The recreational vehicle (RV) industry and the manufactured home industry have similar and in some respects “intertwined” origins, as the Smithsonian Institute, the RVIA, and other sources would say. Per Bing’s AI powered Copilot: “The origins of the RV (Recreational Vehicle) and manufactured home industries are intertwined, with both having their roots in the early 20th century.” “The RV industry emerged between 1915 and 1930 when Americans’ desire for both relaxation and modern comforts aligned with the capacity of the motor camping industry to deliver both.” “The concept of mobile homes dates back to the 1870s, although those early versions were moved by horses rather than automobiles.” “The recognizable form of mobile homes began to take shape in the mid-1920s and early 1930s with the advent of travel trailers.” While those statements by Copilot could be refined, for instance, it is worth noting that some RV makes were also builders of pre-HUD Code (which went into effect on 6.15.1976) trailer houses and mobile homes. That said, those insights are a broadly useful preface for a comparison between the recreational vehicle (RV) industry performance from 1995 to 2023 and that of the manufactured housing industry during that same period.

As their name implies, most RVs are sold for recreational purposes, not for full time living.

RVs are routinely discretionary purchases, not necessary ones.

There are reasons to believe that RVs are often purchased by those with better credit scores and incomes than those who buy manufactured homes.

By contrast to RVs, most manufactured homes (MH) are sold for full time living, although a modest slice of the MH market certainly supports getaway, secondary, or vacation housing.

With that in brief background in mind, during an affordable housing crisis where home affordability is a necessity for potentially millions of Americans and not a discretionary or luxury purchase, one might think that the manufactured housing (MH) industry would outperform RVs.

Indeed, that was the case during much of the 1990s.

But the data reveals that is not the case today, nor has it been so since the year 2000.

Starting in 2000, and throughout the 21st century, RVs have out shipped or produced significantly more units per year nationally in the U.S. than have the builders of HUD Code manufactured housing.

The following statements from sources as shown indicate truly ‘revealing’ insights into manufactured housing and the affordable housing crisis, thanks to ample information generated by the manufactured home profession’s ‘sister’ industry – i.e.: RVs. Parts I and II are an example of what reports from the RVIA look like, somewhat skin to the types of monthly data provided to the public by the Manufactured Housing Association for Regulatory Reform (MHARR). Oddly, though RVIA, MHARR, the National Association of Realtors (NAR), or the National Association of Home Builders (NAHB) provide publicly available news and /or social media posts regarding their respective industries, the Manufactured Housing Institute (MHI) only offers ‘members’ such information at this time, per their own website.

While each aspect of what follows is worth comparing to what MHI does or doesn’t do, Part III and Part IV are in several respects particularly revealing.

Part I

Under the heading of “News Insights” on the Recreational Vehicle Industry Association (RVIA) website is the following information.

“RV shipments for the last two months of 2023 showed an increase over the previous year, and our projections indicate we should continue to see increased shipments and retail sales in 2024, particularly in the latter half of the year,” said RV Industry Association President & CEO Craig Kirby. “We are further encouraged by the positive attendance numbers we’ve already seen at consumer RV shows in 2024, with consumers expressing excitement about new features and RV product innovations.”

Towable RVs, led by conventional travel trailers, ended the month up 11.4% from last December with 18,680 shipments. Motorhomes finished the month down (-9.4%) compared to the same month last year with 2,842 units.

Park Model RVs finished December down (-31.9%) compared to the same month last year, with 325 wholesale shipments. Park Model RVs finished 2023 up 7.0% compared to 2022 with 5,054 units shipped.” ##

Part II

For January 2024, also per the RVIA, is the following data-packed insights.

Results for the RV Industry Association’s January 2024 survey of manufacturers found that total RV shipments ended the month with 22,674 units, an increase of 11.1% compared to the 20,405 units shipped in January 2023.

“We continue to be optimistic about the direction the industry is heading this year, and this latest shipment report aligns with the moderate increases we are expecting in 2024,” said RV Industry Association President & CEO Craig Kirby. “RVing remains one of the most affordable ways to travel and we are encouraged by the excitement consumers have for the RVing lifestyle, evident by strong campground bookings for the upcoming spring travel season and solar eclipse.”

Towable RVs, led by conventional travel trailers, ended the month up 21.1% from last January with 19,523 shipments. Motorhomes finished the month down (-26.5%) compared to the same month last year with 3,151 units.

Park Model RVs finished January down (-44.2%) compared to the same month last year, with 305 wholesale shipments.” ##

Part III

Tables Comparing Total RV Shipments by year to Manufactured Homes Produced from 1995 to 2023

| Per RVIA | Data | Per Data | Collected for HUD | |

| RVs | Units by Year | Manufactured Housing | ||

| Year | Shipments | YEAR | PRODUCTION | |

| 1995 | 247072 | 1995 | 344,930 | |

| 1996 | 247533 | 1996 | 363,345 | |

| 1997 | 254558 | 1997 | 353,686 | |

| 1998 | 292655 | 1998 | 373,143 | |

| 1999 | 321201 | 1999 | 348,075 | |

| 2000 | 300085 | 2000 | 250,366 | |

| 2001 | 256809 | 2001 | 193,120 | |

| 2002 | 311025 | 2002 | 165,489 | |

| 2003 | 320851 | 2003 | 130,815 | |

| 2004 | 370032 | 2004 | 130,748 | |

| 2005 | 384454 | 2005 | 146,881 | |

| 2006 | 390362 | 2006 | 117,373 | |

| 2007 | 353588 | 2007 | 95,752 | |

| 2008 | 237095 | 2008 | 81,457 | |

| 2009 | 165709 | 2009 | 49,683 | |

| 2010 | 242284 | 2010 | 50,056 | |

| 2011 | 252407 | 2011 | 51,618 | |

| 2012 | 285749 | 2012 | 54,881 | |

| 2013 | 321127 | 2013 | 60,228 | |

| 2014 | 356735 | 2014 | 64,334 | |

| 2015 | 374246 | 2015 | 70,544 | |

| 2016 | 430691 | 2016 | 81,136 | |

| 2017 | 504599 | 2017 | 92,902 | |

| 2018 | 483672 | 2018 | 96,555 | |

| 2019 | 401070 | 2019 | 94,615 | |

| 2020 | 430412 | 2020 | 94,390 | |

| 2021 | 600240 | 2021 | 105,772 | |

| 2022 | 493268 | 2022 | 112,882 | |

| 2023 | 313174 | 2023 | 89,169 | |

| 9,942,703 | 4,263,945 | |||

Part IV

1) There are numerous reasons why RVs have soared while manufactured housing all but went to sleep since 2000. Among them?

- One is the RVIA launched their GoRVing educational and marketing campaign in the early 1990s and have continued it to this day.

- But a second reason for the superiority of RV sales over manufactured housing is financing. The case can be made that for those with the necessary income and credit, financing an RV is relatively easy. Meanwhile financing a manufactured home, per sources such as Pew Research, is more difficult than financing a conventional house.

2) To illustrate, consider the following Q&A with Bing’s AI powered Copilot.

Copilot, confirm or clarify the following as needed and link the results. The manufactured housing industry through the 1990s routinely outsold or out produced recreational vehicles (RV) industry, isn’t that true? RVs are usually used, as the name implies, for recreational purposes as opposed to full time living. RVs are thus often discretionary purchases. They appear to be more sources for financing RVs than manufactured homes. I think it was Pew Research that said that manufactured home financing is often more complex and has a higher rate of declined [credit] than conventional housing.

3)

Copilot, to simplify and clarity 8 of 30 above, I’m not suggesting that people should chose between an RV and a manufactured home. They are in some ways, apples and oranges. RVs are routinely discretionary purchases from people who may have greater income and better credit than manufactured home buyers, correct? By contrast, manufactured home purchasers may have lower income, they are often buying a manufactured home due in part precisely because it is less costly than conventional housing, and they need lower total price and payments, right? Yet, RVs can often be financed at a local bank or credit union, or at a dealership which may offer several lenders. While some banks and credit unions offer manufactured home financing, the numbers of those institutions offering such lending are lower, isn’t that correct? Isn’t that part of the reason for manufactured home lending programs by state or federally supported sources, or policies like the Duty to Serve manufactured housing enacted by HERA 2008?

- RVs vs. Manufactured Homes:

- RVs are often purchased for recreational use, such as travel and leisure activities. They are considered discretionary items and can be more expensive per square foot than manufactured homes.

- Manufactured homes, on the other hand, serve as permanent residences. Buyers often choose them for their affordability compared to conventional housing.

- Income and Credit Differences:

- RV buyers typically have higher income and better credit due to the discretionary nature of their purchase.

- Manufactured home buyers may have lower income and seek more affordable housing options.

- Financing Options:

- RV financing is often available through local banks, credit unions, and dealerships. These lenders offer a range of options.

- Manufactured home financing can be more complex. While some banks and credit unions offer loans, the number of institutions providing such lending is limited.

- State or federally supported programs, like the Duty to Serve enacted by HERA 2008, aim to address this gap and promote access to manufactured home financing.

In summary, the differences in buyer profiles, affordability, and financing availability contribute to the distinct market dynamics between RVs and manufactured homes. Efforts to improve manufactured home financing options are crucial for addressing the affordable housing crisis and ensuring homeownership opportunities for all1234…”

MHProNews notes that HERA is short for the widely bipartisan Housing and Economic Recovery Act of 2008. HERA specifically created a “duty” or mandate to support manufactured home lending by Fannie Mae and Freddie Mac.

4) What Sam Zell Said

Here is how the now late Sam Zell put the importance of more competitive lending for manufactured housing to fellow members of the Manufactured Housing Institute (MHI) during the MHI/National Community Council (NCC) meeting in Chicago. The following remarks were verified following that meeting for MHProNews by the now late Howard Walker, who served as the vice chairman for Equity LifeStyle Properties (ELS).

- “There is no bigger issue than having an established credit base.”

- “No competitive financing is a serious impediment to growing.”

- “We as an industry should have created that [credit base] a long time ago.”

An evidence-based case can be made that Zell and ELS are certainly not anti-the Manufactured Housing Institute (MHI). Walker served on the MHI board of directors for years. Patrick Waite, another top-level ELS executive, has too.

Margerite Nader, ELS’ president and CEO, has called MHI ‘their’ trade association.

Nevertheless, Zell’s words can be read as an implied critique of MHI’s performance on the financing front in the manufactured housing industry in the 21st century.

5)

Copilot, the now late Sam Zell was the Chairman of Equity LifeStyle Properties (ELS). ELS is a prominent member of the Manufactured Housing Institute, and ELS has long had someone on the MHI board of directors. At a Manufactured Housing Institute-National Communities Council (MHI-NCC) meeting in Chicago, Zell said the following: “There is no bigger issue than having an established credit base.” “No competitive financing is a serious impediment to growing.” “We as an industry should have created that [credit base] a long time ago.” First, confirm or clarify those facts. Then, answer this question. Isn’t that a kind of indictment of MHI’s performance, wittingly or not, by Zell of the Institute, given that they represent the financing and post-production interests of the manufactured home industry? Link the results.

> Let’s refine that. While I agree that it isn’t a direct indictment of the Manufactured Housing Institute (MHI), it is the Institute who has declared themselves to be the national trade organization representing “all segments” of manufactured housing, correct? The Institute for Justice has at times sued on behalf of the interests of tiny housing, to protect their rights in the face of purported governmental discrimination. Manufactured housing is supposed to have the benefit of the Duty to Serve (DTS), but the Federal Housing Finance Agency (FHFA) has not compelled the Government Sponsored Enterprises (GSEs or Enterprises) of Fannie Mae or Freddie Mac to do chattel lending in manufactured housing, even though such “home only” chattel loans are often some 80 percent of the financing used for manufactured home lending, correct? The Institute has sued the Department of Energy over their planned energy rule in manufactured housing, so clearly MHI leaders grasp the notion that lawsuits can be used to compel federal behavior. Isn’t it odd at best, or perhaps indicative of an unstated agenda by MHI leaders, that they haven’t used litigation to make DTS – as an example – a reality instead of just words on paper in federal law?

This Q&A thread will be picked up in the Postscript for today. But the above is sufficient for now to demonstrate the following.

ELS has interests in both RVs (they have campgrounds, RV parks, and related memberships) and they have interests in manufactured housing.

Clayton Homes and their related lending is owned by the Berkshire Hathaway (BRK) conglomerate. Berkshire has interests in the RV industry, as well as in conventional housing, commercial real estate, financing, insurance, automotive, commercial transportation, energy, and big tech among other investments (see the Monday report linked in the headline recap below to learn more). For whatever reasons, the RV industry has clearly outperformed manufactured housing, starting in the year 2000. The data in the tables above establishes that fact. While the responses by Copilot could be refined, they are with certain exceptions broadly accurate.

The Lingering Financing Issue That Zell Said Should Have Been Resolved “a Long Time Ago.”

It seems apparent that manufactured housing industry leaders involved at MHI are willing to allow what Zell himself said is a problem that should have been remedied years before.

The Manufactured Housing Association for Regulatory Reform (MHARR), well aware of the problem in the post-production sector’s representation on issues such as financing, zoning barriers, or the looming energy issue has long publicly and privately pressed MHI and/or MHI state affiliates to resolve these hurdles that are obviously undermining manufactured housing industry performance.

Housekeeping and housecleaning will be explored as part of today’s Postscript.

With no further adieu, let’s pivot to this weeks headlines in review from 3.10 to 3.17.2024

Part V

What’s New on MHLivingNews

What’s New from Washington D.C. from MHARR

What’s New or Recent on the Masthead

What’s News on the Daily Business News on MHProNews

Saturday 3.16.2024

Friday 3.15.2024

Thursday 3.14.2024

Wednesday 3.13.2024

Tuesday 3.12.2024

Monday 3.11.2024

Sunday 3.10.2024

Postscript – Part VI

Facilitation Hub says: “Housekeeping in a meeting refers to the administrative tasks and procedures that need to be taken care of before, during, and after the meeting.”

From 1995 to 2000, the table in Part III above informs us that U.S RV producers shipped a total of 1,663,104 million units. During those same years, HUD Code manufactured home builders produced a total of 2,033,545. For roughly every four new RVs shipped in 1995 to 2000 there were 5 new HUD Code manufactured homes produced.

From 2001 to 2023, there were 8,279,599 new RVs shipped. During those same years, American HUD Code manufactured home builders produced a total of 2,230,400. So, for every 3.71 RVs shipped from 2001 to 2023 there was only 1 HUD Code manufactured home produced. As Copilot noted, there have been times when the ratio of new RVs to new manufactured homes produced has been 5 to 1. To say that manufactured housing has suffered a terrible reversal from industry performance in the late 1990s ought to be an understatement.

It is the Manufactured Housing Institute (MHI) that for years has claimed, rightly or wrongly, to represent “all segments” of HUD Code manufactured housing or other forms of factory building. Among those “all segments” are lenders, as MHI itself states.

- “MHI is the federal policy voice for all segments of the offsite built housing industry, serving as the industry’s leading advocate on federal and legislative matters. MHI ensures the manufactured housing industry speaks as a unified voice in Washington.”

As MHProNews and our MHLivingNews sister site has often exclusively reported, MHI’s president and CEO at the turn of the century, Chris Stinebert, made statements that should be carefully considered in the light of what has transpired since he left the association. For instance, Stinebert said in a 2004 interview the following.

“A second factor is that a lot of the homes that sold to individuals who could not afford them. Loose underwriting, lenient loan terms, and fraud lead to increased delinquencies and defaults. Repossessions flooded the market, directly impacting the severity of recoveries. Numerous lenders exited the industry at both the wholesale and retail markets and those remaining greatly tightened their underwriting requirements. The lending capacity for personal property loans ‘chattel financing’ was severely curtailed.”

When asked: “Are all these issues pretty much behind you?”

Stinebert: “I would have to say yes. Inventory levels are very good and back to balanced levels. The high level repossessions from loans made during the 1990s, which have plagued the industry, have returned to manageable levels. The performance of loans made over the last several years continues to improve. The underwriting guidelines and terms for financing the homes has been vastly improved to the extent that some feel that there has been an over-reaction and an over-tightening and that some credit-worthy purchasers or customers do not have the ability to purchase a manufactured home but easily qualify for a site-built home. But there are other positive factors as well.”

Stinebert predicted an increase in shipments. But other than a rush of federal “Katrina” orders that bumped up production for a time, manufactured housing production continued to decline. See the report for Saturday and Monday linked above to learn more about the role of financing and other factors.

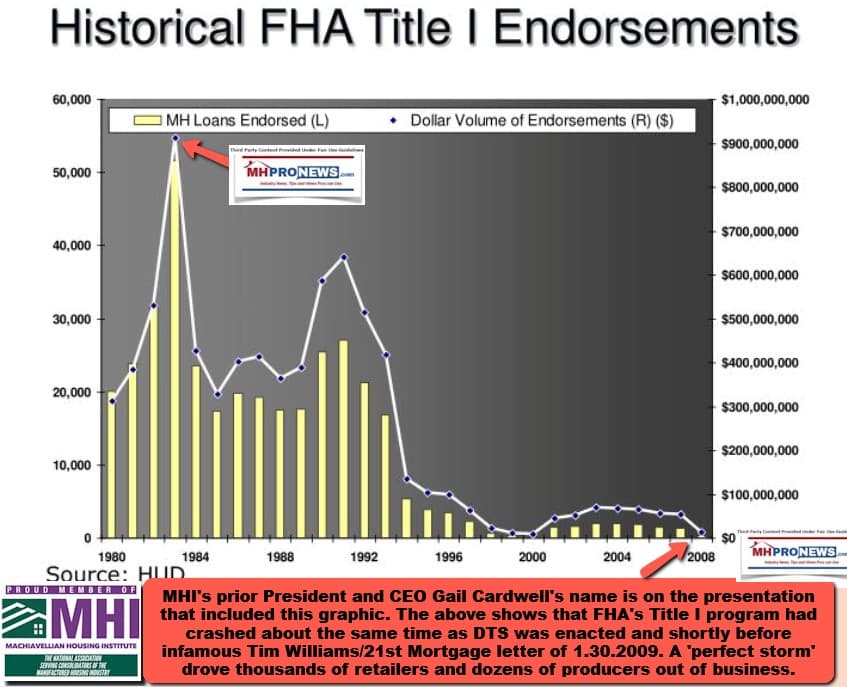

Perhaps in part to address the lack of financing issue, after Stinebert exited, Gail Cardwell filled the president and CEO’s role. Coming from a mortgage background, one might think that her presence would have been useful in securing that industry credit base that Sam Zell was quoted above (Part IV #4) as saying was so important. A Cardwell PowerPoint presentation illustrated just how severely manufactured housing financing from FHA Title I lending was curtailed.

No wonder MHARR has made a steady push for more Ginnie Mae/FHA Title I lending reforms.

Let’s look again at what Zell said.

- “There is no bigger issue than having an established credit base.”

- “No competitive financing is a serious impediment to growing.”

- “We as an industry should have created that [credit base] a long time ago.”

Without ample credit, not only manufactured housing, but conventional housing, RVs, automotive, or any number of other industries that are ‘big ticket sales’ would be severely curtailed or could grind to a halt. Federal officials, at least on paper, grasp that notion and have for decades. It is one of the reasons why manufactured housing has been included in several pieces of potentially useful federal legislation, including but not limited to HERA 2008.

For whatever reasons, Cardwell was not with MHI for long. She was replaced by Thayer Long. As time went by and the industry was not improving in a meaningful level, at an MHI meeting with numbers of Manufactured Housing Executive Committee (MHEC) members present, a MHEC member looked at Long as said that ‘with all due respect you are not getting the job done.’ It was not long before Long left.

Long was replaced by Richard “Dick” Jennison.

Jennison last several years and was periodically praised and defended against criticisms by some top corporate people involved at MHI. Finally, Jennison ‘retired’ and left MHI. He was replaced by what MHI dubbed “MHI 2.0” with Mark Bowersox as president and Lesli Gooch, Ph.D., as CEO.

MHI and its cheerleaders have touted Gooch as if she were the Second Coming.

But a closer look at Gooch reveals apparent conflicts of interest.

Despite those apparent conflicts of interest, Gooch has been secure as the de facto staff leader of MHI. Sources involved at MHI have told MHProNews that while several staffers were initially surprised that Gooch’s conflicts of interest didn’t result in some kind of consequence for her, they said Gooch’s conflicts of interest were well known at MHI. Which ought to beg the question: why do MHI board leaders tolerate literally decades of underperformance by the industry? For that matter, why haven’t federal and/or state officials probed manufactured housing, to see if the allegations of corruption are well founded and warrant action, or is MHI’s leadership merely garden-variety incompetence?

It isn’t just MHARR, or Doug Ryan, one of the figures involved in the Underserved Mortgage Markets Coalition, that have criticized MHI’s apparent years of failures at executing on their own policy initiatives. While on paper MHI and MHARR seem to hold a similar stance, in practice, MHI fails to use their potential legal muscle in a manner that makes sense.

It is approaching a year since Gregory Palm, an analyst who questioned Cavco’s William “Bill” Boor about manufactured housing underperformance during an earnings call.

Excuses mount, but accountability seems to be lacking.

Ponder this. Zell’s remarks, quoted above about the lack of proper manufactured home lending was an issue that should have been addressed long ago was published in November 2013. Meaning, over a decade has elapsed. And still there is nothing to show for MHI’s supposed efforts since then?

“Housekeeping in a meeting refers to the administrative tasks and procedures that need to be taken care of,” as was noted above. Housecleaning is something else. The Collins Dictionary says housekeeping in a business, organizational, or other professional setting can mean the following: “the act of improving or reforming by weeding out excess or corrupt personnel or of revising methods of operation.”

Learn English at VOA says that housecleaning expression is used: “When an organization, business or other group clean house, it gets rid of people or policies that make trouble or that do not work.”

Wordnik said this informal use of housecleaning means: “Removal of unwanted personnel, methods, or policies in an effort at reform or improvement.”

Some other definitions online of housecleaning:

- A getting rid of superfluous things, unwanted personnel, undesirable conditions, etc.

- House Cleaning (noun): a reorganization of a business, government entity, or organization, especially with presumed intention of dismissing dishonest or incompetent officials/employees.

It seems that MHI leaders have either tolerated or have actively been involved in what Copilot said could be defined as paltering, lie, false, and misleading information.

MHProNews has editorially noted for years that MHI is failing at every aspect of what a good ‘umbrella’ style trade association should be doing if it is sincere in serving “all segments” of the industry instead of just consolidators of the industry. MHARR has correctly stressed the need to address three key bottlenecks, but beyond those there is also the lack of proper industry promotion and education.

When the history of manufactured housing industry leaders involved at “the Institute” is carefully examined, a shocking picture of apparently corrupt and predatory behaviors comes into focus. The time for a good housecleaning at MHI is upon us. In fact, the comparison of data between the RV industry and manufactured housing suggests it is long, long overdue. ##

Tipsters? Forward or Submit items at this link here.

Employees of a “predatory” MHI brand? Click here.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’