“UMH Properties, Inc. has a 55-year history of providing quality affordable housing. UMH owns and operates a portfolio of 135 manufactured home communities containing 25,800 developed

homesites situated in 11 states. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through our joint venture with Nuveen Real Estate.” That and the following are according to UMH’s latest annual report. “Manufactured home communities satisfy a fundamental need of providing quality affordable housing. As home prices continue to rise and available home inventory continues to shrink, the supply of affordable housing becomes an ever-increasing concern. We are committed to being a part of the solution to America’s affordable housing crisis.” “UMH has long believed that we have an obligation to create sustainable and environmentally friendly communities that have a positive societal impact. Throughout our history, we have and will continue to develop and invest in environmentally friendly initiatives that conserve energy and natural resources. We build, upgrade and manage well-maintained communities that our residents are proud to call home. We believe in enriching the lives of the people impacted by our Company, such as our employees, residents, neighbors and shareholders.” The featured image above is from their annual report which said that photo is from: “SEBRING SQUARE, Sebring FL, Acquired in 2021.”

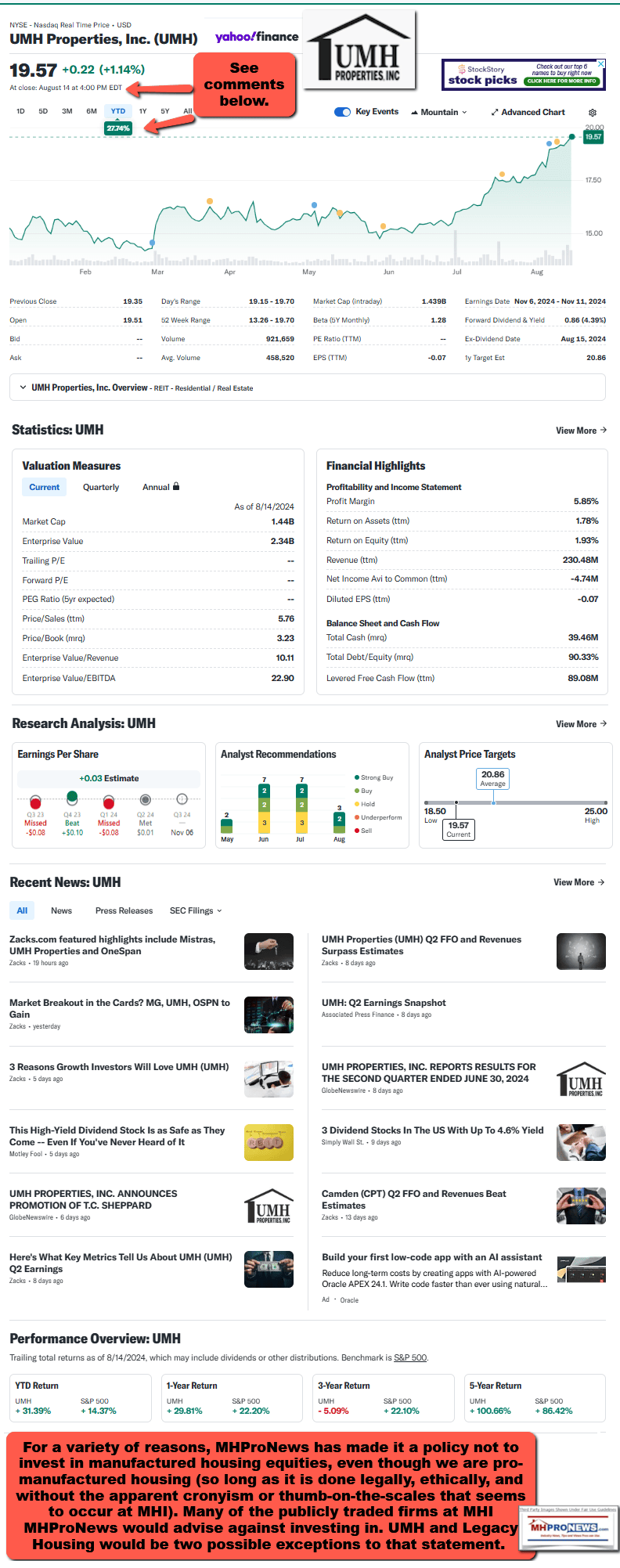

According to Yahoo Finance (see Part II), while UMH Properties trailed the S&P 500 on their 3-year returns, they have outperformed the S&P on the 5-year, YTD, and 1-year returns.

Many in manufactured housing have failed to consistently make the proper case for land-lease. For example. In U.S. commercial real estate, some multifamily housing scenarios, and even from time to time in single-family housing land-lease occurs. Why don’t industry voices consistently and persistently make a better case for land-lease while exposing the problems with specific operators who do so in a problematic fashion? Like anything else, land-lease can be done well, so-so, poorly, or badly. UMH makes a case for land-lease done well in MHVille.

The results for the quarter in Part I are per UMH’s press release as shown. But per their annual report:

2023 Year in Review

23% INCREASE IN SALES

13%

INCREASE IN SAME PROPERTY NOI

2.5%

INCREASE IN COMMON STOCK DIVIDEND

1,040

NEW RENTAL UNITS ADDED

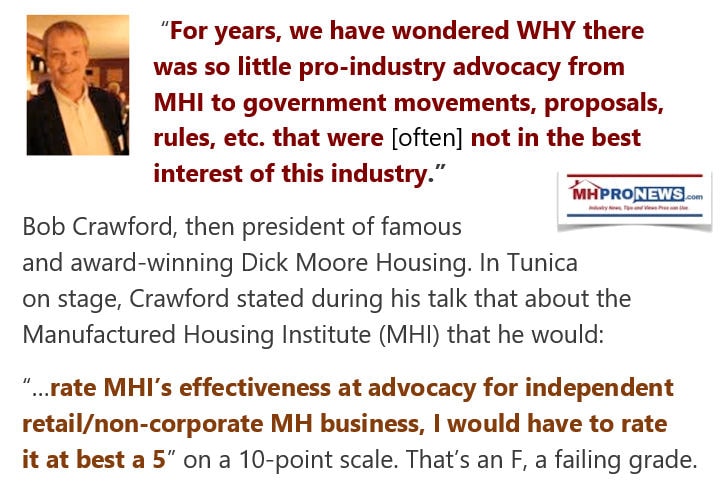

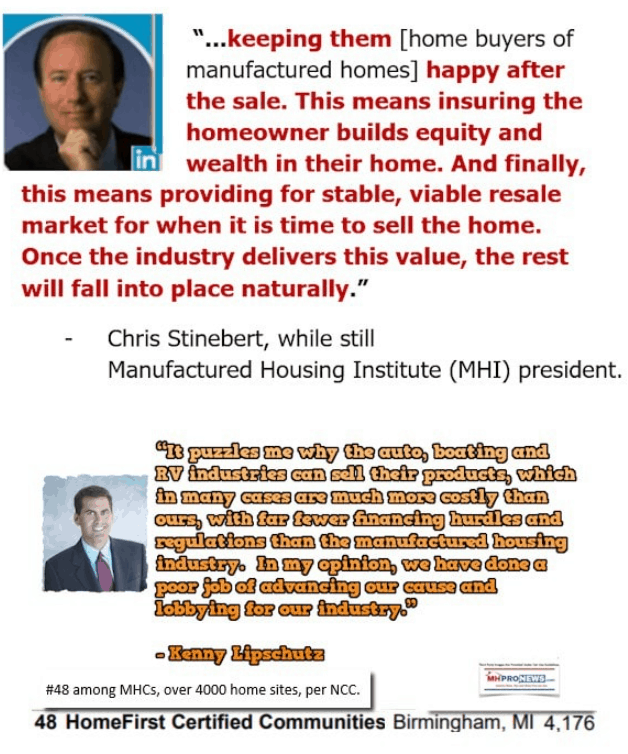

Perhaps as a ‘gig’ to their “predatory” rivals members at the Manufactured Housing Institute (MHI) and at several MHI-linked state associations, UMH’s annual report also stresses fair dealing with residents.

We are careful to treat our residents and associates fairly, recognizing that all contractual relations require good faith and fair dealing. We are proud to invest in communities and improve the quality of life for our existing residents. In some cases, we subsidize the community transition for existing residents because it is the right thing to do. This results in great community relations and eventually in increased profits. We know that our shareholders only want to be invested in a company that can earn strong returns while treating its residents fairly.

The low-cost producer of a quality product always wins. UMH is the low-cost producer of 1,000 sq. ft. to 2,400 sq. ft. three-bedroom, two-bath housing on a 5,000 sq. ft. lot with a shed. Most of our lots have their own driveway and curbside garbage pickup. We provide a housing product most people must see to believe. A household with an annual income of $40,000 can rent a

home from UMH for approximately $1,000 per month and they only need one month’s rent and one month’s security deposit to move in. Approximately 10,000 households are very pleased to rent homes from UMH. We maintain waiting lists for our rental homes, have 94% rental home occupancy, 98% rent collection, and below 30% annual rental home turnover with repair

and maintenance costs of just $400 per unit, per year. Shareholders can view the communities they own by watching the drone videos on our website.

Among the remarks from Eugene Landy, Chairman of UMH Properties are the following.

Every business succeeds only where there is good faith and fair dealing by all. The path to maximizing shareholder value is by creating and owning needed housing and treating our residents equitably. To do this, we need satisfied residents as well as satisfied investors. Investors should be proud to own UMH because we serve an important social mission by providing affordable housing and doing it in an environmentally friendly manner. Our success has led to increased property values and earnings, which investors realize through increased dividends. We believe that this will also translate to an increased stock price. Our residents should be proud to live in our communities. We take great pride in improving the communities and the quality of life that is provided by living in a UMH community. We are always fair with residents and limit our rent increases. With resident and investor acceptance, UMH is positioned to further build upon our success.

That and more are in their annual report at this link here. MHProNews will provide some analysis and commentary in Part II, further below.

Part I:

FREEHOLD, NJ, Aug. 06, 2024 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE:UMH) (TASE:UMH) reported Total Income for the quarter ended June 30, 2024 of $60.3 million as compared to $55.3 million for the quarter ended June 30, 2023, representing an increase of 9%. Net Income Attributable to Common Shareholders amounted to $527,000 or $0.01 per diluted share for the quarter ended June 30, 2024 as compared to a Net Loss of $4.4 million or $0.07 per diluted share for the quarter ended June 30, 2023. Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), was $16.8 million or $0.23 per diluted share for the quarter ended June 30, 2024, as compared to $13.0 million or $0.21 per diluted share for the quarter ended June 30, 2023, representing a 10% per diluted share increase.

A summary of significant financial information for the three and six months ended June 30, 2024 and 2023 is as follows (in thousands except per share amounts):

| Three Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Total Income | $ | 60,328 | $ | 55,290 | ||||

| Total Expenses | $ | 49,307 | $ | 46,371 | ||||

| Net Income (Loss) Attributable to Common Shareholders | $ | 527 | $ | (4,418 | ) | |||

| Net Income (Loss) Attributable to Common Shareholders per Diluted Common Share | $ | (0.01 | ) | $ | (0.07 | ) | ||

| FFO (1) | $ | 16,182 | $ | 12,043 | ||||

| FFO (1) per Diluted Common Share | $ | 0.23 | $ | 0.19 | ||||

| Normalized FFO (1) | $ | 16,807 | $ | 13,049 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.23 | $ | 0.21 | ||||

| Basic Weighted Average Shares Outstanding | 71,418 | 61,236 | ||||||

| Diluted Weighted Average Shares Outstanding | 71,884 | 61,760 | ||||||

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Total Income | $ | 118,008 | $ | 107,897 | ||||

| Total Expenses | $ | 97,715 | $ | 91,611 | ||||

| Net Loss Attributable to Common Shareholders | $ | (5,737 | ) | $ | (9,715 | ) | ||

| Net Loss Attributable to Common Shareholders per Diluted Common Share | $ | (0.08 | ) | $ | (0.16 | ) | ||

| FFO (1) | $ | 30,228 | $ | 22,683 | ||||

| FFO (1) per Diluted Common Share | $ | 0.43 | $ | 0.37 | ||||

| Normalized FFO (1) | $ | 31,824 | $ | 24,769 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.45 | $ | 0.41 | ||||

| Basic Weighted Average Shares Outstanding | 70,291 | 60,186 | ||||||

| Diluted Weighted Average Shares Outstanding | 70,700 | 60,844 | ||||||

A summary of significant balance sheet information as of June 30, 2024 and December 31, 2023 is as follows (in thousands):

| June 30, 2024 | December 31, 2023 | |||||||

| Gross Real Estate Investments | $ | 1,574,196 | $ | 1,539,041 | ||||

| Marketable Securities at Fair Value | $ | 28,673 | $ | 34,506 | ||||

| Total Assets | $ | 1,441,295 | $ | 1,427,577 | ||||

| Mortgages Payable, net | $ | 491,030 | $ | 496,483 | ||||

| Loans Payable, net | $ | 77,367 | $ | 93,479 | ||||

| Bonds Payable, net | $ | 100,479 | $ | 100,055 | ||||

| Total Shareholders’ Equity | $ | 743,980 | $ | 706,794 | ||||

Samuel A. Landy, President and CEO, commented on the results of the second quarter of 2024.

“We are pleased to announce another solid quarter of operating results. During the quarter, we:

| ● | Increased Rental and Related Income by 9%; | |

| ● | Increased Sales of Manufactured Homes by 7%; | |

| ● | Increased Community Net Operating Income (“NOI”) by 11%; | |

| ● | Increased Same Property NOI by 11%; | |

| ● | Increased Same Property Occupancy by 130 basis points from 86.4% to 87.7%; | |

| ● | Improved our Same Property expense ratio by 110 basis points from 40.4% in the second quarter of 2023 to 39.3% at quarter end; | |

| ● | Amended our unsecured credit facility to expand available borrowings by $80 million from $180 million to $260 million syndicated with BMO Capital Markets Corp., JPMorgan Chase Bank, NA and Wells Fargo, N.A; | |

| ● | For the fourth time since 2020, raised our quarterly common stock dividend by $0.01 representing a 4.9% increase to $0.215 per share or $0.86 annually; | |

| ● | Issued and sold approximately 2.4 million shares of Common Stock through our At-the-Market Sale Program at a weighted average price of $15.46 per share, generating gross proceeds of $36.9 million and net proceeds of $36.1 million, after offering expenses; | |

| ● | Issued and sold approximately 29,000 shares of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $23.18 per share, generating gross proceeds of $670,000 and net proceeds of $659,000, after offering expenses; | |

| ● | Subsequent to quarter end, issued and sold approximately 765,000 shares of Common Stock through our At-the-Market Sale Program at a weighted average price of $16.94 per share, generating net proceeds of $12.8 million, after offering expenses; and | |

| ● | Subsequent to quarter end, issued and sold approximately 150,000 shares of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $23.01 per share, generating net proceeds of $3.4 million, after offering expenses.” | |

Mr. Landy stated, “UMH is pleased to report that Normalized FFO for the second quarter increased to $0.23 from $0.21 last year, representing an increase of approximately 10%. Sequentially, Normalized FFO increased from $0.22 to $0.23, representing an increase of approximately 5%. UMH has intentionally acquired value-added communities with vacant sites over the past 10 years. We have been improving the communities through our capital improvements, adding approximately 800 homes per year and selling 200 homes per year. These investments have added to the supply of affordable housing and generated best-in-class operating results.

“Our same property operating results continue to demonstrate the effectiveness of our business plan. Same property NOI increased by 11.0% for the quarter and 13.2% for the first six months, compared to the corresponding prior year periods. UMH has now increased same property NOI by double digits for four consecutive quarters. This increase was driven by an increase in rental and related income of 9.0% and 9.7% for the three and six months, respectively, partially offset by an increase in same property expenses of 6.1% and 4.8%, respectively. The growth in rental and related income is primarily attributed to a strong increase in occupancy of 380 units and rental rate increases of 4.9%.

“Our sales for the quarter increased from $8.2 million to $8.8 million, representing an increase of 7%. Notably, our gross margin increased from 30% last year to 38% this year. Sales demand remains strong, and we anticipate another solid quarter of profitable home sales in the third quarter.

“We are initiating guidance for the remainder of 2024, with Normalized FFO in a range of $0.91-0.95 per diluted share for the full year, or $0.93 at the midpoint. This represents approximately 8% annual normalized FFO growth at the midpoint over full year 2023 Normalized FFO of $0.86 per diluted share.

“UMH continues to execute on our long-term business plan of acquiring communities. Our high-quality communities continue to experience strong demand for our products, which is translating to growing occupancy, net operating income and property value. Our 3,300 vacant sites and 2,200 acres of vacant land give us a runway to generate earnings growth for years to come. We maintain a strong balance sheet to ensure that we can execute our organic growth plan and be prepared when external acquisition opportunities become available. This strategy has allowed us to build a first-class portfolio of manufactured housing communities that deliver shareholders a resilient and growing dividend, greater scale, and improved net asset value per share.”

UMH Properties, Inc. will host its Second Quarter 2024 Financial Results Webcast and Conference Call. Senior management will discuss the results, current market conditions and future outlook on Wednesday, August 7, 2024, at 10:00 a.m. Eastern Time.

The Company’s 2024 second quarter financial results being released herein will be available on the Company’s website at www.umh.reit in the “Financials” section.

To participate in the webcast, select the webcast icon on the homepage of the Company’s website at www.umh.reit, in the Upcoming Events section. Interested parties can also participate via conference call by calling toll free 877-513-1898 (domestically) or 412-902-4147 (internationally).

The replay of the conference call will be available at 12:00 p.m. Eastern Time on Wednesday, August 7, 2024, and can be accessed by dialing toll free 877-344-7529 (domestically) and 412-317-0088 (internationally) and entering the passcode 7242441. A transcript of the call and the webcast replay will be available at the Company’s website, www.umh.reit.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 136 manufactured home communities containing approximately 25,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Note:

(1) Non-GAAP Information: We assess and measure our overall operating results based upon an industry performance measure referred to as Funds from Operations Attributable to Common Shareholders (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (loss) attributable to common shareholders, as defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, the change in the fair value of marketable securities, and the gain or loss on the sale of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper – 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities, and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the adoption of the FFO White Paper – 2018 Restatement, for all periods presented, we have elected to exclude the gains and losses realized on marketable securities investments and the change in the fair value of marketable securities from our FFO calculation. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating performance. We define Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), as FFO excluding certain one-time charges. FFO and Normalized FFO should be considered as supplemental measures of operating performance used by REITs. FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which have a different cost basis. However, other REITs may use different methodologies to calculate FFO and Normalized FFO and, accordingly, our FFO and Normalized FFO may not be comparable to all other REITs. The items excluded from FFO and Normalized FFO are significant components in understanding the Company’s financial performance.

FFO and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as alternatives to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. FFO and Normalized FFO, as calculated by the Company, may not be comparable to similarly titled measures reported by other REITs.

The diluted weighted shares outstanding used in the calculation of FFO per Diluted Common Share and Normalized FFO per Diluted Common Share were 71.9 million and 70.7 million shares for the three and six months ended June 30, 2024, respectively, and 61.8 million and 60.8 million shares for the three and six months ended June 30, 2023, respectively. Common stock equivalents resulting from stock options in the amount of 409,000 for the six months ended June 30, 2024, were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive. Common stock equivalents resulting from employee stock options to purchase 4.0 million shares of common stock amounted to 466,000 shares, for the three months ended June 30, 2024, were included in the computation of Diluted Net Income per Share. Common stock equivalents resulting from stock options in the amount of 524,000 and 658,000 shares for the three and six months ended June 30, 2023, respectively, were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive.

The reconciliation of the Company’s U.S. GAAP net income (loss) to the Company’s FFO and Normalized FFO for the three and six months ended June 30, 2024 and 2023 are calculated as follows (in thousands):

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2024 | June 30, 2023 | June 30, 2024 | June 30, 2023 | |||||||||||||

| Net Income (Loss) Attributable to Common Shareholders | $ | 527 | $ | (4,418 | ) | $ | (5,737 | ) | $ | (9,715 | ) | |||||

| Depreciation Expense | 15,001 | 13,751 | 29,742 | 27,124 | ||||||||||||

| Depreciation Expense from Unconsolidated Joint Venture | 204 | 166 | 401 | 325 | ||||||||||||

| (Gain) Loss on Sales of Depreciable Assets | 10 | (5 | ) | 13 | (37 | ) | ||||||||||

| (Increase) Decrease in Fair Value of Marketable Securities | (3,338 | ) | 2,548 | 2,031 | 4,943 | |||||||||||

| Loss on Sales of Marketable Securities, net | 3,778 | 1 | 3,778 | 43 | ||||||||||||

| FFO Attributable to Common Shareholders | 16,182 | 12,043 | 30,228 | 22,683 | ||||||||||||

| Amortization of Financing Costs | 607 | 538 | 1,163 | 1,056 | ||||||||||||

| Non-Recurring Other Expense (a) | 18 | 468 | 433 | 1,030 | ||||||||||||

| Normalized FFO Attributable to Common Shareholders | $ | 16,807 | $ | 13,049 | $ | 31,824 | $ | 24,769 | ||||||||

(a) Consists of non-recurring one-time legal fees ($18 and $51, respectively), and costs associated with the liquidation/sale of inventory in a particular sales center ($0 and $382, respectively) for the three and six months ended June 30, 2024. Consists of special bonus and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($431 and $862, respectively) and non-recurring expenses for the joint venture with Nuveen ($3 and $50, respectively), one-time legal fees ($30 and $50, respectively), fees related to the establishment of the OZ Fund ($4 and $37, respectively), and costs associated with an acquisition that was not completed ($0 and $31, respectively) for the three and six months ended June 30, 2023.

The following are the cash flows provided by (used in) operating, investing and financing activities for the six months ended June 30, 2024 and 2023 (in thousands):

| 2024 | 2023 | |||||||

| Operating Activities | $ | 37,605 | $ | 53,002 | ||||

| Investing Activities | (58,758 | ) | (94,396 | ) | ||||

| Financing Activities | 7,598 | 49,706 | ||||||

| (2) | The following are the assumptions used in the 2024 Normalized FFO guidance: |

| – | Rent increases of 5%; | |

| – | Occupancy of 400 rental units in the second half of 2024; | |

| – | Overall capital needs to fund rental home purchases, notes, expansions, and improvements of approximately $110-$120 million for the year; | |

| – | Includes the opportunistic sales of common and preferred stock through our ATM programs; and | |

| – | Excludes any potential acquisitions, dispositions, and development projects. |

Contact: Nelli Madden

732-577-9997

# # # #

Part II – Additional Information with More MHProNews Analysis and Commentary

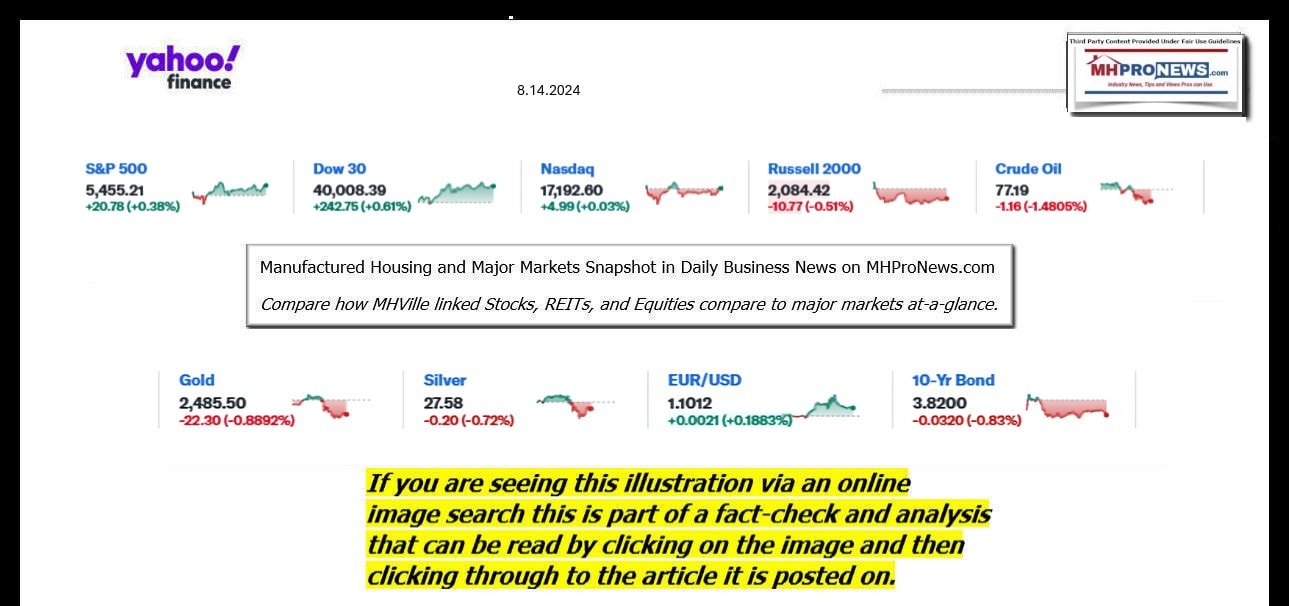

1) According to Yahoo Finance on 8.15.2024 is the following.

Performance Overview: UMH

Trailing total returns as of 8/14/2024, which may include dividends or other distributions. Benchmark is S&P 500.

YTD Return

1-Year Return

3-Year Return

5-Year Return

To see this image below in a larger size, depending on your device,

click the image and follow the prompts. For instance, you may be able

to click the image below, select ‘open image in new tab’ and then click the plus sign to expand the image

into a larger or the largest size.

3) UMH Properties has arguably gone out of its way to provide support for the Manufactured Housing Institute (MHI) at events such as the Innovative Housing Showcase (IHS). Perhaps it is no surprise that MHI has at times given one of their dubious ‘awards’ to UMH. Given that some award winners have poor ratings with the Better Business Bureau (BBB) and otherwise in online reviews, an MHI award should arguably not carry much weight with investors, researchers, or others.

For that matter, the RV MH Hall of Fame award was generally respected until about a decade or so ago, but as the influence of MHI insiders in that organization apparently grew, the selection process appears to have become more ‘insiders’ and their allies focused than it is about authentic achievements.

3) That noted, a more in depth look at UMH is found in the report linked below. It has been dubbed a “clinical” analysis.

4) Perhaps as important is the need to debunk the criticism of notorious MHI member Frank Rolfe’s criticism of UMH leadership’s push for robust manufactured housing development. While others at MHI unfortunately ‘bad mouthed’ UMH’s valuation behind their backs, Rolfe picked a specific topic and did so in a public fashion. The case can be made that Rolfe and other UMH critics were mistaken. That said, Rolfe has made a serious point that there appears to be no serious desire to solve the affordable housing crisis. Rolfe specifically said public officials and “special interests” were involved in undermining affordable housing. Previously, Rolfe named MHI when he made the case that manufactured housing sales are underperforming due in part to MHI’s failures. As each of the linked reports reflect, while Rolfe may be correct on those notions, he is an interesting case of finger pointing where one finger points out (and sometimes rightly so) but meanwhile three fingers are pointing back at him (arguably for problematic if not illegal business practices).

5) For a variety of reasons, MHProNews has made it a policy not to invest in manufactured housing equities, even though we are pro-manufactured housing (so long as it is done legally, ethically, and without the apparent cronyism or thumb-on-the-scales that seems to occur at MHI). Many of the publicly traded firms at MHI MHProNews would advise against investing in. UMH and Legacy Housing would be two possible exceptions to that statement. While MHProNews would advise (see linked reports) that certain areas at UMH Properties could be improved (sales, for example, arguably could and should be stronger), a turning point for our evaluation of UMH’s vision occurred when in a previous earnings call, Eugene and Sam Landy laid out their case for essentially tripling the number of land-lease communities in the U.S. That report ought to be in the must-reading list for investors, affordable housing advocates, public officials, and many others.

6) A more details report is planned that will unpack UMH’s latest earnings call. For now, just one more observation will be made beyond encouraging readers to check back for that report and analysis. The Landys (see above) have made a compelling argument for not only their brand, but for growing the industry’s footprint as part of the solution to the affordable housing crisis. They have done so, per Copilot, without the kind of negative media coverage and litigation that has been filed against several of their MHI peers. There is an argument to be made that UMH, Legacy Housing, and other firms that appear to be sincere in their desire for organic growth to forge a new post-production trade group to supplant the posturing and problem-plagued MHI. There ought to be a ‘white hat’ trade group that has authentic and enforced standards for a code of ethical conduct and are focused on robust growth with good public relations. UMH has seemingly done a far better job of good resident relations, avoiding the negative media and pushback that has attended several of their fellow MHI members in the community sector.

Google recently suffered a serious defeat in court. While it will be appealed, some observers are saying that it could change the landscape of antitrust enforcement. If so, it is not a stretch to think that several MHI member brands, some of them already hit by multiple antitrust claims could well be upended in the months or years to come. Until our more detailed follow up, see the linked and related items to learn more. ##

https://www.manufacturedhomepronews.com/lawmakers-put-federal-agencies-on-notice-after-scotus-loper-bright-ruling-ended-decades-of-chevron-deference-obvious-manufactured-housing-implications-facts-analysis-plus-mhmarkets/

Postscript A to Part II, teaser for Part III. UMH Properties outperforming the S&P 500 arguably ought to be standard fare for manufactured housing during an affordable housing crisis. But that is not always the case. In 2022, manufactured housing connected equities (see further below) often did not perform well. Comparing the 9 macro-markets snapshot to the manufactured housing linked equities is a useful insight. But also useful are comparisons between the headlines from left-leaning CNN vs. those on right-leaning Newsmax. There are no other known publishers in MHVille trade media that offers a feature like the one below. In minutes a day, someone can get impressions and insights that over time could yield significant new understanding of events, obstacles and opportunities. Getting information from both the left and right is useful, and in the troubling state of contemporary corporate media, is regrettably necessary for a clear and accurate understanding of our nation and world.

Postscript B to Part II. As is noted and linked in the above, UMH Properties is already doing several things well. With the correct adjustments, it is entirely possible that in 10 years or less, UMH could be the dominant player in manufactured home communities (MHC), surpassing larger firms like Equity LifeStyle Properties (ELS) and Sun Communities (SUI). They could achieve that without the kind of legal and image concerns that other in MHI and MHI-linked state associations have fostered. Something similar might be said about Legacy Housing could, with savvy adjustments, surpass Cavco Industries and Skyline Champion. Check out our earnings call report on ELS and our next reports on Legacy Housing and others that are just ahead. ##

Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

NOTICE: following the TPG deal with CAPREIT, TPG has been added to our tracked stocks list below.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

- In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 8.14.2024

- Inflation milestone: Consumer Price Index slows below 3% for first time since March 2021

- Why car insurance is still so expensive even as car prices are dropping

- Disney wants wrongful death suit thrown out because widower bought an Epcot ticket and had Disney+

- The specialty flooring company, formerly called Lumber Liquidators, filed for Chapter 11 bankruptcy yesterday and is closing 94 locations across the U.S.

- LL Flooring files for bankruptcy and will close 94 stores

- Made with diced red onions, lettuce, pickles, Thousand Island dressing, American cheese and a nearly half-pound, hand-smashed burger patty, the Big Smasher is a standout offering burger lovers deserve.

- Chili’s take on the Big Mac is beating McDonald’s at its own game

- Texas sues General Motors, alleging illegal selling of driver data

- Mars agrees to buy Pringles maker Kellanova in $36 billion deal

- Rising food costs have put a strain on Social Security recipients’ finances.

- ‘I’m down to eating ramen’: Social Security benefits aren’t keeping up with inflation

- Starbucks is struggling. So it hired fast food’s Mr. Fix-It

- The changes coming to the Realtor commission model upend decades of legal and political wrangling to protect the standard 5%-6% rate on home sales.

- The change that Realtors’ powerful trade group resisted for decades is finally happening

- The West needs China for clean energy. It will pay a price to break free

- UAW files federal labor charges against Donald Trump and Elon Musk after threatening workers on X interview

- News outlets were sent leaked Trump campaign files. They chose not to publish them

- Young people in China aren’t spending on romance. That’s a problem

- Big Lots is closing hundreds of stores after warning it could go out of business

- How Elon Musk has turned X into a pro-Trump machine

- Is pumpkin spice a summer flavor? IHOP and Krispy Kreme are the latest retailers to say yes

- A key inflation gauge showed price hikes slowed last month. But economic jitters remain

- Paris Olympics ratings soar 82% over Tokyo Games, delivering big boost to NBC’s Peacock streamer

- Starbucks’ CEO is out. Chipotle’s Brian Niccol is taking over

- Boeing scores rare sales win over Airbus, despite ongoing safety issues

- Home Depot issues a warning about the economy

- King Charles banknotes sell for 12 times their value as collectors scramble for early editions

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

Headlines from right-of-center Newsmax – 8.14.2024

- Watchdog Claims Thousands of Discrepancies in ActBlue Records

- A Republican group investigating ActBlue, an organization that raises money for Democrats, claims it has found more than 60,000 potential discrepancies in donations made to the Biden-Harris presidential campaign. [Full Story]

- Israel at War

- US Envoy: Israel, Hezbollah Can Avoid War

- Top Hamas Official: Losing Faith in US as Mediator

- Hamas Out of Gaza Truce Talks, Iran Considers Israel Attack

- IDF: Tel Aviv Rockets Came From Gaza Humanitarian Route

- Netanyahu Denies Changing Hostage Deal Parameters

- Blinken OKs Sale to Israel of $20B in Military Equipment

- Iran Threatens to Strike Israel if Hamas Cease-Fire Deal Fails

- Biden Says Gaza Cease-Fire Could Stop Iran Attacking Israel

- US Pushes Peace Deal as Iran Attack Looms

- Israel Military: 100 Hamas Terrorists Killed in Rafah

- Newsmax TV

- Walberg: UAW Leaders Don’t Speak for Members

- Daniel Epstein: Investigate the Bidens

- Ernst Money to Afghanistan Must Stop

- Caroline Sunshine: Harris ‘Plagiarizing’ Trump

- Sheriff: Harris Doesn’t Support Law Enforcement

- Miami Mayor: Must Convince More Hispanics to Vote GOP

- Roger Stone: Hacked Email Had ‘Nothing Sensitive’

- Van Duyne: Harris’ Policies Won’t Fly in Texas

- Minnesota Bar Owner: Gov. Walz Destroyed My Business

- Newsfront

- WHO Declares Mpox Outbreaks in Africa Global Health Emergency as New Form of Virus Spreads

- The World Health Organization has declared the mpox outbreaks in Congo and elsewhere in Africa a global emergency, with cases confirmed among children and adults in more than a dozen countries and a new form of the virus spreading. Few vaccine doses are available on the…… [Full Story]

- Palm Beach Mulls Closing Mar-a-Lago

- Heavy congestion caused by the Secret Service’s road closure in front [Full Story]

- Monmouth Poll: Dems Energized by Harris Pick

- A new poll finds a surge in enthusiasm among Democrats since Kamala [Full Story]

- Report: Biden Still Angry With Pelosi, Obama

- President Joe Biden remains bitter over how he was replaced atop the [Full Story]

- Court Upholds $267M Legal Fee Award in Dell Lawsuit

- Five law firms should receive $267 million in legal fees for [Full Story]

- Google Ads From Harris Campaign Rewrite Headlines

- The Harris campaign has been editing news headlines and descriptions [Full Story]

- Related

- Dem Voter Registration Spikes After Kamala’s Launch

- Harris’ Ukraine Policy Unclear, Relations Strained

- UAW Launches Pro-Harris Campaign to Rally Workers Across US

- Harris Aides: VP Is Strategically Ambiguous on Energy

- AP Poll: Harris Gives Democrats ‘Hope’ After Biden Ouster

- Wall Street Bosses’ Positions on Trump, Harris

- Biden: Harris Is Not Progressive

- Walz Fires Back: Don’t ‘Denigrate’ My Service Record

- Official Probe Reveals Secret Service Jan. 6 Failures

- The U.S. Secret Service has fulfilled only one of six recommendations [Full Story] | Platinum Article

- Trump Loses 3rd Bid for Judge Merchan to Step Aside

- A New York judge declined for a third time to step aside from the [Full Story]

- Russia Pulls Troops in Ukraine After Incursion

- Russia has been pulling some troops out of Ukraine to respond to [Full Story]

- Related

- Ukraine’s Kursk Attack Surprised Russia and Perhaps Some of Its Backers

- Russia: Ukraine’s Land Grabbing Puts Stop to Peace

- Ukrainian Troops Pull Down Russian Flag in Sudzha

- Germany Issues Arrest Warrant for Ukrainian Diver in Nord Stream Probe

- WH: Ukraine Advance in Russia ‘Real Dilemma’ for Putin

- Possible Seaport Strike Could Back up Goods for Months

- A potential strike at U.S. seaports on the East Coast and Gulf of [Full Story]

- Army Fires Command Sgt. Maj. of D.C. Task Force

- The senior enlisted leader in charge of the Army branch that oversees [Full Story]

- Florida: Say Bye to Your Car Insurance Bill if You Live in These Zip Codes

- Otto Quotes

- 3 Years Later, Afghans Suffer as Taliban Celebrates

- It’s been three years since the U.S. withdrew from Afghanistan, [Full Story]

- Cost of Healthcare Is Big Concern for Voters Over 50

- Older voters are keenly interested in the cost of healthcare, a new [Full Story]

- Judge: Protesters Can’t Block Jewish UCLA Students

- A federal judge ruled Tuesday that the University of California, Los [Full Story]

- Florida: Say Bye to Your Car Insurance Bill if You Live in These Zip Codes

- Otto Quotes

- Germany Probes Military Base Water Supply Sabotage

- A German military base next to Cologne airport was temporarily sealed [Full Story]

- Bryan Steil to Newsmax: Probe ActBlue for ‘Potential Money-Laundering Scheme’

- Bryan Steil, R-Wis., has urged the Federal Election Commission [Full Story]

- Comer Seeks Info on Trump Assassination Attempt Censorship

- House Oversight Committee Chair James Comer, R-Ky., is seeking [Full Story]

- China, Russia War Games Heighten US Concern

- Joint military exercises between China and Russia have raised [Full Story]

- Scientists Predict Diseases by Analyzing Tongue

- A computer algorithm developed by Iraqi and Australian researchers [Full Story]

- Well-Funded Rep. Ilhan Omar Wins Minnesota Primary

- Ilhan Omar, D-Minn., one of the progressive House members known [Full Story]

- Harris Surprises Dems by Backing Trump’s Tip Tax Plan

- Vice President Kamala Harris surprised Democrats by announcing that [Full Story]

- GOP Picks Matt Corey to Challenge Conn. Sen. Murphy

- Matt Corey, a Connecticut entrepreneur who unsuccessfully ran for the [Full Story]

- Texas Sues GM for Allegedly Violating Drivers’ Privacy

- General Motors has been sued by the state of Texas, which accused the [Full Story]

- ICE Arrests Haitian National Charged With Rape

- Immigration and Customs Enforcement (ICE) agents arrested a [Full Story]

- Polls: Majority Support Troops to Secure Border

- A number of recent polls show widespread dissatisfaction with the [Full Story]

- Study: TikTok Stacks Algorithm in China’s Favor

- TikTok’s algorithm promotes content favorable to the Chinese [Full Story]

- 2,300 Pounds of Meth Found Hidden in Celery at Georgia Farmers Market

- Celery was used to conceal more than 2,300 pounds (1,043 kilograms) [Full Story]

- Gov. Newsom to Schools: Restrict Cellphone Use

- California Gov. Gavin Newsom sent letters Tuesday to school [Full Story]

- Biden Admin. Calls on Supreme Court to OK Student Loan Plan

- The Biden administration called on the Supreme Court to reinstate the [Full Story]

- Quiz Company Sues Michigan State Over Hitler Pic

- An online quiz company is suing Michigan State University (MSU) after [Full Story]

- Walz Fires Back: Don’t ‘Denigrate’ My Service Record

- Minnesota Gov. Tim Walz, the Democrat presumptive vice-presidential [Full Story]

- More Newsfront

- Finance

- Google Ads From Harris Campaign Rewrite Headlines

- The Harris campaign has been editing news headlines and descriptions within Google search ads that make it seem as if major publishers are on her side in the presidential race, Axios reported on Wednesday…. [Full Story]

- Wall Street Fear Gauge in Record Retreat After Last Week’s Massive Spike

- Ernst: Money Flow to Afghanistan Must Stop

- UAW Launches Pro-Harris Campaign to Rally Workers Across US

- ‘Moderate-Left’ Musk Goes Full MAGA

- More Finance

- Health

- Scientists Predict Diseases by Analyzing Tongue

- A computer algorithm developed by Iraqi and Australian researchers can diagnose diabetes, stroke, anemia, COVID-19, and a wide range of vascular and gastrointestinal issues with remarkable accuracy by observing the color of your tongue…. [Full Story]

- WHO Declares Mpox Outbreaks in Africa Global Health Emergency

- Lilly to Doctors: Stop Selling Copycat Weight-Loss Drugs

- Bout of Shingles May Raise Odds for Cognitive Decline

- Body’s ‘Biomolecular’ Makeup Shifts in 40s and 60s

To see this image below in a larger size, depending on your device,

click the image and follow the prompts. For instance, you may be able

to click the image below, select ‘open image in new tab’ and then click the plus sign to expand the image

into a larger or the largest size.