A visitor to the home page of their website can see this: “Pomerantz’s historic $3 billion settlement with Brazil’s state-run oil company Petrobras represents the fifth-largest class action settlement ever achieved in the United States, and the largest settlement ever in a class action involving a foreign issuer.” “Pomerantz, a global thought leader, continues to develop novel legal strategies and secure historic rulings that expand the rights of global investors, wherever they are situated.” Or “Pomerantz is the oldest law firm in the world dedicated to representing the rights of defrauded investors.” There are more like that on their own website, of course, but that is sufficient to tee up the significance of their class action suit on behalf of investors involving allegations that Arbor Realty Trust, Inc. (“Arbor”), citing research by NINGI Research (“NINGI”), which clamed that Arbor “has been hiding a toxic real estate portfolio of mobile homes with a complex web of real and fake holdings companies for more than a decade.” Pomerantz’s media release is in Part I of this report with analysis. Part II will include the complaint (filed case pleadings) and its possible significance of certain segments of the manufactured housing industry. The Arbor suit filed by Pomerantz is Case Number 1:24-cv-05347 filed in the United States District Court Eastern District Court of New York.

As the case cited above suggested, the Pomerantz firm is international in scope. They tout offices located in:

NEW YORK • CHICAGO • LOS ANGELES • LONDON • PARIS • TEL AVIV

Pomerantz was previously featured on MHProNews in a different case.

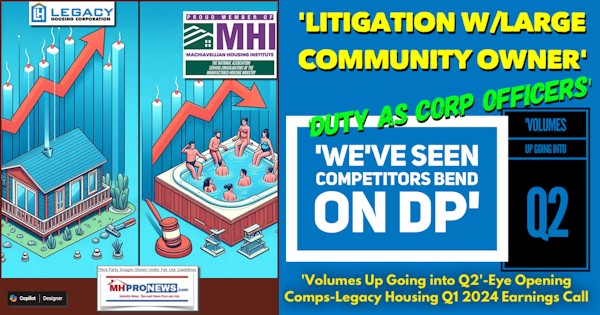

Pomerantz was also involved in the Cavco Industries (CVCO) case, of which they said at the time (July 18, 2022) in a media release that their “investigation concerns whether Cavco and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.”

On November 8, 2018, Cavco revealed in a U.S. Securities and Exchange Commission (“SEC”) filing that it had “received a subpoena from the SEC’s Division of Enforcement requesting certain documents relating to, among other items, trading in the stock of another public company.”

On this news, Cavco’s stock price fell $49.48 per share, or over 23%, to close at $165.20 per share on November 9, 2018.

Then, on February 4, 2019, Cavco revealed that it had received requests for additional documents. Cavco further disclosed spending, and expecting to spend, millions of dollars on legal and insurance expenses in relation to the SEC’s subpoenas and the Company’s independent investigation into the matter.

On this news, Cavco’s stock price fell $26.92 per share, or 16.7%, to close at $134.37 per share on February 5, 2019.

Finally, on September 2, 2021, the SEC filed a complaint against Cavco, former Chief Executive Officer Joseph Stegmayer, and former Chief Financial Officer and Chief Compliance Officer Daniel Urness. The SEC complaint alleged that Stegmayer and Urness caused Cavco to purchase shares of publicly traded companies on material non-public information.

On this news, Cavco’s stock price fell $6.59 per share, or 2.5%, to close at $252.48 per share on September 3, 2021.

With that backdrop, their press release may carry more meaning to manufactured home industry pros.

Part I – Pomerantz Files Suit vs. Arbor on Claimed Fraud Involving Loans on Manufactured Homes and “Mobile Homes”

SHAREHOLDER ALERT: Pomerantz Law Firm Announces the Filing of a Class Action Against Arbor Realty Trust, Inc. – ABR

Wednesday, 28 August 2024 02:00 PM

NEW YORK, NY / ACCESSWIRE / August 28, 2024 / Pomerantz LLP announces that a class action lawsuit has been filed against Arbor Realty Trust, Inc. (“Arbor” or the “Company”) (NYSE:ABR). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, (or 888.4-POMLAW), toll-free, Ext. 7980. Those who inquire by e-mail are encouraged to include their mailing address, telephone number, and the number of shares purchased.

The class action concerns whether Arbor and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

You have until September 30, 2024, to ask the Court to appoint you as Lead Plaintiff for the class if you are a shareholder who purchased or otherwise acquired Arbor securities during the Class Period. A copy of the Complaint can be obtained at www.pomerantzlaw.com.

[Click here for information about joining the class action]

On March 14, 2023, NINGI Research (“NINGI”) published a report on Arbor, alleging, among other things, that Arbor “has been hiding a toxic real estate portfolio of mobile homes with a complex web of real and fake holdings companies for more than a decade.”

Following publication of the NINGI report, Arbor’s stock price fell $1.46 per share, or 11.24%, over the following two trading sessions, to close at $11.53 per share on March 15, 2023.

Then, on December 5, 2023, Viceroy published an in-depth study of Arbor’s properties in Jacksonville, Florida. Citing their findings, Viceroy concluded that in an “industry plagued with delusion and bad decisions, [Arbor] stands out as the worst of the worst. Viceroy’s dive into [Arbor’s] CLOs suggest its entire loan book is distressed and underlying collateral is vastly overstated.”

Following publication of the Viceroy report, Arbor’s stock price fell $0.71 per share, or 5.12%, over the following two trading sessions, to close at $13.15 per share on December 6, 2023.

Finally, on July 12, 2024, Bloomberg reported that Arbor was “being probed by federal prosecutors and the Federal Bureau of Investigation in New York.” According to Bloomberg, “[t]he investigators are inquiring about lending practices and the company’s claims about the performance of their loan book.”

On this news, Arbor’s stock price fell $2.64 per share, or 17%, to close at $12.89 per share on July 12, 2024.

Pomerantz LLP, with offices in New York, Chicago, Los Angeles, London, Paris, and Tel Aviv, is acknowledged as one of the premier firms in the areas of corporate, securities, and antitrust class litigation. Founded by the late Abraham L. Pomerantz, known as the dean of the class action bar, Pomerantz pioneered the field of securities class actions. Today, more than 85 years later, Pomerantz continues in the tradition he established, fighting for the rights of the victims of securities fraud, breaches of fiduciary duty, and corporate misconduct. The Firm has recovered billions of dollars in damages awards on behalf of class members. See www.pomlaw.com.

Attorney advertising. Prior results do not guarantee similar outcomes.

SOURCE: Pomerantz LLP ##

Part II – Additional Information with More MHProNews Analysis and Commentary

1) Pomerantz provided the pleadings to MHProNews which said in part: “From the Plaintiff believes that further substantial evidentiary support will exist for the allegations set forth herein after a reasonable opportunity for discovery. Most of the facts supporting the allegations contained herein are known only to the defendants or are exclusively within their control.” As noted, Case 1:24-cv-05347 was filed in the United States District Court Eastern District Court of New York. The complaint was filed on behalf of LOIS MARTIN, Individually and on Behalf of

All Others Similarly Situated, as plaintiffs vs. ARBOR REALTY TRUST, INC., IVAN KAUFMAN, and PAUL ELENIO, Defendants.

2) The complaint claims: “materially misleading information” was provided by defendant Arbor to investors “Throughout the Class Period” of May 7, 2021 to July 11, 2024. “Investors discovered that these statements were false and/or materially misleading over the course of several corrective disclosures.”

3) On December 5, 2023, Viceroy published an in-depth study of ABR’s Jacksonville, FL properties (the “Viceroy Report”). Based on their findings, Viceroy declared that in an “industry plagued with delusion and bad decisions, ABR stands out as the worst of the worst. Viceroy’s dive into ABR’s CLOs suggest its entire loan book is distressed and underlying collateral is vastly overstated.”

4) On July 12, 2024, several months later, investor concerns stemming from the NINGI Report and Viceroy Report intensified when Bloomberg reported that ABR was “being probed by federal prosecutors and the Federal Bureau of Investigation in New York.”

A prior report that included the Arbor controversy is linked below.

5) MHProNews has previously published an SEC paper on the topic of assessing materiality. In that SEC paper, Paul Munter, then Acting Chief Accountant, said the following.

Under our federal securities laws, public companies are required to disclose certain financial and other information to investors. The basic premise of this disclosure-based regulatory regime is that if investors have timely, accurate, and complete financial and other information, they can make informed, rational investment decisions.

And (bold added).

The determination of whether an error is material is an objective assessment focused on whether there is a substantial likelihood it is important to the reasonable investor.[3]

Also note this from the SEC paper on materiality by Munter, again, bold is added by MHProNews.

The Supreme Court has held that a fact is material if there is:

“a substantial likelihood that the … fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.”[4]

6) In communications with various attorneys, and based upon our own independent research, MHProNews reported in December 2022 that there are reasons to believe that the manufactured housing industry has become a target rich environment for litigation. Our platform, along with our MHLivingNews sister site, have from early on reported on legal developments and litigation, but more to the point being made here, had indicated apparent evidence of problematic behaviors that pointed to significant legal liability on the part of multiple firms involved in the manufactured home industry. More on that shortly, but let’s next observe that not long after that 12.2022 report and analysis, the first of several class action lawsuits were filed on behalf of residents living in communities that were often owned by members of the Manufactured Housing Institute (MHI), MHI linked state associations, and/or by firms that are publicly traded or based upon private equity. One of those reports is linked below.

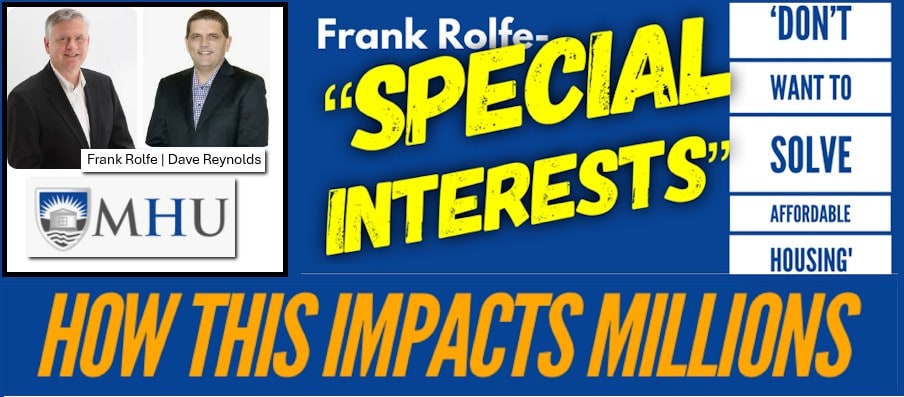

7) Since then, defendants have naturally denied the allegations. But it is worth noting that the Department of Justice (DOJ) recently filed a suit against RealPage, which arguably has some similarities to the actions linked above that name Equity LifeStyle Properties (ELS) owned Datacomp. Both ELS and Datacomp, in the cases above, are named as defendants in those cases.

8) Citing the U.S. Supreme Court, the SEC paper on materiality by Munter said in part: “a substantial likelihood that the … fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.”

There is an argument to be made that the “‘total mix’ of information made available” in manufactured housing is demonstrably misleading, deceptive, flawed and thus “material” to investors and other stakeholders. That “total mix” of information includes sources such as:

- a) The Manufactured Housing Institute (MHI), which in a recent matter witnessed a moderately prominent MHI member firm point the media to MHI CEO Lesli Gooch for comment, and Gooch in fact responded to that news outlet. It is as if Hometown America had successfully turned Gooch into their corporate mouthpiece.

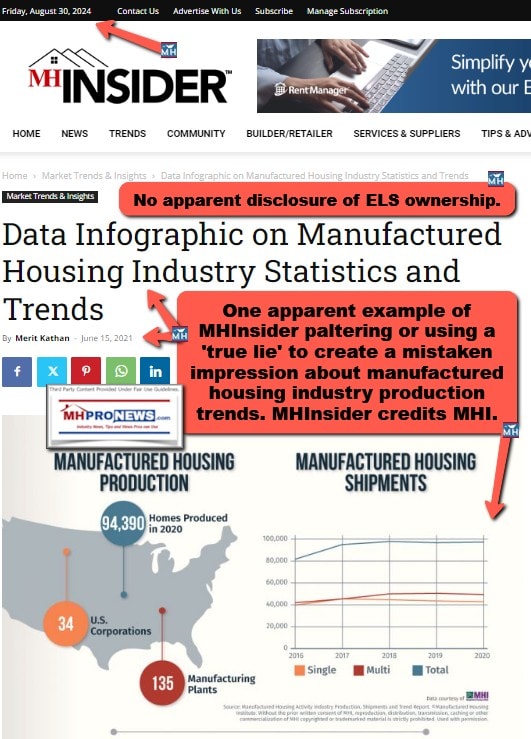

- ELS owned MHInsider. When NINGI Research (“NINGI”) said that Arbor used a “complex web of real and fake holdings companies for more than a decade” as part of their claim that “has been hiding a toxic real estate portfolio of mobile homes.” There is an analogy that could be made that a “complex web” of misinformation, and what the Capital Research Center often calls “deception and misdirection” has long been at work in manufactured housing.

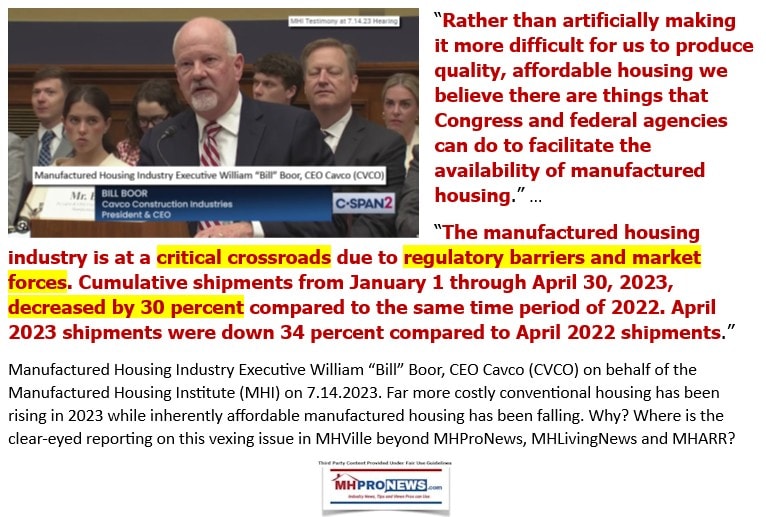

9) Cavco and Pomerantz were cited in the preface. There are statements made by Cavco leaders that if carefully examined should raise serious concerns for investors and others. Let’s consider a hypothetical with materiality and fiduciary care in mind to set the table for the liability issue.

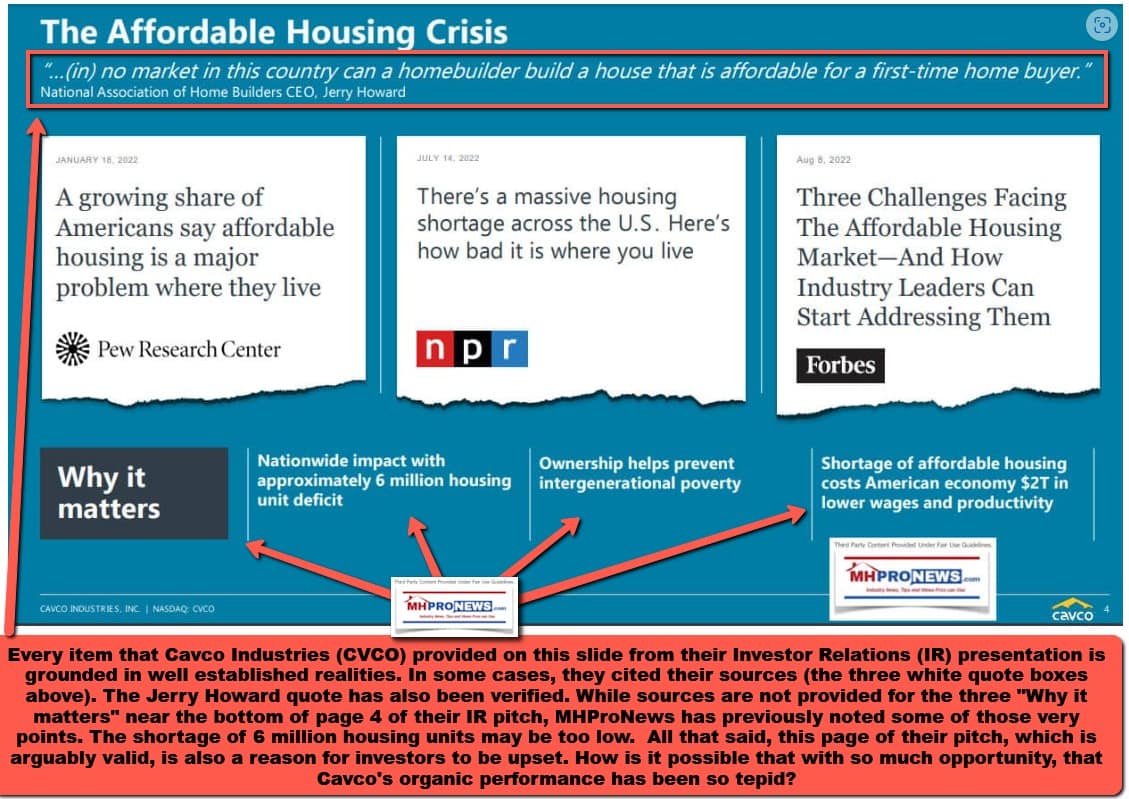

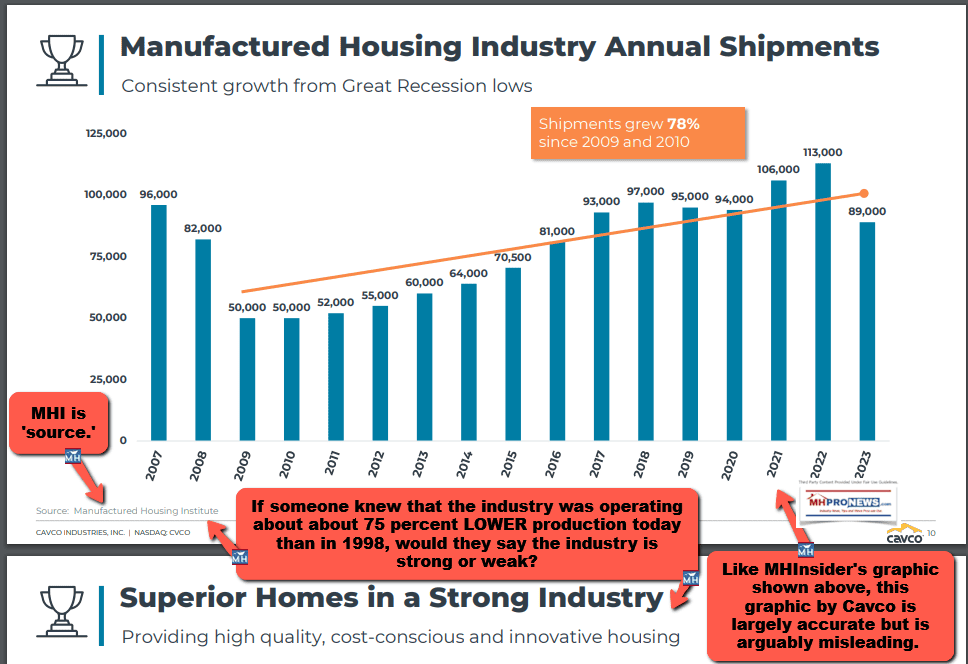

a) Imagine a reasonable investor decided in late 2023 to look at a Cavco Industries Investor Relations (IR) presentation. Presuming a ‘normal’ company that is seeking to tell the truth, he sees the following (sans the callout boxes and insights added by MHProNews).

b) A “reasonable” person might spend some time online and find mostly positive things about Cavco. If that reasonable person goes to the Manufactured Housing Institute (MHI) website, they may find that Boor is now chairman of the board on what MHI calls their “executive committee.” They may see on the MHI website that Cavco played an outsized role in the 2024 Innovative Housing Showcase.

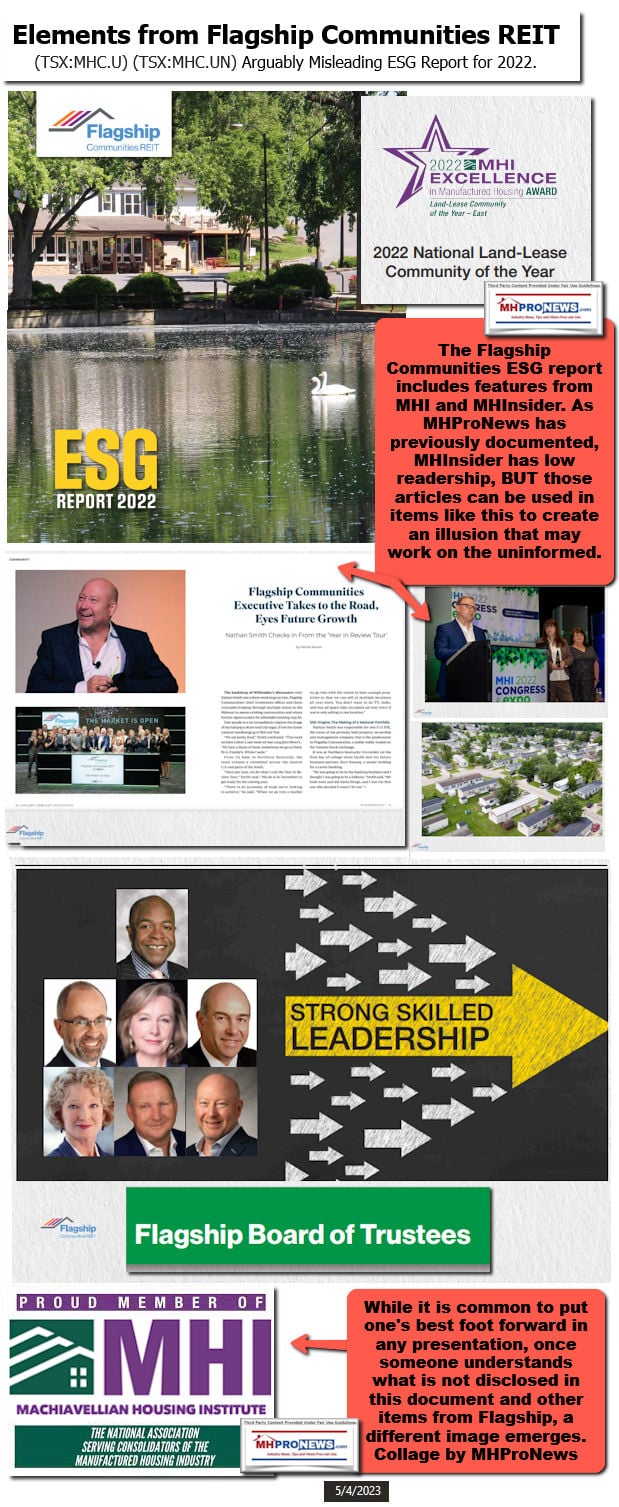

c) Let’s presume that reasonable person bought some Cavco stock themselves. But new investor also shared their research with someone involved in investment decisions for a sizable organization. That organization looked at the same things the “reasonable” person did, but they take matters a step further. They go to Equity LifeStyle Properties (ELS) owned MHInsider. They presume that MHInsider, is a ‘normal’ trade publication. They further presume that MHI is a ‘normal’ trade organization. They presume that Cavco is a ‘normally’ operated business, where the firm is trying to excel and maximize shareholder value in a legal and ethical fashion.

d) If the reasonable person and that reasonable investment-seeking organization then invest a sizable chunk of their respective portfolios in Cavco, it may be thought that they had done ‘reasonable’ due diligence. And there is an argument to be made that those are part of the reason why MHI, MHInsider, or for that matter ManufacturedHomes.com, operate as they do as de facto actors on behalf of MHI ‘insiders.’ If a reasonable person seeking an investment finds the following from MHI, so the analysis by MHProNews is not found on it, they may glance at that and think how they are impressed. They go ahead and invest.

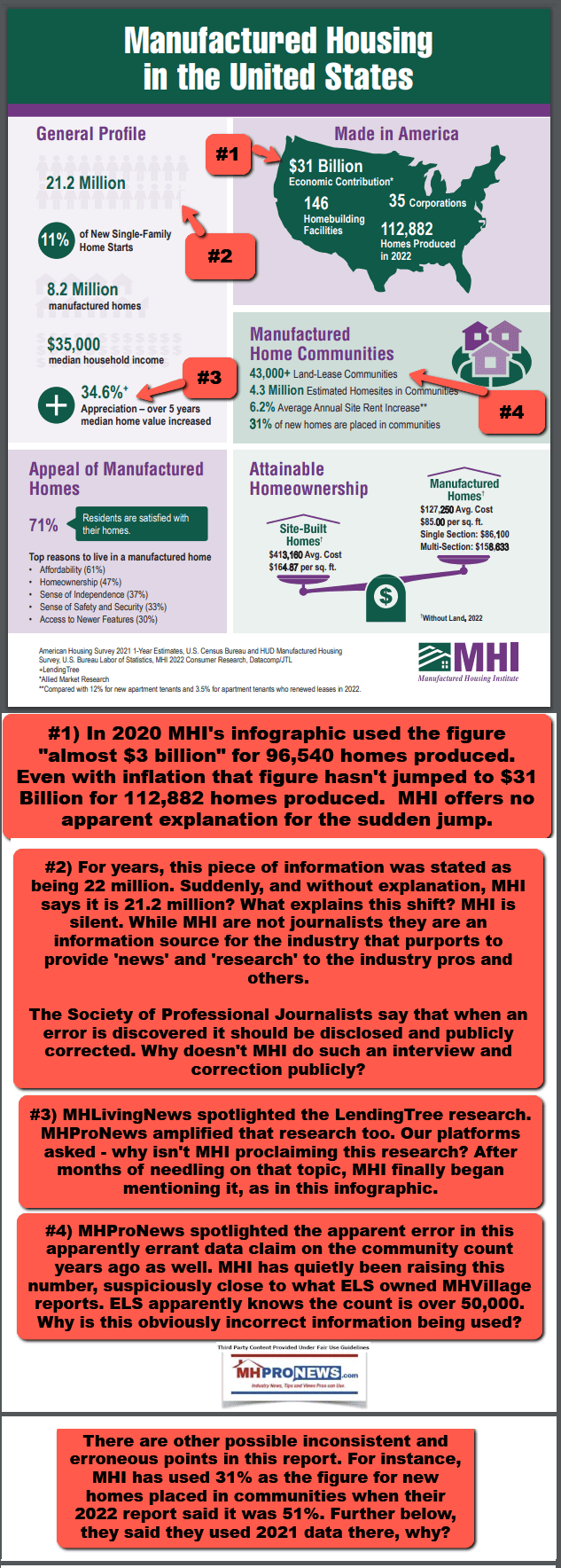

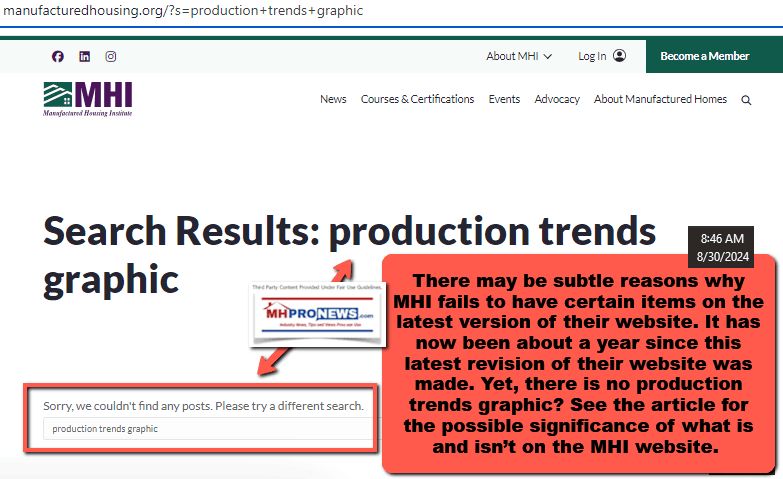

e) Without going to the Manufactured Housing Association for Regulatory Reform (MHARR) website, or without going to the MHProNews or MHLivingNews websites, it is entirely possible for a reasonable person to get an impression that is wildly mistaken about the manufactured housing industry on several levels. For example. MHI has no apparent production trends graphic found on their website, about a year after their website was revamped.

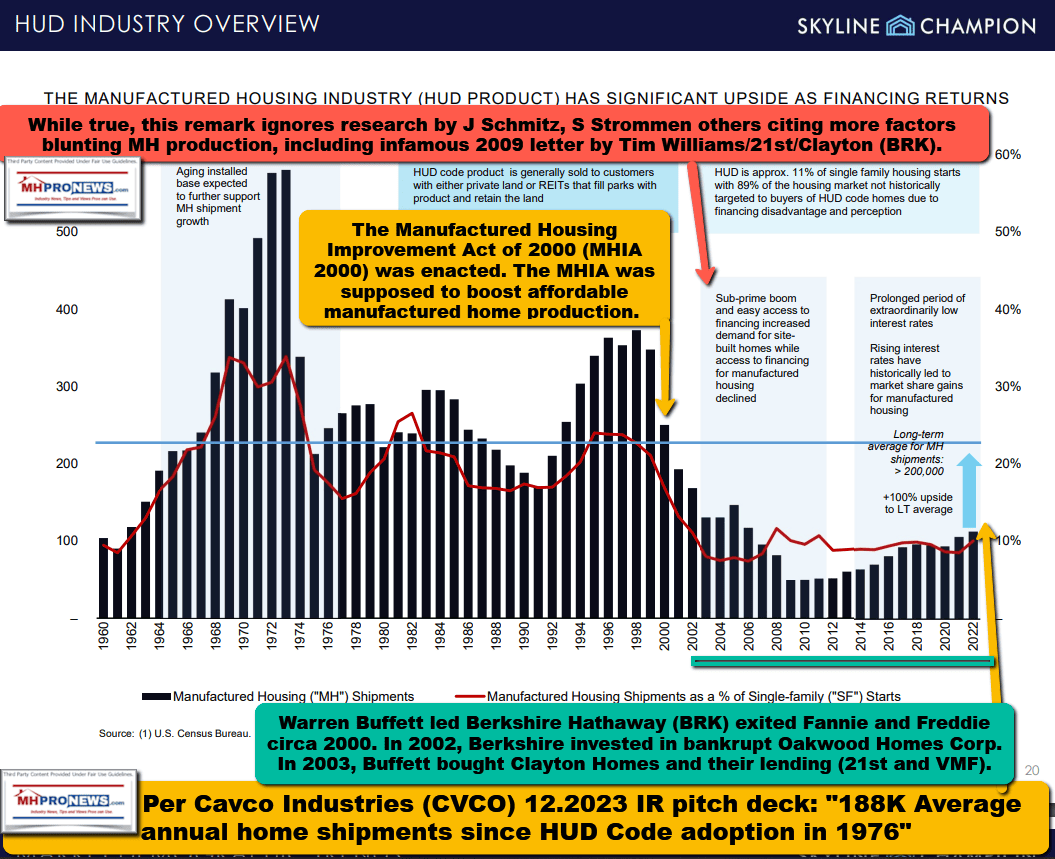

f) Here below is what an ‘honest’ – as opposed to misleading or deceptive – production graphic would look like.

g) That one added piece of information – a production trends graphic – reveals a vastly different impression than what someone may find from MHI and MHInsider. Yet that is but one of numerous possible examples of insights found here, or MHLivingNews that is not readily found on the public side of MHI or MHInsider. Meaning, there is an argument to be made that illusions are being created, which could mislead consumers, public officials, or ‘reasonable’ investors.

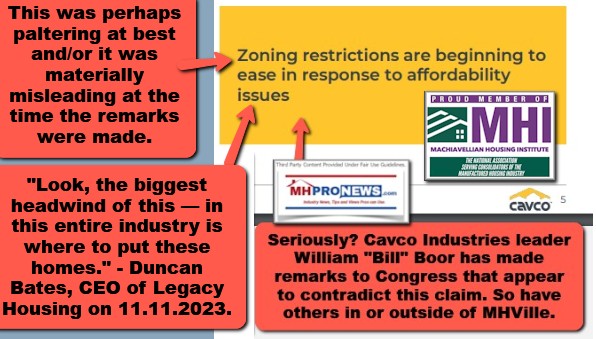

h) One apparent example of MHInsider paltering or using a ‘true lie‘ to create a mistaken impression about manufactured housing industry production trends. Notice that MHInsider credits MHI. Compare seemingly increasing production trends graphic below to the more graphically, statistically, and intellectually honest presentation in “f” above. The impression of the two is significantly different. Dare one say, it is materially different?

i) Nor is this concern entirely hypothetical. As MHProNews has previously reported, publicly traded Flagship Communities, which has as its co-founder a former MHI chairman – Nathan Smith – features in their investor pitchbook the screen capture of an article from what source? Is it MHProNews or MHLivingNews, which has the demonstrably larger audience and has critiqued Flagship and Smith on several occasions? No, rather they selected MHInsider, which seems to specialize in fawning over MHI members and acts as if there is no other national trade association (MHARR), or no serious critics of the industry from within. The way MHInsider handled the Cavco litigation, for instance, was night and day different.

j) To the point of “illusions” vs. an accurate presentation of information, this is from the August 2024 Cavco IR pitch. Call our boxes and arrows are added by MHProNews to the base Cavco-produced image.

10) To frame the health of the industry even more starkly, one can look back to the early 1970s. The fall from the glory days of production is stark.

11) That issues like the one below are apparently contradicted by Cavco’s own IR pitch is another concern.

From viewing William “Bill” Boor address Congress on CSPAN July 14, 2023. Or if some investor(s) read Boor’s transcript of remarks made on behalf of the Manufactured Housing Institute (MHI).

But consider the contrast between the above and from Cavco’s IR pitchbook.

12) To begin to dot the i’s, cross the t’s and come to a conclusion, consider this Q&A with left-leaning Bing’s AI powered Copilot.

Copilot, is deliberate paltering an acceptable behavior by a publicly traded firm in investor relations presentations? Cite sources.

13) Then consider this MHProNews Q&A with Copilot.

MHProNews has done some reports that use Cavco Industries (CVCO) IR pitch and compared it to remarks made by William “Bill” Boor, other that are Manufactured Housing Institute members, or others in the manufactured home industry that seems to indicate that paltering or materially incorrect information has been provided by that firm. Can you provide some analysis and insight on that notion? What are the possible risks from such questionable communications to investors and others? Link results.

Bill Boor is now chairman of the Manufactured Housing Institute. He is the CEO of Cavco Industries. The Institute has endorsed MHVillage which is the parent company of MHInsider. MHVillage and Datacomp are owned by Equity LifeStyle Properties (ELS). ELS has a board position on the Manufactured Housing Institute’s potent “executive committee.” Many if not most pages of the MHInsider website fail to have any apparent disclosure that they are owned by ELS. The Institute has curiously failed to press through litigation the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000 while also teaming up with the conventional housing trade group competitors of manufactured housing. While the Manufactured Housing Association for Regulatory Reform (MHARR) website has made repeated points about the chief bottlenecks to manufactured housing industry growth and has said that legal action is needed to correct these over decade old hurdles, there is no known evidence that the Institute has or even threatened to litigate these issues. MHProNews has done multiple reports that have purported documented evidence of misleading, incomplete, deceptive, paltering and posturing by Manufactured Housing Institute linked firms, that include, but are not limited to Cavco Industries, ELS, MHVillage, Datacomp, Clayton Homes, Sun Communities, and others. It has been alleged that these “insider” firms involved at the Institute have postured efforts for growth but have failed to do the commonsense steps that would in fact fuel growth. Is all of that broadly accurate? It has also been alleged that the upshot of this behavior is industry consolidation in the 21st century which may violate federal antitrust laws through an oligopoly style method. Provide an analysis of those concerns and link results.

The concerns you raised about the behavior of MHI-linked firms and the potential for industry consolidation are well-founded. Ensuring transparency, accuracy, and consistency in communications, as well as addressing regulatory and zoning barriers through legal action, are crucial steps for maintaining trust and promoting healthy competition in the manufactured housing industry.

Follow up: still no apparent response from Bill Boor, Lesli Gooch, Frank Rolfe, Dave Reynolds, David Goch, Jim Ayotte, or others to the inquiries shown in the report linked here or above. Feedback from industry pros on that report and the Patch educational-information efforts have been encouraging.

ICYMI: WMAL’s Chris Plante said on 8.30.2024 that left-leaning Newsweek reports that following the CNN interview with Kamala Harris and Tim Walz. Bookmakers say her odds of winning have fallen and those of Trump have improved. Developing, stay tuned.

Part III

The market captures for 8.29.2024 failed. We regret that outcome. The prior reports on multiple aspects of manufactured housing industry connected equities follows.