Citing MarketBeat, Bing’s AI powered Copilot said on 8.4.2024 that: “SG Capital Management LLC recently made a new investment in Legacy Housing Co. (NASDAQ: LEGH). They purchased 71,197 shares of the company’s stock, valued at approximately $1,532,0001. This investment was disclosed in their latest Form 13F filing with the Securities & Exchange Commission1.” According to Yahoo Finance on 8.4.2024, Skyline Champion share price has experienced a year-to-date increase of 1.82%. By comparison, there more modest-sized rival Legacy Housing has enjoyed a YTD increase of 5.08 percent. In the last six months, Legacy Housing (LEGH) stock has jumped 9.55 percent higher, stated a tool on Yahoo Finance. Financial News site Zacks has reported that analysts are saying that Legacy could surge by 26.68 percent, see that and more further below.

B. Riley rates Legacy a “strong buy.”

As longtime and detail-minded readers of MHProNews should know, Legacy Housing (LEGH) is a vertically integrated producer of manufactured homes that include financing, retail, and floor planning among the offers of the HUD Code, workforce housing, and tiny home factory-builder. Per sources, Legacy is a dual member of the Manufactured Housing Institute (MHI) and the Manufactured Housing Association for Regulatory Reform (MHARR). Some of the qualities that set appear to set the firm apart from others at MHI will be explored in Part II further below.

In Part 1 that follows, MHProNews has at times edited the spacing, but has kept the text as in the original report. The tweak in spacing makes and adding bullets makes it easier to spot the various institutional investors that have added or modified their position in Legacy (LEGH). Note that the ‘free report’ offer by MarketBeat is a method used by stock-news platforms to build their potential contacts and clients. MHProNews is not encouraging that step.

Part I According to MarketBeat on 8.3.2024

SG Capital Management LLC Makes New Investment in Legacy Housing Co. (NASDAQ:LEGH)

Written by MarketBeat

August 3, 2024

SG Capital Management LLC acquired a new position in Legacy Housing Co. (NASDAQ:LEGH – Free Report) in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 71,197 shares of the company’s stock, valued at approximately $1,532,000. SG Capital Management LLC owned 0.29% of Legacy Housing at the end of the most recent reporting period.

A number of other hedge funds also recently added to or reduced their stakes in the business.

- Voss Capital LLC lifted its stake in Legacy Housing by 6.4% in the fourth quarter. Voss Capital LLC now owns 830,000 shares of the company’s stock worth $20,933,000 after acquiring an additional 50,000 shares during the period.

- Mill Road Capital Management LLC lifted its position in shares of Legacy Housing by 7.3% during the fourth quarter. Mill Road Capital Management LLC now owns 500,798 shares of the company’s stock valued at $12,630,000 after buying an additional 33,998 shares during the last quarter.

- Vanguard Group Inc. lifted its position in shares of Legacy Housing by 5.2% during the first quarter. Vanguard Group Inc. now owns 441,383 shares of the company’s stock valued at $9,499,000 after buying an additional 21,995 shares during the last quarter.

- Cerity Partners LLC purchased a new stake in shares of Legacy Housing during the fourth quarter valued at about $1,872,000.

- Finally, ABS Direct Equity Fund LLC purchased a new stake in shares of Legacy Housing during the fourth quarter valued at about $1,261,000.

89.35% of the stock is owned by hedge funds and other institutional investors.

Legacy Housing Stock Performance

NASDAQ:LEGH traded down $1.10 during midday trading on Friday, hitting $26.50. The company’s stock had a trading volume of 58,615 shares, compared to its average volume of 70,976. Legacy Housing Co. has a fifty-two week low of $17.67 and a fifty-two week high of $29.31. The firm’s 50 day moving average is $24.15 and its 200-day moving average is $23.34. The company has a debt-to-equity ratio of 0.03, a current ratio of 3.76 and a quick ratio of 2.88. The firm has a market cap of $644.48 million, a P/E ratio of 12.50 and a beta of 1.06.

Legacy Housing (NASDAQ:LEGH – Get Free Report) last issued its quarterly earnings results on Thursday, May 9th. The company reported $0.60 earnings per share for the quarter, topping the consensus estimate of $0.36 by $0.24. Legacy Housing had a net margin of 29.70% and a return on equity of 12.33%. The company had revenue of $43.24 million for the quarter, compared to the consensus estimate of $38.07 million. During the same quarter in the prior year, the company earned $0.65 EPS. Equities analysts anticipate that Legacy Housing Co. will post 2.34 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

LEGH has been the subject of several analyst reports. B. Riley raised shares of Legacy Housing from a “hold” rating to a “strong-buy” rating in a research report on Tuesday, May 14th. CJS Securities initiated coverage on shares of Legacy Housing in a report on Friday, June 7th. They set an “outperform” rating and a $33.00 price objective on the stock. Finally, Wedbush reiterated an “outperform” rating and issued a $25.00 price target on shares of Legacy Housing in a report on Friday, May 10th.

About Legacy Housing

Legacy Housing Corporation engages in the building, sale, and financing of manufactured homes and tiny houses primarily in the southern United States. It manufactures and provides for the transport of mobile homes, including 1 to 5 bedrooms with 1 to 3 1/2 bathrooms; and provides wholesale financing to dealers and mobile home parks, as well as retail financing to consumers. ##

Part II – Additional Information with more MHProNews Analysis and Focused Commentary

Note that Copilot apparently treats MarketBeat as a ‘trusted’ resource, and that a double check of the institutional investor ownership in Legacy Housing. It also confirmed the figure 89.35% is the percentage of Legacy cited by Bing. “89.35% of the stock is owned by hedge funds and other institutional investors.” That noted, consider the following additional insights.

1) According to a Q&A with Copilot by MHProNews on 8.4.2024:

Legacy Housing’s stock is currently trading at $26.502, with a market cap of $644.48 million2. The company has a 52-week high of $29.31 and a low of $17.672.”

2) The screen capture collage elements that follow, including arrows and call out boxes are by MHProNews, but the base information is per Yahoo Finance.

3) Next, consider this Q&A with Copilot.

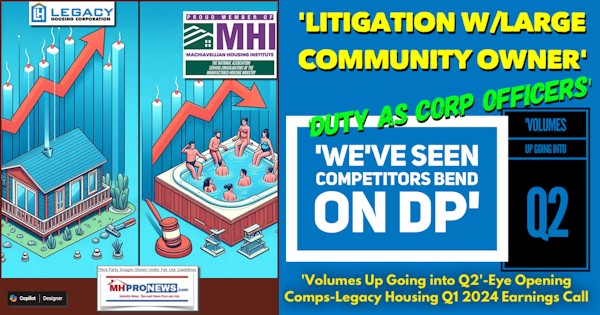

What I’d like to get a handle on is this. My impression, based on various reports on Legacy Housing (LEGH), Skyline Champion, and Cavco Industries on MHProNews, is that while all three firms have stated their willingness to grow by acquisition, that Legacy is the one that appears to be more focused on opening new sales centers (for organic growth, as an example), while Skyline Champion (SKY) and Cavco (CVCO) appear to be doing more along the lines of growth through M&A. Provide some feedback on that.

- Legacy Housing (LEGH):

- Legacy Housing has indeed been focusing on organic growth by opening new sales centers. This strategy aims to expand their market reach and enhance direct sales capabilities1.

- Skyline Champion (SKY):

- Skyline Champion has been actively pursuing growth through mergers and acquisitions (M&A). They have expanded their retail distribution network and enhanced their financing capabilities through strategic acquisitions23. This approach allows them to increase their market share and streamline operations across their extensive network of manufacturing facilities and retail centers4.

- Cavco Industries (CVCO):

- Cavco Industries also emphasizes growth through acquisitions. They have been expanding their distribution partnerships and developing innovative products and finance solutions5. This strategy helps them to navigate market challenges and capitalize on opportunities for growth67.

Overall, while all three companies are open to growth through acquisitions, Legacy Housing appears to be more focused on organic growth through new sales centers, whereas Skyline Champion and Cavco Industries are leveraging M&A to enhance their market presence and operational efficiency.

Does this help clarify their strategies? If you have any more questions or need further details, feel free to ask! …”

4)

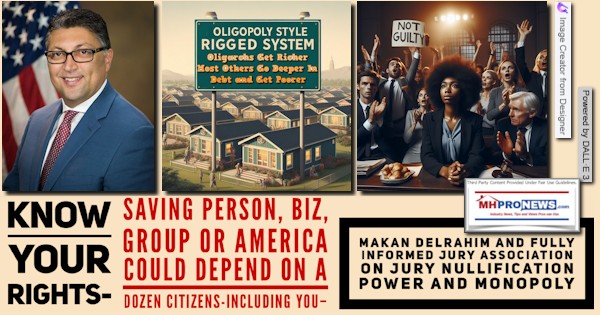

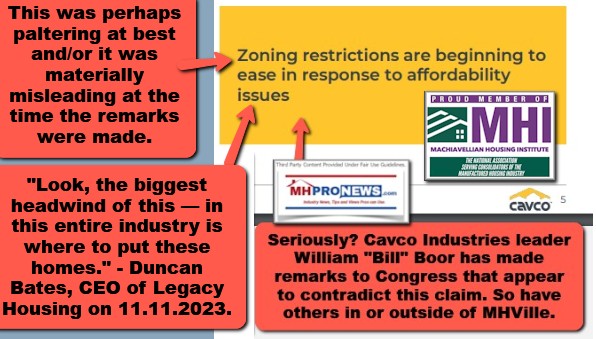

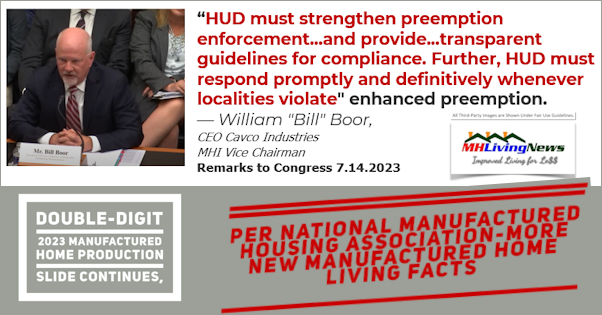

It is also my impression that Duncan Bates and Curt Hodgson have been more vocal about the challenges of zoning and placement barriers than their larger counterparts at Cavco and Skyline Champion. Cavco, for example, has curiously stated in their investor relations pitch that zoning barriers seem to be improving, even though Bill Boor at Cavco told Congress almost the opposite. Cavco got tagged with a sizable fine by the SEC, and even Skyline got dinged, but to my knowledge, Legacy Housing has not had that sort of issue that seemed to be based on behavior that the SEC ultimately fined. https://www.manufacturedhomepronews.com/masthead/project-saturn-code-name-monarch-sec-v-cavco-stegmayer-et-al-federal-suit-revelations-about-cavco-skyline-champion-other-manufactured-housing-brands-apparen/ Provide some color on those notions.

- Zoning and Placement Barriers:

- Legacy Housing (LEGH): Duncan Bates and Curt Hodgson have indeed been more vocal about the challenges related to zoning and placement barriers. They have highlighted these issues as significant obstacles to the growth of the manufactured housing industry12.

- Cavco Industries (CVCO): Cavco has presented mixed messages regarding zoning barriers. While their investor relations materials suggest improvements in zoning regulations3, Bill Boor, Cavco’s CEO, has expressed concerns about these barriers in congressional testimonies4.

- Skyline Champion (SKY): There is less emphasis from Skyline Champion on zoning barriers in their public statements compared to Legacy Housing5.

- SEC Fines and Legal Issues:

- Cavco Industries: Cavco faced a significant fine from the SEC due to issues related to insider trading and other regulatory violations4. This has impacted their reputation and highlighted the need for stricter compliance measures.

- Skyline Champion: Skyline Champion has also faced regulatory scrutiny and fines, although the details are less prominent compared to Cavco6.

- Legacy Housing: To date, Legacy Housing has not faced similar SEC fines or legal issues. Their focus has been more on operational growth and addressing industry challenges without major regulatory setbacks78.

Your understanding of these companies’ strategies and challenges is well-founded. If you have any more questions or need further details, feel free to ask! …”

5)

To elaborate on the above a bit more, analyst Greg Palm quizzed Bill Boor during a 2023 earnings call about why manufactured housing production was so weak, right? Boor replied with what some observers indicated was a kind of double-talk about inventory levels, an issue that every industry that uses retailers periodically deals with and normally work through in a timely fashion. While this ‘stocking issue’ had ripple effects in manufactured housing in the last part of 2022 and most of 2023, it seems that Legacy was less impacted, your take?

Regarding the impact on Legacy Housing, it does appear that they were less affected by these stocking issues compared to their peers. Here are a few reasons why:

- Operational Efficiency: Legacy Housing has maintained a strong focus on operational efficiency and cost control, which may have helped them navigate inventory challenges more effectively.

- Sales Strategy: Their emphasis on opening new sales centers and direct sales channels likely provided more stable demand and better inventory management.

- Market Positioning: Legacy’s market positioning and product offerings might have been better aligned with consumer demand during this period, allowing them to maintain steadier production levels.

Overall, while the broader industry faced significant challenges with inventory and production, Legacy Housing’s strategic focus and operational strengths seem to have mitigated the impact on their business.

Does this align with your observations? If you have more questions or need further details, feel free to ask! …”

6) MHProNews has editorially stated for years that we hold no position in the companies that we report on, which is still true at this time. There are now a handful of firms, including Legacy Housing, Nobility Homes, and UMH Properties that MHProNews would consider investing in, because they appear to hold pro-industry and pro-corporate growth stances, unlike several firms involved at the Manufactured Housing Insitute (MHI). That said, after some years of observation, there are apparently some companies that are publicly traded in manufactured housing whose investment thesis, based on their own corporate remarks and investor relation (IR) pitches, are arguably flawed or misleading. There appears to be a group of consolidation-focused members involved at the Manufactured Housing Institute (MHI) and/or MHI linked state associations that include firms that seem to behave in ways contrary to MHI’s postured, but seemingly unenforced fig leaf of a “code of ethical conduct.” MHI, their board, senior staff, and outside attorney have declined comment on those concerns and others that have been raised by multiple antitrust suits and other legal, regulatory, and investigative reports. Per a source deemed reliable, there is only one so-called ‘predatory’ firm that is known to have withdrawn from MHI membership, and that is Havenpark Communities, but the reason for Havenpark leaving is unclear, and again, MHI is not being transparent by ignoring requests for comments. It is interesting to note that some of those same firms that have been hit by multiple complaints by firms such as the customer complaints, reviews by rating agencies like the Better Business Bureau (BBB) and consumer complaint platforms, such as PissedConsumer have been given so-called ‘awards’ for ‘excellence’ by MHI, despite their apparently problematic status in many cases even with their own employees. Note that these editorial observations are our own, and may or may not comport with the views of others involved manufactured housing.

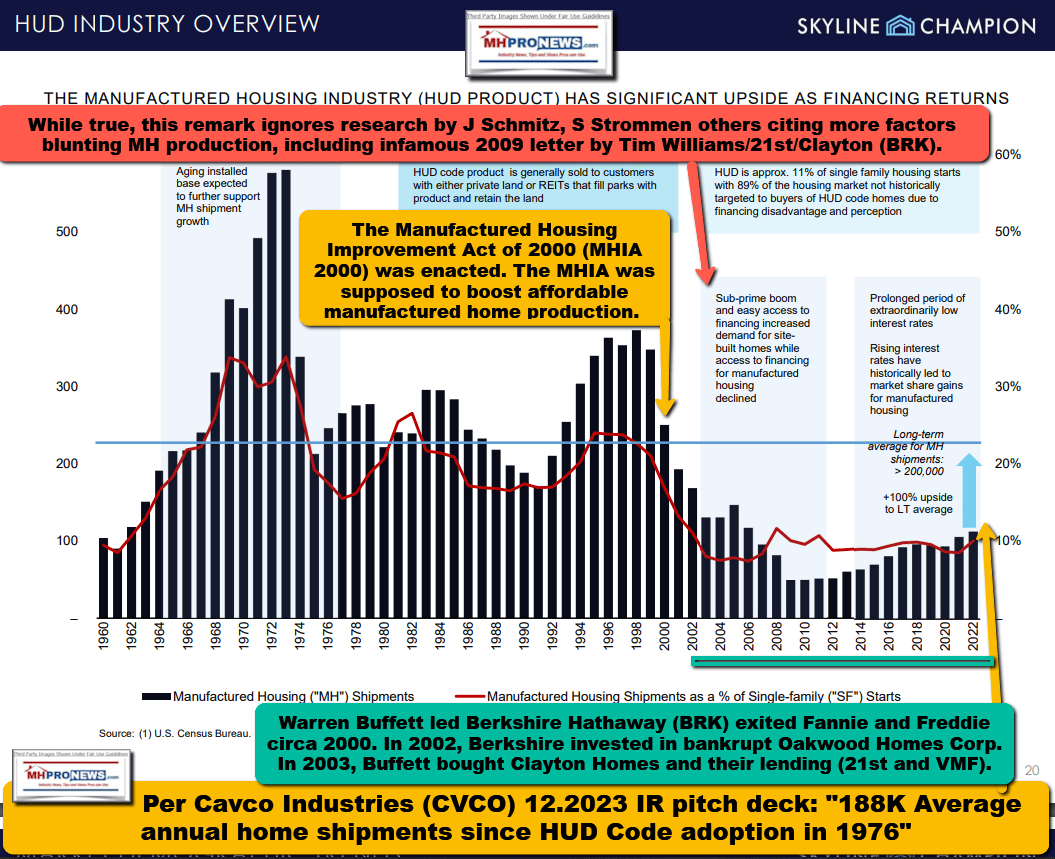

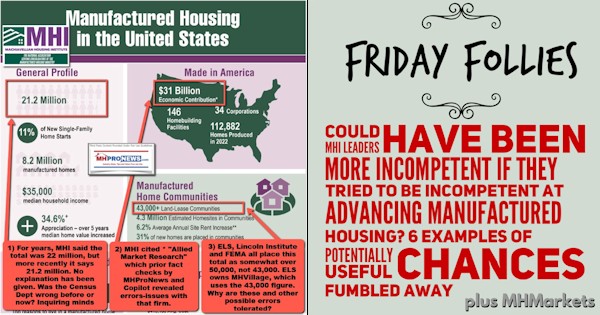

7) That said, it is MHI linked MHEI, their ‘educational’ arm, that held a “tricks of the trade” “educational” session that featured MHI member Yes! Communities. But for all of the so-called “education” that MHI is offering over the course of years, the Manufactured Housing Association for Regulatory Reform (MHARR) has reported that for 15 of the last 17 years, the manufactured housing industry has collectively been performing nationally at fewer than 100,000 new homes per year. That’s a mere shadow of the production reported by the industry in the mid-to-late 1990s, when surpassing 300,000 new homes produced per year was common. The national population has grown since, and industry production has fallen? That vexing disconnect is rarely, if ever, addressed by pro-MHI bloggers and publications. MHI claims in its form 990 that they want to foster industry growth, but when they have been presented with opportunities to do so, they have curiously turned their backs on that opportunity and instead of aligning with pro-growth MHARR they have instead aligned with the rivals of manufactured housing, namely, the conventional housing industry. It is so bizarre that it simply can’t be made up.

8) It is in this sort of apparently treacherous environment that publicly traded firms like Legacy Housing (LEGH), Nobility Homes (NOBH), and UMH Properties (UMH) are operating. Needless to say, numbers of non-publicly traded firms are operating in this environment too. It may be difficult for some ethically-minded companies to wrap their minds around the notion that they are metaphorically being shivved by members of trade groups that they are supporting. The goal seems to be consolidation of the industry in an oligopoly style methodology which may make it more difficult for antitrust investigators to spot and root out. That said, complaints have been made, including by members of Congress.

9) Legacy Housing CEO Bates and Executive Chairman Curt Hodgson have publicly spoken out about the zoning problems that several consolidation-focused MHI members seem to be on both sides of the fence on, depending on who their audience is.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

The problem is both simple and vexing. Manufactured housing obtained favorable federal legislation approaching 20 and 25 years ago, as MHARR has frequently observed. Yet those laws aren’t being properly enforced, which MHI has at various times admitted. But then MHI fails to do what is obvious and necessary – i.e.: take legal action – to sue to enforce the industry’s rights. MHI communications and behaviors are purportedly a mix of posturing, preening, and propaganda that pretends to seek enforcement of laws, though some of their higher-profile members have openly said that the status quo is part of their business model. If MHI is the trade group for consolidators, then that is what they should say, rather than they are working for the interests of all. Again, repeated efforts to get MHI and/or their attorney or their designated communications professional to respond to such fact-based and years of evidence supported concerns to respond to, but they remain mute. The quotes by Copilot at the base of this image are revealing.

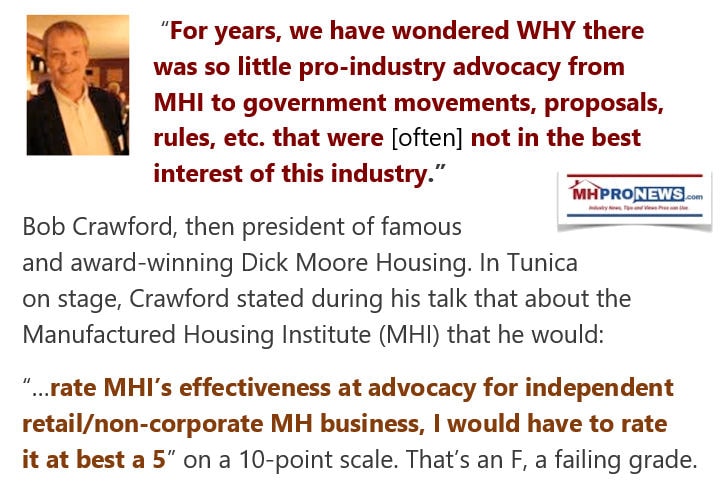

10) High profile MHI member Frank Rolfe, who is arguably notorious in his own right, nevertheless has publicly ripped MHI and public officials for their duplicity. Two state associations pulled their membership from MHI because MHI was purportedly not acting in a manner that advanced the interests of the industry at large.

One well positioned MHI member told MHProNews that the ‘f-cking greedy’ have taken over the association.

11) From an objective analysis of where firms like Legacy Housing (LEGH), Nobility Homes (NOBH), UMH Properties (UMH) and others are operating, they must make day by day decisions that go beyond the normal challenges of business. They are having to deal with so-called “sabotage monopoly” and “moat” tactics that the Biden-Harris era DOJ and FTC have at times talked about, but at least as far as manufactured housing is concerned, they have yet to act on. MHARR has periodically called on members of Congress and others involved in federal oversight to act.

12) Restated, Legacy Housing (LEGH), Nobility Homes (NOBH), UMH Properties (UMH) and others that don’t engage in apparently illicit practices are having to watch their backs from potentially illegal behaviors that MHI is failing to protect them from, despite their own antitrust document. To put an even sharper point on the matter, several firms are doing exemplary work in several respects, given that a trade group – i.e.: MHI – that many are paying dues to is so apparently failing them.

We began this report with the news that “SG Capital Management LLC recently made a new investment in Legacy Housing Co. (NASDAQ: LEGH). They purchased 71,197 shares of the company’s stock, valued at approximately $1,532,0001. This investment was disclosed in their latest Form 13F filing with the Securities & Exchange Commission1.” Other hedge funds and institutional investors have bought into the Legacy Housing investment track record, as Part I detailed. The company has done yeoman’s work on several levels from an investor perspective. To be clear, as a deeper dive into previous MHProNews reports will reveal, Legacy has had its share of challenges. But they addressed those head-on. They did so and continued to generate good returns. When you report the bad and the ugly, as we do when the evidence calls for it, it is nice to be able to report the good news too. Time will tell, but there are reasons to believe that at Legacy Housing, the best is yet to come.

13) To learn more about Legacy, see the linked and related reports.

To learn more about the vexing bigger picture of manufactured housing, MHARR and the articles linked below are useful places to start.

Manufactured housing should be soaring during an affordable housing crisis, but it is relatively snoring by historic measures instead. Some firms like Legacy Housing appear to be working towards genuine organic growth, despite the efforts (or lack thereof) by others who are often involved at MHI.

MHProNews Notice: expect the latest national new home production figures to be provided by MHARR later today or tomorrow on their website.

14) Near the heart of the free enterprise system is the notion of finding a public need and filling it in an honest fashion that creates mutual victories for buyers and sellers alike.

Companies ideally earn profits by providing a good service and a product that offers good value.

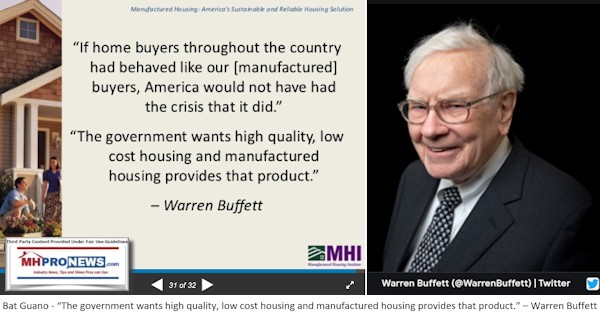

Manufactured housing is that product.

Ironically, instead of growing the industry, companies like Buffett’s have apparently worked to thwart the industry instead. Who says? An array of sources, that include examples linked below.

Congress previously probed some of these issues and took plenty of testimony that revealed that enhanced preemption over zoning and placement issues is not being properly enforced. The issues are known. The solutions are apparent.

MHProNews spent over a year with what today is called Copilot to reveal the often-treacherous nature of how a few involved at MHI are apparently acting in a duplicitous and what Copilot called an “Orwellian” manner. More recently, MHI began a similar process with Google’s AI powered Gemini. Gemini quickly saw the need to enforce “enhanced preemption.” For more on those topics, see the linked reports that follow, which are routinely cross linked to more evidence and information.

Legacy Housing, Nobility Homes, and UMH are among the publicly traded firms that our research, backed up with AI fact checks, suggest are built for the long haul. There are certainly privately held companies that have stood the test of time as well and done so honorably. The current administration talked a big game on antitrust, and at least with respect to manufactured housing, there is no known evidence of any serious steps having been taken. That said, the winds of change are blowing. There may be a new sheriff by this time next year cleaning house. Whoever is in the White House or your local state house, MHProNews plans on shining the light of facts, evidence, and truth to prompt the potential for positive changes that could witness a new era of robust growth for manufactured housing. The markets may be in for a bumpy ride, based on recent Asian, domestic and other events. Being invested in firms built to last is a good idea. It is also a good idea to stay tuned to your most reliable source for manufactured housing “Industry News, Tips, and Views that Pros Can Use” © where “We Provide, You Decide.” ©###

PS: MHProNews Programming Note: a new special report is pending. Watch for it.

To see the text in the image below in a larger size, depending on your device,

click the image and follow the prompts. Or click through the link below to the article.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’