To be “clinical” in analysis is defined by Oxford Languages as “efficient and unemotional; coldly detached.” The term “clinical” is used in medicine and science, which sheds light on this alternative definition: “relating to the observation and treatment of actual patients [i.e.: subjects] rather than theoretical or laboratory studies.” A person (or organization) can be healthy, and may still go to a medical doctor (MD) for a checkup. When there is a fundamental understanding of manufactured housing (or any other profession), Warren Buffett had a valid point when he said that there is much to be learned by reading annual (or other) reports. That is said clinically, because MHProNews is on record clinically observing critical problems with Buffett-led Berkshire Hathaway’s arguably corrosive impact on our industry and others. Even though telemedicine and other technologies are increasingly making even medical examinations possible remotely, in fairness, the most accurate clinical analysis occurs in person who knows what they are looking for and has the time and access needed to find what the causes and cures are for the weaknesses and strengths. With that backdrop, and noting that MHProNews is on record observing several apparent areas of superiority between UMH Properties and numbers of its publicly traded peers in the Manufactured Housing Institute (MHI) and/or other affiliations, this report and analysis will provide the text of UMH Properties quarterly operational update in Part I.

Highlighting added in Part I is added by MHProNews.

Part II will unpack that information from UMH and do so in a clinical faction against the backdrop of broader industry and U.S. housing market insights. As a blatant tease, based on known information without laying eyes on the subject in some years, there are ways that UMH Properties is superior to its rivals. There are also areas where meh or seemingly weak performance could likely be improved for the benefit of consumers, shareholders, the company, and the manufactured home industry.

Part III is our Daily Business News on MHProNews macro- and manufactured housing industry connected equities updates.

Part I

UMH PROPERTIES, INC. SECOND QUARTER 2024 OPERATIONS UPDATE

UMH Properties, Inc.

Wed, Jul 10, 2024, 4:25 PM EDT

FREEHOLD, NJ, July 10, 2024 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE:UMH) (TASE:UMH), a real estate investment trust (REIT) specializing in the ownership and operation of manufactured home communities, is providing investors with an update on our second quarter 2024 operating results:

- During the second quarter, UMH converted 144 new homes from inventory to revenue generating rental homes. UMH now owns approximately 10,100 rental homes with an occupancy rate of 95.0%.

- During the second quarter, UMH sold 105 homes of which 35 were new home sales. Gross home sales revenue for the second quarter was $8.8 million as compared to $8.2 million last year, representing an increase of approximately 7%.

- Year to date, overall occupancy increased by 196 units to 87%. During the second quarter, overall occupancy increased by 64 units. Year over year, overall occupancy increased by 430 units, representing an increase of 195 basis points in our occupancy rate.

- Our occupancy gains and rent increases achieved throughout 2023 and 2024 have increased our June 2024 rental and related charges by 10%, resulting in our annualized monthly rent roll generating $207 million.

- Our second quarter collection rate is at 98% and should continue to grow over the next few weeks.

Samuel A. Landy, President and CEO of UMH Properties, Inc., stated “UMH continues to experience strong demand for sales and rentals at our locations. Our business plan of acquiring communities, making improvements and filling vacant sites is resulting in strong income and occupancy growth. Our initial quarterly results are in line with our expectations.

“Manufactured housing is most efficient with just-in-time inventory which is how we are operating today. During the first half of the year, we replenished our inventory, which will allow us to further increase occupancy, revenue and sales income in the second half of the year. We currently have 315 homes on site that are ready for occupancy or are being set up and another 140 homes expected to be delivered over the next few weeks.

“We have positioned the company with a strong balance sheet so that we can continue to invest in new homes, capital improvements and the expansion of our communities, which will enhance the long-term value of our portfolio and ultimately increase our earnings per share. Additionally, we are prepared to acquire new communities when accretive investment opportunities become available.”

It should be noted that the financial information set forth above reflects our preliminary estimates with respect to such information, based on information currently available to management, and may vary from our actual financial results as of and for the second quarter ended June 30, 2024. UMH’s second quarter results will be released on Tuesday, August 6, 2024, after the close of trading on the New York Stock Exchange and will be available on the Company’s website at www.umh.reit, in the Financials section. Senior management will discuss the results, current market conditions and future outlook on Wednesday, August 7, 2024, at 10:00 a.m. Eastern Time.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 136 manufactured home communities containing approximately 25,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Contact: Nelli Madden …”

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following observations, with the remarks in the preface, prior reports, and the above in mind.

1)

I’m not aware of any antitrust lawsuits or class action lawsuits or accusations of predatory behavior involving UMH Properties. Can you do a check and clarify, correct, or confirm that notion?

- UMH Properties, Inc. v. Greenwich Twp. Bd. of Supers.:

- In this case, the Township considered mobile homes and mobile home communities as the same class of housing when determining the fair share of housing1.

- However, this case does not directly involve antitrust or predatory behavior accusations against UMH Properties.

- Class Action Lawsuits:

- If you’re interested in open class action lawsuits, you can check out ClassAction.org’s list2. However, I didn’t find any specific UMH Properties-related cases there.

- Antitrust Lawsuits:

- While there’s no specific antitrust lawsuit involving UMH Properties in my current information, it’s essential to note that antitrust cases can be complex and may arise unexpectedly.

- For instance, Google recently faced an antitrust lawsuit related to monopolizing the advertising technology market3.

Remember that legal situations can evolve, so it’s a good idea to stay informed through reliable sources or legal professionals. If you need further assistance, feel free to ask! 😊

Learn more

1 law.justia.com 2 classaction.org 3 sites.law.berkeley.edu…”

MHProNews: so, as noted in the inquiry to Copilot, among the publicly traded firms that are members of MHI, UMH Properties (UMH) may well be the bright and shining star.

2) According to Yahoo Finance yesterday (7.11.2024) UMH has enjoyed a 32.96 percent 5-year return. According to Y Charts: “S&P 500 5 Year Return is at 85.62%…and 63.71% last year.” Investopedia stated: “The [S&P] index has returned a historic annualized average return of around 10.26% since its 1957 inception through the end of 2023.”

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

3) Per the UMH Properties website: “We own and operate 135 manufactured home communities with approximately 25,700 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina and Georgia” and “UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.” With that in mind, from their latest quarterly update:

- During the second quarter, UMH sold 105 homes of which 35 were new home sales.

- Year to date, overall occupancy increased by 196 units to 87%. During the second quarter, overall occupancy increased by 64 units.

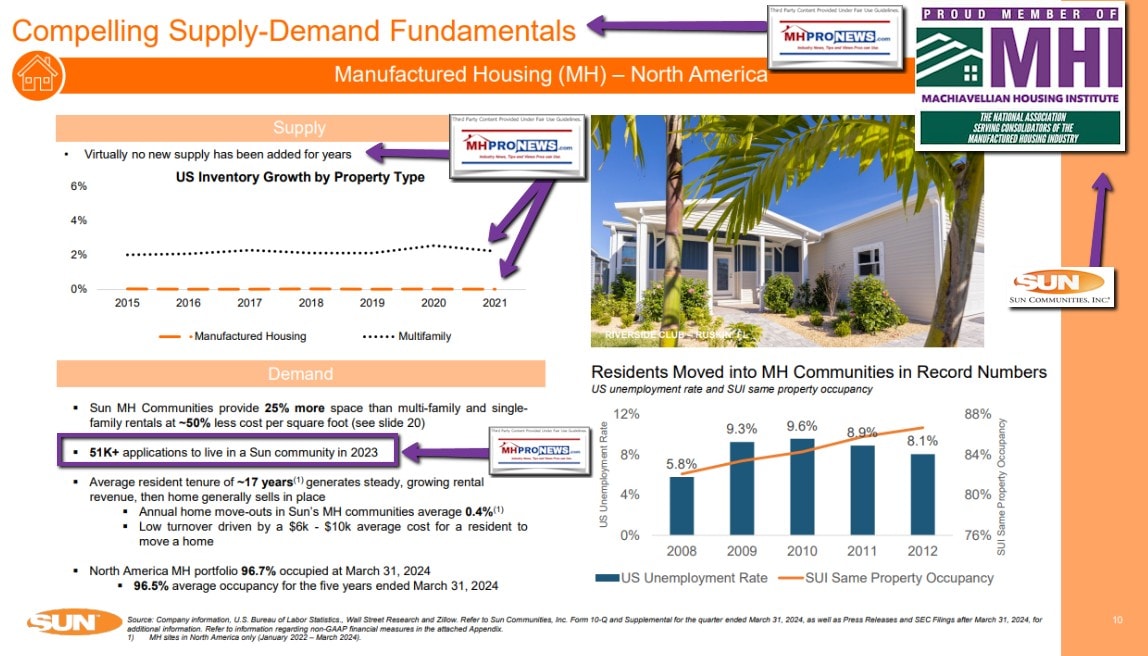

a) Investopedia says: “Key performance indicators (KPIs) measure a company’s success vs. a set of targets, objectives, or industry peers.” That comparison to industry peers is an issue, but so too is the broader picture of what the velocity, conversion, and fill rates are with respect to their own operation. UMH doesn’t say how many applications they had to achieve that result, but Sun Communities curiously stated that their firm received 55,000 applications in 2022 alone and 51,000 in 2023 (an embarrassingly poor conversion rate for Sun). It seems that stock analysts are all too often not asking the tough and obvious questions. Since Sun has made these total applications for the year a ‘talking point,’ perhaps UMH should too? And in doing so, they should have either an outside expert explore how that could be improved or determine a methodology for company insiders to be able to input ideas to improve that in a fashion that won’t put those who speak up at risk (say via all anonymous input process), or both.

b) But based on the information above, the firm is selling less than one home per community per month. If, as President and CEO Sam Landy, J.D., asserted, they have “strong demand” for manufactured home rentals and homes for sale, then that conversion rate appears to be relatively slow during an affordable housing crisis.

c) Comparing to residential real estate, Rocket Homes said the typical listed homes: “had an average of 62 days on market in Jun 2024, up by 38.2% compared to last year.”

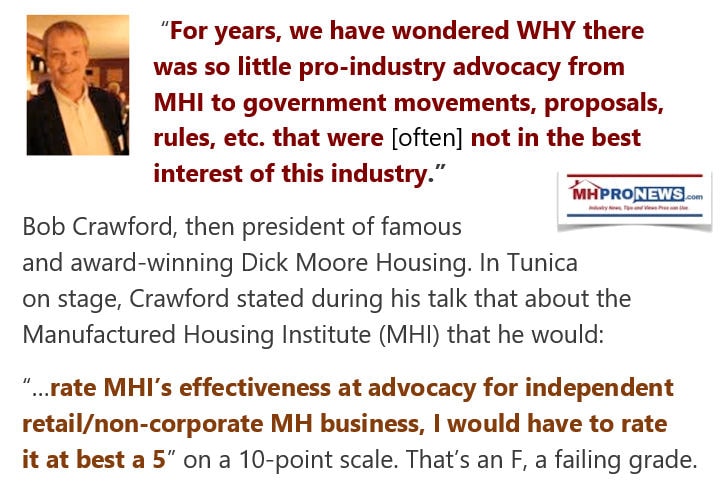

4) UMH Properties understandably mentions their MHI ‘awards’ but that may not be nearly as impressive to an informed source. MHI’s awards have gone to operations that have poor Better Business Bureau (BBB) ratings.

5) Not because ‘AAA – It’s All About Allen’ is so vitally important, but at least someone at MHI has made the statement that production (meaning sales) could be doubled. Allen SECO ally David Roden recently found the moxie to ask why the Manufactured Housing Institute (MHI) isn’t implementing a GoRVing style campaign? While Roden’s inquiry was over a decade after this platform made similar inquiries, nevertheless, Roden’s point is valid. Better late than never, and better more voices speaking up than fewer.

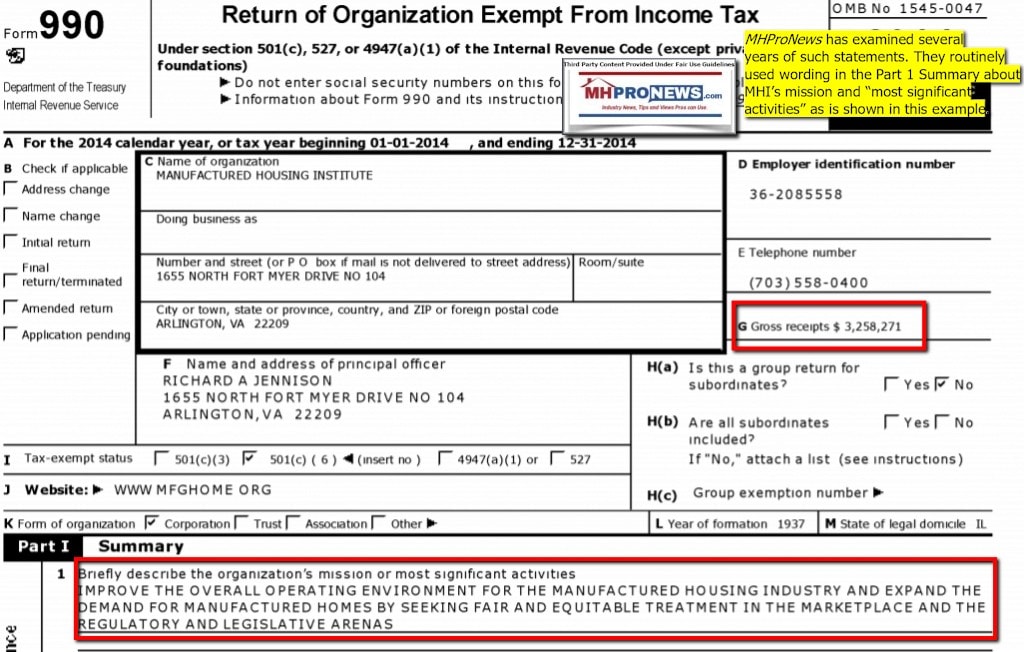

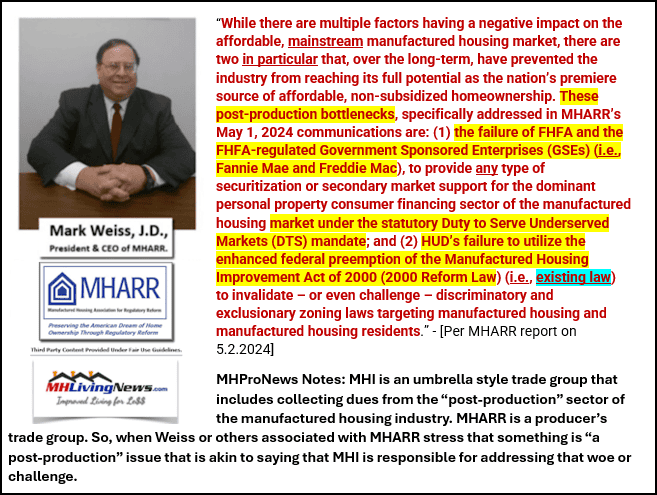

6) To further illustrate just how relatively poorly manufactured housing industry performance is in general (not just UMH Properties), MHI’s prior CEO Richard “Dick” Jennison boldly said that the industry should be doing 500,000 new homes a year. Based on the current pace, that would require about a fivefold increase in sales and production. One wonders when will Jennison’s name fall into the same memory hole on the MHI website that Chris Stinebert, Gail Cardwell, and Thayer Long did?

7) To further illustrate just how problematic MHI’s apparently self-contradictory behavior and claims are, while MHI says they are working to improve the operating environment of the industry, they also have joined forces with the competitors of manufactured housing. What, exactly, has that alliance with conventional builders yielded that is measurable in terms of performance by MHI and/or their corporate brands?

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

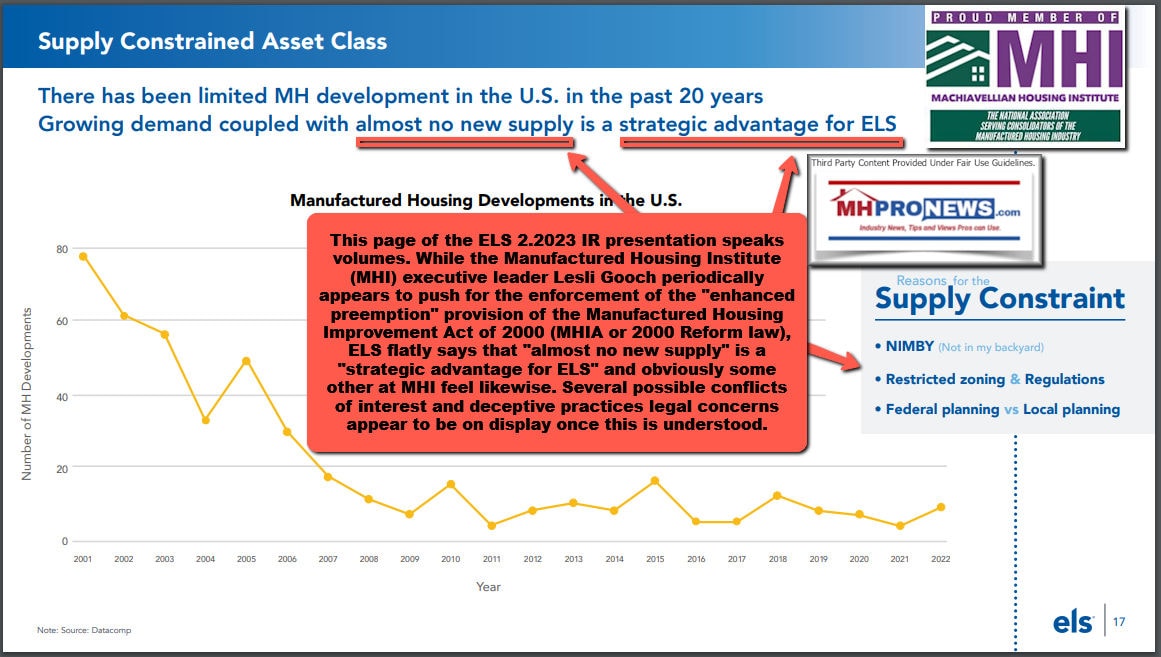

8) But it is in the light of those points above that reality, versus deception and misdirection, comes into focus. UMH Properties rivals are openly celebrating as a business model advantage that the number of new communities being developed has been blunted in the 21st century. Without robust developing, how is the industry supposed to expand? Without the ability to do more single-home placements on private properties on scattered lots, how is the industry going to expand? ELS, Sun, and Flagship have each said in their own words that constraints on the industry is part of their business model. That works against the interests of street retailers and producers, but because consolidation seems to result from that constraint, it appears that the publicly traded producers that are MHI members are often (not always) okay with this status quo.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

9) Which should logically bring UMH Properties leadership to what was perhaps one of the most significant remarks by them, or others, in 2024. Eugene and Sam Landy both said that there needs to be a push for more developing. Collectively, what they proposed just months ago would effectively triple the number of manufactured home communities (MHCs) in the country. That’s the kind of bold thinking, that combined with methods to accelerate sales, could vastly improve the fortunes of both UMH and the broader industry. Plus, such a strategy could benefit hundreds of thousands to millions of new affordable housing seekers.

10) UMH’s leadership has to realize what MHProNews has reported for years. Namely, that quietly – or recently, openly and publicly, fellow MHI members have arguably unjustly dissed UMH.

11) That dissing of a firm with a seemingly enviable record compared to others occurs despite the fact that UMH has been a ‘team player’ for MHI by investing sizable sums for support of the Innovative Housing Showcase (IHS), which certainly is not something that directly benefits UMH as much as it would producers.

12) There is a case to be made that UMH could team up with Legacy Housing, Nobility Homes and others who are not publicly traded to form a new post-production trade group. UMH, and other ‘white hat’ brands in MHI are arguably feeding the hands that are biting them. This is despite the fact that the incentives are many, and drawbacks are shrinking to break away from MHI.

13) In our view, there is an evidence-based case to be made that UMH Properties is obviously superior in several respects to their publicly traded peers at MHI on the MHC side in the NCC. They are superior to some of the non-publicly traded firms too, as some examples below also illustrate. UMH is uniquely positioned because they respectfully, yet publicly, challenged the prevailing narrative of their ‘colleagues’ at MHI. If UMH takes the next logical steps, they could unleash their own constrained performance, improve their yields for investors, boosting manufactured housing nationally and do it in a manner that could cause public officials to scrutinize the bad actors in MHVille. The time for several firms to part ways with MHI and form an ethical post-production trade group is growing more apparent month by month. See the related reports to learn more. Part III and the market report follows. ##

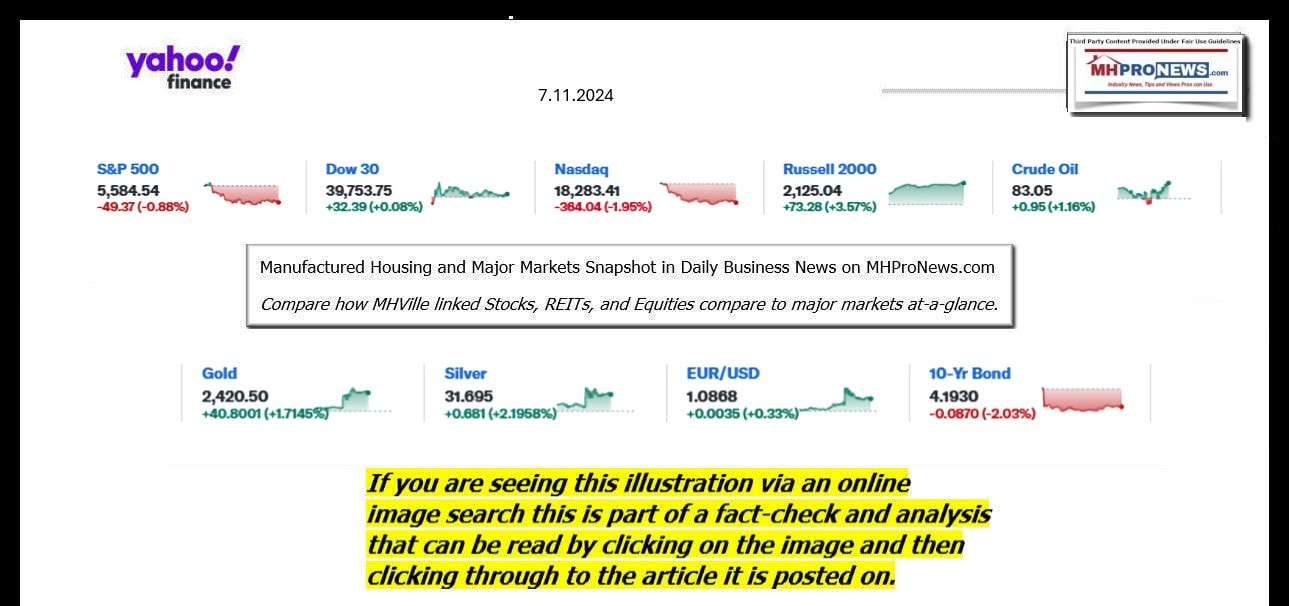

Part III – Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

MHProNews note, bold emphasis added below.

Headlines from left-of-center CNN Business – 7.11.2024

- A frustrated White House press corps finally gets to question Biden

- Last month, McDonald’s entered the increasingly fierce fast food value menu war with a $5 meal deal.

- Why fast food value menus aren’t as good a deal as you might think

- A Huawei store in Berlin in September 2023.

- Germany moves to ban China’s Huawei, ZTE from its 5G network

- American consumers have been battling high prices for the past three years, with many now starting to pull back on their spending.

- Prices fell in June for the first time since the start of the pandemic

- Whitestown – Circa March 2021: Tractor Supply Company Retail Location. Tractor Supply is Listed on the NASDAQ under TSCO.

- Tractor Supply warned climate change and a lack of diversity would hurt business. Now it’s ignoring those risks

- President Joe Biden speaks during the CNN Presidential Debate on Thursday, June 27, 2024.

- Hollywood turns on Biden as major supporters and fundraisers call on him to withdraw from race

- EU competition chief Margrethe Vestager addresses media, following an investigation into Apple Pay, in Brussels in May 2022.

- iPhone users in Europe will no longer have to use Apple Pay for mobile payments

- Huma Abedin and Alexander Soros attend the 2024 Met Gala on May 6 in New York City.

- Huma Abedin is engaged to George Soros’ son Alex

- A Chase bank branch stands in lower Manhattan on January 12, 2024 in New York City.

- Your bank is about to reveal key information about the US economy’s health

- Jane Fraser is trying to pull chronically struggling Citigroup out of the gutter. She may actually pull it off

- Biden administration announces a $1.7 billion plan to juice electric vehicles in America

- MOD Pizza announces new owner in attempt to stave off bankruptcy

- Costco membership fees are going up for the first time since 2017

- Archegos founder Bill Hwang found guilty in multibillion-dollar fraud trial

- NBC’s Lester Holt to interview President Biden on Monday

- CBS News president Ingrid Ciprián-Matthews abruptly steps down amid Paramount merger

- Elon Musk beats $500 million severance lawsuit by fired Twitter workers

- New York University settles lawsuit over antisemitism for undisclosed amount

- Target will stop accepting this old-school form of payment

- The fate of a single investor who nearly tanked the market is now in the hands of a New York jury

- Samsung’s AI-powered foldable phones get slimmer, thinner, pricier

- CNN chief Mark Thompson announces sweeping overhaul of news network, cuts 100 jobs

- Starbucks is giving away a free gift for one day only

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

Headlines from right-of-center Newsmax – 7.11.2024

- This headline function failed yesterday. MHProNews regrets the error and any inconvenience.

click the image and follow the prompts.