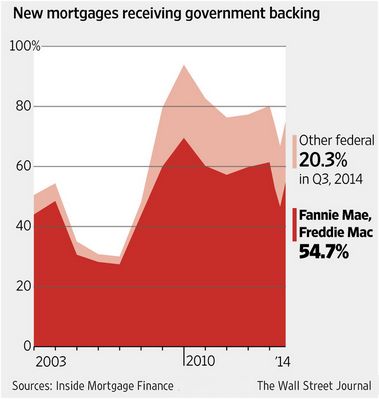

The Wall Street Journal (WSJ) and HousingWire are among the media sources telling MHProNews that Fannie Mae and Freddie Mac will ease requirements on a variety of mortgage loans.

The Wall Street Journal (WSJ) and HousingWire are among the media sources telling MHProNews that Fannie Mae and Freddie Mac will ease requirements on a variety of mortgage loans.

The move is not thought to impact personal property (home only) manufactured home (MH) lending, but would apply to those MH loans using the Government Sponsored Enterprises (GSEs) for such financing.

As was previously reported by MHProNews in a more detailed report, Laurie Goodman, director of the Housing Finance Policy Center at the Urban Institute, estimates that this move could result in 1.2 million additional loans per year.

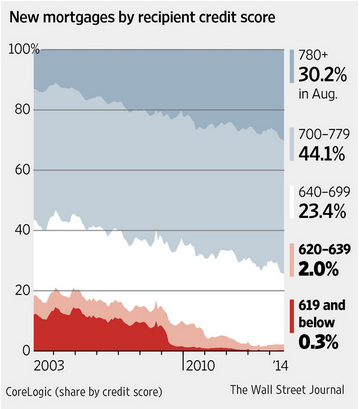

The announcement and the WSJ graphic should cause manufactured housing professionals to consider what the Wisconsin Housing Alliance’s Amy Bliss, Dick Ernst of FinmarkUSA and other industry voices have expressed on the subject of parity in lending on manufactured homes. Where is the level playing field for America’s most affordable homes?

WSJ stated that while the GSE’s standards are relaxed on paper, not all lenders are ready to come of their current loan underwriting. U.S. Bank Chief Executive Richard Davis called it “a good sound bite” but said his bank wasn’t prepared to make changes.

Davis said, “Unless we are convinced that the rules are going to be permanent and there is not going to be a look back or a reach back in future times…we are simply going to stay on the sidelines in the concerns of both compliance risks and other uncertainties.” As regular MHProNews re aders know, U.S. Bank announced last month that they’d pull out of MH lending, for details, click here.

aders know, U.S. Bank announced last month that they’d pull out of MH lending, for details, click here.

Midwest Manufactured Housing Federation (MMHF) Chairman Ron Thomas, Sr. has said in an video interview with MHProNews that the federal government has to play a legitimate role “cosigning” for millions much as they did since the creation of FHA. To see that video and related discussion on how manufactured housing can advance, please click to see the new article linked here. ##

(Graphic Credits, Inside Mortgage Finance, Core Logic and WSJ)