Cavco Industries Inc. (NASDAQ:CVCO) remains on the radar of investors, with a number of them increasing their stake in the company.

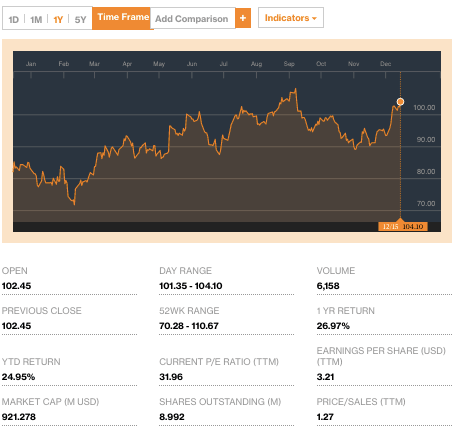

In their November 8th earnings report, Cavco delivered $1.03 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.92 by $0.11. The company had a net margin of 4.08 percent and a return on equity of 8.37 percent.

Per the Cerbat Gem, equities analysts predict that the company will post $3.55 EPS for the current fiscal year.

Investor activity in Cavco includes:

- JPMorgan Chase & Company increased its stake in Cavco Industries by 1,925.3 percent in the second quarter.

- GW&K Investment Management LLC increased its position by 27.6% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). GW&K owns about 1.08 percent of Cavco worth $9,587,000.

- Teacher Retirement System of Texas increased its position by 14.3% in the second quarter. Mason Street Advisors LLC acquired a new stake in Cavco during the second quarter valued at about $152,000.

- BNP Paribas Arbitrage SA acquired a new stake in the company during the second quarter valued at about $243,000.

As Daily Business News readers are aware, Phoenix, AZ-based Cavco Industries is one of the largest producers of manufactured homes, as well as a builder of modular and park model homes, vacation cabins and commercial structures. Factory-built homes are designed and produced by Cavco under such brand names as Cavco Homes, Fleetwood Homes and Palm Harbor Homes.

Cavco Industries Q2 earnings report results are linked here.

Cavco was also recently featured as British insurance giant Legal & General made a significant move in its stake in the company, and is one of the manufactured home industry connected stocks tracked every business day by the Daily Business News, with the most recent report, linked here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.