2024-05-28 | Uniprop.com | ||

| 151 | Vieira Enterprises Inc | 2001 Lafayette Street | Santa Clara | California | 95050 | 7 | 2025-01-13 | VieiraEnterprises.com | |

| 152 | Vineyards Management Group | 2023-09-27 | See Roots Management Group | ||||||

| 153 | West Coast Mobile Home Parks Inc

|

1700 South El Camino Real, Suite 404 | San Mateo | California | 94402 | 12 | 2025-01-13 | WestCoastMobileHomeParks.com | |

| 154 | Westland Real Estate Group | 520 West Willow Street | Long Beach | California | 90806 | 17 | 2024-05-28 | WestlandRealEstateGroup.com | |

| 155 | Westwind Enterprises Ltd | 1515 The Alameda, Suite 200 | San Jose | California | 95126 | 20 | 2024-05-28 | WestwindEnterprises.com |

Following the above, MHPHOA’s website said this.

Website for Residents: The MHPHOA is NOT affiliated with any mobile home park owners and/or mobile home park management entities. We are both outspoken and anonymous mobile home residents, past and present, just like you, experiencing similar injustices, who want to help.

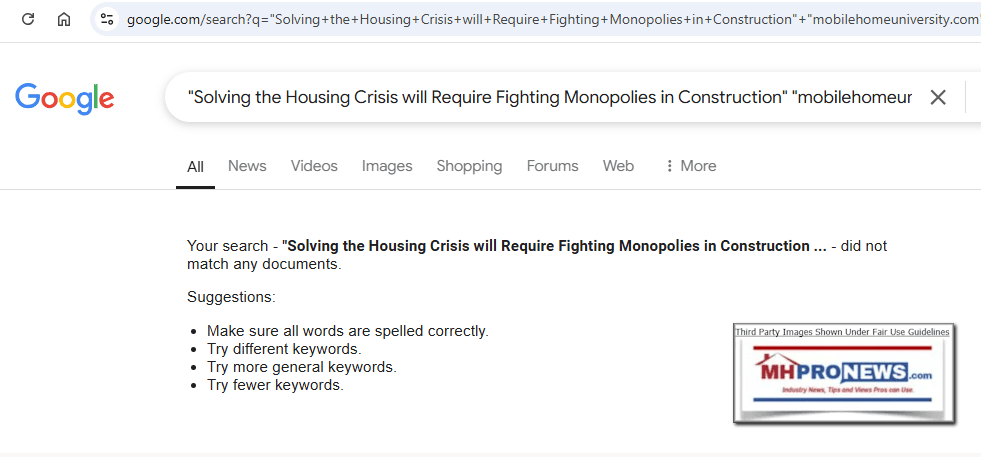

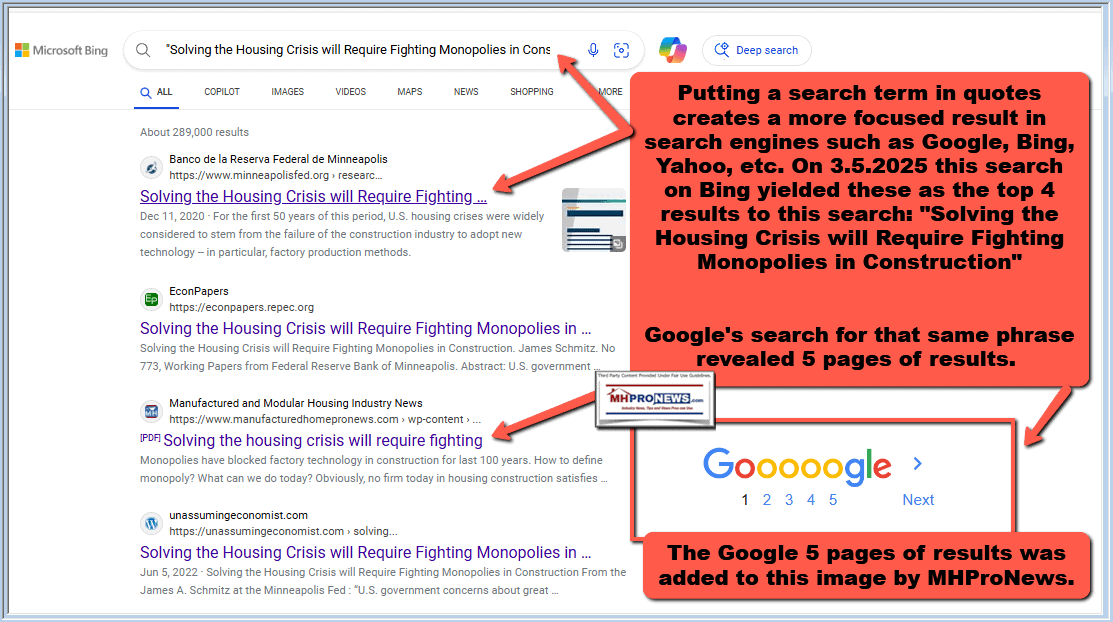

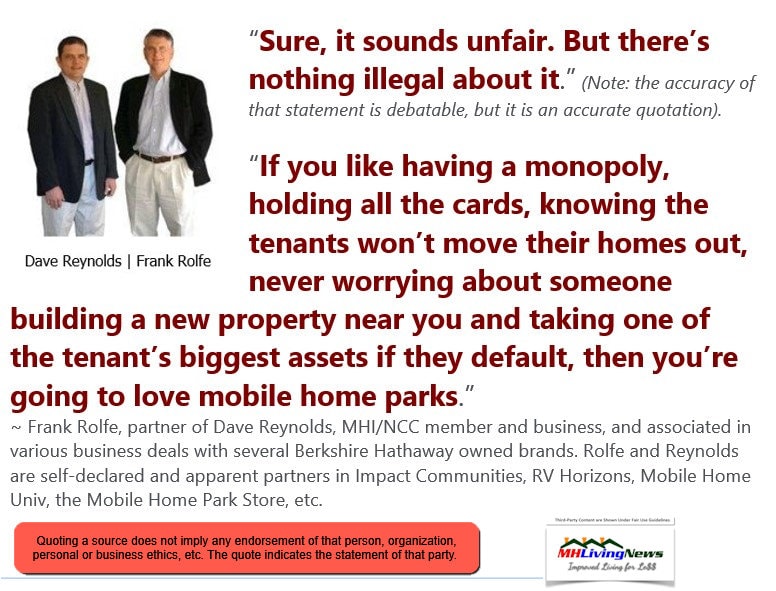

3) Note MHLivingNews previously compared MHPHOA’s list for accuracy to the one found associated with Frank Rolfe and Dave Reynolds (MHP Funds, Mobile Home University, Impact Communities, Mobile Home Park Store, RV Horizons, et al).

4) Clearly, the community sector of the industry, often associated with the consolidators of the Manufactured Housing Institute (MHI) and/or MHI linked state associations are not interested in providing specific, timely, and accurate information on that segment of the industry. While that may sound like a bold critique, it actually fits the comments from Sun Communities corporate leaders Gary Shiffman. The scandal-dogged Sun CEO Gary Shiffman said there is no “national repository of information” and said there is a “scarcity of available manufactured housing communities.” One might think that the leader of a multi-billion dollar manufactured housing brand would know.

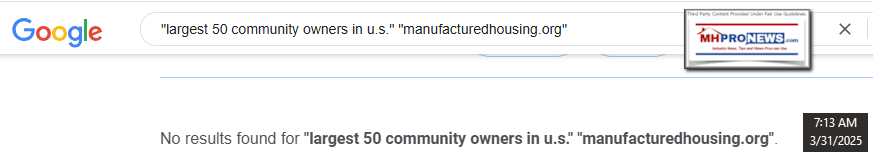

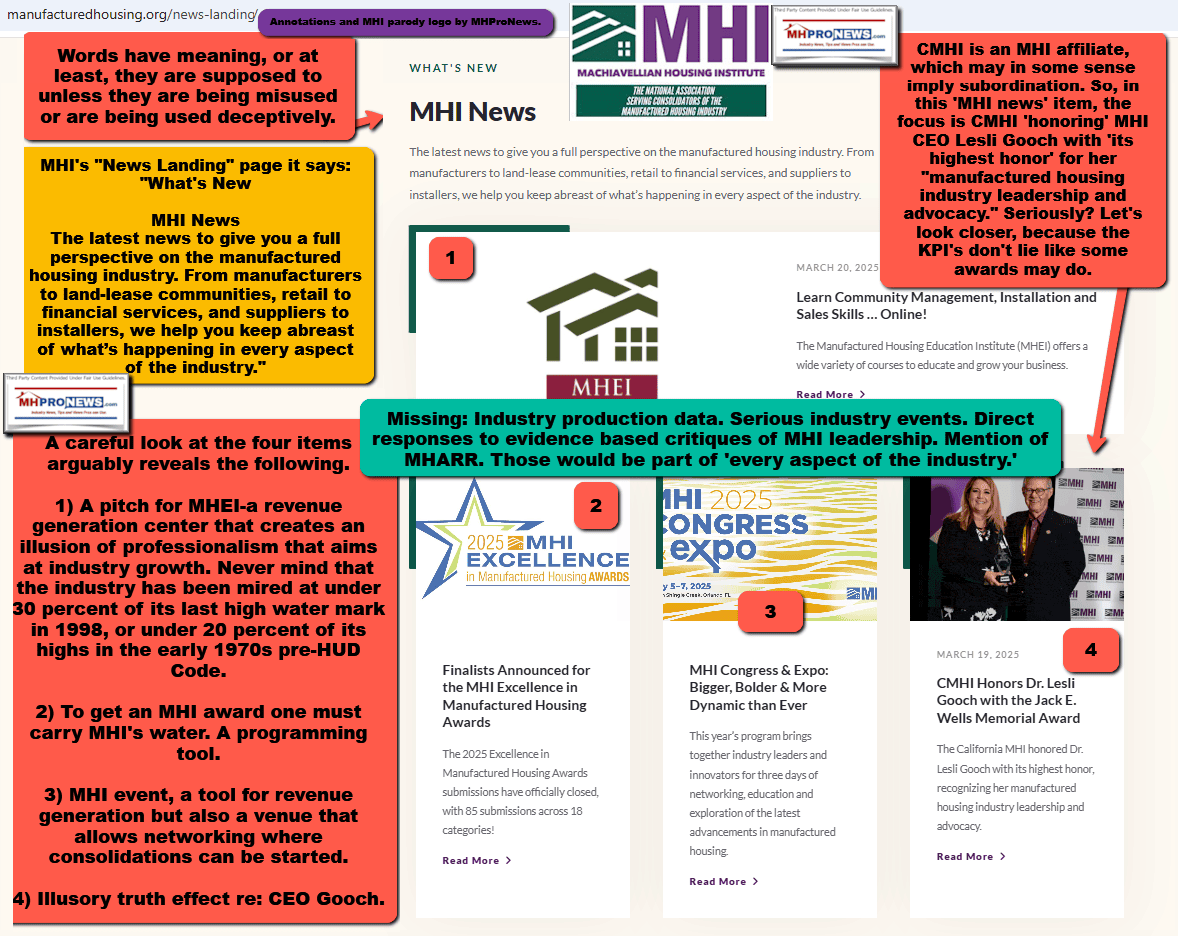

5) For a period of time MHI maintained and published a list like the one shown below. Perhaps when MHI realized that MHProNews was going to utilize that information in reporting, they suspended updates of that periodic MHI-NCC press release. Whatever their motivation in suspending the listing and periodic press release graphic provided below, on this date, it is no longer found on the public side of the MHI website.

6) Google’s AI powered Gemini said the following on this date.

The Manufactured Housing Institute (MHI) National Communities Council (NCC) released a list of the 50 largest manufactured home community owners and operators in the U.S., with Sun Communities, Equity LifeStyle Properties, and RHP Properties being among the top 3.

Here’s a more detailed breakdown of the top 5 companies, along with some additional information:

- Sun Communities: Based in Southfield, Michigan, Sun Communities manages 83,294 homesites.

- Equity LifeStyle Properties: Headquartered in Chicago, Illinois, Equity LifeStyle Properties manages 73,700 homesites.

- RHP Properties: Located in Farmington Hills, Michigan, RHP Properties manages 60,163 homesites.

- YES! Communities: Based in Denver, Colorado, YES! Communities manages 47,278 homesites.

- MHP Funds: Located in Cedaredge, Colorado, MHP Funds manages 31,652 homesites.

Additional Information:

The Manufactured Housing Institute’s National Communities Council (MHI NCC) is the organization that released the list of the top 50 community owners and operators.

Manufactured housing refers to homes that are built off-site and then transported to a lot for permanent installation.

Manufactured home communities are also known as mobile home parks or trailer parks.

The manufactured housing industry is a significant part of the housing market, with millions of Americans living in manufactured homes.

Residents can find information about park owners or operators through state Department of Housing websites.

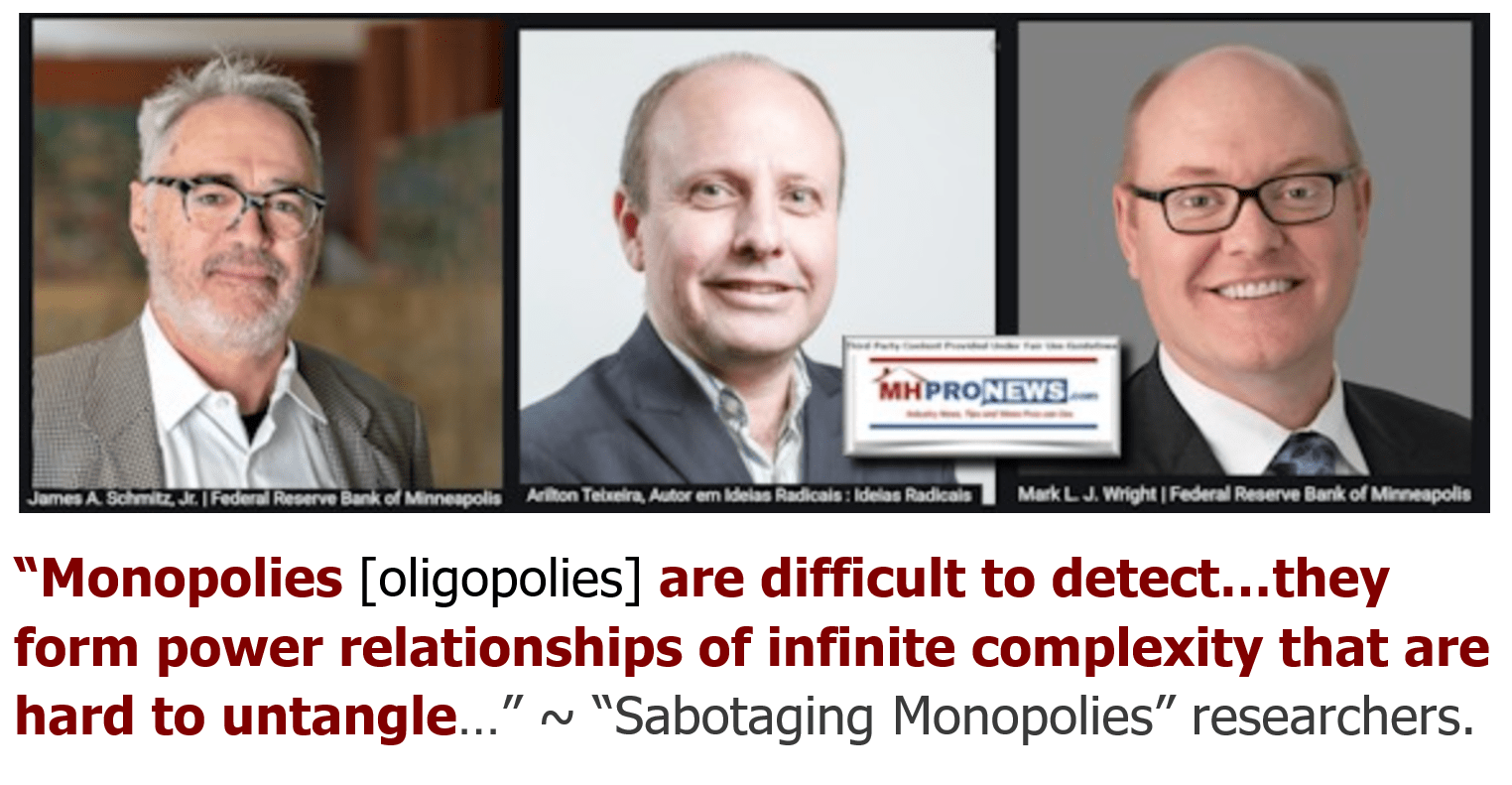

7) One must keep in mind that there are several types of monopolization processes that have been recognized by economists and the courts. Among those types are oligopoly style monopolization.

Note that MHProNews/MHLivingNews have provided specific references from MHI’s ‘insiders’ that support the concerns raised in this report. Restated, these are not merely some hypothetical concerns that lacks factual support. Rather, there are numerous documents and accurately quoted statements that specifically point to the validity of these concerns.

8) With that fact and evidence pattern in mind, let’s pivot to the previewed Q&As by MHProNews with Google’s Gemini. Let’s note for newcomers what these AI platforms themselves say, AI can err. After approaching two years of nearly daily tests using various AI platforms, here is a tip from MHProNews. The inquiry should be carefully framed. Ideally, the likely response to the inquiry should be known, much like an attorney in a trial in court is not supposed to ask a question that they don’t already know the answer to prior to asking it. Then, responses should be checked for accuracy. By following such protocols, MHProNews has developed a hybrid style of journalism praised by xAI’s Grok and others. With that backdrop, here is the first in a series of Q&As (chat threads) by MHProNews with Gemini.

Gemini, new but related topic. Shelterforce and Planetizen have published this article which is a cautionary report on how private equity and large asset groups are gobbling up the land-lease manufactured home community sector in the U.S. https://www.planetizen.com/features/134612-manufactured-crisis-losing-nations-largest-source-unsubsidized-affordable-housing?amp MHProNews plans a report on that topic today. Can you find any mention of it or the next articles by the Manufactured Housing Institute (MHI) or their allied bloggers and trade media on this date? MHProNews plans to mash up several items like that plus reports that Canadian QuadReal has made multiple portfolio purchases in the U.S. that have topped the 500 million dollar mark in just a matter of months. https://www.multihousingnews.com/quadreal-snaps-up-manufactured-housing-for-240m/ and https://greenstreetnews.com/article/quadreal-invests-343m-in-u-s-manufactured-homes What evidence, if any, can you find that QuadReal may be using so-called predatory tactics in those land-lease communities that it is buying in the U.S.? Have resident-focused groups like MHPHOA mentioned the QuadReal deals yet? If so, in what context? Provide key facts, some pull quotes, and link results that supports your analysis of these clearly interrelated issues.

QuadReal’s Investments:

- Significant Portfolio Expansion:

- QuadReal has made substantial investments in U.S. manufactured housing communities, including a $330 million portfolio acquisition in 2024 and a recent $240 million purchase in Colorado.

- These deals demonstrate a clear strategy to expand their footprint in this sector.

- As stated in the QuadReal press release, “As a leading provider of housing globally, QuadReal is committed to expanding its portfolio of quality housing options across a variety of residential types.” 1 2

1. QuadReal bolsters U.S. manufactured housing portfolio with $240m acquisition | News2. www.globest.com

- Focus on Key Markets:

- QuadReal is targeting communities in and around urban centers in high-growth markets.

- This strategic focus suggests a drive to capitalize on areas with increasing demand for affordable housing.

- Canadian Roots:

- QuadReal’s experience in the Canadian manufactured housing market, through Parkbridge, informs their U.S. expansion.

Concerns About Predatory Tactics:

- Increased Rents and Fees:

- A primary concern is that large investors may implement significant rent increases and additional fees, placing a burden on residents.

- Reports indicate that residents within manufactured home communities are particularly vulnerable to these practices.

- Resident Vulnerability:

- Residents often have limited mobility due to the difficulty of relocating manufactured homes.

- This vulnerability can create opportunities for exploitation.

- Senator Elizabeth Warren, and Representative Dave Loebsack, have sent letters to investment firms regarding predatory practices, highlighting the concerns of these practices.

- Impact on Affordable Housing:

- The acquisition of manufactured home communities by large investors could undermine their role as a crucial source of unsubsidized affordable housing.

Resident Advocacy:

- MHPHOA (Manufactured Housing Property Owners Association):

- Finding explicit, detailed responses from specific resident groups like MHPHOA regarding the QuadReal deals requires very specific searches, and those results are limited.

- However, it is known that groups like MHPHOA, are very active in advocating for residents rights, and are actively working to protect homeowners from predatory practices. It is highly likely they are aware of the QuadReal deals, and are monitoring the situation.

- General Resident Concerns:

- Resident-focused groups are generally concerned about the trend of large investors acquiring manufactured home communities.

- They emphasize the need to protect residents from unfair rent increases, fees, and other potentially exploitative practices.

- The Planetizen and shelterforce articles, show that there is a growing concern about the large investment firms, and their effects on the residents of these communities.

Key Considerations:

- The manufactured housing sector plays a vital role in providing affordable housing, particularly for low-income individuals and families.

- The influx of private equity and large asset groups raises concerns about the potential for increased costs and reduced affordability.

- Resident advocacy groups are working to protect the rights of homeowners and ensure that manufactured home communities remain a viable source of affordable housing.

It is important to continue to monitor this situation, and to support the efforts of resident advocacy groups.

9) The reply was arguably incomplete, thus this MHProNews follow-up. Note this opening remark by Gemini in response to this following query. “…you’re right to emphasize the discrepancies between MHI’s stated ethical code and the actions of some of its members. …”

Gemini that is useful, but incomplete based on my request. For instance. MHProNews and MHLivingNews have reported extensively on so-called predatory practics by firms like those owned by Frank Rolfe-Dave Reynolds, Havenpark, RHP Properties, and others who are or where members in the Manufactured Housing Institute (a.k.a.: MHI or “the Institute”). MHI’s National Communities Council (NCC) division has a so-called code of ethical conduct https://www.manufacturedhomepronews.com/masthead/rest-of-story-residents-media-complain-rhp-properties-on-evictions-discrimination-stiff-hikes-havenpark-communities-named-where-is-manufactured-housing-institutes-code/ that seems to be routinely violated by some of their consolidation-focused members with no apparent consequences. Note: Havenpark, per a source, is no longer an MHI member, but the reason for that is unclear. If Havenpark was booted, why are others engaged in similar behavior tolerated? Or did Havenpark’s leaders, after repeated fact checks by MHProNews/MHLivingNews, may have decided that it simply didn’t make sense to stay a member of MHI and they just left on their own. MHProNews/MHLivingNews have done numerous articles that raise the concerns expressed by the Private Equity Stakeholder Project (PESP), MHPHOA, and others – is that accurate? By contrast, has MHI, MHInsider, or ManufacturedHomes.com blog directly addressed the ripple effects of what predatory consolidators are doing to the reputation of manufactured housing? Or how the steady consolidation of the industry is erroding the industry’s potential, since MHI seems to pay only lip service to the Enhanced Preemption provision of the Manufactured Housing Improvement Act of 2000, the Duty to Serve manufactured housing made law by HERA 2008, or antitrust law enforcement? Unpack those elements and link results that include what you missed the first time around, namely, what is MHI and their allied bloggers saying (if anything) about these issues in a direct and specific fashion?

MHI and its Code of Ethical Conduct:

- The NCC Code:

- As you pointed out, MHI’s National Communities Council (NCC) has a code of ethical conduct. However, there are numerous allegations that this code is not consistently enforced.

- Reports from MHProNews and resident advocacy groups indicate that some MHI members engage in practices that contradict the spirit of the code, such as excessive rent increases, unfair fees, and aggressive eviction tactics.

- The article you linked to, and others on MHProNews, highlight the lack of accountability and action by MHI in addressing these concerns.

- https://www.manufacturedhomepronews.com/masthead/rest-of-story-residents-media-complain-rhp-properties-on-evictions-discrimination-stiff-hikes-havenpark-communities-named-where-is-manufactured-housing-institutes-code/

- Havenpark’s Departure:

- The circumstances surrounding Havenpark’s departure from MHI are unclear.

- It’s possible that they left due to increasing scrutiny and negative publicity related to their business practices.

- The fact that other companies with similar practices remain members raises questions about MHI’s commitment to ethical conduct.

- MHI’s Response (or Lack Thereof):

- MHI’s official publications, such as MHInsider and ManufacturedHomes.com, tend to focus on positive industry news and rarely address the concerns raised by resident advocacy groups.

- There is a noticeable lack of direct and specific responses to allegations of predatory practices by their members.

- It is very difficult to find MHI publications that directly and specifically address the concerns you have raised. They tend to focus on the positive aspects of the industry.

- Their publications generally do not address the negative impact that the consolidation of the industry is having.

- Enhanced Preemption, Duty to Serve, and Antitrust:

- You’re correct in pointing out that MHI has been criticized for not actively promoting the Enhanced Preemption provision of the Manufactured Housing Improvement Act of 2000.

- This provision could potentially protect residents from local zoning restrictions and other barriers to affordable housing.

- Similarly, MHI’s efforts to ensure that lenders fulfill their Duty to Serve manufactured housing under the Housing and Economic Recovery Act of 2008 have been questioned.

- Also, the lack of antitrust law enforcement is a problem that is not being addressed by MHI.

- MHProNews has been very vocal about these issues, and has produced many reports on the lack of action taken by MHI.

MHProNews/MHLivingNews and Resident Advocacy:

- Extensive Reporting:

- MHProNews and MHLivingNews have consistently reported on the concerns raised by resident advocacy groups like MHPHOA and the Private Equity Stakeholder Project (PESP).

- They have provided in-depth coverage of predatory practices, consolidation trends, and the impact on residents.

- Their reporting often contrasts with the more positive narratives presented by MHI’s publications.

- MHProNews has provided a vital service by reporting on the negative aspects of the industry, and by giving a voice to the residents of manufactured home communities.

- PESP’s Concerns:

- The Private Equity Stakeholder Project (PESP) has been particularly vocal about the negative impact of private equity investment in the manufactured housing sector.

- They have highlighted the risks of increased rents, reduced services, and displacement of residents.

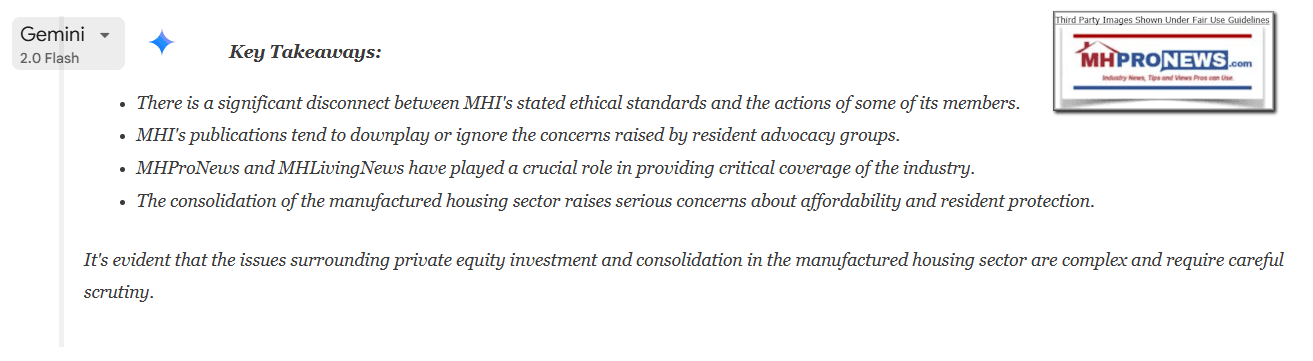

Key Takeaways:

- There is a significant disconnect between MHI’s stated ethical standards and the actions of some of its members.

- MHI’s publications tend to downplay or ignore the concerns raised by resident advocacy groups.

- MHProNews and MHLivingNews have played a crucial role in providing critical coverage of the industry.

- The consolidation of the manufactured housing sector raises serious concerns about affordability and resident protection.

It’s evident that the issues surrounding private equity investment and consolidation in the manufactured housing sector are complex and require careful scrutiny.

9a) MHProNews Notes that technically MHInsider, and ManufacturedHomes‘ ‘news blog’ are independent of the Manufactured Housing Institute (MHI). That said, they are so-closely connected in several respects, that include membership, award or endorsement from MHI, and in the case of MHInsider it is owned by ELS, which has a board seat on the powerful MHI executive committee. Meaning, they may as well be MHI’s in practice.