Vance Ginn’s and Erik Randolph’s fact-packed column for Real Clear Policy via WND to MHProNews uses recent migration data from federal or nonprofit sources, PODS, U-Haul and other sources to make economic points which obviously have housing in the background of the “record” 46 million Americans who moved in just 1 year. Ginn and Randolph do not specify the types of housing involved, but the broad facts they present clearly has manufactured housing relevance, as this report, analysis and commentary will reveal. First their report, which is focused on economic issues and how they are playing out in individual states here in the U.S., which their findings were made available to MHProNews courtesy of the WND NewsCenter. Then additional information which will become manufactured housing specific with MHProNews analysis and commentary.

WND MONEY

Economically free states outperforming those with regulatory burdens

46 million Americans changed zip codes in a 12-month period ending in February 2022

By WND News Services

Published July 31, 2022 at 10:16am

[Editor’s note: This story originally was published by Real Clear Policy.]

Real Clear Policy

Florida Gov. Ron DeSantis recently responded to questions about California Gov. Gavin Newsom’s ads airing in Florida, “It’s almost hard to drive people out of a place like California given all their natural advantages, and yet they are finding a way to do it.” He noted that California is hemorrhaging its population because of bad progressive economic policies so that they could be more free.

Florida ranks third in the nation for economic freedom, according to the Fraser Institute. And California ranks second to last.

Our own study supports the position of DeSantis.

Freer states that were more reluctant to shut down their economies due to COVID-19 are doing much better economically than states with severe shutdowns. Even a state like California is suffering — which was considered an American paradise for nearly a century, with its perfect weather and natural beauty.

This month’s U.S. jobs report showed an increase of 372,000 net nonfarm jobs in June, yet it’s still under the pre-shutdown number by 524,000. The Biden administration trumpeted the good news of job growth, yet the real story is in the details. Labor participation is lagging and inflation-adjusted average hourly earnings are declining, and the bulk of the new jobs added are decisively in lower-tax, pro-growth-oriented states.

Residents are fleeing California, New York, Illinois, and Pennsylvania for places like Georgia, Florida, Tennessee, and Texas. DeSantis noted that it was once unusual to see California license plates in Florida, but it’s now a growing trend.

Of the 14 states that have recovered all their jobs lost due to the shutdowns, 12 are in states with legislatures and governors, championing a better fiscal and regulatory climate. This supports lower costs of living that offer new residents greater purchasing power and better opportunities to weather a looming recession.

Perhaps the most important statistic is how Americans are voting with their feet.

Forty-six million Americans changed zip codes in a 12-month period ending in February 2022. That’s the most moves since 2010. According to the U.S. Census Bureau, in 2021, California, New York, and Illinois had the highest domestic migration losses, and Florida, Texas, and Arizona gained the most.

Pods, a moving and storage company, offers up their own data on where Americans are increasingly headed. Virtually every destination benefitting now is in the Southeast, Texas, or Arizona. Pods continually cites that people say the lower cost of living as a primary reason for relocation.

U-Haul released a report showing essentially the same results. And there are private research organizations as well with more corroborating evidence, such as How Money Walks that uses IRS data.

And it’s not just people that are moving but businesses, too.

In June, Caterpillar Inc., a Fortune 500 company, announced they are moving their headquarters from Deerfield, Illinois, where they have been since the early 1900s, to Irving, Texas. This makes Texas now the headquarters of 54 of the Fortune 500 companies in the world. Remington Firearms, America’s oldest firearms manufacturer, recently announced its relocation from New York to LaGrange, Georgia.

The list goes on and on.

Competition amongst states for residents and businesses is a booming trend that doesn’t look like it will abate soon. Undoubtedly, ad campaigns and recycled political rhetoric will ratchet up the fight on both political sides for new residents and commercial enterprises. Yet the policies of lower spending and taxes, deregulation, and stronger property rights resulting in more freedom are winning.

Prolonged COVID-19-related shutdowns and excessive government mandates proved to be a formula for economic destruction. The evidence in favor of economic opportunity and robust markets is overwhelming.

Fortunately, Americans are now seeing and acting on not only mounting evidence but also their own real-life experiences — which is the true test of which approach is more viable.

Vance Ginn is Chief Economist at the Texas Public Policy Foundation, and former Associate Director for Economic Policy of the White House’s Office of Management and Budget, 2019-2020. Erik Randolph is the Director of Research at the Georgia Center for Opportunity.

[Editor’s note: This story originally was published by Real Clear Policy.] ##

Additional Information with More MHProNews Analysis and Commentary

For added context, the following image-quotes and presentation/discussion announcement illustrations reflect some of the insights research by Randolph and Ginn have produced in the last two years.

The facts above per WND/Real Clear Policy and the insights that follow represent a significant opportunity for manufactured housing. While there are political and other ramifications, following some data points, consider what this analysis will first lay out some facts and the unpack what the data reflects.

The policies of so-called ‘blue states’ (Democratic Party dominated states) have, per their findings, generally caused the citizens of blue states to feel a greater economic pinch than those living in ‘red’ states (those states with predominately Republican leadership). In response, 2020 Census data reflects that a well-documented out-migration that resulted in California and some other places losing a Congressional representative while Florida and or other red states gained a Congressional seat.

The estimated 332.4 million Americans living in the U.S.A. in 2022 divided by those 46 million who ‘changed zip codes’ means that one out of every 7.23 people moved during the 1-year period that Ginn and Randolph researched. So, out of every ten people from a given households that someone passes in a store represents about a 13.8 percent chance that they moved from one zip code to another recently.

Contrast that with what the Brookings Institute said about 2019. “For the first time on record, fewer than 10% of Americans moved in a year.” That per Brookings on 11.22.2019. Society was becoming more stable under Trump in terms of housing and migration than it has been under Biden. Similarly, Moving.com reported that in 2018, “32 million people in the US moved in 2018.” The velocity of people moving increased from 2018 to the period covered by Ginn and Randolph that ended in early 2022 by about 144 percent.

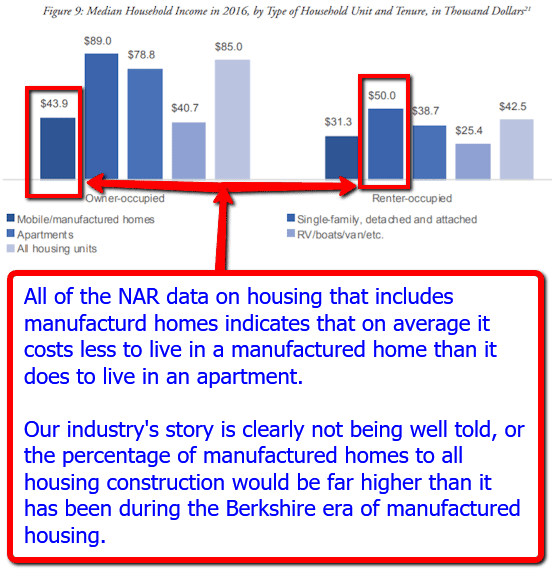

Those trends have social, political but also manufactured housing industry implications. Statista reported 5 days ago that: “As of 2021, the U.S. Census Bureau counted about 83.9 million families in the United States. The average family consisted of 3.13 persons…” That 46 million people Ginn and Randolph said changed zip codes means that about 14.7 million housing units were needed by those that moved. The data provided by the research of Scholastica “Gay” Cororaton informed manufactured housing industry professionals that most renters could afford to make the payments on a manufactured home. Those who sold a house routinely often bought another. Those are also opportunities to sell a new HUD Code manufactured home.

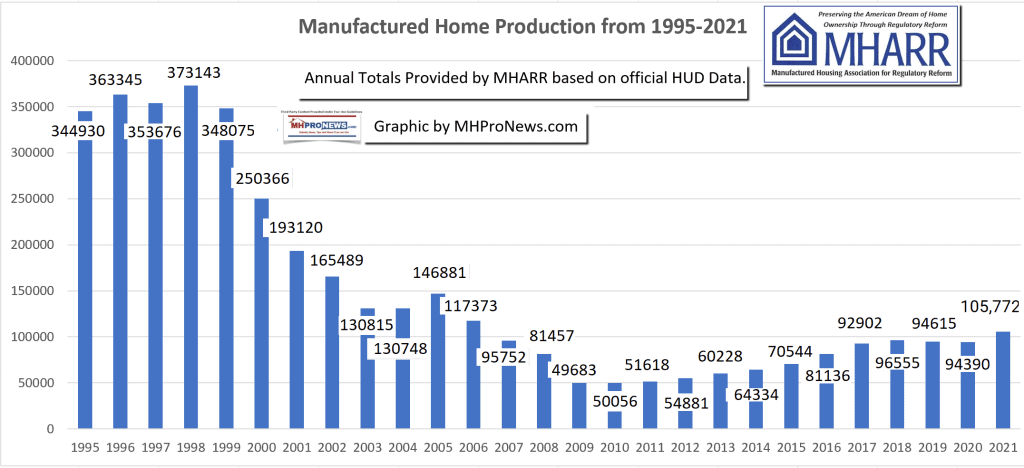

Millions of times a year, someone somewhere in the U.S. could be selling a new manufactured home. But that then means that manufactured housing, collectively as an industry, is merely scratching the surface of its potential.

New national data is about to emerge for May 2022 manufactured housing sales later this week. It will shed some light if the concerns raised by the Texas Manufactured Housing Association (TMHA), a Manufactured Housing Institute (MHI) state affiliate, are coming to pass.

Either way, conventional housing has largely been trending downward in recent months as inflation and the economy have slowed into recession, despite the team Biden and routine Democratic reluctance to admit that 2 consecutive quarters of contractions have occurred.

Affordable housing is necessary. Manufactured housing plays a vital role in that realm, as many policy analysts admit. When Freddie Mac says that most American would consider a manufactured home, that implies that well over have of those 14.7 million housing units needed in the period examined by Ginn and Randolph might have resulted in a manufactured home.

This is has several implications. Among them is a data-driven tremendous indictment of the industry’s post-production sector. The Manufactured Housing Improvement Act (MHIA) of 2000 has not been properly implemented, which is a post-production issue. MHI leaders have admitted as much. That is a post-production issue.

The new Manufactured Housing White Paper, as well as the reports linked above, laid out several details that demonstrated just how troubling MHI’s behavior and outcomes have been. There is no escaping the logical conclusion that the industry needs a serious course correction in the post-production realm. Thankfully, the Manufactured Housing Association for Regulatory Reform (MHARR) has been doing its job – and more – by faithfully pressing the issues needed for producers. MHARR has also routinely signaled for much of the 21st century that the post-production side of the industry is failing at its claimed role.

When numbers of independents and others among MHI members are grumbling about the lack of progress at getting more competitive financing – which is also already mandated by federal law – and the dominating brands at MHI seem to be satisfied with the status quo because they are consolidating the industry as a result, it should raise an issue that ought to be on the minds of industry professionals in every state. Namely, once the shakeout from the rapidly approaching November 2022 midterms occur, state and/or federal level investigations ought to take place in Democratic as well as Republican led states that examine the pattern of MHI behaviors.

The data above from WND/Real Clear Policy is clear that opportunities for our profession abound. And yet, the industry is underperforming by historic data as the MHProNews infographic above reflects.

The only way that the industry is going to properly tap those ample opportunities is by addressing the issues with the post-production sector. A parallel path approach is warranted.

- MHI should be pressed by investigations, perhaps litigation, and via other means into doing its claimed job properly for representing “all segments” of the manufactured home industry.

- The industry’s white hat independents should organize a new authentic vs. an ersatz post-production trade association.

- White hat independents as well as consumers should make common cause whenever possible to accomplish the changes needed.

The facts don’t lie, and the data presented herein has clear implications. Industry professionals who want to be long-term with far higher earnings potential in this profession have to act accordingly.

Wishing without proper action is not a strategy for success. Only the proper actions, outlined in the bullets and this segment above, will suffice. It will take effort (see Masthead linked below). There will be resistance.

But the rewards ought to make the efforts worthwhile. Do the math that follows to fully grasp the potential.

One of the data points from the Freddie Mac research on consumer interest in manufactured housing said this: “62% of people say they are likely to consider purchasing a manufactured home in the future.” Applying the data herein, if just one in four of those 14.7 million households that moved in that 12-month period had hypothetically bought a manufactured home, that could have been some 3.675 million new manufactured homes sold. But instead, only about 105,000 new units were produced in 2021.

The data adds up to potential that is an astonishing 35 times greater than what is actually occurring. That is enough incentive for savvy professionals to dare to challenge the various moats that have been established that have aimed to artificially limit the industry in its current anemic state. Nothing happens without the proper understanding, discipline, courage, and ‘can do’ effort. ###

Again, our thanks to free email subscribers and all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.