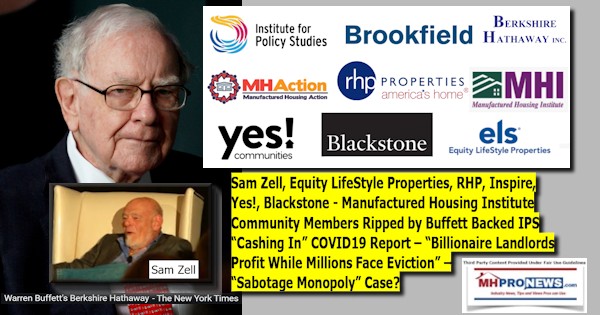

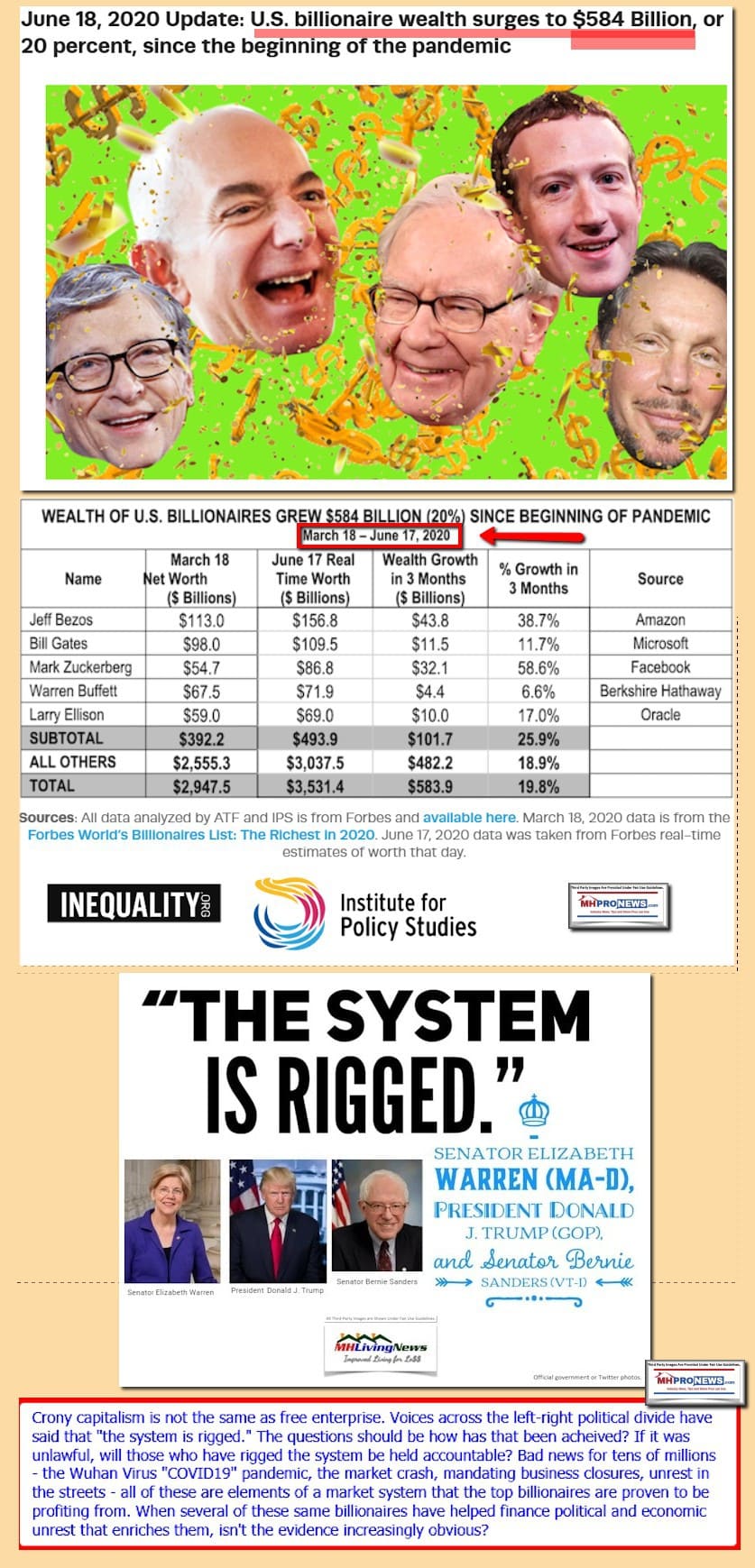

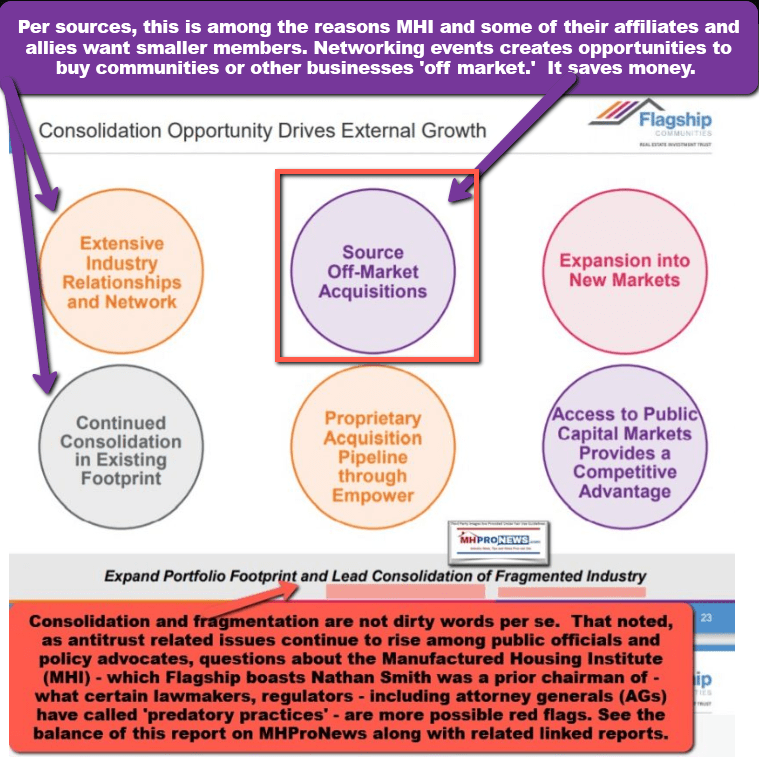

The Warren Buffett ‘dark money’ supported Institute for Policy Studies (IPS) has released a report entitled “Cashing in on Our Homes.” Left-leaning Common Dreams is one of several platforms spotlighting IPS’ “Cashing in on Our Homes” subtitled “Billionaire Landlords Profit While Millions Face Eviction.” IPS ironically – or tactically? – has been the beneficiary of Warren Buffett connected “dark money” funding through the NoVo Foundation, per Influence Watch. The NoVo Foundation is run by Warren’s son Peter Buffett and his wife, as MHProNews has spotlighted previously in a report linked here. Beyond Sam Zell led Equity LifeStyle Properties (ELS), RHP Properties, and Inspire Communities are among the Manufactured Housing Institute/National Communities Council (MHI/NCC) connected firms named by IPS and their fellow researchers. The convoluted maze IPS describes may fit a different but related modernized case of “sabotage monopoly” insights revived by researchers James A. Schmitz Jr., Arilton Teixeira, and Mark L. J. Wright. That and the more recent report for ProMarket by Schmitz and David Fettig on “Monopolies – Silent Spreaders of Poverty and Inequality” linked here once more provides potentially interrelated insights.

IPS’, MHAction, and their allied left-leaning groups involved in the documented slam of several billionaires and their corporate interests include the manufactured home community sector, but also look at other aspects of rental housing too.

“In addition to converting single-family homes to rentals, in the mid-2010s, investors realized they could turn a quick profit by purchasing manufactured home communities (and the land under the trailers) and almost immediately raise the rent charged for the “lot” where people’s homes are located. Some of the richest private equity firms, including Blackstone, have already bought up tens of thousands of manufactured home lots.21” per the IPS report. IPS lists MHAction among the groups involved in the research and report.

As longtime and detail-minded MHLivingNews and MHProNews readers know, Buffett’s dark money support via the Tides bears mention for MHAction’s role in this same IPS report. Multifamily, residential rentals, and manufactured home community owners are all named in the same research. Some of the manufactured home specific statements are as follows.

“Apollo Global Management, an investment firm with $455 billion in assets under management, is also a corporate landlord that owns thousands of rental homes and manufactured housing communities.30 Apollo was founded and is largely owned by three billionaires with a combined wealth of $17.6 billion: Leon Black ($8.6 billion), Josh Harris ($5 billion) and Marc Rowan ($4 billion). Black ranked 55th on Forbes’ richest list — his wealth surged $1.76 billion during the pandemic.31” states the “Cashing In on Our Homes” report.

Cashing In then says, “Apollo is a major purveyor of “contract for deed,” more commonly known as “rent-to-own,” arrangements that prey on aspiring low-income buyers. The firm owns Inspire Communities, which has 47 manufactured housing communities with 13,000 units,32 and has pushed thousands of homes through predatory “contract for deed” arrangements.33”

Deeper into the report, which weaves between the various segments of corporate/billionaire owned rental properties and manufactured home community operators, is this.

“Billionaire Landlord: J. Bruce Flatt ($2.6 billion) Brookfield Asset Management/RHP Properties (67,000 manufactured home units)

The Canadian private equity firm Brookfield Asset Management (Brookfield) first bought a fleet of manufactured home communities across 13 U.S. states for $2 billion in 2016, partnering with RHP Properties’ manufactured home business.80 RHP promotes itself as the “nation’s largest private owner and operator of manufactured home communities.”81 By 2021, RHP had $5 billion in assets, including more than 67,000 manufactured home sites in nearly 270 communities in 28 U.S. states.82 During the pandemic, RHP has continued purchasing manufactured home communities, rolling up 9 communities with 2,200 homes.83 Brookfield’s manufactured housing investments are only a portion of its $88 billion holdings, in multifamily, hotels, retail, warehouses and other real estate.84

RHP has a record of raising rents on its lower-income — often fixed-income — residents and skimping on upkeep. As Jorge De La Cruz, a resident of a manufactured home community in New York shared with members of a housing justice group organizing manufactured housing tenants, MH Action: “After [RHP Properties] took over [in 2017], they’ve been overloading our monthly finances by aggressively increasing rent. Our monthly lot rent now stands at $906 per month [up from $633 per month] and that doesn’t even include any utilities. We are struggling to pay all of our bills now, let alone save money to take an occasional vacation. Their business model is ridiculous… RHP Properties didn’t even bother to get up to speed on the Tenant Protection Act that passed in New York. That Act protected manufactured homeowners like me from having our rent increased more than 3% per year unless that increase was justified. RHP couldn’t justify it, and we forced them to cut back on their proposed increase because we organized. My wife and I talk about how heart-broken we are about paying a predatory corporation so much money for lot rent especially when there is nothing to show for those rent increases. There is nowhere in our community for our children to play safely, nor a community center for seniors to gather.”

During the pandemic, RHP has continued to raise rents. Residents said rents doubled over the past decade at one New York community, with another 4% hike in 2020.85 Rents at one Delaware RHP community rose by $100 from 2018 to 2019, and again during the pandemic.86 In 2020, RHP settled with the residents of a Massachusetts park over improperly hiking rents over five years; RHP made small rent reductions and paid $100,000 to the 350 residents and former residents.87

In addition to rent hikes, residents at several RHP parks have complained about persistent, unaddressed problems.88 A Florida RHP resident had to go to a local TV station to get a tree removed that undermined her home’s foundation, damaged her driveway, partly blocked her back door and was a building code violation — two years after she filed her initial complaint.89 During the pandemic, with heightened sanitation concerns, RHP failed to repair a septic leak that left a pond of sewage in front of her home and backed up into her sink and shower for months before county officials issued a violation and RHP made a partial, temporary fix.90

According to Francine Townsend, a resident of an RHP property in New York and a member of MH Action, “[I] t feels like our corporate owners don’t care at all about the residents who live here… Last Spring, I had problems with my sewage. It was affecting the entire yard. RHP told me it was my responsibility. When the plumber came… he made it clear that it was the corporate owner’s problem. The corporate owners entirely exploited the plumber for his labor. RHP asked him if he could do the job for them. He told them it was an expensive, labor-intensive job… They never paid that man. It was below zero outside, he worked for hours.”

RHP has also continued to pursue evictions despite the economic and health crises. From mid-March 2020 through January 2021, it has filed at least 27 evictions in Sunbelt five states according to data from the Private Equity Stakeholder Project.91

As of the end of September 2020, Brookfield had total revenues of $45.6 billion and paid $650 million in dividends to shareholders.92 They also held $33.5 billion in capital available for investments.93 And one of their companies, Brookfield Property Group, contributed $635,000 to the “No on 21” campaign, which opposed a California rent control initiative aimed at alleviating the state’s housing crisis.94”

Deeper into the IPS “Cashing in on Our Homes” report is this on Blackstone, which owns rental properties as well as manufactured home communities. “Fortune magazine dubbed Blackstone “the world’s biggest corporate landlord” that had “relentlessly expanded its reach in real estate. 121” As longtime and detail minded MHProNews readers know, Blackstone acquired a portfolio of manufactured home communities. It is one of the publicly traded firms listed in our business-nightly stock and markets connected reports.

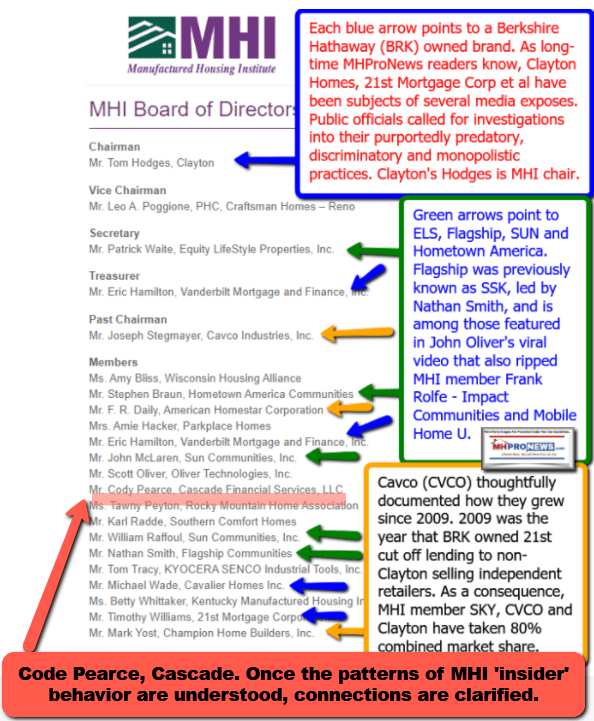

Skipping over non-manufactured home sectors, one then comes in the IPS report to this manufactured housing industry connected firm that has a Manufactured Housing Institute (MHI) Executive Committee board member, Peter Waite, with publicly-traded ELS.

Sam Zell, Equity Group Investments and Equity Lifestyle Properties (ELS)

“Sam Zell is credited as a key architect of the Real Estate Investment Trust (REIT). Zell’s 50-year-old Equity Group Investments empire of REITs generates over $5 billion in annual revenue from about 240,000 residential units.158 Zell has described his aggressive real estate investments as “dancing on the skeletons of other people’s mistakes.”159…The single biggest Zell-chaired REIT, Equity LifeStyle Properties (ELS), is the largest owner of manufactured home communities, with nearly 160,000 units across North America.162”

Sun Communities (SUI) and ELS are at the apex of manufactured home community operators by site count, per the most recent MHI data that was published, per the chart linked below.

“Cashing in“ continues on ELS as follows.

“LifeStyle has a history of ignoring maintenance issues that undermine the safety and wellbeing of its tenants both before and throughout the COVID-19 pandemic. In 2014, a group of mobile home residents in California sued ELS for maintenance failures, citing “improperly maintained sewage, electrical and water systems.”163 After losing the battle to keep the dispute within arbitration, ELS was slapped with a $110 million guilty verdict by

the Santa Clara County Superior Court—only for the ruling to be overturned by a judge later that year.164 California residents again brought ELS to court in 2017, this time successfully, when a judge approved a class action lawsuit due to excessive and fraudulent late fees ELS charged tenants across the state between 2010 and 2017.165

Beth Helmick, a resident of an ELS-owned manufactured home community in Florida shared this with fellow members of MH Action, a group that supports residents of manufactured home communities: “I moved into my home in Buccaneer Estates hoping for an affordable home and loving community where my husband and I could live near my daughter and grandkids and hopefully retire. But we quickly learned that the ELS manager sold us a home that had been destroyed by water and mold damage. Our home made us sick for years and we’ve spent our savings to fix all the damage that ELS had just tried to paper over. On top of that, ELS just keeps raising our rent and fees every year without any justification. Our neighbors are choosing between paying rent and taking their medicine or buying food. That’s outrageous. And after Hurricane Irma, ELS didn’t help residents recover. Instead, they harassed homeowners to repair their homes while people waited for years for help from the government.”

After a slew of legal battles between the company, tenants and municipalities,166 both ELS and ERP implemented 90-day halts on rent increases and evictions early on in the pandemic, from April to June 2020.167 But after June, ELS resumed filing evictions against tenants. According to evictions tracking data from the Private Equity Stakeholder Project, ELS filed evictions against at least one tenant at 14% of its manufactured home communities in Florida (15 of 108) and nearly one-third of the communities in Arizona (8 of 26), as the virus spread rapidly in both states, killing thousands. Equity Group Investments companies have filed at least 50 evictions in Florida, Arizona, Texas, Tennessee and Georgia since the pandemic began.168”

There is more in their full report linked here on Zell and his real estate empire, but skipping over non-manufactured home landlords to MHI award-winner Yes! Communities – which has historic ties to now-Berkshire Hathaway (BRK) owned Clayton Homes – is the following.

Yes! Communities (56,000 manufactured home units)

Yes! Communities is one of the largest owners and operators of manufactured home communities in the U.S. It owns 265 communities in 21 states, including over 56,000 home sites.231 Yes! was developed by private equity groups Stockbridge Capital and BaseCamp Capital. In 2016, the private equity firms cashed out and sold 71% of their stake in Yes! to the Government of Singapore Investment Corporation.232 Government-sponsored agencies Freddie Mac and Fannie Mae smoothed the transaction with $1 billion in debt financing support.233 Stockbridge Capital Group, with $18 billion in assets under management and $399 million in cash on hand, still owns 29%.234

Yes! Communities is a notoriously aggressive eviction filer, using eviction notices as a tool to threaten and harass residents to collect overdue rent as well as fines and fees owed from everchanging community rules. A 2018 Atlanta Journal-Constitution investigation found that Yes! “files eviction notices at nearly twice the average rate [in metro Atlanta … This amounted to about 1,000 filings for its nearly 1,800 units in 2016.”235

During the COVID-19 pandemic, Yes! continued its aggressive eviction practices and has filed at least 71 eviction cases in Arizona, Florida, Oklahoma and Texas.236 Over half of those evictions, 42, were filed after the September 2020 Centers for Disease Control and Prevention order halting evictions for many tenants who had suffered income disruptions during the public health emergency.237”

Warren Buffett is also named in this IPS/MHAction, et al authored report. But Buffett’s interests, per the group, are in connection with other forms of rental property investments.

What Do They Want?

Among the recommendations of the nonprofit groups involved in publishing heavily footnoted 49 pages in their report?

- “Pass a Tenants’ Bill of Rights that includes just cause eviction and rent control…

- Make massive investments in Black and Brown homeownership at levels appropriate to address the scale of the inequity and racist history of U.S. housing policies…”

A report in March 24, 2020 by MHProNews that involved several of these same nonprofit groups was making the case for “universal rent control.”

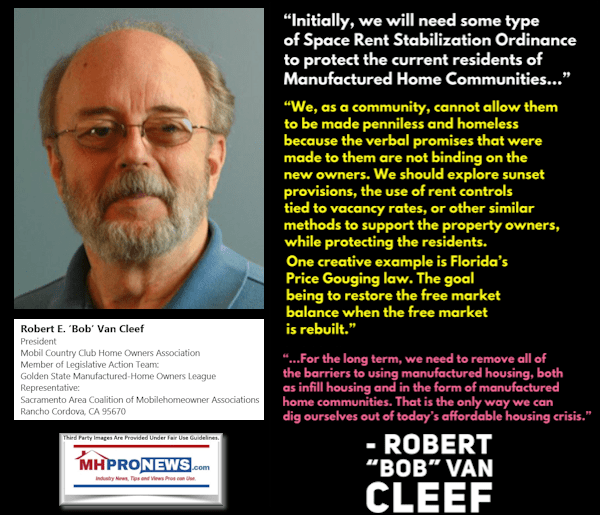

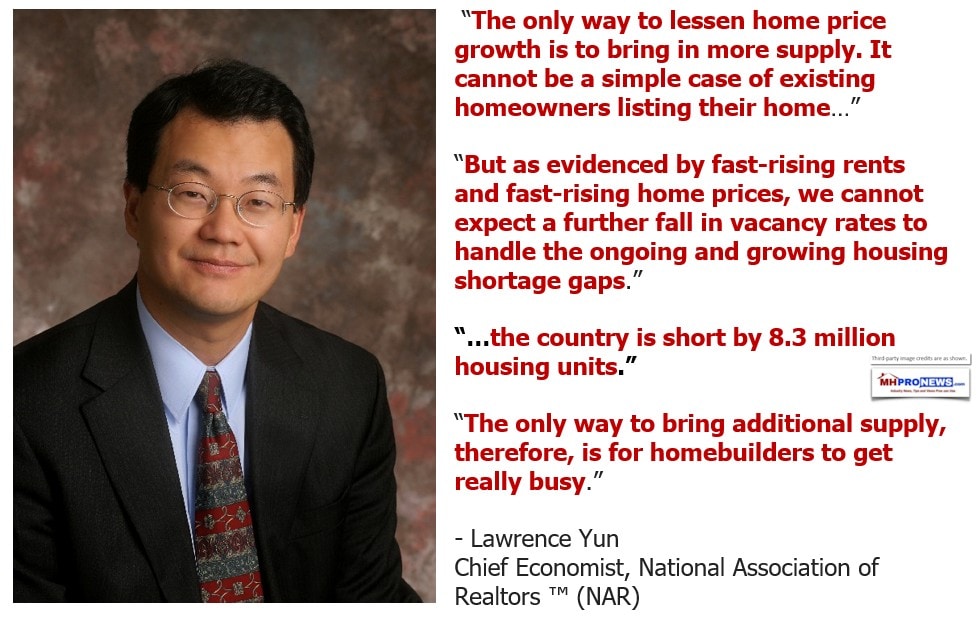

As MHProNews and our MHLivingNews sister site has previously reported several times, rent control alone would never solve the housing crisis. That is a matter of mathematics and economics 101.

RHP and other MHI members have apparently taken aggressive steps that lead to the enactment of rent control, even though it has historically solved nothing in the U.S., or Canada for that matter.

Only more construction and development could accomplish any lessening of upward pressures on housing costs, given the current population levels and related growth. That is per the National Association of Realtors (NAR) chief economist Lawrence Yun, Ph.D.

The left-leaning National Low Income Housing Coalition (NLIHC) has said that some 7 million affordable housing units are needed. As numerous researchers – as well as investors – have observed, that can best be accomplished by building more low-cost units.

Schmitz-Teixeira-Wright Federal Reserve connected research and Schmitz-Fettig related for ProMarkets have each identified manufactured homes as part of the solution. While their points are arguably incomplete, their broad points that builders and HUD itself are part of the problem are significant. See those reports linked above and below.

Put differently, applying the notion of “sabotage monopoly” to the housing/rental crisis yields the troubling specter that these are crises that are being deliberately fueled by consolidators.

To round out the top lines that go beyond manufactured housing, IPS/MHAction et al said the following in their media release. Left-leaning Common Dreams is one of the websites that have spotlighted a recent IPS/MHAction et al report dubbed “Cashing in on Our Homes.”

“INTRODUCTION:

The COVID-19 pandemic has brought to light what we have always known: Our homes are vital to our safety, health, and well-being. But a handful of billionaires and corporate landlords have seen the pandemic as an opportunity to cash in on these hard times.

Instead of more billionaire bailouts, we need to make sure all families can stay safely in our homes. And we must start to rebuild housing systems in this country using innovative strategies that center Black and Brown families and make it clear that our homes are for people, not profit.

While the pandemic has devastated Black and Brown communities, a small handful of wealthy, white billionaire landlords are cashing in to the tune of millions. In this report, produced by Bargaining for the Common Good, the Institute for Policy Studies, and the Americans for Financial Reform Education Fund, we lay out clearly who’s winning, who’s losing, and what to do about it.

KEY FINDINGS:

- There are 61 individual billionaire landlords in America with collective wealth totaling $240.9 billion.

- These billionaire landlords have seen their wealth increase $24.4 billion since mid-March 2020.

- Corporate landlords have a worsening track record of poor maintenance, rising rents and fees, and harassment of tenants and evictions.

- 20 corporate landlord companies are responsible for at least 3,152 evictions across the U.S. during the pandemic.

- Many large landlords received financial support from the coronavirus relief package — sometimes while continuing to file eviction notices against their tenants.

- One in five renters weren’t caught up on their rent as of early February 2021. This represents 5 million Americans. If being behind on rent were a state, it would be the fifth-largest state in America.

- Latinx and Black renters have been the most likely to lose employment income and fall behind on rent — and are now at substantially higher risk of eviction. The 20 corporate landlords in this report:

- Are owned or led almost exclusively by white, male mega-millionaires and billionaires.

- Own or manage almost 2 million units of housing— about 4 percent of all rental housing units in the United States, or more than one in 25 rental units nationwide.

- Have amassed at least $245 billion in “cash on hand”— loans, cash and other funds from investors, banks and financial firms — to purchase homes and companies active in the market.

- Ten of these 20 corporate landlords operate in the state of California, the largest U.S. housing market. We looked at these firms, their cash on hand and political contributions, and the crisis facing renters in California here.

The top 20 billionaire landlords include these well-known billionaires:

- Stephen Schwarzman

- Donald Bren

- Leon Black

- Josh Harris

- Marc Rowan

- Stephen Ross

- Barry Sternlicht

- Sam Zell

- George Marcus

- Bruce Flatt

- Stephen Feinberg

- Mack Pogue”

##

Once more, the full IPS report named Warren Buffett specifically. Given the numerous corporate, nonprofit, and other possible connections, it is entirely possible that there are more funders to this scathing IPS/MHAction et al report from those involved in manufactured housing or the rental housing industry.

To see examples of the documented financial ties between Buffett bucks IPS, MHAction and others, see the reports linked above and below.

Additional MHProNews Analysis and Commentary in Brief

There is a value to these IPS/MHAction reports. But the true agenda behind these reports should be understood. It is only common sense to realize that Warren Buffett, George Soros, and billionaires like them that provide funding for these leftist nonprofits are not literally attacking themselves. Several notions/points merit consideration.

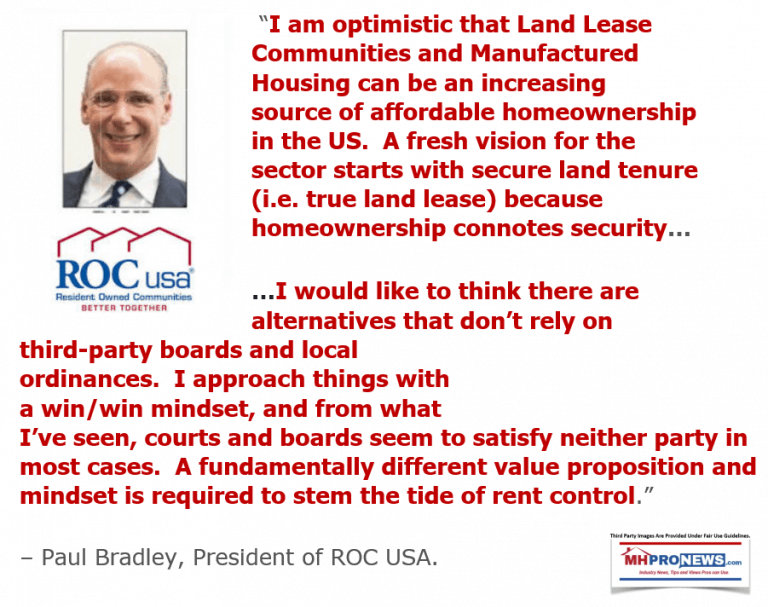

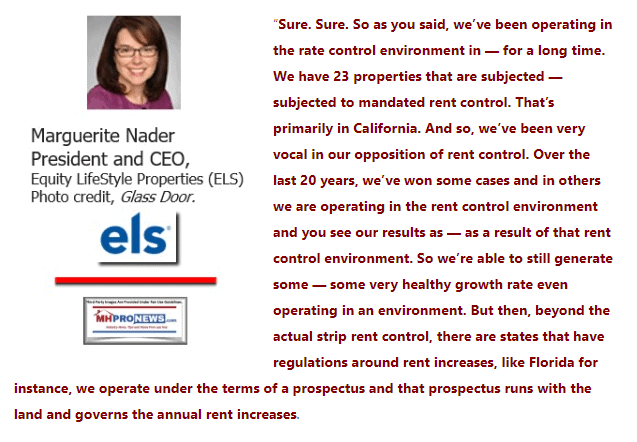

1) MHAction, IPS, et al are a kind of mirror of MHI in this sense. Just as MHI arguably postures doing good for manufactured housing independents, MHAction, IPS, others are posturing doing good for residents of manufactured home communities and renters that are the focus of this new report. Rent control has not solved the problems they claimed once enacted, as reports like the one linked below revealed. Who makes that point plain? Marguerite Nader, President and CEO of ELS and RHP, among others. So too have community residents. Residents and independents are being harmed. But the obvious winners are the giant corporations that continue to consolidate.

2) As Schmitz-Teixeira-Wright in 2018 and Schmitz-Fettig observed in 2020, millions of more units of HUD Code manufactured housing could be/are an important part of the solution to much of the affordable housing crisis. Unfortunately, that option has been neutered. They argued that HUD and builders were part of that problem.

3) There have been numerous voices from among residents, but also among manufactured housing ‘white hat’ professionals that have shed light on the authentic solution necessary. That must include a far more robust implementation of existing laws which have been thwarted in a fashion that harms independents, residents, and prospective buyers alike.

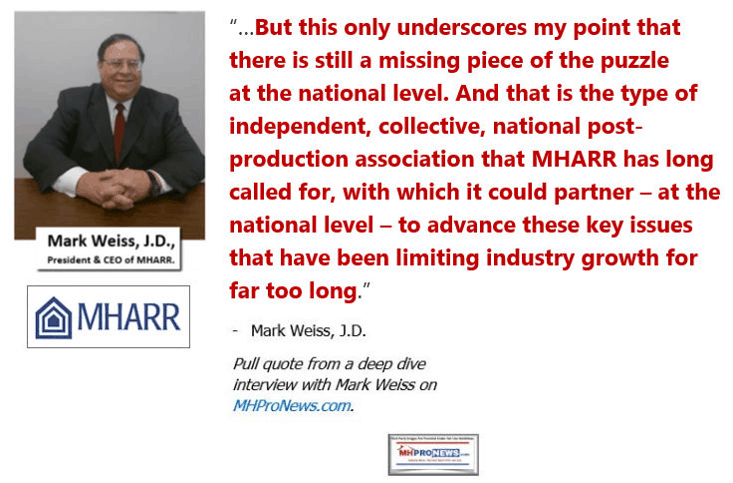

The Manufactured Housing Association for Regulatory Reform (MHARR) has argued for years that the solution is to make sure existing laws are more robustly enforced.

MHI on paper says similarly. But when the patterns are closely examined, MHI are routinely going around the problem rather than taking the direct route of solutions based on a rigorous and robust enforcement of existing law.

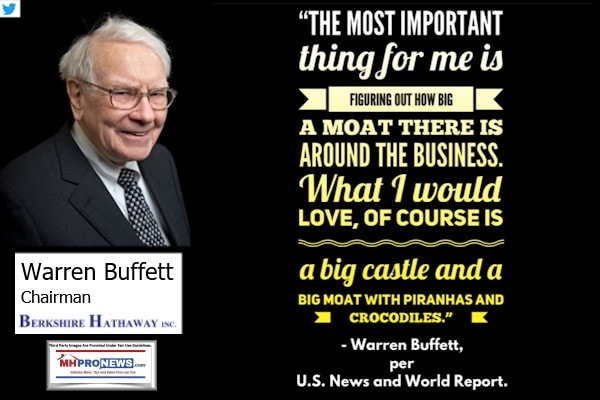

Prominent MHI member Frank Rolfe has bluntly said that there should be no more new manufactured home communities built. Doing that would only increase the pressure cooker that is building. Additionally, Rolfe boldly stated that their version of the “moat” is flatly about having a local or other monopoly.

For those who may recall the MHI so-called Code of Ethical Conduct, which arguably window dressing that has been ignored once again in favor of their ‘big boy’ members in this latest negative news outrage, it seems that means as much to them as their antitrust guidelines and their honesty in their IRS Form 990 statements under oath.

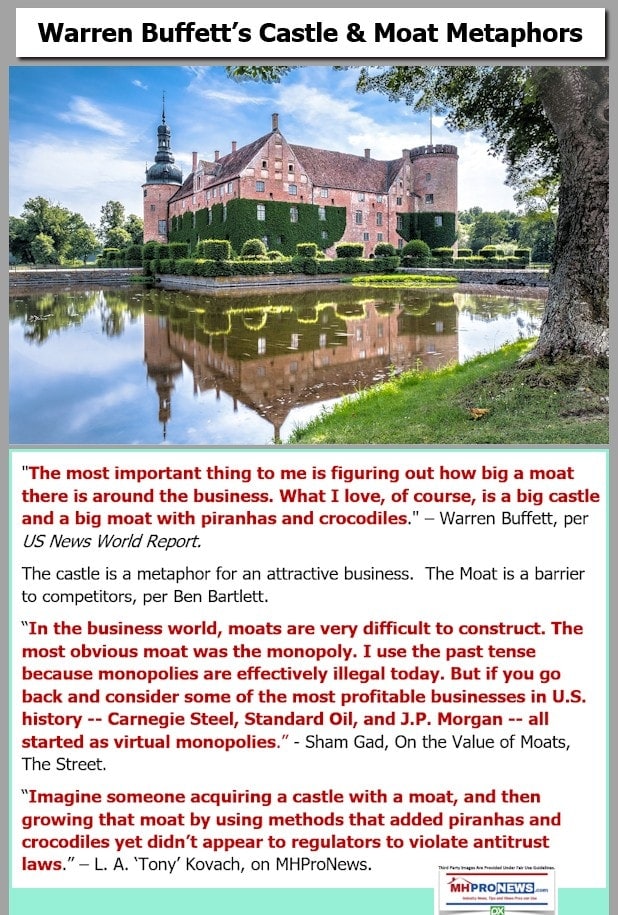

The Schmitz and his colleagues’ insights on the historic nature of “sabotage monopolies” are arguably at work in our manufactured home profession, but in others too.

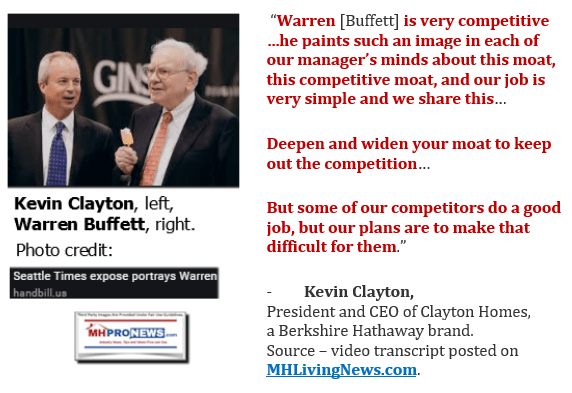

Much of this gets back to the deployment of Buffettesque castle and moat methods. Bad news is arguably part of the moat.

For those who do not know that Buffett – and others like him – are on both sides of such issues, bringing those financial ties up may make no sense…at first. But once the castle and moat methods are understood, once the harm caused to white hat brands is grasped, and once the impact of new regulations which bigger businesses can navigate better than smaller ones, the sinister motivations come into sharper focus.

To learn more, see the related reports. For possible action steps by white hats, see the report linked below.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.