Richard J. “Dick” Klarchek, the former chairman and CEO of Chicago-based Capital First Realty, purportedly used phony residents at Sterling Estates manufactured home community in Justice, IL. Sterling is located in a Southwestern Chicago suburb, and the charges included falsified documentation meant to appear to a lender that seemed to boost occupancy and inflate site fee income. That was one of multiple schemes Klarchek-led Capital First Realty (CFR) allegedly used to defraud Bank of America (BOA), which serviced the loan on Sterling Estates.

Among those reported allegations were nine counts of bank fraud and one count of making a false statement. By accident or design, the claimed plea occurred during the cover of raucous runup to the 2020 general election. Crain’s Chicago Business said that Klarchek pled guilty to the apparently lesser charge of providing false financial statements in June 2009 to Bank of America.

Those charges of false statement to BOA were noted by World News Monitor, Newsbreak, Flipboard, and on Crain’s Facebook page. The charges included about 109 reportedly fictitious residents which inflated the property’s income by nearly $120,000.

Crain’s said Klarchek plead guilty on October 27, 2020 to a judge that he falsified documents regarding Sterling Estates. Crain’s Albert “Alby” Gallun reported “his [Klarchek’s] chief transgression: instructing his employees to list fictitious tenants at the, which allowed him to provide a phony income statement to the bank that serviced the property’s mortgage.”

Crain’s apparently inaccurately stated that the Sterling community in Justice was “a 744-site park” [sic]. Sterling Estates is currently shown as being owned by giant RHP Properties. At the time that Capital First Realty owned Sterling Estates, it reportedly had some 800 home sites. While the thrust of their report appears sound, community and terminology details had glitches.

MHProNews knows the location, which is located near two interstate highways.

Indeed, RHP’s video promoting Sterling Estates in the southwestern Chicago metro town of Justice also stated that the property has 802 homes.

No direct feedback from Klarchek or his attorney confirmed the guilty plea.

Typical Google searches turned up nothing.

Nor did a search of the U.S. Attorneys Northern District of Illinois website.

However, the U.S Attorney’s office thoughtfully provided MHProNews with the case number, 1:20-cr-00463: USA v. Klarchek.

They also provided other information and insights. That included the fact that on Tuesday October 27, 2020 Honorable Andrea R. Wood – an Obama-Administration appointee who Wikipedia says received her commission on October 15, 2013 – docket said for 10:30 AM CT that a change of plea had been scheduled and video of that proceeding was recorded.

As was previously reported, a person with knowledge told MHProNews that said source was “surprised” by the charges after an incident that occurred over a decade ago. That report with more details is linked below.

Additional Related or Tangential Information and MHProNews Commentary

According to the plea document, “KLARCHEK created the Klarchek Enterprise as a complex structure of Case: 1:20-cr-00463 Document #: 16 Filed: 10/27/20 Page 2 of 20 PageID #:56 3 approximately forty interlocking entities in which various functions involved in operating the manufactured home communities (ownership, management, rental, sales and financing of sales) were purportedly divided and organized into separate and multiple corporations and limited liability companies (the Klarchek Enterprise Companies).”

“KLARCHEK was owner and president of Capital First Realty, Inc., through which KLARCHEK managed and provided oversight of the on-site management of the manufactured home communities in the Klarchek Enterprise. Sterling Estates was a manufactured home community in the Klarchek Enterprise. KLARCHEK was owner and president of Capital Home Sales LLC, which was comprised of sales, finance and rental divisions, each of which was divided into multiple entities,” the pleadings stated.

The document added that: “On April 29, 2003, KLARCHEK caused Bank of America to lend approximately $40.5 million to Sterling Estates (the Klarchek Sterling Estates Loan). Bank of America sold the loans that it made to Sterling Estates to a trust for which Wells Fargo was the trustee and the beneficiaries included Citibank, Comerica Bank, JPM Chase Bank and Wells Fargo Bank (the Wells Fargo Trust), but continued to service these loans on behalf of the Wells Fargo Trust.” That was the loan noted in the narrative further above as reported by Crain’s. The entire plea document is found at this link here.

The plea says that a possible sentence would include and “anticipated advisory sentencing guidelines range of 63 to 78 months’ imprisonment, in addition to any supervised release, fine, and restitution…” Age, health, the COVID19 pandemic, lack of prior criminal history, and other factors may mitigate that possible sentence.

The original 11 counts of the federal charges initially included another community beyond Sterling Estates, and several business entities, which are all found in the federal pleading at this link here.

Sterling Estates

With respect to the more current details about Sterling Estates, post CFR, are the following points. Note that these are not connected to Klarchek, save historically, as noted herein above.

Despite the hype in the RHP Properties video posted above, the BBB on this date shows a 1 out of 5 star rating based on consumer input for that property, which is not Better Business Bureau (BBB) accredited. By contrast, Google ratings by over 200 individuals gives Sterling Estates 2.8 out of 5 stars.

The Crain’s Chicago Business report indicated that Klarchek would probably not serve any time due to age and health. He was ordered to repay some debt even though his bankruptcy case was closed.

At a minimum, this issue may reflect that federal officials are willing to probe problematic behavior that is all too easy to find in various mainstream media reports, as well as at MHProNews and/or MHLivingNews.

As MHProNews has been reporting for years, there are several troubling issues that may or may not have criminal, antitrust, RICO, predatory practices, or other elements that often include larger community operators that are for whatever reason often Manufactured Housing Institute (MHI) members, and/or have ties to MHI members.

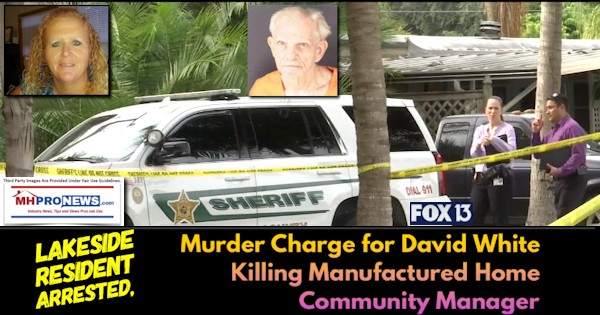

MHProNews has also noted that there may be some level of increased risk to community managers, due to the purported pressure cooker atmosphere that has existed for some time in various properties.

See the report above and below.

MHProNews will continue to monitor and report on this community-sector related and other manufactured home industry-connected matters.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.