If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Amazon does it again

- It posted record profits of $3.6 billion, and shows little sign of slowing down

- LIVE UPDATES OPEC member: ‘Not possible’ for Iran’s oil exports to go to zero

- Microsoft was worth $1 trillion for a hot second

- 3M, the company that makes Scotch tape, is cutting 2,000 jobs

- Chipotle shares drop sharply on news that US health investigation is expanding

- A water shortage could hurt Iraq’s oil boom

- The economy looked like a drag just a few months ago. Not anymore

- This new fund makes investing in marijuana easier than ever

- Wall Street is killing the European investment bank

- Deutsche Bank and Commerzbank abandon merger talks

- Carlos Ghosn, ex-Nissan chief, has been released from jail in Japan

- $4 gas is here. Now what?

- Netflix’s not-so-secret weapon to win the streaming wars

- An NFL star gave his teammates Amazon stock. There’s a better gift

- How to recover from a bad job interview

- Location, location, location: The right way to invest in real estate

- The secret market of private real estate listings

- When $30,000 property taxes hit a little harder

- Rustic yet modern, these converted barns are a creative’s dream

- Most expensive home in US sold for $238 million

- ‘AVENGERS: ENDGAME’ IS HERE

- How much will Marvel’s epic finale make this weekend?

- Disney’s amazing April is about to get even better

- Marvel lifts its TV game to higher power for Disney+

- China could help push ‘Endgame’ to a billion dollar weekend

- ‘Avengers: Endgame’ already breaking records

Select Bullets from Fox Business…

- Amazon crushes earnings expectations, but revenue growth slows

- Facebook’s new campus for Oculus gets $515 million of financing

- Nokia president on 5G: ‘Take it seriously what China is about to do’

- WATCH: More privacy concerns surrounding Amazon’s Alexa devices

- Low-tax states top among best places to make a living in 2019

- Construction job market booming: These states are hiring

- Americans abandoning New York, New Jersey, other high-tax states

- Parkland, Florida shooter could inherit $432,000; public defenders ask to withdraw

- Twitter CEO Jack Dorsey reveals 1 thing he would change if he had to ‘start the service again’

- 10 most hacked passwords revealed in 2019 report

- The top 5 destinations for millennials in the US

- US weekly jobless claims post biggest rise in 19 months

- NFL Draft rookie contract scale: What Kyler Murray, other prospects will earn

- 24-year-old Wisconsin Powerball winner may lose nearly half to tax

- Stop & Shop strike cost company up to $110M in profits

- Opinion: California’s high gas prices shouldn’t be a mystery

- Marvel’s ‘Avengers: Endgame’ debuts: A look at the franchise by numbers

- Retired brigadier general slams AOC’s characterization of the VA

- Amgen, Astellas pay $125M to settle Medicare kickback allegations

- It’s not the economy right now for voters: Here’s why

- On Take Your Child to Work Day, teach your kids this about juggling career, family

- Varney: Like Sanders, Biden’s age, history, race, gender to be problems

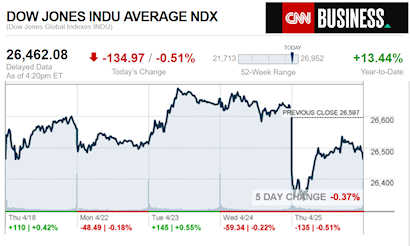

Today’s markets and stocks, at the closing bell…

Today’s Big Movers

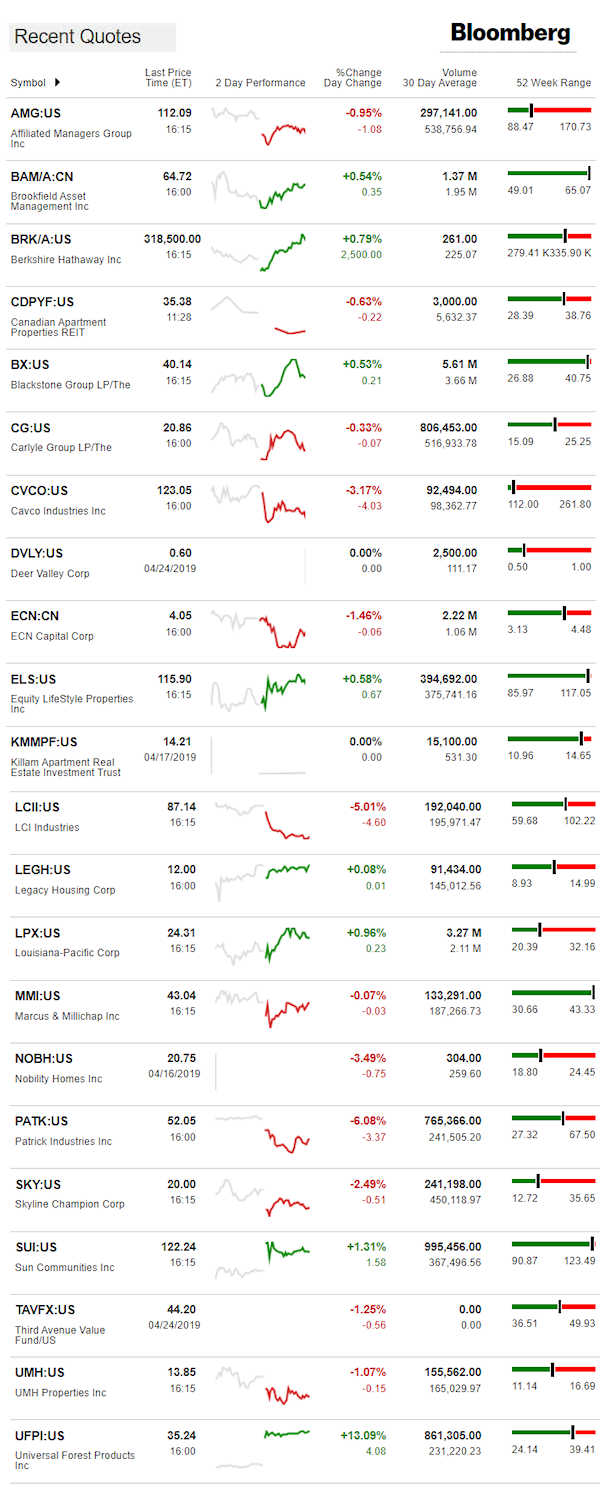

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

OPIS Global Head of Energy Analysis Tom Kloza talks to Fox Business’ Maria Bartiromo on the outlook for oil prices.

As noted in the teaser at top, rising fuel prices produces very few smiles in MHVille.

That said, those with a long-term view might bite their lip, grin and bear it if – if – the following details are kept in mind.

Iran’s regime has long fomented unrest in the Middle East, per several federal and international sources. The U.S. missed a chance in 2009, during the Obama Administration, to take steps like this one during Iran’s so-called Green Revolution. Without any noteworthy support or nod from America, the protests by the people of Iran against their regime faded.

That in turn has resulted in more U.S. military deaths and injuries, from IEDs, and other Iranian supplied attacks on our nation’s soldiers serving in the Middle East. It doesn’t just hurt the U.S., but to our regional allies. There are obvious human as well as military costs to that tragic cycle.

Fast-forward to the present.

Iranian unrest has grown since President Donald J. Trump has taken office. Popular protests have resulted in periodic clashes between government and protesters. While no one is predicting that the government there will be toppled anytime soon, it won’t happen at all if there are no pressures on the regime.

That said, there’s a clear double-standard. The U.S. understandably protests China or Russian spies and other activities in the U.S., but our nation’s espionage agencies are also engaged in similar efforts in lands around the world.

The world is what it is. It makes little sense to hide reality from “We, the People” when spy services around the world already know what the score is. While we won’t fisk some of the details in the video below, it does note the influence that Iran has been deadly for Americans and others in the region for years.

Straight talk to citizens is useful. If pressure on the Iranian regime causes it to topple, that could arguably be good for the Iranian people, and it could be good for the United States and our allies in the Middle East.

As this writer is someone who was born in Tehran, with internal insights from Iran, we bring a perspective to this topic that few in manufactured housing could.

Short term pain could be longer term gain. Many of the Iranian people want to see regime change. See related reports, further below.

Related Reports:

“You Made Me, Promises, Promises…” Historic Iranian, American Lessons in Freedom

Understanding the News as Business, and Manufactured Housing

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.