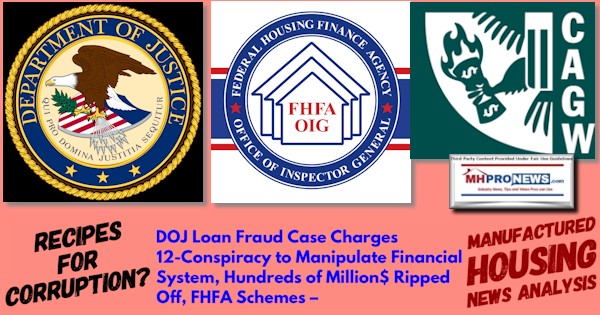

The topic or legal category, per the Department of Justice (DOJ) media site, for the first of this series of federal reports is “Mortgage Fraud.” A series of press releases from DOJ and the Federal Housing Finance Agency (FHFA) Office of Inspector General (OIG) will follow in sequence in this report. Those federal investigations and charges will be followed by an MHProNews news analysis to show how these could be viewed by pro-manufactured housing professionals, advocates, and others interested in advancing affordable housing, which is a key to solving the affordable housing crisis.

But let’s tee this set of official federal reports up with this short preface. In no specific order of importance:

- The mortgage fraud schemes reported – per these official federal sources – would mathematically be roughly equal to the average retail cost of some 5,700 new HUD Code manufactured homes.

- This arguably fits the concerns raised by MHProNews in several recent reports, including, but not limited to this below.

- One of the FHFA item’s is almost mind-numbing stunning in its implication. Imagine, after the housing and financial crisis circa 2008, and the establishment of the conservatorship by the FHFA of Fannie Mae and Freddie Mac – the Government Sponsored Enterprises (GSEs) or Enterprises – if FHFA delegated their authority for corporate oversight to the very organizations that FHFA is charged by Congress to oversee. By way of analogy, it would be akin to an already convicted major criminal organization being given the authority to oversee themselves by the parole board. If that analogy seems harsh to some, never forget that the 2008 housing/financial crisis cost tens of millions of Americans collectively trillions of dollars.

There is more, but that is sufficient to set the table for this series of official federal releases that span a timeframe from March 2021 going back a few years. Once you read this – and these are official sources – some might shake their heads and wonder, how much money is grifted and never recovered?

Department of Justice

U.S. Attorney’s Office

Northern District of Georgia

Eleven plead guilty to running multi-year mortgage fraud scheme

ATLANTA – Eleven defendants have pleaded guilty to conspiracy to defraud the United States in a mortgage fraud scheme spanning more than four years and resulting in the approval of more than 100 mortgages based on fabricated documents and false information. Many of the loans are insured by the Federal Housing Administration (FHA) resulting in claims being paid for mortgages that have defaulted.

“These defendants brazenly manipulated the real estate lending process by using their knowledge of the system,” said Acting U.S. Attorney Kurt Erskine. “Mortgage fraudsters threaten the soundness of the real estate market in our community and divert critical resources away from those borrowers who properly qualify for loans. Rooting out bad actors who attempt to abuse the system for their own personal gain makes the mortgage lending system safer and fairer for everyone.”

“These defendants who dragged down our economy by using deception, will now be sentenced and forced to reimburse the victims of their conspiracy,” said Chris Hacker, Special Agent in Charge of FBI Atlanta. “The FBI is committed to combating such criminal activity to protect our citizens and the real estate market from predators who are most interested in pocketing money that they have no right to.”

“These offenders engaged in blatant criminal acts with the sole purpose of enriching themselves at the cost of a federal housing program designed to assist millions of American homebuyers. Their fraudulent undertaking strikes at the fiscal integrity of the FHA and we will work diligently in conjunction with our law enforcement partners to hold them accountable” said Wyatt Achord, Special Agent in Charge, HUD Office of Inspector General.

“The Federal Housing Finance Agency, Office of Inspector General (FHFA-OIG) is committed to holding accountable those who waste, steal, or abuse the resources of the Government-Sponsored Enterprises regulated by FHFA. We are proud to have partnered with the U.S. Attorney’s Office for the Northern District of Georgia in this case,” said Edwin S. Bonano, Special Agent-in-Charge, FHFA-OIG, Southeast Region.

According to Acting U.S. Attorney Erskine, the charges, and other information presented in court: The defendants participated in a conspiracy in which homebuyers and real estate agents submitted fraudulent loan applications to induce mortgage lenders to fund mortgages.

Listing agents Eric Hill and Robert Kelske represented a major nationwide homebuilder and helped more than 100 homebuyers who were looking to buy a home, but who were unqualified to obtain a mortgage, commit fraud. The agents instructed the homebuyers as to what type of assets they needed to claim to have in the bank, and what type of employment and income they needed to submit in their mortgage applications.

Hill and Kelske then coordinated with multiple document fabricators, including defendants Fawziyyah Connor and Stephanie Hogan, who altered the homebuyers’ bank statements to inflate their assets and to create bank entries reflecting false direct deposits from an employer selected by the real estate agent. The document fabricators also generated fake earnings statements that matched the direct deposit entries to make it appear that the homebuyer was employed, and earning income, from a fake employer. Other participants in the scheme then acted as employment verifiers and responded to phone calls or emails from lenders to falsely verify the homebuyers’ employment. Defendants Jerod Little, Renee Little, Maurice Lawson, Todd Taylor, Paige McDaniel and Donald Fontenot acted as employment verifiers. Hill and Kelske coordinated the creation and submission of the false information so that the lies to the lenders were consistent.

In another aspect of the scheme, real estate agent Anthony Richard falsely claimed to represent homebuyers as their selling agent in order to receive commissions from the home sales. In reality, Richard had never even met the homebuyers he claimed to represent. To avoid detection, he often notified closing attorneys that he would be unable to attend the closing and sent wire instructions for the receipt of his commissions. When Richard received his unearned commissions, he kicked back the majority of the commissions to Hill or Kelske for enabling him to be added to the deal, keeping a small share for his role in the scheme.

The following defendants have pleaded guilty to conspiring to defraud the United States:

- Eric Hill, 50, of Tyrone, Georgia

- Robert Kelske, 52, of Smyrna, Georgia

- Fawziyyah Connor, 41, of Tyrone, Georgia

- Stephanie Hogan, 57, of Norcross, Georgia

- Jerod Little, 42, of McDonough, Georgia

- Renee Little, 33, of McDonough, Georgia

- Maurice Lawson, 36, of Powder Springs, Georgia

- Todd Taylor, 54, of Fairburn, Georgia

- Paige McDaniel, 49, of Stockbridge, Georgia

- Donald Fontenot, 52, of Locust Grove, Georgia

- Anthony Richard, 44, of Locust Grove, Georgia

These defendants have agreed to pay restitution to the victims of their conspiracy, including the Department of Housing and Urban Development, which insures many of the residential mortgages in the United States. Sentencing hearings have been set for these defendants before U.S. District Judge Mark H. Cohen.

A twelfth defendant, Cephus Chapman, 49, of Warner Robins, Georgia is awaiting trial. Members of the public are reminded that the indictment only contain charges. The defendant is presumed innocent of the charges and it will be the government’s burden to prove the defendant’s guilt beyond a reasonable doubt at trial.

This case is being investigated by the Federal Bureau of Investigation, Department of Housing and Urban Development Office of Inspector General, and Federal Housing Finance Agency Office of Inspector General.

Assistant U.S. Attorneys Alison Prout and Ryan Huschka are prosecuting the case…

Topic(s):

Mortgage Fraud

Component(s):

Updated March 19, 2021

##

Next, is this DOJ news release, also from March, 2021.

Department of Justice

U.S. Attorney’s Office

Western District of New York

Robert And Todd Morgan, Two Others, Charged With Wide-Ranging Mortgage And insurance Fraud Scheme

BUFFALO, N.Y.–U.S. Attorney James P. Kennedy, Jr. announced today that a federal grand jury has returned a 104-count indictment charging Robert Morgan, Todd Morgan, Frank Giacobbe, and Michael Tremiti, with conspiracy to commit wire fraud and bank fraud for their roles in a wide-ranging mortgage fraud scheme. The defendants each face charges of wire and bank fraud. Robert and Todd Morgan are also charged with defrauding insurance companies. The charges carry a maximum penalty of 30 years in prison and a fine in the amount of double the loss caused by the crimes.

“Upon executing search warrants in this case, my Office, together with our law enforcement partners, acted quickly to take action in an effort to try to limit the amount of damage occasioned by the defendants’ alleged widespread fraud,” noted United States Attorney Kennedy. “While that effort succeeded in that objective, the unfortunate truth is that the swiftness with which we moved may have also contributed to the reasons for which the original indictment in this case was dismissed by the Court. In the end, however, this new indictment now ensures that the defendants will be held to answer for the serious crimes alleged therein.”

Assistant U.S. Attorneys Elizabeth R. Moellering and Douglas A.C. Penrose, who are handling the case, stated that according to the indictment, between 2007 and January 2019, the defendants conspired with Kevin Morgan, Patrick Ogiony, Scott Cresswell, and others fraudulently to obtain funds from financial institutions such as Arbor Commercial Mortgage, LLC, Berkadia Commercial Mortgage, LLC, UBS and Deutsche Bank, and government sponsored enterprises, including Federal Home Loan Mortgage Corporation (Freddie Mac), and the Federal National Mortgage Association (Fannie Mae).

During the course of the conspiracy, the defendants engaged in a scheme to defraud financial institutions and government sponsored enterprises by providing false information to lenders in support of applications for mortgage loans to purchase properties, refinance properties or build properties. As part of the applications for mortgage loans, the defendants submitted inflated and false rent rolls which included non-existent tenants and inflated rents to fraudulently increase the income for a building in order to justify a loan amount that they would not otherwise qualify for. Similarly, in order to further inflate the income, defendants told lenders they were receiving fake fees, such as stating that residents paid for cable when it was actually included in the rent. Defendants also fraudulently reduced and improperly capitalized expenses in order to make the property appear to generate more income to, again, justify a larger mortgage loan than they would otherwise qualify for.

The defendants took steps to conceal the fraud from the lenders, including by making vacant units appear occupied during inspections by turning radios on in vacant units, by placing welcome mats and shoes in hallways outside vacant units, and by paying individuals to pretend to be tenants in units the inspectors would enter.

In the wire fraud conspiracy to defraud insurers, Todd Morgan and Robert Morgan are accused of conspiring with Kevin Morgan and Scott Cresswell to present false and inflated contracts and invoices to insurance companies for repairs after damages to properties in Robert Morgan’s real estate portfolio.

While the loans which were the subject of defendants’ alleged fraudulent conduct exceeded $400 million in value, the total loss sustained by financial institutions and government sponsored enterprises throughout the mortgage fraud scheme is currently estimated to exceed $9,500,000. The loss resulting from the insurance fraud scheme is currently estimated at approximately $3,000,000.

The defendants were arraigned before U.S. Magistrate Judge H. Kenneth Schroeder and were released on conditions.

Defendants Kevin Morgan and Patrick Ogiony were previously convicted of conspiracy to commit bank fraud, and defendant Scott Cresswell was previously convicted of conspiracy to commit wire fraud for their roles in the multi-million dollar fraud scheme. All three defendants are awaiting sentencing.

The indictment is the result of an investigation by the Federal Bureau of Investigation, under the direction of Special Agent-in-Charge Stephen Belongia, and the Federal Housing Finance Agency, Office of Inspector General, under the direction of Special Agent-in-Charge Robert Manchak, Northeast Region.

The fact that a defendant has been charged with a crime is merely an accusation and the defendant is presumed innocent until and unless proven guilty.

# #

Topic(s):

Financial Fraud

Mortgage Fraud

Component(s):

Updated March 4, 2021

####

There are others, but the above is sufficient to make the headline and related MHProNews preface point at the top. Next, is this from the Federal Housing Finance Agency (FHFA) Office of the Inspector General (FHFA OIG). This report obtained by MHProNews is labeled “redacted.” As bad as this may seem to be, how much has been redacted out of the dozens of pages of embarrassing revelations about Fannie Mae? And the related embarrassment to FHFA? This is also a March 2021 report.

Only part of the Executive Summary from this ‘redacted’ FHFA OIG official document will be quoted. The implications for manufactured housing should be apparent, but MHProNews will make the case for how to connect the dots further below.

Federal Housing Finance Agency

Office of Inspector General

Corporate Governance: Fannie Mae Senior Executive Officers and Ethics Officials Again Failed to Follow Requirements for Disclosure and Resolution of Conflicts of Interest, Prompting the Need for FHFA Direction

Executive Summary

Since 2017, we have published several reports on Fannie Mae’s framework for the disclosure, review, and resolution of senior executive officers’ (SEO) conflicts of interest (COIs), including implementation of and compliance with that framework. In these reports, we found failures by Fannie Mae’s former Chief Executive Officer (CEO) to timely and fully disclose potential conflicts as well as breakdowns in oversight by Fannie Mae Board of Directors’ (Board) Nominating and Corporate Governance Committee (NGC) and by the Federal Housing Finance Agency (FHFA) that created weaknesses in Fannie Mae’s risk management structure.

Since 2017, we have published several reports on Fannie Mae’s framework for the disclosure, review, and resolution of senior executive officers’ (SEO) conflicts of interest (COIs), including implementation of and compliance with that framework. In these reports, we found failures by Fannie Mae’s former Chief Executive Officer (CEO) to timely and fully disclose potential conflicts as well as breakdowns in oversight by Fannie Mae Board of Directors’ (Board) Nominating and Corporate Governance Committee (NGC) and by the Federal Housing Finance Agency (FHFA) that created weaknesses in Fannie Mae’s risk management structure.

Fannie Mae recognizes that potential, actual, or apparent COIs, when not disclosed or addressed properly, pose significant risk to its reputation and undermine its goal of operations in accordance with “the highest standards of compliance and ethics.” Accordingly, the Board and Fannie Mae management revised their governance documents related to COIs in response to the Directive. Fannie Mae acknowledges that adherence to the letter and spirit of these governance documents requires buy-in from all employees. Internal Enterprise documents describe Fannie Mae as having “zero tolerance” for ethics violations.

In this evaluation, we assessed, for the period from November 1, 2018, to June 30, 2020 (Review Period), whether Fannie Mae and its SEOs followed the Directive and revised governance documents for the disclosure and resolution of potential, actual, or apparent COIs. Based on our review of Fannie Mae’s documents, we found a mixed record.

…

We identified a total of 32 relevant COI matters involving all SEOs during our Review Period, 7 of which related to the current CEO and 25 related to other SEOs. We first assessed whether the CEO and other SEOs made timely disclosures of these COI matters. Of the seven involving the current CEO, Fannie Mae records show that he failed to make timely COI disclosures in three instances, in contravention of the FHFA Directive and governance documents. While the CEO instructs employees to comply with Fannie Mae’s conflict of interest framework, Fannie Mae’s records show that he failed to comply 43% of the time.

Of the 25 matters involving other SEOs, two other very senior SEOs failed to make timely disclosures in 2 instances. For example, an SEO failed to disclose a personal friendship with the co-founder of a supplier over a four[1]year period, during which approximately $25 million in contracts were awarded to [redacted] friend.

…

###

The entire FHFA OIG document is linked here as a download.

Those three reports above are all from March, 2021. But the last item prompted a look a few years back. So, this next FHFA OIG report – which is once more dozens of pages in length – has the following as the title and executive summary. It dates back to 2015. It is arguably indicative of a pattern.

Federal Housing Finance Agency

Office of Inspector General

FHFA’s Oversight of Governance

Risks Associated with

Fannie Mae’s Selection and

Appointment of a New Chief Audit

Executive Summary

Why OIG Did This Report

As we have explained in prior reports, FHFA, as conservator for Fannie Mae and Freddie Mac (collectively, the Enterprises), has delegated to each Enterprise a significant portion of their day-to-day management and risk controls. For this governance approach to succeed, FHFA must be confident that the Enterprises’ directors and committees are properly exercising the powers they have been given and fulfilling their responsibilities. Otherwise, there is a substantial risk that the Enterprises will operate in an unsafe and unsound manner, suffer losses, and expose U.S. taxpayers to further financial risks.

In 2012, FHFA delegated to the Enterprises the authority to hire executive officers while retaining authority to review and approve the compensation of those officers. Consequently, the Enterprises’ boards and board committees assumed greater control over the selection of executive officers, and Agency review of Enterprise appointments became less formal.

The purpose of this evaluation was to assess FHFA’s oversight of Fannie Mae’s appointment of its Chief Audit Executive (CAE) in October 2013. The CAE directs Fannie Mae’s Internal Audit Department (Internal Audit), which is a critical element of Fannie Mae’s risk management controls. Pursuant to the Sarbanes-Oxley Act of 2002 (Sarbanes-Oxley or the Act)1 and as expressly codified in Fannie Mae’s governance documents, its Internal Audit function is tasked with providing independent, objective assurance of the Enterprise’s governance, risk management, and control processes.

What OIG Found

OIG found that the process used by Fannie Mae’s Audit Committee to select a candidate to fill the important and challenging CAE position was haphazard, at best…

…

1 Sarbanes-Oxley Act, Pub. L. No. 107-204, 116 Stat. 745 (2002) (codified at 15 U.S.C. §§ 7201-66 (2006)).

###

The entire FHFA OIG report referenced above is linked here.

MHProNews has previously reported over the years on the annual Citizens Against Government Waste (CAGW) that documents vast amounts of waste, fraud, and corruption. Per CAGW: “Citizens Against Government Waste (CAGW) is a 501(c)(3) private, nonpartisan, nonprofit organization representing more than 1 million members…” CAGW’s Prime Cuts 2020 included this: “The 2020 version [of CAGW Prime Cuts] contains 593 recommendations that would save taxpayers $444.3 billion in the first year and $4 trillion over five years.”

Now, that is what a private nonprofit research group was able to identify.

CAGW may have some advantages, so to speak, in doing and reporting on such troubling corruption, waste and enormous sums, given of decades of experience looking under the hood. But one of several possible points that could and should be made is this. Waste, fraud, and corruption – which are a bipartisan or nonpartisan issue – totals are enormous. Having reviewed CAGW reports in both Democratic and Republican Administrations reveals much the same thing. To CAGW’s credit, some of their recommendations have been implemented over the years. But on the vexing side, others have not or new waste, fraud, and corruption took the place of what occurred before.

The above federal and CAGW insights should be considered through the lens of the following reports and news-analysis by MHProNews. They are shown in no particular order of importance.

Keep in mind that MHProNews previously reported on allegations of corruption in FHFA and allegations of improper lobbying by Fannie Mae.

One of several possible takeaways are as follows.

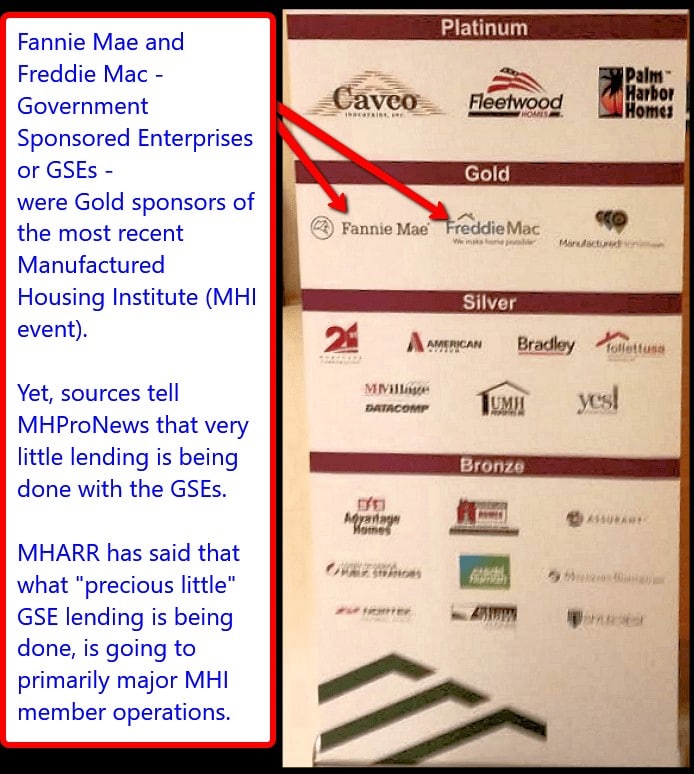

As far as FHFA – or more broadly, GSE conflicts of interest – MHProNews is purportedly the only trade publisher in manufactured housing that reported on the apparent conflict of interest hiding in plain sight photo captured below.

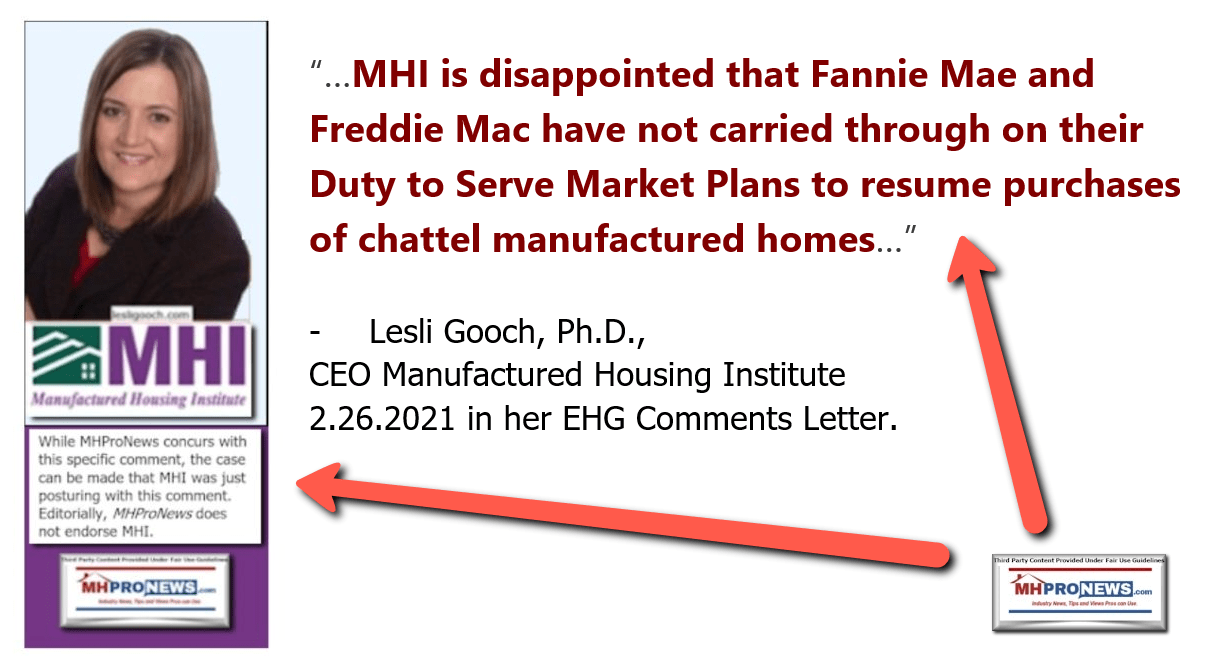

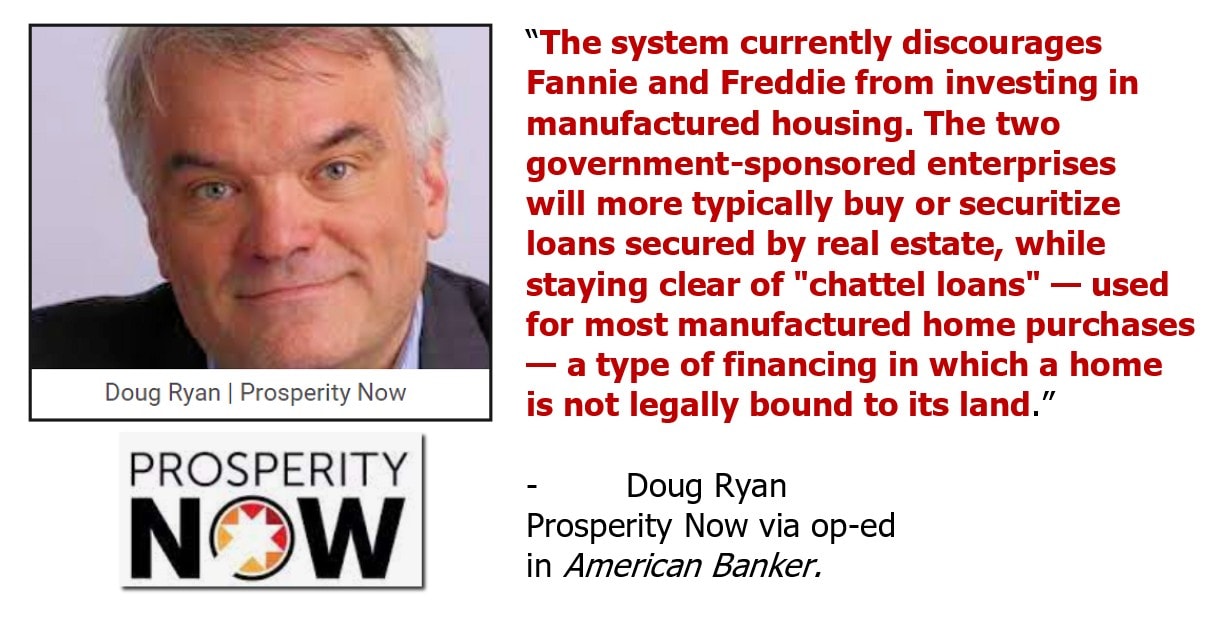

When this writer both live – in person in Washington, D.C. in December 2019 – and then later in virtual reports in December 2019 and March 2021 – made the argument to the actual and virtual faces of the disgraceful handling of legal mandates imposed on FHFA, Fannie and Freddie. That disgraceful handling may constitute various regulatory and/or legal lines. At a minimum, the case is easily made how a decade-plus of failures has harmed the very people – minorities, lower income Americans of all backgrounds, and white hat independents and others – that the law is supposed to serve. As MHARR’s Mark Weiss argued, it is aptly described as a “shell game.”

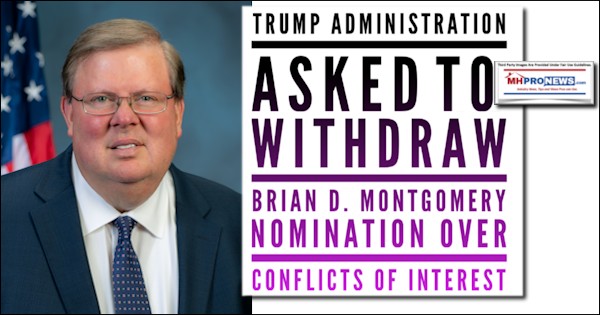

MHProNews has documented and raised concerns about purported evidence-based cases of conflicts of interest that directly impact manufactured housing. Some of those reports, which cross both Democratic and Republican administrations, are shown below.

HUD Secretary Marcia Fudge’s term has just begun, and she deserves some wiggle room. That said, there are already concerns that may signal more of the same as has occurred in the past 2 decades since the enactment of the Manufactured Housing Improvement Act (MHIA) of 2000 (sometimes called the 2000 Reform law).

Some would have a hard time imagining the astronomical and costly levels of corruption that exist in the federal government. This is not limited to an impact on manufactured homeowners or those who may desire affordable home ownership. Rather, which perhaps MHProNews alone has reported in our industry failure to provide access to affordable housing, the research report linked below during the Obama-Biden Administration years made the case that cost our economy $2 trillion dollars a year.

When, MHProNews raises concerns about the purported corruption and undermining of manufactured housing from within, that is an evidence-based case. When viewed through the lens of the kinds of corruption, waste, and fraud revealed in the reports reviewed and linked from the above, it should be seen not as hyperbole, but rather as almost expected.

The system is not only rigged, it is corrupt. That corruption has links that arguably include the Iron Triangle between lawmakers, bureaucrats and special interests.

To learn more see the related reports. To consider how these problems might be addressed, see the report linked below.

Finally, keep in mind that the system is apparently rife with opportunities for corruption. The larger and deeper the pockets, the case might be made that the more sophisticated and easier the corruption could be carried out.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in-your-face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.