A year has come and gone since analyst Greg Palm for Craig-Hallum Capital Group LLC pointedly asked Cavco’s William “Bill” Boor ‘Why is manufactured home industry production so weak?’ As part of the presentation and discussion below for their most recent quarterly results earnings call on 5.24.2024, Cavco’s Boor said: “Community orders are still lagging. Every community has its own story. So, improvement will happen over a period of time.” Also per Boor: “The order strength we’ve seen thus far has primarily come from retail dealers.” Perhaps in response to concerns raised by MHProNews due to a report based on OSHA findings, Boor stressed their claim that safety is ‘improving’ at Cavco, with details to follow below. Boor also stated that they are growing the number of company-owned or captive retail centers – again, more details follow in Part I below.

Also, perhaps due to reporting by MHProNews about numbers of unhappy employees at Cavco (and several other Manufactured Housing Institute (MHI) member brands), Boor addressed efforts to improve employee satisfaction and retention.

Boor also boasted about well north of $100 million dollars in stock buybacks. More on that will be part of our analysis in Part II, following their earnings call via Yahoo Finance and Thompson Reuters.

Note that some typos have been corrected in their transcript, like Kentucky Dream Homes (i.e.: the original text had small d and h = dream homes), lost vs. last production days (i.e.: Boor to Palm: “heavily influenced by the lost production days that”), plant vs. plan, and highlighting has been added by MHProNews. Our editorial recommendation is to read all of their remarks, as the added highlighting should not be construed as covering every item deemed in our analysis to be of importance. While it may not always seem like exciting reading, this may be one of the more wide-ranging arrays of topics discussed by Cavco during their quarterly earnings call in some time. Regular and detail-minded MHProNews readers should note not only what is said, but significant items that have gone unstated or are downplayed – more on that in Part II.

As today (5.27.2024) falls on Memorial Day 2024, Part III of this report will have a Memorial Day focus which is not directly related to Cavco Industries. Some may call it a patriots plus historic segment.

Part I

Q4 2024 Cavco Industries Inc Earnings Call

Thomson Reuters StreetEvents

Sat, May 25, 2024, 7:06 AM EDT

Participants

Mark Fusler; Investor Relations; Cavco Industries Inc

William Boor; President, Chief Executive Officer, Director; Cavco Industries Inc

Allison Aden; Chief Financial Officer, Executive Vice President, Treasurer; Cavco Industries Inc

Paul Bigbee; Chief Accounting Officer; Cavco Industries Inc

Greg Palm; Analyst; Craig-Hallum Capital Group LLC

Jay McCanless; Analyst; Wedbush Securities Inc.

Daniel Moore; Analyst; CJS Securities, Inc.

Michael Chapman; Analyst; Aviance Capital Partners LLC

Presentation

Operator

Good day, and thank you for standing by. Welcome to the fourth quarter fiscal year 2024 Cavco Industries Earnings Call. (Operator Instructions) Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker today, Mark Fusler, Corporate Controller, and Investor Relations. Please go ahead.

Mark Fusler

Good day and thank you for joining us for Cavco Industries fourth quarter and fiscal year 2024 earnings conference call. During this call, you’ll be hearing from Bill Boor, President and Chief Executive Officer; Allison Aden, Executive Vice President and Chief Financial Officer and Paul Bigbee, Chief Accounting Officer.

Before we begin, we’d like to remind you that comments made during this conference call by management may contain forward looking statements, including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions.

All forward-looking statements involve risks and uncertainties which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in a forward-looking statements made by or on behalf of Cavco.

Encourage you to review Cavco’s filings with the Securities and Exchange Commission, including without limitation, the company’s most recent Forms 10-K and 10-Q, which identify specific factors that may cause actual results or events to differ materially from those described in any forward-looking statements.

In this conference call also contains time-sensitive information, that is accurate only as of the date of this live broadcast Friday, May 24, 2024. Cavco undertakes no obligation to revise or update any forward-looking statement, whether written or oral to reflect events or circumstances after the date of this conference call, except as required by law.

Now I’d like to turn the call over to Bill Boor, President, and Chief Executive Officer. Bill?

William Boor

Thanks, Mark. Welcome and thank you for joining us today to review our fourth quarter results. The fourth quarter was the transition quarter we were looking for. Coming out of the holidays, we had a number of plants on four day schedules, four day a week production schedules and several took extended holiday shutdowns in January due to low backlogs at the time. Those initial lost production days the beginning of the quarter drove our essentially flat sequential wholesale shipments.

During the quarter, though order rates strengthened and almost all of our plants have now worked their way back to five day schedules and begun increasing their daily production rates. We saw the first quarter to quarter backlog increase since the downturn began, which is what we are looking for to indicate that buyers are continuing to return to the market.

We had hoped this would be facilitated by declining mortgage rates. But as you know, that didn’t happen. Still, buyers are returning because they need homes, they’re adjusting to the higher rates and they’re adjusting their expectations around the home they can afford.

On a same plant basis, orders continued their sequential improvement for the sixth straight quarter. It hasn’t been dramatic, but it has been consistently improving despite the lack of rate relief noted earlier.

Within the context of what I’ve said here, our capacity utilization for the quarter was consistent with the last few at approximately 60%. However, given the downtime earlier in the quarter, the takeaway is that we left the quarter at a higher utilization and we started.

Regarding the backlog improvement, we ended the quarter with $191 million, up from $160 million in Q3. Pricing in the backlog was basically flat. So this represents a unit backlog improvement of roughly 20%.

At quarter end, we had about seven to eight weeks in the backlog. Despite a small reduction in average selling price, we were able to maintain gross margin in the housing segment at 22.4%, which was flat compared to the same to the gross margin last quarter.

I know there’s continuing interest in understanding the status of community orders. We’ve discussed this for several quarters. Having said that, we expect it to take a few quarters into calendar 2024 to really see meaningful improvement.

Community orders are still lagging. Every community has its own story. So improvement will happen over a period of time. Our expectation remains that community orders will improve this calendar year as inventory levels come down. The order strength we’ve seen thus far has primarily come from retail dealers. So the order boost from communities is still ahead.

Commenting on the fiscal year, our teams across operations, including retail and financial services really showed their ability to react quickly and effectively to market dynamics. Despite the slowdown, we’ve maintained healthy margins, profitability, and cash flows.

Now as we increase schedules, our operators are ramping production rates in an effort to keep backlogs and check. This is the nature of the industry and the ability to adapt quickly as being shown throughout our operations.

I want to take a few minutes to comment on the year we just completed and some of the really important accomplishments. Our stated objective as the market got hit with rapid interest rate increases was not only to effectively manage the cycle, but to stay focused on our priorities. So we would come out of the down cycle stronger and even more prepared to supply homes to deserving families.

First and foremost — first and foremost, our plants continued an impressive improvement in our safety results this fiscal year. This fiscal year, our total recordable injury rate was reduced 37%, which continues a multiyear trend of significant improvement in calendar 2023. We experienced a 35% lower incident rate compared to the industry benchmark.

We also grew our retail footprint by adding 15 stores in the fiscal year after growing 19 stores in fiscal year ’23. This growth is in support of our planned distribution needs, and our current system stands at 79 retail locations. We announced the first nationally available HUD approved line of duplex homes. Interest in our Anthem series has exceeded expectations, and we anticipate orders for this new answer to the affordable housing crisis to grow in the coming quarters.

We also continued development and rollout of our digital marketing platform across our family of brands with very strong contacts and lead generation. We completed the integration of the Solitaire acquisition, which closed in late fiscal year ’23. This included efforts to optimize product offerings across the combined retail system as well as refreshing the Solitaire product offering.

The full impact of this acquisition will show in the improving markets. We advanced our people strategy with continued improvements in leadership and development, pay and benefits, career processes and workplace improvements. This work is resulting in higher skills, reduce turnover and improve job satisfaction, and it creates the foundation for our long-term success.

A critically important part of that people strategy is training and development. After a standing started only a few years ago, Cavco was recognized this past year as one of the top training organizations in the world through the training magazine’s Apex award.

We purchased a $110 million of our stock while maintaining a very strong balance sheet capable of supporting our continued growth investment. With all these improvements, steady increases in orders and a return to normal community orders still ahead of us, we’re looking forward to producing more quality, affordable homes in the quarters and years ahead.

With that, I’d like to turn it over to Allison to discuss the financial results in more detail.

Allison Aden

Thank you, Bill. Net revenues for the fourth fiscal quarter of 2024 was $420.1 million, down $56.3 million or 11.8% compared to $476.4 million during the prior year period. Sequentially, net revenues decreased $26.7 million, driven by a reduction in both units sold and to a lesser extent, average selling prices, partially offset by higher revenues in financial services.

Within the factory-built housing segment, fourth quarter revenue was $398.5 million, down $57.6 million or 12.6% from $456.1 million in the prior year quarter. The decrease was primarily due to a reduction in homes sold.

Sequentially for the factory-built housing segment, net revenues compared to the prior quarter was down 28.4 million or 6.7% from $426.9 million. The decrease was due to a reduction in homes sold and lower average selling price per home.

Factory utilization for Q4, 2024 was approximately 60% when considering all available days for reduction, but with nearly 70% excluding scheduled downtime for local market conditions. This utilization level was consistent with the past four quarters.

For the financial services segment, net revenue increased 6.4% to $21.6 million in Q4 of 2024 from $20.3 million in the prior year period. This increase was primarily due to more insurance policies in force and higher insurance premiums as recent rate increases become realized, partially offset by fewer loan sales.

Consolidated gross profit in the fourth fiscal quarter as a percentage of net revenue was 23.6%, down the 170 basis points from 25.3% in the same period last year. In the factory build housing segment, the gross profit declined 200 basis points to 22.4% in Q4 of 2024 versus 24.4% in Q4 of 2023, driven by lower average selling prices and volume, partially offset by lower input costs.

Gross profit as a percentage of revenue in financial services decreased slightly to 45% in Q4 of 2024 from 45.7% in Q4 of 2023. Selling, general and administrative expenses in the fourth quarter of fiscal 2024 with $61.4 million or 14.6% of net revenue, compared to $66.4 million or 13.9% of net revenue during the same quarter last year.

The decrease in SG&A expense was due to costs in the prior year that did not recur in 2024, including costs for third party tax consultants, Solitaire acquisition costs, lower cost of the litigation between indemnified former officer and the SEC and lower compensation on reduced earnings.

Speaking at the SEC litigation with the former officer, in May of 2024, the SEC settled all outstanding claims against our former CFO, closing of pending matters. Interest income for the fourth quarter was $5.3 million, up 35.6% from the prior year quarter. Increase over the prior year, primarily due to higher interest rates on larger cash balances.

Pretax profit was 26.7% this quarter to $42.9 million from $58.6 million for the prior year period. The effective income tax rate was 21% for the fourth fiscal quarter compared to 19.1% in the same period last year.

Net income to Cavco stockholders was $33.9 million compared to net income of $47.3 million in the same quarter of the prior year. Diluted earnings per share this quarter was $4.3 versus $5.39 per share in last year’s fourth quarter. Now I’ll turn it over to Paul to discuss the balance sheet.

Paul Bigbee

Thank you, Allison. Comparing the March 30, 2024, balance sheet, April 1, 2023, the cash balance was $352.7 million, up $81.3 million or 30% from $271.4 million at the end of the prior fiscal year. The increase is primarily due to net income adjusted for noncash items such as depreciation, stock compensation expense and gain on sale of loans and investments of $11 million.

Working capital adjustments, providing approximately $55.7 million of cash related to inventory and account receivable decreases and consumer and commercial loan activity with payments received in the sale of loans greater than the use of cash for originated loans. These increases were partially offset by paydowns in accounts payable and accrued liabilities. The acquisition of Kentucky Dream Homes for $17.9 million.

Net PP&E purchases of $17.4 million and share repurchases of $109.3 million. Restricted cash and the related other current liability increase from cash collected on service loans in our Financial Services segment.

Prepaid and other assets was lower due to reduction in delinquent Ginnie Mae loans, partially offset by higher prepaid insurance. The remaining change is due to normal amortization of prepaids.

Property plant and equipment is down primarily due to current year purchases more than offset by depreciation and the sale of unutilized equipment acquired with solid share. Accrued expenses and other current liabilities are down from lower accrued bonuses, customer deposits and as mentioned above, for reduction in delinquent Ginnie Mae loans.

Lastly, stockholders’ equity exceeded $1 billion, up $57.1 million from $976.3 million as of April 1, 2023.

And with that, I’ll turn it back to Bill.

William Boor

Thank you, Paul. Again, let the moment pass without a comment about the SEC situation and closure of that issue. As Allison mentioned, our former CFO and the SEC reached a settlement that was recently made public. I’ve been here since the start of this situation initially as an independent director and then in my current role. I’m very proud that this company has continued to operate with excellence and grow in many important ways during this time.

I can’t count how many times I’ve told investors how much I look forward to the day when I can report that this issue is behind us and today is that day. For those investors who have stuck with us throughout on behalf of everyone at Cavco, thank you very much for your continued confidence in us. With that, Marvin, please go ahead and open the line for questions.

Question and Answer Session

Operator

Thank you. At this time we’ll conduct a question and answer session. (Operator Instructions)

Greg Palm, Craig-Hallum.

Greg Palm

Yeah, hi, everyone. Thanks for taking the questions. I wanted to start with a little bit of color on what you’re seeing in the community channel, correct me if I’m wrong made it sound like it was sort of much change in expectations there. But curious if you can just comment on visibility levels and relative to last quarter, maybe we’ll start there.

William Boor

Yes. Thanks, Greg. It’s — It is kind of more of the same on that even over the last several quarters, we kind of hate to speculate here as you know, but we were still working kind of well into calendar 2024 before we thought that we’d really start seeing community orders ramp up significantly. And so we’re still not to that point and it’s kind of been more of the same.

I think they’re working through it. Even though the orders aren’t here yet, I’m confident in my discussions that inventories are coming down. And so we still feel the same as we have for a while that we should see improvement this calendar year.

Greg Palm

Yeah, makes sense. And I know you’re cognizant of you don’t provide any guidance, but you at least gave a little bit of color around production rates where it was, where it is today? Should we at least — is there any sort of sense on, an increase in production rates, for instance, this quarter versus last?

William Boor

Yeah. Tried to characterize this quarter as we see it, which is this past quarter, which is that it’s been one of transition. In our shipment numbers were really heavily influenced by the lost production days that I mentioned at the beginning of the quarter. And as I said in my comments, we talk about a utilization of 60%. But if you think about that lost time at the beginning that means we finished the quarter at a higher pace.

So we’re starting to, as I indicated, schedules are getting back. It’s not only schedules, but it’s also run rates that the plants are managing, trying to ramp back up and stay kind of in line with market demand. So that in some cases, through the backlogs don’t actually get away from us. So I think we’re clearly in a better position now. Then we were at the beginning of the calendar year and then we were for most all last year.

We’ve seen that steady improvement in wholesale orders. And I do think I’m repeating myself here a little bit, but I do think that’s noteworthy given that we haven’t really seen interest rate relief. So if you have a view that interest rates have some potential for going down a little bit in the coming quarters and if you agree with our view that community orders are a bit of a tailwind, then, I think, we’re heading to some better times in notwithstanding some significant economic shock.

Greg Palm

Yeah, makes sense. Couple of for Allison. First on SG&A, it was down a little bit sequentially. Was that mostly just on lower revenue and the variable portion? And I guess more importantly, how do you sort of feel about SG&A going forward in terms of an absolute level?

Allison Aden

Yeah. As I mentioned in the call, when you compare it to the prior year, obviously were down for the nonrecurring costs and quarter to quarter, you saw the reduction that we have no SEC related indemnify costs of former officers.

I think that as we look at cost now and as we go forward, we’ve talked about [CS and J] SG&A, the high variable cost component to that. So we’re looking at a pretty steady state right now. And of course, as the top line grows, we’ll see our variable compensation flowed through SG&A. So still stays up pretty consistent to the level of top line and so high component that’s variable.

Greg Palm

Okay. And then my last one was just more of a clarification, was there any purchase accounting impact on gross margin associated with the Solitaire acquisition in this past quarter? We passed that at this point.

Allison Aden

I’d say largely we’re past and it is a small amount.

William Boor

We are still selling that that inventory off, but it’s pretty insignificant at this point, Greg.

Greg Palm

Perfect. I will leave it there. Thanks.

William Boor

Thank you.

Operator

(Operator Instructions) Jay McCanless, Wedbush.

Jay McCanless

Hey, good morning, everyone. So the first question I had was shipments being down 12% in the quarter versus the industry being up nearly 15%. Can you talk about what’s going on there and what the plan is to maybe catch, but then be back in line with the industry over the next couple of quarters.

William Boor

Yeah, Jay, I think this is a really important question because I think there’s noise in what people kind of see at a headline level. The first point I want to make is that if you really dissect the industry shipments and you can do this with the publicly available head shipment data, if you really dissect it and look at it on a regional basis, even though the industry was up.

I think I’m talking year-over-year for this discussion, even though the industry was up 15%, I think it was 14.7 Mark? when you look at it regionally, the range of increases and decreases is more than you might expect. And just to give you a feel, the South Central, which includes Tennessee, Alabama, Kentucky, Mississippi, just looking at the numbers here, that was up 50%.

You contrast that to an area like East North Central, Illinois, Michigan, Ohio, which was down 31%. So I’m belaboring the point. But if you dissect that, you really have to look at how any given manufacturer lines up with their exposure to those regions to get a clear picture of whether the food stayed with market or not?

Now setting that aside to really understand the answer your question, the other thing I’d say and I’m again, working year-over-year numbers, you need to look at both shipments and backlog changes. And when you do you really get a clear picture of what underlying demand and a more normalized view of share is.

So let’s talk about last year, let’s remember where we were in the industry last year. The context behind our shipments than we shipped this roughly 4,500 units. And during the quarter, our backlog dropped to [$180 million]. So if you remember, we are kind of in a really declining backlog environment.

So roughly 40% of our volume that quarter represented backlog depletion. Now this quarter was the opposite. We shipped about 3,900, a little over 3,900 units that our backlog grew $30 million. So we shipped below the new order level. Why? Because, again, at the beginning, we lost days due to lack of backlog in certain plants.

So I’m not — I mean, that explains our year-over-year comparison in the context of Andrew line demand. It’s clearly stronger now that the remaining question is why didn’t the overall HUD market showed the same trends, right?

We don’t have visibility into industry backlogs. But, just on if you just divided our shipments last year by HUD shipments, it would have suggested a 21% market share. Frankly, that’s higher than our share of capacity is higher than our market share over time. So the only thing that I can conclude from that is that while we were had at the backlog and we’re still shipping at a relatively high rate and depleting that backlog, others in the industry presumably didn’t have the same backlog. They had kind of already hit a point where they had to start pulling back.

So we are the industry in that period of time. So I hope this isn’t too lengthy. I’m trying to think it’s a really critical thing because I think it would be easy to misunderstand the shipment comparison. So at some point when you looked at both shipment and backlog changes, you really get a more normalized view of underlying market share and underlying demand. And despite the shipment numbers, our underlying demand is significantly greater now than it was a year ago.

So now that plant’s going forward, this was a quarter with some transition and I’m going to keep saying it because again, you had a company like us that had to take some downtime at the beginning, but then was getting back to higher schedules at the end.

So once the industry kind of reestablishes a workable backlog, you’re going to see the dynamics settle out and you’re going to see people reflecting more consistent. You want to call it market share type ratios.

So I hope that wasn’t too much and I’m happy to answer questions, but I really — but now at face value of people look at the year-over-year on shipment numbers, I know that, in my opinion, you could really get off track just looking at those headlines. So yeah, through a lot at you, come back. I mean, your questions, if any that didn’t make sense.

Jay McCanless

No, it makes sense. I guess the next one I had, if you look at if you look at the rapid rise in the number of retail stores, is there anything we need to be cognizant of from a GAAP accounting perspective, in terms of those internal sales versus external sales, maybe some of those shipments are getting not hung up but maybe not recognized yet until those are sold at retail?

William Boor

There was a little bit of that and I could have added that to my long complicated explanation. But I kind of felt like that was a little bit of a fringe issue for us. We certainly are more integrated. If you just look at retail sales compared to our wholesale shipments, so it does create some changes, like you mentioned there kind of moment in time, changes in the overtime will work themselves through.

And of course, it also changes, things like your average selling price, which, as you know, is a combination of retail and wholesale price for us. But I think you’re right, I’d just say it was a kind of a main event that we would have highlighted.

Jay McCanless

Okay. It’s good, it’s good to hear. Thank you. And then I guess with the rise that we saw in mortgage rates in April, and then a little bit of pull back in May, I guess would it be safe to say that demand? And I think based on the way you answered some of the other questions, this is the case, but has the demand that you saw exiting 4Q continued into 1Q ’25?

William Boor

Yeah. We are definitely. If you take that snapshot in time at the end of the quarter transitioning into our first fiscal quarter, there was definitely, definitely, yeah. And I think that’s — I’m apologize for repeating myself. I just think that’s noteworthy because we didn’t get the rate improvement, right?

In fact, and it’s splitting hairs because it was pretty mild. But rates ended the quarter, the fourth fiscal quarter, a little bit higher than they entered it. So they have that kind of demand come through being a part of its spring selling season, but they have that kind of underlying demand come through without a boost in interest rate improvement. I think is really noteworthy.

Jay McCanless

Yeah, that is — and then when I think about inputs to gross margin, sounds like you’re going to get a little bit of boost from potentially increased volume. But what about some of the other inputs, labor, OSB, some of those? I know there were some noise around OSB earlier in the year. So any color, commentary you can give us on gross margin and directionally how you’re feeling about that as we move into the next quarter?

Allison Aden

So I mean, essentially, we’ve seen lumber and OSB somewhat level off, but we continue to stay obviously close to that component of our gross margin as we move forward. But there’s just a little bit of volatility. So there’s a little hard to predict.

Jay McCanless

Okay. And the next question I had just maybe could you talk about where chattel rates are now and maybe versus last year at this time?

Paul Bigbee

Yeah, sure, Jay. So right now, they’re about still at that low 9% range. So kind of a range of 9% to 9.4%. And then kind of if we look at kind of towards last year, it looks like they were in the high 8% range.

Jay McCanless

Okay, great. That is all I have for now. I’ll get back in queue. Thank you.

William Boor

Thanks, Jay.

Operator

Daniel Moore, CJS Securities.

Daniel Moore

Thank you. Thanks for taking the questions. Obviously, you covered a lot of them. I guess first off, maybe just talk about ASPs. Are you seeing the sort of trade down to lower priced, maybe lower optioned homes continue and what it was your expectations for the direction of ASPs versus what we saw in Q4 for the next couple of quarters?

William Boor

Yeah, It’s been kind of almost surprisingly consistent story over the last couple of months or last couple of quarters via. I always first think about the same house selling out in the market. And across the entire landscape, I’d say we continue to see really pretty minor leakage of pricing and I’m always trying to put a context because it is — it has been through our fourth quarter kind of just a very slow reduction and still at a pretty high level.

But as far as trade down, I think we just we definitely have seen on the mix shift to singles, which we kind of looked at and say, well, some of that’s probably people trading down. I mentioned in my comments that I think buyers are coming to terms with the home they can afford.

That doesn’t mean for everyone that you’ve got to go from a multi-section to a single section might just mean a reduction in options or different floor plan. But the trend towards single, I think, and it’s not been dramatic if that trend kind of indicates what you’re mentioning and that people are kind of moving down. We always talk about this a couple of different parts of the market at the intersection with a lower price. They’re not low price but a lower price site-built home.

We absolutely — you’ve heard us say it before, we absolutely know because of our own retail and our connection to our independent retailers. We know there are people that are considering and then many are buying higher priced manufactured homes rather than their site build options at this point. But yeah, they’re moving down a little bit even within the manufactured housing scope. I think that’s all how have they been adjusting to interest rates and the impact on the monthly costs.

Daniel Moore

Okay. And I appreciate the color on the community — community developers and kind of where we are in the expectation that some of its uptick later in the year. But aside, that is a static group. Maybe just talk about dialogues conversations efforts you’re having at expanding or increasing penetration to that obviously large category, even if orders are still quiet at the moment.

William Boor

Yeah. Now you don’t stop your efforts to stay close to those folks. And I think we, as a company see an opportunity really to continue to deepen relationships there and get frankly, get more business out of that group. It’s really tightly connected to something we changed a couple of years ago in our company.

We had previously had all of our plants with their own sales teams, which we still have and they are the ones closest to the — where the rubber hits the road. But then we added a national sales team and manufacturing and a component of the national sales team was a group that we’re still continuing to build out focused on communities.

And when I talk about communities, I’ve said this before when we say communities historically, we’ve always included builder developers and land lease community operators kind of in that whole category.

So we’ve definitely upped our game as far as approaching that segment. And not only do we look forward to that segment coming back to the market. But we’re looking forward to penetrating a little bit better ourselves.

Daniel Moore

And then you touched on this build prepared remarks, but as orders have improved, would you prefer to lead back — backlogs continue to build as we look out into fiscal [Q4], we expect to ramp production in line with order rates from what we saw exiting the quarter?

William Boor

Yeah, our members, I haven’t heard this discussion too much in the last little bit. But our members in years gone by the questions always revolved around what would be the ideal back backlog. And my answer was always if you could lock one and it wouldn’t change, you’d want it to be probably around six weeks. As you kind of plan your production a gives you a quick delivery for the customer, which is an advantage of factory-built housing.

Now we’re actually touch above that and it’s increasing. But really instead of thinking about it as an entire system to answer your question more directly, each one of our plants is in a little bit different situation. We have some that I think they really got to work hard to keep the backlogs from getting away from meaning getting too long.

And we’ve got others that are under that seven week to eight week range that are still open to build up to a more comfortable level. So it’s –we got — it’s the theme today is transition, right? We’ve kind of got the gamut as far as on plants that are in a little bit different position, but they’re all, generally, they’re all seeing the opportunity to increase production.

We definitely if we can help that, we want to deliver homes. We don’t want to see backlogs. So anywhere near what we’ve seen in the past couple of years and seven weeks to eight weeks on average is a pretty nice spot.

Daniel Moore

Great. I’m going to ask one or two more quickly that you kind of asked, but I’m not sure what the if I have perfect clarity on the answer. So forgive me, but traffic and order rates at retail, how are they trending thus far in April and May? Have they picked up from where you left — left off at the end of fiscal Q1, given we’re into a little bit seasonally stronger period?

William Boor

Yeah, I think you did pick up my comments, so even kind of tried to shy away from giving too much update in quarter, but there was a trajectory in the fourth quarter rate and that trajectory is nothing changed that trajectory. It is — it would turn on an upward path. And I’ve kind of commented even through the downturn that traffic in retail has been pretty encouraging.

People didn’t stop coming to retail stores. They were just puzzling over how to make the purchase happen. And one of the things we’ve certainly noticed recently is that even though traffic is already at a healthy rate and an improving for getting a higher conversion rate, and that’s really what’s changed is the conversion rate more than a huge uptick in the number of people they’re visiting or calling. It’s been a — there’s been a positive trend.

Daniel Moore

Okay, really helpful. And then last for me is you touched on the components of gross margin with utilization certainly improving as we exit the quarter and that trajectory. Is there any reason gross margins wouldn’t be up a little bit, is it sort of a bottom for the near term? Some are we just kind of staying away from that? Thanks again, I appreciate it.

Allison Aden

Yeah, I mean, I would say that isn’t talked about before on the gross margins is very hard to predict. And we did. You’re right in that despite a small reduction that we had in the history this quarter, we were able to maintain the gross margin for the housing segment at 22.4%.

So instead of — we continue to stay close to the price and pressure on price. And we continue to stay focused on watching the commodity pricing and really managing our variable costs. So you see a lot of consistency in both the utilizations in the AST and in our ability to keep our costs on a variable cost structure. And that’s resulted in fairly consistent margins over the last three quarters.

Daniel Moore

Okay. Thanks again, appreciate the color and congrats on putting the investigation to final fully to bed — a long road and the efforts are appreciated and as is the transparency. Thank you again.

William Boor

Thanks for that, Dan.

Operator

Michael Chapman, Aviance Capital Partners.

Michael Chapman

Thanks. I guess everybody’s kind of focused on the shorter term. I guess kind of a question more about kind of the longer-term corporate strategy around retail and kind of captive finance. You mentioned conversion rates going up and that’s helping. And I would assume internally conversion rates are something that you would like to see increase.

Obviously, you mention of buydowns of interest rates that help that. When you’re thinking out three years to five years, is the retail build out, what helps you get closer to the customer and increase conversion rates? And is there a need to have a bigger captive finance component so that you can — you can be even higher more adept at converting the customers at the end. Any thoughts around how you think that plays out for you guys over the next couple of years? I really appreciate it.

William Boor

Yeah, let me try to tackle. You could tell me if I leave anything out. The — one thing I’d say about our strategy with retail in general or with distribution is that we are perfectly happy working with independent dealers in close relationships.

We’ve got so many good relationships out there that have been going on for a long time. And we work with them even our digital marketing project that we’ve talked about over time or not project but our work in digital marketing. A lot of that has been focused on actually giving tools to our independent dealers to help them get leads and help them have flow through real-time information about our products and quicker response times.

So we don’t really — I’ve said this a number of times when we think about company-owned retail, it’s basically we will expand in the company-owned retail when we looked at one of our plants and have long-term concerns about access to market. If the solution is too greenfield or buy a retailer in that area and own it, we’re more than happy to do it, but it’s not really a driver to us to grow retail in its own right outside of that strategic reason.

And again, that’s because we’re so comfortable at the independents. So I think we can get just as close to the customer with digital marketing and tight relationships with retailers, if they’re independent frankly, as we can and store, maybe that’s a little bit of an overstatement, but I think it’s generally true.

On financing, we’re always looking at this. We have talked for a number of years now when people talk to us about capital allocation that we’ve got a healthy balance sheet and we’re always kind of looking at the balance of whether putting more capital allocation to our lending business makes sense. And why would it make sense? Well, in the commercial side, it would make sense if one of our dealers needed floorplan lending and we thought we could provide it and that would strengthen our relationship.

And so we’ve done that for a long time and we’ll continue to do it and we’ll expand it if that’s what the market kind of indicates is the best opportunity. And on the consumer side, our CountryPlace Mortgage has been doing consumer loans for, I think 25 years. So it’s kind of the same story that we haven’t traditionally levered that in a big way to do things like rate buy-downs to increase turns, that’s a tool we have.

And so we’re kind of we love our position both on commercial and consumer lending, and we’re more than willing to lean in on that if that’s what we think the opportunity is at any given point in the market. And I think we’ve got machine on that side of the business that can really support our manufacturing business as well. So really let me know if I didn’t touch on all aspects of your question, was a good question.

Michael Chapman

Yeah. No, that’s helpful. I mean, this is looking like we’re close to the bottom, your gross margins are a lot better now than they were last couple of downturns. And I think that’s the industry is consolidated. You guys have gotten better at what you do, but that gives you more flexibility.

And then to your point, given how clean your balance sheet is, I mean, I would think that there’s no need to run your gross margins up to ’26, ’27, if you can increase the velocity through your plants and actually get gross margins by just increasing the turns. And that’s kind of where I’m getting at is with that flexibility, what are the levers? And you kind of mentioned it that you can pull to do that.

You’re tight with your independent dealer channel and obviously you can do buy-downs and other stuff like that. But I think from an investor standpoint, we’re always looking at like that. What’s happening in the site-built homes and they seem to be able to get pretty good conversion rates and bring in traffic.

And the idea would be what are the things that you can do to get onto a similar trajectory that those guys have been on? Because it seems like financial flexibility should allow you to trial a bunch of different things. And so if you have a or are planning what those would be to allow you to increase the velocity would be helpful for us to know as investors?

William Boor

Yeah. And I guess I would kind of tell you that the lending space is clearly an active space in our industry and so will trade things sometimes on a smaller scale that probably never reach the radar screen. But it’s all in kind of testing and figuring out what we think the right decision at the time is.

If we went back and this isn’t true for now, but it’s kind of more on the strategic question you’re asking, if we went back when the retailers were having big inventory challenges, frankly, I think it would have been a little bit foolish for us to think we could increase turns by, for example, doing a commercial lending program because the orders weren’t out there to be had. You would have been kind of throwing away money.

And now we’re in a different situation, but we’re on an upswing. So you have to decide is the market given us as much as we need so that we can keep backlogs and rate range in a given plant? Or would it help to kind of boost that a little bit?

So those are the kind of discussions that are always going on here. One thing I’m really happy about in the company is that the leaders of all of those operations are our lending leaders and very close contract — contact. Frankly, daily if not — weekly, if not daily, with leaders in our MH side.

And so I think the team has really come together in a way where they can optimize these kind of issues.

Michael Chapman

But is their ability to increase capital to the lending side to increase conversion rates? Or is it that’s kind of concurrent with what happens in the market, but is that something that you can do to increase the velocity through there by having more financing available either floor plan or other for you guys? Or is that kind of like you’ve mentioned there’s small things you can do, but they’re under the radar that it doesn’t make sense to throw big amounts of money at that because the cost benefits not there. And so strategically, there will be changes on the margin, but nothing that is imminently noticeable from the outside.

William Boor

Yeah. So that what I was mentioning there is all part of your ear to the ground and trying to figure out what’s going to be the best trade-off at any given point in time. That’s your question, can we allocate capital to ensure that’s why we have such a strong balance sheet. So if we saw the need to go out with more lending on the commercial or the consumer side, we absolutely have the firepower to do it.

From a company strategy perspective, we’re a core businesses and manufacture, right? And we don’t want our balance sheet to become a lending balance sheet. So we’re also conscious of that and conscious why people invest in us. But we absolutely have the ability if there was a competitive situation to kind of swings in capital over the lending side and either act aggressively or protect our interest.

Michael Chapman

Great. Appreciate it. Thanks for the time.

William Boor

Yeah, questions. Thank you.

Operator

Jay McCanless, Wedbush.

Jay McCanless

I thanks to my follow-ups. The first one, what did the share repurchase authorization at the end of the — end of fiscal 24. How much is the have outstanding?

Allison Aden

Yeah. So outstanding at the end of 2024, we have $126.4 million of remaining on the authorization.

Jay McCanless

$126.4 million?

Allison Aden

Yeah, sir.

William Boor

That was finishing up one. And then remember the Board gave us an additional $100 million even as we were finishing up less.

Jay McCanless

And then still opportunistic on that? Or how are you thinking about repurchase for this year?

Allison Aden

It would stay consistent in our capital allocation strategy. And as we’ve touched on during the call, the first and foremost, we’d like to put dollars into our plan[t] improvements, expansion of efficiency and effectiveness.

Also, we stay active as you’ve seen historically in the M&A market. And then we really continue to so just mentioned, ongoing evaluation of opportunities in our lending operation, we really use the share repurchases and the balance is a way to really responsibly balance of the cash that we have and responsibly manage the balance sheet.

So you’ve seen historically when we’re in the market and sometimes we’ll love CVA from quarter to quarter. Just based on activity that we’re seeing in the marketplace and also a bidding opportunities with some of our M&A pipeline.

Jay McCanless

And so then going back to the industry shipments in the first quarter of calendar ’24. I mean, who’s taking volume at this point? Is that the larger manufacturers or who — I guess, who do you guys’ think was driving that plus 15 for the quarter.

William Boor

Hey, Jay, kind of goes back to my long-winded answer that I think the regions are really where you’d have to dig into. I think it was more a regional story than it was one manufacturer taking and a month — a quarter isn’t a long time for variations in those kind of numbers.

So if I would give you any kind of trend, we touched on one of the other questions, but the products that are moving the best are the lower price points. So you’ve got regional differences and then a general movement toward lower price point home.

So any plan[t] that is positioned in a region that had good growth and was positioned at lower price points was kind of in the sweet spot for that limited period of time. But I don’t think — I don’t think you’re seeing material shifts in market share just based on the data that you were looking at?

Jay McCanless

And then the last one I was going to ask it sounds like there’s still is a little bit of pricing pressure out there and kind of the same question that before is that something that you’re seeing the larger players, everyone trying to compete for price? Or is this smaller, more regional players that where you’re having to be more aggressive on your pricing to be competitive?

William Boor

Yeah. Well, I think one reason why we haven’t seen bigger reductions in price in this downturn is that we really haven’t seen anyone getting — get into financial stress, right? Everyone’s still presumably got pretty good gross margins and coming off some very strong earnings year.

So people haven’t been desperate in a sense of financial distress. We haven’t had that activity, but the pricing reductions that we’ve seen are kind of carry episodic and its very location oriented, whether it’s big players or small. I don’t think I could generate or generalize about that.

And it’s been modest. It really has. If we see the — we see the order trends that we’ve talked a lot about on this call than I think that kind of takes some of the motivation out of even that small amount of leakage away.

Jay McCanless

Okay. So to paraphrase and please fix or change this if I need to, but it . Is that is that the right way to think about it?

William Boor

Sure. And a lot of that is in the retail store trying to get them to the right product, right?

Jay McCanless

Got it. Okay, great. Thanks for taking my follow-up.

William Boor

Thanks, Jay.

Operator

Thank you. I’m showing no further questions at this time. I would now like to turn it back to Bill Boor, President, and CEO for closing remarks.

William Boor

I know we’re running short on time, and I appreciate everyone’s interest and the good discussion. There is no doubt we look back on fiscal ’24 as a down year. But I wanted to share one reflection that I had when I was kind of looking over results. The stock despite the down market, resulting in our plant system running at a significantly reduced pace all year long, not only was this the third highest net income year in our history have more than doubled the income from three years ago, which was a record at the time.

So I think just putting it in perspective, we’ve come a long way and with expectations of improving conditions in front of us. So thank you all as always for your interest in Cavco, and we look forward to keeping you updated on our progress.

Operator

Thank you for your participation in today’s conference. This does conclude the program. You may now disconnect. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

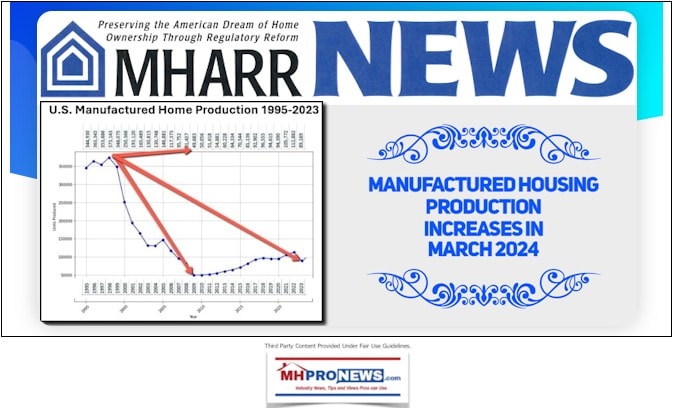

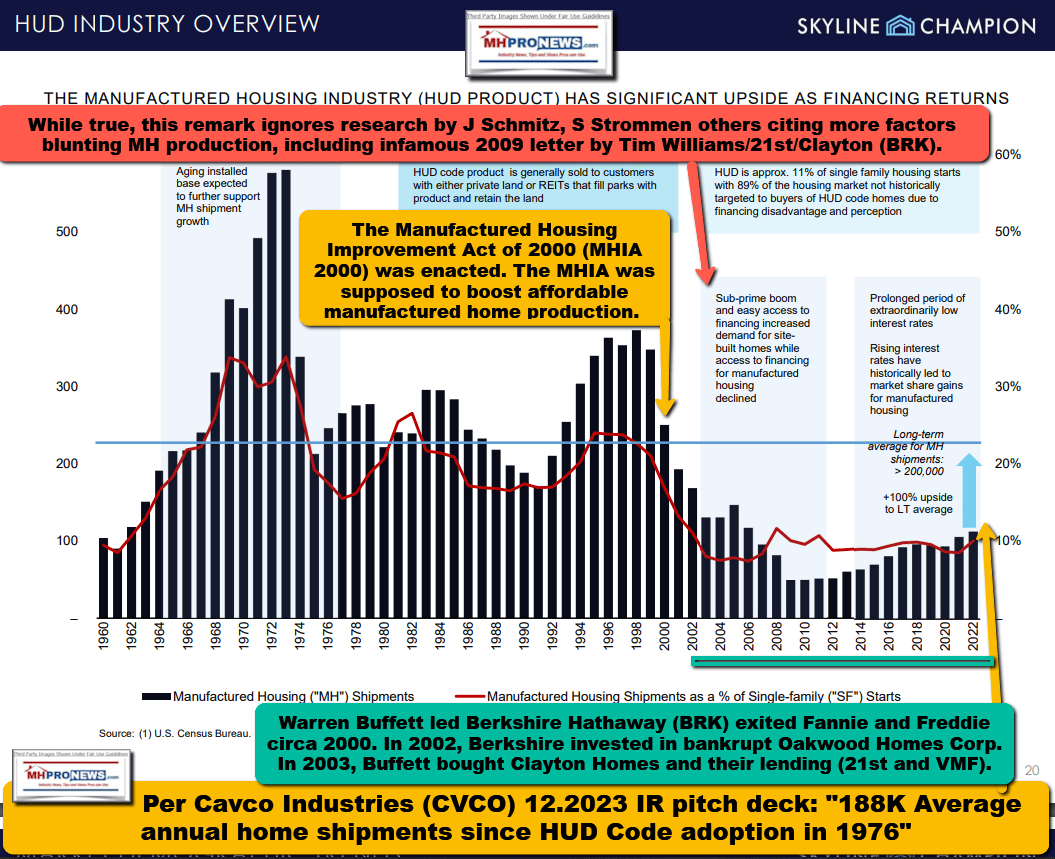

A true story. Once upon a time, the pre-HUD Code industry was approaching 600,000 new units annually. Later, manufactured housing in the later 1990s was approaching 400,000 new homes produced in one year and was consistently over 300,000 new homes produced annually for years running. Yet during an affordable housing crisis, 2023 closed out nationally with only 89,169 new homes produced? When Boor mentions the ‘downturn’ in the discussion above, that second item is what is unstated. In no particular order of importance are the following observations.

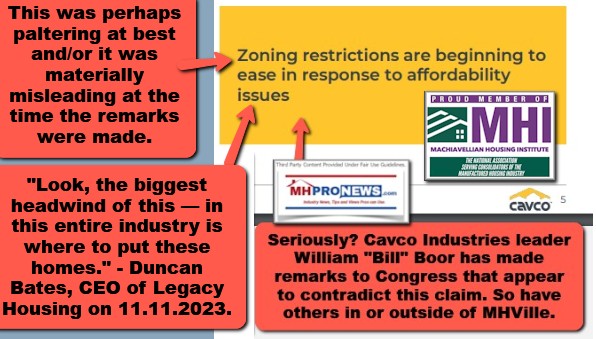

1) Despite several research reports and mainstream media articles focused on manufactured housing, how zoning barriers are harming the industry, there was no question raised on that point.

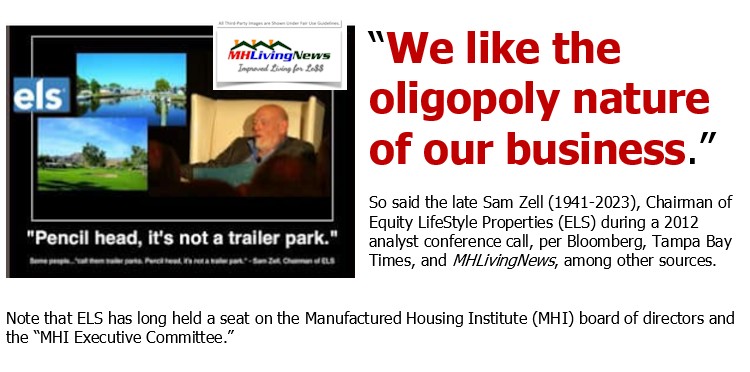

2) The statement was made in their earnings call (Part I) that the industry is ‘consolidated.’ While that obviously could be viewed as a relative term, it reflects the clarity among investor-analysists and Cavco’s leaders on the topic of consolidation that MHProNews has been making for several years. It should be noted that consolidation in manufactured housing has been achieved during a protracted period of historic manufactured housing industry underperformance. That didn’t hardly rate a whimper in this earnings call, despite the fact that about a year ago, it was analyst Greg Palm who raised this topic with Boor during a 2023 quarterly earnings call.

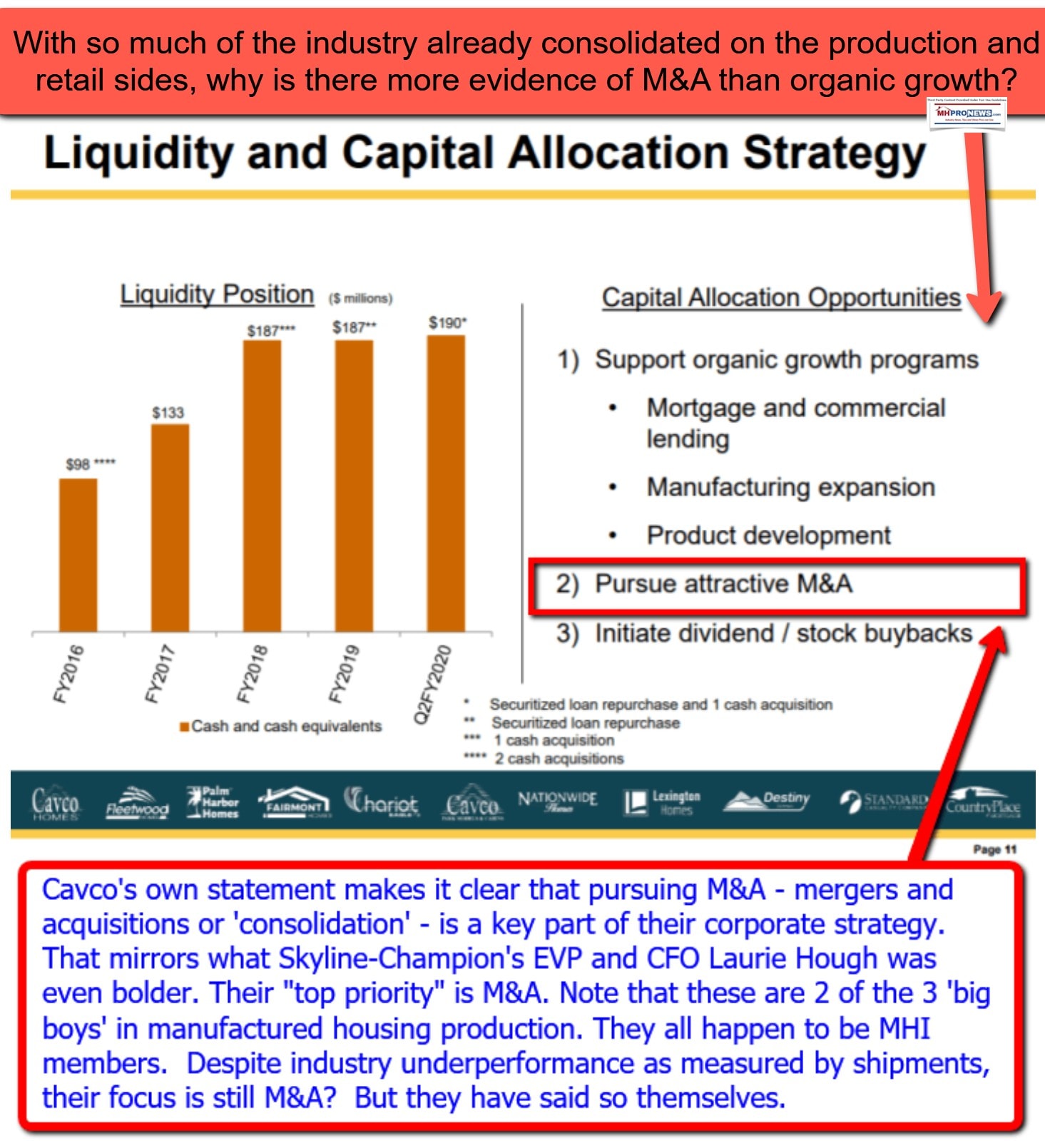

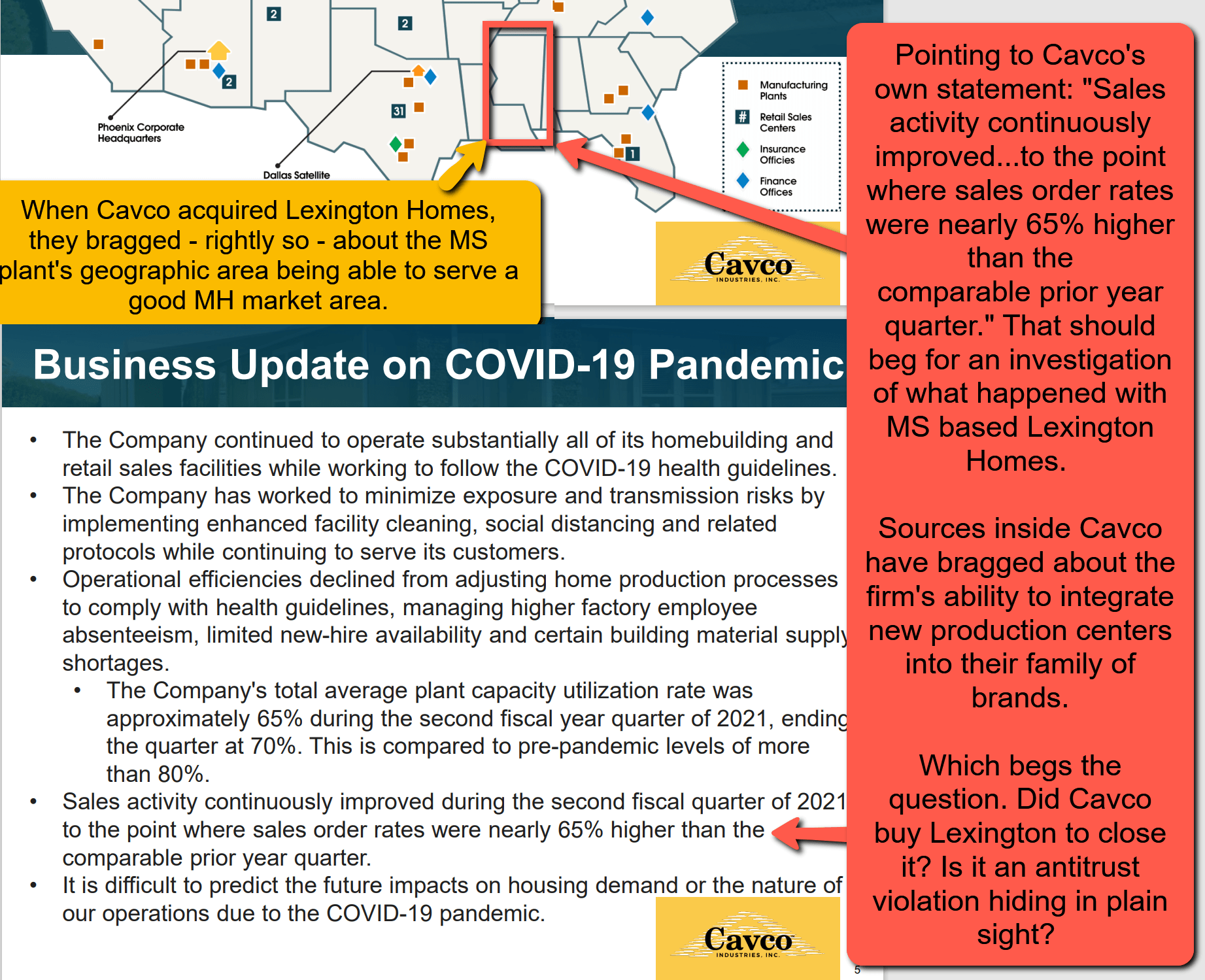

Industry consolidation is also described by terms such as mergers and acquisitions (M&A) activities. For many companies in MHVille that are publicly traded, the issue of expansion often revolves around the question of expansion via developing a new plant or production center, a new retail center or community (sometimes referred to as a greenfield development), vs. buying an existing property or enterprise. Not only did Cavco make this clear over the course of years, but so did Berkshire-Hathaway (BRK) owned Clayton Homes and Skyline Champion (SKY).

The first of the following illustrations is from 4.14.2021, and the base image is a Cavco screen capture from a then-relevant investor relations (IR) presentation. Almost never mentioned, save by MHProNews or our MHLivingNews sister site, is the significance of buying Lexington Homes. Lexington, per sources, was a member of the Manufactured Housing Association for Regulatory Reform (MHARR). There is a case to be made that while those firms are routinely independents, and thus a natural choice for consolidators, there is also an argument that by doing so, perhaps the most important voice in the manufactured housing association world that challenges the narrative spun by the Manufactured Housing Institute (MHI) is thus obviously weakened. Given that MHARR has often been the source of information about manufactured housing that MHI doesn’t share or doesn’t share in a similar fashion (perhaps due to their focus on consolidation vs. organic growth), the relative importance of MHARR can’t be downplayed. Bluntly, was Lexington a “killer” acquisition by Cavco? And since there appears to be an ongoing collusive pattern of behavior involving MHI members, a charge raised in several antitrust suits involving numbers of MHI members, would it be a surprise if Cavco was hit by new legal action by law firms that specialize in harms done to investors, the public, or by state/federal officials? The odds are good that several involved at Cavco (past or present) likely know. It is questionable, therefore, that the Lexington plant was allowed to go idle in the first place, and then that it was allowed to stay idle when backlogs in production were long (ex: 2022) and millions of dollars were available to make Lexington a useful and productive part of the Cavco family of brands, from their own shareholders’ perspective. There are any number of material and legal issues that ought to be raised about Lexington Homes and Cavco.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

As a relevant segue, when or if an accurate history of the rise and fall of manufactured housing in the late 20th century vs. the early 21st century is written, it will be MHProNews and MHLivingNews that are cited for facts like these on the topic of consolidation (a.k.a. oligopoly style monopolization). Other trade publishers and bloggers in MHVille will likely be cited as examples of how the ‘amen corner’ for consolidators looked and behaved in terms of their ears and eyeballs tickling content. Precisely because MHProNews has been willing to defy conventional wisdom by doing deeper dives into meaty manufactured housing industry issues, this publication is apparently by far the most read in MHVille trade media. Comparing SimilarWeb data vs. what our server metrics reveal about what some would say is our ‘main’ rival, our primary server indicates that we are over 30 times their visits and much higher pageviews and pageviews per visitor too. Put differently, we have more visitors like yourself in a day than they do in a month. Facts and cogent expert analysis are magnets for people who seek a deeper understanding vs. the superficial and often relatively meaningless, save for those who spin a narrative useful to their own agenda.

Cavco and several of their consolidated brands is covered in the report linked below.

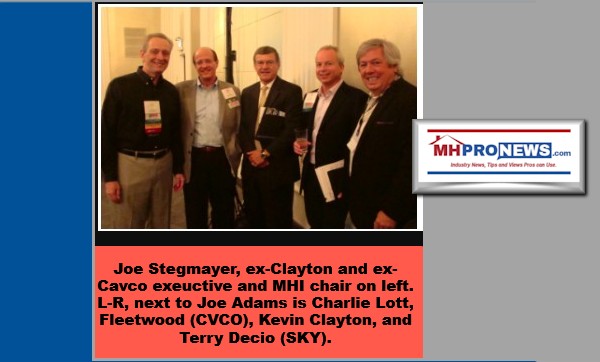

3) “Selling general and administrative (SG&A) expenses comprise all direct and indirect selling costs, operational overhead costs, and administrative expenses unrelated to production and sales,” per Gartner. “SG&A often includes rent, utilities, legal fees and insurance.” One reason cited by Cavco for their decline in SGA expenses was due to: “lower cost of the litigation between indemnified former officer and the SEC and lower compensation on reduced earnings.” This is a reference to the big bruhaha at Cavco with the Securities and Exchange Commission (SEC) involving Joe Stegmayer, Dan Unruh, and others. It is an example that crossing legal and regulatory lines are not a risk-free proposition. While some in MHVille seem to have an Enron-WorldCom-Madoff-esque mindset that the sun will never set on some scheme to boost their market position, the years of battles by Cavco in dealing with apparently illegal activities resulted in some apparent harms and costs. While an argument can be made that Cavco got off fairly light, despite spending millions in defense and settlements, it also produced a trove of evidence that may prove useful for potentially more devastating legal claims that may still emerge in the foreseeable future.

Decio is linked to MHI member Skyline Champion (SKY). But his remarks to MHProNews in that video interview referenced above mirror those of Joseph “Joe” Stegmayer during a video produced in connection with the Innovative Housing Showcase (IHS), the latest iteration of which is coming up in a couple of weeks. The type of paltering and posturing deception becomes apparent to those who look at the details and who grasp the industry’s past and potential are revealed in such remarks by Stegmayer and Decio. In fairness, the longer the ruse is attempted to posture efforts toward growth while failing to take the obvious steps needed to achieve that growth based on actual market and regulatory realities, the more likely such slips of the lip that sunk their own MHI backed narrative are likely to occur.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

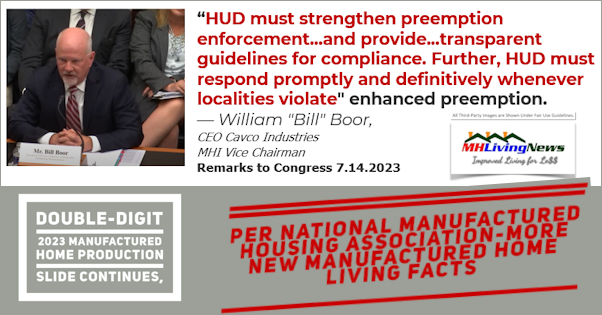

This photo above by Cavco with then HUD Secretary Marcia Fudge at an Innovative Housing Showcase (IHS) event is an example of how Boor could have raised the issue of federal “enhanced preemption” made law under the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, 2000 Reform Act, 2000 Reform Law, etc.). There is no known indication that he did so. When MHI apparently had a question planted during a Congressional hearing with Fudge, the shocking response from Fudge drew essentially no attention from MHI nor MHI linked bloggers and publishers. Why should it, if the MHI’s unstated (or in the case of publicly traded companies in their investor pitches, stated) goals is actually more consolidation?

4) Boor is currently MHI’s chairman. Previously, Boor was vice-chairman of MHI, at a time when he essentially had a chairman for that trade group that effectively worked for Cavco Industries (i.e.: Leo Poggione). Prior to Boor, Stegmayer was also an MHI chair. Stegmayer served as a Clayton Homes division president before going to Cavco. Instead of stock buybacks, why isn’t Cavco pressing for a public campaign to promote the industry via MHI? Or instead of buybacks, why isn’t Boor pressing for legal action to get the enhanced preemption provision of the MHIA enforced? They can’t logically have it both ways. The numbers of apparently contradictory statements and behaviors is stunning, for those who pay attention to the details.

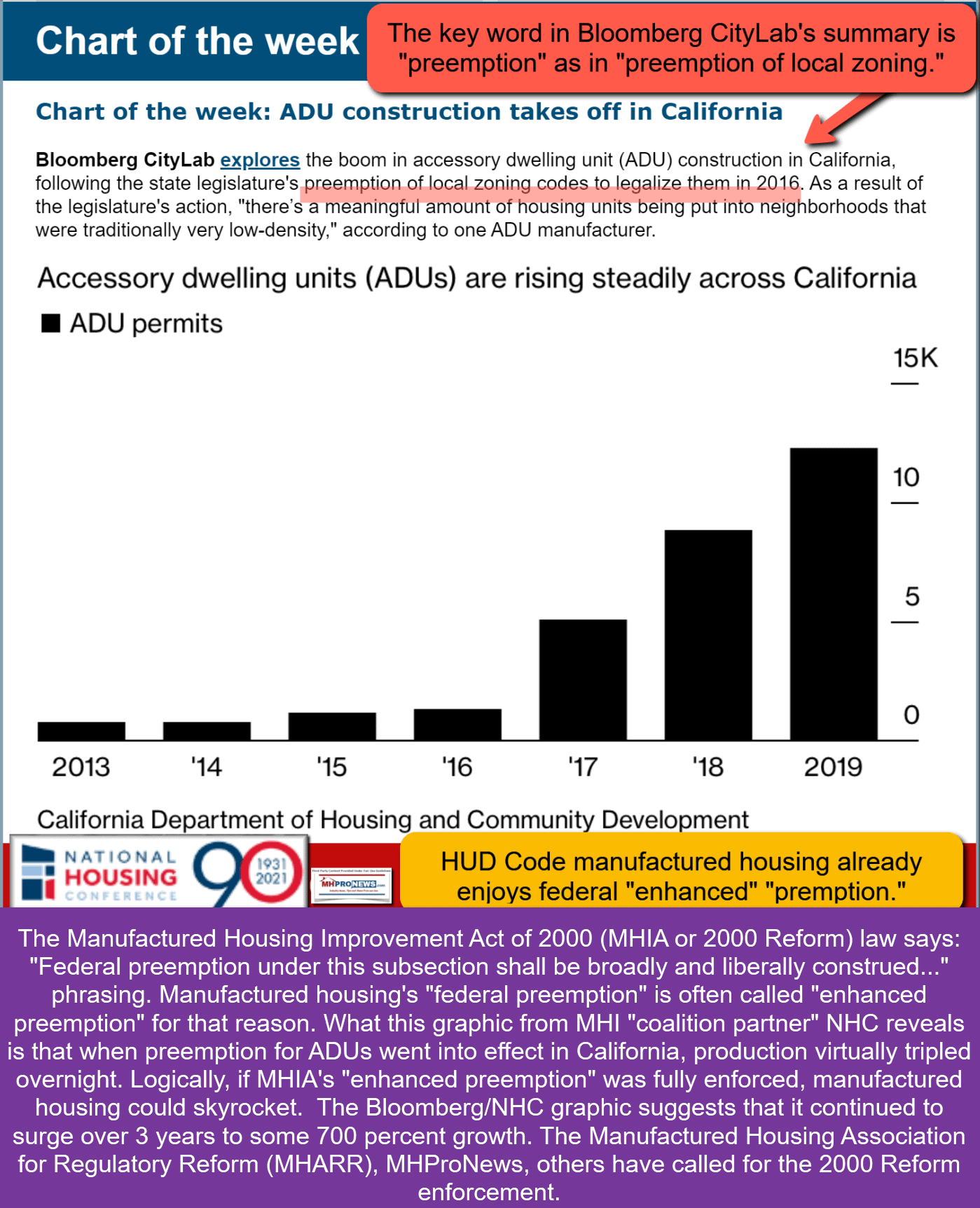

5) As MHProNews/MHLivingNews have previously documented over the course of several years, the accessory dwelling units (ADUs) experience in California reveals what statewide preemption can accomplish. Applying that concept nationally to manufactured housing and enhanced preemption could produce a similarly dramatic result.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

6) Where is the accountability for this remark by Boor? Why isn’t that catching up to site building mentioned at all in Cavco’s most recent earnings call?

7) Pardon me, but it should be clear that the educated and experienced professionals at Cavco (or MHI for that matter) can’t be this stupid.

Indeed, Boor’s remarks (linked above) to Congress prove that he understands the enhanced preemption issue quite well. Indeed, he should.

But that is why his own investor relations pitch is arguably so self-indicting (see Cavco’s affordable housing crisis screen capture below). When they correctly point out that it is millions of housing units needed, and that manufactured housing can supply them, that’s true. But then, if they fail to take the logical steps of launching litigation that would yield the very thing that Boor told Congress he wants to see enforced, that reveals either incoherent, self-contradictory, corrupt, inept, or fill in the blank levels of dramatic disconnects. These pros read this publication; we know that from sources deemed reliable. Their senior staff read MHProNews/MHLivingNews. They are not ignorant of these concerns. They have been asked to address them directly, and they decline to respond. That is their God-given and constitutionally protected right to remain silent in action. While we editorially respect that right, it also leaves them open to the obvious charges of failing to act in the best interests of either their shareholders, members of the industry, and others seeking affordable housing. All of those are harmed by this pattern of behavior. Furthermore, much of their earnings call discussion above is also contradicted by historic patterns. In the 1980s, when interest rates where far higher, manufactured home sales were far higher than they are today. During the 1980s, new manufactured homes produced were often 3 times their 2023 levels. There should be far more individuals gravitating from conventional housing to manufactured homes that is apparently occurring. If there were not federal laws that they could rely upon, that would be a different matter. But there are potentially useful federal laws, like the 2000 Reform Law, and they know it!

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

7) Cavco’s leaders are obviously not alone in this problematic pattern. That is part of the reason why MHProNews predicted in December of 2022 that manufactured housing could become a target rich environment for litigation. Before a year had passed, multiple antitrust suits were launched. Coincidence? Hardly.

Some on the political center-right (fee.org comes to mind) claim there should be no antitrust laws at all. Nonsense. Recognition for the need for laws to control monopolistic behavior goes back to at least the time of founding father Thomas Jefferson.

Monopoly power (be it one dominating brand, a duopoly, or an oligopoly style of monopolization) in business inevitably leads to monopoly influence over government. Democrats and Republicans alike grasp that quite well. While Democrats may seem to press the case more often, that also means that when Democrats are in power, the question should arise, why do they fail to tackle the issues related to manufactured housing?

8) Much more could be said about the earnings call discussion above. But it could be boiled down to this. Cavco has spent over $100 million in buybacks alone in the last year. Why wasn’t some of that money used to press for litigation, more effective lobbying, and for greater public acceptance of manufactured homes as the obvious solution to the affordable housing crisis? That’s how organic growth would be achieved. It is why a Cavco executive testified to Congress prior to Boor’s remarks on how HUD had failed manufactured housing and was failing to press for enhanced preemption enforcement under the MHIA.

9) Cavco’s (and other leading MHI member brands) can’t have it both ways. They can’t grandstand and ‘complain’ to Congress, using truth in testimony standards, and then fail to take the steps needed before or after that testimony to do what they can to advance their corporate and industry cause. There are apparently reasons why MHI leaders lean on silence or ducking questions and accountability now, vs. the direct engagement and prompt responses that they used to give previously. It is apparently because they know we have de-coded the patterns of communications and behavioral disconnects. They likely (or certainly) know that they can’t meaningfully say we don’t know what we are talking about, because we have decades of hands-on experience in the industry that predates publishing that produced documented results. Daniel Mandelker, J.D., in his pitch to improve manufactured housing industry results (see below) acted as if MHI didn’t exist. A lobbying and legal group is needed, said Mandelker, to advance the industry’s cause in battles like zoning. That is just one of several apparent misses from academics peering into why manufactured housing is mysteriously underperforming. But it is no mystery at all.

10) Time will tell if a day of reckoning will come while Boor is still at Cavco. But his own words, their own corporate IR pitch deck, their own corporate history are all indictments of their failures to act in the best interests of shareholders, stakeholders, at MHI for the industry in general, and as good citizens. Which good corporate citizenship an apt note to shift to the Memorial Day reflections that follow in Part III, below. Meanwhile to learn more about Cavco and years of 21st century industry underperformance, see the linked and related reports. ##

Part III – Memorial Day 2024 Reflections

The history of America is sometimes more complicated than millions have been led to believe. While there is much to celebrate, there are also troubling episodes that shed light on what is occurring in our profession and so many others too. Not many would accuse the late Marine General Smedley Bulter of being unpatriotic. Yet, he came to the conclusion that “war is a racket.” He went on a speaking tour to educate the public on what that military-industrial complex racket looked like and behaved like. The Cambridge dictionary defines a racket as: “a dishonest or illegal activity that makes money: They were jailed for running a protection/prostitution racket.”

There appears to be an awakening occurring in the U.S. on the left and the right. On the left, millions of Democrats are realizing that the party they have cast so many votes for has routinely failed to deliver on their promises. Media operations that leaned left were often shilling for corporate powers that they may have postured as being a check on their power.

On the center-right, some like Fee.org has made recent (and prior) arguments opposing antitrust laws. From FEE’s self-description: “About FEE: FEE’s mission is to inspire, educate, and connect future leaders with the economic, ethical, and legal principles of a free society. These principles include: individual liberty, free-market economics, entrepreneurship, private property, high moral character, and limited government.” Such individuals often point to Thomas Jefferson, yet Jefferson (noted here and above) opposed monopoly power.

When the billionaires/corporate class essentially run the two major parties, the effect is wealth is steadily transferred to a relatively small group financial/political elitist. Authors/speakers/academics/influencers like Dr. Kevin Roberts at the Heritage Foundation or Hanne Nabintu Herland are among those who have been exposing that trend. Note that neither Herland nor Roberts oppose free enterprise or limited government. Rather, they recognize that the power those few wield is harmful to society – including smaller businesses where innovation often occurs and new wealth is created.

If it takes a book for Herland to carefully document her case, and numbers of articles by Heritage and Roberts to make theirs, is it any wonder that it requires longer articles to document what has gone awry in manufactured housing?

It should not be thought that by referencing any individual or group that everything that they ever did or said is thus endorsed. Those are the games some play when a tweet or social media post is retweeted or shared. Oh, such and such and so and so did this or that and that was wrong. Yeah, and only a pair of individuals since Adam and Eve are said to be without any stain of sin. There won’t be much quoting going on if perfection is the standard. Even the corrupt can occasionally speak some insightful truth. Even those trying to promote a better outcome for America will be guilty of several errors.

That said, “Don Jr.” in the prior Memorial Day reflections linked below said in response to an inquiry from MHProNews that antitrust-enforcement is the #2 or #3 issue in the country.

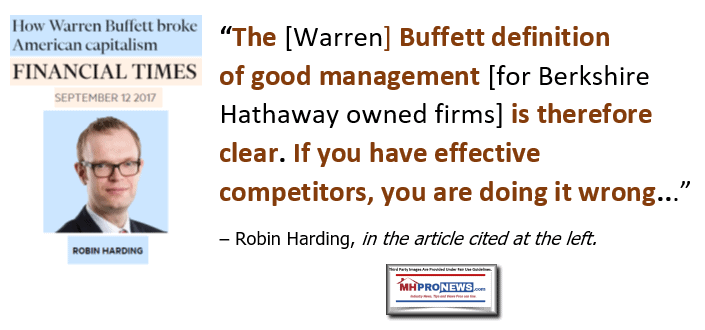

From the political left, the Financial Times featured the critique of Robin Harding of Warren Buffett’s moat strategy. Harding said he was a fan of Buffett’s until he realized he wasn’t saving capitalism, rather Buffett was undermining free enterprise.

Jonathan Kanter, J.D., for the Antitrust Division at the Department of Justice specifically named the moat method in one of his remarks on antitrust enforcement. Will Kanter do anything? That’s a separate question. But it may be progress of a kind that the topic of moats and housing (among others) was raised.

Memorial Day serves to remind us of the sacrifices of those who fought in wars to keep Americans free. That is a noble sentiment. But it can also be noble to fight other types of battles for freedom and the rights of Americans. If ‘the system is rigged,’ as at least 70 percent (per Pew Research) of the country believes it is, then fighting a rigged system is a noble endeavor. That’s part of what antitrust laws can do. Who will actually fight those fights is another question. Democrats talked up antitrust in 2019 and 2020. What happened to all of that rhetoric?

Talk isn’t cheap. Talk can be expensive.

We began this report and analysis focused on Cavco and their earnings call and unpacked some of its meaning and apparent disconnects. Deceptive practices have become too common in America. Saying one thing, while doing another is a strategy used by many in politics and business.

The question on Memorial Day is what sort of America do we want in the future? Because elections are looming. The case can be made that however flawed in this or that way deposed President Trump might be, he is the runaway best option among the field. The fact that many in the billionaire class have opposed Trump inside and outside of the Republican Party should be a clue that he is considered to be their enemy. Even if Democrats replace Joe Biden before the election, as many speculate will occur, it must be kept in mind that Biden-Harris-Democrats have essentially run this nation for the past 3 1/3 years. Inflation is making the poor and middle class generally poorer. It is making a tiny fraction of the population wealthier.

Freedom isn’t free. That means that not only must it be fought for (when unavoidable) on battlefields, but freedom must also be fought for in board rooms, basements, backyards, and beyond.

Slavery comes in many forms. Slavery and economic servitude have long been the economic and political condition of most of the human race for most of human history. Memorial Day is a fine time for families, friends, and fun. But it is also a good opportunity to reflect on what must be done to secure a future that many on the left and right agree is slipping away into the control of ever fewer hands. That’s the opposite of the American Dream. That should not be tolerated in our profession, nor in any others. Happy Memorial Day. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’